Professional Documents

Culture Documents

Group Assignment Hdba-Hdplm

Group Assignment Hdba-Hdplm

Uploaded by

samweldaudi25Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Group Assignment Hdba-Hdplm

Group Assignment Hdba-Hdplm

Uploaded by

samweldaudi25Copyright:

Available Formats

Group assignment submitted 5th February ,2024

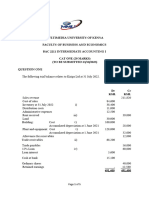

Question one

The following trial balance was extracted from the books of XYZ the close of

business on 29th February 2023

Particulars Dr (Tshs) C r (Tshs)

Purchases and sales 92,800 157,165

Cash at bank 4,100

Cash in hand 324

Capital account I March 2022 11,400

Drawings 17,100

Office furniture 2,900

Rent 3,400

Wages and salaries 31,400

Discounts 820 160

Debtors and creditors 12,316 5,245

Stock 1st march 2022 4,120

Provision of doubtful debts 405

Delivery van 3,750

Van running costs 615

Bad debts written off 730

174,375 174,375

Additional information

a) Stock 29th February 2, 2024 Tshs 2,400

b) Wages and salaries accrued at 29" February 2022 Tshs 340

c) Rent prepaid at 29" February 2022 Tshs 72

d) Increase the provision for doubtful debts by Tshs 91

e) Provide for depreciation as follows: office furniture Tshs 380 and delivery van

Tshs 1,250

Required:

a) Prepare statement of profit and loss for the year ended

b) Prepare statement of financial position

Question two

You have extracted a trial balance and drawn up accounts for the year ended 31st

December 2023. There was a shortage of Tshs 78,000 on the credit side of the trial

balance, a suspense account being opened for that amount.

During 2024 the following errors made ni 2023 were found:

a) Tshs 125,000 received from sales of old equipment has been entered in the

sales account.

b) Purchases day book had been overcast by Tshs 10,000.

c) A private purchase of Tshs 140,000 had been included in the business

purchases.

d) Bank Charges Tshs 22,000 entered in the cash book have not been posted of

the bank charges account.

e) A sale of goods to Mali Tshs 230,000 was correctly entered in the sales book

but entered in the Mali account as Tshs 320,000.

Required:

i. Show the requisite journal entries to correct the errors.

ii. Write up the suspense account showing the correction of the errors.

iii. The net profit originally calculated for 2023 was Tshs 400,820. Show your

calculation of the correct net profit for the year

You might also like

- Answers To General English Test CAMBRIDGEDocument15 pagesAnswers To General English Test CAMBRIDGEEduar Aguirre79% (19)

- Contentitemfile Clal2kacze0km0a21x7daf3m2 PDFDocument3 pagesContentitemfile Clal2kacze0km0a21x7daf3m2 PDFJoseph OndariNo ratings yet

- Trial QuestionsDocument3 pagesTrial Questionsmoha officialNo ratings yet

- CPA Paper 1 Financial Accounting 2Document9 pagesCPA Paper 1 Financial Accounting 2philipisingomaNo ratings yet

- Accountancy & Auditing-IDocument4 pagesAccountancy & Auditing-Izaman virkNo ratings yet

- ACC 2101 CA1 With TemplateDocument8 pagesACC 2101 CA1 With TemplatedeboevaniaNo ratings yet

- Accounts Mock - 29178435Document6 pagesAccounts Mock - 29178435mopibam555No ratings yet

- Test Series: May, 2022 Mock Test Paper 2 Foundation Course Paper - 1: Principles and Practice of AccountingDocument5 pagesTest Series: May, 2022 Mock Test Paper 2 Foundation Course Paper - 1: Principles and Practice of AccountingGayathiri RNo ratings yet

- ACC 108 Assignment Dec w3 2s2324Document3 pagesACC 108 Assignment Dec w3 2s2324Ghie RodriguezNo ratings yet

