Professional Documents

Culture Documents

3.15.5 Ab4e Supplementary - First Time Adoption

3.15.5 Ab4e Supplementary - First Time Adoption

Uploaded by

Mark Anthony B. Bacayo0 ratings0% found this document useful (0 votes)

0 views4 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

0 views4 pages3.15.5 Ab4e Supplementary - First Time Adoption

3.15.5 Ab4e Supplementary - First Time Adoption

Uploaded by

Mark Anthony B. BacayoCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 4

Appendix 3.15.

5

Ab4e

Prepared by: Date:

Client:

Reviewed by: Date:

Period:

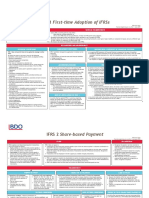

SUPPLEMENTARY CORPORATE DISCLOSURE CHECKLIST (IFRS)

~ Additional Disclosures for First Time Adopters of IFRS

Scope

This checklist should be completed for all entities that are adopting IFRS for the first time.

IFRS Reference Y/N/NA Comments

1 Comparative Information

IFRS 1.1 On first time adoption, comparative figures must be

1.6, 21 presented in accordance with IFRS subject to specific

exemptions and prohibitions contained within IFRS 1.

However, it is also necessary to present and disclose

the Statement of Financial Position at the transition

date.

Have comparatives (including two years comparatives for

the Statement of Financial Position) been disclosed in

accordance with IFRS 1?

IFRS 1.2 Where historical summaries or comparative information

1.22 using previous GAAP is shown (on a voluntary basis),

is:

This information prominently labelled as not being

prepared under IFRS; and

The nature of the main adjustments required to make it

comply with IFRS?

IFRS 1.3 If the entity did not present financial statements for the

1.28 previous period, has this been disclosed?

2 Explanation of Transition to IFRS

IFRS 2.1 Is an explanation provided explaining how the transition

1.23A from previous GAAP to IFRS affected the reported

financial performance, position and cash flows?

IFRS 2.2 If the entity applied IFRS historically (however, it did

1.23B, 4A not in the previous financial period, as it did not have an

explicit and unreserved statement of compliance) has it

disclosed:

The reason it stopped apply IFRS; and

The reason it is resuming the application of IFRS?

IFRS 2.3 In the situation noted in 2.2, if the entity elects not to

1.23B, 4A apply IFRS 1, has it explained the reasons for electing to

apply IFRS as if it had never stopped applying them?

Audit – Mar ‘20 App 3.15.5 / 1 of 4 04/18

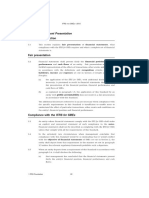

Appendix 3.15.5

Ab4e

IFRS Reference Y/N/NA Comments

3 Reconciliations

IFRS 3.1 Are the following disclosed:

1.24(a) Reconciliations to the entity’s equity reported under

previous GAAP to IFRS for the following dates:

The date of transition to IFRS; and

The end of the latest period presented under

previous GAAP;

IFRS A reconciliation of the last total comprehensive

1.24(b) income reported under previous GAAP to the total

comprehensive income shown for the same period

under IFRS?

IFRS These reconciliations must give sufficient detail to enable

1.25 the user to understand the material adjustment(s) to the

Statement of Financial Position and the Statement of

Comprehensive Income.

IFRS Errors made under previous GAAP and identified during

1.26 the transitional process must be distinguished from

transitional adjustments that relate to changes in

accounting policies.

IFRS 3.2 If the entity presented a Statement of Cash Flows under its

1.25 previous GAAP, has it explained the material adjustments

to the Statement of Cash Flows?

IFRS 3.3. If the entity recognised or reversed any impairment losses

1.24(c) for the first time in preparing its opening IFRS Statement

IAS 36

of Financial Position, have the disclosures that would

have been required if the entity had recognised these in

the period beginning with the date of transition to IFRS

been disclosed?

4 Where Interim Financial Statements have Already been Prepared under IFRS

IFRS 4.1 If, during the period covered by its first IFRS financial

1.27A statements, an entity changes its accounting policies or its

use of the exemptions contained within IFRS 1, has it

explained the changes between its first IFRS interim

financial report and its first IFRS financial statements, in

accordance with paragraph 23, and has it updated the

reconciliation required by paragraphs 24(a) and (b)?

