Professional Documents

Culture Documents

Tim Leonard Financial Disclosure Report For 2010

Tim Leonard Financial Disclosure Report For 2010

Uploaded by

Judicial Watch, Inc.Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tim Leonard Financial Disclosure Report For 2010

Tim Leonard Financial Disclosure Report For 2010

Uploaded by

Judicial Watch, Inc.Copyright:

Available Formats

Rev. 1/20!

FINANCIAL DISCLOSURE REPORT FOR CALENDAR YEAR 2010

2. Court or Organization U.S. District Court, Oklahoma

5a. Report Type (check appropriate type) ] Nomination, [] Initial Date [] Annual [] Final

Rcport Required by the Ethics in Government Act of 1978 (5 U.S.C. app..~q~" I01-111)

I. Person Reporting (last name, first, middle initial) Leonard, Tim D.

4. Title (Article Ill judges indicate active or senior status; magistrate judges indicate full- or part-time) District Judge - Senior Status

3. Date of Report 04/29/201 I 6. Reporting Period 01/01/2010 to 12/31/2010

5b. [] Amended Report

7. Chambers or Office Address 4301 U.S. Courthouse 200 N.W. Fourth Street Oklahoma City, OK 73102

8. On the basis of the information contained in this Report and any modifications pertaining thereto, it is, in my opinion, in compliance with applicable laws and regulations. Reviewing Officer Date

IMPORTANT NOTES: The instructions accompanying this form must be followed. Complete ail parts,

checking the NONE box for each part where you have no reportable informatiot~ Sign on last page.

I. POSITIONS. (Reporting individual only; see pp. 9-13 of filing instructions.)

[~ NONE (No reportable positions.) POSITION

1. 2. 3. 4. Board Member

NAME OF ORGANIZATION/ENTITY University of Oklahoma Spike (Track & Field) Club

II. AGREEMENTS. m,porti,g individual only; seepp. 14-16 of filing instructions.)

~] NONE (No reportable agreements.)

DATE PARTIES AND TERMS

Leonard, Tim D.

FINANCIAL DISCLOSURE REPORT Page 2 of 8

Name of Person Reporling Leonard, Tim D.

Dale of Report 04/29/2011

111. NON-INVESTMENT INCOME. (Repo,~ing individual and spouse; seepp. 17-24 offillng instructions.)

A. Filers Non-lnvestment Income

D

NONE (No reportable non-investment income.) DATE SOURCE AND TYPE

Oklahoma Public Employees Retirement

INCOME

(yours, not spouses)

I. 2010 2. 3. 4.

$15,385.44

B. Spouses Non-Investment Income - if you were married during anyportion of the reporting year, complete this section.

(Dollar arnount not required except for honorariaO

NONE (No reportable non-investment income.) DATE

1. 2. 3. 4.

SOURCE AND TYPE

IV. REIMBURSEMENTS - transportation, lodging, food, entertainment

(Includes those to spouse and dependent children; see pp. 25-27 of f!ling instructions.)

~]

NONE (No reportable reimbursements.) SOURCE DATES LOCATION PURPOSE ITEMS PAID OR PROVIDED

2. 3.

4 5.

FINANCIAL DISCLOSURE REPORT Page 3 of 8

Name of Person Reporting Leonard, Tim D.

Date of Report 04/29/201 I

V. GIFT S. ancludes those to spouse and dependent children; see pp. 28-31 of filing instructions.)

NONE (No reportable gifts.)

SOURCE

1. 2. 3. 4. 5.

DESCRIPTION

VALUE

VI. LIABILITIES. anctudes those of spouse and dependent children; see pp. 32-33 of.fillng instructions.)

NONE (No reportable liabilities.)

CREDITOR

1. 2. 3. 4. 5.

DESCRIPTION

VALUE CODE

FINANCIAL DISCLOSURE REPORT Page 4 of 8

Name of Person Reporting Leonard, Tim D.