- Accounting For Everyone - 1201-OEDocument3 pagesAccounting For Everyone - 1201-OEsjsjjdksnsNo ratings yet

- Sem 2 - End Sem PapersDocument23 pagesSem 2 - End Sem Paperslalith sasankaNo ratings yet

- 11 April Account Subjective Question'Document3 pages11 April Account Subjective Question'Nishant NepalNo ratings yet

- FDN J22 - TS 2 - P1 Account - QueDocument5 pagesFDN J22 - TS 2 - P1 Account - QueShantanu JadhavNo ratings yet

- Asynch Activities 2 CTA SEDocument1 pageAsynch Activities 2 CTA SElingat airenceNo ratings yet

- 6.1 Class Work Question On PGBPDocument5 pages6.1 Class Work Question On PGBPRakNo ratings yet

- MC 3 Topic 4 Def Tax Question A232Document4 pagesMC 3 Topic 4 Def Tax Question A232thanusri0103No ratings yet

- Accounts June 2024Document8 pagesAccounts June 2024rajdjpurohitNo ratings yet

- Intacc V1 ProblemsDocument26 pagesIntacc V1 ProblemsacctgnotesforreviewNo ratings yet

- FR2 Past Papers 24 AttemptsDocument107 pagesFR2 Past Papers 24 AttemptsAbdullah FarooqiNo ratings yet

- Bac 2211 Cat&assignment Sep 2023Document5 pagesBac 2211 Cat&assignment Sep 2023toniruii98No ratings yet

- CA Foundation Accounts Q MTP 1 June 2024 Castudynotes ComDocument8 pagesCA Foundation Accounts Q MTP 1 June 2024 Castudynotes Comgokulthilagam362No ratings yet

- Revision Questions-1Document6 pagesRevision Questions-1stanleymudzamiri8No ratings yet

- FAR Preweek (B44)Document10 pagesFAR Preweek (B44)Haydy AntonioNo ratings yet

- Accounts Mega ModelDocument8 pagesAccounts Mega Modellekha ram100% (1)

- 4 6026199395324659830Document30 pages4 6026199395324659830Beka Asra100% (1)

- Audit of LiabilitiesDocument54 pagesAudit of LiabilitiesWerpa PetmaluNo ratings yet

- Acctg 102 Prelim Quiz 1 With SolutionDocument9 pagesAcctg 102 Prelim Quiz 1 With SolutionYsabel ApostolNo ratings yet

- AFAR First Preboard May 2023 BatchDocument14 pagesAFAR First Preboard May 2023 BatchRhea Mae CarantoNo ratings yet

- 05 Completing The Accounting Cycle PROBLEMSDocument5 pages05 Completing The Accounting Cycle PROBLEMSbetlogNo ratings yet

- Tutorial Questions - Accounting Non-Profit OrganizationDocument3 pagesTutorial Questions - Accounting Non-Profit OrganizationMoriatyNo ratings yet

- BAC 211 Group AssDocument12 pagesBAC 211 Group AssStephan Mpundu (T4 enick)No ratings yet

- Test Series: November, 2022 Mock Test Paper 2 Foundation Course Paper - 1: Principles and Practice of AccountingDocument5 pagesTest Series: November, 2022 Mock Test Paper 2 Foundation Course Paper - 1: Principles and Practice of AccountingRajesh MondewadNo ratings yet

- 18.01.2022 11 ACCOUNTS POST MID TERM 2021-22 CC Post Mid Acc 11Document3 pages18.01.2022 11 ACCOUNTS POST MID TERM 2021-22 CC Post Mid Acc 11Jr.No ratings yet

- Mock 2024 - Higher Level - QPDocument20 pagesMock 2024 - Higher Level - QPMUSTHARI KHANNo ratings yet

- MTP 23 54 Questions 1717476460Document8 pagesMTP 23 54 Questions 171747646023prfb31No ratings yet

