Professional Documents

Culture Documents

Payslip May 2023

Payslip May 2023

Uploaded by

udaykumarh20Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Payslip May 2023

Payslip May 2023

Uploaded by

udaykumarh20Copyright:

Available Formats

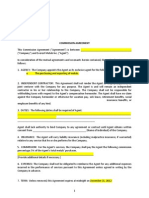

HINDUSTAN ZINC

YASHAD BHAVAN,

UDAIPUR.

Payslip for the month of MAY 2023

————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————

Emp Code :590016 UAN :101546093687

Emp Name :UDAY KUMAR H EPF No :RJUDR00012720000037399

Global Joining:18/12/2019 EPS No :RJUDR0001272000001180668

Location :UDAIPUR PAN :AHMPU1970C

Grade :M7 IFSC CODE :HDFC0000119

DOJ :18/12/2019 Bank AC No :50100312463692

Designation :ASSISTANT MANAGER Bank Name :HDFC BANK LTD

Total Days :31.00 Pay Days :31.00

LWP :0.00 Arrear Days:0.00

————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————

EARNINGS STANDARD WAGE CURRENT MONTH ARREAR(+/—) YTD | DEDUCTIONS CURRENT MONTH YTD

————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————

BASIC 29600.00 29600.00 0.00 60068.00| P.F. 3552.00 7208.00

HOUSE RENT ALLOWANCE 11840.00 11840.00 0.00 24027.00| V.P.F. 3848.00 7809.00

BONUS MONTHLY 5920.00 5920.00 0.00 12014.00| INCOME TAX DEDUCTION 3201.00 14862.00

UNIFORM WASHING ALLOWANCE 1000.00 1000.00 0.00 2032.00| STAFF TRANSPORT CHARGES 150.00 300.00

PERSONAL ALLOWANCE 17806.00 17806.00 0.00 36132.00| HOUSE RENT RECOVERY 400.00 800.00

LTA TAXABLE EXECUTIVE 2467.00 2467.00 0.00 5006.00| ADVANCE SALARY 1183.00 2191.00

————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————

GROSS EARNINGS 68633.00 0.00 139279.00| TOTAL DEDUCTIONS 12334.00 33170.00

————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————

NET PAY 56299.00

————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————

(RUPEES FIFTY SIX THOUSAND TWO HUNDRED NINETY NINE ONLY)

————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————

—————————————————————————————————————————————————————————————————————————————————————————————————

TAX CALCULATIONS NEW REGIME OLD REGIME|PERK & OTHERS................................

————————————————— —————————— —————————|HOUSE PERK 61843

TOTAL EARNING 900609 900609|

LESS: *REIMBURSEMENTS 12032 12032|INVESTMENTS U/S 80C..........................

ADD : PERKS & OTHERS 61843 61843|PF—DED 89017

TOTAL GROSS 950420 950420|

|

LESS: EXEMPTION U/S10/OTHERS 0 0|

LESS: PROFESSION TAX 0 0|

LESS: STANDARD DEDUCTION 50000 50000|

NET SALARY 900420 900420|

|

LESS: HOUSING LOAN INTEREST 0 0|

LESS: INVEST. U/S 80C 0 89017|

LESS: INVESTMENTS U/S 80(OTH) 0 0|

|

TAXABLE INCOME 900420 811403|

|

TOTAL TAX 46866 77773|

———————————————————————————————————————————————————|

TAX APPLIED AS PER NEW REGIME 46866 |

———————————————————————————————————————————————————|

LESS: TAX DEDUCTED AT SOURCE 14862 |

|

BALANCE TAX PAYABLE 32004 |

BALANCE NUMBER OF MONTHS 10 |

MONTHLY TAX 3201 |

—————————————————————————————————————————————————————————————————————————————————————————————————

Private and Confidential. This is a system—generated document and signature is not required

You might also like

- NextGen Healthcare Official Offer LetterDocument3 pagesNextGen Healthcare Official Offer LetterLorenzo CzarNo ratings yet

- Rep ShowDocument1 pageRep ShowHEMANTNo ratings yet

- Country of GuyanaDocument3 pagesCountry of Guyanasaeed_r2000422No ratings yet

- TheoryofacctsexamDocument7 pagesTheoryofacctsexammarvin barlisoNo ratings yet

- Management Accounting ReviewerDocument76 pagesManagement Accounting ReviewerJess Guiang CasamorinNo ratings yet

- USAJobs Training Workbook FINALDocument166 pagesUSAJobs Training Workbook FINALPatriciaDuckers100% (1)

- Payslip Apr 2023-1Document1 pagePayslip Apr 2023-1udaykumarh20No ratings yet

- Ilovepdf MergedDocument5 pagesIlovepdf Mergedudaykumarh20No ratings yet

- PAYSLIp MergedDocument4 pagesPAYSLIp Mergedudaykumarh20No ratings yet

- Payslip Mar 2023-1Document1 pagePayslip Mar 2023-1udaykumarh20No ratings yet

- Bajaj AllianzDocument1 pageBajaj AllianzKolkata Jyote MotorsNo ratings yet

- Payslip APR 900546Document1 pagePayslip APR 900546jyprakash17No ratings yet

- April Sathish Pay SlipDocument1 pageApril Sathish Pay Slipmsathish7428No ratings yet