Date of Report 04/29/201 I

VII. INVESTMENTS and TRUSTS - income, value, transactions (Includes those of spouse and dependent children; see pp. 34-60 of filing instructions.)

NONE (No reportable income, assets, or transactions.) Description of Assets (including trust assets) Place "(X)" after each asset exempt from prior disclosure Income during reporting period

(1) (2)

Gross value at end of reporting period

(1) (2) (I)

Transactions during reporting period

(2) (3) (4) Date Value Gain mm/dd/yy Code2 Code 1 (J-P) (A-H)

Amount Code 1 (A-H)

Type (e.g., div., rent, or int.)

Value Code 2 (J-P)

Value Method Code 3 (Q-W) R R Q W W W W W Q T T W T T T T T

Type (e.g., buy, sell, redemption)

(5) Identity of buyer/seller (if private transaction)

Property # 1, Beaver Co, OK (1980 for $50,000)

2. 3. 4. 5. 6. 7. 8. 9. Leonard Mt lnv LLC real estate Gunnison Co, CO 2004 $300,000 Property #1,0kla County, OK (appraisal July 2003)(X) Oil & Gas Royalty Interest, Beaver Co, OK Oil & Gas Working Interest, Beaver Co, OK Armagost Unit Oil & Gas Working Interest, Beaver Co, OK, Leonard # 1 Oil & Gas Working Interest, Beaver Co, OK, Barby # 1 Oil & Gas Working Interest, Beaver Co, OK, Beard # 1 Oil & Gas Royalty Interest, Meade Co, KS appraisal 3/18/97 IRA Acct - Fidelity Dividend Growth II. 12. IRA Acct - Fidelity Money Market OK Public Employees Retirement, Okla. City, OK Cash Value Life Insurance, Chattanooga, TN Bank of Okla - Checking Acct, Okla. City, OK Bank ofOkla - Savings, Okla. City, OK

Fidelity Mutual Funds - Spartan Market Index (X)

C A

Rent Rent None

K N N K K K K K K J K K J J J K K

E F D D B C A B D A A A A A

Royalty Royalty Royalty Royalty Royalty Royalty Dividend Distribution Dividend Interest Interest Interest Dividend Dividend

Sold (part) Buy

05/13/10 05/13/10

J J

Sold (part) Sold (part)

05/13/10 05/13/10

J J

A A

Fidelity Mutual Funds - Dividend Growth

(x)

1. Income Gain Codes: (See Column s B 1 and D4) 2. Value Codes (See Columns CI and D3) 3. Value Method Codes (See Column C2)

A =$1,000 or tess F =$50,001 - $100,000 J $15,000 or less N =$250,001 - $500,000 P3 -$25,000,001 - $50,000,000 Q =Appraisal U =Book Value

B =$1 ,g01 - $2,500 G =$100,001 - $1,000,000 K =$15,001 - $50,000 O =$500,001 - $1,000,000 R =Cosl (Real Estate Only) V =Other

C =$2,501 - $5,0~ H I =$1,000,001 - $5,000,000 L =$50,001 - $100,000 P 1 =$1,000,001 - $5,000,000 P4 =More Ihan $50,000,000 S =Assessment W =Estimated

D =$5,001 - $15,0~0 H2 =M ore than $5.000,000 M =$100,001 - $250,000 P2 =$5,000,001 - $25,000,000 T =Cash Market

E =$15,001

FINANCIAL DISCLOSURE REPORT Page 5 of 8

Name of Person Reporting Leonard, Tim D.

Dale of Report 04/29/201 l

VII. INVESTMENTS and TRUSTS - income, value, transactions (Includes those of spouse and dependent children; see pp. 34-60 of filing instruction.,~)

~] NONE (No reportable income, assets, or transactions.)

