Professional Documents

Culture Documents

Monthly Oil Market Report - Nov 2023

Monthly Oil Market Report - Nov 2023

Uploaded by

Malika YunusovaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Monthly Oil Market Report - Nov 2023

Monthly Oil Market Report - Nov 2023

Uploaded by

Malika YunusovaCopyright:

Available Formats

Power BI Desktop

Monthly Oil Market Report

November 2023

Refinitiv Oil Research

oil_research_global@refinitiv.com

Downloaded from Refinitiv Eikon

by malika@blackmoorip.com on 11/10/2023 14:02:31

Power BI Desktop

Monthly Oil Market Report -November 2023

An LSEG

An LSEG Business

Business

Summary Points: Quarterly GDP Figures (%) Quarterly GDP Figures (%)

Supply, Demand and Stocks US Eurozone UK China India Previous Latest

• The IMF kept its global GDP growth for 2023 unchanged 8

at 3% in October but revised down its 2024 estimate by 0.1

percentage points to 2.9%. IMF chief economist Pierre- 20

Olivier Gourinchas said that the fund remained concerned 6

about risks related to the real estate crisis in China, volatile

commodity prices, geopolitical fragmentation, and a

resurgence in inflation. 0 4

• Oil demand growth forecasts for 2023 remain almost

unchanged but 2024 forecasts are being revised down, as 2

oil demand in China remains robust despite its challenging -20

economic conditions.

0

2021 2022 2023 CNGDP=ECI INGDPQ=ECI EUGDQY=ECI

• Compared to September, OPEC output increased by

180,000 bpd in October. OPEC-10 production rose by

150,000 bpd. Angolan and Nigerian output showed gains

last month. Quarterly Supply (mnbpd) Quarterly Demand (mnbpd)

• OPEC-10 production in August was around 557,000 bpd OPEC Supply Non OPEC Supply OECD Supply US Demand Europe D… China De… Other Asia … OECD De…

lower than its pledged output. West African members of the 50

group produced over 667,000 bpd less than the target.

40

• After rising by almost 2 million bpd in 2023, non-OPEC

20

production is likely to increase by 1.25 million bpd next

year.

20

• Current supply and demand projections show a drop in 40

global oil stocks of more than 570,000 bpd in 2023, which

translates into almost 210 million bbl of inventory draw.

Global inventories increased by almost 132 million bbl in

0 0

2022. Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

20- 20- 20- 20- 21- 21- 21- 21- 22- 22- 22- 22- 23- 23- 23- 23- 20- 20- 20- 20- 21- 21- 21- 21- 22- 22- 22- 22- 23- 23- 23- 23-

20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20

Contact us to provide feedback or to learn more about the Refinitiv

Downloaded from OilRefinitiv

Research Team (oil_research_global@refinitiv.com) for other questions.

Eikon

by malika@blackmoorip.com on 11/10/2023 14:02:31

Power BI Desktop

Monthly Oil Market Report - November 2023

An LSEG

An LSEG Business

Business

Benchmark Prices ($/bbl) Brent / WTI Spread ($/bbl) Brent Market Structure

15 LCOc6-LCOc1 LCOc12-LCOc1 LCOc24-LCOc1

Brent (LCOc1) WTI (CLc1)

10

100

5 0

50

0

-50

0 -5

2016 2018 2020 2022 2016 2018 2020 2022 2016 2018 2020 2022

Brent / Dubai EFS M3 Arbitrage WTI Market Structure

20 CLc6-CLc1 CLc12-CLc1 CLc24-CLc1

10

10

5 0

0

-50

-10

2016 2018 2020 2022 2016 2018 2020 2022 2016 2018 2020 2022

Contact us to provide feedback or to learn more about the Refinitiv

Downloaded from OilRefinitiv

Research Team (oil_research_global@refinitiv.com) for other questions.

Eikon

by malika@blackmoorip.com on 11/10/2023 14:02:31

Power BI Desktop

Monthly Oil Market Report - November 2023

An LSEG

An LSEG Business

Business

Brent vs USD Brent vs Dow Jones Industrial Avg Brent vs S&P 500

Brent (LCOc1) Dow Jones (.DJI) Brent (LCOc1) S&P 500 (.INX)

Brent (LCOc1) USD (.DXY)

40K 5K

110

100 100 100 4K

30K

100

3K

50 50 50

20K

90 2K

0 0 0

2016 2018 2020 2022 2016 2018 2020 2022 2016 2018 2020 2022

WTI vs USD WTI vs Dow Jones Industrial Avg WTI vs S&P 500

WTI (CLc1) USD (.DXY) WTI (CLc1) Dow Jones (.DJI) WTI (CLc1) S&P 500 (.INX)

40K 5K

110

100 100 100 4K

30K

100

3K

50 50 50

90 20K

2K

0 0 0

2016 2018 2020 2022 2016 2018 2020 2022 2016 2018 2020 2022

Contact us to provide feedback or to learn more about the Refinitiv

Downloaded from OilRefinitiv

Research Team (oil_research_global@refinitiv.com) for other questions.

Eikon

by malika@blackmoorip.com on 11/10/2023 14:02:31

Power BI Desktop

Monthly Oil Market Report - November 2023

An LSEG Business

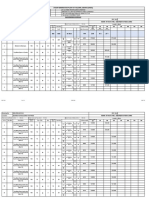

October production from OPEC was at 27.90 million bpd, with the OPEC10 production at 22.82 million bpd. The Oct production was 0.17 million bpd higher m-o-m while output from the OPEC-10 members

was up by 0.14 million bpd. Compliance to the cuts was at 304% of the pledged numbers. The announcements to the extension of the voluntary cuts is expected to keep Saudi output at the 9 million bpd

range for the rest of 2023. Nigerian output continues to increase with October levels hitting their highest since December 2020. Iranian output also continues to increase with levels last seen in 2018 and

the country's oil minister had been quoted by the state media that the crude output would reach 3.4 million bpd by Q3 2023.

OPEC Monthly Production (mnbpd)

Date Algeria Angola Congo Equatorial Guinea Gabon Iraq Iran Kuwait Libya Nigeria Saudi Arabia UAE Venezuela

May 2023 0.96 1.10 0.28 0.05 0.19 4.00 2.95 2.55 1.12 1.40 10.00 2.89 0.74

June 2023 0.95 1.09 0.28 0.05 0.19 4.03 2.90 2.55 1.12 1.42 9.96 2.89 0.75

July 2023 0.95 1.14 0.28 0.06 0.20 4.20 2.90 2.55 1.10 1.30 9.02 2.89 0.75

August 2023 0.94 1.08 0.27 0.06 0.19 4.22 3.10 2.55 1.12 1.37 9.01 2.89 0.76

September 2023 0.95 1.05 0.27 0.06 0.19 4.24 3.15 2.55 1.14 1.48 8.98 2.91 0.76

October 2023 0.96 1.10 0.26 0.05 0.19 4.26 3.17 2.55 1.15 1.53 9.00 2.92 0.76

Source: Reuters OPEC Survey

African OPEC members Production History Middle East OPEC members Production History

Angola Congo Gabon Equatorial Guinea Algeria Libya Nigeria Iran Kuwait UAE Iraq Saudi Arabia

1.5 20

1.1 11

1.2 1.4 1.3 1.5 1.4 1.4 1.3 1.5 10 10 10 10 10 10 9

9 9

4

1.2 1.2

1.1 1.2 1.2 1.1 1.1 1.1 1.1

1.1

5 5 4 4 4 4 4 4 4 4

1.1 10

1.0 1.0

1.0 1.0 1.0 1.0 1.0 0.9 1.0

2

3 3 3 3 3 3 3 3 3 3

3 3 3 3 3 3 3 3

3 3

1.1 1.1

1.1 1.1 1.1 1.0 1.1 1.1 1.1 1.1

3 3 3 3 3 3 3 3 3 3

0 0

Nov 2022 Jan 2023 Mar 2023 May 2023 Jul 2023 Sep 2023 Nov 2022 Jan 2023 Mar 2023 May 2023 Jul 2023 Sep 2023

Contact us to provide feedback or to learn more about the Refinitiv

Downloaded from OilRefinitiv

Research Team (oil_research_global@refinitiv.com) for other questions.

