Professional Documents

Culture Documents

ENVC - Assignment #3 - Case Memo II - Facebook - 2022H

ENVC - Assignment #3 - Case Memo II - Facebook - 2022H

Uploaded by

Yash SanghaviCopyright:

Available Formats

You might also like

- The Lessons From Microsoft: by Dennis W. CarltonDocument8 pagesThe Lessons From Microsoft: by Dennis W. CarltonDuy NghiNo ratings yet

- The Rise of Artificial Intelligence: Real-world Applications for Revenue and Margin GrowthFrom EverandThe Rise of Artificial Intelligence: Real-world Applications for Revenue and Margin GrowthNo ratings yet

- 24 B1 Addtl Final Test Jan2021Document2 pages24 B1 Addtl Final Test Jan2021Wei JunNo ratings yet

- (Mission 2022) Secure Daily UPSC Mains Answer Writing Practice: 25 May 2022Document9 pages(Mission 2022) Secure Daily UPSC Mains Answer Writing Practice: 25 May 2022realindian.patroiticNo ratings yet

- Business Strategies and Solving Social Problems FA23Document8 pagesBusiness Strategies and Solving Social Problems FA23pradyut.agrawal18No ratings yet

- CH 003Document25 pagesCH 003bigbufftony100% (1)

- Ibrahim Assignment 3 Information TechnologyDocument4 pagesIbrahim Assignment 3 Information Technologysardar hussainNo ratings yet

- Sem3 Part2 Dec 2020 G.E Question PaperDocument31 pagesSem3 Part2 Dec 2020 G.E Question PaperIsha JainNo ratings yet

- BIT303 Assignment 2 - Feb 2019 Semester PDFDocument3 pagesBIT303 Assignment 2 - Feb 2019 Semester PDFdnhzrdNo ratings yet

- Advanced Technology in Management End Term ExaminationDocument3 pagesAdvanced Technology in Management End Term Examinationkaushal dhapareNo ratings yet

- UMED95-15-3Exam Paper Online Exam - Main - Frenchay - Jan - 2024Document2 pagesUMED95-15-3Exam Paper Online Exam - Main - Frenchay - Jan - 2024Đình Sơn LêNo ratings yet

- Sample Exam Paper - ITC506-19Document5 pagesSample Exam Paper - ITC506-19AhmedNo ratings yet

- Model Question: BBA/Third Semester / IT 203: Management Information SystemDocument1 pageModel Question: BBA/Third Semester / IT 203: Management Information SystemNimdorje SherpaNo ratings yet

- IELTS Writing Task 2Document15 pagesIELTS Writing Task 2Nguyen Hang100% (2)

- New Modes of Competition: Implications For The Future Structure of The Computer IndustryDocument59 pagesNew Modes of Competition: Implications For The Future Structure of The Computer IndustryjimakosjpNo ratings yet

- End-Term-Question Paper BGS22Document3 pagesEnd-Term-Question Paper BGS22Param ShahNo ratings yet

- AbdelRhman Yasser Mohamed Managment QuizDocument7 pagesAbdelRhman Yasser Mohamed Managment QuizyaraNo ratings yet

- Tutorial Assign Term TwoDocument3 pagesTutorial Assign Term Twoshak najakNo ratings yet

- Full Download Management Information Systems 3rd Edition Rainer Solutions ManualDocument35 pagesFull Download Management Information Systems 3rd Edition Rainer Solutions Manualelijahcookj6x9100% (41)

- Course Outline and Assignments: Management Information Systems SampleDocument5 pagesCourse Outline and Assignments: Management Information Systems SampleIshita KotakNo ratings yet

- MGMT 701: Strategy and Competitive Advantage: Jhchoi@wharton - Upenn.eduDocument7 pagesMGMT 701: Strategy and Competitive Advantage: Jhchoi@wharton - Upenn.eduChaucer19No ratings yet

- Harbir Singh's SyllabusDocument13 pagesHarbir Singh's SyllabusTiya JainNo ratings yet

- File 12Document9 pagesFile 12ProvisualTestNo ratings yet

- Full Download PDF of Test Bank For Multinational Business Finance 13th Edition by Eiteman All ChapterDocument35 pagesFull Download PDF of Test Bank For Multinational Business Finance 13th Edition by Eiteman All Chapterusulliarnoob100% (6)

- MSC Construction Law Dissertation TopicsDocument8 pagesMSC Construction Law Dissertation TopicsPaperWritingHelpOnlineSingapore100% (1)

