Professional Documents

Culture Documents

Harvey E Schlesinger Financial Disclosure Report For 2010

Harvey E Schlesinger Financial Disclosure Report For 2010

Uploaded by

Judicial Watch, Inc.Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Harvey E Schlesinger Financial Disclosure Report For 2010

Harvey E Schlesinger Financial Disclosure Report For 2010

Uploaded by

Judicial Watch, Inc.Copyright:

Available Formats

AO I0 Rev.

1/2011

FINANCIAL DISCLOSURE REPORT FOR CALENDAR YEAR 2010

2. Court or Organization Middle District of Florida

5n. Report Type (check appropriate type) ] Nomination,

[] Initial

Report Required by the Ethics in Go vernment Act of 1978 (5 U.S.C. app..~.~" 101-111)

I. Person Reporting (last name, first, middle initial) Schlesinger, Harvey E. 4. Title (Article III judges indicate active or senior status; magistrate judges indicate full- or part-time)

3. Date of Report 05/02/2011

6. Reporting Period 01/01/2010 to 12/31/2010

Date

[] Annual [] Final

Senior US District Judge

5b. [] Amended Report

7. Chambers or Office Address I 1-150 US Courthouse 300 N Hogan Street Jacksonville, Florida 32202-4246

8. Off the basis of the information contained in this Report and any modifications pertaining thereto, it is, in my opinion, in compliance with applicable laws and regulations.

Reviewing Officer

Date

IMPORTANT NOTES: The instructions accompanying this form must be followed Complete all parts,

checking the NONE box for each part where you have no reportable information. Sign on last page.

I. POS ITI ONS. tRepo.fng individual only; see pp. 9-13 of fillng instructions.)

~] NONE (No reportable positions.) POSITION

1. 2. 3. Trustee Can 5 TrusteeCan 5 Trustee Can 5

NAME OF ORGANIZATION/ENTITY River Garden Hebrew Home for the Aged and River Garden Holding Co The Community Foundation Middle District of Florida Historical Society

II. AGREEMENTS. mepom,# i, divldual o,ly; s,, ~. 14-16 of fillng instructionx)

[-~ NONE (No reportable agreements.)

DATE

PARTIES AND TERMS

Schesin_qer, Harvev E.

FINANCIAL DISCLOSURE REPORT Page 2 of 8

Name of Person Reporting Schlesinger, Harvey E.

Date of Report 05/02/2011

Ill. NON-INVESTMENT INCOME. tR,por, ng indi,idual ond~pouse: see pp. 17-24 of filing instructions.)

A. Filers Non-Investment Income

~]

NONE (No reportable non-investment income.)

DATE

SOURCE AND TYPE

INCOME (yours, not spouses)

2. 3. 4.

B. Spouses Non-Investment Income - if you were married during any portion of the reporting year, complete this section~

(Dollar amount not required except for honoraria.)

NONE (No reportable non-investment income.)

DATE

I. 2. 3. 4.

SOURCE AND TYPE

IV. REIMBURSEMENTS --transportation, Iodglng, food, entertainmen~

(Includes those to spouse and dependent children; see pp. 25-27 of filing instructions.)

NONE (No reportable reimbursements.)

SOURCE

National Employment Lawyers Assoc.

DATES Sept 10-11

LOCATION St Petersburg, FI

PURPOSE

ITEMS PAID OR PROVIDED

car mileage, lodging, meals

Speaker at seminar

3. 4. 5.

FINANCIAL DISCLOSURE REPORT Page 3 of 8

Name of Person Reporting Schlesinger, Harvey E.

Dale of Report

05/02/2011

V. GIFTS. and.de. :ho.e ,o spo.se ..d depe.den, children; see pp. 28-31 of filing instructions.)

NONE (No reportable gifts.) SOURCE DESCRIPTION VALUE

VI. LIABILITIES. ancl, des ,hose olspo,se .nd devend, nt c~ildren; see pv. 32-33 of filing instructlon.t) NONE (No reportable liabilities.) CREDITOR

1. 2. 3. 4. 5.

DESCRIPTION

VALUECODE

FINANCIAL DISCLOSURE REPORT Page 4 of 8

Name of Person Reporting Schlesinger, Harvey E.

Date of Repor~ 05/02/201 I

NONE (No reportable income, assets, or transactions.)

A. Description of Assets (including trust assets) Place "(X)" after each asset exempt from prior disclosure B. Income during reporting period (I) (2) i Amount Type (e.g., Code l div., rent, (A-tl) or int.)

