Professional Documents

Culture Documents

JR Ewing Werlein Financial Disclosure Report For 2009

JR Ewing Werlein Financial Disclosure Report For 2009

Uploaded by

Judicial Watch, Inc.Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

JR Ewing Werlein Financial Disclosure Report For 2009

JR Ewing Werlein Financial Disclosure Report For 2009

Uploaded by

Judicial Watch, Inc.Copyright:

Available Formats

I

Aoso

Roy. 1/20SO

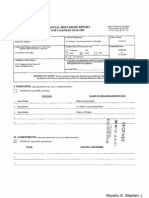

FINANCIAL DISCLOSURE REPORT

FOR CALENDAR YEAR 2009

geport Requi,vd by the Ethics"

in Government Act of 1978 (5 U.S.C, app. 101-111)

L Person ReFortiag (last name, first, middle initial) WEP.LEIN, JR,, EWING 4. Title (Article Itl judges indicate active or senior status; magistrate judge.s indicate f~ll- or pan-tlme) DISTRICT JUDGE-SENIOR STATUS

,2, Court or Organization U SDC/SO. DIST, TEXAS 5a, Report Type (cheek appwpriate type) [] Nomination, [] Initial Date [] Annual

3, Date of Report 07/26/2010 6. Reporting Period [] Final 01/01/2009 to 1213112009

7, Chambers or Office Address 515 RUSK AVENUE, ROOM 1152! HOUSTON, TX 77002-2605

.... 5b, [] Amended Report 8, On the basis of the information contained in this Report and any modifications pertaining thereto, it is, in my opinion, tn compliance with applicable laws and regulations. Reviewing O~eer Date

IMPORTANT NOTES: The instructions accompanying this form must be followea~ Complete all parts,

checking the NONE box for each part where you have no reportable information. Sign on last pag~

I. P OSITI ONS. tR~o,a~g itul~vidaal only; see 1~. 9-13 of filing instructions,)

~ NONE t?Vo reportable positions.}

POSITION

1. 2, 3. 4. Co-Trustee Director & Chairperson Director As Chairperzoa of TMH Board, director ex officio w/vote of following: Trust No. 1

NAME_OF ORGANIZATION/ENTITY

The Methodist Hospital, Houston, Texas TMH Medical Office Bldgs Condoruinium Assoc. Medvest Holdings, Inc.; Methodist Health Centers; Methodist International; (eontd in Note (I) in Part VIII) Diagnostic Center Hospita! Corp. of Texas; Medvest Inc, (contd in Note (2) in Part VIII) Estate No, 1 Trust No. 2 :.-

5.

As Chairn~an of TMH Board, director ex officio w/o vote of following:

6. 7.

Executor Trustee

;.-J

II. AGREEMENTS. ~R~oni.~ ~,,~:~a: o~:y~ s~e ~. S~-~ ~ of ~,n~ ~etio~.J

NONE (No reportable agreements_)

i-.-i

DATE

1.

PARTIES AND TERMS

Werlein Jr., Ewing

FINANCIALDISCLOSURE REPORT Page 2 ef 24 [ WERLEIN, JR., EWING IIl. NO1N-INVESTMENT INCOME. ~R~oni, g iui.a~al u.~ *~o~e~ ,ee pr, 17-~ omti.g i~aio,~.~ A. Filers Ran-Investment Income NONE (No reportable non-investment income.) DATE 1. 2. 3. 4. SOURCE AND TYPI~,

07/26/2010

~ (yours, not spouses)

B, Spouses N0n-Investment Income - If you were merried during any portion of the reporting,year, complefc this sectior~

(Dollar amount not required except for honoraria_)

NONE (No reportable non-investment income.) DATE 1. 2. 3. 4. SOURCE AND TYPE

IV. REIMBURSEMENTS --t,~n~rortoao..iodgi.g, yo~ .,ert~g. .... ~

(Includes those to s~us~ and dependent children: see pp. 25-27 of filing i~tructions,)

NO~ ~o reportable reimbursement.) ~ ~

09/23-24/2009

~

New York, ~

~

M~ting wi$ M~i~l

ITEMS PAID ORPROV~ED

T~nspo~ation, lodging, and meals

1,

The Methodist Hospital

School Affiliate 2. 3. 4. 5.

FINANCIAL DISCLOSURE REPORT

Page 3 of 24

~ame Of Person Reporting

Date of Report

wzm~z~,j~., EWlNG

07t26/2010

[]

NONE (No reportable gifts.) ~ DESCRIPTION NALUE

1. 2. 3. 4. 5.

[-~

NONE (No reportable liabilities.) CREDITOR . DESCRIPTION

t. 2. 3. 4. 5,

FINANCIAL DISCLOSURE REPORT Page 4 of 24

fPerson Repotting

Date of Report

WERLEIN, JR., EWING [ N ....

[

07/26/2010

VII. INVESTMENTS and TRUSTS -- j~o.,.. ~alne, transactions (Includes those of spouse and dependent children; see pp. 34-60 ~/flling instructions.)

1---1 NO~IE (No reportable income, assets, or transactions.)

A. Description of Assets (including trust assets) Place "(X)" after each asset prior B. Income during reporting period ~ (2) Amoum ] Type(e.g., div., rent, C. [ Gross value nt endt of repo~ng period (I)--~--~-- (2) Value [Value [ D, Transactions during reporting period (l) Type(e.g., (2) (3) ~ Date Value Gain[ (5) Identity of

~xemptdisclosure Code I I from

1. ~i 3. 4. 5. ~ 6. 7. 8. 9. I0. 11. 12. Hallibl~r~on com. Ha!|ibnrton com. BP PLI2, AD[~ ..... Exxon Nobil com. Anadarko Petroleum Cot0. ~m. WaI-M~rt St~r~ com. Exxon-~obil corn. Johnson ~z Johnson, com. Conoco ?hillips, com. Texas Capital Bankshares, com. HCP Inc., com. f/k/a HealthCare Prop. CNL Lifestyle Props Ine. units A A A A A A

Code 2 I Moa,od I boy, oe,. I Cod 2 I Code ~ I m.~d~.

_____~ . T T T ...... T T T T T T T T V V T T T K K L N K J L M L L J K K K J K

transaction)

A A 12 D A A B C B

Dividend Dividend Dividend Dividend Dividend Dividend Dividend Dividend Dividend None Dividend Dividend Dividend Dividend Dividend Dividend

See note (3) in Part See note (3) in Part

"13." Hines P..ErT, units 14, 15. 16. AT&T, cam. (X) Bristol-I~yers Squibb, com. (X~ Burlington Northern Santa Fe, corn. (X)

17,

Cisco Systems, com. (X)

None

1. Incmm: Gain C.~I~: (Se Columns BI a~gl D4) 2. Va}~ C, Od~ (S~ Coinrtms ~1 and DS) 3, Value Method Codes (See t~oloran C2)

A ~$1,000 or less F ~$50,001 - $100,000 ~ =$15,000 of Ices N =$250,001 - $50n,000 P.] ~.$25,000,001 - $50,000,000 Q =AppratsM O ~Book Value

B =$1,001 - $2.500 G =$100.1~)1 - $1,000,000 K =$15.001 - $50.000 O --~500,00 |. $1.000,000 R--Co~t (Real ~slale Only) V --~Other

C =$2,501 - $5,000 H 1 =$I.00~.001 - $5,00D,000 L--$50,001 - $100,000 PI =$1,000,0o!. $5.000,000 P4 =More lhan $50.00~,000 S =Asse~mr,~nt W =Estimated

D ~$5.001 - $15.000 1-12 ~M~ than $5,000.000 M =$|00,00t ~ =$5.0o0,001 - $25.00o,~00 T =C~h Market

E =$15,001 - $50,000

FINANCIAL DISCLOSURE REPORT

Page 5 of 24

NameofPerson Reporting WERLEIN, JR,, EWING

Date of Rep0rt 07/26/2010

VII. INVESTMENTS and TRUSTS - ~,~o~,. ,,I,,, ,.o .... ,io.. (Itlclud~s those of spouse and depettdent children; see pp, 34-60 of filing inslruetion$.)

