Professional Documents

Culture Documents

Questions - Section B - Taxation Law

Questions - Section B - Taxation Law

Uploaded by

Suneet KapoorCopyright:

Available Formats

You might also like

- Practice Questions Income Tax Bba-Vi Sem Short & Long Practice QuestionsDocument15 pagesPractice Questions Income Tax Bba-Vi Sem Short & Long Practice QuestionsRahulNo ratings yet

- Income Tax - I Previous Years Question Papers: Short Answer Questions (2marks Each)Document17 pagesIncome Tax - I Previous Years Question Papers: Short Answer Questions (2marks Each)Prabhakar BhattacharyaNo ratings yet

- Question BankDocument2 pagesQuestion BankSandeep YadavNo ratings yet

- TAXATION - Various ConceptsDocument19 pagesTAXATION - Various Conceptslc17358No ratings yet

- Accounts ImportantDocument63 pagesAccounts ImportantAshok dore Ashok doreNo ratings yet

- Questions - Section C - Taxation LawDocument2 pagesQuestions - Section C - Taxation LawSuneet KapoorNo ratings yet

- FDNACCT - Quiz #1 - Answer Key - Set ADocument5 pagesFDNACCT - Quiz #1 - Answer Key - Set AleshamunsayNo ratings yet

- Xii CommerceDocument7 pagesXii CommerceJatinNo ratings yet

- FDNACCT - Quiz #1 - Answer Key - Set CDocument4 pagesFDNACCT - Quiz #1 - Answer Key - Set CleshamunsayNo ratings yet

- 7 Reasons to Become an Income Investor: Financial Freedom, #214From Everand7 Reasons to Become an Income Investor: Financial Freedom, #214No ratings yet

- Question Bank AFMDocument5 pagesQuestion Bank AFMkamalpreetkaur_mbaNo ratings yet

- Sofia Times October 2017Document27 pagesSofia Times October 2017dhanrajkamatNo ratings yet

- Taxation in BangladeshDocument6 pagesTaxation in BangladeshSakibNo ratings yet

- Chapter 10 Review For Test 2023Document6 pagesChapter 10 Review For Test 2023Fausto SosaNo ratings yet

- Azi Tax Law Notes 1Document60 pagesAzi Tax Law Notes 1azizur rahamanNo ratings yet

- Income Tax Important Questions 4Document4 pagesIncome Tax Important Questions 4Chembula JahnaviNo ratings yet

- Group, Div B Mms1 Sem 2 Bhartividyapeeth's Institute of Management Research & StudiesDocument32 pagesGroup, Div B Mms1 Sem 2 Bhartividyapeeth's Institute of Management Research & StudiessurajbhandareNo ratings yet

- Full Download Financial Accounting A Business Process Approach 3rd Edition Reimers Solutions ManualDocument36 pagesFull Download Financial Accounting A Business Process Approach 3rd Edition Reimers Solutions Manualdrizitashao100% (48)

- Module 3 Exercises Statement of Changes in EquityDocument3 pagesModule 3 Exercises Statement of Changes in EquityArjay CorderoNo ratings yet

- Tax Planning CasesDocument68 pagesTax Planning CasesHomework PingNo ratings yet

- FM UT 2 Anna UniversityDocument3 pagesFM UT 2 Anna UniversityRam VasuNo ratings yet

- Homework T2 - FSDocument3 pagesHomework T2 - FSCrayZeeAlexNo ratings yet

- Exam Module3 PDFDocument11 pagesExam Module3 PDFKen ChiaNo ratings yet

- Essay QuestionsDocument1 pageEssay QuestionsHarry SaiNo ratings yet

- FABM2 Module 3 Exercises - Statement of Changes in EquityDocument3 pagesFABM2 Module 3 Exercises - Statement of Changes in EquityJennifer NayveNo ratings yet

- Assignment - TaxationDocument2 pagesAssignment - TaxationMuskan MittalNo ratings yet

- First Question BankDocument16 pagesFirst Question BankviradiyajatinNo ratings yet