Gross value at end of reporting period (i) (2) Value Value Code 2 Method

(J-P) Code 3

D. Transactions during reporting period

(I) Type (e.g., buy, sell, redemption)

{2) (3) (4) Date Value Gain mm/ddh~, Code 2 Code I (J-P) (A-H)

(Q-W) I. 2. 3. CSX JP Morgan Chase Wells Fargo Money Market Assets (change name from Wachovia) A A B A D C C C C A A A A A A A A Dividend Dividend Dividend Interest Interest Dividend Dividend Dividend Dividend Dividend Dividend Dividend Dividend Dividend Dividend Dividend Dividend J J J J O K K K K J J J J J J J K T T T T

T T T T T T T T T T T

(5) Identity of buyer/seller (if private transaction)

: 4. Jax Fed CU 5. 6. 7. 8. 9. 10. I1. 12. 13. 14. 15. Fifth Third Bank Eaton Vance Income Mgt Natl Muni Income Fund (exchange from Eaton Vance FI Muni) Invesco Van Kampen Trust Muni(name change from Van Kampen Eq I Shares Dow Jones Harley Davidson Home Depot Vodaphone Walt Disney Holding Intel Marriott Int"l

09/21/10 06/01/10

16. St Joe

T T

17.

NuveenMuni Fund

I. Income Gain Codes: (5c Columns BI and D4) 2. Value Codes (See Columns CI and D3) 3. Value Method Codes (See Column C2)

A =$1.000 or less F =$50,001 - $100,000 J -$15.O00 or less N $250.001 - $ 500.0(~0 P3 =$25.000.001 - $50.000,000 Q -Appraisal U B~k Value

B =$1.001 - $2.500 G =$100.091 - $1,0~0,000 K =$15,0OI - $50.000 O =S500.001 R =Cost (Real Estate Only) V =Otho"

C =$2.501 - $5.000 I I I =$ 1,0~0.001 - $5,000,000 L =$50.001 - $100.000 PI =$1.000.001 - $5.000.000 P4 =Mo~e than $50.000.000 S =Asscssm~l W =Es~imalcd

D =$5.001 - $15.000 112 =More than $5.000.00~ M =$100.001 . $250.000 P2 =$5.000.001 . $25.000.000 T =Cash Market

E =$ 15,001 - $50.000

FINANCIAL DISCLOSURE REPORT Page 5 of 8

Name of Person Reporting Schlesinger, Harvey E.

Date of Report 05/02/201 I

VII. INVESTMENTS and TRUSTS -i.co.~e, val~e, ,.o.~o.lo,~ ~tncludcs those of spouse and dependent children; see plx 34-60 of filing instruction~)

NONE (No reportable income, assets, or transactions,)

Description of Assets (including trust asset~) Place "(X)" after each asset exempt from prior disclosure Income during reporting period (i) (2) I Amount Type (e.g., div., rent, i Code 1 (A-tl) or int.) Gross value at end of reporting period (i) (2)

Value Value

Transactions during reporting period

(I) Type (e.g., buy, sell, redemption) (2) (3) (4) Dale Value mm/dd~, Code 2 (J-P) (5) Identity of buyer/seller (if private transaction)

Code 2

(J-P)

Method

Code 3

Gain Code I (A-H)

(Q-W) 18. GE 19. Ford Motor 20. 21. 22. 23. Cisco Systems Prudential Financial Tampa Florida Waste Broward County Airport WellsFargo Bank Swaps A A A A A A B Dividend Dividend Dividend Dividend Dividend Interest Interest J K T T Sold (pan) Sold (part) Eaton Vance Prime Rate Franklin NY Tax Free Nuveen Insd NY Muni Rochester Muni Fund The Jacksonville Bank Florida Cap Bank Citadel Broadcasting Ameris Bank Region Bank A C C D A B A D A Dividend Dividend Dividend Dividend Interest Interest Dividend Interest Interest J K K M M M J N J T T T T

T T T T T

J J J J T T Matured I0/01/10 J A public

24. 25. 26. 27. 28. 29. 30. 31. 32. 33. 34.

