Professional Documents

Culture Documents

Benefits On Reg 22 (2) Retirment Dt. 29.11.2023

Benefits On Reg 22 (2) Retirment Dt. 29.11.2023

Uploaded by

udpr.personnel0 ratings0% found this document useful (0 votes)

0 views1 pageOriginal Title

Benefits on Reg 22(2) Retirment Dt. 29.11.2023

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

0 views1 pageBenefits On Reg 22 (2) Retirment Dt. 29.11.2023

Benefits On Reg 22 (2) Retirment Dt. 29.11.2023

Uploaded by

udpr.personnelCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

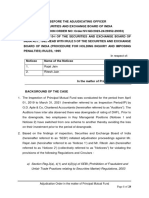

FCI HQ-EP024(11)/3/2023-EP

1332537/2023/EP-HQ

I/748273/2023

F. No. FCI HQ-EP024(11)/3/2023-EP

FOOD CORPORATION OF INDIA

HEADQUARTERS,

16-20, BARAKHAMBA LANE, NEW DELHI

Date: Signature Date

(CIRCULAR NO. EP-01-2023-37)

Subject: Clarification regarding entitlement of terminal benefits to employees of the

Corporation on pre-mature retirement under Regulation 22(2) of FCI (Staff) Regulations,

1971 – reg.

Reference is invited to Circular No. EP-01-2021-24 dated 09.07.2021 regarding

‘Periodic Review of Corporation Employees for strengthening of administration under

Regulation 22(2) of FCI (Staff) Regulations, 1971’. This office is in receipt of queries seeking

clarification as to whether the employees on pre-mature retirement under Regulation 22(2) of

FCI (Staff) Regulations, 1971 are entitled for terminal benefits.

Matter has been thus examined and noted that the FCI Hqrs. New Delhi Circular No.

EP-01-2021-24 dated 09.07.2021 and DoPT OM no. 25013/03/2019-Estt.A-IV dated

28.08.2020 clarify that pre-mature retirement under these rules is not a penalty. It is distinct

from Compulsory Retirement which is one of prescribed penalty under disciplinary regulations.

Therefore, an employee, retired under Regulation 22(2) of FCI (Staff) Regulations, 1971,

shall be entitled for terminal benefits as applicable in case of superannuation viz. , Gratuity,

Pension Fund, Contributory Provident Fund (CPF), PRMS benefits, Leave encashment,

Memento, Traveling Allowance (TA), Composite Transfer Grant (CTG) and Transportation

rates as per relevant rules concerning these benefits.

This is for information, guidance and compliance by all the concerned.

//This issues with the approval of the Competent Authority//

(Subhash Chander)

Dy. General Manager (EP)

Distribution:

As per standard mailing list.

You might also like

- Teacher's Service RecordDocument4 pagesTeacher's Service Recordemmancastro78% (27)

- WB Vs Vivekananda VidyamandirDocument3 pagesWB Vs Vivekananda VidyamandirShubh DixitNo ratings yet

- Revision of Room Rent Consultation Fee and Icu ChargesDocument3 pagesRevision of Room Rent Consultation Fee and Icu ChargesaccasonuNo ratings yet

- Doppw Issues Notification For Central Government Employees Covered Under The NpsDocument2 pagesDoppw Issues Notification For Central Government Employees Covered Under The NpsRajendra Nath MitraNo ratings yet

- Mumbai - 400051 NSE Scrip Symbol: MAXIND Mumbai - 400001: India !limitedDocument13 pagesMumbai - 400051 NSE Scrip Symbol: MAXIND Mumbai - 400001: India !limitedAmrut BhattNo ratings yet

- Purchase of Medicines From Apollo Extension - 30092022Document1 pagePurchase of Medicines From Apollo Extension - 30092022AKSHIT AGARWALNo ratings yet

- DR 08102022Document2 pagesDR 08102022GK TiwariNo ratings yet

- Document 128Document1 pageDocument 128akhlaqur rahmanNo ratings yet

- Order No. 99Document1 pageOrder No. 99accasonuNo ratings yet

- Bases Conversion and Development AuthorityDocument2 pagesBases Conversion and Development Authorityapril aranteNo ratings yet