Eikon

by malika@blackmoorip.com on 11/10/2023 14:02:31

Power BI Desktop

Monthly Oil Market Report - November 2023

An LSEG

An LSEG Business

Business

North Sea Differentials West Africa Differentials Mediterranean Differentials

BonnyLight Forcados QuaIboe Cabinda Girrasol AzeriBTC CPCBlend SaharanBlend

Forties Oseberg Troll Ekofisk

10 10

5

5 0

0

0 -10

2019 2020 2021 2022 2023 2019 2020 2021 2022 2023 2019 2020 2021 2022 2023

North America Differentials Middle East Differentials Russian Differentials

LLS Mars Bakken WTIMidland WCS OmanDubai QatarLand QatarMarine Murban Urals NWE UralsMED ESPO

20

0

0

-20 10

-20

-40

0

-60 -40

2019 2020 2021 2022 2023 2019 2020 2021 2022 2023 2019 2020 2021 2022 2023

Contact us to provide feedback or to learn more about the Refinitiv

Downloaded from OilRefinitiv

Research Team (oil_research_global@refinitiv.com) for other questions.

Eikon

by malika@blackmoorip.com on 11/10/2023 14:02:31

Power BI Desktop

Monthly Oil Market Report - November 2023

• Diesel flows into Europe in October tumbled to their lowest since May 2022 on the back of weaker industrial demand An LSEG

LSEG Business

Business

An

and many refineries in key supply locations such as India, the Middle East and US closing units for maintenance.

Global shipments this month fell to 4.64 million mt, which is a massive drop from 5.67 million mt last month, Refinitiv

tracking shows, and well below the 7.31 million mt delivered a year ago when Europe ramped up purchases ahead of LGO Futures vs EFS

the February EU ban on Russian fuels. Despite the slowdown in euro zone manufacturing activities, buyers are

returning to stock up with the onset of colder weather as a large turnaround programme in the region curbed local LGO EFS

supplies. Cracks are holding their own at around the $30/bbl mark, which is almost four times that of gasoline and

double pre-Ukraine invasion levels. 0

• Jet fuel shipments from the East of Suez to Europe arriving in October were estimated at 1.71 million mt, down 1,500

slightly than the already low 1.85 million mt delivered in September, due mostly to refinery maintenance in the Middle

East and India even as demand stayed robust. Exports reached a record 2.38 million mt in August. The stronger jet -100

fuel fundamentals have widened the regrade further while differentials for CIF NWE cargoes have risen sharply to

$68.25/mt, nearly 13% up since start of October. These values suggest European refiners have a big incentive to

boost jet fuel output but it’s unclear if such moves have been made given the risk of going into winter with limited 1,000 -200

heating oil inventory.

• Northwest Europe (NWE) gasoline exports in October to the United States (US) and West Africa (WAF), its two key

markets, increased on the back of a surge in loadings for WAF, particularly Nigeria, while that to the US were stable. -300

NWE shipments last month on the two routes rose to 1.62 million mt, a sharp increase from a revised 1.31 million mt in

September and a tad less than 1.68 million mt in August, Refinitiv tracking shows. Exports so far in November are 500

lagging behind at 238,000 mt. Europe margins are at their seasonal lows with more challenges on the horizon as test -400

runs are planned in December at the Nigerian Dangote refinery while Belgium seeks to emulate the Netherlands and Jul 2021 Jan 2022 Jul 2022 Jan 2023 Jul 2023

tighten export-product specifications.

EBOB and MOGAS Arb SWAP NWE Naphtha Crack vs Brent SWAP

EBOB MOGAS Arb Spread NAPHCRK Brent (LCOc1)

40 1,200

1,000

20

1,000 100

800

0

600

500 50

-20 400

Jul 2021 Jan 2022 Jul 2022 Jan 2023 Jul 2023 Jul 2021 Jan 2022 Jul 2022 Jan 2023 Jul 2023

Contact us to provide feedback or to learn more about the Refinitiv

Downloaded from OilRefinitiv

Research Team (oil_research_global@refinitiv.com) for other questions.

Eikon

by malika@blackmoorip.com on 11/10/2023 14:02:31

Power BI Desktop

Monthly Oil Market Report - November 2023

An LSEG

An LSEG Business

Business

Northwest Europe Refinery Margins US Gulf Coast Refinery Slate Singapore Refinery Slate

Brent_Cracking NWERefSlate 14

9

15

13

8

10 12

7

11

5

10 6

Jan 2024 Mar 2024 May 2024 Jul 2024 Sep 2024 Jan 2024 Mar 2024 May 2024 Jul 2024 Sep 2024 Jan 2024 Mar 2024 May 2024 Jul 2024 Sep 2024

Mediterranean Refinery Margins US Gulf Coast Refinery Margins Singapore Refinery Margins

MEDRefSlate Urals_Cracking EsSider_Cracking WTI Cracking Margin Mars Cracking Margin Murban Dubai

20 4 20

40

15 15

3

10 10

20 2

5 5

1

0 0 0

Jan 2024 Mar 2024 May 2024 Jul 2024 Sep 2024 Jan 2023 Apr 2023 Jul 2023 Oct 2023 Jan 2023 Apr 2023 Jul 2023 Oct 2023

Contact us to provide feedback or to learn more about the Refinitiv

Downloaded from OilRefinitiv

Research Team (oil_research_global@refinitiv.com) for other questions.

Eikon

by malika@blackmoorip.com on 11/10/2023 14:02:31

Power BI Desktop

Monthly Oil Market Report - November 2023

An LSEG Business

Singapore refining margins ($/bbl) China refining throughput (million MT)

Crude Slate Cracking C1 Dubai Cracking C1 Murban Cracking C1 Upper Zakum Cracking C1

20

60

50

Jul 2023 Aug 2023 Sep 2023 Oct 2023 Nov 2023 Jul 2022 Jan 2023 Jul 2023

Indian refinery throughput (kT)

Med refining margins ($/bbl)

24K

Med Crude Slate Cracking C1 Med CPC Blend Cracking C1 Med Urals Cracking C1

40 22K

20

20K

0

-20 18K

May 2023 Jun 2023 Jul 2023 Aug 2023 Sep 2023 Oct 2023 Nov 2023 Jan 2022 Jul 2022 Jan 2023 Jul 2023

NWE refining margins ($/bbl) Japan refinery throughput (kbpd)

NWE Crude Slate Cracking C1 NWE Urals Cracking C1 NWE Arab Light Cracking C1 3,000

40

20 2,500

-20 2,000

May 2023 Jun 2023 Jul 2023 Aug 2023 Sep 2023 Oct 2023 Nov 2023 Jul 2022 Jan 2023 Jul 2023

Contact us to provide feedback or to learn more about the Refinitiv

Downloaded from OilRefinitiv

Research Team (oil_research_global@refinitiv.com) for other questions.

Eikon

by malika@blackmoorip.com on 11/10/2023 14:02:31

Power BI Desktop

Monthly Oil Market Report - November 2023

An LSEG

An LSEG Business

Business

West Africa Freight Costs (Dirty) Russia Freight Costs (Dirty) North Sea Freight Costs (Dirty)

Bonny T-Jamnagar VLCC Bonny T-Rotterdam Su… Bonny T-Lavera Su… Novorossiysk–IT Augusta Suezmax Primorsk–Rotterdam Aframax GB Hound Point–Qingdao/… GB Hound Point–Uls… GB Sullom Voe…

30

30

25

10

20

20

15

5

10 10

Sep 2023 Oct 2023 Nov 2023 Sep 2023 Oct 2023 Nov 2023 Sep 2023 Oct 2023 Nov 2023

US Freight Costs (Dirty) Northwest Europe Freight Costs (Clean) European Diesel Arb Freight Costs (Clean)

Corpus Christi–GB Milford Suezmax Corpus Christi–IN Vizag VLCC Rotterdam-… Fawley-Ne… Rotterda… Rotterda… Rotterda… Yanbu-Le Havre Houston-Amsterdam Houston-Rotterdam

40 40

34.15

50

35

30

34.10 40

30

20

30

25

34.05

10 20 20

Sep 2023 Oct 2023 Nov 2023 Sep 2023 Oct 2023 Nov 2023 Sep 2023 Oct 2023 Nov 2023

Contact us to provide feedback or to learn more about the Refinitiv

Downloaded from OilRefinitiv

Research Team (oil_research_global@refinitiv.com) for other questions.