[] NONE (No reportable income, assets, or transactions.)

A. Description of Assets (lnclnding trust nsscts) Plac~ "(X)" after each asset =emp! from prior dls~losure B. Income during ~ r~porting period Amount Code I (A-H) Type (e.g., div., rent, or inl.) C. Gross value at cad of reporting period Value Code 2 (.LP) I } I Gain Code l (A-H) Identity of buyer/seller (if private transaction) D. Transactions during reporting period

Value Typc (e,g., } Date I Value Method buy, sell, I mm/dd/yy [ Code 2 Code 3 redemption) | I (JP) (Q-W)

18. Comcast Corp. Class A (X)

! 19. Dean Foods Co., com. (X)

Dividen~

None

J

21 T

20.

Goodyear, ecru. (X)

None A Dividend

21.

Hewlett Packard, com. (X)

22,

Intel Corp., com. (X)

Dividend

23.

24.

IBM, ecru. (X)

JP Morgan Chase, corn. (X)

Dividend Dividend

25. LSI Co~.,~r,. (~)

26. Pepsico, Inc., ecru, (X) A

No, e

Dividend

J

K

T

T

2~i

Target Corp., com. (X)

Dividend

28.

Tr~house Foods, com. (X)

None

29~

Zimmer Holdings, Inc., com. (X)

None

30. 31.

MUTUAL FUNDS: Fidelity IV[M Fund

Dividend

~.

Fidelity Low Price Stock

Dividend

331

Fidelity Contrafund

Dividend

T T

34.

Fidelity Mid-Cap Stock

Dividend

FINANCIAL DISCLOSURE REPORT Page 6 of 24

] WERLEIN, JR., EWING

07~6/2010

NONE (No reportable income, assets, or transactions,)

A, ~c~pt~n of AsS~ 0nluding t~st as~ts) B. Income dudn~ repo~ng ~ri~ C. Gro~ value at end of ~infi ~riod D. T~n~io~ durin~

~{

orint.)

(J-P)

~ C~ 3

r~ption)

35. 36. 37. 38. 39. 40. 4!. 42, .43.

Asse~k Larg~p Value Sold Asse~ark ~rge-Cap Gro~

None 09/2 !/09 K None

Buy

0111~09 J

[ .......

(addl)

Buy (addl) Sold

01/1~09 09/21109 K 09/21/~ 09~ 1/09 J 01/1~09 09~ 1109 01112109 09121/09 03~3/09 09/21/09 0~!9/09 04115t09 K J J J L J B

~setmark Smal~id-Cap Value A~etmark Smal~id-Cap G~h Asse~ark ln~mational

None None None

Sold Sold Buy Sold

Asse~a& Real ~tate Seeuriti~

None

Buy (a~l) Sold

45. 46. 47. 48. 49. 50~ 5 I.

A~m~ Tax-Exempt

Dividend

Sold Sold

~ean Cenm~ Tax-Free Bond

Di~dend

Sold Buy (aa~0

Sold -

05/21109 J

A Buy (addl) Buy (addl)

108110/09 J I ~09/09 : J

FINAINCIAL DISCLOSURE REPORT

DateofReport

Page 7 of 24

w~a.LEr~, Reporting [ NameofPersonJR., EWING

]

07/26/2010

VII. INVESTMENTS and TRUSTS --ineo ..... t~e, t .... ctions (Includes those of ltpou .... d dependent children see pp. 34-60 ellcling instrttctlort~)

[] NONE (No reportable income, assets, or transactions.)

A. Des~riptiuxq of A~sets (including trust assets) Place "(X)" after each asset exempt from prior disclosure B. Income daring reporting period (1) (2) Amount Type (e.g,, Code I div., rent, {A-H) or int.) c. Gross value at end of reporting period (I) (2) Value Value Code 2 Method (J-P) Code 3 (Q-W) K T D. Transactions d-ring reporting period (1) Type (e.g., buy, sell, redemption) (2) (3) (4) Date Value Gain !mm/dd/yy Code 2 Code 1 (J-P) (A-H) " (5) Identity of buyer/seller (if private transaction)

52, ~53 54. 55. 56. 57. 158. 59. 60. 61. 62. 63. 64. 6~.

Loomis Sayles Bond Fund Retail

Dividend

(part)

Buy (addl) Buy (addl) Buy (addI)

Sold

02/19/09 04/15/09 08/10109 12/09!09 102/19!09 041I 5/09 05/21109 08/10/09 1 2/3 !I09 ~ 09130/09 02/19109 04/15/09 05121/09 08/10/09 ~ 12/31/09 J 10/21/09i 02/19/09[

J J J J J J J J A A

Thomburg Intematl Value

Dividend

Buy (addl) Sold Sold Buy (addq)

(a~dl)

Fed~ated Man. Trust MM Oakmark Fund A A Dividend Dividend J T Closed Buy (addl)

Buy

J J J

(part) (part)

Sold (part) Buy (addq) 67. Federated Mun. Tr. MM A A Dividend Dividend K T Closed Sold Sold

Sold

68. Clipper Fund

Income Gain Cod~:

A ---$1.000 or less

B =$1.0~! - $2,51~

C =$2.501 - $5.000

D =:$5,001 - :$! 5.000

E =:$I 5.~0! $50.000

(See Columns 121 and D3)

N =$250,001 . $500,000 P3 ~;25,000,001. :$50,600,000 U =Book Va/ue

O =$5~,001 - :$1,000,006

Pt ffi:$1,000,00| . $5,00~,000 P4 ~More thar~ $51),OOO,O00 W=l~stimetcd

P2 =$5,0~0,001 - $25,000,0~0

(Se~ Celunm C2)

V =Other

PageFINANCIAL8 of 24 DISCLOSURE REPORT

Nan~e of Person Reporting WERLEIN, JR,, EWING

Date of Report 07126/2010

NONE (No reportable income, asse~, or transactions.)

A. De~pfion of A~s~ B, Incom~ du~ng C. Gr~ valu~ ~t ~d D. T~n~ction~ du~ng

Pt~ "(X)" ~fier ~h ass~ cxcmp~ from ~ior di~losure

Am~m I T~ (.g., dlv,, r~t, or in,.) ..CAH) ~

Val~ ~2 (J-P)

~ Valu~ ] T~ (~,g., r~mption) C~3(~ 1.

Date [ Value [ Gain [ m~d~ C~c 2 [ Code I [ . i (JP) ~ (AH) [

Id~fi~ o~ buyertseli~ ,~nsac, ion)(ifp~vatc

69, 70. 71. 72~ 73. 74. 75. 76. 77,

78.

(~a)

Sold

Sold

~/15/09 05/21/09 08/1 ~09 1 ~31/09 0M19/09[ J J J

(~a)

Sold (pa~) Buy (addl) Ad~hnt~ U,S. R~I ~t. S~s. A Sold FM1 Larg~ Cap Fund A Dividend ~/15/09 J Dividend A K T Buy (addl) Sold (pa~) Sold

B~y (addi) Harbor Intema~l Fund Investor Cla~ Sold A Dividend K T Buy (add!)

Buy (addl)

02/]9/09 ~/1~/09

08/] 0/09

12/31/09 K

79.

102/19/09

80. 81.

~/15/09 J

Sold (paff) Buy (addl) H~rbcr Capital Appr~iation Fund None K T Sold Buy

05/21/~

82.

12/31109

~.

02/!9/09

84.

(addl)

~ ,Buy (addl)

~/I 5/~

0512110~

FINANCIAL DISCLOSURE REPORT

Page 9 of 24

Name of Person Reporting

Date of Report

07/26/2010 I WERLEIN, JIL, EWING

NONE ~o reportable income, assets, or ~ansactions.)

D~ription of Asse~ ~ss value al ~ Tma~iom daring ~a~iag ~od

(including trust ~e~)

Flaoc"(X)"aflereacha~t ex~plfrompriord~losure

] re~ning ~i~

of ~poaing ~ri~

] 0)

lAment ,C~el

(2)

T~e(c.g., div..~nt.

