Professional Documents

Culture Documents

Eco 8 (2) Notes

Eco 8 (2) Notes

Uploaded by

anushkaprajput05250 ratings0% found this document useful (0 votes)

2 views9 pagesOriginal Title

Eco 8(2) Notes

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

2 views9 pagesEco 8 (2) Notes

Eco 8 (2) Notes

Uploaded by

anushkaprajput0525Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 9

CH 8(2) Money Supply 🗒️

Measuring Money Supply 🎀Here's a simplified explanation:

Measuring the money supply is important for

two main reasons:

1. Understanding Money Growth: By

analyzing how much money is in circulation,

we can better understand what's driving

changes in the money supply. This helps

economists and policymakers get a clearer

picture of what's happening with the

economy.

2. Managing Monetary Policy: Central banks

use monetary policy to stabilize prices and

promote economic growth. They do this by

controlling the supply of money. By

measuring the money supply, central banks

can see if there's too much or too little money

in the economy compared to what's needed

for stable prices and economic growth. They

can then adjust their policies accordingly to

keep the economy on track.

In simple terms, measuring the money supply

helps economists and policymakers

understand how the economy is doing and

whether it's necessary to make any

adjustments to keep things stable and

growing.

The Sources of Money Supply ☘️First major source of money supply:-

Sure, let's simplify it:

1. **Factors Affecting Money Supply:**

- Money supply in an economy depends on

two main things:

- Decisions made by the central bank.

- How commercial banks respond to policy

changes initiated by the central bank.

2. **Nature of Money:**

- Money can either have intrinsic value itself

or represent ownership of something

valuable, like commodities or debt

instruments.

- In modern economies, currency is a form

of money issued by the government or central

bank. It's considered legal tender, meaning

it's accepted as payment for goods and

services.

- Paper currency is essentially a type of

debt. It's a liability for the central bank and an

asset for the people who hold it.

3. **Central Bank's Role:**

- Central banks have the authority to issue

currency, making them the primary source of

money in most countries.

- The currency issued by central banks is

called fiat money. It's not backed by a

physical commodity like gold but is

guaranteed by the government.

- Ideally, the currency issued by the central

bank should be backed by assets like gold

and foreign exchange reserves. However,

most countries operate on a minimum

reserve system, where the central bank only

needs to keep a certain minimum amount of

reserves to issue currency.

☘️Second Major source of money supply:-

● The second major source of money

supply is the banking system of the

country.

● Banks create money supply in the

process of borrowing and lending

transactions with the public. Money so

created by the commercial banks is

called 'credit money’

● Advancement in technology has made

it possible for the development of new

form of money viz. Central Bank

Digital Currencies (CBDCs).

● Reserve Bank broadly defines CBDC

as the legal tender issued by a central

bank in a digital form.

● CBDCs would appear as liability on a

central bank’s balance sheet.

● The Crypto currencies face significant

legislative uncertainties and are not

legally recognized in India as

currency. Hence, these are not

categorized as money.

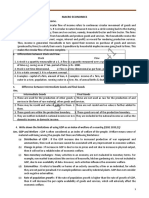

Measurements of money supply 🧸Sure, here's a simplified mind map:

M1 = Currency notes and coins with the ```

people + demand deposits with the Reserve Bank of India (RBI) Measures of

banking system (Current and Saving Money Supply:

deposit accounts) + other |

deposits with the RBI. |-- Monetary Statistics Compilation:

| |

M2 = M1 + savings deposits with post | |-- Since July 1935, RBI compiles and

office savings banks. publishes monetary statistics.

|

M3 = M1 + time deposits with the banking |-- Evolution of Money Supply Measures:

system. | |

| |-- Till 1967-68: Only M1 (Narrow

M4 = M3 + total deposits with the Post measure) published - Currency + Demand

Office Savings Organization Deposits.