Eikon

by malika@blackmoorip.com on 11/10/2023 14:02:31

Power BI Desktop

Monthly Oil Market Report - November 2023

An LSEG Business

Freight rates for key routes from Middle East Freight rates for key routes from West Africa Freight rates for key routes in Med

ME-China-VLCC ME-NWE-VLCC ME-USG-VLCC WAF-China-VLCC WAF-USG-VLCC WAF-USAC-Suezmax Cross Med-Suezmax Cross Med-Aframax

6 4

3

4

$/bbl

$/bbl

$/bbl

2

2

1 1

Mar 2023 May 2023 Jul 2023 Sep 2023 Nov 2023 Mar 2023 May 2023 Jul 2023 Sep 2023 Nov 2023 Mar 2023 May 2023 Jul 2023 Sep 2023 Nov 2023

VLCC floating storage Suezmax floating storage Aframax floating storage

Floating storage, confirmed excluding Iran (bbl) Floating storage, potential e… Floating storage, confirmed (bbl) Floating storage, potential (bbl) Floating storage, confirmed (bbl) Floating storage, potential (bbl)

40M 20M

30M 15M

10M

20M 10M

5M

10M 5M

0M 0M 0M

Jan 2023 Apr 2023 Jul 2023 Oct 2023 Jan 2023 Apr 2023 Jul 2023 Oct 2023 Jan 2023 Apr 2023 Jul 2023 Oct 2023

Contact us to provide feedback or to learn more about the Refinitiv

Downloaded from OilRefinitiv

Research Team (oil_research_global@refinitiv.com) for other questions.

Eikon

by malika@blackmoorip.com on 11/10/2023 14:02:31

Power BI Desktop

Monthly Oil Market Report - November 2023

An LSEG Business

• October seaborne exports of crude oil from OPEC were assessed

at 19.44 million bpd, a m-o-m decline of 0.13 million bpd and a y- OPEC Monthly Exports (mnbpd)

o-y decrease of 1.21 million bpd. OPEC Country 2022-10 2022-11 2022-12 2023-01 2023-02 2023-03 2023-04 2023-05 2023-06 2023-07 2023-08 2023-09 2023-10

• Saudi Arabian crude exports continued to recover from August Algeria 0.38 0.28 0.38 0.35 0.38 0.30 0.43 0.42 0.26 0.39 0.41 0.30 0.34

lows to be assessed at 6.66 million bpd, a m-o-m increase of 0.21 Angola 1.16 1.15 1.04 1.12 0.95 0.98 1.03 1.08 1.12 1.29 1.08 1.12 1.27

million bpd. This is still below their YTD monthly average of 6.77 Congo-Brazzaville / 0.22 0.21 0.22 0.25 0.30 0.22 0.23 0.30 0.21 0.30 0.22 0.28 0.20

million bpd. Total crude exports from the Saudi & Kuwait neutral Republic of Congo

zone accounted for 10.1 million bbl. Equatorial Guinea 0.05 0.06 0.05 0.04 0.07 0.03 0.05 0.06 0.05 0.05 0.08 0.03 0.06

Gabon 0.24 0.14 0.20 0.20 0.24 0.17 0.27 0.23 0.22 0.22 0.23 0.20 0.25

• Exports from Middle East OPEC members accounted for 75.7% Iran 0.27 0.33 0.59 0.54 0.58 0.29 1.01 0.66 0.73 0.50 0.41 0.50 0.33

of all OPEC exports, while African members accounted for a further Iraq 3.79 3.58 3.66 3.46 3.80 3.67 3.25 3.46 3.50 3.59 3.49 3.61 3.59

22.8%, with Venezuela contributing for 1.5%. Shipments from Kuwait 2.00 1.84 1.69 1.94 2.01 1.77 1.80 1.72 1.79 1.50 1.67 1.50 1.56

Saudi Arabia alone accounted for more than a third of all OPEC Libya 1.00 0.88 0.92 0.90 1.01 0.94 0.84 1.03 0.85 0.93 0.89 0.95 0.87

exports last month. Nigeria 1.08 1.22 1.44 1.50 1.47 1.55 1.27 1.32 1.57 1.08 1.34 1.45 1.43

Saudi Arabia 7.36 7.26 7.62 6.75 6.99 7.23 7.27 6.96 7.04 6.65 5.57 6.45 6.66

• The conflict between Israel and Hamas in Gaza broke on 07th United Arab Emirates 2.98 2.95 2.81 2.84 2.93 2.86 2.76 2.77 2.98 2.76 2.77 2.77 2.58

Oct, which caused a heightened threat for supply disruption Venezuela 0.11 0.08 0.22 0.14 0.20 0.24 0.43 0.36 0.27 0.41 0.32 0.42 0.29

pushing benchmark prices up by 7.5% the same week. However,

Total 20.65 19.99 20.83 20.04 20.92 20.26 20.62 20.37 20.59 19.67 18.47 19.57 19.44

with no actual disruption to trade flows and no escalation until now

into the other Middle East countries, prices have retreated since to

pre-conflict levels

• The demand weakness in Asia continues to prevail, although Seasonality of OPEC crude oil exports (2018 OPEC Exports for Report month(mnbpd)

Chinese arrivals in October saw a marginal uptick. Saudi Arabia &

Russia confirmed that they would continue their voluntary cuts until

onwards) 100%

7.4%

6.5%

4.5%

1.8%

1.7%

1.5%

1.3%

1.1%

0.3%

8.0%

100.0%

13.3%

the end of the year which indicates that demand recovery could be Max Current Year Min

18.5%

strained leading into Q1 2024.

800 750.8

34.2%

• Saudi Arabia has announced that it would maintain its December

50%

OSP unchanged for the flagship Arab Light grade to Asia - a $4/bbl

premium over the Dubai / Oman index. This was inline with

mnbbls

expectations as refining margins continue to remain stressed, with

600

Singapore refinery margin dropping from $6.72 to $2.79 in October.

497.0

0%

• Nigeria's NNPC has launched a new grade of crude called t

bia Iraq rat… wai eria gola ibya eria n la n a al

ra i u g L Alg Ira zue abo ille … uine Tot

Nembe as the country's production has been ramping up. Nembe i A m K Ni An ne G av l G

was formerly added to the Bonny Light stream but is now made 400 aud abE Ve zz

ra ator

ia

S r B

0 5 10 dA o - u

available as a separate grade. The first cargoes of Nembe were n ite ng Eq

sold in October as two 950,000 bbl shipments to France and Load Month U Co

Contact us to provide feedback or to learn more about the Refinitiv

Downloaded from OilRefinitiv

Research Team (oil_research_global@refinitiv.com) for other questions.

Eikon

by malika@blackmoorip.com on 11/10/2023 14:02:31

Power BI Desktop

Monthly Oil Market Report - November 2023

An LSEG Business

• Monthly condensate exports from the OPEC in October OPEC Condensate Monthly Exports (million bbl)

dropped marginally to 7.7 million bbl, a m-o-m decrease of 0.1 Load Country 2022-10 2022-11 2022-12 2023-01 2023-02 2023-03 2023-04 2023-05 2023-06 2023-07 2023-08 2023-09 2023-10

million bbl.

