Professional Documents

Culture Documents

Form 3

Form 3

Uploaded by

Santhosh SOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form 3

Form 3

Uploaded by

Santhosh SCopyright:

Available Formats

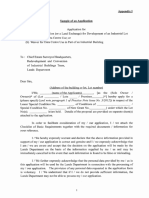

FORM 3

[See rules 256 (3) (a) and (b) and 257 (1)]

RETURN FOR ASSESSMENT/ OF PROPERTY TAX TO BE SUBMITTED BY

THE TRANSFEROR / TRANSFEREE

GREATER CHENNAI CORPORATION

Application Number:

(to be filled by ULB)

1. Zone No. Ward No. Mobile Number

2. Building Plan A

3. Property Tax Number

4. Name of the Owner (Mandatory)

5. Name of the Occupier

6. Address:

Door Number

Apartment Number

Street

Colony Name

Locality or Area Name

Pin Code

Village Name

Survey Number

7. Communication Address (if different from the land,

building, telecom tower, structure being assessed)

8. Email address

9. Building Plan Approval Number, if available Building

Plan Approval Date, if available

10. Existing Owner Name:

Mobile Number :

Email:

11 Name of the Transferee:

Mobile Number:

Email:

12. Nature of transaction (Sale/ Gift /

Settlement / Will / Inheritance, etc.)

13. Sale Consideration (Rs.) if applicable:

1. Residential

14. Property Type:

2. Non-Residential (includes shops, shopping

complexes, cinema theatres, offices, banks, ATMs,

hotels, restaurants, pubs, hostels, gyms, bars,

parlours, hospitals, nursing homes, clinics,

dispensaries, diagnostic labs, educational institutes,

guest houses, lodges, clubs and other places of

entertainment, marriage halls, community halls, and

any other establishment that is non- residential in

nature)

3. Mixed Usage (Part residential and part-non

residential)

4. Vacant land

5. Any other category*

Specify

*The GCC may expand the list to include any other

usage categories as per extant provisions of the

Act and Rules

15. Property Registration Particulars:

(i) Registered Document No.

(ii) Date of Registration

(iii) Name of Sub. Registrar Office

16. Bounded by:

(North by)/South by)

(East by)/West by)

17. Name of the owner as per Revenue records of the

GCC (Transferor):

18. Name of the owner of the land, if it is owned by a

different person and details of necessary documents

(like lease deed, etc.,)

19. Are there any arrear demand of property tax on the

property transferred If yes,

I. Property tax Paid up to :

II. Receipt No. and Date:

20. Indicate if there are any pending / ongoing court cases

relating to the ownership of the property (if yes,

mention details)

DECLARATION

I ...................hereby declare that the particulars furnished and the documents produced along with the

application are and correct to the best of my knowledge. If any of the details and documents are found to be

incorrect or false, understand that I will be liable for appropriate action as per the rules.

Further, I declare that the above said property is not situated in any water body or waterways or water

catchment area. I am aware that if the furnished information is wrong, legal action will be initiated against me.

Name of Transferee: Signature of the applicant

Correspondence Address : Date:

Documents to be submitted by the applicant:

1. Copy of the receipt for upto date payment of property tax and arrears along with the original property tax

demand book or card

2. Copy of the documents which confer the title of the property on the Transferee. The transferee would also

be required to produce the original documents before the assessor at the time of enquiry or verification, if

required.

3. Encumbrance Certificate from the Registrar's Office

4. In case of transfer request by inheritance, the applicant is required to submit Death Certificate and Legal

Heir Certificate.

Note:

1. The application should be submitted within three months from the date of registration of the title deed in

case of transfer of property or within one year in case of inheritance

2. If the particulars furnished and the documents produced are found to be correct, Transfer Order will be

issued within fifteen working days from the date of receipt of application.