(excluding National Savings Certificates). | |

| |-- From 1967-68: Introduction of AMR

(Aggregate Monetary Resources) - Broader

measure.

| |

| |-- Since April 1977: Four measures

introduced as per SWG(Second Working

Group Of money supply) recommendations:

| |

| |-- M1: Currency + Demand

Deposits + Other Deposits with RBI.

| |

| |-- M2: M1 + Savings Deposits with

Post Office.

| |

| |-- M3: M1 + Time Deposits with

Banks.

| |

| |-- M4: M3 + Total Deposits with

Post Office Savings Org. (Excluding NSCs).

|

|-- Definitions of Money Supply Measures:

|

|-- M1: Currency + Demand Deposits +

Other Deposits with RBI.

|

|-- M2: M1 + Savings Deposits with Post

Office.

|

|-- M3: M1 + Time Deposits with Banks.

|

|-- M4: M3 + Total Deposits with Post

Office Savings Org. (Excluding NSCs).

```

This mind map simplifies the evolution and

definitions of the various measures of money

supply prepared and published by the

Reserve Bank of India.

Determinants of Money Supply 🌸Here's a simplified explanation:

Determinants of Money Supply:

1. Exogenous View: Some believe that the

central bank determines the money supply

from outside factors.

2. Endogenous View: Others think that

changes in economic activities, like people's

preference for holding cash versus deposits

and interest rates, determine the money

supply.

3. Current Approach: The current practice

focuses on the "money multiplier approach."

This approach looks at the relationship

between the money stock and the monetary

base, which is the sum of currency in

circulation and bank reserves.

4. Money Multiplier Concept: Before

understanding the determinants of money

supply, it's essential to know about the money

multiplier.

In simple terms, the determinants of money

supply are explained based on how the

central bank, commercial banks, and the

public interact, and how changes in the

economy affect people's behavior regarding

money.

Concept of Money Multiplier 🔖Here's a simplified explanation:

The Money Multiplier Concept:

- When the Reserve Bank of India creates

money, it's called the monetary base or

high-powered money.

- Banks also create money by giving out

loans. They use their excess reserves to

make these loans and earn interest.

- A one-rupee increase in the monetary base

leads to more than a one-rupee increase in

the money supply. This increase is called the

money multiplier.

- The money supply is the total amount of

money in the economy, including currency

held by the public and bank deposits.

- We can calculate the money supply (M)

using the money multiplier (m) and the

monetary base (MB). The formula is M = m x

MB.

- The money multiplier (m) is a ratio that

shows how changes in the money supply

relate to changes in the monetary base. It's

the ratio of the stock of money to the stock of

high-powered money.

- For example, if the central bank injects

Rs.100 crore into the economy, and it leads to

a Rs.500 crore increase in the final money

supply, the money multiplier is 5. This means

that each unit of the monetary base creates 5

units of money supply.

- The size of the money multiplier depends on

the reserve ratio. The reserve ratio is the

fraction of deposits that banks keep as

reserves. The money multiplier is the

reciprocal of the reserve ratio, which means

it's 1 divided by the reserve ratio (1/R).

- The reserve ratio determines how much

money banks can create from the reserves

they hold. If the reserve ratio is low, banks

can create more money, leading to a higher

money multiplier. If the reserve ratio is high,

the money multiplier is lower.

The Money Multiplier Approach to Supply 1. The behaviour of the Central Bank