Description of Assets (including trust assets) Place "(X)" after each asset exempt from prior disclosure Income during reporting period (1) (2) Amount Type (e.g., Code I div., rent, (A-H) or int.) Gross value at end of reporting period (1) (2) Value Value Code 2 Method Code 3 (J-P) (Q-W) J J J K K J J J J K K J J J J J J T T T T T T T W T T T T T T T T T See Sec. VIII Buy 08/11/10 J Transactions during reporting period (1) Type (e.g., buy, sell,

redemption)

(2) (3) (4) Date Value Gain mm/dd/yy Code 2 Code 1 (J-P) (A-H)

(5) Identity of buyer/seller (if private transaction)

18. 19. 20. 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. 31. 32. 33. 34.

Fidelity Mutual Funds - Growth Company

(x)

Fidelity Mutual Funds - Aggressive Growth

A A A A A A A

Dividend Dividend Dividend Dividend Dividend Dividend Interest None

(x)

Fidelity Mutual FUnds - Cash Reserve (X) Devon Energy - Common Stock (X) Noble Corporation - Common Stock (X) Sand Ridge Energy Charles Schwab Money Market Fund (X) Non-producing Royalty Interest, Brazoria Co, TX (X) Bank ofOkla - Checking Acct, Okla. City, OK IRA Acct - CD - Bank of Beaver, OK Vanguard 500 Index Mutual Funds Vanquard Strategic Equity Fund Fidelity Mutual Funds - Growth & Income Fidelity Small Capitol Stock Sentinel Investments Oakmark Equity & Income Fund Oakmark Global Fund

A A A A A A A A A

Interest Interest Dividend Dividend Dividend Dividend Dividend Dividend Dividend

1. Income Gain Codes: (See Columns BI and D4) 2. Value Codes (See Columns CI and D3) 3. Value Method Codes (See Column C2)

A =$1,000 or less F =$50,001 - $100.000 J =$15.000 or less N =$250,001 - $500,000 P3 =$25.000,001 - $50,000,000 Q =Appraisal U =Book Value

B =$1.001 - $2,500 G =$100,001 - $1,000,000 K -$15,001 - $50,000 O =$500,001 - $1,000,000 R =Cost (Real Estate Only) V =Other

C =$2.501 - $5,000 H 1 =$1,000.001 - $5,000.000 L =$50,001 - $100,000 PI =$1,000,001 - $5,000.000 P4 =More than $50,000,000 S =Assessment W =Estimated

D =$5,001 - $15,000 H2 =More than $5.000,000 M $100,001 - $250.000 P2 =$5,000.001 - $25.000.000 T =Cash Markcl

E =$15,001 - $50,000

FINANCIAL DISCLOSURE REPORT Page 6 of 8

Name of Person Reporting Leonard, Tim D.

Dale of Report 04/29/2011

VII. INVESTMENTS and TRUSTS - income, value, transactions (Includes those of ~pouse and dependent children; see pp. 34-60 of filing instruction,t)

~] NONE (No reportable income, assets, or transactions.)

A. Description of Assets (inc!uding trust assets) Place "(X)" after each asset exempt from prior disclosure B. Income during reporting period (l) Amount Code I (A-H) (2) Type (e.g., div., rent, or int.) C. Gross value at end of reporting period (l) Value Code 2 (J-P) (2) Value Method Code 3 (Q-W) Type (e.g., buy, sell, redemption)

Transactions during reporting period

(2)

Date mm/dd/yy

(3)

Value Code 2 (J-P)

(4) Gain Code 1 (A-H)

(5) Identity of buyer/seller (i f private transaction)

35. 36. 37 38. 39.

ING Direct- CD Legacy - Money Market ReliaStar Insurance Annuity Acct (ING) TIAA CREF - Annuity First Oklahoma Investment LLC

A A A A B

Interest Interest Interest Interest Interest

T Closed 08/02/I 0 J

J L J

T T T

1. Income Gain Codes: (See Columns B 1 and D4) 2, Value Codes (See Columns C 1 and D3) 3. Value Method Codes (See Column C2)

A =$1,000 or less F =$50,001 - $100,000 J $15,000 or less N =$250,001 - $500,000 P3 =$25,000,001 - $50.000,000 Q =Appraisal U =Book Value

