Professional Documents

Culture Documents

Rental Income Worksheet Principal Residence, 2-To 4-Unit Property: Monthly Qualifying Rental Income

Rental Income Worksheet Principal Residence, 2-To 4-Unit Property: Monthly Qualifying Rental Income

Uploaded by

maemae1229Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Rental Income Worksheet Principal Residence, 2-To 4-Unit Property: Monthly Qualifying Rental Income

Rental Income Worksheet Principal Residence, 2-To 4-Unit Property: Monthly Qualifying Rental Income

Uploaded by

maemae1229Copyright:

Available Formats

Rental Income Worksheet

Principal Residence, 2- to 4-unit Property: Monthly Qualifying Rental Income

Address of Principal Residence:

Documentation Required:

§ Schedule E (IRS Form 1040) OR

§ Lease Agreement or Fannie Mae Form 1007 or Form 1025 Rental Unit Rental Unit Rental Unit

Enter

Step 1. When using Schedule E, determine the number of months the property was in service by dividing the Fair Rental Days by 30.

If Fair Rental Days are not reported, the property is considered to be in service for 12 months unless there is evidence of a shorter term of service.

Step 1. Result: The number of months the property was in service: Result

Step 2. Calculate monthly qualifying rental income using Step 2A: Schedule E OR Step 2B: Lease Agreement or Fannie Mae Form 1025.

Step 2 A. Schedule E - Part I For each property complete ONLY 2A or 2B

Enter total rents received (from the non-owner-occupied units). May enter rent from

A1 individual unit(s) or combine. Enter

A2 Subtract total expenses. Subtract

A3 Add back insurance expense. Add

A4 Add back mortgage interest paid. Add

A5 Add back tax expense. Add

Add back homeowners’ association dues. This expense must be specifically identified on

A6 Schedule E in order to add it back. Add

A7 Add back depreciation expense or depletion. Add

Add back any one-time extraordinary expense (e.g., casualty loss). There must be evidence

A8 of the nature of the one-time extraordinary expense. Add

Equals adjusted rental income. Total 0 0 0

A9 Divide by the number of months the property was in service (Step 1 Result). Divide 0 0 0

Step 2A. Result: Monthly qualifying rental income (or loss): Result 0 0 0

Step 2B. Lease Agreement OR Fannie Mae Form 1025 For each property complete ONLY 2A or 2B

This method is used when the transaction is a purchase, the property was acquired subsequent to the most recent tax filing.

B1 Enter the gross monthly rent (from the lease agreement) or market rent (from Form Enter

1025) for the applicable rental unit

B2 Multiply gross monthly rent or market rent by 75% (.75). The remaining 25% accounts for

vacancy loss, maintenance, and management expenses.

Multiply x.75 x.75 x.75

Equals monthly rental income per unit Total 0 0 0

Combine the monthly rental income of all non-owner-occupied rental units (up to a

maximum of 3 rental units since rental income is not eligible on the unit occupied by the

B3 borrower). Add 0

Step 2B. Result: Monthly qualifying rental income: Result 0

Step 3. Determine the qualifying impact using the combined result of Step 2A or Step 2B.

3A Add the monthly qualifying rental income to the borrower’s monthly qualifying income.

0

3B Identify the full amount of the PITIA as the borrower’s primary housing expense

and include it in the debt-to-income ratio.

Use proposed PITIA when the subject property; existing PITIA when not the subject property.

DU Data Entry Monthly Income and Combined Housing Expenses Mortgage Liabilities

Subject Property Enter the amount of the monthly qualifying income “Subject Net Cash.” Include as the borrower’s primary housing

expense. For refinance transactions, identify the

mortgage as a subject property lien.

Enter the amount of the monthly qualifying income “Net Rental.” Include as the borrower’s primary housing

Non-Subject expense.

Property

Refer to the Rental Income topic in the Selling Guide for additional guidance.

