Professional Documents

Culture Documents

Robert L Vining JR Financial Disclosure Report For 2010

Robert L Vining JR Financial Disclosure Report For 2010

Uploaded by

Judicial Watch, Inc.Copyright:

Available Formats

You might also like

- Electricity Bill July 2023Document2 pagesElectricity Bill July 2023Eric Cartman100% (2)

- Receipt: Transfer OverviewDocument3 pagesReceipt: Transfer Overviewdargo75% (4)

- 2022 Navy Federal Credit Union Open Up Method?? ?Document23 pages2022 Navy Federal Credit Union Open Up Method?? ?Anthony Bobbsemple82% (22)

- 2161 DocsDocument133 pages2161 DocsJudicial Watch, Inc.83% (12)

- 1878 001Document17 pages1878 001Judicial Watch, Inc.100% (5)

- Template For Accounting ManualDocument4 pagesTemplate For Accounting ManualKent TacsagonNo ratings yet

- Steven J McAuliffe Financial Disclosure Report For 2010Document15 pagesSteven J McAuliffe Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Samuel Conti Financial Disclosure Report For 2010Document7 pagesSamuel Conti Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Walter T McGovern Financial Disclosure Report For 2010Document7 pagesWalter T McGovern Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Rudi M Brewster Financial Disclosure Report For 2010Document7 pagesRudi M Brewster Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Procter R Hug JR Financial Disclosure Report For 2010Document8 pagesProcter R Hug JR Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Richard A Schell Financial Disclosure Report For 2010Document7 pagesRichard A Schell Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Phyllis A Kravitch Financial Disclosure Report For 2010Document8 pagesPhyllis A Kravitch Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Joseph A Greenaway JR Financial Disclosure Report For 2010Document7 pagesJoseph A Greenaway JR Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Tanya M Walton Pratt Financial Disclosure Report For Walton Pratt, Tanya MDocument7 pagesTanya M Walton Pratt Financial Disclosure Report For Walton Pratt, Tanya MJudicial Watch, Inc.No ratings yet

- Loretta A Preska Financial Disclosure Report For 2010Document14 pagesLoretta A Preska Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Kermit E Bye Financial Disclosure Report For 2006Document7 pagesKermit E Bye Financial Disclosure Report For 2006Judicial Watch, Inc.No ratings yet

- Claudia Wilken Financial Disclosure Report For 2010Document7 pagesClaudia Wilken Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Richard J Holwell Financial Disclosure Report For 2010Document9 pagesRichard J Holwell Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Morris S Arnold Financial Disclosure Report For 2010Document10 pagesMorris S Arnold Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Robert B Propst Financial Disclosure Report For 2010Document7 pagesRobert B Propst Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Callie V Granade Financial Disclosure Report For 2010Document24 pagesCallie V Granade Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Stanley R Chesler Financial Disclosure Report For 2010Document9 pagesStanley R Chesler Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- William D Stiehl Financial Disclosure Report For 2010Document16 pagesWilliam D Stiehl Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Robert L Jordan Financial Disclosure Report For 2010Document11 pagesRobert L Jordan Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Gregory K Frizzell Financial Disclosure Report For 2010Document7 pagesGregory K Frizzell Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Tucker L Melancon Financial Disclosure Report For 2010Document7 pagesTucker L Melancon Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Roger Vinson Financial Disclosure Report For 2010Document20 pagesRoger Vinson Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- William R Furgeson Financial Disclosure Report For 2010Document9 pagesWilliam R Furgeson Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Jackson L Kiser Financial Disclosure Report For 2010Document8 pagesJackson L Kiser Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Nina Gershon Financial Disclosure Report For 2010Document16 pagesNina Gershon Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Simeon T Lake Financial Disclosure Report For 2010Document9 pagesSimeon T Lake Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- William T Hart Financial Disclosure Report For 2010Document8 pagesWilliam T Hart Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Howard A Matz Financial Disclosure Report For 2010Document12 pagesHoward A Matz Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Bruce M Selya Financial Disclosure Report For 2010Document19 pagesBruce M Selya Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Stephen Anderson Financial Disclosure Report For 2010Document7 pagesStephen Anderson Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Robert S Lasnik Financial Disclosure Report For 2010Document7 pagesRobert S Lasnik Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Joseph E Irenas Financial Disclosure Report For 2010Document11 pagesJoseph E Irenas Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Frank H Seay Financial Disclosure Report For 2010Document25 pagesFrank H Seay Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- William C Bryson Financial Disclosure Report For 2010Document8 pagesWilliam C Bryson Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Daniel L Hovland Financial Disclosure Report For 2010Document7 pagesDaniel L Hovland Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Susan O Mollway Financial Disclosure Report For 2010Document7 pagesSusan O Mollway Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Clarence A Beam Financial Disclosure Report For 2010Document7 pagesClarence A Beam Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Robert R Beezer Financial Disclosure Report For 2010Document9 pagesRobert R Beezer Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Mark W Bennett Financial Disclosure Report For 2010Document15 pagesMark W Bennett Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- James E Gritzner Financial Disclosure Report For 2010Document10 pagesJames E Gritzner Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Rosemary S Pooler Financial Disclosure Report For 2010Document7 pagesRosemary S Pooler Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Harold R DeMoss JR Financial Disclosure Report For 2010Document9 pagesHarold R DeMoss JR Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- John R Smoak Financial Disclosure Report For 2010Document7 pagesJohn R Smoak Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Christopher C Conner Financial Disclosure Report For 2010Document14 pagesChristopher C Conner Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Leonard I Garth Financial Disclosure Report For 2010Document8 pagesLeonard I Garth Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Patrick J Duggan Financial Disclosure Report For 2009Document7 pagesPatrick J Duggan Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Robert P Patterson JR Financial Disclosure Report For 2010Document9 pagesRobert P Patterson JR Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Christina C Reiss Financial Disclosure Report For Reiss, Christina CDocument9 pagesChristina C Reiss Financial Disclosure Report For Reiss, Christina CJudicial Watch, Inc.No ratings yet