- 1Document47 pages1radhikabihani18No ratings yet

- 4th Week Case DigestDocument90 pages4th Week Case DigestPaul Roel SolonNo ratings yet

- Cicular 11 of 2023Document2 pagesCicular 11 of 2023piyush jainNo ratings yet

- Group BoptionDocument12 pagesGroup BoptionAbhinav Krishna PNo ratings yet

- Bases Conversion V COA Case DigestDocument3 pagesBases Conversion V COA Case DigestAndriel Gayle P. YuloNo ratings yet

- Tata Consumer Products Limited: Postal Ballot NoticeDocument17 pagesTata Consumer Products Limited: Postal Ballot NoticevenkateshNo ratings yet

- DR 03 Advt 02 10 2021Document36 pagesDR 03 Advt 02 10 2021RakeshNo ratings yet

- LTC CircularDocument9 pagesLTC Circulardogonda adminNo ratings yet

- AG II (Technical)Document1 pageAG II (Technical)Storage DivisionNo ratings yet

- ContractorDocument9 pagesContractorAchyut KanungoNo ratings yet

- 003 - BCDA v. COA (2009)Document8 pages003 - BCDA v. COA (2009)Cheska VergaraNo ratings yet

- 82 Irene G. Ancheta Et Al. (Rank-And-File Employees of The Subic Water District) vs. Commission On Audit, G.R. No. 236725, February 02, 2021Document21 pages82 Irene G. Ancheta Et Al. (Rank-And-File Employees of The Subic Water District) vs. Commission On Audit, G.R. No. 236725, February 02, 2021Melvin PernezNo ratings yet

- SB Order 10-2023 - Clarifications On MSSC Scheme 2023 PDFDocument2 pagesSB Order 10-2023 - Clarifications On MSSC Scheme 2023 PDFsachinrajesh2kNo ratings yet

- G.R. No. 178160Document7 pagesG.R. No. 178160Anton Ric Delos ReyesNo ratings yet

- Annex UreaDocument1 pageAnnex UreaSubbuNo ratings yet

- Interim Order in The Matter of Sankalp Projects LimitedDocument14 pagesInterim Order in The Matter of Sankalp Projects LimitedShyam SunderNo ratings yet

- Reconstitution Guidelines For LPGDocument67 pagesReconstitution Guidelines For LPGadarsh kumarNo ratings yet

- BCDA v. COA (G.R. No. 178160)Document7 pagesBCDA v. COA (G.R. No. 178160)shallyNo ratings yet

- DR - 27102021 RMKCRDocument2 pagesDR - 27102021 RMKCRBhartendu ShakyaNo ratings yet

- SPS For BSNL DRs 20220114Document15 pagesSPS For BSNL DRs 20220114swapanNo ratings yet

- SOP GrantofExemption 06092023Document42 pagesSOP GrantofExemption 06092023viru2u85No ratings yet

- Chapter Xiii: Department of Public Enterprises: 13.1.1 Irregular Payment To EmployeesDocument6 pagesChapter Xiii: Department of Public Enterprises: 13.1.1 Irregular Payment To EmployeesbawejaNo ratings yet

- G.R. No. 178160Document5 pagesG.R. No. 178160Joshua Buenaobra CapispisanNo ratings yet

- DocumentDocument1 pageDocumentVijay RajNo ratings yet

- Circular Pnesion 13122023Document12 pagesCircular Pnesion 13122023Ayush SinghNo ratings yet

- Dop 2022 B.ODocument2 pagesDop 2022 B.ORiyas MohamedNo ratings yet

- TCPL Postal Ballot NoticeDocument20 pagesTCPL Postal Ballot NoticeAnbarasu MookiahpandianNo ratings yet

- CHD DR 2023 0055 Konsulta Package For LTODocument2 pagesCHD DR 2023 0055 Konsulta Package For LTOivylantapeNo ratings yet

- BCDA V COADocument3 pagesBCDA V COADanielle LimNo ratings yet

- Corrigendum 31 March 2023: Subject: Information Bulletin of NEET (UG) 2023 - Clause 5.2.2-RegDocument1 pageCorrigendum 31 March 2023: Subject: Information Bulletin of NEET (UG) 2023 - Clause 5.2.2-RegHarshitha RajannaNo ratings yet