Fannie Mae Form 1037 02/23/16

You might also like

- What Every Real Estate Investor Needs to Know About Cash Flow... And 36 Other Key Financial Measures, Updated EditionFrom EverandWhat Every Real Estate Investor Needs to Know About Cash Flow... And 36 Other Key Financial Measures, Updated EditionRating: 4.5 out of 5 stars4.5/5 (15)

- AnnuitiesDocument172 pagesAnnuitiespronto2347100% (1)

- Result Step 1. ResultDocument1 pageResult Step 1. ResultKalyan YadavNo ratings yet

- Income From House Property PDFDocument7 pagesIncome From House Property PDFGiri SukumarNo ratings yet

- Income From House PropertyDocument17 pagesIncome From House PropertySourav MahadiNo ratings yet

- Income From House Property: Section/Rule Subject MatterDocument21 pagesIncome From House Property: Section/Rule Subject Matterphanidhar varanasiNo ratings yet

- Unit 8 PDFDocument19 pagesUnit 8 PDFAsar QabeelNo ratings yet

- Income Tax 20220119Document56 pagesIncome Tax 20220119asadazhar002No ratings yet

- Income From House Property: Section/Rule Subject MatterDocument29 pagesIncome From House Property: Section/Rule Subject MatterRajesh NangaliaNo ratings yet

- House Property NotesDocument38 pagesHouse Property Notesshriram bhatNo ratings yet

- Final 2,4 ADocument5 pagesFinal 2,4 Anegegav596No ratings yet

- Gross Income From Business and ProfessionDocument5 pagesGross Income From Business and ProfessionGene Lorenzo SalonNo ratings yet

- EA EA1 SU2 OutlineDocument23 pagesEA EA1 SU2 OutlineAashu AntilNo ratings yet

- Chapter 3 Case V-Irish Rental IncomeDocument9 pagesChapter 3 Case V-Irish Rental IncomegerlaniamelgacoNo ratings yet

- House Property IncomeDocument21 pagesHouse Property IncomekhNo ratings yet

- 02 House Property Notes 23Document14 pages02 House Property Notes 23Hritik HarlalkaNo ratings yet

- US Internal Revenue Service: f8860 - 2000Document2 pagesUS Internal Revenue Service: f8860 - 2000IRSNo ratings yet

- HP and PGBP PDFDocument106 pagesHP and PGBP PDFRavi YadavNo ratings yet

- Special Liabilities San Carlos CollegeDocument23 pagesSpecial Liabilities San Carlos CollegeRowbby Gwyn100% (1)

- Tax HandoutDocument6 pagesTax Handoutshekharsuhani5No ratings yet

- House PropertyDocument18 pagesHouse PropertyNidhi LathNo ratings yet

- Income From House Property Notes For CA CSCMA StudentsDocument28 pagesIncome From House Property Notes For CA CSCMA StudentsSantosh Chavan100% (1)

- TAX 2202E TBS02 02.solutionDocument3 pagesTAX 2202E TBS02 02.solutionZhitong LuNo ratings yet

- S021 - Haroon Shaik DIT AssignmentDocument10 pagesS021 - Haroon Shaik DIT AssignmentHaroonNo ratings yet

- Module 2 - Completing The Accounting CycleDocument45 pagesModule 2 - Completing The Accounting CycleShane TorrieNo ratings yet

- Rental - English 2022-23Document4 pagesRental - English 2022-23Crispus SaviaNo ratings yet

- US Internal Revenue Service: f8860 - 1999Document2 pagesUS Internal Revenue Service: f8860 - 1999IRSNo ratings yet

- AASB 16 Check: Are Outgoings Recognised On Balance Sheet?Document4 pagesAASB 16 Check: Are Outgoings Recognised On Balance Sheet?Puneet SharmaNo ratings yet

- II. Income Under The House Properties :: Basis of Charge Section 22Document4 pagesII. Income Under The House Properties :: Basis of Charge Section 22Akash Singh RajputNo ratings yet

- Income From House PropertyDocument7 pagesIncome From House PropertyDivya KakranNo ratings yet

- IntAcc 2 - CHAPTER 13 NotesDocument5 pagesIntAcc 2 - CHAPTER 13 NotesikiNo ratings yet

- Closing Entries, Worksheet, Post Closing Trial BalanceDocument12 pagesClosing Entries, Worksheet, Post Closing Trial BalanceHendra SetiyawanNo ratings yet

- 1491816804house Property, Othersources, Salary, Clubbing, Setoff, Tax Planning PDFDocument168 pages1491816804house Property, Othersources, Salary, Clubbing, Setoff, Tax Planning PDFPranav PuriNo ratings yet

- Exercise Accruals Adjusting EntriesDocument3 pagesExercise Accruals Adjusting EntriesNatalie Irish VillanuevaNo ratings yet

