Professional Documents

Culture Documents

Tim Leonard Financial Disclosure Report For 2009

Tim Leonard Financial Disclosure Report For 2009

Uploaded by

Judicial Watch, Inc.Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tim Leonard Financial Disclosure Report For 2009

Tim Leonard Financial Disclosure Report For 2009

Uploaded by

Judicial Watch, Inc.Copyright:

Available Formats

~o to

. Roy. i/~oto

I

I

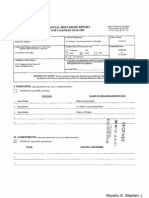

FINANCIAL DISCLOSURE REPORT

FOR CALENDAR YEAR 2009

2, Court or Organization U.S. District Court Oklahoma Sa. Report Type (cheek appropriate type) [] Nomination, [] Initial Date [] Annual [] Final

R~w,.t Req.ir~a by the Ethics

in Government Act of 1978

0 u,s.c, app. tot-lit)

! 3. Date of Report 04/22t2010 6. Reporting Period 01/0112009 to 12/31/2009

i~ Pm-~on Reporting (last name, first, mlddle initial) Leonard, Tim D. 4, Title (Article HI judges indicate active or senior statu~4 rnagis~ate judges indicate full- or part-time) District Judge - Senior Status

5b. [] Amended Report 7~ Chambers or Office Addres~ 4301 LI.S. Courthouse 200 N.W. Fourlh Street Oklahoma City, OK 73102 8, On the basi~ of the information toatained in this Report and any modifications pertaining thereto, it i~, in my opinion, in compliance with applicable laws and regulations. Reviewing Officer Date

IMPORTANT NOTES: The instruaions accompanying this form mast be followe~ Complete all parts,

checking the NONE box for each part where you have no reportable information. Sign on last page.

I. POSITIONS. ~a~oorn,,g i,ai~n~ on0,; "~W. ~-i~ o/,~i,g ~,,,a~o,~.)

~ NONE (No reportable positions.) POSITION

I. Board Member

NAME OF ORGANtZATION~NTITY

University of Oklahoma Spike (Track & Field) Club

NONE (No re~rtable agreements.) ~ PARTIES A~ TE~S

I.

Leonard, Tim D.

FINANCIAL DISCLOSURE REPORT I Name of Pe.r~on Reporting

Page 2 of8

I Leonard, Tim D.

D,,e of Report [ 04/2212010 [

III. NON-INVESTMENT INCOME. (Repo,ang indivldual and spouse; see pp. I7-24 of fillng instructions.)

A. Filers Non-Investment Income NONE (No reportable non-investment income,) DATE

1. 2009 2.

SOURCE AND TYPE

Oklahoma Public Employees Retirement

INCOME

(yours, not spouses) $15,385.44

3. 4.

B. Spouses Non-Investment Income - if you were married during any portion of the reporting ),ear, complete this section.

(Dollar amount not required except.for honoraria.)

~-] NONE (No reportable non-investment income.) DATE

1. Dec. 2009 2. 3. 4.

SOURCE AND TYPE

Contract Employee - Henry Zarrow Foundation

IV. REIMBURSEMENTS -,,~,~pon~io,~

(Includes those to spouse and dependent children: see pp. 25-27 of filing instruclions.)

NONE (No reportable reimbursements.) SOURCE

1.

DATES

LOCATION

PURPOSE

ITEMS PAID OR PROVIDED

2. 3. 4. 5.

PageFINANCIAL3 of 8 DISCLOSURE REPORT [

Leonard, Tim D. [

Name of Person Reporting

Date of Report

04/22/2010

V. GIFTS. a.a.~ ~ho~e to ~po~ am de~.~e~ ~h~: ~ ~. ~-~ o/rm~g

NONE (No re~rtable g~s.) SOUR~g

1. 2. 3. 4. 5.

DESCRIPTION

VI. LIABILITIES. a-a.~ tho~ of ~po~e ..~ ~.d~.t ~u~,~.; ~ p~ ~.~ of fding i~truction~.) NONE (No reporta61e liabiliies.) CREDITOR

1. 2. 3. 4.