- Gujarat Technological UnversityDocument2 pagesGujarat Technological UnversityKrutika Goyal100% (1)

- FABM 2 Module 4 Exercises Statement of Cash FlowDocument3 pagesFABM 2 Module 4 Exercises Statement of Cash FlowJennifer NayveNo ratings yet

- Important Questions - Income Tax PDFDocument6 pagesImportant Questions - Income Tax PDFShourya Rajput100% (1)

- M.M 80 Accounts 12thDocument7 pagesM.M 80 Accounts 12thjashanjeetNo ratings yet

- FM QB New NewDocument22 pagesFM QB New NewskirubaarunNo ratings yet

- Ba 4202 FM Important QuestionsDocument6 pagesBa 4202 FM Important QuestionsRishi vardhiniNo ratings yet

- FINC 655 Summer 2012 Exam #1 - You Must Show All of Your Work To Receive Any Credit Problems (5pts Each)Document7 pagesFINC 655 Summer 2012 Exam #1 - You Must Show All of Your Work To Receive Any Credit Problems (5pts Each)Sheikh HasanNo ratings yet

- Activity 1.2.1Document1 pageActivity 1.2.1De Nev OelNo ratings yet

- TaxationDocument3 pagesTaxationMohit LambaNo ratings yet

- DT QB For StudentDocument4 pagesDT QB For Studentdipali mohodNo ratings yet

- All Subjects 5Document25 pagesAll Subjects 5thg198589No ratings yet

- Monika Kadam: Account SettingsDocument26 pagesMonika Kadam: Account SettingsAlok SinghNo ratings yet

- Accounting For Liabilities: Learning ObjectivesDocument39 pagesAccounting For Liabilities: Learning ObjectivesJune KooNo ratings yet

- Unit 1Document8 pagesUnit 1Diksha ReddyNo ratings yet

- Wesleyan University - Philippines College of Business and Accountancy Midterm Exam in Accounting 2 Name: Score: Course, Block and Year: ProfessorDocument4 pagesWesleyan University - Philippines College of Business and Accountancy Midterm Exam in Accounting 2 Name: Score: Course, Block and Year: ProfessorelminvaldezNo ratings yet

- Que Bank PFMDocument5 pagesQue Bank PFMAmit KesharwaniNo ratings yet

- Question BankDocument8 pagesQuestion BankEvangelineNo ratings yet

- Angel High School & Junior Colllege, Loni Kalbhor Subject: Book Keeping & Accountancy Question BankDocument21 pagesAngel High School & Junior Colllege, Loni Kalbhor Subject: Book Keeping & Accountancy Question BankShruti sukumarNo ratings yet

- 12th Accountancy Fundamental QuestionsDocument4 pages12th Accountancy Fundamental QuestionsKushagra VermaNo ratings yet

- Topic 1 Practice QuestionDocument2 pagesTopic 1 Practice Questionaarzu dangiNo ratings yet

- Before Course Exam SBSDocument17 pagesBefore Course Exam SBSGia LâmNo ratings yet

- Income Tax Question BankDocument8 pagesIncome Tax Question Banksurya.notes19No ratings yet

- 2009-05-01 063811 Multiple Choice-2Document12 pages2009-05-01 063811 Multiple Choice-2Andrea RobinsonNo ratings yet

- PracticeDocument8 pagesPracticehuongthuy1811No ratings yet

- R2.0 - FA - Exam FA PRJ P1SepOct2018 QuestionsDocument24 pagesR2.0 - FA - Exam FA PRJ P1SepOct2018 QuestionssxywangNo ratings yet

- Mba Summer 2022Document2 pagesMba Summer 2022Dhruvi PatelNo ratings yet

- Chapter 7Document36 pagesChapter 7Mai PhamNo ratings yet

- AssingmentDocument4 pagesAssingmentGarima LohanNo ratings yet

- 25 - Vvimp Interview QuestionsDocument14 pages25 - Vvimp Interview QuestionsBala RanganathNo ratings yet