- Robert L Hinkle Financial Disclosure Report For 2010Document8 pagesRobert L Hinkle Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Deborah K Chasanow Financial Disclosure Report For 2010Document20 pagesDeborah K Chasanow Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- James C Cacheris Financial Disclosure Report For 2010Document7 pagesJames C Cacheris Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- William T Moore JR Financial Disclosure Report For 2010Document20 pagesWilliam T Moore JR Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Gerard E Lynch Financial Disclosure Report For 2010Document9 pagesGerard E Lynch Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Harvey E Schlesinger Financial Disclosure Report For 2010Document8 pagesHarvey E Schlesinger Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- David S Doty Financial Disclosure Report For 2010Document7 pagesDavid S Doty Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Stephen V Wilson Financial Disclosure Report For 2010Document14 pagesStephen V Wilson Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Richard L Nygaard Financial Disclosure Report For 2010Document7 pagesRichard L Nygaard Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Richard L Voorhees Financial Disclosure Report For 2010Document8 pagesRichard L Voorhees Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Paul J Barbadoro Financial Disclosure Report For 2010Document7 pagesPaul J Barbadoro Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- 1488 09032013Document262 pages1488 09032013Judicial Watch, Inc.100% (1)

- 11 1271 1451347Document29 pages11 1271 1451347david_stephens_29No ratings yet

- CC 081213 Dept 14 Lapp LDocument38 pagesCC 081213 Dept 14 Lapp LJudicial Watch, Inc.No ratings yet

- Stamped Complaint 2Document5 pagesStamped Complaint 2Judicial Watch, Inc.No ratings yet

- Stamped ComplaintDocument4 pagesStamped ComplaintJudicial Watch, Inc.No ratings yet

- SouthCom Water Safety ProductionDocument30 pagesSouthCom Water Safety ProductionJudicial Watch, Inc.No ratings yet

- Gitmo Freezer Inspection ReportsDocument4 pagesGitmo Freezer Inspection ReportsJudicial Watch, Inc.No ratings yet

- State Dept 13-951Document4 pagesState Dept 13-951Judicial Watch, Inc.No ratings yet

- Gitmo Freezer Inspection ReportsDocument4 pagesGitmo Freezer Inspection ReportsJudicial Watch, Inc.No ratings yet

- September 2004Document24 pagesSeptember 2004Judicial Watch, Inc.No ratings yet

- LAUSD Semillas AckDocument1 pageLAUSD Semillas AckJudicial Watch, Inc.No ratings yet

- Cover Letter To Requester Re Response Documents130715 - 305994Document2 pagesCover Letter To Requester Re Response Documents130715 - 305994Judicial Watch, Inc.No ratings yet

- July 2007 BulletinDocument23 pagesJuly 2007 BulletinJudicial Watch, Inc.No ratings yet

- CVR LTR SouthCom Water Safety ProductionDocument2 pagesCVR LTR SouthCom Water Safety ProductionJudicial Watch, Inc.No ratings yet

- JTF GTMO Water Safety App W ExhDocument13 pagesJTF GTMO Water Safety App W ExhJudicial Watch, Inc.No ratings yet

- June 2004Document17 pagesJune 2004Judicial Watch, Inc.No ratings yet

- December 2005Document7 pagesDecember 2005Judicial Watch, Inc.No ratings yet

- Model UNDocument2 pagesModel UNJudicial Watch, Inc.No ratings yet

- 13-1150 Response Re Judicial WatchDocument1 page13-1150 Response Re Judicial WatchJudicial Watch, Inc.No ratings yet