B =$1,001 - $2,500 G =$100,00 t - $1,000,000 K =$15,001 - $50,000 O =$500,001 - $ 1,000,000 R =Cost (Real Estate Only) V -Other

C =$2.501 - $5,000 H I =$1,000.001 - $5,000,000 L =$50,001 - $100.000 P 1 =$1,000.001 - $5,000,000 P4 =More than $50,000,000 S =Asscssmenl W =Estimated

D =$5,001 - $15,000 H2 ~More tb, an $5,000,000 M =$100.001 - $250,000 P2 =$5,000,001 - $25,000,000 T =Cash Market

E =$15,001- $50,000

FINANCIAL DISCLOSURE REPORT Page 7 of 8

Name of Person Reporting Leonard, Tim D.

Date of Report 04/29/201 I

VIII. ADDITIONAL INFORMATION OR EXPLANATIONS. a,,dlco,,,,o~,,., o~,epor,.)

Part VII, Line 35: Citizens Index Mutual Funds changed name to Sentinel Investments

FINANCIAL DISCLOSURE REPORT Page 8 of 8

Name of Person Rcportlng Leonard, Tim D.

Date of Report 04/29/2011

IX. CERTIFICATION.

1 certify that all information given above (including information pertaining to my spouse and minor or dependent children, if any) is accurate, true, and complete to the best of my knowledge and belief, and that any information not reported was withheld because it met applicable statutory provisions permitting non-disclosure. 1 further certify that earned income from outside employment and honoraria and the acceptance of gifts which have been reported are in compliance with the provisions of 5 U.S.C. app. 501 et. seq., 5 U.S.C. 7353, and Judicial Conference regulations.

Signature: S/Tim D. Leonard

NOTE: ANY INDIVIDUAL WHO KNOWINGLY AND WILFULLY FALSIFIES OR FAILS TO FILE THIS REPORT MAY BE SUBJECT TO CIVIL AND CRIMINAL SANCTIONS (5 U.S.C. app. 104)

Committee on Financial Disclosure Administrative Office of the United States Courts Suite 2-301 One Columbus Circle, N.E. Washington, D.C. 20544

You might also like

- The Pirates of Manhattan II Highway To SerfdomDocument4 pagesThe Pirates of Manhattan II Highway To SerfdomStephon Lynch0% (1)

- Sie Study Manual P 121Document313 pagesSie Study Manual P 121Nredfneei riefh100% (5)

- NISM Investment Adviser Level 1 - Series X-A Study Material NotesDocument26 pagesNISM Investment Adviser Level 1 - Series X-A Study Material NotesSRINIVASAN69% (16)

- 2161 DocsDocument133 pages2161 DocsJudicial Watch, Inc.83% (12)

- 1878 001Document17 pages1878 001Judicial Watch, Inc.100% (5)

- Series 65 101Document52 pagesSeries 65 101Cameron Killeen100% (3)

- Syllabus IIIDocument85 pagesSyllabus IIIAsħîŞĥLøÝå100% (1)

