Professional Documents

Culture Documents

ING Think Rising Rice Energy Prices in Philippines Fuel Inflation Concerns

ING Think Rising Rice Energy Prices in Philippines Fuel Inflation Concerns

Uploaded by

kimjayCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ING Think Rising Rice Energy Prices in Philippines Fuel Inflation Concerns

ING Think Rising Rice Energy Prices in Philippines Fuel Inflation Concerns

Uploaded by

kimjayCopyright:

Available Formats

THINK economic and financial analysis

Article | 29 August 2023 Philippines

Rising rice and energy prices in the

Philippines fuel inflation concerns

The 'crucial 3': will the return of rice and energy price spikes delay

Bangko Sentral ng Pilipinas’ easing plans?

Bags of rice at a

market in Manila,

Philippines

Philippine inflation on the downtrend... for now

Philippine inflation hit a peak of 8.7% year-on-year in January 2023, driven by a mix of resurgent

domestic demand and elevated global commodity prices. Inflation has since moderated to

4.7%YoY as of July.

A string of aggressive monetary tightening (rate hikes totalling 425bp) on top of moderating global

energy prices helped nudge the inflation path towards the Bangko Sentral ng Pilipinas’ (BSP's)

inflation target of 2-4%. The BSP projects inflation will settle back within target by the fourth

quarter.

However, recent developments could derail the current slowdown, particularly with price pressures

for key commodities flaring up again.

Article | 29 August 2023 1

THINK economic and financial analysis

Rice, transport and power = the crucial three

Past episodes of high inflation in the Philippines have been driven in large part by supply-side

issues. Local rice production is inadequate to meet domestic demand and so the country relies on

imports of the grain from neighbouring economies. The Philippines also depends on imported

energy for power generation and transport, highlighting how vulnerable the economy is to sharp

fluctuations in global energy prices.

We have identified three key items in the CPI basket, namely rice, electricity and transport, which

combined account for 23.41% of the total. For the most recent inflation episode, the crucial

three accounted for 41% of inflation for 2022, highlighting the importance of stabilising price

movements for these key commodities.

Given their weight in the CPI basket and the country’s dependence on imports of rice and energy,

any sharp upticks for the so-called “crucial 3” could spell a renewed flareup for Philippine inflation.

The 'crucial 3' for Philippine inflation: rice, transport and

electricity

Source: Philippine Statistics Authority

It’s not a meal without rice

Rice is the main staple in the Philippines and meals are not considered a “full meal” without it. This

fact is reflected in the 9.6% weight of rice in the CPI basket. Crop damage from storms or inclement

weather has forced the Philippines to import more of the staple to shore up supply in the

past. Developments in 2023 cloud the domestic production outlook with the onset of the El Niño

weather phenomenon on top of the recent export ban from India.

Legislation passed in 2019 (RA 11203) removed quotas on rice importation, which in theory could

help augment domestic supplies, however the Philippines could face elevated import costs given

the impact of El Niño on rice exporters and the India rice export ban. Rice inflation recently moved

past the target (4.2%YoY) and could increasingly become a concern should supply conditions

tighten further in the coming months.

Article | 29 August 2023 2

THINK economic and financial analysis

Philippines reliant on rice imports

Source: Philippine Statistics Authority

Energy dependent

On top of being dependent on rice imports, the Philippines is also dependent on energy imports for

power generation and transportation. Transport and electricity have substantial weights in the CPI

basket, at 9.02 points and 4.8 points respectively. The spike in global energy prices in 2022 was one

of the key drivers for inflation with transport and electricity registering inflation of 12.9%YoY and

18.5%YoY.

The recent resurgence in global energy prices due to developments in Ukraine and production cuts

has resulted in higher Philippine domestic pump prices. This development should eventually filter

through to higher electricity costs with 13.5% of power generation driven by oil-based power

plants.

Furthermore, high inflation for transportation and electricity often results in second-round

effects. Expensive transport and electricity costs could fuel an increase in prices for items that

require transport and electricity in production, resulting in even more price pressures.