Algeria 4.7 1.0 3.2 2.3 3.5 3.1 1.4 2.2 1.5 0.7 2.3 4.7 4.6

• Algeria accounted for 59.7% of the volumes, with a total export Iran 1.6 0.8

of 4.6 million bbl. The cargoes were destined to Italy, Spain, Iraq 0.3

China, Gibraltar and the United States. Kuwait 0.4

Libya 3.7 1.2 3.8 3.4 2.5 3.7 3.1 2.5 4.3 2.5 2.4 3.1 3.0

• Libya accounted for a total of 3.0 million bbl. Exports were United Arab Emirates 0.4

headed to Germany, Spain, France and Netherlands. Total 10.2 2.2 7.8 6.5 5.9 6.8 4.5 4.7 5.8 3.2 4.7 7.8 7.7

OPEC Condensate Exports by Load Country (million bbl) OPEC Condensate by Destination (million bbl)

Load Country Algeria Iran Iraq Kuwait Libya United Arab Emirates Algeria Libya

10.2

10

3.7 7.8 7.8 7.7

6.8

6.5

5.9 5.8 Gibraltar 0.7

3.1 3.0 Spain 1.7

3.8

1.6 4.7 4.7

5 3.7 4.5 Spain 1.2 France (…

2.5

3.4

0.8 4.3 3.2

2.5 2.4

2.2 3.1 United States 0.8

4.7 4.7 4.6

3.5 2.5

1.2 3.2 3.1

2.3 2.2 2.3

1.0 1.4 1.5

0.7

0

2022-10 2022-11 2022-12 2023-01 2023-02 2023-03 2023-04 2023-05 2023-06 2023-07 2023-08 2023-09 2023-10 China 0.8 Italy 0.7 Germany 0.6 Netherlands 0.6

Contact us to provide feedback or to learn more about the Refinitiv

Downloaded from OilRefinitiv

Research Team (oil_research_global@refinitiv.com) for other questions.

Eikon

by malika@blackmoorip.com on 11/10/2023 14:02:31

Power BI Desktop

Monthly Oil Market Report - November 2023

An LSEG Business

Saudi Arabia Exports by month (mnbpd) Saudi Exports by load port & dest region Saudi Arabia & Kuwait Neutral Zone

8 cargoes for Report month by Destination

7.6 Ras al Khafji

APAC-Others

(million bbl)

7.4 Grade Khafji Ratawi (Wafra Ratawi) Eocene (Wafra Eocene)

7.3

Yanbu

7.0 United Arab E… 0.9

7 APAC-Top 4 India 0.4

6.7 United Arab Emirates

China 3.5

6.7 0.9

North America India 0.4

10.1

Ras Tanura mnbbl

Med and North Africa

6

5.6 South Africa and Indian Ocean

Singapore 0.6

South Korea 3.3

Oct 2022 Jan 2023 Apr 2023 Jul 2023 Oct 2023 Middle East

Iraq Exports by month & grade split (mnbpd) Iraq exports by Grade & Destination (mnbpd) Kuwait exports by Grade & Dest (mnbpd)

Basrah Bl… Basrah H… Basrah Light Basrah M… Kirkuk Kurdish C… Basrah Medium Basrah Heavy Kuwait Blend Kuwait Super Light South Ratqa (Lower Fars)

Turkey Spain

(Blank) 0.16

0.03 China 0.03 0.03

2.35 2.63 Indonesia 0.03

2.45 2.68 Japan 0.11 China 0.32

2.61

3 2.25

2.20 India 0.48 China 0.80 India 0.03

2 Croatia 0.03

(Blank) 0.06

3.59 Vietnam 0.25

1.47 India 0.07

United… 0.13 million bpd Croatia 0.03 million bpd

United Arab Emir… France… 0.05 Japan 0.11

1 1.26 0.09

1.00 1.02 1.01 0.97 Greece 0.21

Spain 0.03 United Arab Emirates Myanmar 0.08

0.80

0.69 0.07

Netherlands 0.13

0 Italy 0.20 India 0.58 Taiwan 0.17 South Korea 0.17

Jan 2023 Apr 2023 Jul 2023 Oct 2023

Contact us to provide feedback or to learn more about the Refinitiv

Downloaded from OilRefinitiv

Research Team (oil_research_global@refinitiv.com) for other questions.

Eikon

by malika@blackmoorip.com on 11/10/2023 14:02:31

Power BI Desktop

Monthly Oil Market Report - November 2023

An LSEG Business

UAE Exports by Load ports (mnbpd) UAE exports by Grade & Destination (mnbpd) ADNOC exports by Load port / berth (mnbpd)

Das Island 2.98 Murban Upper Zakum Das Umm Lulu Crude Oil Dubai Mubarraz Zirku Island Das Island Fujairah Jebel Dhanna/Ru… Mubarraz Island

3 2.77 2.76 2.77 2.77

Fateh Terminal

2.58 India (Blank) 0.04 Zirku Island - Crude Oil Terminal SP…

Fujairah Thailand 0.07 0.01 0.01

Jebel Dhanna/Ruwais …

Singapore 0.02 0.19

Hamriyah (Sharjah) Malaysia 0.04

2 Japan 0.28

South Korea

Jebel Ali 2 0.04 Zirku Island - C…

ADCO Fujairah…

0.21 0.79

Jebel Dhanna/Ru… Philippines

0.02 Malaysia 0.10

Khor Fakkan 2.58 Singa… 0.02

South Korea

2.45

Mubarraz Island Japan 0.31 million bpd 0.07 million bpd

1

1 Thailand 0.12

Zirku Island

flows mnbpd Indonesia 0.02 ADCO Fujairah S…

China 0.02 0.27

Das Island - Crude Oil S…

Netherlands 0.03

China 0.55 Das Island - Crude Oil SPM 6 0.16

0 0 India 0.01

May 2023 Jul 2023 Sep 2023 0.42

Qatar exports by month & grade (mnbpd) Oman exports by month (mnbpd) Middle East exports by dest region

Al Rayyan Al Shaheen Das Qatar Land Qatar Marine

1.0 1.06

0.99 0.99 1.01

0.97 APAC-Others

0.19

Oman

0.20 0.90 0.90

0.6 0.16 Kuwait

0.13 0.21

0.21 0.19 0.13

United Arab Emirates

0.18 0.16 0.10

0.16 APAC-Top 4

0.4 0.5

0.12 0.13

0.32 0.36 Iraq

0.32 0.32

0.27 0.28 0.28 Med and North Africa

0.2

Middle East

Saudi Arabia

0.0 0.0

Jan 2023 Apr 2023 Jul 2023 Oct 2023 Jan 2023 Apr 2023 Jul 2023 Oct 2023

Contact us to provide feedback or to learn more about the Refinitiv

Downloaded from OilRefinitiv

Research Team (oil_research_global@refinitiv.com) for other questions.

Eikon

by malika@blackmoorip.com on 11/10/2023 14:02:31

Power BI Desktop

Monthly Oil Market Report - November 2023

An LSEG Business

• Crude exports from North African OPEC member Libya dropped by 80,000 bpd

m-o-m to be assessed at 0.87 million bpd. Algerian exports increased by 40,000

African OPEC exports by Destination for Report month (mnbpd)

bpd to 340,000 bpd.

China Spain United St… South Africa United Ki…

• The Dubai - Brent spread retracted significantly from its gains in September,

with October levels ending at $1.85/bbl from a high of $4.15/bbl towards the end

of Sept. While the Israel - Hamas conflict played a role in the uncertainly over

Middle-East supplies, they have had little impact to the physical trade flows.

Nigeria 0.09

Congo-Braz… Nigeria 0.09

Dubai Brent EFS ($/bbl)

10 Libya 0.12

Nigeria 0.33

DUB-EFS-1M

Libya 0.08 Alg… An…

Libya 0.04 Algeria… Angola 0.09 Algeri…

0 Canada Netherlands Malaysia Portugal

Gab… Nig…

Angola 0.72 Equatorial G… Libya 0… An… Nig… …

Jan 2023 Apr 2023 Jul 2023 Oct 2023 Nigeria 0.…

Italy Nigeria 0.08 Ango… Lib… Libya …

African OPEC Exports for Report month (mnbpd) Nigeria … Al… Congo-Br…

France (Southern)

Nigeria 1.43 Australia Sout… Gre… Cro…

Nigeria 0.10

Angola 1.27 Algeria 0.03

Libya 0.07 Nigeria 0.07

Gabon… Liby… Nige…

Libya 0.87 Thailand Israel

Ta… Peru Ur… Si…

Libya 0.37 Gabo… Alg…

Algeria 0.34 Ang… Nig…

India

Cote DIvoire Co… Ni… Ni… Eq…

Gabon 0.25 Libya 0.05 Al… …

Indonesia Poland Ukraine

Angola … Ga… Nigeria 0.06

Congo-Brazzaville / Re… 0.20

Turkey Germ…

Sweden

Equatorial Guinea 0.06

Nigeria 0.29 Congo-… Lib… Nigeria 0.06 Gabon 0.03 Nigeri… Li… Angola

Contact us to provide feedback or to learn more about the Refinitiv

Downloaded from OilRefinitiv

Research Team (oil_research_global@refinitiv.com) for other questions.