Audit – Mar ‘20 App 3.15.5 / 2 of 4 04/18

Appendix 3.15.5

Ab4e

IFRS Reference Y/N/NA Comments

5 Designation of Financial Assets or Financial Liabilities

IFRS 5.1 If the entity is permitted to designate previously

1.29 recognised financial assets or liabilities at ‘fair value

through profit or loss’ or as ‘available-for-sale’, are the

following disclosed:

The fair value of any financial assets or liabilities

designated into each category (at the date of

designation); and

The classification and carrying amount in the previous

financial statements?

6 Use of Fair Value as Deemed Cost

IFRS 6.1 Property, Plant or Equipment, Investment Properties

1.30 or Intangibles

If fair value is used as deemed cost in the transitional

Statement of Financial Position, for any of the assets

noted above, do the financial statements disclose:

The aggregate of those fair values; and

The aggregate adjustment to the carrying amounts

reported under previous GAAP?

IFRS 6.2 Investments in Subsidiaries, Joint Ventures or

1.31 Associates

If fair value is used as deemed cost in the transitional

Statement of Financial Position (parent as opposed to

consolidated), for any of the assets noted above, do the

financial statements disclose:

The aggregate deemed cost of those investments for

which deemed cost is their previous GAAP carrying

amount;

The aggregate deemed cost of those investments for

which deemed cost is fair value; and

The aggregate adjustment to the carrying amounts

reported under previous GAAP?

IFRS 6.3 Oil and Gas Assets

1.31A

If an entity uses the exemptions in paragraph D8A(b) of

IFRS 1 for oil and gas assets, has it disclosed:

That fact; and

The basis on which carrying amounts determined

under previous GAAP were allocated?

Audit – Mar ‘20 App 3.15.5 / 3 of 4 04/18

Appendix 3.15.5

Ab4e

IFRS Reference Y/N/NA Comments

6 Use of Fair Value as Deemed Cost (Continued)

IFRS 6.4 Operations Subject to Rate Regulations

1.31B

If an entity uses the exemptions in paragraph D8B of

IFRS 1 for operations subject to rate regulations, has it

disclosed:

That fact; and

The basis on which carrying amounts determined

under previous GAAP were allocated?

IFRS 6.5 Severe Hyperinflation

1.31C

If an entity elects to measure assets and liabilities at fair

value and to use that fair value as deemed cost in its

opening IFRS Statement of Financial Position because of

severe hyperinflation, has it disclosed, how, and why the

entity had, and then ceased to have, a functional currency

that has both of the following characteristics:

A reliable general price index is not available to all

entities with transactions and balances in the

currency; and

Exchangeability between the currency and a relatively

stable foreign currency does not exist?

Audit – Mar ‘20 App 3.15.5 / 4 of 4 04/18

You might also like

- Demolition Cost EstimateDocument3 pagesDemolition Cost EstimateRodolf Bautista57% (14)

- Largest Fintech Unicorns - CFTE Fintech RankingDocument52 pagesLargest Fintech Unicorns - CFTE Fintech RankingvivekinductusNo ratings yet

- PAS 1 With Notes - Pres of FS PDFDocument75 pagesPAS 1 With Notes - Pres of FS PDFFatima Ann GuevarraNo ratings yet

- Ifrs 1 PDFDocument2 pagesIfrs 1 PDFBheki Tshimedzi0% (1)

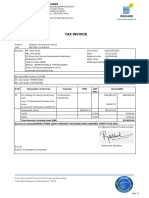

- Tax Invoice: Excitel Broadband Pvt. LTDDocument1 pageTax Invoice: Excitel Broadband Pvt. LTDSaikat Bose0% (3)

- Ifrs 1:: First-Time Adoption ofDocument17 pagesIfrs 1:: First-Time Adoption ofEshetieNo ratings yet

- Ifrs 1 - 2005Document49 pagesIfrs 1 - 2005jon_cpaNo ratings yet

- Assignment ON Ifrs1-First Time Adoption of IfrsDocument46 pagesAssignment ON Ifrs1-First Time Adoption of IfrsMohit BansalNo ratings yet

- Chapter 23Document40 pagesChapter 23rameelamirNo ratings yet

- Audited FS IllustrationDocument123 pagesAudited FS IllustrationEphraim MandalNo ratings yet