O)

Value ] C~e2

(2)

[ Value [ M~h~ ~( ~de 3

O)

T~(e.g., buy. sell.

~2)

[ Date Value Gain ,~ C~e2,~e, , td~of buyer/mBer

or int.) ~[ (A-~ J[

(S-P)

re~on) J [ [(J-P) (A-H)

(if pfvate

~ Sold (pa~)

~msaction)

86. gT. 88. Oa~ark Global Sel~I Fund Cl~s I A Dividend K T

08/10/09 3 12/31/09 02119/09 J

(addl)

Buy

Buy

(addl) (van)

~ 91. 92. 93. 94. 93. 96. 97. ~ 98. 99. 100. 101. ~ 02. Vanward Prime MM Fund A Dividend M T Sold 05/21109 J Touchstone Sands ~pita] Solt None J T Pimc0 High Yield Fund Class D A Dividend J T Sold Sold (pa~) Buy Sold 05121109 08110/09 ~ J i 1~I/09 02/19/09 ] 04/15/09 05~ 1/09 08/10/09 12111/09 ~ 02/19/09 ~/I 5/09 ~

J J J 3 J J J

(~a)

Buy (addl) Sold Sold Buy (addl)

B A

(paa)

Sold

Sold

(pan)

Sold (pa~)

08/10/09

FI~CIAL DISCLOSU~ ~PORT Page 10 of 24

IName

of P~rson RepoSing

I ~

Date of 07~6~010

.~. WERLEIN, JR., EWING

NONE ~o reportable income, assets, or transactions.)

A. D~eripfion of Asse~ (including trust ~se~) Pla~"(X)afler~ehas~t ! , B. Income dufng repoeing period C. Gr~ value ~l end of repogiag ~riod Value J-P) ~ Value { C~e3 ! D. Tmmetion* dung r~oning ~ri~

IAmunt[ T~(e.g., ~ (Arl) [ orint.)

[ T~e(e.g., ~ redemption)

[ ~te I Value Gain] (J-P} , (A-H)

ld~tiwof {ifprivatc

103. ~ Mo~ High Yield Bond Fund 104. 105.

Dividend

Buy Buy (addl) Buy (addl) Sold

02119/09 J ~/15!09 J 05121/09 ] 08/10/09 t 2/11/09 08/10/09 12/t 1/09 05121/09 K 08/1W09 12111/09 K 05/21/09 J 08/10/09] 1~31/09 09/30/09 J J M A J J J A

t 07. 108. Pimo Emerging L~al Bond Fund 109. 110. Pimco Uncons~in~ Bond Fund Class D 11 I. 112. 13. SSGK Emerging Marke~ Fund 114. 115. I 16. Prime Fund-~pital Rese~es MM 117. Nuveen ~un. Mkt. Op~r. Fund (X) A A ]" Dividend Dividend L J T T A Di~dend K T A Diadem K T A Dividend K T

Buy (addl) Buy Buy (addq) Buy Buy (~ddl) Buy (addt) Buy Sold (paa) Buy (aa~0 Open

19. Dallas, ~ Ind. Seh. bonds

Interest

Redeemed

09/0t/09

FINANCIAL DISCLOSURE REPORT

Name of Person Reporting

Dale of Report

Page 11 of 24

WERLE|N, JR., EWING

07/26/2010

VII. INVESTMENTS and TRUSTS - i~m,. ,ata,, transactions ancludes those of spouse and dependent children; seepp. 34-60 of ruing instructions.)

NONE (No reportable income, assets, or transactions.)

A. Description of Assets (inolnding trust assets) Place "(X)~ after each asset exempt from prior disclosure B. C. ] Income during Gross value at end|1 reporting period of reporting period (1) i (2) (1) I (2) I (l) (2) (3, (4) I (5) Amount Type (e.g., Value I Value I Type (e.g., Code I din., rent, Code 2 I Method I buy, sell, (AH) redemption) or int.) (J-P) Code 3 {Q-W) B Interest K T D, Transactions during reporling period

Date Value Gain I mtrddd/yy I Code 2 } Code I i l (J-P)] (A-H)!

Identity of buyerlsellcr (if private transaction)

! 120. Frisco, TX AMBAC bonds

122. Lower Colo. R.iv. Auth. Tex. (X) 123. Montgomery Co. Pa. Hghr. Ed. (X) 12~. Illinois Den. ~in. Auth, (X) 125. Texas St. ~pt. HSG& CMTY)kffairs (X) 126. Meriden Conn. GI0 Bonds (X) 127. Mission TX Cons. lndpt. Seh. Dist. (X) 128. Austin ISD "rex. U/T Ref. SeT. A (X) 129. New Jersey St. Tmnsn. TR FD Auth. Sys. SeT A (X) 130. UnivTex Perm Univ FD RarDG SeT. B (X) "131. Pearland TX Indpt $ch Dist SeT A U/T B/EDD (X) A A A A A A

None Interest Interest Interest None Interest None Interest None Interest

J J

T T Redeemed 11/15/09 J

J K J K K K K

T T T T T T T

132. ACCOUNTSIN FINANCIAl INST: ........... 133, Merrill Lynch Cash/Money Aects i34. NoCthem Trust Bank, Houston, check, acct. 135. Bank of America, Houston, TX (Accounts) 136. Encore Bank, Houston, CD A A A A Dividend Interest Interest Interest K K N T T T Redeemed 04110/09 L

I, Income (}~a Codes;

A =$1,000 or ~

B =$ I,~ I - $2,5~

C =$2.501 - $5.~

D =$5,~ 1 - $15.~

E =~ 15,~ I - $~0,~

3, Val~ M~hod C~ (~c Colu~ ~)

Q =A~I U ~ok Value

R ~l (R~I ~mte Only) V

S =A~e~l

T ~ Market

FINANCIAL DISCLOSURE REPORT

r~ .... f eer~o~ Report~

WERLEIN, JR., EWING

Date o~Report

07,r26/2010

Page 12 of 24

VII. INVESTMENTS and TRUSTS - ~nco.,eo vat~ t,~o~ ~na~ those of spouse and dependent children; see pp. 34-60 of filing inslrttctio~ts.)

NOI~E (No reportable income, assets, or transactions.)

A, Description of Assets (iv.eluding trust assets) Place ~(X)" after ~ach asset [ ! B. Income during reporting period O) (~) Amount Type (e.g., (A-H) or int.) | C. Gross value at end of reporting period i (1) [ (2) ] Value I Value (J P) Code 3 (Q-W) D. Transactions during reporting period (0 Type (e.g., redemption) (2) Date (3) Value (J-P)

Gain (A-H)

Identity of (if private transaction)

137. Intervest Bank, Clearwater, FL, CD 138. Key Bank USA CD 139. Comerica Bank, Houston (acets) 140. Texas Capital Bank, Houston (acct) 141. ILEAL ESTATE: 142. Condo-Latimer Co,, CO 143. Working Interest-Cabot U., Andrews Co., TX 144. Royalty Interest, Eetor Co., TX 145. Royalty Interest, Wheeler Co., TX 146. Royalty Interest, Martin Co., TX 147. Royalty Interest, Glasseock County, TX (X) 148. Fractional int. in real property, Kerr County, TX 149. RETItLEMENT & IRA ACCOUNTS: 50. IRA Acct: John Hancock Ind. Ret.Annuity 15 I. IRA Aect: CGM Focus Fund 152. IRA ROLLOVER ACCOUNT: All entries that follow from Lines 155 153. through 203 are under the discretionary

B C A A

Interest Interest Interest Interest L L J T T T

Redeemed

04/06/09

E D A A A D A

Rent Royal~ Royalty Royalty Royalty Rent Rent

N K J J J J J

W W W W W W W I

None A E Dividend Dividend Interest

K L PI

V T T

See Note-Part VIII

FINANCIAL DISCLOSURE REPORT Page 13 of 24

~ of~e~o~ Reporting WERLEIN, JR., EWING

Date of Report 07/26/2010

NONE ~o reportable income, assets, or transactionsO

A.