- Audprob Final Exam 1Document26 pagesAudprob Final Exam 1Joody CatacutanNo ratings yet

- MC 4 - Deferred Tax - A231Document4 pagesMC 4 - Deferred Tax - A231Patricia TangNo ratings yet

- BBS 110 Introduction To Financial Accounting: Test IIDocument8 pagesBBS 110 Introduction To Financial Accounting: Test IIlloydbwalya588No ratings yet

- 201.AFA IP.L II December 2020Document4 pages201.AFA IP.L II December 2020leyaketjnuNo ratings yet

- AP 200 3 Change in Accounting Estimates Change in Accounting Policy and Correction of Errors StudentsDocument4 pagesAP 200 3 Change in Accounting Estimates Change in Accounting Policy and Correction of Errors StudentsMonica mangobaNo ratings yet

- Abfa1513 220518Document6 pagesAbfa1513 220518CRYSTAL NGNo ratings yet

- F2 Dept (N)Document3 pagesF2 Dept (N)aslamhamza949No ratings yet

- Activity 6 Statement of Cash FlowsDocument2 pagesActivity 6 Statement of Cash Flowsnglc srzNo ratings yet

- CAT 2 Urgent DBM EveningDocument3 pagesCAT 2 Urgent DBM EveningCollins WandatiNo ratings yet

- CPAR - 91 - AFAR First Preboard ExamDocument18 pagesCPAR - 91 - AFAR First Preboard ExamAllyson VillalobosNo ratings yet

- FAR Problem Quiz 1Document6 pagesFAR Problem Quiz 1Ednalyn CruzNo ratings yet

- ACC 281 SEMINAR QUESTIONS Version 2Document8 pagesACC 281 SEMINAR QUESTIONS Version 2Joel SimonNo ratings yet

- Answers Practical Assignments Week 46 2022/2023 Name ... Student Number .... . Assignment 1 FastprintDocument5 pagesAnswers Practical Assignments Week 46 2022/2023 Name ... Student Number .... . Assignment 1 FastprintT.F. EvansNo ratings yet

- CAF Test2 Accounts June23 R2 (Que)Document4 pagesCAF Test2 Accounts June23 R2 (Que)AISHWARYA DESHMUKHNo ratings yet

- Receivables ProblemsDocument5 pagesReceivables ProblemsAbbygailNo ratings yet

- Account Test 2Document5 pagesAccount Test 2klaw6048No ratings yet

- Extra Questions - A LevelDocument8 pagesExtra Questions - A LevelMUSTHARI KHANNo ratings yet

- Assignment Farm Accounts 2023Document4 pagesAssignment Farm Accounts 2023Charles ChikumbiNo ratings yet

- WP contentuploads202302FINANCIAL ACCOUNTING PAPER 1.1 Dec 2023 PDFDocument22 pagesWP contentuploads202302FINANCIAL ACCOUNTING PAPER 1.1 Dec 2023 PDFProsperity Thēë BwøyNo ratings yet

- Financial Accounting Test1Document5 pagesFinancial Accounting Test1musa mosesNo ratings yet

- P08. Cash & Accrual BasisDocument3 pagesP08. Cash & Accrual Basisayushiridara kwonNo ratings yet

- Dac1102 Past Examination Paper 11.04.2023 1Document10 pagesDac1102 Past Examination Paper 11.04.2023 1marumoduberemofilwerethabilevaNo ratings yet

- FAR05 - Preweek HandoutDocument10 pagesFAR05 - Preweek HandoutHatdogNo ratings yet

- Auditing Problems: First PreboardDocument8 pagesAuditing Problems: First PreboardCarlo AgravanteNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- IP Lab ManualDocument72 pagesIP Lab ManualKayalvizhi ElamparithiNo ratings yet