This Property may be transferred to ………………………………………………………………………

…………………………………………………………………………………………………………………………

Assessor A.R.O

You might also like

- Rent Agreement With NocDocument3 pagesRent Agreement With NocVICTORIA SHOPNo ratings yet

- 2018 4028 rtb1Document6 pages2018 4028 rtb1Emma ArmitageNo ratings yet

- QC Government - Transfer of OwnershipDocument24 pagesQC Government - Transfer of OwnershipLorish ArguellesNo ratings yet

- rtb1 FormDocument6 pagesrtb1 FormJonathan HarrisNo ratings yet

- Law School Survival Guide: Outlines and Case Summaries for Torts, Civil Procedure, Property, Contracts & Sales, Evidence, Constitutional Law, Criminal Law, Constitutional Criminal Procedure: Law School Survival GuidesFrom EverandLaw School Survival Guide: Outlines and Case Summaries for Torts, Civil Procedure, Property, Contracts & Sales, Evidence, Constitutional Law, Criminal Law, Constitutional Criminal Procedure: Law School Survival GuidesRating: 5 out of 5 stars5/5 (1)

- Comprehensive Real Estate Property Due Diligence Checklist For Land Sales (Pre-Closing)Document4 pagesComprehensive Real Estate Property Due Diligence Checklist For Land Sales (Pre-Closing)esraramosNo ratings yet

- Land Registration and Title Reconstitution - Dec11Document34 pagesLand Registration and Title Reconstitution - Dec11Law_Portal100% (1)

- Lambda Rho Beta Fraternity-Ltd - Atty SabioDocument38 pagesLambda Rho Beta Fraternity-Ltd - Atty SabioRhei BarbaNo ratings yet

- Simple Guide for Drafting of Civil Suits in IndiaFrom EverandSimple Guide for Drafting of Civil Suits in IndiaRating: 4.5 out of 5 stars4.5/5 (4)

- 2020 Report To The Community, A Defining DecadeDocument68 pages2020 Report To The Community, A Defining DecadeKen KnickerbockerNo ratings yet

- Application For Gift PermissionDocument5 pagesApplication For Gift PermissionRamisha JainNo ratings yet

- Form 1Document2 pagesForm 1Santhosh SNo ratings yet

- Application For Real Property Tax Exemption and Remission: General InstructionsDocument4 pagesApplication For Real Property Tax Exemption and Remission: General InstructionsAnthony Juice Gaston BeyNo ratings yet

- Sme13 Title Investigation ReportDocument8 pagesSme13 Title Investigation ReportKapil KumarNo ratings yet

- Assets & Liabilities - FormDocument6 pagesAssets & Liabilities - Formsenthil.fso499No ratings yet

- 1578311410-Check List Imble PropertyDocument3 pages1578311410-Check List Imble PropertyalishNo ratings yet

- Conveyancing and Registration Procedure Manual: 1. Sale of Settled LandDocument15 pagesConveyancing and Registration Procedure Manual: 1. Sale of Settled Landabigail lettmanNo ratings yet

- Rent Repayment Order Form (UK, 2016)Document10 pagesRent Repayment Order Form (UK, 2016)Guillaume GonnaudNo ratings yet

- Affidavit FormatDocument7 pagesAffidavit FormatreptNo ratings yet

- Ms. Lyka Laynk, Plaintiff Civil Case No. 2 For:unlawful DetainerDocument3 pagesMs. Lyka Laynk, Plaintiff Civil Case No. 2 For:unlawful DetainerYannie MalazarteNo ratings yet

- Housing Loand Persmission FormDocument8 pagesHousing Loand Persmission FormK.SuganyaNo ratings yet

- Revised Format For Filing Affidavit Regarding Criminal Background, Assets, Liabilities and Educational Qualifications.Document7 pagesRevised Format For Filing Affidavit Regarding Criminal Background, Assets, Liabilities and Educational Qualifications.Nikhil SinghNo ratings yet

- Registration of Documents: South DistrictDocument32 pagesRegistration of Documents: South Districtannu technologyNo ratings yet

- 2010 1 1 - TextDocument6 pages2010 1 1 - TextRex Lagunzad FloresNo ratings yet

- Santos Ventura v. Santos, G.R. 153004, 5 Nov. 2004Document6 pagesSantos Ventura v. Santos, G.R. 153004, 5 Nov. 2004Homer SimpsonNo ratings yet

- Adjudicated and The Decision in The Registration Proceedings Continues To Be Under The Control of The CourtDocument9 pagesAdjudicated and The Decision in The Registration Proceedings Continues To Be Under The Control of The CourtEzra Denise Lubong RamelNo ratings yet

- Fed AlcsDocument82 pagesFed AlcsAung Khin LimNo ratings yet

- Annexure 14Document9 pagesAnnexure 14Omnia GroupsNo ratings yet

- Lease Agreement With Express Eviction and Future Search Clauses.Document4 pagesLease Agreement With Express Eviction and Future Search Clauses.ScribdTranslationsNo ratings yet