D~dptio~ oFA~ (i~luding ~t ae~) Pta~ ~(X)" a~er each a~t exempt f~m prior d~closure

B.

I~m during m~ing period Amount ~ T~e (e.g. t div., ~n~ (A-H) ~ or inQ

C.

~ro~ valu~ at ~nd of ~ing ~fiod Valu~ ~e 2 (J-P) Value M~ ~dc 3 T~c (c.~, buy, ~ll, ~demption)

D.

Transactions du~ng r~po~ing p~

Dat~ Valu~ [ Gain ~ffd~yy C~e 2 ~ Code I (J-P) [ (A-~

Idenfi~ of buy~dseller (if private t~n~ctJon)

154. management o f a reg[ster~ investment manager. 155. --Pfizer [n~,, com.

156. --Altria Group, com.

157. --Schwab MM Funds I158. --Americredit Corp., com.

Sold

02/23/09

159. --Comcast Corp. New CI. A

Sold

02/20109

(part)

160. --Consol. Energy, com.

161. --Leucadia Natl Corp., com.

162. --Mercu~ Genl Corp., com. 163. -NVR Inc., com. 164. --Capital One Fin. Corp., com. 165. --Key Energy Serv., com.

166. -RLI Corp., com. 16Z --Berkshire Hathaway CL B 168. ~-Cintas

Sold

02/20/09

Cdr~., com. .......

"i69. -Amer. Eagle Outfitters New, com.

170. --Ganneti Co., com. Sold 02/20/09 J

I. Income Gain Cedes:

A =$1,0~0 or te~

B =$1.0~1 $2.500

C -$2,501 ~ $5,0~

D =$5,~ t

3. Value M~ ~ (~e Colu~ ~)

Q =App~l U =B~ V~

R ~t (R~I ~te Only) V~

S =A~t W

FINANCIAL DISCLOSURE REPORT Pagv 14 of 24

Name of Person Reporting

/ WERLEIN, JR., EWING

VII. INVESTMENTS and TRUSTS --t,,~o,~, ~,,~, ~,~t~o,~ a~o~d~ ~o~ of s~ and dep~dem cldldren see pp. 34-60 of filing ins,rucfions.)

NO~E ~o reportable income, assets, or transactions.)

A,

D~iption of Ass~ (including t~ ~)

B.

Income during r~ing ~ri~ Amount] T~ (e.g.,

C.

Gr~ value at end of ~po~ng ~iod Valu~ Code 2 VaI~ Meth~ (~

D.

Pla~ ~(X)" a~r ea~ a~t e~mpl from prior d~los~e

~de I

die., ~nt,

T~ (e.g., ~y, sell,

Date m~yy [

Value Gain~ Code 2 ] C~ 1

Identity of ~yeds~l!~r tr~action)

171. --Home Depot, com. ! 72. --Tyco lntl Ltd., com. 173. --Tower Group Inc., com.(~a Casdepoint Hld~ F., corn,) 174. --Coleman Cable Inc., ~m.

175, --Johnson & Johnson, com.

176~"

--~ FOO~ Inc., com.

Sold 02~3/09 J

1~7. --M~elo Madd~ PP~S Inc.~ com, !78. --Sh~in Williams ~., ~m. 179. --~IT Financial T~t 180. --Li~ M~ia Co~. CL A, com. "~81. ] ""

Sold Sold (pa~) Me~ed (wi~ line 202)

03/18109 ~ J 02t20109 J t 1/25/09 K B See ~nes 202 and 203

183. --R~ublle S~cs, c~m.

. 184. --B~n Pfiv. Finl Hldg, 185. --Ho~eh~ad Hldg eo~.,

187. --Kohl~ C~., ~m.

I. lmome Gain Co6e.~: (Sen Colturms BI mid D4) 2, Value Codes (SecCol~mml Cl and D3) 3. Val~ Method Codes

A ---$1,000 or I..~ F =$50,001. $I00,0~0 J =$!5.000 oriess N =,1;250,001 -$500.000 P3 =$25.000,001 - $50/000.000 Q ~App~al~lfl

B =,1; 1,001 - $2,$00 G =$100,0OI - $1.0001000 K =~15.001 - 150.000 O ~$500.001 . $1.000,000 R --Cost (Real E.~tat Only)

C =$2,501 - $5,000 H t =$1,000.0Ot - $5,000,000 L =$S0.Ot3i - $100,000 P[ P4 =More th~n $50.090.000 S

D =$5,00! - ,1; 15,000 H2 =More tlmn $5,000,000 M =$100,001 - $250,000

E =$15,001 - $50,000

FINANCIAL DISCLOSURE REPORT Page 15 of 24

Name of Vernon Reporting WERLIgIN, JR., EWING

Date orr~rt 07/26/2010

NONE (No reportable income, assets, or transactions.)

A. ~ription of Am~ (including trust ~) Place "(~" a~er e~h asset exempt from prior di~l~ure B. Income during r~oning ~fi~ Am~nt [ T~o (e.g., C~e t fliv., rcnt, (A-~ or int.) C. O~s value at end of ~ning Vatu~ C~e 2 (J-P) Value Meth~ ~ (~ C~3 188. --Microsoft, com. ~ 89. --M~ Group, com. Type (e.g., buy, sell, r~emption) D. T~n~ctiom daring ~o~ing p~fiod

~te[ ~d~yy C~o 2 ~e I ] [V~uo Gain (J-P) ~ (A-~ I ~_~ _

l~nfity of ~y~/~ler (ifprivaie tra~ction)

191. --Pi~acle Gas R~s., com.

Sold

03/18/09

192. --S~k~r Co~., com.

! 9~. -Wellpoint, Inc., com.

198. --Procter & Gamble, com.

Buy

02/23/09

199, --~ogcr, com.

Buy

09t09109 l"10/30/~

K K ............

200. --N0~m 0&O, corn,

Buy

~01. --Am~. ~ver Banksh., com.

Buy

1~07/09

202, --Li~r~ Media Co~. A, com. 203. --Direct TV ~1. A, com.

l 1~5109

reorg. ~om line ] 80

I l~M09 E Divided Distributed

merger f~m line 180

2~. TRUST N0. I

0710~109

P1

S~ Note in Part VIII

1, h~ra(: Ooin Cod~: (Se~ Column~ BImd D4) 2. ~elu C.o~s (&~c Colurm~ C1 at~ O3) 3. Value: Method Co~s (,Set: Column C2)

A =$1,000 or les~ V --$:~O,00l - $100,000 J =$15,000 or less H =12~0,001 - $500,000 P3 =$2.%000,001 - $50,000,00~ Q =Appmimi U =Book Valtm

B =$1,00! - $2,$00 O =$100.0Ol - $].D00,000 K =$15,001 . $50,000 O =$5D0,001 - $1,0~0,0~ R ,=Co~t (Real Esmt Only) Y =Other

C =,$2#01 - $$,0~0 H l =$ 1,0OO,001 - $~,000~000 L--$50,001 - $ 100,000 PI =$!,0O0.001. $5.000.000 P4 =Mort: than S =A~e~ment W =E~imated

D H2 =Morn than $5.00OJ]00 M =$100,~01 - $250,000 P2 =$5,~00,001 T

FINANCIAL DISCLOSURE REPORT Page 16 of 24

Nome Of Person Reporting

Date of Report

WERU:IN, JR., EW~NG

o7/26/2OlO

VII. INVESTMENTS and TRUSTS -i.eo,.e, vat.e, transactions anclades those of s~use a~ d~en~nt children; see pp. 34-60 of ~ding imtrucaon~)

NONE (No reportable income, assets, or ~ansactionsO

A. D~i~ion of As~ (i~cluding t~st ~sets) B. l~me during repo~ing p~ri~ (~) (2) diD., renL or int.) C. Gr~s value ~t end of r~po~ing period (~) (2) 0) D, Tmnsa~tion~ dung re~ing C2) [ O) (4)

P]S~ "{X)" ~e~ ~h ~

exempt from ~ior di~losur

Amount T~c (~.8.,

Code I (A-H)

Value

Va]~

T~ (c.~,

buy~ sell, r~mption)

Dat~~

m~d~

Value

~e 2 (J-P) ~,

Gain

C~e i (A-~

ld~nti~

buyer/seller (if private transaction)

Code 2 Me~ (I-P) [ Cede 3 ~(~ P] T

205.