- CNR Company ProfileDocument6 pagesCNR Company ProfilejhonNo ratings yet

- The One and A Half ShirtDocument3 pagesThe One and A Half ShirtNikhil LohithakshanNo ratings yet

- Mine Quarry PlanningDocument34 pagesMine Quarry PlanningAnggan PranataNo ratings yet

- This Study Resource WasDocument3 pagesThis Study Resource WasRavenNo ratings yet

- Charismatic Leadership and Social Change: A Weberian PrespectiveDocument9 pagesCharismatic Leadership and Social Change: A Weberian PrespectiveAnonymous CwJeBCAXpNo ratings yet

- Pres PerfDocument3 pagesPres PerfAndrei MilitaruNo ratings yet

- The Sea: Edward Bond - His Life, Works and Critical ReceptionDocument60 pagesThe Sea: Edward Bond - His Life, Works and Critical ReceptionImran KhanNo ratings yet

- Bongani Simelane: Personal InformationDocument3 pagesBongani Simelane: Personal InformationBongani SimelaneNo ratings yet

- Multimodal Terminal at Gabtoli: Location: Gabtoli Client: Dhaka North City Corporation Site Area: 13.5 Acres (Apprx)Document24 pagesMultimodal Terminal at Gabtoli: Location: Gabtoli Client: Dhaka North City Corporation Site Area: 13.5 Acres (Apprx)Tanvir MuttakinNo ratings yet

- Vehicle Inspection CheklistDocument1 pageVehicle Inspection CheklistshaheerNo ratings yet

- Adobe Scan 8 Nov 2021Document10 pagesAdobe Scan 8 Nov 2021AstarothNo ratings yet

- Judy WakabayashiDocument18 pagesJudy WakabayashizlidjukaNo ratings yet

- Case Law Digest On Delay CondonationDocument150 pagesCase Law Digest On Delay CondonationSridhara babu. N - ಶ್ರೀಧರ ಬಾಬು. ಎನ್0% (1)

- SPM GlossaryDocument13 pagesSPM GlossaryKidusNo ratings yet

- Sports ManagementDocument7 pagesSports ManagementKomal GhiyaNo ratings yet

- Re-Arranged Rankwise ListDocument282 pagesRe-Arranged Rankwise ListSuneel ReddyNo ratings yet

- Attorneys General Letter To ChaseDocument8 pagesAttorneys General Letter To ChaseAnthony TalcottNo ratings yet

- Business Studies Notes: Unit 3Document13 pagesBusiness Studies Notes: Unit 3Matt Robson100% (1)

- Program Studi Magister Akuntansi Fakultas Ekonomika Dan Bisnis Universitas Gadjah MadaDocument2 pagesProgram Studi Magister Akuntansi Fakultas Ekonomika Dan Bisnis Universitas Gadjah MadaNadia OctasiaNo ratings yet

- Rudge CJ ThesisDocument446 pagesRudge CJ Thesis11111No ratings yet

- Introduction To RomanticismDocument15 pagesIntroduction To RomanticismayeshashafeeqNo ratings yet

- Poem Analysis PresenationDocument8 pagesPoem Analysis PresenationMunachiNo ratings yet

- Belgrade Retail Market Report Q2 2013Document3 pagesBelgrade Retail Market Report Q2 2013Author LesNo ratings yet

- Neraca PT Indofood 019,020Document2 pagesNeraca PT Indofood 019,020Nur Abdillah AkmalNo ratings yet

- PF - TOPIC 4.1 - Morality - Reasons and ImpartialityDocument30 pagesPF - TOPIC 4.1 - Morality - Reasons and Impartialityplpals25xxNo ratings yet

- Sampling Conditioning SystemDocument24 pagesSampling Conditioning System王祚No ratings yet

- Tma 04Document21 pagesTma 04Neil YoungNo ratings yet

- 5 Major Elements of Uber StrategyDocument2 pages5 Major Elements of Uber StrategyWirastio RahmatsyahNo ratings yet