12/30/10 03/24/10

J J

A public A public

106/28/l 0

Bankrupt

! 1 I/11/10 J

Closed Account

I. Income Gain Codes: (Sc Columns BI and IM) 2. Value Codes (See Col.amas CI and 3. Value Method Codes (See Column C2)

=$1.000 or less =$50,001 - $100.000 J =$15.000 o,r less =$250.001 - $500.000 P3 =$25.000.001 - $50.000.000 =Appraisal =Book Value

B =$1.001 - $2.500 G =$100.001 - $1.000.000 K =$15.001 - $50.00~ O =$500.001 R =cost (Rcal Estate Only) V =Other

C =$2.501 - $5,000 I11 =$1,000,001 - $5.000.000 L =$50.001 . $100.000 P4 =More than $50,000.000

D =$5.001 - $15,000 112 =M~e than $5,0(~.000 M =5100.001 . $250.000 P2 =$5.000.001 - $25,000.000 T =Cash Market

E =$15,001- $50,000

W =Estimated

FINANCIAL DISCLOSURE REPORT Page 6 of 8 VII. IN V ESTMENTS and T RU STS -i ....

Name of Person Reporting Schlesinger, Harvey E.

Date of Report 05/02/2011

e. value, transactions (Includes those of spouse and dependent children: see pp. 34-60 of filing instructions.)

NONE (No reportable income, assets, or transactions.)

A. Description of Assets (including trust assets) Place "(X)" after each asset exempt from prior disclosure B. Income during reporting period (I) Amount I Code l (A-II) i 35. Hancock Bank (2) Type (e.g., div., rent, or int.) C. Gross value at end of rrponing period (I) (2) Value Value Method Code 2 (J-P) Code 3 (Q-W) D. Transactions during relx)rling period (I) Type (e.g., buy, sell, redemption) (2) (3) (4) Date Value Gain mm/dd/yy Code 2 Code I (J-P) (A-H)

Identity of buyer.tseller (if private transaction)

D A A A

Interest Dividend Dividend Dividend

O J J J

T T T T Buy Buy Buy

06/24/10 05/21/10 07/01/10 J J

Closed Accounts Public Public Public

36. Suncor

37. First American Tax Free

38. 39.

Thomburg Ltd Muni Fund

07/01/10 J

I. Income Gain Codes: (5 Columns BI and D4) 2. Value Codc~ (See Columns CI and D3) 3. Value Method Codes (S~e Column C2)

A =$1,000 or less F =$50.001 - $100.000 J =$15.000 or Ices N =$250.0~1 - $500.000 P3 =$25.000.001 - $50.000.090 Q =Appraisal U -Book Value

B -$1,001 - $2.500 G =$100.0~1 - $1.000,000 K ~$15.001 - $50.0~) O =$50~.001 - $1.0~<).0~0 R =Cosl (Real Estalc Only) V =Olher

C =$2.501 - $5.0~) III =$1.000.0~1 - $5.000.0~0 L =$50.001 - $100.000 PI =$1.000.001 - $5.000.000 P4 =Mo~e than $50.00~.0~0 S =Assessment W =Estimated

D =$5.001 - $15,000 112 =More Ihan $5.000,000 M =$100.001 . $250.000 P2 =$5.0~0.001 . $25.00~.000 T =Cash Markcl

E =$15,001 - $50.0~)

FINANCIAL DISCLOSURE REPORT Page 7 of 8

Name of Person Reporting Schlesinger, Harvey E.

Date of Report 05/02/201 I

VIII. ADDITIONAL INFORMATION OR EXPLANATIONS. (indicate part of repor~)

FINANCIAL DISCLOSURE REPORT Page 8 of 8 IX. CERTIFICATION.

Name of Person Reporting Schlesinger, Harvey E.

Date of Report 05/02/2011

1 certify that all information given above (including information pertaining to my spouse and minor or dependent children, if any) is accurate, true, and complete to the best of my knowledge and belief, and that any information not reported was withheld because it met applicable statutory provisions permitting non-disclosure. I further certify that earned income from outside employment and honoraria and the acceptance of gifts which have been reported are in compliance with the provisions of 5 U.S.C. app. 501 et. seq, 5 U.S.C. 7353, and Judicial Conference regulations.