I~ ROLLOVER AC~. NO. 2, All ontdes that follow

Dividend

206. lin~s 21O th~ 291 se under ~e ~ll discretiona~ 207. management of a registered inv=stmgnt manager.

Interest

210. -F~ml Hom~ L~ Mt~ Co~ Not~ du~ 03109

R~d~m~d

03115~9

212. --Fed, Nafl Mtg Assn. Callable Not~ due 01/10 213. --F~I Natl Mtg As~c. due 07/13

.... Redeemed 01/11/09 M

[~1~, --~L U~r~. Mone~Fd .....

215. --U.S. T~asu~ Bill due 1]/09 216. 217, --U.S. $rem~ Bill due 12/09 218. " 219. --U.S. TrsasuD, Bill dae 12/10

Redeemed , 02/03/@

Bay Rode~med Buy gedes~d Buy 03/13~9 11/l 9/09 05~8/09 1 ~17/09 1~17/09

N

L L L L M

ROLLOVER ACCT ~2: ~. --Chase ~anhaaan Co~. Subordinate Noms Redeemed 02/15/09 L C

I. IncOme Gain Co~:

A =$ L00Oor Ices

B =$1,00! ~ $2,5~

3. Value M~hod C~

Q =Appmhal

R ~ost (Rea! ~te Only)

S =A~t

FINA1NCIAL DISCLOSURE REPORT

Page 1 7 of 24

N~a of Per,. Reporti.g

WERLEIN, JR,, EWING

0712612010

NONE (No reportable income, assets, or transactions3

A, D~ription of A~ B. ~ncome during C. Gross value at end D. Tm~aaians du~ng ~ing pefi~

O)

Pla~ "(X)" ~ ~ch ns~{ ~xempt ~om prior disclo~

(~)

O) I (~)

Value C~ 2 Value Mclhod

CD~~ (21~~ (~1

O)

(s)

Id~tity of

Amount T~ (e,g. ~de I div., ~K

T~e (e.g., [ Dat~ ~ Value Gain buy. sell.

(Q-~

222. --Goldman 8ac~ G~oup SR Unsub ~o~ Redeemed 05[1 ~/09 L

Global

223. -Citigroup inc. Senior Notes

224. --Target Co~. Notes

225. --Proctor & Gamble Co~. Notes

226. --AT&T Notes

Buy

02/06/09

227. --Con0co Phillips Noles

Buy

02/10/09

228. --Aragon Inc. Not~

Buy

02/17/09

229. --Hewlett Packard Notes

230. --Medlronic Inc. Notes

Buy

Buy

02/25/09

!03/10/09

231, --Procter & Gamble Notes

Buy

03/24/09

232. --Wells Fargo MT Notes

Buy

Buy

12/17/09

233. -Morgan Stanley Not~

12/17109

2~4. EQUITIES IN IRA R~LLOVER ACCT #2:

235. --American Express, com. 236. --BP PLC, ADR

237. --ChevioeTexaco, com.

238. --KO, com.

FINANCIAL DISCLOSURE REPORT

Name of Person Reportlag

Date of Report

Page 18 of 24

WERLEIN, JR., EWING

07/26/20t0

NONE ~o reportable income, assets, or ~ansactions.)

A. D~c~ption of ~s~ (including trust assets) Pia~ ~)" afl~ ~ as~l ~mpt from pri~ disc~su~ B. ]nco~ du~ng r0~ng ~fiod Amount T~ (e.g., C~e I [ div,, ~nt, (A-~ or int.) C. Gross valu~ at ~d of repo~g ~dod Value Code 2 (J-P) [ Value [ Meth~ [ C~e 3 T~ (e.g., buy, sell, rede~tion) D. Tm~cfio~ during r~ing

Date m~d~

Value Gain , C~e 2 Code t[ (J-P) ~ (A-H)

Idenfi~y of buy~rtsIler (ifp~vat

140. --GE~ corn,

241. --~TC, corn,

242. --J.P. Morgan Chase, com.

243. --JNJ. corn. 244. --LLY, oom.

2~. --Merck, com.

Buy (addl) Sold

05126109 11/04/09

11/04/09

K K

K

(~)

Buy (addl)

1246. --PEP, com. 247. --WM~, corn.

248. --Walgreen, corn,

249. --McGraw-Hill, Inc., com.

250. --Microsoft Corp., com. 251. --Altria Group, com. 252. --Bank or" America, com. ~53, --Ameriprise Fint Inc., com. 254, --Automatic Data Proe., com. 255. --Emerson Elec, Co., com. Sold 05/26/09 K Sold 05/26t09 J A

I. Income Gain Codes: (See Cohlmm~ BIaad D4) 2. Value C~l~ (Se= Colutnn~ I and D3) 3. Value Mell~d Codes (See Column C2)

A =$ I.O00 or less F ~$50,~11 - $100,000 J =$15,00~ or le~ N =S250,001 - $500,000 P~ =$25,000,001 - $50,~]0,000 Q =Apprai~l U =Book Val~

8 =$ 1,001 - $2,500 G ~$100,001 - $1,000,000 K =$15,0Ol - 550,000 O =5500,001 - $1,000,000 R ---Cost (Real Estate Only) V ~3thm-

C =$2,501 - $5,000 HI =$1,000,001 - 55,000,000 L =550,001 - $100,O00 PI =$t,000,O01 - $5,000.000 P4 =Ma~e than $50,000.000 S =Assessment W =F.stimated

D =$5.00 t - :i 15.000 rlZ=Mere than $5,000,000 M =5|00,001 P2 =$5,000,001 - 525.000.000 T =Cash Market

E =$

FINANCIAL DISCLOSURE REPORT Page 19 of 24

[ Name of Person Reporting WERLEIN, 3R,, EWING

07./26/2010

VII. INVESTMENTS and TRUSTS - ~come, ,o~t~ ~.,~eao,. (t.ctuae, a,o~.e of s~use a~a aem~d~n~ a,ua~en;

NO~ ~o repomable income, assets, or transactions.)

A. De~ption of Ass~ (including ~st ~sets) Place "{X)" aR~r ~ch asset =~pt from ~or discl~ur* , B. Income during ~po~ing period C. Gross value at ~d o~o~in~ D. T~ns~fi~ du~ng repo~ing

(t)

~ount Code 1 (A-H)

(2)

T~ (~,g., div., rent, or int.)

(l)

Value Cod~ 2 (J4)

(2)

Value Method Code 3 (Q-W)

0)

T~e (e.g., buy, sell, redemption)

(2)

(~)

(~)

Value Gain [ ~e 2 (J-P) (A-~ Identity of buyeffsell~ (if privat~ transition)

Date m~d~I

256. --HSBC Hldg PLC,

257. --Occid~n~ Pete Co~. Cal., com.

258. -~ate~il~r, Inc., com.