5.

DESCRIPTION

VALUE CODE

FINANCIAL DISCLOSURE ~PORT ] L~nard, Name ofD. Reporting Tim Person Page 4 of 8

l ~

Date o~" Report ~/22/2010

~ONE (No reportable income, assets, or tra~actions.)

A. D~pfion of Asse~ (including trust ~se~) B. In,me d~g r~ng ~od ~ Am~nt C~e I ~ (A-H) C. Gross value at end of rep~ng p~ T~ebuy,sel~ (e.g., r~empfion) D. T~n~tions d~ng ~g ~ri~

ex~plPla~ "(~"~om afterprior~h~sclosure~t

(e.g., Value Valae C~e 2 Me~ T~ediv., r~ or int.) (J-P) Code3

.....

I. 2. 3. 4. 5. 6. 7. 8. 9. 10. 1 I. 12. 13. 14. 15. 16, 17. Prope~ # 1, ~aver Co, OK (1980"~or

~

C A Kent Rent None E F DD D C A A A D A A A A Rayalty Royal~ Royal~ Royal~ Royalty Royalty ~vidend Divi~nd Dividend Dividend Interest Interest Interest Dividend K K K J 2I J K K N N K L L L L K

(Q-w) ~ ......

R R Q W W W W W Q Sold T T W T T T T Buy

~td~te } Value--1 Gain [~ [ Code 2 ICo~ ! [ [ 0P)](A-H)

Identity of buy~/seller {if priv.

~_ ~

~eaon)

Sso,o~)

~onard Mt [nv LLC real estate G~nison Co, CO 20~ $300,0~ Prope~ #1,Okla County, OK (~praisal July 2003)(X) Oil & ~as Royal~y Imer~t B~ver Co, OK Oil & Gas Wo~ing lnteres~ B~ver ~, OK A~ost Unit Oil & Gas Wo~ing lnte~st, Beaver Co, OK, Leonard # 1 Oil & G~ Working lnmr~K Beaver Co, O~ B~by # 1 Oil & G~ Wo~ing Interest, Beav~ Co, OK, Beard #1 Oil & O~ Royal~ Interes~ Me~e Co, ~ appmi~l 3/18/97 t~ Aect - Fidelity Orow~ & Income Mutual Fun& IRA Acct - Fidelity Dividend Gro~h IRA Acct - FideliW Money Market OK Public Employees Retirement, Okla. City, OK Cash Value Life Insurance, Chattanooga, TN Bank of Okla - Checking Aect, Okla. City, OK Bank ofOkla - Savings, Okla. City, OK Fidelity Mutual Funds - Spartan Market Index (X)

10/21/09 10/21/09

J J

1. l,acom Gain Codes: 2- Value Codes (See Coltanns C I and D3) 3. Value Method Codes (S~ Column C2)

A ---$ 1,000 Or less J =$15,000or less N =$250,001. $50~000 P3 ---$25,000.00! - $50,000,000 Q =Apprai~l U =Book Valae

B =$ l,O01 - $2,500 K =$15,001 * $50,000 O =$500,001 - $1,000.000 R. =~ost (Peal Estate Only) V ~:)ther L =$50,001 - $100,000 P1 --$1,000,001 - $$,000,0~0 P4 =Mo~ ~m $50,000,000 S =As~ssmc~nt W =P~lima~d M =$100,00t P2 =$5,000,O01 T ~sh Market

FINANCIAL DISCLOSURE REPORT

~,me of Person Reporting

Date of Repor|

Page 5 of 8

Leonard, Tim D.

04/22/2010

nd depend~nt children; see pp. 34~ of filing i~u~io~.)

VII. INVESTMENTS and TRUSTS - ~nco~e, vutne, transactions (Includes ~hose of spo ....

~ NONE ~o re~rtable income, assets, or transaction.)

