Professional Documents

Culture Documents

20240520-g01 News

20240520-g01 News

Uploaded by

arifinx470 ratings0% found this document useful (0 votes)

1 views2 pagesWaitbsbaj

Original Title

20240520-g01_News

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentWaitbsbaj

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

1 views2 pages20240520-g01 News

20240520-g01 News

Uploaded by

arifinx47Waitbsbaj

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

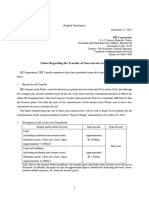

Note: This document has been translated from the Japanese original for reference purposes only.

In the event of any discrepancy

between this translated document and the Japanese original, the original shall prevail.

May 20, 2024

Company name: DENSO CORPORATION

Name of representative: Shinnosuke Hayashi, President and CEO

(Securities code: 6902;

Tokyo and Nagoya Stock Exchanges)

Inquiries: Tadashi Arai, Director, Finance and

Accounting Div.

(Telephone: +81-50-1738-6018)

Announcement Regarding the Sale of Investment Securities and

Expected Posting of Extraordinary Gains in Non-Consolidated Results

DENSO CORPORATION (the “Company”) hereby announces that as of today it resolved to sell a portion of its

investment securities holdings of Renesas Electronics Corporation (“Renesas Electronics”) (the “Sale”). As a result

of the Sale, the posting of extraordinary gains (gains on the sale of the investment securities) is expected in the non-

consolidated results for the financial year ending March 31, 2025, as detailed below:

1. Reason for the sale of a part of the shareholdings

The Company is working on the four initiatives of its financial strategy, which was renewed in the financial year

ending March 31, 2022, to balance solving social issues and business growth: (i) reinforce profit structure, (ii)

reduce low-profit assets, (iii) improve capital structure, and (iv) engage in dialogue with markets. Based on

these financial strategies, the Company’s basic policy is to not hold strategic holding shares being low-profit

assets unless a rationale for holding them is recognized.

In accordance with such policy, the Company has considered methods of the sale of Renesas Electronics shares

and has decided to adopt the method of the sale described below and sell a portion of the Renesas Electronics

shares held by the Company.

From the time the Company invested in Renesas Electronics in 2013 and increased its stake in Renesas

Electronics in 2018, the Company has established a business relationship that enables a stable procurement of

in-vehicle semiconductors and it has achieved a certain level of results based on collaboration by accumulating

the joint development of technologies and products related to competitive in-vehicle systems.

As a result of a comprehensive review from the perspective of the Company’s future semiconductor strategy

and capital efficiency, and after examining the rationale for holding Renesas Electronics shares as well as

considering the fact that the original purpose of the investment has been fulfilled to a certain extent, the

Company has decided to sell a part of its shareholdings in order to pursue investments that will contribute to its

growth strategy.

Since maintaining and strengthening its business collaborative relationship with Renesas Electronics is essential

for the sustainable enhancement of its corporate value, the subject of the sale is limited to a portion of its

investment securities holdings. The Company will continue to consider the rationality of holding onto the

remaining shares, taking into account the development of the business collaboration with Renesas Electronics

after the sale, the positioning of each in-vehicle semiconductor in the automotive industry, which is undergoing

a period of change, and its semiconductor strategy and capital efficiency.

After the Sale, the Company will continue to maintain and strengthen its business collaboration with Renesas

Electronics.

2. Details of the sale of a part of the shareholdings

(1) Shares to be sold Ordinary shares of Renesas Electronics Corporation

(2) Number of shares to be sold 78,127,800 (4.4% of the issued shares excluding treasury shares)

(3) Delivery completion date May 23, 2024

(4) Gains on the sale of the Approximately 175.5 billion JPY (estimated)

investment securities *Please note that the amount of the gains on the sale of the investment

securities is an estimated amount calculated based on the current stock price

of Renesas Electronics shares and other factors and is subject to change.

(5) Method of the sale Expected to be sold in the overseas markets with BofA Securities Japan Co.,

Ltd. (“BofA”) as bookrunner (provided that, in the U.S., the sales shall be

made only to qualified institutional buyers as defined in the U.S. Securities

Act of 1933), and in Japan.

(6) Lock-up The Company intends to undertake with BofA that it will not sell or

otherwise dispose of the Renesas Electronics ordinary shares (except for the

Sale) without the prior written consent of BofA for a period from the signing

date of the share purchase agreement relating to the Sale until 270 days after

the signing date.

3. Impacts on financial results

The Company expects to post the gains on the sale of the investment securities as mentioned above resulting

from the Sale as extraordinary gains in the non-consolidated results for the financial year ending March 31,

2025, and the Company will announce the actual amount of the extraordinary gains once it is determined.