- Ch. 6Document11 pagesCh. 6Ali nawazNo ratings yet

- Cae05-Chapter 8 Leases Problem DiscussionDocument22 pagesCae05-Chapter 8 Leases Problem Discussioncris tellaNo ratings yet

- Adj. EntriesDocument41 pagesAdj. EntriesElizabeth Espinosa Manilag100% (2)

- A Case Study: House Property Under Income Tax, Wealth Tax and FEMADocument8 pagesA Case Study: House Property Under Income Tax, Wealth Tax and FEMAManoj Nikumbh MKNo ratings yet

- Income Under The Head House Property2Document80 pagesIncome Under The Head House Property2bhuvana600048No ratings yet

- Income From House Property 12th July 23Document39 pagesIncome From House Property 12th July 23Ashish KumarNo ratings yet

- U I T U: Module 33 Taxes I Divi UALDocument1 pageU I T U: Module 33 Taxes I Divi UALAnonymous JqimV1ENo ratings yet

- Property IncomeDocument75 pagesProperty IncomeAwaiZ zahidNo ratings yet

- HUMTUM15 TH AugDocument2 pagesHUMTUM15 TH AugSushil_Pandey_4297No ratings yet

- Income From House PropertyDocument32 pagesIncome From House PropertyhanumanthaiahgowdaNo ratings yet

- Project House PropertyDocument35 pagesProject House PropertyishichadhaNo ratings yet

- Income From Property Part2Document8 pagesIncome From Property Part2aisha jabeenNo ratings yet

- Rental Properties 2021: Guide For Rental Property OwnersDocument52 pagesRental Properties 2021: Guide For Rental Property Ownersuly01 cubillaNo ratings yet

- Sas Certified Accounting Technician Level 1 Module 2Document29 pagesSas Certified Accounting Technician Level 1 Module 2Plame GaseroNo ratings yet

- Unang Pahina Far LiabilitiesDocument41 pagesUnang Pahina Far LiabilitiesNadin Olga SemiraNo ratings yet

- Recapture of Investment Credit: PropertiesDocument2 pagesRecapture of Investment Credit: PropertiesIRSNo ratings yet

- ACCT 6011 Assignment #2 Template W21Document5 pagesACCT 6011 Assignment #2 Template W21patel avaniNo ratings yet

- House Property - Summary (PY 2020-21 AY 2021-22)Document5 pagesHouse Property - Summary (PY 2020-21 AY 2021-22)Aruna RajappaNo ratings yet

- BCom Business Taxation Income Tax and Sales Tax Numerical 2018Document5 pagesBCom Business Taxation Income Tax and Sales Tax Numerical 2018AHSAN LASHARINo ratings yet

- Rental Income and Expenses 2021Document2 pagesRental Income and Expenses 2021Finn KevinNo ratings yet

- Investment Declaration ManualDocument10 pagesInvestment Declaration ManualAbhinav VivekNo ratings yet

- Fabm1 PPT Q2W1Document62 pagesFabm1 PPT Q2W1giselle100% (1)

- Unit II Lesson 5 and 6 ADJUSTING ENTRIES and FSDocument25 pagesUnit II Lesson 5 and 6 ADJUSTING ENTRIES and FSAlezandra SantelicesNo ratings yet

- Fundamentals of Accountancy Business and Management 1 11 FourthDocument4 pagesFundamentals of Accountancy Business and Management 1 11 FourthPaulo Amposta CarpioNo ratings yet

- Real Estate investing: 2 books in 1: Create Passive Income with Real Estate, Reits, Tax Lien Certificates and Residential and Commercial Apartment Rental Property InvestmentsFrom EverandReal Estate investing: 2 books in 1: Create Passive Income with Real Estate, Reits, Tax Lien Certificates and Residential and Commercial Apartment Rental Property InvestmentsNo ratings yet

- Rental-Property Profits: A Financial Tool Kit for LandlordsFrom EverandRental-Property Profits: A Financial Tool Kit for LandlordsNo ratings yet

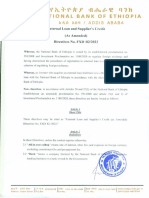

- Commercial Banking System and Role of RBI - Assignment April 2023 BZesppk7IEDocument7 pagesCommercial Banking System and Role of RBI - Assignment April 2023 BZesppk7IERohit GambhirNo ratings yet