A. ~s~ption of ~s~ (including tm~ ~e~) Pla~ "(X)" after ~h amet exempt~omp~ord~los~ B. Income du~n~ r~ing ped~ C. Gro~ value at ~nd of reporting period

D. T~o~

~-~ (2)

-~

Value C~e2 O-P) Value Method Code 3 T~ (e.g., b~,sell, r~emption) Date ] Value GaM mm/d*W [ Code2 ! C~e I I {Jldentiv of b~yerl~Her

~o~t ) T~e (e.g., C~e I I div.,ren~ (A-~ or int.)

18.

Fideli~ Mutual Funds - Dividend Gro~h

(x)

Fidelity Mutual F~ - Gro~h & In.me

Divi~nd

T K A

19.

(x)

Fidelity Mutual Fun~ - ~o~h Company

Dividend

Sold

10/21109

20.

(x) (x)

Dividend

21.

Fideli~ Mural Funds - A~r~ive Gro~ Fidelity Mutant FUn~ - Cash Rese~e (X)

Dividend

~ 22.

Dividend

] 23.

Devon Energy ~ ~mmon St~k (X)

Dividend

24.

Noble Co.option - CommoR St~k (X)

Dividend

25,

Sand Ridge Ener~

Di~dend

Buy

06/18/09

26,

Ch~les Schwab Money Market FuM (X)

Inmrest

27.

Non-producing Royalty Interest. Brazoria Co, TX (X) Bank ofOkla - Checking AccL Okla, City.

None

28.

OK

29. IRA Acct - CD - Bank of Beaver, OK

Interest

Interest

30.

31. 32,

Vanguard 500 Index Mutual Funds

Vanquard Strategic Equity Fund

A

A

Dividend

Dividend Dividend

K

J J

T

T

Fidelity Mutual Funds - Growth & Income

33.

34.

Fidelity Small Capitol Stock

Sentinel Investments

A

A

Dividend

Dividend

J

J

T

T S~e See. VIII

1, Ino~.te Gain Cod~: (See Columns B I and D4) 2. Value Codel (See Columns C 1 and D3) 3. Value Method Codes (See Coluwal C2)

A =$1.O00 or ley~ F ---$50.001 - $|00,000 J 2515.000 or less N =:~250.O01 - $500.000 P3 -~25,000.001 - $50,000,000 Q =Aplx,aisal U =~]Elook %talt~:

B =$1,001 - $2,509 O =$ IO0,O01 - $ I ,O00.OO0 K =$15,001 - $50,000 O ~$500.001 - $1,000,00O R =Cost (R~al Estate Only) V =Offt~-

C .~,2,501 - $5,000 HI ---$1.000.O0l - $5,1~0.000 L ~.50.001 - St00,000 PI =$1,000,001 - $5,000,0~0 P4 ~Mofe than $50,1300,000 S =Assessment W =Estlnu~ted

D =$5.001 - $15.000 H2 =More than M =$100.0~1 - $250.000 P2 =$$.000.001 - $25.000.000 T.~--ash Mark~

E =$15.001 - $50,000

FINANCIAL DISCLOSURE REPORT Page 6 of 8

[ Name of Person [~eporting

DateofReport

L~o.~ra, Tim D.

04/22/2010

NONE (No re~rtabte income, assets, or transactions.)

Descri~ion of As~ (including ~t ~) Place "(X)" after ~h reset ex~pt f~m prior di~l~u~ Income during r~ing ~ount Code I (A-H) T3~e (e.g., div., r~t, or int.) ~oss valnc at end] T~tions during re~ng ~riod [

Value Code 2 {J-P)

T~e (e.g., ~ Value ] Me~od buy, sell, ~ ~ ] Code 3 [ r~emption}

Date m~d~

Value Code 2 (J-P)

Gain Code I (A-H)

Id~ti~ of , buys/seller (if private

35.

O~ark Equity & ln~e Fund

Dividend

36.

O~ark Global Fund

Di~dend

37. 38. 39, 40. 41.

ING Direct - CD Legacy - Money Market ReliaStar Insurance Annuity Aect (ING) T1AA CREF - Annuity First Oklahoma Investment LLC

A A A A B

Interest Interest Interest Interest Interest

K J J L J

T T T T T

FINANCIAL DISCLOSURE REPORT Page 7 of 8

Name of Pe~on Reporting | Leonard, Tim D.