As the Company has adopted the International Financial Reporting Standards (IFRS) and the gains on the Sale

will be treated as other comprehensive income in the consolidated accounts, there will be no impact on the

consolidated results.

You might also like

- Infocept Pte LTD - 2021Document47 pagesInfocept Pte LTD - 2021Lin ZincNo ratings yet

- PropertyGuru 2020 Financial StatementDocument115 pagesPropertyGuru 2020 Financial StatementTerence LeeNo ratings yet

- Toshiba Press Release About Consortium Led by Bain CapitalDocument5 pagesToshiba Press Release About Consortium Led by Bain CapitalJack PurcherNo ratings yet

- PDF FileDocument7 pagesPDF FileSaroj KhadangaNo ratings yet

- FAR570 Topic 2 EARNINGS PER SHAREDocument25 pagesFAR570 Topic 2 EARNINGS PER SHARE2022920039No ratings yet

- 1 Toshiba - Bain Share Purchase AgreementDocument3 pages1 Toshiba - Bain Share Purchase AgreementJack PurcherNo ratings yet

- Q4-2022-2023 Japana Kubota ReportDocument30 pagesQ4-2022-2023 Japana Kubota ReportnainqaecNo ratings yet

- LXI - Prospectus - Subsequent Issue - 20 01 2022Document246 pagesLXI - Prospectus - Subsequent Issue - 20 01 2022sky22blueNo ratings yet

- BSE Kotak 11092017Document5 pagesBSE Kotak 11092017Rohit NiraleNo ratings yet

- Vicom LTD: A Member ofDocument2 pagesVicom LTD: A Member ofCalebNo ratings yet

- Earning Per ShareDocument22 pagesEarning Per Sharekimuli FreddieNo ratings yet

- Ias-33 EpsDocument59 pagesIas-33 Epssyed asim shahNo ratings yet

- June 2016 QDocument8 pagesJune 2016 QNirmal ShresthaNo ratings yet

- Afm June 2016 QTDocument13 pagesAfm June 2016 QTBijay AgrawalNo ratings yet

- Financial Year Ended270820211623Document6 pagesFinancial Year Ended270820211623SOMNATH DHEMARENo ratings yet

- Notice of Establishment of Joint Venture Company With Dena Co., Ltd. and Added As A Specified SubsidiaryDocument3 pagesNotice of Establishment of Joint Venture Company With Dena Co., Ltd. and Added As A Specified SubsidiaryryanNo ratings yet

- 2020 12 30 Disposal of Wholly Owned Subsidiary Boustead Salcon Water Solutions - 3Document3 pages2020 12 30 Disposal of Wholly Owned Subsidiary Boustead Salcon Water Solutions - 3arissaNo ratings yet

- 01 enDocument15 pages01 enKhairul ScNo ratings yet

- FC GPRDocument15 pagesFC GPRAnant MishraNo ratings yet

- Dixon Tech - HaitongDocument6 pagesDixon Tech - HaitongpalakNo ratings yet

- (MP#496) - Dividend Investors, Buy This Undiscovered Debt-Free Company With The High Insider Ownership For Your Income Portfolio (NYSE, Industrial Sector) - Seeking AlphaDocument21 pages(MP#496) - Dividend Investors, Buy This Undiscovered Debt-Free Company With The High Insider Ownership For Your Income Portfolio (NYSE, Industrial Sector) - Seeking AlphaAndrew OstaNo ratings yet

- Motherson Announces Its 1st Acquisition in JapanDocument13 pagesMotherson Announces Its 1st Acquisition in JapanAamir KhanNo ratings yet

- Earnings Per Share FCDocument8 pagesEarnings Per Share FCSivel InamikNo ratings yet

- Monthly Portfolio April 2021Document37 pagesMonthly Portfolio April 2021Visnu SankarNo ratings yet

- Methodology Document of Nifty Cpse Index: January 2020Document13 pagesMethodology Document of Nifty Cpse Index: January 2020Sai Samapath KarumudiNo ratings yet

- Exam in Accounting-FinalsDocument5 pagesExam in Accounting-FinalsIyarna YasraNo ratings yet

- Financial ReportingDocument83 pagesFinancial ReportingLorena TudorascuNo ratings yet

- Prospect UesDocument149 pagesProspect Uesmeghavichare786No ratings yet

- Tatva Chintan Pharma Chem LTD IPODocument1 pageTatva Chintan Pharma Chem LTD IPOparmodNo ratings yet