- New EPF Rules 2021 - Latest Amendments To EPF ActDocument9 pagesNew EPF Rules 2021 - Latest Amendments To EPF ActJyotihckNo ratings yet

- ONGC CircularEPS - Feb2023Document6 pagesONGC CircularEPS - Feb2023Honey singhNo ratings yet

- Result - DR - 04 - Food Analyst - 23 - 08 - 2022Document4 pagesResult - DR - 04 - Food Analyst - 23 - 08 - 2022Bhavana avhadNo ratings yet

- G.R. No. 178160 February 26, 2009 Bases Conversion and Development Authority, Petitioner, vs. Commission On Audit, Respondent.Document2 pagesG.R. No. 178160 February 26, 2009 Bases Conversion and Development Authority, Petitioner, vs. Commission On Audit, Respondent.Drimtec TradingNo ratings yet

- BCDA v. COA, G.R. No. 178160, February 26, 2009.Document7 pagesBCDA v. COA, G.R. No. 178160, February 26, 2009.Emerson NunezNo ratings yet

- NEWSLETTER - February 2024 - RegulatoryDocument12 pagesNEWSLETTER - February 2024 - RegulatoryVedant MaskeNo ratings yet

- (BCDA v. COA) (2009) G.R. No. 178160Document7 pages(BCDA v. COA) (2009) G.R. No. 178160jofel delicanaNo ratings yet

- En Banc: Petitioner, vs. COMMISSION ON AUDIT, RespondentDocument10 pagesEn Banc: Petitioner, vs. COMMISSION ON AUDIT, Respondentdenbar15No ratings yet

- Case Ix Pawan Kumar Garg and Others V Chairman & Managing Director, Bharat Sanchar Nigam Limited, New Delhi and Others FactsDocument5 pagesCase Ix Pawan Kumar Garg and Others V Chairman & Managing Director, Bharat Sanchar Nigam Limited, New Delhi and Others FactsHarsha AmmineniNo ratings yet

- 2Document28 pages2radhikabihani18No ratings yet

- Circular No. 12 of 2023 Ex Gratia To DPS NWNPDocument2 pagesCircular No. 12 of 2023 Ex Gratia To DPS NWNPpiyush jainNo ratings yet

- Postal Ballot Notice Dated 20.03.2024Document13 pagesPostal Ballot Notice Dated 20.03.2024Suraj 1212No ratings yet

- SB Order 22 2023 29112023Document3 pagesSB Order 22 2023 29112023KumaravelNo ratings yet

- EPFOs Original Letter Regarding Mandatory Seeding of Aadhaar Number For ECRDocument2 pagesEPFOs Original Letter Regarding Mandatory Seeding of Aadhaar Number For ECRSudhir BarotNo ratings yet

- Mfdac Report On The Account of Dha RajanpurDocument101 pagesMfdac Report On The Account of Dha RajanpurkashafkhanmaqsoodNo ratings yet

- BCDA V COADocument5 pagesBCDA V COAFidea EncarnacionNo ratings yet

- Periodicreviewunderfr 56 BMRD VDocument16 pagesPeriodicreviewunderfr 56 BMRD VAtul AnchalNo ratings yet

- Documents 59362 2667424 EPS-CircularSCJudgementEPS-95.pdfDocument2 pagesDocuments 59362 2667424 EPS-CircularSCJudgementEPS-95.pdfpaonemechNo ratings yet

- BCDA V COADocument7 pagesBCDA V COATheodore BallesterosNo ratings yet

- ASEAN+3 Multi-Currency Bond Issuance Framework: Implementation Guidelines for the PhilippinesFrom EverandASEAN+3 Multi-Currency Bond Issuance Framework: Implementation Guidelines for the PhilippinesNo ratings yet

- How Better Regulation Can Shape the Future of Indonesia's Electricity SectorFrom EverandHow Better Regulation Can Shape the Future of Indonesia's Electricity SectorNo ratings yet

- Good Medical Practice 2013Document36 pagesGood Medical Practice 2013Pokoj 228No ratings yet

- AKWEI AND OTHERS v. AWULETEY AND OTHERSDocument9 pagesAKWEI AND OTHERS v. AWULETEY AND OTHERShighcourt1kumasiNo ratings yet