- PFSSPL Pay Slip 50002019 Aug 2022Document1 pagePFSSPL Pay Slip 50002019 Aug 2022Satyam MishraNo ratings yet

- Hdfcergo Pay Slip 25297 Sep 2023Document1 pageHdfcergo Pay Slip 25297 Sep 2023bunnyakg14No ratings yet

- Payslip Feb 2022Document1 pagePayslip Feb 2022PRASHANT BANDAWARNo ratings yet

- Hdfcergo Pay Slip 22652 Nov 2022Document1 pageHdfcergo Pay Slip 22652 Nov 2022Rahul RampalNo ratings yet

- Rnlic Pay Slip 70648381 Oct 2023Document1 pageRnlic Pay Slip 70648381 Oct 2023Neeraj BhardwajNo ratings yet

- Rnlic 70742997 Sep 2020 Payslip 70742997Document1 pageRnlic 70742997 Sep 2020 Payslip 70742997rishi.diwakarrNo ratings yet

- All SalaryslipDocument3 pagesAll Salaryslipbajajfinance.aakashNo ratings yet

- Teamhgs 221983 Nov 2019 Payslip 221983Document1 pageTeamhgs 221983 Nov 2019 Payslip 221983Himanshu KumarNo ratings yet

- Hdfcergo 9920 Aug 2022 Payslip 9920Document1 pageHdfcergo 9920 Aug 2022 Payslip 9920Pramila TyagiNo ratings yet

- DGSL - PAY - SLIP - 162781 - APRIL - 2023 DDFDocument1 pageDGSL - PAY - SLIP - 162781 - APRIL - 2023 DDFVarun GunjalNo ratings yet

- SLA Cold Reading HandbookDocument1 pageSLA Cold Reading HandbookRajeshNo ratings yet

- DGSL - PAY - SLIP - 162781 - FEB - 2023 DDFDocument1 pageDGSL - PAY - SLIP - 162781 - FEB - 2023 DDFVarun GunjalNo ratings yet

- Hdfcergo 9920 Jan 2022 Payslip 9920Document1 pageHdfcergo 9920 Jan 2022 Payslip 9920Pramila DeviNo ratings yet

- Teamhgs 165148 Nov 2017 Payslip 165148Document1 pageTeamhgs 165148 Nov 2017 Payslip 165148Mohammad IrfanNo ratings yet

- CRSPL 0175 TaxForecastDocument1 pageCRSPL 0175 TaxForecastHement PawarNo ratings yet

- 7Document1 page7solankivijayv8No ratings yet

- HDFCERGO 23442 TaxForecastDocument1 pageHDFCERGO 23442 TaxForecastsurveyor.maheshkNo ratings yet

- KPMG MAR 2024 67546 PayslipDocument1 pageKPMG MAR 2024 67546 PayslipnikitachaudharyworldNo ratings yet

- Sipl Pay Slip 608474 Jan 2024Document1 pageSipl Pay Slip 608474 Jan 2024sanjayNo ratings yet

- KPMG FEB 2024 67546 PayslipDocument1 pageKPMG FEB 2024 67546 PayslipnikitachaudharyworldNo ratings yet

- FC 101634Document1 pageFC 101634Parth BeriNo ratings yet

- 06005965 (8)Document1 page06005965 (8)surisam.rNo ratings yet

- KPMG MAR 2024 100502 PayslipDocument1 pageKPMG MAR 2024 100502 PayslipNeha JainNo ratings yet

- Payslip Jun 2022Document1 pagePayslip Jun 2022KrishnaKumar SinghNo ratings yet

- SSB 4575Document1 pageSSB 4575Ramesh KumarNo ratings yet

- Payslip - 2023 01 27Document1 pagePayslip - 2023 01 27kamalhakimi18No ratings yet

- CACTUS MAY 2023 CIC02774 PayslipDocument1 pageCACTUS MAY 2023 CIC02774 Payslipuraza.octavoNo ratings yet

- Calcium 01Document1 pageCalcium 01Ramesh KumarNo ratings yet

- 1829000400100863ffd PSP - RPTDocument9 pages1829000400100863ffd PSP - RPTASIFA FARHADNo ratings yet

- Chintan Shah APR 2023 PayslipDocument1 pageChintan Shah APR 2023 Payslipsunil jadhavNo ratings yet

- Dar CementDocument1 pageDar Cementatifah3322No ratings yet

- Chintan Shah MAY 2023 PayslipDocument1 pageChintan Shah MAY 2023 Payslipsunil jadhavNo ratings yet

- Sipl Pay Slip 238596 Dec 2022Document1 pageSipl Pay Slip 238596 Dec 2022sachinshetty205No ratings yet

- Mohd Naim FNF STDocument2 pagesMohd Naim FNF STMohd NaimNo ratings yet

- Hgsis Pay Slip 32781 Nov 2022Document1 pageHgsis Pay Slip 32781 Nov 2022Vineet TibrewalNo ratings yet