of Money

Here's a simplified explanation:

🖤Here's a simplified explanation:

The Central Bank's Role:

The Money Multiplier Approach: - The central bank controls the

- Proposed by Milton Friedman and Anna issuance of currency.

Schwartz in 1963. - It determines the supply of

- It considers three factors that directly high-powered money, which is the

affect money supply: basis for the money supply in the

(a) High-powered money (H): This is the economy.

money created by the central bank. - The money stock in the economy is

(b) Reserve ratio (r): This is the ratio of influenced by the money multiplier

reserves that banks keep to the deposits and the monetary base (H), which is

they hold. It reflects how much banks controlled by the central bank.

keep in reserve compared to how much - If the behavior of the public and

they lend out. commercial banks remains constant,

(c) Currency-deposit ratio (c): This is the the total supply of money in the

ratio of currency held by the public to economy will change in line with the

bank deposits. It shows how much people supply of high-powered money issued

prefer to hold in cash versus keeping it in by the central bank.

banks.

In simple terms, the central bank

These factors represent the behaviors of: plays a crucial role in controlling the

- The central bank (high-powered money). amount of money in circulation by

- Commercial banks (reserve ratio). regulating the supply of high-powered

- The general public (currency-deposit money.

ratio).

Now, let's see how each factor affects the

overall money supply in the economy. ➡️

3. The behaviour of the public 2. The behaviour of Commercial Banks

🖤 Here's a simplified explanation

incorporating the key points from your notes:

🖤 Here's a simplified explanation

incorporating the key points from your notes:

1. **Behavior of the Public:** 1. **Commercial Banks' Role in Money

- Demand deposits can expand multiple Supply:**

times, while currency held by the public does - Commercial banks create money by

not. issuing loans.

- When deposits are converted into - The behavior of commercial banks affects

currency, banks can create less credit money, the ratio of their cash reserves to deposits,

reducing the overall level of multiple known as the reserve ratio.

expansion and the money multiplier. - If the required reserve ratio on demand

- The currency-deposit ratio (c) reflects deposits increases, banks need more

people's banking habits and is influenced by reserves, leading them to reduce loans,

economic activity, financial sophistication, and deposits, and the money supply.

access to financial services. - Conversely, if the required reserve ratio

- A smaller currency-deposit ratio leads to a decreases, banks can expand deposits and

larger money multiplier because more the money supply.

high-powered money can be used as - A smaller reserve ratio leads to a larger

reserves, which then gets transformed into money multiplier, meaning banks can create

money. more money.

- The time deposit-demand deposit ratio

affects the money multiplier; an increase 2. **Excess Reserves:**

means more free reserves, leading to greater - Excess reserves are funds that banks

deposit expansion and monetary expansion. keep beyond the required amount.

- They are crucial in determining the money

2. **Money Multiplier Determinants:** supply.

- The size of the money multiplier depends - The excess reserves ratio is negatively

on the required reserve ratio (r), excess related to the market interest rate.

reserve ratio (e), and currency ratio (c). - If interest rates increase, the opportunity

- Lower ratios result in a larger money cost of holding excess reserves rises, leading