- Bad Debts & Allowance For Doubtful DebtsDocument24 pagesBad Debts & Allowance For Doubtful Debtsyyy10No ratings yet

- World Data SetDocument2 pagesWorld Data SetJ HerbertNo ratings yet

- Internal Audit ManualDocument3 pagesInternal Audit ManualMitch Tokong MinglanaNo ratings yet

- THE Sale: On Wednesday, The 27 Day NOVEMBER, 2019 OF at 3.00 P.M. at The Auction CentreDocument4 pagesTHE Sale: On Wednesday, The 27 Day NOVEMBER, 2019 OF at 3.00 P.M. at The Auction CentreBulat BulatNo ratings yet

- Lecture 11 SociologyDocument29 pagesLecture 11 SociologyMehar ShaniNo ratings yet

- General Contractor: Working With ADocument4 pagesGeneral Contractor: Working With ATamires AndradeNo ratings yet

- Singapore Airlines v. CIR CTA No. 7500Document15 pagesSingapore Airlines v. CIR CTA No. 7500bianca.denise.dawisNo ratings yet

- Appeal For Review of Legal Advice From DPPDocument8 pagesAppeal For Review of Legal Advice From DPPDavid Hundeyin100% (2)

- Sumarsono Dan Partana (2002)Document18 pagesSumarsono Dan Partana (2002)Dian NovitaNo ratings yet

- Re James O'Keefe Nov 2021 S&SW Special MasterDocument37 pagesRe James O'Keefe Nov 2021 S&SW Special MasterFile 411No ratings yet

- Partial Withdrawal Form Borang Permohonan Pengeluaran SebahagianDocument2 pagesPartial Withdrawal Form Borang Permohonan Pengeluaran SebahagianSh Shaeza50% (2)

- UNFCCC - United Nations Framework Convention On Climate ChangeDocument6 pagesUNFCCC - United Nations Framework Convention On Climate Changeuday KumarNo ratings yet

- Color Purple Research Paper TopicsDocument4 pagesColor Purple Research Paper Topicsaflbqtfvh100% (1)

- Mahathir MohamadDocument2 pagesMahathir Mohamadme_nea9161No ratings yet

- The Controversial Peace Document Packet-1Document5 pagesThe Controversial Peace Document Packet-1AzraelNo ratings yet

- Form of TransferDocument2 pagesForm of TransferNurin IrdinaNo ratings yet

- Petition For Settlement of EstateDocument4 pagesPetition For Settlement of EstateSTEPHEN NIKOLAI CRISANGNo ratings yet

- COURSE OUTLINE UstDocument9 pagesCOURSE OUTLINE UstJan AlabaNo ratings yet

- Ferreria v. Vda. de GonzalesDocument4 pagesFerreria v. Vda. de GonzalesLaura MangantulaoNo ratings yet

- Consumer Boycott FlyerDocument2 pagesConsumer Boycott FlyerBDS-KampagneNo ratings yet

- Booking Confernfrmation Ebkg08228036Document2 pagesBooking Confernfrmation Ebkg08228036kidistmoredoNo ratings yet

- Process Flow of Parcelization SPLIT Project Asof 24092021 1Document7 pagesProcess Flow of Parcelization SPLIT Project Asof 24092021 1Cara Lucille RosNo ratings yet

- PHI101-Branches of Philosophy-PHI UI-2021-140Document10 pagesPHI101-Branches of Philosophy-PHI UI-2021-140Adegbola IbrahimNo ratings yet

- Emergency National Security Supplemental Appropriations Act, 2024Document370 pagesEmergency National Security Supplemental Appropriations Act, 2024Daily Caller News Foundation100% (1)

- Affidavit of Birth: FurthermoreDocument2 pagesAffidavit of Birth: FurthermoreJoey SingsonNo ratings yet

- Affidavit of Fact: Moorish AmericansDocument7 pagesAffidavit of Fact: Moorish Americansoryah El100% (1)

- 341 Pages Blackrock Maryland SOS They DeletedDocument341 pages341 Pages Blackrock Maryland SOS They DeletedAdam P.CNo ratings yet