- July 2006Document24 pagesJuly 2006Judicial Watch, Inc.No ratings yet

- 13-1150 Responsive Records 2 - RedactedDocument29 pages13-1150 Responsive Records 2 - RedactedJudicial Watch, Inc.No ratings yet

- STAMPED ComplaintDocument4 pagesSTAMPED ComplaintJudicial Watch, Inc.No ratings yet

- December 2005 Bulletin 2Document14 pagesDecember 2005 Bulletin 2Judicial Watch, Inc.No ratings yet

- Atlanta IntraregionalDocument4 pagesAtlanta IntraregionalJudicial Watch, Inc.No ratings yet

- Agreement To Organize A BankDocument3 pagesAgreement To Organize A BankrotiliNo ratings yet

- Annex 41 Notes To FSDocument2 pagesAnnex 41 Notes To FSEdzel Espina PerezNo ratings yet

- Spouses Tan Vs China Banking CorpDocument6 pagesSpouses Tan Vs China Banking CorpmichelledugsNo ratings yet

- Nims Corrected Brief005!23!2019Document81 pagesNims Corrected Brief005!23!2019RussinatorNo ratings yet

- EF3e Int Filetest 2aDocument6 pagesEF3e Int Filetest 2aNuno Ribeiro100% (1)

- Digital Payments Driving Financial InclusionDocument73 pagesDigital Payments Driving Financial InclusionAyush NahakNo ratings yet

- The Burma Code Vol-6Document469 pagesThe Burma Code Vol-6kerrypwlNo ratings yet

- 03 Corp HY FactsheetDocument6 pages03 Corp HY FactsheetRoberto PerezNo ratings yet

- Role of Commodity Exchange in Agricultural GrowthDocument63 pagesRole of Commodity Exchange in Agricultural GrowthSoumyalin Santy50% (2)

- Edge Cities or Edge Suburbs?Document25 pagesEdge Cities or Edge Suburbs?Urbam RedNo ratings yet

- NEW REKENING KORAN ONLINE 454301034832532 2024-03-01 2024-03-31 00350349.pd 20240418 102419 0000Document2 pagesNEW REKENING KORAN ONLINE 454301034832532 2024-03-01 2024-03-31 00350349.pd 20240418 102419 0000murakatacreativeNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Rakshit KashyapNo ratings yet

- Wire TransferDocument1 pageWire TransferSteeh Vin-WealthNo ratings yet

- Wealth-X World 2014Document53 pagesWealth-X World 2014westelm12No ratings yet

- Arun y Kamath (2015)Document21 pagesArun y Kamath (2015)Leonardo VelizNo ratings yet

- Liam Law Vs Olympic Sawmill: Conditions For Escalation ClauseDocument2 pagesLiam Law Vs Olympic Sawmill: Conditions For Escalation ClauseblessaraynesNo ratings yet

- BF 130Document4 pagesBF 130Dixie CheeloNo ratings yet

- CTC VoucherDocument56 pagesCTC VoucherJames Hydoe ElanNo ratings yet

- Victor Hong Final Statement Submitted To UK Court, RBS Shareholder Rights LitigationDocument41 pagesVictor Hong Final Statement Submitted To UK Court, RBS Shareholder Rights LitigationFailure of Royal Bank of Scotland (RBS) Risk Management100% (2)

- Cosajay V MERS (RI 2013)Document11 pagesCosajay V MERS (RI 2013)Thom Lee ChapmanNo ratings yet

- Account Closure Request Form WellworthDocument1 pageAccount Closure Request Form WellworthHimanshuNo ratings yet

- Presentation For Computer ExhibitionDocument13 pagesPresentation For Computer ExhibitionBest VideosNo ratings yet

- Documents Used in Foreign TradeDocument85 pagesDocuments Used in Foreign TradeSanjeev PanditNo ratings yet

- Table of ContentsDocument10 pagesTable of ContentsUsman ManiNo ratings yet

- Manila Metal Container Corp. v. PNBDocument2 pagesManila Metal Container Corp. v. PNBElwell Mariano75% (4)

- The Nigerian Stock Exchange: 1st Tier SecuritiesDocument5 pagesThe Nigerian Stock Exchange: 1st Tier SecuritiesBawonda IsaiahNo ratings yet

Robert L Vining JR Financial Disclosure Report For 2010

Robert L Vining JR Financial Disclosure Report For 2010

Uploaded by

Judicial Watch, Inc.Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Robert L Vining JR Financial Disclosure Report For 2010

Robert L Vining JR Financial Disclosure Report For 2010

Uploaded by

Judicial Watch, Inc.Copyright:

Available Formats

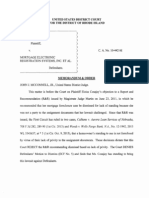

AO 10 Rev.