- KTTC Quiz 1 & 2Document15 pagesKTTC Quiz 1 & 2nhuphan31221021135No ratings yet

- Taxation Theory QuestionsDocument7 pagesTaxation Theory QuestionsAtiaTahiraNo ratings yet

- CFR 1 Quiz 1Document7 pagesCFR 1 Quiz 1Ahmed SamadNo ratings yet

- Questions Answers - Section C - Taxation LawDocument79 pagesQuestions Answers - Section C - Taxation LawSuneet KapoorNo ratings yet

- Questions - Section C - Taxation LawDocument2 pagesQuestions - Section C - Taxation LawSuneet KapoorNo ratings yet

- Question Answers - Section B - Taxation LawDocument16 pagesQuestion Answers - Section B - Taxation LawSuneet KapoorNo ratings yet

- Defamation Law in IndiaDocument4 pagesDefamation Law in IndiaSuneet KapoorNo ratings yet

- Introduction of JurisprudenceDocument2 pagesIntroduction of JurisprudenceSuneet KapoorNo ratings yet

- Nature of Indian ConstitutionDocument7 pagesNature of Indian ConstitutionSuneet KapoorNo ratings yet

Questions - Section B - Taxation Law

Questions - Section B - Taxation Law

Uploaded by

Suneet KapoorCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Questions - Section B - Taxation Law

Questions - Section B - Taxation Law

Uploaded by

Suneet KapoorCopyright:

Available Formats

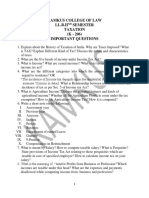

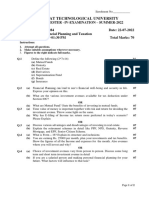

Section B

Note: Attempt any two questions. Each question carries 10 marks

6. What are the test to determine the residential status of individual?

7. Explain the transactions which are excluded from the meaning of ‘transfer’ for the

purposes of capital gains.

8. What do you understand by Self-Assessment?

2016

6. What are the tests to determine the residential status of an individual? 7. What is

depreciation? Discuss in detail.

8. What is ‘Agricultural Income’? What are its kinds? Explain.

2018

6. What is the process of Computing Income Tax

7. What is Income? Explain the fundamental principles of determining income. 8. Discuss the

exempted Income of House Property

2017

6. How the residential status of HUF is determined ? Discuss. 7. What is Salary? Discuss in

detail.

8. What is income from House Property ? Explain

2018

6. What are perquisites? What perquisites are included in the salary income of an

employee?

7. What do you mean by capital gain? How are capital gains calculated?

8. What do you understand by Provident Fund? Explain different types of Provident Funds.

2019

6. What do you understand by depreciation? How is the depreciation deduction availed

while company income is from business or profession?

7. Explain different types of provident funds.

8. Discuss how the capital gains are calculated.

2022

6. What do you mean by Capital Assets?

7. What do you mean by Tax and Fee and what is the difference between the two?

8. What is the basis of charge of Salary income as given in section 15 of Income Tax Act,

1961?

2023

6. What is exemption? Discuss the exemption under Section, 80G of Income-Tax Act?

7. Discuss the method of calculation of Capital Gains.

8. Define Previous Year. How previous year will be determined.

You might also like

- Practice Questions Income Tax Bba-Vi Sem Short & Long Practice QuestionsDocument15 pagesPractice Questions Income Tax Bba-Vi Sem Short & Long Practice QuestionsRahulNo ratings yet

- Income Tax - I Previous Years Question Papers: Short Answer Questions (2marks Each)Document17 pagesIncome Tax - I Previous Years Question Papers: Short Answer Questions (2marks Each)Prabhakar BhattacharyaNo ratings yet

- Question BankDocument2 pagesQuestion BankSandeep YadavNo ratings yet

- TAXATION - Various ConceptsDocument19 pagesTAXATION - Various Conceptslc17358No ratings yet

- Accounts ImportantDocument63 pagesAccounts ImportantAshok dore Ashok doreNo ratings yet

- Questions - Section C - Taxation LawDocument2 pagesQuestions - Section C - Taxation LawSuneet KapoorNo ratings yet