'Crucial 3' inflation spike to complicate BSP’s plan to ease?

BSP recently hinted at a potential policy reversal by the first quarter of 2024, pointing to forecasts

where inflation would be well within target by that time.

The BSP is an inflation-targeting central bank with the goal of keeping inflation within the band of

2-4%. Recent tightening episodes were in 2014, 2018 and 2022 with BSP hiking rates to deal with

price spikes induced by rising costs for rice and energy.

The recent uptick in rice prices coupled with the resurgence in global energy costs could spark

renewed price pressures and prevent headline inflation from settling well within the BSP’s inflation

target band. We had originally pencilled in a BSP rate cut by the first quarter of next year given the

disappointing second-quarter GDP report. However, if we continue to see rice and energy prices

tick higher in the coming months, we could see BSP delaying its planned easing to mid-2024.

Article | 29 August 2023 3

THINK economic and financial analysis

BSP could delay rate cuts should inflation flare up again

Source: Philippine Statistics Authority and BSP

Author

Nicholas Mapa

Senior Economist, Philippines

nicholas.antonio.mapa@asia.ing.com

Disclaimer

This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information

purposes without regard to any particular user's investment objectives, financial situation, or means. ING forms part of ING Group

(being for this purpose ING Group N.V. and its subsidiary and affiliated companies). The information in the publication is not an

investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial

instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING

does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss

arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s),

as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose

possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person

for any purpose without the prior express consent of ING. All rights are reserved. ING Bank N.V. is authorised by the Dutch Central

Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial

Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam). In the United Kingdom

this information is approved and/or communicated by ING Bank N.V., London Branch. ING Bank N.V., London Branch is authorised by

the Prudential Regulation Authority and is subject to regulation by the Financial Conduct Authority and limited regulation by the

Prudential Regulation Authority. ING Bank N.V., London branch is registered in England (Registration number BR000341) at 8-10

Moorgate, London EC2 6DA. For US Investors: Any person wishing to discuss this report or effect transactions in any security

discussed herein should contact ING Financial Markets LLC, which is a member of the NYSE, FINRA and SIPC and part of ING, and

which has accepted responsibility for the distribution of this report in the United States under applicable requirements.

Additional information is available on request. For more information about ING Group, please visit http://www.ing.com.

Article | 29 August 2023 4

You might also like

- Chapter 2 Review of Related LiteratureDocument11 pagesChapter 2 Review of Related LiteratureKharylle Cambel100% (1)

- ING Direct Case Study AnaysisDocument7 pagesING Direct Case Study AnaysisAbby Leigh GrabitzNo ratings yet

- Economics Kensian Macro EconomicsDocument4 pagesEconomics Kensian Macro EconomicsHohaho YohahaNo ratings yet

- Ecoman Final Paper s130367 Armado AvegailDocument21 pagesEcoman Final Paper s130367 Armado AvegailAbby ArmadoNo ratings yet

- Econometrics Project (Hu 351) Inflation With Covid Consumption Baskets Under Supervision of Prof. Seema SinghDocument17 pagesEconometrics Project (Hu 351) Inflation With Covid Consumption Baskets Under Supervision of Prof. Seema SinghAviral YadavNo ratings yet

- Ap AssignmentDocument2 pagesAp AssignmentReighn DilaoNo ratings yet

- Article Related To Stat With ReflectionDocument3 pagesArticle Related To Stat With ReflectionRyan OriasNo ratings yet

- PWC Philippines M&A Challenge Preliminary Round: November 06, 2020Document22 pagesPWC Philippines M&A Challenge Preliminary Round: November 06, 2020Mary Anne JamisolaNo ratings yet

- Philippine Taxation-Case StudyDocument5 pagesPhilippine Taxation-Case StudyedrickgodwinsantosNo ratings yet