1/2011

FINANCIAL DISCLOSURE REPORT FOR CALENDAR YEAR 2010

2. Court or Organization U.S. District Court, NDGA

5a. Report Type (check appropriate type) ] Nomination, [] Initial Date [] Annual [] Final

Report Required by the Ethics in Go ~ernm en t Act of 1978 (5 U.S.C. app. 101-111)

I. Person Reporting (last name, first, middle initial) Vining,, Robert L. 4. Title (Article III judges indicate active or senior status; magistrate judges indicate full- or part-time) A~icle III- Senior Status

3. Date of Report 05/I 1/201 I 6. Reporting Period 01/01/2010 to 12/31/2010

5b. [] Amended Report

7. Chambers or Office Address 600 East First St., Room 345 Rome, GA 30161-3181

8.On the basis of the information contained in this Report and any modifications pertaining thereto, it is, in my opinion, in compliance with applicable laws and regulations.

Reviewing Officer

Date

IMPORTANT NOTES: The instructions accompanying this form must be followed. Complete all parts,

checking the NONE box for each part where you have no reportable information. Sign on last pag~

I. POSITIONS. ~ R,poni,g ~,,a~v~a.ot onty; ~ee pv. 9-t ~ of ~li,g instructions.)

~] NONE (No reportable positions.) POSITION NAME OF ORGANIZATION/ENTITY

2. 3. 4. 5.

II. AGREEMENTS. tRevo~.g i.ai.~d.ot o.ly: ~ee vp. 14-16 of filing instructions.)

~-] NONE (No reportable agreements.) DATE PARTIES AND TERMS

Vinin.q, Robert L.

FINANCIAL DISCLOSURE REPORT Page 2 of 7

Name of Person Reporting Vining,, Robert L.

Date of Report 05/! 1/701 I

111. NON-INVESTMENT INCOME. (~epor~.g individual a.dspoose; ~eepp, 17-24 of filing instruction~.)

A. Fliers Non-Investment Income

~]

NONE (No reportable non-investment income.)

DATE

SOURCE AND TYPE

INCOME

(yours, not spouses)

2. 3. 4.

B. Spouses Non-Investment Income - if you were married during any portion of the reporting year, complete this section.

(Dollar amount not required except for honoraria.)

~]

NONE (No reportable non-investment income.)

DATE SOURCE AND TYPE

I. 2. 3. 4.

IV. REIMBURSEMENTS - transportation, lodging, food, entertainmenL

(Includes those to spouse and dependent children; see pp. 25-27 of filing instructions.)

NONE (No reportable reimbursements.) SOURCE

1. 2. 3. 4. 5.

DATES

LOCATION

PURPOSE

ITEMS PAID OR PROVIDED

Name of Person Reporting

Date of Report 05/I 1/2011

PageFINANCIAL3 of 7 DISCLOSURE REPORT [ Vining,, Robert 1_

V. GIFTS. a.cludes ,hose ,o s~,ouso a.# #,pe~d~t children; see pp. 28-31 of filing instructions.) NONE (No reportable gifts.) SOURCE

I. 2. 3. 4.

DESCRIPTION

VALUE

5.

VI. LIABILITIES. a.cl.~es those oi,~,o~s~ a.# de,~.~.t chil~r~.; s~e ~,~ 32-33 of filing instructions.)

~--~

NONE (No reportable liabilities.)

CREDITOR

Dalton-Whitfield Bank Dalton, GA (Name changed from Premier National Bank of Dalton) Promissory Note

DESCRIPTION

VALUECODE

K

3. 4. 5.

FINANCIAL DISCLOSURE REPORT Page 4 of 7

Name of Person Reporting Vining,, Robert L.

Date of Report 05/11/201 I

VI I. INVESTMENTS and TRUSTS - income, value, ,~u,~a,lo~ anct~d,~ those of spouse and dependent children; see pp. 34-60 of filing instruction~.)

1~ NONE

(No reportable income, assets, or transactions.)

B. Income during reporting period [ (I) (2) Amount Type (e.g., Code I div., rent, (A-H) or int.)

A. Description of Assets (including trust assets) Place "(X)" after each asset exempt from prior disclosure

Gross value at end of reporting period (1) (2) Value Value Method Code 2

(J-P) Code 3

D. Transactions during reporting period (1) Type (e.g., buy, sell, redemption) (2) (3) (4) Date Value Gain mm/dd/yy Code 2 Code I (J-P) (A-H) (5) Identity of buyer/seller (if private transaction)