259. --Halliburton Co., com. 260. --Home Depot, Inc., com. 261. --Praxair Inc., com. 262, --Proctor & Gamble., com. 263. --Target Corp., earn. 264. -Transoeean, com. 265. --United Technologies Corp., com. 266. --Cisco Systems Inc., com. 267. --Medtronie l~te., com. : 268. -Mierochip Tech., Inc., com. 269. --P~triot Coal Corp., com. "270. --Peabody Energy Corp., com. 271. --TexasInstruments, com. 272."" --Kraft Foods Inc., com.

t. lt~ome C.~ Codes: (See Colinmrs El and D4) 2. V,~lue Cod~ {se Colutrms | mtd D3) 3. Value Method Cod~ (See ~.olurrm C2)

A =$ t.000 or less F ,=~;50,001. $ t00.000 J =$15,~00 or Ms N =$250,001 - $500,000 P3 -$25,000,001 - ~0,0~0,000 Q =Appmisat U =Book V~lu

B =$1.00t o $2,500 G =$100,O0t - $1 .O00,000 K =115.001 o $50,000 O =$500,00t - $1,000,000 R =Cost (Real Esaat e Only) V =Other

C =$:2,501 - $5,000 HI ~-~ 1,0OO,001 - $5,000.000 L =$50.00t - $ t 00,000 PI =St,000.001 - $5.000,~0 P4 =More th~ $50.000.000 S =A~t W =Estimated

D =$5,001 - $15.000 H2 ---More titan M =$100,00 ! - $250,000 P2 =$5,000,001 - $25.000,000 T =Cesh Market

E =$15,001 - ~50,000

FINANCIAL DISCLOSURE REPORT

Name of Persou Reporting WERLE[N, JR., EVirlNG

Date of Report 07/26/2010

Page 20 of 24

VII. INVESTMENTS and TRUSTS -- ~.~o,.~, ~e, t,~,~,a~o,~ a.aaa~ ,ha~ of ~ns~ o.~ ~p,~.r e~u~.;

NONE (No reportab& income, assets, or transactions.)

A, D~ription of A~ (i~luding ~st a~e~) Place "(X)" after ~h a~et exen~t~ompfiord~elosure B. Income during ~ing ~d~ Am~nt [ T~e (e.g., C~e I J! div., rent, (A-H) [ or i~t.) f] C. Gro~ value at end , of ~po~ng ~fiod Value C~2 (J-P) Value M~h~ C~ 3 (Q-W) ~ T~ (e.g., buy,~ll, red~ption) D. Transaetion~ during repo~ing ~Hod

Dale ]m~ ] ]

Va~e Code 2 {J-P)

Gain Code I (A-~

I~n~ty of ~ycr/seller (if private tr~saction)

273. --Abboa Labs, cam. 274. --~B L~., com.

Buy Sold

05126/09 11/04/09

276. --Entergy Corp. New, com. 277. --Exelon Corp., com.

278. --Fomento Ecnmco Mex,o cam. 279, --Freeprt. MeMoran CPR & Gold, earn,

280. --Genl Dynamics Corp., com. 281. -McDermott Inq, com.

282. -McD0nalds, com. 283. -Natl 0ilwel! Vareo, com. 284. --Philip Morris lntl, com. 285. --Total SA., com.

286. --Becton Dickinson, com. 287. CAStt ACCOUNTS IN IRA ROLLOVER ACCT #2: 288. --ML Bank USA RASP Closed 0210311Y) M Buy !/04/09 J

Sold

05/26/09 J

Sold

05/26/09

289. --ML Bank B&T FSB RASP

Closed

02/03/09 L

I, Income Gain Code~: (S~e Coltmms BI and D4) 2. Value Cod~s (S~e Colunms Ci aml D3) 3. V~lue Method Codes (S~e Co~urtm U2)

A =$1,000 or less F ~$ 50.001 - $100.000 J ~$15,000or le~s N =.~250,00t . $500,000 F3 =$25,000.001 - $50,000.000 Q ~Appraisal U ~Book Valt~

B =$|,001 - $2~500 G =$100.001 - $1,000,000 K =$15,001 - $5;0,000 O --$500,00I -$1.000,1~0 R =Cost (R~al Estate Only) V --Other

C =$2,501 - $5.000 H I =$1.000.001. $5.000,000 L =$50.001 - $100,000 Pl =$1.0[JO~0Ol - $$.000.000 F4 =M~e than $50.1~0,000 S =Asse~lt W =~,:~tlmnted

D =$5.00 ! - $15,000 H2 =M~e thal~ $5.000.000 M =$~00.001 - 5250.000 P2 ~$S,00~,00I o $25,000,000 T =Uash Mark!

E =$15,001 - $50,001)

Page 21 0f24 VII. INVESTMENTS and TRUSTS - ~ .......

~

A. D~cription of A~ (in~luding t~ asse~) PIa~ ~(X)" a~er ~h ~et ex~pt from prior di~losu~ B, lnco~ during r~o~ing ~ri~ Amount Code 1 (A-H)

WERLEIN, JR,, EWING ~.~, Iran.~c~ions ([nlud~ th~e of sp ......

C. Gr~ value at ~ of r~o~ing Value Code 2 [ (J-P) [, l d dependent Children; see pp.

07/26/2010

NO~E ~o repo~abte income, assets, or ~sact~o~.)

D. Tmn~c~ions du~ng r~mg pe~od

(0 [ (2)

Type (e.g., div., rent, or int.)

0)

Val~ Meth~ C~c 3 (Q-W)

(2)

o)

T~ (e.g., buy, sell, redemption) [ O~n ~n

(2)

(3)

GMn Co~ ] (A-H) l~nfi~ of ~yegseller tmn~ion)

Date Value m~d~ Code 2 (J-P)

290. --~3 Money Fu~ t 291. --DDG Money Fund 292, Vanguard Prime MM I~ Roliover 293, Vanguard Admiral Trsy MM IRA RolIover 294. ~,:, Estate No. 1: 295. --AT&T inc., com. 296. -Centerpoint Energy Inc., com. 297. -Er, xonMobiI, com. 298. --HSBC Hldg PLC Sp ADR 299. --Southern Co., com. 300. --Pfizer (fk!a Wyeth) 301. --XCEL Energy, Inc,, com. 302. --Halifax Hosp. Med. Cir. FL 303. --New York City G/O Ser, E 304. --Brevard Co. FL Hlth Fac. 305. -New York St, Dorm Auth. Revs. 306. --Abilene -IX ARPT-CTFS Oblig. B B E Divided Dividend IntJDiv, N P] PI T T T

0M~/09 0~/09

Open Sold Sold

07128109 12/| 8/09 12/18/09

Pl M K E D

Sold Sold Sold Sold

12/18/09 12/18/09 12/18/09 12/18/09

L L K L

E D B D

I. Income Gain ~odc~:

A =$I,000 or ltas

B -~;1.00l - $2,~

3. Valu~ Meted ~ (See Colu~ ~)

Q =A~al U =B~ Value

R =~t (K~I ~e Only) V ~er

S =A~t W ~i~t~

T =C~h

FINANCIAL DISCLOSURE REPORT Page 22 of 24

~o~ of Person Reportiog WERLEIN, JR.~ EWING

Date of Report 07/2612010

VII. INVESTMENTS and TRUSTS -. i ...... ~.~, ,ransactior~s (lncl.des those of zpouse and d~.nd~tc~dmn; seepp. 34~O of fd~ ins~u~io~)

NO~E (No reportable income, assets, or ~ansactions.)