- MGMT 223: Business Strategy: Jhchoi@wharton - Upenn.eduDocument7 pagesMGMT 223: Business Strategy: Jhchoi@wharton - Upenn.edusvkbharathiNo ratings yet

- Solutions Manual For Business and Society Ethics and Stakeholder Management 6th Edition by Archie, CarrolDocument7 pagesSolutions Manual For Business and Society Ethics and Stakeholder Management 6th Edition by Archie, Carrollouismark3747No ratings yet

- Module 2 - Task 1 - Notes and Questions From The SupervisorDocument3 pagesModule 2 - Task 1 - Notes and Questions From The SupervisorGowthami NalluriNo ratings yet

- Assignment 1Document1 pageAssignment 1Prem SwnpNo ratings yet

- B.A. LL.B - 1st - Semester - ET - 2021Document28 pagesB.A. LL.B - 1st - Semester - ET - 2021NiharikaNo ratings yet

- MGT890djdj BiologyDocument12 pagesMGT890djdj Biologypl205041No ratings yet

- Testbank - Multinational Business Finance - Chapter 1Document11 pagesTestbank - Multinational Business Finance - Chapter 1Uyen Nhi NguyenNo ratings yet

- CAT Week 2 GRP 3Document2 pagesCAT Week 2 GRP 3rahouo devNo ratings yet

- Ujian Tengah Semester Program S1 Universitas Prasetiya Mulya Semester 1 Tahun Akademik 2020/2021Document5 pagesUjian Tengah Semester Program S1 Universitas Prasetiya Mulya Semester 1 Tahun Akademik 2020/2021asdasdasdafasNo ratings yet

- Interm Coursebook Unit1Document8 pagesInterm Coursebook Unit1Rami AhmedNo ratings yet

- King's International Foundation - Business and Society (0LEC30BS)Document2 pagesKing's International Foundation - Business and Society (0LEC30BS)khalid alkhalifaNo ratings yet

- POB Chapter 1 ReviewDocument8 pagesPOB Chapter 1 ReviewHayden ElshawNo ratings yet

- Assignment 1 Geme 521Document6 pagesAssignment 1 Geme 521Raggar P CammNo ratings yet

- Case QuestionsDocument8 pagesCase QuestionsUsman ShakoorNo ratings yet

- Lecture 3Document9 pagesLecture 3Skyy I'mNo ratings yet

- Williams Paper2Document9 pagesWilliams Paper2api-571976805No ratings yet

- Problem Solution EssayDocument14 pagesProblem Solution Essayry 7117No ratings yet

- Wharton-Proc MGMT in MFG SyllDocument15 pagesWharton-Proc MGMT in MFG SyllyashNo ratings yet

- Instructions: Use The Frameworks/models Taught in The Lectures To Do The Analysis. GoodDocument1 pageInstructions: Use The Frameworks/models Taught in The Lectures To Do The Analysis. GoodSoorajKrishnanNo ratings yet

- Operations Strategy (Singh) SU2014Document6 pagesOperations Strategy (Singh) SU2014HrishikeshNo ratings yet

- IELTS Writing Task 2 Question TypesDocument13 pagesIELTS Writing Task 2 Question TypesBushra AlamNo ratings yet

- Group Presentation Guidelines - 22-23-s1Document2 pagesGroup Presentation Guidelines - 22-23-s1Nguyễn Quốc HưngNo ratings yet

- Dwnload Full Management Information Systems 3rd Edition Rainer Solutions Manual PDFDocument35 pagesDwnload Full Management Information Systems 3rd Edition Rainer Solutions Manual PDFwelterfogbeltg7bq100% (12)

- Assessment 1 (10%) Online Test - S2-2023Document3 pagesAssessment 1 (10%) Online Test - S2-2023s3878775No ratings yet

- Reading Questions Chapter 2 Rainer IIS 4eDocument6 pagesReading Questions Chapter 2 Rainer IIS 4eJasongNo ratings yet

- Dr. Ram Manohar Lohiya National Law University, LucknowDocument2 pagesDr. Ram Manohar Lohiya National Law University, LucknowVipul GautamNo ratings yet

- Assignment Instructions - EduvosDocument8 pagesAssignment Instructions - EduvosAmandakeaNo ratings yet

- Decision Making Test 1Document12 pagesDecision Making Test 1Destiney StevenNo ratings yet