Date of Report

04/22/2010

VIII. ADDITIONAL INFORMATION OR EXPLANATIONS.

Part VII, Line 35: Citizens Index Mutual Funds changed name to Sentinel Investments

FINANCIAL DISCLOSURE REPORT

Page 8 of 8

Name of Person Reporting

Date of Report

04/22/2010

] Leonard, Tim D.

IX. CERTIFICATION.

I certify that all information given above (including information pertaining to my spouse and minor or dependent children, if any) is accurate, true, and complete to the best of my knowledge and belief, and that any information not reported was withheld because it met applicable statutory provisions permRting non-disclosure. 1 further certify that earned income from outside employment and honoraria and the acceptance of gifts which have been reported are in compliance with the provisions of.5 U.S.C. app. 501 et. seq., 5 U.S.C. 7353, and Judicial Conference regulalions.

NOTE: ANY INDIVIDUAL WHO KNOWINGLY AND WILFULLY FALSIFIES OR FALLS TO FILE THIS REPORT MAY BE SUBJECT TO CIVIL AND CRIMINAL SANCTIONS (5 U.S.C. app. 104)

FILING INSTRUCTIONS Mail signed original and 3 additional copies to: Committee on Financial Disclosure Administrative Office of the United States Courts Suite 2-301 One Columbus Circle, N.E. Washington, D.C. 20544

You might also like

- Application For Letters of AdministrationDocument27 pagesApplication For Letters of Administrationtalk2marvin70No ratings yet

- Polity Ready ReckonerDocument55 pagesPolity Ready ReckonerYash MhadgutNo ratings yet

- 2161 DocsDocument133 pages2161 DocsJudicial Watch, Inc.83% (12)

- 1878 001Document17 pages1878 001Judicial Watch, Inc.100% (5)

- Barrido v. NonatoDocument1 pageBarrido v. NonatoMaureen CoNo ratings yet

- 01 Boracay Foundation vs. Province of AklanDocument11 pages01 Boracay Foundation vs. Province of Aklanmltoquero100% (1)

- Affidavit and Affidavit of Loss - Andres (Cessation and Bir Documents)Document2 pagesAffidavit and Affidavit of Loss - Andres (Cessation and Bir Documents)Antonio J. David II80% (5)