A. D~cdption of Ass~ (including ~st assu~) Pla~ "(X)" after ~h ass~ exempt f~om prior di~losam B. lncom during ~ging ~ri~ (~) (2) ~aunt T~ (e.g., C~ I div., ren~ (A-H) or inL) C. Gross value at end offing p~ (~) Value Code 2 (J-P) (2) Value M~ C~e 3 (Q-W) (~) T~ (e.g. buy, sell, ~emption) D. Tin.actions during r~ing (2) Date m~d~ (3) Val~ C~e 2 (J-P) (~) Gain Code [ (A-~ (~) I~ bay~/~ller (if privale transaction)

307. -Citibaak MM

Oosed

12/02109

308. --Real Pro~, Ha~is Count, ~

309. --Real Property, Kerr County, TX 310. --Fidelity MM 311. TrustNo. 2: 312. --Fidelity lVIM A Dividend M

W Open T Op~m 12/10/09 12/16/09 M

FINANCIAL DISCLOSURE REPORT Page 23 of 24

~ .... r v ..... ~.o~.~ WERLEIN, JR., EWING 07/26/2010

VIII. ADDITIONAL INFORMATION OR EXPLANATIONS.

(1) Pan ] POSITIONS, line 4, also the following subsidiaries: The Methodist Hospital Foundation; The Methodist Hospital, The Methodist Hospital Foundation, The Methodist Hospital Research Institute, TMH Health Care Group, and TMH Medical Office Buildings Condominium Association (2) Part I POSITIONS, line 5, also the following subsidiaries: Methodist Willowbrook Medical Office Bldgs Condominium Association; Methodist Willowbrook Medical Office Bldgs 11 Condominium Association; San Jaeinto Methodist-Alexander Condominium Association; San Jacinto Methodist Hospital; SJMH Condominium Association; The Methodist Hospital Condominium Association; and TMH Medical Office Buildings. (3) Part VI1, page 4, lines 12 and 13: The year-end values of CNL Lifestyle Props. ]nc. units, and Hines PEIT, which are real estate REITS that are not publicly traded, are clerived from the issuers estimates of value at year end. (4) Part VII, page ] 2, line ! 50: The year-end value of IRA account in John Hancock Ind Retirement Annuity, which is not publicly traded, was provided by John Hancock Life Inn. Co. (5) Part VIII, page 15, line 204: Trust No. 1 was distributed to contingent beneficiaries after death of the primary beneficiary.

PageFINANCIAL24 of 24 DISCLOSURE REPORT [ WERLEIN, JR,, EWING

I

Name of Person Reporting

Date of Report

07/26/2010

IX. CERTIFICATION.

I certify that all information given above (including information pertaining to my spouse and minor or dependent children, if any) is accurate, true, and complete to the best of my knowledge and belief, and that any information not reported was withheld because it met applicable statutory provisions permitting non-disclosure, I further certify that earned income from outside employment and honoraria and the acceptance of gifts which have been reported are in compliance with the provisions of 5 U.S.C. app. 501 e.t. seq., 5 U.S.C. 7353, and Judicial Conference regulations.

NOTE: ANY INDIVIDUAL WHO KNOWINGLY AND WILFULLY FALSIFIES OR FALLS TO FILE TIIIS REPORT MAY BE SUBJECT TO CIVIL AND CRIMINAL SANCTIONS (5 U~S.C. app. 104)

FILING INSTRUCTIONS Mail signed original and 3 additional copies to: Committee on Financial Disclosure Administrative Office of the United States Courts Suite 2-301 One Columbus Circle, N.E. Washington, D.C. 20544

You might also like

- 1878 001Document17 pages1878 001Judicial Watch, Inc.100% (5)

- 2161 DocsDocument133 pages2161 DocsJudicial Watch, Inc.83% (12)

- Operations Management, Compelte Slides, Supply Chain ManagementDocument919 pagesOperations Management, Compelte Slides, Supply Chain ManagementSadiq Sagheer100% (12)

- Richard H Kyle Financial Disclosure Report For 2009Document8 pagesRichard H Kyle Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Robert L Jordan Financial Disclosure Report For 2009Document10 pagesRobert L Jordan Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Lawrence L Piersol Financial Disclosure Report For 2009Document8 pagesLawrence L Piersol Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- James B Zagel Financial Disclosure Report For 2009Document10 pagesJames B Zagel Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Robert R Beezer Financial Disclosure Report For 2009Document9 pagesRobert R Beezer Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Sidney A Fitzwater Financial Disclosure Report For 2009Document9 pagesSidney A Fitzwater Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Jose A Fuste Financial Disclosure Report For 2009Document8 pagesJose A Fuste Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Thomas L Ludington Financial Disclosure Report For 2009Document21 pagesThomas L Ludington Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Richard L Nygaard Financial Disclosure Report For 2009Document7 pagesRichard L Nygaard Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Donald J Stohr Financial Disclosure Report For 2009Document8 pagesDonald J Stohr Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- William H Barbour JR Financial Disclosure Report For 2009Document11 pagesWilliam H Barbour JR Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Bernard A Friedman Financial Disclosure Report For 2009Document15 pagesBernard A Friedman Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Kimberly A Moore Financial Disclosure Report For 2009Document11 pagesKimberly A Moore Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- JR Solomon Oliver Financial Disclosure Report For 2009Document9 pagesJR Solomon Oliver Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Lawrence J ONeill Financial Disclosure Report For 2010Document19 pagesLawrence J ONeill Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Victor Marrero Financial Disclosure Report For 2009Document24 pagesVictor Marrero Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Joseph A DiClerico JR Financial Disclosure Report For 2009Document15 pagesJoseph A DiClerico JR Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Charles A Pannell Financial Disclosure Report For 2009Document9 pagesCharles A Pannell Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Thomas M Rose Financial Disclosure Report For 2009Document9 pagesThomas M Rose Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Gregory K Frizzell Financial Disclosure Report For 2009Document8 pagesGregory K Frizzell Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Charles S Haight JR Financial Disclosure Report For 2009Document10 pagesCharles S Haight JR Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Bruce M Selya Financial Disclosure Report For 2009Document18 pagesBruce M Selya Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Sandra Ikuta Financial Disclosure Report For 2009Document8 pagesSandra Ikuta Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Henry R Wilhoit Financial Disclosure Report For 2009Document8 pagesHenry R Wilhoit Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Helen Gillmor Financial Disclosure Report For 2009Document17 pagesHelen Gillmor Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Stephen J Murphy III Financial Disclosure Report For 2009Document8 pagesStephen J Murphy III Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Jose A Gonzalez JR Financial Disclosure Report For 2009Document10 pagesJose A Gonzalez JR Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Leonard B Sand Financial Disclosure Report For 2009Document14 pagesLeonard B Sand Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Jackson L Kiser Financial Disclosure Report For 2009Document8 pagesJackson L Kiser Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Tim Leonard Financial Disclosure Report For 2009Document8 pagesTim Leonard Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Stephan P Mickle Financial Disclosure Report For 2009Document7 pagesStephan P Mickle Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Raymond W Gruender Financial Disclosure Report For 2009Document8 pagesRaymond W Gruender Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Larry J McKinney Financial Disclosure Report For 2009Document8 pagesLarry J McKinney Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- James B Loken Financial Disclosure Report For 2009Document9 pagesJames B Loken Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Garnett T Eisele Financial Disclosure Report For 2009Document12 pagesGarnett T Eisele Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Clarence A Brimmer Financial Disclosure Report For 2009Document7 pagesClarence A Brimmer Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Robert E Maxwell Financial Disclosure Report For 2009Document8 pagesRobert E Maxwell Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Frank H Seay Financial Disclosure Report For 2009Document8 pagesFrank H Seay Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Chester J Straub Financial Disclosure Report For 2010Document16 pagesChester J Straub Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- John P Gilbert Financial Disclosure Report For 2009Document11 pagesJohn P Gilbert Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Dan Aaron Polster Financial Disclosure Report For 2009Document14 pagesDan Aaron Polster Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- John F Motz Financial Disclosure Report For 2009Document10 pagesJohn F Motz Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Simeon T Lake Financial Disclosure Report For 2009Document9 pagesSimeon T Lake Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- David Hittner Financial Disclosure Report For 2009Document11 pagesDavid Hittner Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Tom S Lee Financial Disclosure Report For 2009Document8 pagesTom S Lee Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- David S Tatel Financial Disclosure Report For 2009Document11 pagesDavid S Tatel Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Thomas A Varlan Financial Disclosure Report For 2009Document9 pagesThomas A Varlan Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Bobby R Baldock Financial Disclosure Report For 2009Document9 pagesBobby R Baldock Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Howard A Matz Financial Disclosure Report For 2009Document13 pagesHoward A Matz Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Myron H Thompson Financial Disclosure Report For 2010Document14 pagesMyron H Thompson Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- William Eugene Davis Financial Disclosure Report For 2009Document8 pagesWilliam Eugene Davis Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Samuel Conti Financial Disclosure Report For 2009Document7 pagesSamuel Conti Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Richard L Williams Financial Disclosure Report For 2009Document8 pagesRichard L Williams Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Joseph A Greenaway JR Financial Disclosure Report For 2009Document7 pagesJoseph A Greenaway JR Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- John Gleeson Financial Disclosure Report For 2009Document6 pagesJohn Gleeson Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Richard T Haik Financial Disclosure Report For 2009Document11 pagesRichard T Haik Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Janet T Neff Financial Disclosure Report For 2010Document8 pagesJanet T Neff Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Patrick J Duggan Financial Disclosure Report For 2009Document7 pagesPatrick J Duggan Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Tena Campbell Financial Disclosure Report For 2009Document22 pagesTena Campbell Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Asset Rotation: The Demise of Modern Portfolio Theory and the Birth of an Investment RenaissanceFrom EverandAsset Rotation: The Demise of Modern Portfolio Theory and the Birth of an Investment RenaissanceNo ratings yet