- Terrence L OBrien Financial Disclosure Report For 2010Document8 pagesTerrence L OBrien Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- James C Dever Financial Disclosure Report For 2010Document10 pagesJames C Dever Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- John G Koeltl Financial Disclosure Report For 2010Document10 pagesJohn G Koeltl Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- William Eugene Davis Financial Disclosure Report For 2010Document8 pagesWilliam Eugene Davis Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Howard D McKibben Financial Disclosure Report For 2010Document8 pagesHoward D McKibben Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Mary A Lemmon Financial Disclosure Report For 2010Document9 pagesMary A Lemmon Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Marilyn L Huff Financial Disclosure Report For 2010Document14 pagesMarilyn L Huff Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Jon O Newman Financial Disclosure Report For 2010Document26 pagesJon O Newman Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- William F Nielson Financial Disclosure Report For 2010Document13 pagesWilliam F Nielson Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Mark S Davis Financial Disclosure Report For 2010Document16 pagesMark S Davis Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- James A Beaty JR Financial Disclosure Report For 2010Document8 pagesJames A Beaty JR Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Sandra S Beckwith Financial Disclosure Report For 2010Document20 pagesSandra S Beckwith Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- James L Dennis Financial Disclosure Report For 2010Document8 pagesJames L Dennis Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Andrew J Kleinfeld Financial Disclosure Report For 2010Document9 pagesAndrew J Kleinfeld Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Simeon T Lake Financial Disclosure Report For 2010Document9 pagesSimeon T Lake Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- William T Moore JR Financial Disclosure Report For 2010Document20 pagesWilliam T Moore JR Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Roger J Miner Financial Disclosure Report For 2010Document8 pagesRoger J Miner Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- H J Wilkinson III Financial Disclosure Report For 2010Document10 pagesH J Wilkinson III Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Alfred V Covello Financial Disclosure Report For 2010Document30 pagesAlfred V Covello Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Sarah S Vance Financial Disclosure Report For 2010Document12 pagesSarah S Vance Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- James Knoll Gardner Financial Disclosure Report For 2010Document11 pagesJames Knoll Gardner Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- John H McBryde Financial Disclosure Report For 2010Document9 pagesJohn H McBryde Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- William Keith Watkins Financial Disclosure Report For 2010Document8 pagesWilliam Keith Watkins Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- George S Agee Financial Disclosure Report For 2010Document12 pagesGeorge S Agee Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Carlos F Lucero Financial Disclosure Report For 2010Document8 pagesCarlos F Lucero Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Martha C Daughtrey Financial Disclosure Report For 2010Document8 pagesMartha C Daughtrey Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Robert G Doumar Financial Disclosure Report For 2010Document19 pagesRobert G Doumar Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Stephen M McNamee Financial Disclosure Report For 2010Document12 pagesStephen M McNamee Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Loretta A Preska Financial Disclosure Report For 2010Document14 pagesLoretta A Preska Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Brian M Cogan Financial Disclosure Report For 2010Document15 pagesBrian M Cogan Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Richard G Seeborg Financial Disclosure Report For 2010Document10 pagesRichard G Seeborg Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Raymond W Gruender Financial Disclosure Report For 2010Document8 pagesRaymond W Gruender Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Stanley Marcus Financial Disclosure Report For 2010Document8 pagesStanley Marcus Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Thomas A Varlan Financial Disclosure Report For 2010Document16 pagesThomas A Varlan Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Robert S Lasnik Financial Disclosure Report For 2010Document7 pagesRobert S Lasnik Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Brock D Hornby Financial Disclosure Report For 2010Document13 pagesBrock D Hornby Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- James B Loken Financial Disclosure Report For 2010Document10 pagesJames B Loken Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Ruggero J Aldisert Financial Disclosure Report For 2010Document12 pagesRuggero J Aldisert Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Robert L Jordan Financial Disclosure Report For 2010Document11 pagesRobert L Jordan Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- J A McNamara Financial Disclosure Report For 2010Document10 pagesJ A McNamara Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Irma E Gonzalez Financial Disclosure Report For 2010Document8 pagesIrma E Gonzalez Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- John L Coffey Financial Disclosure Report For 2010Document9 pagesJohn L Coffey Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- James E Gritzner Financial Disclosure Report For 2010Document10 pagesJames E Gritzner Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Barbara Keenan Financial Disclosure Report For 2010Document22 pagesBarbara Keenan Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Lynn S Adelman Financial Disclosure Report For 2010Document9 pagesLynn S Adelman Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- David G Campbell Financial Disclosure Report For 2010Document11 pagesDavid G Campbell Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Deborah K Chasanow Financial Disclosure Report For 2010Document20 pagesDeborah K Chasanow Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Robert R Beezer Financial Disclosure Report For 2010Document9 pagesRobert R Beezer Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Robert J Kelleher Financial Disclosure Report For 2010Document16 pagesRobert J Kelleher Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Russel H Holland Financial Disclosure Report For 2010Document20 pagesRussel H Holland Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Morris S Arnold Financial Disclosure Report For 2010Document10 pagesMorris S Arnold Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Leonard I Garth Financial Disclosure Report For 2010Document8 pagesLeonard I Garth Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Sandra L Lynch Financial Disclosure Report For 2010Document15 pagesSandra L Lynch Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Stanley R Chesler Financial Disclosure Report For 2010Document9 pagesStanley R Chesler Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Barbara M Lynn Financial Disclosure Report For 2010Document30 pagesBarbara M Lynn Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Marcia M Howard Financial Disclosure Report For 2010Document9 pagesMarcia M Howard Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Lynn N Hughes Financial Disclosure Report For 2010Document10 pagesLynn N Hughes Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Claire C Cecchi Financial Disclosure Report For Cecchi, Claire CDocument16 pagesClaire C Cecchi Financial Disclosure Report For Cecchi, Claire CJudicial Watch, Inc.No ratings yet