Eikon

by malika@blackmoorip.com on 11/10/2023 14:02:31

Power BI Desktop

Monthly Oil Market Report - November 2023

An LSEG Business

• Nigerian exports held relatively steady, to be assessed at 1.43 million bpd, while Angolan exports were up by 150,000

bpd m-o-m with total exports assessed at 1.27 million bpd.

West African OPEC Exports by month (mnbpd)

• Gabon's exports increased by 50,000 bpd to 250,000 bpd, while shipments from Eq Guinea increased by 30,000 bpd.

Exports from Congo dropped by 80,000 bpd, to be assessed at 200,000 bpd, its lowest volumes for this year. Angola Congo-Brazzaville / Republic of … Equatorial Guinea Gabon Nigeria

West African OPEC exports by Destination Region for Report month (mnbpd) 3 1.50 1.57 1.45

1.43

1.55 1.08

1.27

Load Country APAC- APAC- Baltics Latin Med and North South Africa UKC/ West Total 1.08

Others Top 4 America North America and Indian NWE Africa

Africa Ocean 2

Angola 0.23 0.19 0.60 0.15 0.08 0.01 1.27

Congo-Brazzaville / 0.02 0.14 0.05 0.20

Republic of Congo 1 1.29 1.27

1.16 1.12 1.08 1.08

1.04

Equatorial Guinea 0.03 0.03 0.06 0.95

Gabon 0.03 0.03 0.06 0.10 0.02 0.25

Nigeria 0.08 0.12 0.07 0.37 0.25 0.09 0.39 0.06 1.43 0

Total 0.26 0.32 0.88 0.07 0.06 0.66 0.25 0.09 0.54 0.08 3.21 Oct 2022 Jan 2023 Apr 2023 Jul 2023 Oct 2023

Angolan exports by Grade (mnbpd) Nigerian exports by Grade (mnbpd) Other West African exports by Grade &

Destination (mnbpd)

Mondo Oyo

Ebok 0.03 0.01 … Spain

Gindungo 0.04 0.02 CJ Blend 0.04 Bonny Light 0.19 It…

Palanca 0.04 ina Rabi

Nemba 0.30 Egina 0.06 Ch … Lig

Hungo Blend i… ht/

Ma

Ce G… nd

0.05 Usan 0.06 Forcados Blend orial

…

uat

Ne

0.18 Eq

t…

ji

…

Pazflor 0.05

Amenam Blend

ia

Ind

o…

0.06

Braz

N'K

Sangos

1.27 1.43

il

0.06 Okwuibome

Rabi

blic of Congo

0.06

0.51

Gabon

Netherlands

C…

Clov 0.07 million bpd Mostarda Akpo Blend million bpd

Jones Creek million bpd

Repu

0.13 0.07

Dussa

Franc

0.12

e/

e (S

fu

vill

Saturno 0.08 ERHA 0.08

…

zz

nd

ra

Ble

Eta

-B

go

m

Con

Bonga 0.12 en e

Br

Plutonio 0.08 Olombendo 0.10 Agbami 0.09 Dj

az

Ma il

n…

Girassol 0.08 Dalia 0.10 Brass River 0.10 Qua Iboe 0.11 Ch

ina Ma

lay…

…

Contact us to provide feedback or to learn more about the Refinitiv

Downloaded from OilRefinitiv

Research Team (oil_research_global@refinitiv.com) for other questions.

Eikon

by malika@blackmoorip.com on 11/10/2023 14:02:31

Power BI Desktop

Monthly Oil Market Report - November 2023

An LSEG Business

North African OPEC exports by Dest Region for Report month (mnbpd) North African OPEC Exports including Condensate by month (mnbpd)

Algeria Libya

UKC/NWE

Algeria 1.5 1.12

1.10 1.11

North America 1.04 1.06

0.94 0.97 0.97

0.99

APAC-Top 4 0.92

1.0

Med and North Africa

Libya 0.5

Black Sea 0.54

0.48 0.50 0.49 0.48 0.49

0.42 0.40

0.31 0.31

Baltics

0.0

APAC-Others Nov 2022 Jan 2023 Mar 2023 May 2023 Jul 2023 Sep 2023

Algerian exports including Condensate by Grade & Dest (mnbpd) Libyan exports including Condensate by Grade & Dest (mnbpd)

United States 0.03 Canada 0.02 Es Sider France (Northern) 0.02

Italy 0.02

Mesla Thailand 0.02

Spain 0.05

Italy 0.02

El Sharara

Italy 0.14

France (Southern) Italy 0.04

0.10 Mellitah Condensate

Italy 0.02 Germany 0.02

Amna United States

0.03 Poland 0.02

Saharan Blend Gibraltar 0.02

0.49 Brega

Italy 0.03 0.97 Romania 0.02

Algerian Condensate million bpd Bu Attifel million bpd

China 0.02 Spain 0.05

Greece 0.02 Spain 0.04

Saharan Blend

Netherlands 0.02 (Blank) 0.03

Zueitina

South Korea 0.03 France (Southern)

India 0.03 Indonesia 0.03

Bouri (Buri) 0.02

Italy 0.03

Portugal 0.03 Al Jurf Netherlands 0.02

Italy 0.06 United Kingdom 0.06

Netherlands 0.03 Italy 0.09

Sirtica Blend

Contact us to provide feedback or to learn more about the Refinitiv

Downloaded from OilRefinitiv

Research Team (oil_research_global@refinitiv.com) for other questions.

Eikon

by malika@blackmoorip.com on 11/10/2023 14:02:31

Power BI Desktop

Monthly Oil Market Report - November 2023

An LSEG Business

• Key crude oil differentials in the North Sea improved in October, but the market started showing

some weakness in the second half of the month due to falling refinery margins. North Sea exports by month (mnbpd)

Denmark Netherlands Norway United Kingdom

• Forties averaged $1.88/bbl to Dated Brent in October, up from a premium of $0.97/bbl a month

earlier. Johan Sverdrup values also weakened, as light/heavy and sweet/sour differentials narrowed.

The loading program for North Sea grades, which comprise the Dated Brent benchmark, is expected to 0.90 0.84 0.79

2 0.75 0.64

show 745,000 bpd of supply in December, compared to 560,000 bpd a month earlier. Johan Sverdrup 0.68 0.66

0.54 0.53

loadings are set to average around 755,000 bpd compared to 702,000 bpd in November.

1.53 1.57 1.58

1.35 1.44 1.45

• Refinery margins weakened both in NWE and the MED in October compared to the previous month. 1.26 1.31 1.34

1

While diesel cracks remain relatively strong, light distillate cracks came under pressure. Fuel oil cracks

also fell.

• In October, the Brent/Dubai EFS averaged $2.13/bbl, up from $1.64/bbl in September. Two Forties

0

VLCCs left for Asia in October. Nov 2022 Jan 2023 Mar 2023 May 2023 Jul 2023 Sep 2023

Norway exports by Grade & Dest (mnbpd) UK exports by Grade & Dest(mnbpd)

Johan Sverdrup Ekofisk Blend

Denmark 0.02 Canada 0.02

Grane Finland 0.14 Forties Netherlands 0.02

United Kingdom 0.02 France (Northern) 0.05

France (Northern) Netherlands 0.02

Gullfaks Denmark 0.02 Schiehallion

0.02 Poland 0.02 Poland 0.02

France (No… 0.02

Asgard Crude Germany 0.06 Clair

Sweden 0.04 Netherlands 0.02

Italy 0.02

Yme United Kingdom Mariner France (Southern)

0.03 Lithuania 0.04 0.02 Sweden 0.07

Heidrun Netherlands Beryl Netherlands

0.03 Netherlands 0.02

Martin Linge 0.06 Brent Blend

Netherlands

Oseberg Blend 0.05 1.45 Triton Blend

Lithuania 0.02 0.66

Netherl… 0.02 million bpd Netherlands million bpd China 0.03

Balder Wytch Farm 0.02

France … 0.02

Statfjord Finland 0.02 Catcher Germany 0.02

United Kingdom United Ki… 0.02 Germany 0.02

Troll Blend 0.04 Poland 0.26 Flotta

Netherlands 0.02 Netherlands 0.02

Goliat Blend Sweden 0.07 Lancaster

Spain 0.02

Njord Germany 0.05 Alba (U.K.)