multiplier. banks to decrease excess reserves.

- These variables are known as the - Conversely, if interest rates decrease, the

"proximate determinants" of the nominal opportunity cost of excess reserves

money supply. decreases, leading to an increase in excess

reserves.

3. **Money Multiplier Equation:**

- The money multiplier equation includes 3. **Impact of Expected Deposit Outflows:**

the currency-deposit ratio, excess reserves - If banks anticipate higher deposit outflows,

ratio, and required reserve ratio. they increase excess reserves for assurance.

- It's expressed as: m = (1 + c) / (r + e + c) - Conversely, if expected deposit outflows

- The money supply (M) is determined by decrease, banks reduce excess reserves.

the money multiplier (m) and the stock of

high-powered money (H), and varies with 4. **Shocks to Money Supply:**

changes in the monetary base, currency ratio, - Commercial banks' behavior can cause

and reserve ratios. variations in money supply over time.

- During financial crises, banks may be

4. **Example:** reluctant to lend, affecting credit availability.

- Imagine a situation where the currency - Rising interest rates on bank credit can

ratio is low, the excess reserves ratio is coexist with a central bank's easy monetary

minimal, and the required reserve ratio is low. policy, leading to a sharp deceleration in

In this case, the money multiplier would be growth.

high, leading to a larger money supply.

Monetary Supply and Money Supply 🐥Sure, let's break it down:

1. **Stimulating Economic Activity:**

- When a central bank wants to boost

economic activity, it injects liquidity into the

system.

- One way it does this is through open

market operations (OMO), such as buying

government securities.

- This injection of money into the system is

known as high-powered money or the

monetary base.

2. **Effect of Open Market Operations:**

- Assuming banks don't hold excess

reserves and people don't increase currency

holdings, and there's demand for loans, the

banking system creates credit.

- This credit creation process increases the

money supply. The increase in money supply

(∆Money supply) is calculated as:

∆Money supply = 1 / R × ∆ Reserves

- An open market sale, where the central

bank sells securities, has the opposite effect,

reducing reserves and the money supply.

3. **Possibility of Zero Money Multiplier:**

- The value of the money multiplier could

theoretically be zero.

- This could happen if interest rates are

extremely low, leading banks to prefer holding

the injected reserves as excess reserves

instead of lending.

- Essentially, when banks are reluctant to

lend due to very low interest rates, the money

injected into the system doesn't get multiplied

through the banking system, resulting in a

zero multiplier effect.

Effect of Government Expenditure on

Money Supply

🐣Let's simplify:

1. **Ways and Means Advances (WMA) and

Overdraft (OD) Facility:**

‼️ Credit Multiplier=1/ Required Reserve - When the central and state governments'

Ratio cash balances fall below a certain level, they

can get short-term loans from the Reserve

Bank of India (RBI). This facility is called

Ways and Means Advances (WMA) or

overdraft (OD).

2. **Effect on Excess Reserves:**

- When the RBI lends money to the

governments through WMA or OD, it leads to

excess reserves in the banking system.

- Here's how: When the government spends

money, it transfers funds from its account with

the RBI to the recipient's account at a

commercial bank.

- This transaction increases the commercial

bank's reserves with the RBI, creating excess

reserves.

3. **Impact on Money Supply:**