Signature: S/Harvey E. Schlesinger

NOTE: ANY INDIVIDUAL WHO KNOWINGLY AND WILFULLY FALSIFIES OR FALLS TO FILE THIS REPORT MAY BE SUBJECT TO CIVIL AND CRIMINAL SANCTIONS (5 U.S.C. app. 104)

Committee on Financial Disclosure Administrative Office of the United States Courts Suite 2-301 One Columbus Circle, N.E. Washington, D.C. 20544

You might also like

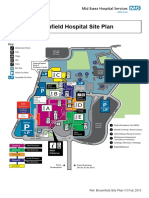

- Broomfield Hospital Site Plan: Café Shops Lifts Information PointsDocument1 pageBroomfield Hospital Site Plan: Café Shops Lifts Information Pointsady trader0% (2)

- Sample Scoping ReportDocument92 pagesSample Scoping ReportEm Mar0% (1)

- Clinical Establishment ActDocument44 pagesClinical Establishment ActNeelesh Bhandari100% (1)

- 2161 DocsDocument133 pages2161 DocsJudicial Watch, Inc.83% (12)

- 1878 001Document17 pages1878 001Judicial Watch, Inc.100% (5)

- ISM CPSM Exam-SpecificationsDocument7 pagesISM CPSM Exam-SpecificationsmsajanjNo ratings yet

- Tesla Motors Expansion StrategyDocument26 pagesTesla Motors Expansion StrategyVu Nguyen75% (4)

- William D Stiehl Financial Disclosure Report For 2010Document16 pagesWilliam D Stiehl Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- John Antoon Financial Disclosure Report For 2010Document8 pagesJohn Antoon Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- George Z Singal Financial Disclosure Report For 2010Document10 pagesGeorge Z Singal Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Robert L Hinkle Financial Disclosure Report For 2010Document8 pagesRobert L Hinkle Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Richard G Seeborg Financial Disclosure Report For 2010Document10 pagesRichard G Seeborg Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Richard Owen Financial Disclosure Report For 2010Document8 pagesRichard Owen Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Leonard I Garth Financial Disclosure Report For 2010Document8 pagesLeonard I Garth Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Procter R Hug JR Financial Disclosure Report For 2010Document8 pagesProcter R Hug JR Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Marsha J Pechman Financial Disclosure Report For 2010Document8 pagesMarsha J Pechman Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Nina Gershon Financial Disclosure Report For 2010Document16 pagesNina Gershon Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Robert L Jordan Financial Disclosure Report For 2010Document11 pagesRobert L Jordan Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Donald E Walter Financial Disclosure Report For 2010Document16 pagesDonald E Walter Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- James E Gritzner Financial Disclosure Report For 2010Document10 pagesJames E Gritzner Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Marcia M Howard Financial Disclosure Report For 2010Document9 pagesMarcia M Howard Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Roger Vinson Financial Disclosure Report For 2010Document20 pagesRoger Vinson Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- John A Woodcock JR Financial Disclosure Report For 2010Document12 pagesJohn A Woodcock JR Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Roslyn O Silver Financial Disclosure Report For 2010Document7 pagesRoslyn O Silver Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- H J Wilkinson III Financial Disclosure Report For 2010Document10 pagesH J Wilkinson III Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Morris S Arnold Financial Disclosure Report For 2010Document10 pagesMorris S Arnold Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Virginia E Hopkins Financial Disclosure Report For 2010Document16 pagesVirginia E Hopkins Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Dennis F Saylor IV Financial Disclosure Report For 2010Document9 pagesDennis F Saylor IV Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Richard J Holwell Financial Disclosure Report For 2010Document9 pagesRichard J Holwell Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- John A Houston Financial Disclosure Report For 2010Document7 pagesJohn A Houston Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- James P Jones Financial Disclosure Report For 2010Document13 pagesJames P Jones Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Marilyn L Huff Financial Disclosure Report For 2010Document14 pagesMarilyn L Huff Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Richard L Voorhees Financial Disclosure Report For 2010Document8 pagesRichard L Voorhees Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- William F Nielson Financial Disclosure Report For 2010Document13 pagesWilliam F Nielson Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Ellen B Burns Financial Disclosure Report For 2010Document18 pagesEllen B Burns Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- William C Bryson Financial Disclosure Report For 2010Document8 pagesWilliam C Bryson Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Robert P Patterson JR Financial Disclosure Report For 2010Document9 pagesRobert P Patterson JR Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Loretta A Preska Financial Disclosure Report For 2010Document14 pagesLoretta A Preska Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- James Knoll Gardner Financial Disclosure Report For 2010Document11 pagesJames Knoll Gardner Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Thad Heartfield Financial Disclosure Report For 2010Document18 pagesThad Heartfield Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- John L Coffey Financial Disclosure Report For 2010Document9 pagesJohn L Coffey Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Mark S Davis Financial Disclosure Report For 2010Document16 pagesMark S Davis Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Richard A Posner Financial Disclosure Report For 2010Document10 pagesRichard A Posner Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Raymond W Gruender Financial Disclosure Report For 2010Document8 pagesRaymond W Gruender Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Irma E Gonzalez Financial Disclosure Report For 2010Document8 pagesIrma E Gonzalez Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Henry R Wilhoit Financial Disclosure Report For 2010Document8 pagesHenry R Wilhoit Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Steven J McAuliffe Financial Disclosure Report For 2010Document15 pagesSteven J McAuliffe Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Joseph A Greenaway JR Financial Disclosure Report For 2010Document7 pagesJoseph A Greenaway JR Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- James B Loken Financial Disclosure Report For 2010Document10 pagesJames B Loken Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Simeon T Lake Financial Disclosure Report For 2010Document9 pagesSimeon T Lake Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Harris L Hartz Financial Disclosure Report For 2010Document10 pagesHarris L Hartz Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- William L Garwood Financial Disclosure Report For 2010Document15 pagesWilliam L Garwood Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Richard M Gergel Financial Disclosure Report For Gergel, Richard MDocument16 pagesRichard M Gergel Financial Disclosure Report For Gergel, Richard MJudicial Watch, Inc.No ratings yet