(Q-W) I. 2. 3. 4. 5. 6. 7. 8. 9. 10. I1. 12. 13. Coca Cola Co. Cohulta Banking Co. Chatsworth, GA Nuveen Tax-Exempt Trust Putnam Research Fund CI-A Wells Fargo Advisors Rental Property #1 Chatsworlh, GA(2002, 79,000) Rental Property #2 Chatsworth, GA (2002, 79,000) BAC CAP TRX I I PFD 6.875 Wachovia Bank N.A. Eaton Vance Insured Municipal Bond Fund Bank of America Corp. 5-15-23 Intemotes Citigroup Capital I x 6% Trust Preferred Secs (Trups) CitigrpCPTR 1 xTRUP6% C A A A A D D D A B C C B B A A A Dividend Interest Interest Dividend Interest Rent Rent Interest Interest Interest Interest Interest Interest Interest Dividend Dividend Dividend M K J K K L L L L K K K K K K J K T T T T T S S T T T T T T T T T T Sold 08/10 K A

14. Georgia PWR SR NTx 5.7% 15. 16. 17. Nuveen EQTY Premium Adv. Royal Bk Scotland Royal Bk Scotland

I. Income Gain Codes: (See Columns B I and D4) 2. Value Cod..s (See Columns CI and D3) 3. Value Method Codes {Scc Column C2)

A =$1,000 or less F =$50.001 - $ 100,000 J =$15.000 or less N =$250.001 - $500.000 P3 =$25.000.001 - $50.0~0.000 Q =Appraisal U =Book Value

B =$1,001 - $2.500 G =$ 100.001 - $ 1.000.000 K =$15,001 - $50.000 O =$500,001 . $1.000.000 R -~?ost (Real Estate Only) V =Other

C =$2.501 - $5,000 I I I =$ 1.000.001 - $5.0~0.000 L =$50,001 - $100.000 p I -$1,000.001 - $5.000.000 P4 =More than $50.0~0.000 S =Assessment W =Estimated

D =$5.001 - $15,000 112 =More than $5.000.000 M =$100.001 - $250.000 P2 $ 5.~00.001 - $25.000.lg)O T -~?ash Market

E $15,001 -$50.000

FINANCIAL DISCLOSURE REPORT Page 5 of 7

Name of Person Reporting Vining,, Robert L.

Date of Report 05/I 1/2011

VII. INVESTMENTS and TRUSTS - i.co,.,, rot.,. ,ro.soctio.~ (Includes those of spouse and dependent children; see pp. 34-60 of filing instrucdons.)

NONE (No reportable income, assets, or transactions.)

Description of Assets (including trust assets) Income during reporting I~riod Gross value at end Transactions during reporting period

of reporting period

(t)

Place "(X)" after each asset exempt from prior disclosure Amount

Code I (A-H)

(2)

Type (e.g.,

div., rent, or int.)

(I)

Value

Code 2 O-P)

(2)

Value

Method Code 3 Type (e.g., buy, sell, ~lemption)

(2) (3) (4) Date Value Gain mm]dd/yy Code 2 Code I (J-P) (A-H)

(5) Identity of buyer/seller (if private Wansaction)

18. 19. 20. 21. 22. 23. 24. 25. 26.

Barclay Spons ADR3 7.1% Wachovia Perp A 8% J General Life Ins. Co. Allianz SE 8.37% PFD Regions Fing Ill 8.875% Condo DaltonGA (X) Condo Dalton GA (X) Southern Co (X) Carroll City Cnty HSP AUTH GA REV ANTC CTF

B D A B B D A A A

Dividend Dividend Interest Dividend Interest Rent Rent Dividend Interest

J K J K J M L K K

T T T T T W W T T Buy

K 10/2 9/10

1. Income Gain Codes: (see Columns BI and [)4) 2. Value Codes (S~c Columns CI and D3) 3. Value Method Codes (See Cohlrrm C2)

A =$1,000 or less F =$50,001 - $100,000 J =$15.000 or Ic~ N =$250.001 - $500.000 P3 =$25.000.001 - $50.0~0.000 Q =Appraisal U =Book Value

B -$1.001 - $2.500 G =$100.001 - $1,000,000 K =$15.001 - $50.000 O =$.~00,001 - $1,000.000 R =Cost (Real Estalc O~ly) V -Other

C =$2.501 - $5.000 It I $1.000.001 - $5.000.000 L =$50.001 - $100.000 PI =SI.000.001 - $5,000.000 P4 =More lhan $50.000.000 S =Asscssm~mt W =Estimated

D =$5,001 - $15.000 112 =More than $5.000,000 M =$100.001 - $250.000 P2 =$5.000.001 - $25.000.000 T =Cash Markcl

E =$15.001 - $50.000

FINANCIAL DISCLOSURE REPORT Page 6 of 7

Name of Person Reporting Vining,, Robcrt L.

Date of Report 05/I 1/2011

VIII. ADDITIONAL INFORMATION OR EXPLANATIONS.

VII. INVESTMENTS and TRUSTS

FINANCIAL DISCLOSURE REPORT Page 7 of 7

IX. CERTIFICATION.

Name of Person Reporting Vining,, Robert L.