- 1488 09032013Document262 pages1488 09032013Judicial Watch, Inc.100% (1)

- 11 1271 1451347Document29 pages11 1271 1451347david_stephens_29No ratings yet

- Stamped ComplaintDocument4 pagesStamped ComplaintJudicial Watch, Inc.No ratings yet

- CC 081213 Dept 14 Lapp LDocument38 pagesCC 081213 Dept 14 Lapp LJudicial Watch, Inc.No ratings yet

- December 2005Document7 pagesDecember 2005Judicial Watch, Inc.No ratings yet

- State Dept 13-951Document4 pagesState Dept 13-951Judicial Watch, Inc.No ratings yet

- Stamped Complaint 2Document5 pagesStamped Complaint 2Judicial Watch, Inc.No ratings yet

- Gitmo Freezer Inspection ReportsDocument4 pagesGitmo Freezer Inspection ReportsJudicial Watch, Inc.No ratings yet

- July 2007 BulletinDocument23 pagesJuly 2007 BulletinJudicial Watch, Inc.No ratings yet

- Gitmo Freezer Inspection ReportsDocument4 pagesGitmo Freezer Inspection ReportsJudicial Watch, Inc.No ratings yet

- SouthCom Water Safety ProductionDocument30 pagesSouthCom Water Safety ProductionJudicial Watch, Inc.No ratings yet

- LAUSD Semillas AckDocument1 pageLAUSD Semillas AckJudicial Watch, Inc.No ratings yet

- CVR LTR SouthCom Water Safety ProductionDocument2 pagesCVR LTR SouthCom Water Safety ProductionJudicial Watch, Inc.No ratings yet

- JTF GTMO Water Safety App W ExhDocument13 pagesJTF GTMO Water Safety App W ExhJudicial Watch, Inc.No ratings yet

- Cover Letter To Requester Re Response Documents130715 - 305994Document2 pagesCover Letter To Requester Re Response Documents130715 - 305994Judicial Watch, Inc.No ratings yet

- September 2004Document24 pagesSeptember 2004Judicial Watch, Inc.No ratings yet

- July 2006Document24 pagesJuly 2006Judicial Watch, Inc.No ratings yet

- Model UNDocument2 pagesModel UNJudicial Watch, Inc.No ratings yet

- June 2004Document17 pagesJune 2004Judicial Watch, Inc.No ratings yet

- 13-1150 Responsive Records 2 - RedactedDocument29 pages13-1150 Responsive Records 2 - RedactedJudicial Watch, Inc.No ratings yet

- STAMPED ComplaintDocument4 pagesSTAMPED ComplaintJudicial Watch, Inc.No ratings yet

- 13-1150 Response Re Judicial WatchDocument1 page13-1150 Response Re Judicial WatchJudicial Watch, Inc.No ratings yet

- December 2005 Bulletin 2Document14 pagesDecember 2005 Bulletin 2Judicial Watch, Inc.No ratings yet

- Atlanta IntraregionalDocument4 pagesAtlanta IntraregionalJudicial Watch, Inc.No ratings yet

- Module 1 Wk1 4th Key Concepts in Buying and Selling Commissions StudentDocument17 pagesModule 1 Wk1 4th Key Concepts in Buying and Selling Commissions StudentFrancine Arielle Bernales100% (1)

- Rototherm Group Product Catalogue 2016Document40 pagesRototherm Group Product Catalogue 2016Charles OnyechereNo ratings yet

- ECON198 Module 1Document4 pagesECON198 Module 1Kevin BelloNo ratings yet

- TS4F01 2 EN Col08Document13 pagesTS4F01 2 EN Col08Kushagra purohitNo ratings yet

- Tolentino Vs Sec of FinanceDocument3 pagesTolentino Vs Sec of FinanceHyuga NejiNo ratings yet

- Design and Implementation of A Computerized Information Management System in Seismic Data ProcessingDocument8 pagesDesign and Implementation of A Computerized Information Management System in Seismic Data Processinganyak1167032No ratings yet

- HT Turorial Question BankDocument16 pagesHT Turorial Question BankA. AnsarNo ratings yet

- Science Learning Center University of Michigan - Dearborn: Use of The OscilloscopeDocument49 pagesScience Learning Center University of Michigan - Dearborn: Use of The OscilloscopeAlex ZadicNo ratings yet

- Chapter 3Document31 pagesChapter 3narasimha100% (1)

- Design of CylinderDocument14 pagesDesign of CylinderRushikesh BhatkarNo ratings yet

- Water Treatment Plant Residuals Management PDFDocument4 pagesWater Treatment Plant Residuals Management PDFWil OrtizNo ratings yet

- Sigmacover 525: Curing table for dft up to 125 μm CuringDocument2 pagesSigmacover 525: Curing table for dft up to 125 μm CuringEngTamerNo ratings yet

- Qualities of Good Measuring InstrumentsDocument4 pagesQualities of Good Measuring InstrumentsMaricar Dela Peña56% (9)

- Program Mechanics Sy 2021-2022Document10 pagesProgram Mechanics Sy 2021-2022Deogracia BorresNo ratings yet

- Seed Nuts BarDocument3 pagesSeed Nuts Barsanjeet_kaur_10No ratings yet

- P6 Science SA1 2017 Rosyth Exam PapersDocument40 pagesP6 Science SA1 2017 Rosyth Exam PapersKui LiuNo ratings yet

- Pdms Catalogue GenerationDocument26 pagesPdms Catalogue GenerationAou UgohNo ratings yet

- Treasure Hunt For Adult-NO ANWERSDocument4 pagesTreasure Hunt For Adult-NO ANWERSKUMATHAVALLI A/P RAMANA MoeNo ratings yet

- Cake Pans - Comes in Different Sizes and Shapes and May Be RoundDocument5 pagesCake Pans - Comes in Different Sizes and Shapes and May Be RoundEj TorresNo ratings yet

- Stag Beetle CP - Flickr - Photo Sharing!Document2 pagesStag Beetle CP - Flickr - Photo Sharing!LeonVelasquezRestrepoNo ratings yet

- Notes in PharmacologyDocument95 pagesNotes in PharmacologyMylz MendozaNo ratings yet

- (David de Las Morenas) The Book of Alpha - 30 RulesDocument151 pages(David de Las Morenas) The Book of Alpha - 30 RulesRd man80% (5)

- Submission Information Form Music SecureDocument2 pagesSubmission Information Form Music SecureLuca SomigliNo ratings yet

- David Byrne - 2018-04 Mojo PDFDocument8 pagesDavid Byrne - 2018-04 Mojo PDFJuan Pablo GraciánNo ratings yet

- To Deleto4Document2 pagesTo Deleto4Paul Savvy100% (1)

- Joint Ventures in SingaporeDocument13 pagesJoint Ventures in SingaporesochealaoNo ratings yet

- AGC 2022 R4 QP Class 5.412e46feDocument1 pageAGC 2022 R4 QP Class 5.412e46fereachsricharanvasireddyNo ratings yet

- CIBIL Consent FormDocument4 pagesCIBIL Consent FormKuldeep BatraNo ratings yet

- Weekly Report JAK2 - Tier III Data Center Project (8 Januari 2020)Document27 pagesWeekly Report JAK2 - Tier III Data Center Project (8 Januari 2020)Ilafya Nur IsninaNo ratings yet