- Jan 2024 PayslipDocument1 pageJan 2024 Paysliprajendrarao5588No ratings yet

- Salary Slip - Adnan ShaikhDocument1 pageSalary Slip - Adnan ShaikhAdnan ShaikhNo ratings yet

- ReportDocument1 pageReportAishwarya KoreNo ratings yet

- Wa0206.Document1 pageWa0206.jitendraprasad1996pNo ratings yet

- Pay Slip 07Document1 pagePay Slip 07Jovica CaricicNo ratings yet

- Arin Sal - JUN - 2022Document1 pageArin Sal - JUN - 2022Amit AgarwalNo ratings yet

- Wanoi General StoreDocument1 pageWanoi General Storeatifah3322No ratings yet

- 11) Aug 2023Document1 page11) Aug 2023incred.digitalNo ratings yet

- ReportDocument1 pageReportPriyanka DodkeNo ratings yet

- Nov PayslipDocument1 pageNov PayslipParth BeriNo ratings yet

- KPMG Pay Slip 91430 Dec 2022Document1 pageKPMG Pay Slip 91430 Dec 2022parulrayatprNo ratings yet

- Jan Pay SlipDocument1 pageJan Pay SlipParth BeriNo ratings yet

- Payslip DEC 1134101Document1 pagePayslip DEC 1134101Trusha BagweNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- GRD 12v2 4. Human Capital Page 45 To 65Document42 pagesGRD 12v2 4. Human Capital Page 45 To 65Rolandi ViljoenNo ratings yet

- Measures For Industrial PeaceDocument24 pagesMeasures For Industrial PeaceHimanshu BandilNo ratings yet

- PRe Departmental ReviwersDocument7 pagesPRe Departmental ReviwersCañon, Lorenz GeneNo ratings yet

- Business Studies: Paper 7115/01 Paper 1Document6 pagesBusiness Studies: Paper 7115/01 Paper 1mstudy123456No ratings yet

- Revenue Regulations No. 3-98 - Fringe Benefit TaxDocument14 pagesRevenue Regulations No. 3-98 - Fringe Benefit TaxRaiza Radoc100% (1)

- Hotel Manager EdpDocument6 pagesHotel Manager Edpapi-251814364No ratings yet

- Amendments To Ias 19 Employee BenefitsDocument8 pagesAmendments To Ias 19 Employee BenefitsRaymond S. PacaldoNo ratings yet

- HRMC Company Overview - Power PointDocument59 pagesHRMC Company Overview - Power PointLisa CappsNo ratings yet

- Developed By-Office Automation Division, IIT Kanpur Page No.1Document2 pagesDeveloped By-Office Automation Division, IIT Kanpur Page No.1Kishan OmarNo ratings yet

- Reward and Compensation SystemDocument5 pagesReward and Compensation SystemPaul ValbarezNo ratings yet

- BAr QsDocument16 pagesBAr QsCJNo ratings yet

- International Outsourcing Law and PracticeDocument135 pagesInternational Outsourcing Law and Practicejosiah9_5No ratings yet

- P6 SMART Notes Till 03.25Document61 pagesP6 SMART Notes Till 03.25Ali AhmedNo ratings yet

- CBDT - E-Filing - ITR 4 - Validation Rules - V 1.0Document16 pagesCBDT - E-Filing - ITR 4 - Validation Rules - V 1.0Kuldeep JatNo ratings yet

- Qureshi Debt Collection AgencyDocument14 pagesQureshi Debt Collection AgencyHammad SaeedNo ratings yet

- SER Memo 11 27 17Document8 pagesSER Memo 11 27 17Adam BelzNo ratings yet

- Payroll Enabling HRDocument212 pagesPayroll Enabling HRsagarthegame50% (2)

- HR AkankshaDocument55 pagesHR AkankshaNishkarsh JainNo ratings yet

- Notes On LTA, Car Lease and Home InternetDocument3 pagesNotes On LTA, Car Lease and Home InternetRiu TypoNo ratings yet

- Bus Math Grade 11 Q2 M2 W4Document6 pagesBus Math Grade 11 Q2 M2 W4Ronald AlmagroNo ratings yet

- Handbook DOLEDocument66 pagesHandbook DOLEMisael Membreve100% (1)

- IAS 19 Employee BenefitDocument20 pagesIAS 19 Employee BenefitAklilNo ratings yet

- AFM Case StudyDocument22 pagesAFM Case StudyVinit JainNo ratings yet

- E-Notes Class & Section: Ba LLB A+B+C Vii/Bba LLB A+B+C Vii Subject Name: Tax Law Subject Code: LLB 403 Faculty: Mr. Sunil KumarDocument10 pagesE-Notes Class & Section: Ba LLB A+B+C Vii/Bba LLB A+B+C Vii Subject Name: Tax Law Subject Code: LLB 403 Faculty: Mr. Sunil KumarRaksha AroraNo ratings yet

- Employee Leave TrackerDocument16 pagesEmployee Leave TrackerWahyudi SantosoNo ratings yet