Date of Report 05/I 1/2011

! certify that all information given above (including information pertaining to my spouse and minor or dependent children, if any) is accurate, true, and complete to the best of my knowledge and belief, and that any information not reported was withheld because it met applicable statutory provisions permitting non-disclosure. I further certify that earned income from outside employment and honoraria and the acceptance of gifts which have been reported are in compliance with the provisions of 5 U.S.C. app. 501 et. seq., 5 U.S.C. 7353, and Judicial Conference regulations.

Signature: S[ Robert L. Vining,

NOTE: ANY INDIVIDUAL WHO KNOWINGLY AND WILFULLY FALSIFIES OR FAILS TO FILE THIS REPORT MAY BE SUBJECT TO CIVIL AND CRIMINAL SANCTIONS (5 U.S.C. app. 104)

Committee on Financial Disclosure Administrative Office of the United States Courts Suite 2-301 One Columbus Circle, N.E. Washington, D.C. 20544

You might also like

- Electricity Bill July 2023Document2 pagesElectricity Bill July 2023Eric Cartman100% (2)

- Receipt: Transfer OverviewDocument3 pagesReceipt: Transfer Overviewdargo75% (4)

- 2022 Navy Federal Credit Union Open Up Method?? ?Document23 pages2022 Navy Federal Credit Union Open Up Method?? ?Anthony Bobbsemple82% (22)

- 2161 DocsDocument133 pages2161 DocsJudicial Watch, Inc.83% (12)

- 1878 001Document17 pages1878 001Judicial Watch, Inc.100% (5)

- Template For Accounting ManualDocument4 pagesTemplate For Accounting ManualKent TacsagonNo ratings yet

- Steven J McAuliffe Financial Disclosure Report For 2010Document15 pagesSteven J McAuliffe Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Samuel Conti Financial Disclosure Report For 2010Document7 pagesSamuel Conti Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Walter T McGovern Financial Disclosure Report For 2010Document7 pagesWalter T McGovern Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Rudi M Brewster Financial Disclosure Report For 2010Document7 pagesRudi M Brewster Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Procter R Hug JR Financial Disclosure Report For 2010Document8 pagesProcter R Hug JR Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Richard A Schell Financial Disclosure Report For 2010Document7 pagesRichard A Schell Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Phyllis A Kravitch Financial Disclosure Report For 2010Document8 pagesPhyllis A Kravitch Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Joseph A Greenaway JR Financial Disclosure Report For 2010Document7 pagesJoseph A Greenaway JR Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Tanya M Walton Pratt Financial Disclosure Report For Walton Pratt, Tanya MDocument7 pagesTanya M Walton Pratt Financial Disclosure Report For Walton Pratt, Tanya MJudicial Watch, Inc.No ratings yet

- Loretta A Preska Financial Disclosure Report For 2010Document14 pagesLoretta A Preska Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Kermit E Bye Financial Disclosure Report For 2006Document7 pagesKermit E Bye Financial Disclosure Report For 2006Judicial Watch, Inc.No ratings yet

- Claudia Wilken Financial Disclosure Report For 2010Document7 pagesClaudia Wilken Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Richard J Holwell Financial Disclosure Report For 2010Document9 pagesRichard J Holwell Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Morris S Arnold Financial Disclosure Report For 2010Document10 pagesMorris S Arnold Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Robert B Propst Financial Disclosure Report For 2010Document7 pagesRobert B Propst Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Callie V Granade Financial Disclosure Report For 2010Document24 pagesCallie V Granade Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Stanley R Chesler Financial Disclosure Report For 2010Document9 pagesStanley R Chesler Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- William D Stiehl Financial Disclosure Report For 2010Document16 pagesWilliam D Stiehl Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Robert L Jordan Financial Disclosure Report For 2010Document11 pagesRobert L Jordan Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Gregory K Frizzell Financial Disclosure Report For 2010Document7 pagesGregory K Frizzell Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Tucker L Melancon Financial Disclosure Report For 2010Document7 pagesTucker L Melancon Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Roger Vinson Financial Disclosure Report For 2010Document20 pagesRoger Vinson Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- William R Furgeson Financial Disclosure Report For 2010Document9 pagesWilliam R Furgeson Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Jackson L Kiser Financial Disclosure Report For 2010Document8 pagesJackson L Kiser Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Nina Gershon Financial Disclosure Report For 2010Document16 pagesNina Gershon Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Simeon T Lake Financial Disclosure Report For 2010Document9 pagesSimeon T Lake Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- William T Hart Financial Disclosure Report For 2010Document8 pagesWilliam T Hart Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Howard A Matz Financial Disclosure Report For 2010Document12 pagesHoward A Matz Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Bruce M Selya Financial Disclosure Report For 2010Document19 pagesBruce M Selya Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Stephen Anderson Financial Disclosure Report For 2010Document7 pagesStephen Anderson Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Robert S Lasnik Financial Disclosure Report For 2010Document7 pagesRobert S Lasnik Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Joseph E Irenas Financial Disclosure Report For 2010Document11 pagesJoseph E Irenas Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Frank H Seay Financial Disclosure Report For 2010Document25 pagesFrank H Seay Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- William C Bryson Financial Disclosure Report For 2010Document8 pagesWilliam C Bryson Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Daniel L Hovland Financial Disclosure Report For 2010Document7 pagesDaniel L Hovland Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Susan O Mollway Financial Disclosure Report For 2010Document7 pagesSusan O Mollway Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Clarence A Beam Financial Disclosure Report For 2010Document7 pagesClarence A Beam Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Robert R Beezer Financial Disclosure Report For 2010Document9 pagesRobert R Beezer Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Mark W Bennett Financial Disclosure Report For 2010Document15 pagesMark W Bennett Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- James E Gritzner Financial Disclosure Report For 2010Document10 pagesJames E Gritzner Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Rosemary S Pooler Financial Disclosure Report For 2010Document7 pagesRosemary S Pooler Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Harold R DeMoss JR Financial Disclosure Report For 2010Document9 pagesHarold R DeMoss JR Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- John R Smoak Financial Disclosure Report For 2010Document7 pagesJohn R Smoak Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Christopher C Conner Financial Disclosure Report For 2010Document14 pagesChristopher C Conner Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Leonard I Garth Financial Disclosure Report For 2010Document8 pagesLeonard I Garth Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Patrick J Duggan Financial Disclosure Report For 2009Document7 pagesPatrick J Duggan Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Robert P Patterson JR Financial Disclosure Report For 2010Document9 pagesRobert P Patterson JR Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Christina C Reiss Financial Disclosure Report For Reiss, Christina CDocument9 pagesChristina C Reiss Financial Disclosure Report For Reiss, Christina CJudicial Watch, Inc.No ratings yet