- Macroeconomic Overview of The Philippines and The New Industrial PolicyDocument18 pagesMacroeconomic Overview of The Philippines and The New Industrial PolicyGwyneth ValdezNo ratings yet

- MPS Aug 2022 EngDocument3 pagesMPS Aug 2022 EngHassaan AhmedNo ratings yet

- Philippines Economic Update October 2019Document4 pagesPhilippines Economic Update October 2019Violet PandaNo ratings yet

- Guevarra, Jeremie C. - Reflection PaperDocument5 pagesGuevarra, Jeremie C. - Reflection Paperjeremie guevarraNo ratings yet

- Article On Year End Assessment OCE PS SBED2Document13 pagesArticle On Year End Assessment OCE PS SBED2Zayrel CasiromanNo ratings yet

- Terminal ReportDocument3 pagesTerminal ReportVince YuNo ratings yet

- 4&5 Assignment Haseeb 1811283Document5 pages4&5 Assignment Haseeb 1811283Haseeb RehmanNo ratings yet

- Mba 324 Diokno On The Economic Growth of The CountryDocument3 pagesMba 324 Diokno On The Economic Growth of The CountryMark Joseph SoreNo ratings yet

- Economic Growth of The PhilippinesDocument3 pagesEconomic Growth of The Philippinesana villaflorNo ratings yet

- Avanti SDocument15 pagesAvanti Skimice5490No ratings yet

- (EN) Bank of Japan - Outlook For Economic Activity and Prices January 2023Document60 pages(EN) Bank of Japan - Outlook For Economic Activity and Prices January 2023Nguyễn TânNo ratings yet

- MACRO IA New OneDocument7 pagesMACRO IA New OneManraj SandhuNo ratings yet

- Narrative Report ExampleDocument2 pagesNarrative Report Examplehiraeth.naharaNo ratings yet

- Inflation Feared With Gov't Directive On RiceDocument6 pagesInflation Feared With Gov't Directive On RiceTheRichmondKidNo ratings yet

- Terminal ReportDocument3 pagesTerminal ReportGOTINGA, CHRISTIAN JUDE AVELINONo ratings yet

- Resilience Through ReformsDocument3 pagesResilience Through ReformsAnthony EtimNo ratings yet

- Ii. Market ConditionsDocument5 pagesIi. Market ConditionsRicarr ChiongNo ratings yet

- IBF 3rd ModuleDocument11 pagesIBF 3rd ModuleMuhammad Azlan TehseenNo ratings yet

- Inflation in 2022Document2 pagesInflation in 2022Lea Moureen KaibiganNo ratings yet

- Group 09 - Macroeconomics ProjectDocument25 pagesGroup 09 - Macroeconomics ProjectsrishtiNo ratings yet

- Crack Grade B: Asian Development OutlookDocument10 pagesCrack Grade B: Asian Development OutlookShubhendu VermaNo ratings yet

- Group 2 Research PresentationDocument24 pagesGroup 2 Research PresentationBeejayNo ratings yet

- Pak China GDP ComparisonDocument10 pagesPak China GDP ComparisonIshaNo ratings yet

- AnalysisDocument4 pagesAnalysisSALLAN JEROME J.No ratings yet

- FTMM2022 374 379Document6 pagesFTMM2022 374 379Nguyen NgocvyNo ratings yet

- Econdev IoDocument22 pagesEcondev IoGumafelix, Jose Eduardo S.No ratings yet

- Aairah Pak Eco Assignment 1Document4 pagesAairah Pak Eco Assignment 1Laiba EjazNo ratings yet

- FICCI Economic Outlook Survey Jan 2011Document18 pagesFICCI Economic Outlook Survey Jan 2011Ashish KumarNo ratings yet

- My Conspect About WoirldDocument41 pagesMy Conspect About Woirldnurzhankamila45No ratings yet

- Assignment No.3: Course Title: Pakistan Today Course Code: Bahu 1043Document5 pagesAssignment No.3: Course Title: Pakistan Today Course Code: Bahu 1043Moater ImranNo ratings yet