- Napierala AndrewDocument2 pagesNapierala AndrewJozef LademoraNo ratings yet

- Final End Term Family Law PaperDocument3 pagesFinal End Term Family Law PaperAadhityaNo ratings yet

- Articulo 6. Why Some Organizations More Competitive v2Document22 pagesArticulo 6. Why Some Organizations More Competitive v2Lewin RamirezNo ratings yet

- Apr 07 Dip Pi Is Pre PortDocument7 pagesApr 07 Dip Pi Is Pre PortJamie ZueNo ratings yet

- Managerial Finance & Accounting Final PaperDocument9 pagesManagerial Finance & Accounting Final PaperMin Khant SoeNo ratings yet

- System Dynamics for Industrial Engineers and Scientific ManagersFrom EverandSystem Dynamics for Industrial Engineers and Scientific ManagersNo ratings yet

- Genesis: Human Experience in the Age of Artificial Intelligence: Why we need to be long and not short on humanity and AI, not humanity or AI, to create a sustained future, togetherFrom EverandGenesis: Human Experience in the Age of Artificial Intelligence: Why we need to be long and not short on humanity and AI, not humanity or AI, to create a sustained future, togetherNo ratings yet

ENVC - Assignment #3 - Case Memo II - Facebook - 2022H

ENVC - Assignment #3 - Case Memo II - Facebook - 2022H

Uploaded by

Yash SanghaviOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ENVC - Assignment #3 - Case Memo II - Facebook - 2022H

ENVC - Assignment #3 - Case Memo II - Facebook - 2022H

Uploaded by

Yash SanghaviCopyright:

Available Formats

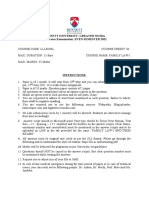

ENVC Individual Assignment # Case Memo II

(Due 11:59 pm Tuesday the 29th)

Dear Class ENVC,

Greetings and this case brings our attention to the ownership and control issues in high

tech entrepreneurship, which provides a distinctive type of challenge in addition to that

of the large corporation.

Look forward to discussing it Wednesday,

Francis

The Second Case - Facebook: A Look at Corporate Governance (2018)

Submit your memo on the case above, for all 3 questions below (300 words)

1. When did Facebook pursue dual-class and why? (100 words, the date is not

specified in the case but your outside research is allowed for our in-depth

discussion)

2. What is the potential regulatory problem of dual-class structure? (100 words)

3. What specific policy combination would you suggest the regulatory body to

consider in order to reduce the potential long-term side effects of issuing

dual-class shares? Why? (100 words)

For the related readings in the Indian and US contexts:

The issue of dual-class structure is becoming an important framework for the startup

ecosystem in the United States, due to its corporate governance implications.

IndiaTech proposes key changes in SR shareholding rules to Sebi (ET, 2021)

“Private control with Public money: How far can we go?” (VIDHI, 2019)

“The Untenable Case for Perpetual Dual-Class Stock.” (Professors Bebchuck and

Kastiel, Harvard Law School Forum, 2017.04.24.)

“What’s the Problem with Dual-Class Stock? A Brief Response to Professors Bebchuck

and Kastiel.” (Berger, Harvard Law School Forum, 2017.04.17)

“Uber vs. Lyft: Who’s at the Wheel?” (Harvard Law School Forum, 2019)

“Big investors fight back over dual-class shares. Controversial structures are the

‘scourge of corporate governance.” (Financial Times, 2019.11.24.)

You might also like

- The Lessons From Microsoft: by Dennis W. CarltonDocument8 pagesThe Lessons From Microsoft: by Dennis W. CarltonDuy NghiNo ratings yet

- The Rise of Artificial Intelligence: Real-world Applications for Revenue and Margin GrowthFrom EverandThe Rise of Artificial Intelligence: Real-world Applications for Revenue and Margin GrowthNo ratings yet

- 24 B1 Addtl Final Test Jan2021Document2 pages24 B1 Addtl Final Test Jan2021Wei JunNo ratings yet

- (Mission 2022) Secure Daily UPSC Mains Answer Writing Practice: 25 May 2022Document9 pages(Mission 2022) Secure Daily UPSC Mains Answer Writing Practice: 25 May 2022realindian.patroiticNo ratings yet

- Business Strategies and Solving Social Problems FA23Document8 pagesBusiness Strategies and Solving Social Problems FA23pradyut.agrawal18No ratings yet