- Property Registration 2Document61 pagesProperty Registration 2Rachell RoxasNo ratings yet

- Free Patent ApplicationDocument12 pagesFree Patent ApplicationAnonymous JqiHOYWms100% (3)

- Tender For Branch OpeningDocument3 pagesTender For Branch OpeningDibyoday BhowmikNo ratings yet

- Procedure For Land Title ReconstitutionDocument2 pagesProcedure For Land Title ReconstitutionEric CortesNo ratings yet

- RTB 1 CDocument6 pagesRTB 1 CPayam LotfiNo ratings yet

- DemystifyingTitleScrutiny PDFDocument4 pagesDemystifyingTitleScrutiny PDFUmesh HbNo ratings yet

- Fedalcs 01062023 A 4Document18 pagesFedalcs 01062023 A 4mdsaifullahjohari88No ratings yet

- LTD Reviewer For FinalsDocument5 pagesLTD Reviewer For FinalsMarleneNo ratings yet

- 2012 3 01 TextDocument6 pages2012 3 01 Textbalu14No ratings yet

- RTB 1Document6 pagesRTB 1AA SpamsNo ratings yet

- Residential Tenancy Agreement BetweenDocument6 pagesResidential Tenancy Agreement BetweenAnkaNo ratings yet

- Final Land TransactionsDocument78 pagesFinal Land TransactionsBaguma Patrick RobertNo ratings yet

- Coverage PrelimsDocument5 pagesCoverage PrelimsJani MisterioNo ratings yet

- Residential Tenancy Agreement BetweenDocument6 pagesResidential Tenancy Agreement BetweenkushNo ratings yet

- Magsombol - LTD ActivityDocument3 pagesMagsombol - LTD ActivityGrant MAGSOMBOLNo ratings yet

- Fort Bonifacio Vs Yllas LendingDocument4 pagesFort Bonifacio Vs Yllas Lendingposh cbNo ratings yet

- HH AgreementDocument22 pagesHH Agreementtamas.kszemanNo ratings yet

- Extrajudicial Settlement of An EstateDocument4 pagesExtrajudicial Settlement of An EstatePAMELA DOLINA100% (1)

- Civ2 3Document24 pagesCiv2 3tartcradleNo ratings yet

- Resident Info Sheet 2023Document1 pageResident Info Sheet 2023v.william.zhengNo ratings yet

- 4 Registered LandDocument26 pages4 Registered LandEdwin OlooNo ratings yet

- Rajasthan Apartment Ownership ActDocument18 pagesRajasthan Apartment Ownership ActPrashant KaushikNo ratings yet

- Void Ab InitioDocument73 pagesVoid Ab InitioKundalini Nagaraja100% (1)

- People Industrial v. CADocument11 pagesPeople Industrial v. CAGedan TanNo ratings yet

- HPK Residential Tenancy Agreement NPDocument8 pagesHPK Residential Tenancy Agreement NPyourxmen2910No ratings yet

- Re - Estate Settlement ProceduresDocument7 pagesRe - Estate Settlement ProceduresRonadale Zapata-AcostaNo ratings yet

- Land Titles Memory Aid AteneoDocument27 pagesLand Titles Memory Aid AteneoStGabrielleNo ratings yet

- 2022 Comprehensive Real Estate Property Due Diligence Checklist For Land SalesDocument4 pages2022 Comprehensive Real Estate Property Due Diligence Checklist For Land SalesLupang HinirangNo ratings yet

- Lambda Rho Beta Fraternity LTD Atty SabioDocument38 pagesLambda Rho Beta Fraternity LTD Atty SabioAbigail AnziaNo ratings yet

- Santos Ventura Honcorma Vs Santos and Riverland With DigestDocument7 pagesSantos Ventura Honcorma Vs Santos and Riverland With DigestjelyneptNo ratings yet

- Land Transactions - Case CompilationDocument28 pagesLand Transactions - Case CompilationNamutosi ImmaculateNo ratings yet

- Law School Survival Guide (Volume I of II) - Outlines and Case Summaries for Torts, Civil Procedure, Property, Contracts & Sales: Law School Survival GuidesFrom EverandLaw School Survival Guide (Volume I of II) - Outlines and Case Summaries for Torts, Civil Procedure, Property, Contracts & Sales: Law School Survival GuidesNo ratings yet