- Richard H Kyle Financial Disclosure Report For 2009Document8 pagesRichard H Kyle Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Jose A Fuste Financial Disclosure Report For 2009Document8 pagesJose A Fuste Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Robert L Jordan Financial Disclosure Report For 2009Document10 pagesRobert L Jordan Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Richard L Nygaard Financial Disclosure Report For 2009Document7 pagesRichard L Nygaard Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Joseph A DiClerico JR Financial Disclosure Report For 2009Document15 pagesJoseph A DiClerico JR Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Frank H Seay Financial Disclosure Report For 2009Document8 pagesFrank H Seay Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- William R Furgeson Financial Disclosure Report For 2009Document9 pagesWilliam R Furgeson Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Sidney A Fitzwater Financial Disclosure Report For 2009Document9 pagesSidney A Fitzwater Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- William H Barbour JR Financial Disclosure Report For 2009Document11 pagesWilliam H Barbour JR Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- JR Solomon Oliver Financial Disclosure Report For 2009Document9 pagesJR Solomon Oliver Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Charles A Pannell Financial Disclosure Report For 2009Document9 pagesCharles A Pannell Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Jackson L Kiser Financial Disclosure Report For 2009Document8 pagesJackson L Kiser Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Avern L Cohn Financial Disclosure Report For 2009Document20 pagesAvern L Cohn Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Robert R Beezer Financial Disclosure Report For 2009Document9 pagesRobert R Beezer Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- William H Pryor JR Financial Disclosure Report For 2010Document9 pagesWilliam H Pryor JR Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Lawrence J ONeill Financial Disclosure Report For 2010Document19 pagesLawrence J ONeill Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Henry C Morgan JR Financial Disclosure Report For 2009Document7 pagesHenry C Morgan JR Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Patrick J Duggan Financial Disclosure Report For 2009Document7 pagesPatrick J Duggan Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Stephen J Murphy III Financial Disclosure Report For 2009Document8 pagesStephen J Murphy III Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Thomas L Ludington Financial Disclosure Report For 2009Document21 pagesThomas L Ludington Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Raymond W Gruender Financial Disclosure Report For 2009Document8 pagesRaymond W Gruender Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Lawrence L Piersol Financial Disclosure Report For 2010Document8 pagesLawrence L Piersol Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- David J Folsom Financial Disclosure Report For 2009Document10 pagesDavid J Folsom Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Clarence A Brimmer Financial Disclosure Report For 2009Document7 pagesClarence A Brimmer Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Myron H Thompson Financial Disclosure Report For 2010Document14 pagesMyron H Thompson Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Edwin M Kosik Financial Disclosure Report For 2009Document9 pagesEdwin M Kosik Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- William Keith Watkins Financial Disclosure Report For 2010Document8 pagesWilliam Keith Watkins Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Kimberly A Moore Financial Disclosure Report For 2009Document11 pagesKimberly A Moore Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Joe L Heaton Financial Disclosure Report For 2010Document8 pagesJoe L Heaton Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Donald J Stohr Financial Disclosure Report For 2010Document7 pagesDonald J Stohr Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Donald J Stohr Financial Disclosure Report For 2009Document8 pagesDonald J Stohr Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Robert L Jordan Financial Disclosure Report For 2010Document11 pagesRobert L Jordan Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Bernard A Friedman Financial Disclosure Report For 2009Document15 pagesBernard A Friedman Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- JR Ewing Werlein Financial Disclosure Report For 2009Document24 pagesJR Ewing Werlein Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- James A Parker Financial Disclosure Report For 2010Document8 pagesJames A Parker Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- James B Zagel Financial Disclosure Report For 2009Document10 pagesJames B Zagel Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Stephan P Mickle Financial Disclosure Report For 2009Document7 pagesStephan P Mickle Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Robert E Maxwell Financial Disclosure Report For 2009Document8 pagesRobert E Maxwell Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Sandra Ikuta Financial Disclosure Report For 2009Document8 pagesSandra Ikuta Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Jose A Gonzalez JR Financial Disclosure Report For 2009Document10 pagesJose A Gonzalez JR Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Kenneth M Karas Financial Disclosure Report For 2010Document7 pagesKenneth M Karas Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- William A Pepper Financial Disclosure Report For 2010Document22 pagesWilliam A Pepper Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- John Antoon Financial Disclosure Report For 2009Document8 pagesJohn Antoon Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Dan Aaron Polster Financial Disclosure Report For 2009Document14 pagesDan Aaron Polster Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Dean Whipple Financial Disclosure Report For 2009Document7 pagesDean Whipple Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Chester J Straub Financial Disclosure Report For 2010Document16 pagesChester J Straub Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Garnett T Eisele Financial Disclosure Report For 2009Document12 pagesGarnett T Eisele Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- John D Holschuh Financial Disclosure Report For 2009Document7 pagesJohn D Holschuh Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Donald L Graham Financial Disclosure Report For 2010Document8 pagesDonald L Graham Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Howard A Matz Financial Disclosure Report For 2009Document13 pagesHoward A Matz Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Tom Stagg Financial Disclosure Report For 2010Document21 pagesTom Stagg Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Roger Vinson Financial Disclosure Report For 2010Document20 pagesRoger Vinson Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Thomas L Ambro Financial Disclosure Report For 2010Document21 pagesThomas L Ambro Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Karen N Moore Financial Disclosure Report For 2009Document9 pagesKaren N Moore Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Frank H Seay Financial Disclosure Report For 2010Document25 pagesFrank H Seay Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Leonard E Davis Financial Disclosure Report For 2009Document7 pagesLeonard E Davis Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Roslyn O Silver Financial Disclosure Report For 2010Document7 pagesRoslyn O Silver Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- JR Ewing Werlein Financial Disclosure Report For 2010Document20 pagesJR Ewing Werlein Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- James A Teilborg Financial Disclosure Report For 2010Document12 pagesJames A Teilborg Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- 1488 09032013Document262 pages1488 09032013Judicial Watch, Inc.100% (1)