- Monthly Economic Review July 2023 - 1Document26 pagesMonthly Economic Review July 2023 - 1H SNo ratings yet

- MANAGERIAL ECONOMICS AssignementDocument12 pagesMANAGERIAL ECONOMICS AssignementSuraj BanNo ratings yet

- Outlook of Bank of Japan Jan 2024Document11 pagesOutlook of Bank of Japan Jan 2024mrfastfuriousNo ratings yet

- 08 Trade and PaymentsDocument26 pages08 Trade and PaymentsMuhammad BilalNo ratings yet

- Nepal Macroeconomic Update 202309Document42 pagesNepal Macroeconomic Update 202309Saurabh ZhaaNo ratings yet

- Pakistan Battles InflationDocument2 pagesPakistan Battles InflationAreesh ZubairNo ratings yet

- 08 Trade and PaymentsDocument27 pages08 Trade and PaymentsMuhammad BilalNo ratings yet

- The Economy and The Demand Side: Macroeconomic and Industry Analysis Macroeconomic AnalysisDocument21 pagesThe Economy and The Demand Side: Macroeconomic and Industry Analysis Macroeconomic AnalysisJohn Paul SiodacalNo ratings yet

- Elevated Inflation Threatens To Slow PH Recovery, Says Amro: News ValueDocument3 pagesElevated Inflation Threatens To Slow PH Recovery, Says Amro: News ValueMaria Rizza IlaganNo ratings yet

- ADB Maintains 2021 Forecast For Philippine EconomyDocument6 pagesADB Maintains 2021 Forecast For Philippine EconomyGISELLE MAE QUIÑONESNo ratings yet

- Code927 Week8 Learning-Task BalaganDocument6 pagesCode927 Week8 Learning-Task BalaganKuroko TetsuyaNo ratings yet

- Pre-SONA July 8Document11 pagesPre-SONA July 8LouiseNo ratings yet

- Economic Status of The PhilippinesDocument3 pagesEconomic Status of The Philippinesmondala.ayamae.aNo ratings yet

- Ing Think Asia Philippines Economy Losing Steam Going Into 2021Document5 pagesIng Think Asia Philippines Economy Losing Steam Going Into 2021api-535558346No ratings yet

- 1Q19 Highlights - PhilippinesDocument2 pages1Q19 Highlights - Philippinesbernadinebautista25No ratings yet

- What Is Your 2021 GDP Outlook For The Philippines and Korea Given The Development of The COVID Vaccine?Document3 pagesWhat Is Your 2021 GDP Outlook For The Philippines and Korea Given The Development of The COVID Vaccine?Mark Lance Eldrick SantosNo ratings yet

- Monetary Policy Report - CanadaDocument12 pagesMonetary Policy Report - CanadaHeenaNo ratings yet

- Key Developments Since The Last MPC Statement: Tate Ank of AkistanDocument2 pagesKey Developments Since The Last MPC Statement: Tate Ank of AkistanWaqaarNo ratings yet

- Me Group 3Document15 pagesMe Group 3Subin KNo ratings yet

- High Food Prices and Below-Average Incomes Disrupt Access To Food in Southern MalawiDocument7 pagesHigh Food Prices and Below-Average Incomes Disrupt Access To Food in Southern MalawiJack NyirendaNo ratings yet

- 1 DrishtiDocument23 pages1 DrishtiNeeraj KumarNo ratings yet

- Bangladesh Quarterly Economic Update: September 2014From EverandBangladesh Quarterly Economic Update: September 2014No ratings yet

- Project On Kotak Mahindra BankDocument67 pagesProject On Kotak Mahindra BankMitesh ShahNo ratings yet

- Roba Metals LC - A1Document2 pagesRoba Metals LC - A1Karan ShahNo ratings yet

- GreatX - Report - Talent Trends 2022Document51 pagesGreatX - Report - Talent Trends 2022Ahmad Edwi NurmahadikaNo ratings yet