- Excess reserves created through

government spending can potentially

increase the money supply.

- This happens because excess reserves

can be used by commercial banks to create

more credit and loans, leading to an

expansion of the money supply through the

money multiplier process.

NUMERICAL ILLUS Pg 8.36

You might also like

- Principles of Economics 10Th Edition Case Test Bank Full Chapter PDFDocument52 pagesPrinciples of Economics 10Th Edition Case Test Bank Full Chapter PDFmirabeltuyenwzp6f100% (11)

- Understand Banks & Financial Markets: An Introduction to the International World of Money & FinanceFrom EverandUnderstand Banks & Financial Markets: An Introduction to the International World of Money & FinanceRating: 4 out of 5 stars4/5 (9)

- Eureka Wow - Money-And-Financial-MarketsDocument208 pagesEureka Wow - Money-And-Financial-MarketsParul RajNo ratings yet

- ScenarioDocument5 pagesScenarioSijo VMNo ratings yet

- Working GroupDocument16 pagesWorking GrouppvaibhyNo ratings yet

- CH - 11Document16 pagesCH - 11faliyarahulNo ratings yet

- Unit II The Concept of Money SupplyDocument24 pagesUnit II The Concept of Money SupplyLoungo GopaneNo ratings yet

- Money Supply: Basic ConceptsDocument27 pagesMoney Supply: Basic ConceptsSandeep SinghNo ratings yet

- MacroDocument21 pagesMacroShivansh JaiswalNo ratings yet

- 2.1 Monetary PolicyDocument48 pages2.1 Monetary PolicyAnu AndrewsNo ratings yet

- Money SupplyDocument6 pagesMoney SupplyShreya RaiNo ratings yet

- New Monetary Aggregates: An Introduction : Sectorisation of The Economy For Money Supply CompilationDocument12 pagesNew Monetary Aggregates: An Introduction : Sectorisation of The Economy For Money Supply CompilationSudipta BhattacharjeeNo ratings yet

- Chapter 5 - The Creation of MoneyDocument25 pagesChapter 5 - The Creation of MoneyReggie AlisNo ratings yet

- Monetary Policy: Presentation byDocument31 pagesMonetary Policy: Presentation bySumant AlagawadiNo ratings yet

- Money SupplyDocument31 pagesMoney SupplyDivya JainNo ratings yet

- Module 2Document33 pagesModule 2DHWANI DEDHIANo ratings yet

- Mahatma Gandhi Central University: ECON4010: Monetary Economics Course Code: ECON4010Document8 pagesMahatma Gandhi Central University: ECON4010: Monetary Economics Course Code: ECON4010Anjali PanwarNo ratings yet

- Chaper 9Document4 pagesChaper 9ChayaNo ratings yet

- RBI Classification of MoneyDocument10 pagesRBI Classification of Moneyprof_akvchary75% (4)

- RBI Classification of MoneyDocument11 pagesRBI Classification of MoneyTejas BapnaNo ratings yet

- SYBCOMDocument18 pagesSYBCOMRajan NandolaNo ratings yet

- MonetaryDocument7 pagesMonetaryrajkumar1307201No ratings yet

- Class 12 Economics HHDocument90 pagesClass 12 Economics HHkomal barotNo ratings yet

- Central University of South Bihar: Assignment of Money and BankingDocument24 pagesCentral University of South Bihar: Assignment of Money and Bankingnirshan rajNo ratings yet

- Lecture No. 12 The Supply of MoneyDocument11 pagesLecture No. 12 The Supply of MoneyMilind SomanNo ratings yet

- Modern Measures of MoneyDocument6 pagesModern Measures of MoneyCrisly-Mae Ann AquinoNo ratings yet

- Money and Banking NotesDocument3 pagesMoney and Banking Noteslakshsjain198No ratings yet

- Unit 16 Equilibrium in Money Market: 16.0 ObjectivesDocument14 pagesUnit 16 Equilibrium in Money Market: 16.0 ObjectivesAjeet KumarNo ratings yet

- Chapter 5 The Creation of MoneyDocument25 pagesChapter 5 The Creation of MoneyReggie AlisNo ratings yet

- Central Bank and Its FunctionsDocument7 pagesCentral Bank and Its FunctionsayushNo ratings yet

- Money and BankingDocument17 pagesMoney and Bankingmuzzammil4422No ratings yet