- CH 003Document25 pagesCH 003bigbufftony100% (1)

- Ibrahim Assignment 3 Information TechnologyDocument4 pagesIbrahim Assignment 3 Information Technologysardar hussainNo ratings yet

- Sem3 Part2 Dec 2020 G.E Question PaperDocument31 pagesSem3 Part2 Dec 2020 G.E Question PaperIsha JainNo ratings yet

- BIT303 Assignment 2 - Feb 2019 Semester PDFDocument3 pagesBIT303 Assignment 2 - Feb 2019 Semester PDFdnhzrdNo ratings yet

- Advanced Technology in Management End Term ExaminationDocument3 pagesAdvanced Technology in Management End Term Examinationkaushal dhapareNo ratings yet

- UMED95-15-3Exam Paper Online Exam - Main - Frenchay - Jan - 2024Document2 pagesUMED95-15-3Exam Paper Online Exam - Main - Frenchay - Jan - 2024Đình Sơn LêNo ratings yet

- Sample Exam Paper - ITC506-19Document5 pagesSample Exam Paper - ITC506-19AhmedNo ratings yet

- Model Question: BBA/Third Semester / IT 203: Management Information SystemDocument1 pageModel Question: BBA/Third Semester / IT 203: Management Information SystemNimdorje SherpaNo ratings yet

- IELTS Writing Task 2Document15 pagesIELTS Writing Task 2Nguyen Hang100% (2)

- New Modes of Competition: Implications For The Future Structure of The Computer IndustryDocument59 pagesNew Modes of Competition: Implications For The Future Structure of The Computer IndustryjimakosjpNo ratings yet

- End-Term-Question Paper BGS22Document3 pagesEnd-Term-Question Paper BGS22Param ShahNo ratings yet

- AbdelRhman Yasser Mohamed Managment QuizDocument7 pagesAbdelRhman Yasser Mohamed Managment QuizyaraNo ratings yet

- Tutorial Assign Term TwoDocument3 pagesTutorial Assign Term Twoshak najakNo ratings yet

- Full Download Management Information Systems 3rd Edition Rainer Solutions ManualDocument35 pagesFull Download Management Information Systems 3rd Edition Rainer Solutions Manualelijahcookj6x9100% (41)

- Course Outline and Assignments: Management Information Systems SampleDocument5 pagesCourse Outline and Assignments: Management Information Systems SampleIshita KotakNo ratings yet

- MGMT 701: Strategy and Competitive Advantage: Jhchoi@wharton - Upenn.eduDocument7 pagesMGMT 701: Strategy and Competitive Advantage: Jhchoi@wharton - Upenn.eduChaucer19No ratings yet

- Harbir Singh's SyllabusDocument13 pagesHarbir Singh's SyllabusTiya JainNo ratings yet

- File 12Document9 pagesFile 12ProvisualTestNo ratings yet

- Full Download PDF of Test Bank For Multinational Business Finance 13th Edition by Eiteman All ChapterDocument35 pagesFull Download PDF of Test Bank For Multinational Business Finance 13th Edition by Eiteman All Chapterusulliarnoob100% (6)

- MSC Construction Law Dissertation TopicsDocument8 pagesMSC Construction Law Dissertation TopicsPaperWritingHelpOnlineSingapore100% (1)

- MGMT 223: Business Strategy: Jhchoi@wharton - Upenn.eduDocument7 pagesMGMT 223: Business Strategy: Jhchoi@wharton - Upenn.edusvkbharathiNo ratings yet

- Solutions Manual For Business and Society Ethics and Stakeholder Management 6th Edition by Archie, CarrolDocument7 pagesSolutions Manual For Business and Society Ethics and Stakeholder Management 6th Edition by Archie, Carrollouismark3747No ratings yet

- Module 2 - Task 1 - Notes and Questions From The SupervisorDocument3 pagesModule 2 - Task 1 - Notes and Questions From The SupervisorGowthami NalluriNo ratings yet

- Assignment 1Document1 pageAssignment 1Prem SwnpNo ratings yet

- B.A. LL.B - 1st - Semester - ET - 2021Document28 pagesB.A. LL.B - 1st - Semester - ET - 2021NiharikaNo ratings yet

- MGT890djdj BiologyDocument12 pagesMGT890djdj Biologypl205041No ratings yet

- Testbank - Multinational Business Finance - Chapter 1Document11 pagesTestbank - Multinational Business Finance - Chapter 1Uyen Nhi NguyenNo ratings yet