- Berger Paints India Limited: Public AnnouncementDocument16 pagesBerger Paints India Limited: Public Announcement563vasuNo ratings yet

- LTN 20091231236Document61 pagesLTN 20091231236babujacobNo ratings yet

- 2 BestWorld Notice of AGMDocument3 pages2 BestWorld Notice of AGMindiatradeteoNo ratings yet

- Index: PPLTVF PPLF PPTSF PPCHFDocument49 pagesIndex: PPLTVF PPLF PPTSF PPCHFTunirNo ratings yet

- 4 Financial Management Questions Nov Dec 2019 PL PDFDocument5 pages4 Financial Management Questions Nov Dec 2019 PL PDFShahriar ShihabNo ratings yet

- MoreDocument3 pagesMoreafdgtdsghfNo ratings yet

- 566 .1 PDFDocument7 pages566 .1 PDFInvest StockNo ratings yet

- Group Class Solution 27 July 12.12 Graded QuestionsDocument2 pagesGroup Class Solution 27 July 12.12 Graded QuestionsGiven RefilweNo ratings yet

- Research: Sintex Industries LimitedDocument4 pagesResearch: Sintex Industries LimitedMohd KaifNo ratings yet

- TradeGecko FYE2020 EarningsDocument110 pagesTradeGecko FYE2020 EarningsTIANo ratings yet

- CG Report 2017 PDFDocument24 pagesCG Report 2017 PDFElena IonNo ratings yet

- Full Note On IND As 33Document7 pagesFull Note On IND As 33bachchanbarman389No ratings yet

- Eminent Technologies (HK) Limited - DeC 2023Document15 pagesEminent Technologies (HK) Limited - DeC 2023Robert ManjoNo ratings yet

- It Governance Technology-Chapter 01Document4 pagesIt Governance Technology-Chapter 01IQBAL MAHMUDNo ratings yet

- Corporate Disclosure and Investor ProtectionDocument19 pagesCorporate Disclosure and Investor ProtectionPaavni Sharma50% (2)

- Tutorial 5 Jan 2022 Question OnlyDocument8 pagesTutorial 5 Jan 2022 Question OnlyMurali RasamahNo ratings yet

- IAS 33 Earnings Per Share - v2Document35 pagesIAS 33 Earnings Per Share - v2AdityaNo ratings yet

- E - Press Release - INCJ - RenesasDocument3 pagesE - Press Release - INCJ - RenesasafdgtdsghfNo ratings yet

- Notice Regarding The Transfer of Non-Current AssetsDocument2 pagesNotice Regarding The Transfer of Non-Current AssetsMufadilah DewantoroNo ratings yet

- Buy-Back of SharesDocument11 pagesBuy-Back of Sharesatul486100% (3)

- Notice of Convocation: Toyota Motor CorporationDocument83 pagesNotice of Convocation: Toyota Motor CorporationFerry SetiawanNo ratings yet

- ATTA AR2017 (Bursa) - Final PDFDocument116 pagesATTA AR2017 (Bursa) - Final PDFah_annNo ratings yet

- Notice Regarding Acquisition of Shares of Takei Co., Ltd. (Making It A Consolidated Subsidiary)Document2 pagesNotice Regarding Acquisition of Shares of Takei Co., Ltd. (Making It A Consolidated Subsidiary)Saroj KhadangaNo ratings yet

- Research Report On LKP SecDocument9 pagesResearch Report On LKP SecVipin PatilNo ratings yet

- Report On Bangladesh Capital MarketDocument22 pagesReport On Bangladesh Capital Marketacecapitalmgt100% (6)

- Financial Analysis 8Document10 pagesFinancial Analysis 8Chin FiguraNo ratings yet

- Absl Amc IpoDocument4 pagesAbsl Amc IpoRounak KhubchandaniNo ratings yet

- STUDENT NAME: Sharath Shyamasunder: UOB NO:-09034024 Corporate FinanceDocument38 pagesSTUDENT NAME: Sharath Shyamasunder: UOB NO:-09034024 Corporate Financesharath1005No ratings yet

- Ias 33 EpsDocument55 pagesIas 33 EpszulfiNo ratings yet

- Stock Fundamental Analysis Mastery: Unlocking Company Stock Financials for Profitable TradingFrom EverandStock Fundamental Analysis Mastery: Unlocking Company Stock Financials for Profitable TradingNo ratings yet

- InfineonDocument31 pagesInfineonManuel GuillenNo ratings yet

- R30ca0181ed0200 Winning ComboDocument40 pagesR30ca0181ed0200 Winning ComboVanHieu LuyenNo ratings yet