- Money & Banking NotesDocument15 pagesMoney & Banking Noteslarissa nazarethNo ratings yet

- Functions of RBI and Conduct of Monetary Policy - Part 2 - Chakshoo Sir - 13-August-2023Document12 pagesFunctions of RBI and Conduct of Monetary Policy - Part 2 - Chakshoo Sir - 13-August-2023anupamsharma.srmsbsNo ratings yet

- SESSION-13 (REPORT) - Jessa LimpiadaDocument8 pagesSESSION-13 (REPORT) - Jessa LimpiadaJessaLimpiadaNo ratings yet

- Economy C2Document19 pagesEconomy C2gagankumarreddy213No ratings yet

- Money and BankingDocument13 pagesMoney and Bankingawadhkishorprasad20No ratings yet

- G7 Public Policy Principles For Retail CBDC FINALDocument27 pagesG7 Public Policy Principles For Retail CBDC FINALForkLogNo ratings yet

- Demand and Supply of MoneyDocument55 pagesDemand and Supply of MoneyMayurRawoolNo ratings yet

- (KTVM) Kinh Te VI Mo - Pham Xuan Truong - Chap 8 Money and Monetary PolicyDocument22 pages(KTVM) Kinh Te VI Mo - Pham Xuan Truong - Chap 8 Money and Monetary PolicyTHANH TẤN TRẦNNo ratings yet

- Final Hard Copy of Money and BankingDocument17 pagesFinal Hard Copy of Money and BankingMohammad Zahirul IslamNo ratings yet

- Remedial Imp. Questions.Document16 pagesRemedial Imp. Questions.Pradeep JoshiNo ratings yet

- Demand and Supply of MoneyDocument55 pagesDemand and Supply of MoneyKaran Desai100% (1)

- Money and Financial System NotesDocument44 pagesMoney and Financial System NotesPriya Sahu78% (9)

- Total Quantity of Money Available To The People at Any Point of The Time in The Economy Is Called Money SupplyDocument20 pagesTotal Quantity of Money Available To The People at Any Point of The Time in The Economy Is Called Money Supplyaaditya modiNo ratings yet

- The Supply of MoneyDocument12 pagesThe Supply of MoneyJoseph OkpaNo ratings yet

- RBI PublicationsDocument33 pagesRBI PublicationsJuned YaseerNo ratings yet

- Money Supply1Document23 pagesMoney Supply1kabba369No ratings yet

- Indian Monetary & Fiscal Policy: 1 Anant Saxena (Lecturer - Itm Universe)Document26 pagesIndian Monetary & Fiscal Policy: 1 Anant Saxena (Lecturer - Itm Universe)anant saxenaNo ratings yet

- Module 4 Monetary PolicyDocument29 pagesModule 4 Monetary Policyg.prasanna saiNo ratings yet

- 10a - Raj Kamlesh MehtaDocument15 pages10a - Raj Kamlesh MehtaRaj MehtaNo ratings yet

- Monetry Policy Eco 5Document71 pagesMonetry Policy Eco 5priyanshu.ryp01No ratings yet

- Weak Student Material - MacroDocument14 pagesWeak Student Material - MacroP Janaki RamanNo ratings yet

- DigitalPaymentBook PDFDocument76 pagesDigitalPaymentBook PDFShachi RaiNo ratings yet

- Assessment 2 - Lesson Plan PPDocument24 pagesAssessment 2 - Lesson Plan PPZaria TariqNo ratings yet

- Quantitative EasingDocument11 pagesQuantitative EasingqttienphongNo ratings yet

- B&I - 2017 AnswersDocument7 pagesB&I - 2017 AnswersGain GainNo ratings yet

- Subject EconomicsDocument12 pagesSubject Economicsamitava deyNo ratings yet

- Money and BankingDocument8 pagesMoney and Bankingsaumyasingh1289No ratings yet

- Chapter 8 Unit 2 - UnlockedDocument23 pagesChapter 8 Unit 2 - UnlockedSanay ShahNo ratings yet

- What Is The Most Important Thing in Your Life ?: What Are We Aspiring For ?Document58 pagesWhat Is The Most Important Thing in Your Life ?: What Are We Aspiring For ?Shambhawi SinhaNo ratings yet

- Bank Fundamentals: An Introduction to the World of Finance and BankingFrom EverandBank Fundamentals: An Introduction to the World of Finance and BankingRating: 4.5 out of 5 stars4.5/5 (4)

- Next Steps for ASEAN+3 Central Securities Depository and Real-Time Gross Settlement Linkages: A Progress Report of the Cross-Border Settlement Infrastructure ForumFrom EverandNext Steps for ASEAN+3 Central Securities Depository and Real-Time Gross Settlement Linkages: A Progress Report of the Cross-Border Settlement Infrastructure ForumNo ratings yet