- JR Ewing Werlein Financial Disclosure Report For 2010Document20 pagesJR Ewing Werlein Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Deborah K Chasanow Financial Disclosure Report For 2010Document20 pagesDeborah K Chasanow Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Lynn S Adelman Financial Disclosure Report For 2010Document9 pagesLynn S Adelman Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Robert G Doumar Financial Disclosure Report For 2010Document19 pagesRobert G Doumar Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Stanley R Chesler Financial Disclosure Report For 2010Document9 pagesStanley R Chesler Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Robert R Beezer Financial Disclosure Report For 2010Document9 pagesRobert R Beezer Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Lawrence H Silberman Financial Disclosure Report For 2010Document7 pagesLawrence H Silberman Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Harold R DeMoss JR Financial Disclosure Report For 2010Document9 pagesHarold R DeMoss JR Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Lynn N Hughes Financial Disclosure Report For 2010Document10 pagesLynn N Hughes Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- James A Teilborg Financial Disclosure Report For 2010Document12 pagesJames A Teilborg Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Frank H Seay Financial Disclosure Report For 2010Document25 pagesFrank H Seay Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- John H McBryde Financial Disclosure Report For 2010Document9 pagesJohn H McBryde Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Unloved Bull Markets: Getting Rich the Easy Way by Riding Bull MarketsFrom EverandUnloved Bull Markets: Getting Rich the Easy Way by Riding Bull MarketsNo ratings yet

- CC 081213 Dept 14 Lapp LDocument38 pagesCC 081213 Dept 14 Lapp LJudicial Watch, Inc.No ratings yet

- 1488 09032013Document262 pages1488 09032013Judicial Watch, Inc.100% (1)

- 11 1271 1451347Document29 pages11 1271 1451347david_stephens_29No ratings yet

- State Dept 13-951Document4 pagesState Dept 13-951Judicial Watch, Inc.No ratings yet

- Stamped ComplaintDocument4 pagesStamped ComplaintJudicial Watch, Inc.No ratings yet

- Stamped Complaint 2Document5 pagesStamped Complaint 2Judicial Watch, Inc.No ratings yet

- Gitmo Freezer Inspection ReportsDocument4 pagesGitmo Freezer Inspection ReportsJudicial Watch, Inc.No ratings yet

- SouthCom Water Safety ProductionDocument30 pagesSouthCom Water Safety ProductionJudicial Watch, Inc.No ratings yet

- JTF GTMO Water Safety App W ExhDocument13 pagesJTF GTMO Water Safety App W ExhJudicial Watch, Inc.No ratings yet

- CVR LTR SouthCom Water Safety ProductionDocument2 pagesCVR LTR SouthCom Water Safety ProductionJudicial Watch, Inc.No ratings yet

- Gitmo Freezer Inspection ReportsDocument4 pagesGitmo Freezer Inspection ReportsJudicial Watch, Inc.No ratings yet

- December 2005 Bulletin 2Document14 pagesDecember 2005 Bulletin 2Judicial Watch, Inc.No ratings yet

- Cover Letter To Requester Re Response Documents130715 - 305994Document2 pagesCover Letter To Requester Re Response Documents130715 - 305994Judicial Watch, Inc.No ratings yet

- Model UNDocument2 pagesModel UNJudicial Watch, Inc.No ratings yet

- July 2007 BulletinDocument23 pagesJuly 2007 BulletinJudicial Watch, Inc.No ratings yet

- 13-1150 Responsive Records 2 - RedactedDocument29 pages13-1150 Responsive Records 2 - RedactedJudicial Watch, Inc.No ratings yet