- Embedded AI-Accelerator DRP-AI - White Paper - Hideaki Abe - Koichi Nose - Kazutaka Kikuchi - RenesasDocument8 pagesEmbedded AI-Accelerator DRP-AI - White Paper - Hideaki Abe - Koichi Nose - Kazutaka Kikuchi - RenesasTechnical NoviceNo ratings yet

- REN - User ManualDocument110 pagesREN - User ManualbahramNo ratings yet

- Mouser EIU January 2023Document42 pagesMouser EIU January 2023Ludo BagmanNo ratings yet

- R5F64 DatasheetDocument103 pagesR5F64 DatasheetWinston diaz valeraNo ratings yet

- BP 2017 04Document68 pagesBP 2017 04Arun Rajkumar K PNo ratings yet

- M34509G4FPDocument145 pagesM34509G4FPAdrian GarciaNo ratings yet

- Datasheet Transistor 2SJ546Document13 pagesDatasheet Transistor 2SJ546Nayla AzzahraNo ratings yet

- Regarding The Change of Names Mentioned in The Document, Such As Mitsubishi Electric and Mitsubishi XX, To Renesas Technology CorpDocument37 pagesRegarding The Change of Names Mentioned in The Document, Such As Mitsubishi Electric and Mitsubishi XX, To Renesas Technology CorpАнтон ПNo ratings yet

- Sistema de Calibración Lente UvDocument3 pagesSistema de Calibración Lente UvAlejandro SánchezNo ratings yet

- Phillips Transistor Cross Reference 1Document29 pagesPhillips Transistor Cross Reference 1H3liax90% (10)

- REN Wireless-Connectivity-Solutions WHP 20231128Document10 pagesREN Wireless-Connectivity-Solutions WHP 20231128SimenaNo ratings yet

- The Disrupter Central & South America PDFDocument14 pagesThe Disrupter Central & South America PDFwreckerNo ratings yet

- B 550Document40 pagesB 550dimafedotov497No ratings yet

- TGCC-Renesas Company Acquisition CaseDocument15 pagesTGCC-Renesas Company Acquisition CaseEthan Chiu邱奕淇No ratings yet

- Renesas Electronics - WikipediaDocument27 pagesRenesas Electronics - WikipediaNUTHI SIVA SANTHANNo ratings yet

- Regarding The Change of Names Mentioned in The Document, Such As Mitsubishi Electric and Mitsubishi XX, To Renesas Technology CorpDocument10 pagesRegarding The Change of Names Mentioned in The Document, Such As Mitsubishi Electric and Mitsubishi XX, To Renesas Technology CorpTahar BenacherineNo ratings yet

- IFX FY2023 Q1 Web ENDocument27 pagesIFX FY2023 Q1 Web ENChao DongNo ratings yet

- R5F2127 MabeDocument59 pagesR5F2127 Mabejose torresNo ratings yet

- The Impacts of Natural Disasters On Global Supply Chains: Ye, Linghe Abe, MasatoDocument29 pagesThe Impacts of Natural Disasters On Global Supply Chains: Ye, Linghe Abe, MasatomurungirakeeliNo ratings yet

- R-Car Starterkit Hardware Manual: R-Car Starter Kit Premier R-Car Starter Kit ProDocument37 pagesR-Car Starterkit Hardware Manual: R-Car Starter Kit Premier R-Car Starter Kit ProbengaltigerNo ratings yet

- StecnoDocument2 pagesStecnojainil shahNo ratings yet

- Top 10 SMD Inductor Manufacturers in The WorldDocument15 pagesTop 10 SMD Inductor Manufacturers in The WorldjackNo ratings yet

- EOM (Assignment 3)Document4 pagesEOM (Assignment 3)shodhan shettyNo ratings yet

- R01uh0912ej0001 h3 m3 vsp2Document39 pagesR01uh0912ej0001 h3 m3 vsp2敬贤No ratings yet

- E - Press Release - INCJ - RenesasDocument3 pagesE - Press Release - INCJ - RenesasafdgtdsghfNo ratings yet

- Self Programming Examples Nec Electronics 78k0kx2 Microcontrollers Application NoteDocument80 pagesSelf Programming Examples Nec Electronics 78k0kx2 Microcontrollers Application NoteTahsin GuvenNo ratings yet

- Flashsta ManualDocument25 pagesFlashsta ManualBeenish MirzaNo ratings yet

- Features: Digital Dual Output 7-Phase AMD PWM ControllerDocument3 pagesFeatures: Digital Dual Output 7-Phase AMD PWM ControllertututNo ratings yet