- FDNACCT - Quiz #1 - Answer Key - Set ADocument5 pagesFDNACCT - Quiz #1 - Answer Key - Set AleshamunsayNo ratings yet

- Xii CommerceDocument7 pagesXii CommerceJatinNo ratings yet

- FDNACCT - Quiz #1 - Answer Key - Set CDocument4 pagesFDNACCT - Quiz #1 - Answer Key - Set CleshamunsayNo ratings yet

- 7 Reasons to Become an Income Investor: Financial Freedom, #214From Everand7 Reasons to Become an Income Investor: Financial Freedom, #214No ratings yet

- Question Bank AFMDocument5 pagesQuestion Bank AFMkamalpreetkaur_mbaNo ratings yet

- Sofia Times October 2017Document27 pagesSofia Times October 2017dhanrajkamatNo ratings yet

- Taxation in BangladeshDocument6 pagesTaxation in BangladeshSakibNo ratings yet

- Chapter 10 Review For Test 2023Document6 pagesChapter 10 Review For Test 2023Fausto SosaNo ratings yet

- Azi Tax Law Notes 1Document60 pagesAzi Tax Law Notes 1azizur rahamanNo ratings yet

- Income Tax Important Questions 4Document4 pagesIncome Tax Important Questions 4Chembula JahnaviNo ratings yet

- Group, Div B Mms1 Sem 2 Bhartividyapeeth's Institute of Management Research & StudiesDocument32 pagesGroup, Div B Mms1 Sem 2 Bhartividyapeeth's Institute of Management Research & StudiessurajbhandareNo ratings yet

- Full Download Financial Accounting A Business Process Approach 3rd Edition Reimers Solutions ManualDocument36 pagesFull Download Financial Accounting A Business Process Approach 3rd Edition Reimers Solutions Manualdrizitashao100% (48)

- Module 3 Exercises Statement of Changes in EquityDocument3 pagesModule 3 Exercises Statement of Changes in EquityArjay CorderoNo ratings yet

- Tax Planning CasesDocument68 pagesTax Planning CasesHomework PingNo ratings yet

- FM UT 2 Anna UniversityDocument3 pagesFM UT 2 Anna UniversityRam VasuNo ratings yet

- Homework T2 - FSDocument3 pagesHomework T2 - FSCrayZeeAlexNo ratings yet

- Exam Module3 PDFDocument11 pagesExam Module3 PDFKen ChiaNo ratings yet

- Essay QuestionsDocument1 pageEssay QuestionsHarry SaiNo ratings yet

- FABM2 Module 3 Exercises - Statement of Changes in EquityDocument3 pagesFABM2 Module 3 Exercises - Statement of Changes in EquityJennifer NayveNo ratings yet

- Assignment - TaxationDocument2 pagesAssignment - TaxationMuskan MittalNo ratings yet

- First Question BankDocument16 pagesFirst Question BankviradiyajatinNo ratings yet

- Gujarat Technological UnversityDocument2 pagesGujarat Technological UnversityKrutika Goyal100% (1)

- FABM 2 Module 4 Exercises Statement of Cash FlowDocument3 pagesFABM 2 Module 4 Exercises Statement of Cash FlowJennifer NayveNo ratings yet

- Important Questions - Income Tax PDFDocument6 pagesImportant Questions - Income Tax PDFShourya Rajput100% (1)

- M.M 80 Accounts 12thDocument7 pagesM.M 80 Accounts 12thjashanjeetNo ratings yet

- FM QB New NewDocument22 pagesFM QB New NewskirubaarunNo ratings yet

- Ba 4202 FM Important QuestionsDocument6 pagesBa 4202 FM Important QuestionsRishi vardhiniNo ratings yet

- FINC 655 Summer 2012 Exam #1 - You Must Show All of Your Work To Receive Any Credit Problems (5pts Each)Document7 pagesFINC 655 Summer 2012 Exam #1 - You Must Show All of Your Work To Receive Any Credit Problems (5pts Each)Sheikh HasanNo ratings yet