- CC 081213 Dept 14 Lapp LDocument38 pagesCC 081213 Dept 14 Lapp LJudicial Watch, Inc.No ratings yet

- Stamped ComplaintDocument4 pagesStamped ComplaintJudicial Watch, Inc.No ratings yet

- 11 1271 1451347Document29 pages11 1271 1451347david_stephens_29No ratings yet

- Gitmo Freezer Inspection ReportsDocument4 pagesGitmo Freezer Inspection ReportsJudicial Watch, Inc.No ratings yet

- June 2004Document17 pagesJune 2004Judicial Watch, Inc.No ratings yet

- Stamped Complaint 2Document5 pagesStamped Complaint 2Judicial Watch, Inc.No ratings yet

- JTF GTMO Water Safety App W ExhDocument13 pagesJTF GTMO Water Safety App W ExhJudicial Watch, Inc.No ratings yet

- Cover Letter To Requester Re Response Documents130715 - 305994Document2 pagesCover Letter To Requester Re Response Documents130715 - 305994Judicial Watch, Inc.No ratings yet

- State Dept 13-951Document4 pagesState Dept 13-951Judicial Watch, Inc.No ratings yet

- Gitmo Freezer Inspection ReportsDocument4 pagesGitmo Freezer Inspection ReportsJudicial Watch, Inc.No ratings yet

- July 2007 BulletinDocument23 pagesJuly 2007 BulletinJudicial Watch, Inc.No ratings yet

- SouthCom Water Safety ProductionDocument30 pagesSouthCom Water Safety ProductionJudicial Watch, Inc.No ratings yet

- CVR LTR SouthCom Water Safety ProductionDocument2 pagesCVR LTR SouthCom Water Safety ProductionJudicial Watch, Inc.No ratings yet

- LAUSD Semillas AckDocument1 pageLAUSD Semillas AckJudicial Watch, Inc.No ratings yet

- December 2005Document7 pagesDecember 2005Judicial Watch, Inc.No ratings yet

- Model UNDocument2 pagesModel UNJudicial Watch, Inc.No ratings yet

- 13-1150 Responsive Records 2 - RedactedDocument29 pages13-1150 Responsive Records 2 - RedactedJudicial Watch, Inc.No ratings yet

- December 2005 Bulletin 2Document14 pagesDecember 2005 Bulletin 2Judicial Watch, Inc.No ratings yet

- September 2004Document24 pagesSeptember 2004Judicial Watch, Inc.No ratings yet

- July 2006Document24 pagesJuly 2006Judicial Watch, Inc.No ratings yet

- Atlanta IntraregionalDocument4 pagesAtlanta IntraregionalJudicial Watch, Inc.No ratings yet

- STAMPED ComplaintDocument4 pagesSTAMPED ComplaintJudicial Watch, Inc.No ratings yet

- 13-1150 Response Re Judicial WatchDocument1 page13-1150 Response Re Judicial WatchJudicial Watch, Inc.No ratings yet

- CRIMINAL LAW 1 JurisDocument36 pagesCRIMINAL LAW 1 JurisOwen Lava100% (1)

- Isinama Ko Kahit Pangsales Yung Iba Kase Hndi Ko Alam Baka Magamit or Shit. Di Ko Mahanap Iba Sorry. Ang Yu V. Ca (December 02, 1994) FactsDocument4 pagesIsinama Ko Kahit Pangsales Yung Iba Kase Hndi Ko Alam Baka Magamit or Shit. Di Ko Mahanap Iba Sorry. Ang Yu V. Ca (December 02, 1994) Factsdnel13No ratings yet

- Philsec vs. Court of Appeals, Supra at 17Document2 pagesPhilsec vs. Court of Appeals, Supra at 17ASGarcia24No ratings yet