- Robert L Hinkle Financial Disclosure Report For 2010Document8 pagesRobert L Hinkle Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Deborah K Chasanow Financial Disclosure Report For 2010Document20 pagesDeborah K Chasanow Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- James C Cacheris Financial Disclosure Report For 2010Document7 pagesJames C Cacheris Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- William T Moore JR Financial Disclosure Report For 2010Document20 pagesWilliam T Moore JR Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Gerard E Lynch Financial Disclosure Report For 2010Document9 pagesGerard E Lynch Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Harvey E Schlesinger Financial Disclosure Report For 2010Document8 pagesHarvey E Schlesinger Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- David S Doty Financial Disclosure Report For 2010Document7 pagesDavid S Doty Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Stephen V Wilson Financial Disclosure Report For 2010Document14 pagesStephen V Wilson Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Richard L Nygaard Financial Disclosure Report For 2010Document7 pagesRichard L Nygaard Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Richard L Voorhees Financial Disclosure Report For 2010Document8 pagesRichard L Voorhees Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Paul J Barbadoro Financial Disclosure Report For 2010Document7 pagesPaul J Barbadoro Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- 1488 09032013Document262 pages1488 09032013Judicial Watch, Inc.100% (1)

- 11 1271 1451347Document29 pages11 1271 1451347david_stephens_29No ratings yet

- CC 081213 Dept 14 Lapp LDocument38 pagesCC 081213 Dept 14 Lapp LJudicial Watch, Inc.No ratings yet

- Stamped Complaint 2Document5 pagesStamped Complaint 2Judicial Watch, Inc.No ratings yet

- Stamped ComplaintDocument4 pagesStamped ComplaintJudicial Watch, Inc.No ratings yet

- SouthCom Water Safety ProductionDocument30 pagesSouthCom Water Safety ProductionJudicial Watch, Inc.No ratings yet

- Gitmo Freezer Inspection ReportsDocument4 pagesGitmo Freezer Inspection ReportsJudicial Watch, Inc.No ratings yet

- State Dept 13-951Document4 pagesState Dept 13-951Judicial Watch, Inc.No ratings yet

- Gitmo Freezer Inspection ReportsDocument4 pagesGitmo Freezer Inspection ReportsJudicial Watch, Inc.No ratings yet

- September 2004Document24 pagesSeptember 2004Judicial Watch, Inc.No ratings yet

- LAUSD Semillas AckDocument1 pageLAUSD Semillas AckJudicial Watch, Inc.No ratings yet

- Cover Letter To Requester Re Response Documents130715 - 305994Document2 pagesCover Letter To Requester Re Response Documents130715 - 305994Judicial Watch, Inc.No ratings yet

- July 2007 BulletinDocument23 pagesJuly 2007 BulletinJudicial Watch, Inc.No ratings yet

- CVR LTR SouthCom Water Safety ProductionDocument2 pagesCVR LTR SouthCom Water Safety ProductionJudicial Watch, Inc.No ratings yet