- Miami Dade Tangible Property 20 159220 2023 Annual BillDocument1 pageMiami Dade Tangible Property 20 159220 2023 Annual Billp13607091No ratings yet

- Expat Tax Ebook 2014 Final July15Document288 pagesExpat Tax Ebook 2014 Final July15SyedNo ratings yet

- Menomonee Falls Express News 091413Document32 pagesMenomonee Falls Express News 091413Hometown Publications - Express NewsNo ratings yet

- CHP 3Document23 pagesCHP 3Laiba SadafNo ratings yet

- Statcon Case Digest 5 PDF FreeDocument5 pagesStatcon Case Digest 5 PDF FreeNicole SilorioNo ratings yet

- (For Public) Doctrines - Taxation & Commercial LawDocument19 pages(For Public) Doctrines - Taxation & Commercial Lawmovieclipsonline28No ratings yet

- Umali vs. Estanislao May 29, 1992Document3 pagesUmali vs. Estanislao May 29, 1992AudreyNo ratings yet

- May 10, 2013 Strathmore TimesDocument36 pagesMay 10, 2013 Strathmore TimesStrathmore TimesNo ratings yet

- Sbu Taxation Law 2021 XVDocument468 pagesSbu Taxation Law 2021 XVNaethan Jhoe L. Cipriano100% (1)

- Mah. Act 3 of 2007 The Maha. Fire Prevention & LSM Act-2006Document63 pagesMah. Act 3 of 2007 The Maha. Fire Prevention & LSM Act-2006Priya Vishvanathan AjayNo ratings yet

- Tax System in IndiaDocument18 pagesTax System in IndiaDEV HUGENNo ratings yet

- Romania - Tax Considerations On Short-Term LettingsDocument6 pagesRomania - Tax Considerations On Short-Term LettingscelmailenesNo ratings yet

- Marketing of Real EstateDocument198 pagesMarketing of Real EstateCarlo MancosuNo ratings yet

- Chapter 3Document12 pagesChapter 3Briggs Navarro BaguioNo ratings yet

- Thane Municipal Corporation, ThaneDocument25 pagesThane Municipal Corporation, ThaneAshiwn PanchalNo ratings yet

- Prathap Project ReportDocument114 pagesPrathap Project ReportSsims 1997No ratings yet

- Punjab Delegation of Financial Rules Updated 2012Document394 pagesPunjab Delegation of Financial Rules Updated 2012Humayoun Ahmad FarooqiNo ratings yet

- METROPOLITAN WATERWORKS SEWERAGE SYSTEM v. THE LOCAL GOVERNMENT OF QUEZON CITYDocument2 pagesMETROPOLITAN WATERWORKS SEWERAGE SYSTEM v. THE LOCAL GOVERNMENT OF QUEZON CITYCharlene MillaresNo ratings yet

- Icard v. The City Council of BaguioDocument2 pagesIcard v. The City Council of BaguioJaja Arellano100% (1)

- Manila Electric Co. vs. Central Board of Assessment Appeals G.R. No. L-47943 May 31, 1982Document3 pagesManila Electric Co. vs. Central Board of Assessment Appeals G.R. No. L-47943 May 31, 1982lassenNo ratings yet

- Mactan v. City of Lapulapu, G.R. No. 181756Document2 pagesMactan v. City of Lapulapu, G.R. No. 181756Rolly Canico ArotNo ratings yet

- Saskatoon Budget at A GlanceDocument3 pagesSaskatoon Budget at A GlanceDavid A. GilesNo ratings yet

- Building Management RateDocument11 pagesBuilding Management RateSopi LabuNo ratings yet

- Table of Remedies by LumberaDocument10 pagesTable of Remedies by LumberaJodea Pearl AbalosNo ratings yet

- Joint Development Agreement TemplateDocument21 pagesJoint Development Agreement TemplateVladNo ratings yet

- Memorandum of Understanding - FC Cincinnati (West End) (00255535xC2130)Document9 pagesMemorandum of Understanding - FC Cincinnati (West End) (00255535xC2130)WCPO 9 NewsNo ratings yet

- Written Submission 23.3.2018Document25 pagesWritten Submission 23.3.2018Vir PatelNo ratings yet

- Draft Troika Memorandum For CyprusDocument24 pagesDraft Troika Memorandum For CyprusEnetEnglishNo ratings yet