- 3.15.8 Ab4h Supplementary - Transition To IFRS 16Document4 pages3.15.8 Ab4h Supplementary - Transition To IFRS 16Mark Anthony B. BacayoNo ratings yet

- IFRS 1 - First Time AdopterDocument9 pagesIFRS 1 - First Time AdopterAkinwumi AyodejiNo ratings yet

- International Financial Reporting Standards (IFRS-1,2,3,4,5)Document13 pagesInternational Financial Reporting Standards (IFRS-1,2,3,4,5)hina4No ratings yet

- IFRS 1 - For PresDocument27 pagesIFRS 1 - For Presnati67% (3)

- Ifrs For Smes 2015Document6 pagesIfrs For Smes 2015Jc GappiNo ratings yet

- 3.15.7 Ab4g Supplementary - Transition To IFRS 15 and IFRS 9Document8 pages3.15.7 Ab4g Supplementary - Transition To IFRS 15 and IFRS 9Mark Anthony B. BacayoNo ratings yet

- Ap3e Non Current Assets Held For Sale Presentation IssueDocument15 pagesAp3e Non Current Assets Held For Sale Presentation IssueNafiul IslamNo ratings yet

- 1st Tym AdoptionDocument15 pages1st Tym Adoptionmishra2210No ratings yet

- Ist Time Adotpion of IFRSDocument99 pagesIst Time Adotpion of IFRSjohnson.iaf6403No ratings yet

- 3.4 Presentation of Financial Statements: Adaptation For The Public Sector ContextDocument133 pages3.4 Presentation of Financial Statements: Adaptation For The Public Sector ContextTung NguyenNo ratings yet

- FRS 1 (8 Jan 2010)Document43 pagesFRS 1 (8 Jan 2010)rexNo ratings yet

- Note 4 - 1FRS 1 - FIRST TIME ADOPTION OF IFRSDocument6 pagesNote 4 - 1FRS 1 - FIRST TIME ADOPTION OF IFRSdemolaojaomoNo ratings yet

- Summary of IFRS 1Document2 pagesSummary of IFRS 1Jydel FamenteraNo ratings yet

- Ias 1Document3 pagesIas 1ash_muhammedNo ratings yet

- Ifrs 1 First Time AdoptionDocument27 pagesIfrs 1 First Time AdoptionHagere EthiopiaNo ratings yet

- Ifrs 1 First Time AdoptionDocument27 pagesIfrs 1 First Time AdoptionSabaa ifNo ratings yet

- Ey Applying Ifrs Leases Transitions Disclsosures November2018Document43 pagesEy Applying Ifrs Leases Transitions Disclsosures November2018BT EveraNo ratings yet

- 2 Presentation of Financial Statements - Lecture Notes PDFDocument14 pages2 Presentation of Financial Statements - Lecture Notes PDFCatherine RiveraNo ratings yet

- Chapter 3 - IAS 1Document10 pagesChapter 3 - IAS 1Bahader AliNo ratings yet

- IAFR (Sahib Rahman 18201017) QuizDocument5 pagesIAFR (Sahib Rahman 18201017) QuizAysha SultanaNo ratings yet

- IFRS IAS SummaryDocument94 pagesIFRS IAS SummaryLin AungNo ratings yet

- 3.15.6 Ab4f Supplementary - Parent Not ConsolidatingDocument2 pages3.15.6 Ab4f Supplementary - Parent Not ConsolidatingMark Anthony B. BacayoNo ratings yet

- Toa First Time AdoptionDocument4 pagesToa First Time AdoptionreinaNo ratings yet

- Non-Current Assets Held For Sale and Discontinued OperationsDocument20 pagesNon-Current Assets Held For Sale and Discontinued OperationshemantbaidNo ratings yet

- IFRS 1 First TimeDocument2 pagesIFRS 1 First TimeCatalin BlesnocNo ratings yet

- Applying IFRS: Presentation and Disclosure Requirements of IFRS 15Document7 pagesApplying IFRS: Presentation and Disclosure Requirements of IFRS 15CescSalinasNo ratings yet

- "Full" Pfrss Refer To The Standards That We Had DiscussedDocument7 pages"Full" Pfrss Refer To The Standards That We Had DiscussedJustine VeralloNo ratings yet