Singapore 0.06

Spain 0.03 France (Northern) 0.02

Norne Sweden 0.02 Netherlands 0.05 Kraken Sweden 0.04 Netherlands 0.02

Contact us to provide feedback or to learn more about the Refinitiv

Downloaded from OilRefinitiv

Research Team (oil_research_global@refinitiv.com) for other questions.

Eikon

by malika@blackmoorip.com on 11/10/2023 14:02:31

Power BI Desktop

Monthly Oil Market Report - November 2023

An LSEG Business

Russia Crude exports by Load ports (mnbpd)

Arctic Gate Terminal (V… 4.99 Russia Crude flows for report month by Grade and Discharge Country (mnbpd)

Articneft Terminal (Kolg… 4.69

4.48 4.53 Urals ESPO blend

Baltiysk (Kaliningrad Ar… 4.17 4.12

4

De Kastri 4

Kaliningrad

3

Kozmino

Murmansk

Novorossiysk 2

2

Prigorodnoye (Sakhalin… Turkey 0.31 Bulgari…

Primorsk

1

Prirazlomnaya Platform

Umba FSO

China 0.09 China 0.65

Ust-Luga 0 0 Greece… Egypt …

May Jun Jul 2023 Aug Sep Oct India 0.07

2023 2023 2023 2023 2023 France (So…

KEBCO Sokol (Sakhalin I)

Russia exports by Load port & Grade (mnbpd) India 1.07 (Blank) 0.08 Denmark 0.02 Un…

Novorossiysk Arco CPC Blend

Sokol (Sakhalin I) 0.03 CPC Blend 1.28

Primorsk 0.19

South Korea 0.12

Italy 0.14

Kozmino

Urals 0.56

Ust-Luga Netherlands 0.13

De Kastri KEBCO

0.09 4.53 Turkey 0.09 Sout… India…

Romania … Turkey … China 0.05 Ind…

Murmansk

Italy 0.34 Arco Varandey Sak…

million bpd KEBCO

Varandey 0.12

ESPO blend France (Southern) 0.11

Prigorodnoye (Sakhalin… 0.72 Russian… Chi… Russian Feder… Chin…

Urals 0.49 (Blank) 0.05 Brun… Ro…

Umba FSO Arco/Novy … Si…

Urals 0.77

China 0.22 Greece 0.10 Egypt 0.03 Cypr… Bul… Egypt … India … China 0.05 Indi…

Contact us to provide feedback or to learn more about the Refinitiv

Downloaded from OilRefinitiv

Research Team (oil_research_global@refinitiv.com) for other questions.

Eikon

by malika@blackmoorip.com on 11/10/2023 14:02:31

Power BI Desktop

Monthly Oil Market Report - November 2023

An LSEG Business

US Crude exports by month (mnbpd) US Crude flows for report month by Grade and Discharge Country (mnbpd)

4.42 4.52

4.30 China

4.02

4 3.71 3.81

3.67 3.69

Cold Lake Netherlands

Eagleford

Italy

3 Louisiana Light Sweet

Ireland

Mars United Kingdom

2

India

West Texas Light Spain

1

France (Southern)

Germany

0

Mar 2023 May 2023 Jul 2023 Sep 2023

US Crude exports by Load port & Grade (mnbpd) Crude Oil South Korea

Corpus Christi Japan

WTI

Houston Mars 0.05 0.05

Crude Oil 0.65 France (Northern)

West … 0.04

GOLA - Galveston Offs… Mars 0.14 Panama

Bayport Eagleford

0.02 United States

WTI 0.21

LOOP Canada

South Sabine Point

WTI 0.32

3.69

Convent million bpd

WTI Singapore

Beaumont Crude Oil WTI 1.00

Denmark

0.22

Freeport (USA) WTI Midland Poland

0.02

Southtex Lightering

WTI 0.41 Bakken 0.02

Contact us to provide feedback or to learn more about the Refinitiv

Downloaded from OilRefinitiv

Research Team (oil_research_global@refinitiv.com) for other questions.

Eikon

by malika@blackmoorip.com on 11/10/2023 14:02:31

Power BI Desktop

Monthly Oil Market Report - November 2023

An LSEG Business

US Crude Oil Imports by Country of Origin Waterborne Crude Oil Imports Arriving Next Three Weeks

Arrival Date Load Country Grade Vessel Discharge Port Barrels

November 12 Brazil Crude Oil SEAWAYS RED Barbers Point 935,610

November 12 Ecuador Napo STELLA Pacific Area Lightering 869,614

6K Canada November 12 Mexico Isthmus NORDSYMPHONY 555,680

November 12 Mexico Maya EAGLE BRISBANE 477,587

Mexico

November 12 Turkey Azeri BTC BORDEIRA Galveston 966,108

Saudi Arabia November 13 Nigeria ERHA EUROCHAMPION 2004 Corpus Christi 314,332

Colombia November 13 Nigeria Oyo EUROCHAMPION 2004 Corpus Christi 317,028

4K

kbd

November 13 Nigeria Yoho EUROCHAMPION 2004 Corpus Christi 330,318

Iraq

November 13 Panama Crude Oil MARIA Pacific Area Lightering 962,064

Brazil November 13 Saudi Arabia Arab Light QAMRAN Baltimore 2,049,737

Ecuador November 14 Nigeria Amenam Blend BARCELONA SPIRIT 985,177

2K November 15 Ecuador Napo LIBRA SUN El Segundo Terminal 535,147

Nigeria

November 15 Trinidad and Tobago Molo CAPRICORN SUN Delaware City 494,159

Total November 16 Iraq Basrah Heavy SEEB Long Beach 1,938,405

November 18 Brazil Peregrino ALMI VOYAGER Texas City 724,595

November 19 Argentina Medanitos UNITY VENTURE Anacortes 533,907

0K

Aug 2023 Sep 2023 November 20 Nigeria Amenam Blend ADVANTAGE START Philadelphia 923,438

November 21 Argentina Crude Oil SEA VALIANT Long Beach 569,600

US Crude Oil Net Imports November 22 Libya Amna ERIK SPIRIT New York 450,000

November 29 Brazil Crude Oil AS SUWAYQ Long Beach 1,871,220

10K

November 29 Saudi Arabia Arab Crude AWTAD US Gulf Lightering Zones 2,050,440

December 1 Argentina Crude Oil NAVE ARIADNE Anacortes 453,145

5K

December 2 Iraq Basrah Medium ZOURVA Los Angeles (incl San Pedro) 2,022,357

Exports Total 21,329,668

kbd

0K

Imports

Net Imports

-5K

-10K

Aug 2023 Sep 2023

Contact us to provide feedback or to learn more about the Refinitiv

Downloaded from OilRefinitiv

Research Team (oil_research_global@refinitiv.com) for other questions.

Eikon

by malika@blackmoorip.com on 11/10/2023 14:02:31

Power BI Desktop

Monthly Oil Market Report - November 2023

An LSEG Business

Permian Crude Oil Production US Crude Oil Production Rig Count

Permian (bpd/rig) Permian (total bpd) Lower 48 Crude Oil Production Alaska Crude Oil Prouction Onshore Rigs Offshore Rigs (RH) Inland Water Rigs (RH)

6.0M 800

Permian (total bpd)

Permian (bpd/rig)

1K 20

5.8M 750

10K

kbd

0K 5.6M 700

Jan 2023 Apr 2023 Jul 2023 Oct 2023 10

5K

Eagle Ford Crude Oil Production 650

EF (bpd/rig) EF (total bpd)

2K 1.2M 0K 600 0

Jun 2023 Jul 2023 Aug 2023 Sep 2023 Jan 2023 Apr 2023 Jul 2023

EF (total bpd)

EF (bpd/rig)

US Onshore Production F'cast, Selected Plays Oil Rigs Gas Rigs

1K

1.1M (bpd; current mnth)

0K 0.41M

600

Jan 2023 Apr 2023 Jul 2023 Oct 2023

1.27M Anadarko

Bakken Crude Oil Production Appalachia

Bakken (bpd/rig) Bakken (total bpd) Bakken

400

2K 1.12M Eagle Ford

Bakken (total bpd)

Bakken (bpd/rig)

1.2M Haynesville

5.9M 0.04M

1K Niobrara

0.68M 200

1.0M Permian

0K Jan 2023 Apr 2023 Jul 2023

Jan 2023 Apr 2023 Jul 2023 Oct 2023

Contact us to provide feedback or to learn more about the Refinitiv

Downloaded from OilRefinitiv

Research Team (oil_research_global@refinitiv.com) for other questions.