- December 2005Document7 pagesDecember 2005Judicial Watch, Inc.No ratings yet

- June 2004Document17 pagesJune 2004Judicial Watch, Inc.No ratings yet

- July 2006Document24 pagesJuly 2006Judicial Watch, Inc.No ratings yet

- 13-1150 Response Re Judicial WatchDocument1 page13-1150 Response Re Judicial WatchJudicial Watch, Inc.No ratings yet

- September 2004Document24 pagesSeptember 2004Judicial Watch, Inc.No ratings yet

- LAUSD Semillas AckDocument1 pageLAUSD Semillas AckJudicial Watch, Inc.No ratings yet

- STAMPED ComplaintDocument4 pagesSTAMPED ComplaintJudicial Watch, Inc.No ratings yet

- Atlanta IntraregionalDocument4 pagesAtlanta IntraregionalJudicial Watch, Inc.No ratings yet

- Historical Background of LubricantsDocument21 pagesHistorical Background of LubricantsDinesh babuNo ratings yet

- Atalla A10160Document4 pagesAtalla A10160FERNANDO JOSE GARCIA FIGUEROANo ratings yet

- Research & Innovation: The EuDocument42 pagesResearch & Innovation: The EurubenpeNo ratings yet

- Controller Job DescriptionDocument1 pageController Job Descriptionmarco thompson100% (2)

- Defiant RPG - GM Guide (Electronic Version) XDocument9 pagesDefiant RPG - GM Guide (Electronic Version) XXosé Lois PérezNo ratings yet

- Bridget Wisnewski ResumeDocument2 pagesBridget Wisnewski Resumeapi-425692010No ratings yet

- BSBCMM511 Simulation PackDocument4 pagesBSBCMM511 Simulation PackmiraNo ratings yet

- Establishing An FFSDocument2 pagesEstablishing An FFSAndrew George ADEMNo ratings yet

- Associated Labor Union v. BorromeoDocument2 pagesAssociated Labor Union v. BorromeoJaneen ZamudioNo ratings yet

- Blue Distinction Specialty Care Program Implementation UpdateDocument2 pagesBlue Distinction Specialty Care Program Implementation Updaterushi810No ratings yet

- Final Report: Simulation Using Star CCM+ Theory and Practice in Marine CFD BenaoeDocument10 pagesFinal Report: Simulation Using Star CCM+ Theory and Practice in Marine CFD BenaoeRaviindra singhNo ratings yet

- Chapter Add On 1Document18 pagesChapter Add On 1Escada BebeyNo ratings yet

- Sunken SlabDocument2 pagesSunken SlabAlexLionNo ratings yet

- Bpacr FinalDocument7 pagesBpacr FinalNivedita CharanNo ratings yet

- Edwin Maturino - Benchmark Reviving The Professional CultureDocument9 pagesEdwin Maturino - Benchmark Reviving The Professional Cultureapi-693631580No ratings yet

- Lesson-2-Climate IiDocument30 pagesLesson-2-Climate IiErica NatividadNo ratings yet

- Experiment No. 2: Aim: A) D Flip-Flop: Synchronous VHDL CodeDocument6 pagesExperiment No. 2: Aim: A) D Flip-Flop: Synchronous VHDL CodeRahul MishraNo ratings yet

- BOOK NEWS: Fire On The Water: China, America, and The Future of The PacificDocument2 pagesBOOK NEWS: Fire On The Water: China, America, and The Future of The PacificNaval Institute PressNo ratings yet

- Mass, Volume, and Density: Goals Shape Formula Symbols Table 2.1Document5 pagesMass, Volume, and Density: Goals Shape Formula Symbols Table 2.1SandyNo ratings yet

- Bus TicketDocument3 pagesBus Ticketk57hzsrnckNo ratings yet

- Lesson Handouts ARGDocument26 pagesLesson Handouts ARGsamantha sisonNo ratings yet

- Cisco GGSNDocument386 pagesCisco GGSNtrunto0% (1)

- FMCG Organisation Chart: Board of DirectorsDocument1 pageFMCG Organisation Chart: Board of DirectorsKumar Panchal0% (1)

- Construct The Relational Model of The Following Scenario. (6 MARKS) System DescriptionDocument2 pagesConstruct The Relational Model of The Following Scenario. (6 MARKS) System DescriptionBushra ShahzadNo ratings yet

- Course Registration SystemDocument11 pagesCourse Registration Systemananthprasad91100% (3)