- Company Rescue Under UK Administration and US Chapter 11Document4 pagesCompany Rescue Under UK Administration and US Chapter 11vidovdan9852No ratings yet

- Your Credit Rating/Loan Eligibility Across The Industry For The Purpose of Obtaining Future CreditDocument2 pagesYour Credit Rating/Loan Eligibility Across The Industry For The Purpose of Obtaining Future CreditAditya AgrawalNo ratings yet

- Wa0084Document3 pagesWa0084akshay chauhanNo ratings yet

- Credit Card Debt Assignment Josh ButlerDocument3 pagesCredit Card Debt Assignment Josh Butlerapi-242789076No ratings yet

- Account Statement 08-04-2023T14 30 46Document2 pagesAccount Statement 08-04-2023T14 30 46Haanain AliNo ratings yet

- Cibil RetailDocument14 pagesCibil Retailchristous p kNo ratings yet

- Singapore To Take Over Sports Hub PPPDocument7 pagesSingapore To Take Over Sports Hub PPPLouis LagierNo ratings yet

- PaySlip Sept 21Document1 pagePaySlip Sept 21pesona mawarNo ratings yet

- 27SEP19 Brought Forward 1,847.12: Date of Issue: Account TypeDocument4 pages27SEP19 Brought Forward 1,847.12: Date of Issue: Account Typeprestigepaintsgh0No ratings yet

- Chapter 09 (Financial Institute and Market)Document33 pagesChapter 09 (Financial Institute and Market)Mega_ImranNo ratings yet

- Webnotice - Po - MT CRP Xii 2024-25Document15 pagesWebnotice - Po - MT CRP Xii 2024-25arunkumarNo ratings yet

- FXD 82 22Document7 pagesFXD 82 22Pal FriendNo ratings yet

- Action Required - Your Credit Card Is Now ClosedDocument1 pageAction Required - Your Credit Card Is Now Closed7fmjtb9k2kNo ratings yet

- Accounting SSIP Grade 11 + 12Document272 pagesAccounting SSIP Grade 11 + 12ayavuyancoko14No ratings yet

- Wise Transaction Invoice Transfer 720336148 1271654884 PTDocument2 pagesWise Transaction Invoice Transfer 720336148 1271654884 PTruizitoxNo ratings yet

- Ibanking Laws Preweek Handout Number 69Document2 pagesIbanking Laws Preweek Handout Number 69John DoeNo ratings yet

- Declared Profit Rates General Pool (LCYFCY) For The Month of June 2023Document4 pagesDeclared Profit Rates General Pool (LCYFCY) For The Month of June 2023ammadbutt132No ratings yet

- Module2 EconDocument45 pagesModule2 EconandreslloydralfNo ratings yet

- Sample Computation (A & B Lots of 750 SQM.)Document2 pagesSample Computation (A & B Lots of 750 SQM.)iquotientsolutionsNo ratings yet

- The BCC Compounding Machine!: Amout Left After ReinvestDocument144 pagesThe BCC Compounding Machine!: Amout Left After ReinvestSathish AmiresiNo ratings yet

- MayaSavings SoA 2023OCTDocument17 pagesMayaSavings SoA 2023OCTfitdaddyphNo ratings yet

- Income Tax Numericals For PracticeDocument3 pagesIncome Tax Numericals For PracticeAdil MalikNo ratings yet

- 2019 10-08 OTHERS - Top 100 Stockholders 2019-Q3Document5 pages2019 10-08 OTHERS - Top 100 Stockholders 2019-Q3Kenneth ShiNo ratings yet

- Everyday Banking Easy Read GuideDocument28 pagesEveryday Banking Easy Read Guidem.r.sathi1506No ratings yet

- ch20 Wiley On Pension Benefits - ExerDocument6 pagesch20 Wiley On Pension Benefits - ExerMelisa TariganNo ratings yet

- Bases of Credit and Credit Investigation AppraisalDocument14 pagesBases of Credit and Credit Investigation AppraisalLaraya, Roy MatthewNo ratings yet

- Ashok KumarDocument2 pagesAshok Kumarapexlofi93421100% (1)

- Credit Limit Inc ReqDocument2 pagesCredit Limit Inc Reqmatt luiNo ratings yet