Eikon

by malika@blackmoorip.com on 11/10/2023 14:02:31

Power BI Desktop

Monthly Oil Market Report - November 2023

An LSEG Business

Marquis Products + Commercial Crude Stocks Δ Days of Supply US Gasoline Balance

Gasoline Diesel Jet Fuel Production Net Imports Product Supplied

40 10

20

35

mln bbls

mln bpd

5

30

0

25

0

-20 20

Jan 2023 Apr 2023 Jul 2023 Oct 2023 Jan 2023 Apr 2023 Jul 2023 Oct 2023 Jan 2023 Apr 2023 Jul 2023 Oct 2023

Marquis Products Stocks US Diesel Balance US Jet Fuel Balance

Gasoline Stocks Diesel Stocks Jet Fuel Stocks Production Net Imports Product Supplied Production Net Imports Product Supplied

6 2

4.0

Product Supplied

0.3bn 4

1

mln bpd

mln bpd

3.8

bbls

0.2bn 2

3.6

0.1bn 0

0

0.0bn -2 3.4

Jan 2023 Apr 2023 Jul 2023 Oct 2023 Jan 2023 Jul 2023 Jan 2023 Apr 2023 Jul 2023 Oct 2023

Contact us to provide feedback or to learn more about the Refinitiv

Downloaded from OilRefinitiv

Research Team (oil_research_global@refinitiv.com) for other questions.

Eikon

by malika@blackmoorip.com on 11/10/2023 14:02:31

You might also like

- Scanning Electron Microscopy (SEM) ConceptsDocument1 pageScanning Electron Microscopy (SEM) ConceptsRangoli SaxenaNo ratings yet

- Monthly Oil Market Report - Feb 2023Document24 pagesMonthly Oil Market Report - Feb 2023asaNo ratings yet

- Strategy Report 17462Document75 pagesStrategy Report 17462krishna_buntyNo ratings yet

- Godrej Consumer Products Limited: Recovery Likely by Q1FY2021Document5 pagesGodrej Consumer Products Limited: Recovery Likely by Q1FY2021anjugaduNo ratings yet

- Insight Alpha - 20210726 - GHNL PA - Venturing Into The SUV SegmentDocument5 pagesInsight Alpha - 20210726 - GHNL PA - Venturing Into The SUV SegmentMuhammad Ovais AhsanNo ratings yet

- Varroc Engineering: IndiaDocument4 pagesVarroc Engineering: IndiaAmit Kumar AgrawalNo ratings yet

- Diwali Muhurat Fundamental 2021Document22 pagesDiwali Muhurat Fundamental 2021Swasthyasudha AyurvedNo ratings yet

- IDirect ElgiEquipments ShubhNivesh June24Document4 pagesIDirect ElgiEquipments ShubhNivesh June24irshad sondeNo ratings yet

- Welcorp q2 Business UpdatesDocument8 pagesWelcorp q2 Business UpdatesVivek AnandNo ratings yet

- Bosch LTD (BOSLIM) : Multiple Variables Drag Margins!Document13 pagesBosch LTD (BOSLIM) : Multiple Variables Drag Margins!SahanaNo ratings yet

- Bajaj Allianz Weekly - January 13 2023Document2 pagesBajaj Allianz Weekly - January 13 2023Gaurav SinglaNo ratings yet

- Saudi Consumer 2020Document9 pagesSaudi Consumer 2020ikhan809No ratings yet

- P.I. Industries (PI IN) : Q1FY21 Result UpdateDocument7 pagesP.I. Industries (PI IN) : Q1FY21 Result UpdatewhitenagarNo ratings yet

- 05january2024 India DailyDocument155 pages05january2024 India Dailypradeep kumarNo ratings yet

- Cummins India (KKC IN) : Analyst Meet UpdateDocument5 pagesCummins India (KKC IN) : Analyst Meet UpdateADNo ratings yet

- Filatex India: All-Time High Spreads Aid Strong Margin PerformanceDocument8 pagesFilatex India: All-Time High Spreads Aid Strong Margin PerformanceMohan MuthusamyNo ratings yet

- Motilal Oswal Sees 6% DOWNSIDE in Bajaj Auto in Line 3Q DemandDocument12 pagesMotilal Oswal Sees 6% DOWNSIDE in Bajaj Auto in Line 3Q DemandDhaval MailNo ratings yet

- China Growth Concerns Vs OPEC Production CutsDocument40 pagesChina Growth Concerns Vs OPEC Production CutsKumara Raj K RamanNo ratings yet

- PN q3 2022 PresentationDocument38 pagesPN q3 2022 PresentationMiguel Couto RamosNo ratings yet

- Pidilite Industries (PIDIND) : High Raw Material Prices Hit MarginDocument10 pagesPidilite Industries (PIDIND) : High Raw Material Prices Hit MarginSiddhant SinghNo ratings yet

- Nigerian-Oil-And-Gas-Update-Quarterly-Newsletter - Edition-2021Document3 pagesNigerian-Oil-And-Gas-Update-Quarterly-Newsletter - Edition-2021cyrilNo ratings yet

- IDirect OilGas SectorUpdate Mar20 PDFDocument12 pagesIDirect OilGas SectorUpdate Mar20 PDFSuryansh SinghNo ratings yet

- 354466122018909bharat Forge LTD Q4FY18 Result Updates - SignedDocument5 pages354466122018909bharat Forge LTD Q4FY18 Result Updates - Signedakshara pradeepNo ratings yet

- Rockwell Industries LTDDocument7 pagesRockwell Industries LTDankityad129No ratings yet

- Bajaj Auto 1QFY20 Result Update - 190729 - Antique Research PDFDocument5 pagesBajaj Auto 1QFY20 Result Update - 190729 - Antique Research PDFdarshanmadeNo ratings yet

- CCL Products LTD - Q3FY24 Result Update - 07022024 - 07!02!2024 - 12Document9 pagesCCL Products LTD - Q3FY24 Result Update - 07022024 - 07!02!2024 - 12Sanjeedeep Mishra , 315No ratings yet

- IDirect Berger Q2FY23Document9 pagesIDirect Berger Q2FY23Rutuparna mohantyNo ratings yet

- Electrical Machinery June 2017Document47 pagesElectrical Machinery June 2017MayankNo ratings yet

- HMCL 20240211 Mosl Ru PG012Document12 pagesHMCL 20240211 Mosl Ru PG012Realm PhangchoNo ratings yet

- BASF CFO Commerzbank ODDO-BHF Corporate ConferenceDocument66 pagesBASF CFO Commerzbank ODDO-BHF Corporate ConferenceTorres LondonNo ratings yet

- Insights Reg PlantationsDocument69 pagesInsights Reg PlantationsNasya YenitaNo ratings yet

- Insights Reg PlantationsDocument69 pagesInsights Reg PlantationsNasya YenitaNo ratings yet

- IDirect UnitedSpirits Q4FY21Document6 pagesIDirect UnitedSpirits Q4FY21Ranjith ChackoNo ratings yet

- Balkrishna Industries: Steady Run Ahead After Strong Q4Document6 pagesBalkrishna Industries: Steady Run Ahead After Strong Q4darshanmadeNo ratings yet

- SiemensIndia Q4FY23ResultReview29Nov23 ResearchDocument8 pagesSiemensIndia Q4FY23ResultReview29Nov23 Research0003tzNo ratings yet

- Edelweiss Weekly Newsletter December 09 2022Document2 pagesEdelweiss Weekly Newsletter December 09 2022arian2026No ratings yet

- BASF CEO Roadshow UKDocument64 pagesBASF CEO Roadshow UKTorres LondonNo ratings yet

- Economic Update: Current Account Surplus Highest in Three Years Thanks To Stronger Oil PricesDocument3 pagesEconomic Update: Current Account Surplus Highest in Three Years Thanks To Stronger Oil PricesÁron KerékgyártóNo ratings yet