- Thomas L Ambro Financial Disclosure Report For 2010Document21 pagesThomas L Ambro Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Asset Rotation: The Demise of Modern Portfolio Theory and the Birth of an Investment RenaissanceFrom EverandAsset Rotation: The Demise of Modern Portfolio Theory and the Birth of an Investment RenaissanceNo ratings yet

- CC 081213 Dept 14 Lapp LDocument38 pagesCC 081213 Dept 14 Lapp LJudicial Watch, Inc.No ratings yet

- 1488 09032013Document262 pages1488 09032013Judicial Watch, Inc.100% (1)

- 11 1271 1451347Document29 pages11 1271 1451347david_stephens_29No ratings yet

- State Dept 13-951Document4 pagesState Dept 13-951Judicial Watch, Inc.No ratings yet

- Stamped ComplaintDocument4 pagesStamped ComplaintJudicial Watch, Inc.No ratings yet

- Stamped Complaint 2Document5 pagesStamped Complaint 2Judicial Watch, Inc.No ratings yet

- Gitmo Freezer Inspection ReportsDocument4 pagesGitmo Freezer Inspection ReportsJudicial Watch, Inc.No ratings yet

- SouthCom Water Safety ProductionDocument30 pagesSouthCom Water Safety ProductionJudicial Watch, Inc.No ratings yet

- JTF GTMO Water Safety App W ExhDocument13 pagesJTF GTMO Water Safety App W ExhJudicial Watch, Inc.No ratings yet

- CVR LTR SouthCom Water Safety ProductionDocument2 pagesCVR LTR SouthCom Water Safety ProductionJudicial Watch, Inc.No ratings yet

- Gitmo Freezer Inspection ReportsDocument4 pagesGitmo Freezer Inspection ReportsJudicial Watch, Inc.No ratings yet

- December 2005 Bulletin 2Document14 pagesDecember 2005 Bulletin 2Judicial Watch, Inc.No ratings yet

- Cover Letter To Requester Re Response Documents130715 - 305994Document2 pagesCover Letter To Requester Re Response Documents130715 - 305994Judicial Watch, Inc.No ratings yet

- Model UNDocument2 pagesModel UNJudicial Watch, Inc.No ratings yet

- July 2007 BulletinDocument23 pagesJuly 2007 BulletinJudicial Watch, Inc.No ratings yet

- 13-1150 Responsive Records 2 - RedactedDocument29 pages13-1150 Responsive Records 2 - RedactedJudicial Watch, Inc.No ratings yet

- December 2005Document7 pagesDecember 2005Judicial Watch, Inc.No ratings yet

- June 2004Document17 pagesJune 2004Judicial Watch, Inc.No ratings yet

- July 2006Document24 pagesJuly 2006Judicial Watch, Inc.No ratings yet

- 13-1150 Response Re Judicial WatchDocument1 page13-1150 Response Re Judicial WatchJudicial Watch, Inc.No ratings yet

- September 2004Document24 pagesSeptember 2004Judicial Watch, Inc.No ratings yet

- LAUSD Semillas AckDocument1 pageLAUSD Semillas AckJudicial Watch, Inc.No ratings yet

- STAMPED ComplaintDocument4 pagesSTAMPED ComplaintJudicial Watch, Inc.No ratings yet