- House Hearing, 110TH Congress - Governance and Financial Accountability of Rural Electric Cooperatives: The Pedernales ExperienceDocument179 pagesHouse Hearing, 110TH Congress - Governance and Financial Accountability of Rural Electric Cooperatives: The Pedernales ExperienceScribd Government DocsNo ratings yet

- Bautista v. Republic, G.R. No. L-3353, December 29, 1950Document1 pageBautista v. Republic, G.R. No. L-3353, December 29, 1950Joms TenezaNo ratings yet

- Pre-Trial Joint LetterDocument4 pagesPre-Trial Joint LetterDarrylSlaterNo ratings yet

- Petitioners Vs VS: Second DivisionDocument7 pagesPetitioners Vs VS: Second DivisionNinaNo ratings yet

- 4 - Tolentino vs. InciongDocument5 pages4 - Tolentino vs. InciongPatrixia Sherly SantosNo ratings yet

- Development of Court System in IndiaDocument17 pagesDevelopment of Court System in IndiaYoYoAviNo ratings yet

- Conflicts of Law and Equity in The Merchant of VeniceDocument4 pagesConflicts of Law and Equity in The Merchant of VenicepppNo ratings yet

- Dualistic Theory PDFDocument11 pagesDualistic Theory PDFsuraj singhNo ratings yet

- WKHS Vs United States (USPS Award Complaint) 1-21-Cv-0484-ZNS - Doc 44 (WKHS Reply To Oshkosh & USA Motion To Dismiss)Document57 pagesWKHS Vs United States (USPS Award Complaint) 1-21-Cv-0484-ZNS - Doc 44 (WKHS Reply To Oshkosh & USA Motion To Dismiss)Fuzzy PandaNo ratings yet

- 31.1 - Shrout Memorandum Motion To DismissDocument8 pages31.1 - Shrout Memorandum Motion To DismissFreeman LawyerNo ratings yet

- Amgen Inc. v. F. Hoffmann-LaRoche LTD Et Al - Document No. 1047Document4 pagesAmgen Inc. v. F. Hoffmann-LaRoche LTD Et Al - Document No. 1047Justia.comNo ratings yet

- Sumption Mann Lecture FinalDocument22 pagesSumption Mann Lecture FinalObiterJNo ratings yet

- CATEGORY: - : Cy Lupong Tagapamayapa Incentives Awards (Ltia) Ltia Form 06-Summary of CasesDocument1 pageCATEGORY: - : Cy Lupong Tagapamayapa Incentives Awards (Ltia) Ltia Form 06-Summary of Casessan nicolas 2nd betis guagua pampanga0% (1)

- David T. Spizzirri & Carol J. Spizzirri Divorce Records, Kenosha County, WI (1993)Document15 pagesDavid T. Spizzirri & Carol J. Spizzirri Divorce Records, Kenosha County, WI (1993)Peter M. HeimlichNo ratings yet

- ACA Lawsuit Put On Hold Over Government ShutdownDocument3 pagesACA Lawsuit Put On Hold Over Government ShutdownHLMeditNo ratings yet

- Construction Dev V EstrellaDocument21 pagesConstruction Dev V EstrellaJennyNo ratings yet

- Leveriza vs. IACDocument2 pagesLeveriza vs. IACJames Peter Garces0% (1)

- Anirudh Rana (Bba LLB - A70621518010)Document5 pagesAnirudh Rana (Bba LLB - A70621518010)Anirudh RanaNo ratings yet

- Resume of 9/11 Commission Staffer Barbara GreweDocument3 pagesResume of 9/11 Commission Staffer Barbara Grewe9/11 Document ArchiveNo ratings yet

- Judiciary Times Newsletter 2017 Issue 02Document11 pagesJudiciary Times Newsletter 2017 Issue 02Ade Firman FathonyNo ratings yet

- John Sargetis Mal Practice Suit Docs.1634784Document5 pagesJohn Sargetis Mal Practice Suit Docs.1634784Penny Morgan ParkerNo ratings yet

- Originalism and Living ConstitutionalismDocument13 pagesOriginalism and Living Constitutionalismtarun donadiNo ratings yet