- Ifrs Bdo 2020Document104 pagesIfrs Bdo 2020SyedNo ratings yet

- 1668681751946465Document8 pages1668681751946465Ila MaeNo ratings yet

- Ifrs 1 AagDocument5 pagesIfrs 1 AagMoses TNo ratings yet

- IFRS1Document1 pageIFRS1Md TurjoyNo ratings yet

- 2007BV09 Ifrs01Document90 pages2007BV09 Ifrs01Faraz Masood AbbasNo ratings yet

- Ifrs 1: Advance Accounting IiDocument12 pagesIfrs 1: Advance Accounting IiAditya ArfanNo ratings yet

- IFRS 2018 - Red - Book - IFRS - 1 - First-Time - Adoption - of - International - Financial - Reporting - StandardsDocument136 pagesIFRS 2018 - Red - Book - IFRS - 1 - First-Time - Adoption - of - International - Financial - Reporting - StandardsPeter ParkerNo ratings yet

- Ifrs 1 First Time AdoptionDocument27 pagesIfrs 1 First Time Adoptionesulawyer2001No ratings yet

- Ias 34 Interim Financial Reporting PDFDocument18 pagesIas 34 Interim Financial Reporting PDFMiraflor Bia�asNo ratings yet

- IFRS1Document2 pagesIFRS1Jkjiwani AccaNo ratings yet

- September 2008 EXPOSURE DRAFT Additional Exemptions For First-Time AdoptersDocument16 pagesSeptember 2008 EXPOSURE DRAFT Additional Exemptions For First-Time AdoptersCAclubindiaNo ratings yet

- Section 3: Financial Statement PresentationDocument5 pagesSection 3: Financial Statement PresentationOu ThouNo ratings yet

- IFRS 1 SummaryDocument4 pagesIFRS 1 SummaryraileanustefNo ratings yet

- MFRS 1Document42 pagesMFRS 1hyraldNo ratings yet

- Annual Improvements To Ifrs Standards 2015-2017 CycleDocument20 pagesAnnual Improvements To Ifrs Standards 2015-2017 CycleCath VeluzNo ratings yet

- Overview of IAS 1Document15 pagesOverview of IAS 1Fazil DipuNo ratings yet

- International Financial Reporting Standards (IFRS) : An OverviewDocument10 pagesInternational Financial Reporting Standards (IFRS) : An Overviewsanjay guptaNo ratings yet

- Appendix 5 - SME-FRF and FRS (Revised) Disclosure ChecklistDocument45 pagesAppendix 5 - SME-FRF and FRS (Revised) Disclosure Checklistl.lawliet.ryuzaki.frNo ratings yet

- IAS-34-interim-financial-reportingDocument18 pagesIAS-34-interim-financial-reportingClarisse Erika EsmeriaNo ratings yet

- Red BV2014 IFRS05 Discont - OperationsDocument20 pagesRed BV2014 IFRS05 Discont - OperationsEricaNo ratings yet

- Improvements To Ifrss: Exposure Draft Ed/2009/11Document68 pagesImprovements To Ifrss: Exposure Draft Ed/2009/11ebaidalla mahjoub ebaidallaNo ratings yet

- Non-Current Assets Held For Sale and Discontinued OperationsDocument22 pagesNon-Current Assets Held For Sale and Discontinued OperationsTeja JurakNo ratings yet

- Summary of Ifrs 1Document9 pagesSummary of Ifrs 1Divine Epie Ngol'esuehNo ratings yet

- Managing the Transition to IFRS-Based Financial Reporting: A Practical Guide to Planning and Implementing a Transition to IFRS or National GAAPFrom EverandManaging the Transition to IFRS-Based Financial Reporting: A Practical Guide to Planning and Implementing a Transition to IFRS or National GAAPNo ratings yet

- Wiley GAAP for Governments 2016: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2016: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- 6.1 Bank and Other Financier Confirmation Request LetterDocument4 pages6.1 Bank and Other Financier Confirmation Request LetterMark Anthony B. BacayoNo ratings yet

- 2.5 F2 Receivables Audit ProgrammeDocument6 pages2.5 F2 Receivables Audit ProgrammeMark Anthony B. BacayoNo ratings yet