- Atlanta IntraregionalDocument4 pagesAtlanta IntraregionalJudicial Watch, Inc.No ratings yet

- Mock Test EnglishDocument47 pagesMock Test EnglishMohit KalalNo ratings yet

- Investment News FreedomDocument3 pagesInvestment News FreedomdjdazedNo ratings yet

- MetLife Srinagar SayeemDocument99 pagesMetLife Srinagar Sayeemsayeemlsm100% (1)

- Schiff's Insurance Observer IndexDocument103 pagesSchiff's Insurance Observer IndexExcessCapitalNo ratings yet

- Canadian INSURANCE CourseDocument509 pagesCanadian INSURANCE CourseDeralianNo ratings yet

- 17 - Findings Conclusion and SuggestionDocument20 pages17 - Findings Conclusion and SuggestionAnkitha KavyaNo ratings yet

- Preview Novarica2006-MN-PAS LHADocument16 pagesPreview Novarica2006-MN-PAS LHAMessina04No ratings yet

- MC01201810853 HDFC Life Pension Guaranteed Plan Brochure - RetailDocument12 pagesMC01201810853 HDFC Life Pension Guaranteed Plan Brochure - RetailMohd SajidNo ratings yet

- Ing BankDocument13 pagesIng BankLacramioara BuleaNo ratings yet

- 80C Deductions: LIC, PF, PPF EtcDocument6 pages80C Deductions: LIC, PF, PPF EtcMerwyn DsouzaNo ratings yet

- How To Log in To Your FRS Online AccountDocument4 pagesHow To Log in To Your FRS Online AccountSharan FosbinderNo ratings yet

- External Wholesaler or Director of Sales or Divisional Manager oDocument3 pagesExternal Wholesaler or Director of Sales or Divisional Manager oapi-78786529No ratings yet

- Great American Forms FILL OUT 2020Document2 pagesGreat American Forms FILL OUT 2020Max Power100% (1)

- AnnuitiesDocument20 pagesAnnuitiesjisansalehin1No ratings yet

- Zambia Income Tax Act 1967 (As Amended 2006)Document100 pagesZambia Income Tax Act 1967 (As Amended 2006)siva chidambaramNo ratings yet

- John Hancock Mut. Life Ins. Co. v. Harris Trust and Sav. Bank, 510 U.S. 86 (1993)Document30 pagesJohn Hancock Mut. Life Ins. Co. v. Harris Trust and Sav. Bank, 510 U.S. 86 (1993)Scribd Government DocsNo ratings yet

- Optimal Option:: SUNY's Personal Retirement Plan As A Model For Pension ReformDocument32 pagesOptimal Option:: SUNY's Personal Retirement Plan As A Model For Pension ReformJimmyVielkindNo ratings yet

- SBI Life - Smart Annuity Plus - Brochure 1Document15 pagesSBI Life - Smart Annuity Plus - Brochure 1prabuNo ratings yet

- Effect of Interest Rate On Profit of Insurance Companies in NigeriaDocument15 pagesEffect of Interest Rate On Profit of Insurance Companies in NigeriaTopArt Tân BìnhNo ratings yet

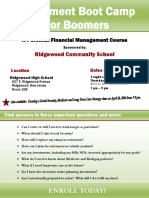

- Retirement Boot Camp For BoomersDocument4 pagesRetirement Boot Camp For BoomersShellyStantonNo ratings yet

- U.S. V. Drescher DoctrineDocument1 pageU.S. V. Drescher DoctrineChiiNo ratings yet

- The African ReinsurerDocument41 pagesThe African ReinsurerseyeolaNo ratings yet

- Metlife Case StudyDocument2 pagesMetlife Case StudyheyNo ratings yet

- LIC ExamDocument11 pagesLIC ExamumeshNo ratings yet

- Advance Financial Planning Pracrice Book Part 2 Case Studies 1Document26 pagesAdvance Financial Planning Pracrice Book Part 2 Case Studies 1Meenakshi67% (3)