- Current Affairs 01jan2013 To 07-Aug-2013Document141 pagesCurrent Affairs 01jan2013 To 07-Aug-2013Gangadri524No ratings yet

- ING-Vysya Summer Training ReportDocument112 pagesING-Vysya Summer Training Reportmukhargoel9096No ratings yet

- 4Q FY2022 Profile PresentationDocument10 pages4Q FY2022 Profile PresentationBeing FlightAttendantNo ratings yet

- Customer Relationship Management On Retail Banking. On ING BANKDocument63 pagesCustomer Relationship Management On Retail Banking. On ING BANKNilesh SahuNo ratings yet

- IJGlobal Magazine - Summer 2021 Issue - 8889f0Document162 pagesIJGlobal Magazine - Summer 2021 Issue - 8889f0Bhavik PrajapatiNo ratings yet

- Internship Report On Islami Bank LimitedDocument66 pagesInternship Report On Islami Bank LimitednaimenimNo ratings yet

- Belgian Economic Mission To Malaysia and Singapore 2014 Participants BrochureDocument204 pagesBelgian Economic Mission To Malaysia and Singapore 2014 Participants BrochureAlif AdnanNo ratings yet

- IcicibankDocument2 pagesIcicibankRohit PrasadNo ratings yet

- Market Analysis of Icici Prudential and Other Insurance-Companies (MARKAT)Document68 pagesMarket Analysis of Icici Prudential and Other Insurance-Companies (MARKAT)NationalinstituteDsnrNo ratings yet

- Romania 2013Document11 pagesRomania 2013Emilia StoicaNo ratings yet

- SEEM3630 Service Management Fall 2021 Group ProjectsDocument4 pagesSEEM3630 Service Management Fall 2021 Group ProjectsMarkNo ratings yet

- Acc Oount Statement Ra PortDocument6 pagesAcc Oount Statement Ra PortAlexandru GradinaruNo ratings yet

- Val IT 2.0Document43 pagesVal IT 2.0Hilsen Castañeda SantosNo ratings yet

- Orange Everyday Statement: Free AtmsDocument2 pagesOrange Everyday Statement: Free AtmssaNo ratings yet

- Belgia AbatoareDocument44 pagesBelgia AbatoareSzala LukeNo ratings yet

- Kotak Mahindra StrategyDocument34 pagesKotak Mahindra StrategyShaddab AliNo ratings yet

- ING Bank: Căldărușe Andrei Cristian, Călin Angela Alexandra, REI An 3, 943, ADocument3 pagesING Bank: Căldărușe Andrei Cristian, Călin Angela Alexandra, REI An 3, 943, AAngela A. CălinNo ratings yet

- Merger - Kotak ING1.1Document23 pagesMerger - Kotak ING1.1kalpesh bhagneNo ratings yet

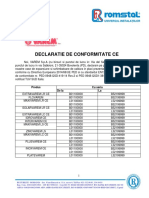

- Declaratie de Conformitate Ce: Cu Seria Produs de La LaDocument3 pagesDeclaratie de Conformitate Ce: Cu Seria Produs de La LaVasile Marian AdrianNo ratings yet

- Anubhav Tripathi CSPO ResumeDocument3 pagesAnubhav Tripathi CSPO ResumeNoor Mohd AzadNo ratings yet

- Birkisnhaw ING - Bank - Case - StudyDocument19 pagesBirkisnhaw ING - Bank - Case - StudyVicente MirandaNo ratings yet

- Advantages and Disadvantages of Bancassuranc1Document32 pagesAdvantages and Disadvantages of Bancassuranc1Kaleem MakkiNo ratings yet

- BE PPT Banks, CSR in BanksDocument34 pagesBE PPT Banks, CSR in Banksanju2091No ratings yet

- 2Q2022 Profile PresentationDocument10 pages2Q2022 Profile Presentationzaraki9No ratings yet

- Global Financial System BelgiumDocument40 pagesGlobal Financial System BelgiumBilal RajaNo ratings yet