- Activity 1.2.1Document1 pageActivity 1.2.1De Nev OelNo ratings yet

- TaxationDocument3 pagesTaxationMohit LambaNo ratings yet

- DT QB For StudentDocument4 pagesDT QB For Studentdipali mohodNo ratings yet

- All Subjects 5Document25 pagesAll Subjects 5thg198589No ratings yet

- Monika Kadam: Account SettingsDocument26 pagesMonika Kadam: Account SettingsAlok SinghNo ratings yet

- Accounting For Liabilities: Learning ObjectivesDocument39 pagesAccounting For Liabilities: Learning ObjectivesJune KooNo ratings yet

- Unit 1Document8 pagesUnit 1Diksha ReddyNo ratings yet

- Wesleyan University - Philippines College of Business and Accountancy Midterm Exam in Accounting 2 Name: Score: Course, Block and Year: ProfessorDocument4 pagesWesleyan University - Philippines College of Business and Accountancy Midterm Exam in Accounting 2 Name: Score: Course, Block and Year: ProfessorelminvaldezNo ratings yet

- Que Bank PFMDocument5 pagesQue Bank PFMAmit KesharwaniNo ratings yet

- Question BankDocument8 pagesQuestion BankEvangelineNo ratings yet

- Angel High School & Junior Colllege, Loni Kalbhor Subject: Book Keeping & Accountancy Question BankDocument21 pagesAngel High School & Junior Colllege, Loni Kalbhor Subject: Book Keeping & Accountancy Question BankShruti sukumarNo ratings yet

- 12th Accountancy Fundamental QuestionsDocument4 pages12th Accountancy Fundamental QuestionsKushagra VermaNo ratings yet

- Topic 1 Practice QuestionDocument2 pagesTopic 1 Practice Questionaarzu dangiNo ratings yet

- Before Course Exam SBSDocument17 pagesBefore Course Exam SBSGia LâmNo ratings yet

- Income Tax Question BankDocument8 pagesIncome Tax Question Banksurya.notes19No ratings yet

- 2009-05-01 063811 Multiple Choice-2Document12 pages2009-05-01 063811 Multiple Choice-2Andrea RobinsonNo ratings yet

- PracticeDocument8 pagesPracticehuongthuy1811No ratings yet

- R2.0 - FA - Exam FA PRJ P1SepOct2018 QuestionsDocument24 pagesR2.0 - FA - Exam FA PRJ P1SepOct2018 QuestionssxywangNo ratings yet

- Mba Summer 2022Document2 pagesMba Summer 2022Dhruvi PatelNo ratings yet

- Chapter 7Document36 pagesChapter 7Mai PhamNo ratings yet

- AssingmentDocument4 pagesAssingmentGarima LohanNo ratings yet

- 25 - Vvimp Interview QuestionsDocument14 pages25 - Vvimp Interview QuestionsBala RanganathNo ratings yet

- KTTC Quiz 1 & 2Document15 pagesKTTC Quiz 1 & 2nhuphan31221021135No ratings yet

- Taxation Theory QuestionsDocument7 pagesTaxation Theory QuestionsAtiaTahiraNo ratings yet

- CFR 1 Quiz 1Document7 pagesCFR 1 Quiz 1Ahmed SamadNo ratings yet

- Questions Answers - Section C - Taxation LawDocument79 pagesQuestions Answers - Section C - Taxation LawSuneet KapoorNo ratings yet

- Questions - Section C - Taxation LawDocument2 pagesQuestions - Section C - Taxation LawSuneet KapoorNo ratings yet

- Question Answers - Section B - Taxation LawDocument16 pagesQuestion Answers - Section B - Taxation LawSuneet KapoorNo ratings yet

- Defamation Law in IndiaDocument4 pagesDefamation Law in IndiaSuneet KapoorNo ratings yet

- Introduction of JurisprudenceDocument2 pagesIntroduction of JurisprudenceSuneet KapoorNo ratings yet

- Nature of Indian ConstitutionDocument7 pagesNature of Indian ConstitutionSuneet KapoorNo ratings yet