- TSX Sherf 2020Document140 pagesTSX Sherf 2020popoNo ratings yet

- Delivers Healthy Performance: Sector: Agri Chem Result UpdateDocument6 pagesDelivers Healthy Performance: Sector: Agri Chem Result UpdatedarshanmadeNo ratings yet

- LJ University L.J. Institute of Management Studies: MbaisemiiDocument3 pagesLJ University L.J. Institute of Management Studies: Mbaisemiiayushi LakumNo ratings yet

- Strategy Valuations Kotak 7may24Document17 pagesStrategy Valuations Kotak 7may24chetanvora.readingNo ratings yet

- IDirect IDFCBank Q4FY23Document6 pagesIDirect IDFCBank Q4FY23Silambarasan AshokkumarNo ratings yet

- Equity Research Report On Pidilite LTDDocument9 pagesEquity Research Report On Pidilite LTDDurgesh ShuklaNo ratings yet

- Edelweiss Weekly Newsletter October 21 2022Document2 pagesEdelweiss Weekly Newsletter October 21 2022Sri DPNo ratings yet

- Century SPARK Q2FY21 12nov20Document5 pagesCentury SPARK Q2FY21 12nov20Tai TranNo ratings yet

- IDirect AmaraRaja CoUpdate Feb21Document6 pagesIDirect AmaraRaja CoUpdate Feb21Romelu MartialNo ratings yet

- Management Accountant Paper 2.2 Dec 2023Document19 pagesManagement Accountant Paper 2.2 Dec 2023MEYVIELYKERNo ratings yet

- IncredDocument10 pagesIncredHarshit MehtaNo ratings yet

- 08april2024 India DailyDocument75 pages08april2024 India Dailyakhilesh kumarNo ratings yet

- Muhurat Picks 2021 - Progressive 22.10.2021Document21 pagesMuhurat Picks 2021 - Progressive 22.10.2021sumitNo ratings yet

- Financial Year ONGCDocument8 pagesFinancial Year ONGCJohnNo ratings yet

- Globus SpiritsDocument5 pagesGlobus SpiritsTejesh GoudNo ratings yet

- OALP Oil and Gas Wrap Up Report 2021 FinalDocument20 pagesOALP Oil and Gas Wrap Up Report 2021 FinalnganugoNo ratings yet

- Macroeconomic Report May 2020 Economic DivisionDocument22 pagesMacroeconomic Report May 2020 Economic DivisionTim SheldonNo ratings yet

- Atul Auto 1QFY20 Result Update - 190813 - Antique ResearchDocument4 pagesAtul Auto 1QFY20 Result Update - 190813 - Antique ResearchdarshanmadeNo ratings yet

- SMIFSDocument14 pagesSMIFSHarshit MehtaNo ratings yet

- Castrol India IC May21Document17 pagesCastrol India IC May21SomendraNo ratings yet

- 06april2023 India DailyDocument158 pages06april2023 India Dailyavinashpathak777No ratings yet

- AngelBrokingResearch ICICI Bank Result Update Q3FY20Document7 pagesAngelBrokingResearch ICICI Bank Result Update Q3FY20Baby FirebladeNo ratings yet

- Economic Indicators for East Asia: Input–Output TablesFrom EverandEconomic Indicators for East Asia: Input–Output TablesNo ratings yet

- Kane 458s ManualDocument36 pagesKane 458s ManualAnresNo ratings yet

- Physiology of The Cardiovascular System - ENG AUDITDocument8 pagesPhysiology of The Cardiovascular System - ENG AUDITmarinescu danNo ratings yet

- Legend of October 2021 Banking Monthly CADocument68 pagesLegend of October 2021 Banking Monthly CAguru GuruNo ratings yet

- Physics - Section A: Mock Test # 1 - Physics Class 11Th (14 Chapters) - Ncert Back Exercise (Converted To MCQS)Document9 pagesPhysics - Section A: Mock Test # 1 - Physics Class 11Th (14 Chapters) - Ncert Back Exercise (Converted To MCQS)Chinmay SinghNo ratings yet

- Chapter Four Axial PumpDocument8 pagesChapter Four Axial Pumpkuma alemayehu100% (1)

- Cummins 1 - of - 3Document100 pagesCummins 1 - of - 3totok100% (1)

- Phy 111 - Eos Exam 2015Document7 pagesPhy 111 - Eos Exam 2015caphus mazengeraNo ratings yet

- Capacities and Specifications GDP25MXDocument14 pagesCapacities and Specifications GDP25MXvicmart3030No ratings yet

- Someks Manual GL1000 CompleteOperatorsManual enDocument135 pagesSomeks Manual GL1000 CompleteOperatorsManual endmitriy.astakhovNo ratings yet

- Easypact Mvs - Mvs12n4nw6aDocument7 pagesEasypact Mvs - Mvs12n4nw6asaravananNo ratings yet

- Datasheet - Sun (10 15) K g03 Lvdeye - 230901 - enDocument2 pagesDatasheet - Sun (10 15) K g03 Lvdeye - 230901 - enprosperNo ratings yet

- Phillips India: Bidding For Floodlighting Eden Gardens: DisclaimerDocument3 pagesPhillips India: Bidding For Floodlighting Eden Gardens: DisclaimerShreshtha SinhaNo ratings yet

- CO2 Energy Vector in The Concept of CircularDocument9 pagesCO2 Energy Vector in The Concept of CircularMr PolashNo ratings yet

- PGDT c3 DiagnosticsDocument14 pagesPGDT c3 DiagnosticsHushanjiNo ratings yet

- Pages From 432912277-Manual-Air-Compresor-Atlas Copco-GA75-2-18Document3 pagesPages From 432912277-Manual-Air-Compresor-Atlas Copco-GA75-2-18Tolias Egw100% (1)

- Canadian Solar-Datasheet-HiKu6 CS6W-MS v1.4 enDocument2 pagesCanadian Solar-Datasheet-HiKu6 CS6W-MS v1.4 enLuiz HenriqueNo ratings yet

- Distribution Grids in Europe: Facts and Figures 2020Document20 pagesDistribution Grids in Europe: Facts and Figures 2020sedepesNo ratings yet

- Tkii BBS FormatDocument13 pagesTkii BBS FormatAmulyaRajbharNo ratings yet

- Lec 11 - Korelasi (Optimized)Document26 pagesLec 11 - Korelasi (Optimized)Asal ReviewNo ratings yet

- A Python Program To Model and Analyze Wind Speed DataDocument16 pagesA Python Program To Model and Analyze Wind Speed DataVelumani sNo ratings yet

- Empilhadeira Hyster 1698731 - (J006) - H-PM-US-EN - (10-2021)Document826 pagesEmpilhadeira Hyster 1698731 - (J006) - H-PM-US-EN - (10-2021)Antonio100% (1)

- Piping Basic: by Aries ChandraDocument18 pagesPiping Basic: by Aries ChandraAries Chandra Abu HasanNo ratings yet

- Chapter 22 TestDocument8 pagesChapter 22 Testnava2002No ratings yet

- UFUser WorksheetsDocument7 pagesUFUser WorksheetsAhmed SayedNo ratings yet

- Auto Tune Live User Guide v01Document27 pagesAuto Tune Live User Guide v01AnthonyNo ratings yet

- Rutland 914i Manual EDocument36 pagesRutland 914i Manual Egregoire de BrichambautNo ratings yet

- Determining The Factors Affecting The Acceptance of Filipinos On The Use of Renewable Energies: A ModelDocument17 pagesDetermining The Factors Affecting The Acceptance of Filipinos On The Use of Renewable Energies: A ModelRFSNo ratings yet

- Flexible All-Perovskite Tandem Solar Cells Approaching 25% Efficiency With Molecule-Bridged Hole-Selective ContactDocument12 pagesFlexible All-Perovskite Tandem Solar Cells Approaching 25% Efficiency With Molecule-Bridged Hole-Selective ContactVeena SnaikNo ratings yet

- 21 Kawo Roundabout Kaduna State, Nigeria.: Table of ContentDocument4 pages21 Kawo Roundabout Kaduna State, Nigeria.: Table of ContentNwosu MichaelNo ratings yet