- CAT Week 2 GRP 3Document2 pagesCAT Week 2 GRP 3rahouo devNo ratings yet

- Ujian Tengah Semester Program S1 Universitas Prasetiya Mulya Semester 1 Tahun Akademik 2020/2021Document5 pagesUjian Tengah Semester Program S1 Universitas Prasetiya Mulya Semester 1 Tahun Akademik 2020/2021asdasdasdafasNo ratings yet

- Interm Coursebook Unit1Document8 pagesInterm Coursebook Unit1Rami AhmedNo ratings yet

- King's International Foundation - Business and Society (0LEC30BS)Document2 pagesKing's International Foundation - Business and Society (0LEC30BS)khalid alkhalifaNo ratings yet

- POB Chapter 1 ReviewDocument8 pagesPOB Chapter 1 ReviewHayden ElshawNo ratings yet

- Assignment 1 Geme 521Document6 pagesAssignment 1 Geme 521Raggar P CammNo ratings yet

- Case QuestionsDocument8 pagesCase QuestionsUsman ShakoorNo ratings yet

- Lecture 3Document9 pagesLecture 3Skyy I'mNo ratings yet

- Williams Paper2Document9 pagesWilliams Paper2api-571976805No ratings yet

- Problem Solution EssayDocument14 pagesProblem Solution Essayry 7117No ratings yet

- Wharton-Proc MGMT in MFG SyllDocument15 pagesWharton-Proc MGMT in MFG SyllyashNo ratings yet

- Instructions: Use The Frameworks/models Taught in The Lectures To Do The Analysis. GoodDocument1 pageInstructions: Use The Frameworks/models Taught in The Lectures To Do The Analysis. GoodSoorajKrishnanNo ratings yet

- Operations Strategy (Singh) SU2014Document6 pagesOperations Strategy (Singh) SU2014HrishikeshNo ratings yet

- IELTS Writing Task 2 Question TypesDocument13 pagesIELTS Writing Task 2 Question TypesBushra AlamNo ratings yet

- Group Presentation Guidelines - 22-23-s1Document2 pagesGroup Presentation Guidelines - 22-23-s1Nguyễn Quốc HưngNo ratings yet

- Dwnload Full Management Information Systems 3rd Edition Rainer Solutions Manual PDFDocument35 pagesDwnload Full Management Information Systems 3rd Edition Rainer Solutions Manual PDFwelterfogbeltg7bq100% (12)

- Assessment 1 (10%) Online Test - S2-2023Document3 pagesAssessment 1 (10%) Online Test - S2-2023s3878775No ratings yet

- Reading Questions Chapter 2 Rainer IIS 4eDocument6 pagesReading Questions Chapter 2 Rainer IIS 4eJasongNo ratings yet

- Dr. Ram Manohar Lohiya National Law University, LucknowDocument2 pagesDr. Ram Manohar Lohiya National Law University, LucknowVipul GautamNo ratings yet

- Assignment Instructions - EduvosDocument8 pagesAssignment Instructions - EduvosAmandakeaNo ratings yet

- Decision Making Test 1Document12 pagesDecision Making Test 1Destiney StevenNo ratings yet

- Napierala AndrewDocument2 pagesNapierala AndrewJozef LademoraNo ratings yet

- Final End Term Family Law PaperDocument3 pagesFinal End Term Family Law PaperAadhityaNo ratings yet

- Articulo 6. Why Some Organizations More Competitive v2Document22 pagesArticulo 6. Why Some Organizations More Competitive v2Lewin RamirezNo ratings yet

- Apr 07 Dip Pi Is Pre PortDocument7 pagesApr 07 Dip Pi Is Pre PortJamie ZueNo ratings yet

- Managerial Finance & Accounting Final PaperDocument9 pagesManagerial Finance & Accounting Final PaperMin Khant SoeNo ratings yet

- System Dynamics for Industrial Engineers and Scientific ManagersFrom EverandSystem Dynamics for Industrial Engineers and Scientific ManagersNo ratings yet

- Genesis: Human Experience in the Age of Artificial Intelligence: Why we need to be long and not short on humanity and AI, not humanity or AI, to create a sustained future, togetherFrom EverandGenesis: Human Experience in the Age of Artificial Intelligence: Why we need to be long and not short on humanity and AI, not humanity or AI, to create a sustained future, togetherNo ratings yet