- Financial Reporting Bulletins (Revised As of 2022) : While Those Deleted Were Marked As SuchDocument16 pagesFinancial Reporting Bulletins (Revised As of 2022) : While Those Deleted Were Marked As SuchMark Anthony B. BacayoNo ratings yet

- Sing 2 2021 1080p WEBRip x264 AAC5 1 - (YTS MX)Document159 pagesSing 2 2021 1080p WEBRip x264 AAC5 1 - (YTS MX)Mark Anthony B. BacayoNo ratings yet

- Aaafz8016h 2022Document5 pagesAaafz8016h 2022yogiprathmeshNo ratings yet

- Mahindra & Mahindra Limited: Rs. in CroresDocument4 pagesMahindra & Mahindra Limited: Rs. in CroresGeorge Chalissery RajuNo ratings yet

- Assignment MGT2134Document14 pagesAssignment MGT2134Hidayatul HikmahNo ratings yet

- 60 In. Dia - Spool Detail-L-2 333333Document1 page60 In. Dia - Spool Detail-L-2 333333niko TanNo ratings yet

- Me Unit 1Document29 pagesMe Unit 1Sangram SahooNo ratings yet

- InvoiceDocument1 pageInvoicealok singhNo ratings yet

- Law Firm ListDocument4 pagesLaw Firm ListDante Gabriel Recide100% (1)

- Axis Bank Airport Lounge Access ProgramDocument5 pagesAxis Bank Airport Lounge Access ProgramHimanshuNo ratings yet

- Questions For ReviewDocument13 pagesQuestions For Reviewنور عفيفهNo ratings yet

- Financial ManagementDocument109 pagesFinancial ManagementAlfe PinongpongNo ratings yet

- CH 13 Study Guide AnsDocument1 pageCH 13 Study Guide AnsLo Ka ChunNo ratings yet

- Effect of Concentration in Airline Market On Spanish Airport TechnicalDocument11 pagesEffect of Concentration in Airline Market On Spanish Airport Technicalnoemie-quinnNo ratings yet

- Gen Math Simple and Compound InterestDocument51 pagesGen Math Simple and Compound InterestMary Grace TolentinoNo ratings yet

- Made By: Olivia, Harshita, Rahul, Arnav, Aryan, Aryaman, Aarya Group Number: 2Document9 pagesMade By: Olivia, Harshita, Rahul, Arnav, Aryan, Aryaman, Aarya Group Number: 2Arnav PradhanNo ratings yet

- Principles of Microeconomics 9Th Edition Sayre Test Bank Full Chapter PDFDocument67 pagesPrinciples of Microeconomics 9Th Edition Sayre Test Bank Full Chapter PDFphenicboxironicu9100% (11)

- AnswerDocument2 pagesAnswerArriane Aquino ViveroNo ratings yet

- ACCOUNTING-14Document4 pagesACCOUNTING-14Mila Casandra CastañedaNo ratings yet

- AS 1418.15-1994 Cranes (Including Hoists and Winches) - Concrete Placing EquipmentDocument40 pagesAS 1418.15-1994 Cranes (Including Hoists and Winches) - Concrete Placing Equipmentvagabond_ldNo ratings yet

- MB 0042Document30 pagesMB 0042Rehan QuadriNo ratings yet

- Depression and New Deal Guided NotesDocument2 pagesDepression and New Deal Guided NotesWinnie sheuNo ratings yet

- Wang Et Al (2017) - Measures of Participation in GVCs and GBCs - w23222Document35 pagesWang Et Al (2017) - Measures of Participation in GVCs and GBCs - w23222Phaninh SengNo ratings yet

- 03 9708 22 MS Prov Rma 23022024050650Document16 pages03 9708 22 MS Prov Rma 23022024050650eco2dayNo ratings yet

- Week 03 Demand and SupplyDocument17 pagesWeek 03 Demand and SupplyTheo DayoNo ratings yet

- Terms in This SetDocument31 pagesTerms in This SetAnna AldaveNo ratings yet

- Grievance Website DetailsDocument4 pagesGrievance Website Detailspranab kumarNo ratings yet

- birdSEED Annual Report 2022 CompressedDocument16 pagesbirdSEED Annual Report 2022 CompressedMegan RosenfeldNo ratings yet

- 01 ESTRUCTURAS Ok-E-03.1Document1 page01 ESTRUCTURAS Ok-E-03.1Jhony PurizacaNo ratings yet