- Strengthening Fiscal Decentralization in Nepal’s Transition to FederalismFrom EverandStrengthening Fiscal Decentralization in Nepal’s Transition to FederalismNo ratings yet

- 74667bos60481 FND p4 cp5Document22 pages74667bos60481 FND p4 cp5anushkaprajput0525No ratings yet

- IPA QuesDocument10 pagesIPA Quesanushkaprajput0525No ratings yet

- SOGA QuesDocument6 pagesSOGA Quesanushkaprajput0525No ratings yet

- ICA QuesDocument9 pagesICA Quesanushkaprajput0525No ratings yet

- The Money Supply ProcessDocument48 pagesThe Money Supply ProcessAlejandroArnoldoFritzRuenesNo ratings yet

- Macroeconomics EC2065 CHAPTER 7 - BANKING, FINANCE, AND THE MONEY MARKETDocument44 pagesMacroeconomics EC2065 CHAPTER 7 - BANKING, FINANCE, AND THE MONEY MARKETkaylaNo ratings yet

- Credit Creation Economics For MbaDocument12 pagesCredit Creation Economics For Mbavinodgupta1960No ratings yet

- ECONTWO Exercise 2Document3 pagesECONTWO Exercise 2Alexandra YapNo ratings yet

- Bai Tap Chuong 12Document5 pagesBai Tap Chuong 12Phương Nghi LêNo ratings yet

- MCQs Chapter 9 - The Money Supply ProcessDocument45 pagesMCQs Chapter 9 - The Money Supply ProcessDinh NguyenNo ratings yet

- Trial and ErrorDocument34 pagesTrial and ErrorZerohedge100% (1)

- CS - GMN - 22 - Collateral Supply and Overnight RatesDocument49 pagesCS - GMN - 22 - Collateral Supply and Overnight Rateswmthomson50% (2)

- ch14 - Baye and JansenDocument24 pagesch14 - Baye and JansenaryanandaeNo ratings yet

- Managing in A Global Economy Demystifying International Macroeconomics 2nd Edition Marthinsen Solutions ManualDocument9 pagesManaging in A Global Economy Demystifying International Macroeconomics 2nd Edition Marthinsen Solutions Manualreumetampoeqnb100% (36)

- The Money Supply and Money MultiplierDocument22 pagesThe Money Supply and Money MultiplierNandiniNo ratings yet

- Tutorial 8Document3 pagesTutorial 8malak aymanNo ratings yet

- Fisher and Wicksell On The Quantity Theory: Thomas M. HumphreyDocument20 pagesFisher and Wicksell On The Quantity Theory: Thomas M. HumphreyLovelesh AgarwalNo ratings yet

- Financial System & BSPDocument46 pagesFinancial System & BSPZenedel De JesusNo ratings yet

- Modern Money Mechanics: A Workbook On Bank Reserves and Deposit ExpansionDocument14 pagesModern Money Mechanics: A Workbook On Bank Reserves and Deposit Expansionjethro gibbins100% (2)

- Tche 303 - Money and Banking Tutorial Assignment 6Document3 pagesTche 303 - Money and Banking Tutorial Assignment 6Tường ThuậtNo ratings yet

- Modern Money MechanicsDocument50 pagesModern Money MechanicsKonrad98% (45)

- Chapter 15 - 3eDocument42 pagesChapter 15 - 3eDJ HoltNo ratings yet

- BankingDocument68 pagesBankingK59 Nguyen Thi Thu HaNo ratings yet

- Grants Interest Rate Observer Summer E IssueDocument24 pagesGrants Interest Rate Observer Summer E IssueCanadianValueNo ratings yet

- Coursenotes BFB4133-090212 102219Document101 pagesCoursenotes BFB4133-090212 102219Makisha NishaNo ratings yet

- Tutorial 5 - Monetary SystemDocument8 pagesTutorial 5 - Monetary SystemQuy Nguyen QuangNo ratings yet

- CH 18 Financial RegulationDocument7 pagesCH 18 Financial RegulationAd QasimNo ratings yet

- W7 Module 008 Determinants of The Money SupplyDocument9 pagesW7 Module 008 Determinants of The Money SupplyJustin GutierrezNo ratings yet

- 7.2credit Creation & MBDocument49 pages7.2credit Creation & MBJacquelyn ChungNo ratings yet

- BCG Matrix ModelDocument5 pagesBCG Matrix ModelMuniji KumarNo ratings yet

- Money Creation and The Banking SystemDocument14 pagesMoney Creation and The Banking SystemminichelNo ratings yet