- JTF GTMO Water Safety App W ExhDocument13 pagesJTF GTMO Water Safety App W ExhJudicial Watch, Inc.No ratings yet

- June 2004Document17 pagesJune 2004Judicial Watch, Inc.No ratings yet

- December 2005Document7 pagesDecember 2005Judicial Watch, Inc.No ratings yet

- Model UNDocument2 pagesModel UNJudicial Watch, Inc.No ratings yet

- 13-1150 Response Re Judicial WatchDocument1 page13-1150 Response Re Judicial WatchJudicial Watch, Inc.No ratings yet

- July 2006Document24 pagesJuly 2006Judicial Watch, Inc.No ratings yet

- 13-1150 Responsive Records 2 - RedactedDocument29 pages13-1150 Responsive Records 2 - RedactedJudicial Watch, Inc.No ratings yet

- STAMPED ComplaintDocument4 pagesSTAMPED ComplaintJudicial Watch, Inc.No ratings yet

- December 2005 Bulletin 2Document14 pagesDecember 2005 Bulletin 2Judicial Watch, Inc.No ratings yet

- Atlanta IntraregionalDocument4 pagesAtlanta IntraregionalJudicial Watch, Inc.No ratings yet

- Agreement To Organize A BankDocument3 pagesAgreement To Organize A BankrotiliNo ratings yet

- Annex 41 Notes To FSDocument2 pagesAnnex 41 Notes To FSEdzel Espina PerezNo ratings yet

- Spouses Tan Vs China Banking CorpDocument6 pagesSpouses Tan Vs China Banking CorpmichelledugsNo ratings yet

- Nims Corrected Brief005!23!2019Document81 pagesNims Corrected Brief005!23!2019RussinatorNo ratings yet

- EF3e Int Filetest 2aDocument6 pagesEF3e Int Filetest 2aNuno Ribeiro100% (1)

- Digital Payments Driving Financial InclusionDocument73 pagesDigital Payments Driving Financial InclusionAyush NahakNo ratings yet

- The Burma Code Vol-6Document469 pagesThe Burma Code Vol-6kerrypwlNo ratings yet

- 03 Corp HY FactsheetDocument6 pages03 Corp HY FactsheetRoberto PerezNo ratings yet

- Role of Commodity Exchange in Agricultural GrowthDocument63 pagesRole of Commodity Exchange in Agricultural GrowthSoumyalin Santy50% (2)

- Edge Cities or Edge Suburbs?Document25 pagesEdge Cities or Edge Suburbs?Urbam RedNo ratings yet

- NEW REKENING KORAN ONLINE 454301034832532 2024-03-01 2024-03-31 00350349.pd 20240418 102419 0000Document2 pagesNEW REKENING KORAN ONLINE 454301034832532 2024-03-01 2024-03-31 00350349.pd 20240418 102419 0000murakatacreativeNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Rakshit KashyapNo ratings yet

- Wire TransferDocument1 pageWire TransferSteeh Vin-WealthNo ratings yet

- Wealth-X World 2014Document53 pagesWealth-X World 2014westelm12No ratings yet

- Arun y Kamath (2015)Document21 pagesArun y Kamath (2015)Leonardo VelizNo ratings yet

- Liam Law Vs Olympic Sawmill: Conditions For Escalation ClauseDocument2 pagesLiam Law Vs Olympic Sawmill: Conditions For Escalation ClauseblessaraynesNo ratings yet

- BF 130Document4 pagesBF 130Dixie CheeloNo ratings yet

- CTC VoucherDocument56 pagesCTC VoucherJames Hydoe ElanNo ratings yet

- Victor Hong Final Statement Submitted To UK Court, RBS Shareholder Rights LitigationDocument41 pagesVictor Hong Final Statement Submitted To UK Court, RBS Shareholder Rights LitigationFailure of Royal Bank of Scotland (RBS) Risk Management100% (2)

- Cosajay V MERS (RI 2013)Document11 pagesCosajay V MERS (RI 2013)Thom Lee ChapmanNo ratings yet

- Account Closure Request Form WellworthDocument1 pageAccount Closure Request Form WellworthHimanshuNo ratings yet

- Presentation For Computer ExhibitionDocument13 pagesPresentation For Computer ExhibitionBest VideosNo ratings yet

- Documents Used in Foreign TradeDocument85 pagesDocuments Used in Foreign TradeSanjeev PanditNo ratings yet

- Table of ContentsDocument10 pagesTable of ContentsUsman ManiNo ratings yet

- Manila Metal Container Corp. v. PNBDocument2 pagesManila Metal Container Corp. v. PNBElwell Mariano75% (4)

- The Nigerian Stock Exchange: 1st Tier SecuritiesDocument5 pagesThe Nigerian Stock Exchange: 1st Tier SecuritiesBawonda IsaiahNo ratings yet