Professional Documents

Culture Documents

Farm Economics fdd260121

Farm Economics fdd260121

Uploaded by

RicardoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Farm Economics fdd260121

Farm Economics fdd260121

Uploaded by

RicardoCopyright:

Available Formats

Weekly Farm Economics: Revised 2020 and 2021 Crop Budgets

Indicate Higher Returns

Gary Schnitkey, Krista Swanson, and Nick Paulson

Department of Agricultural and Consumer Economics

University of Illinois

Carl Zulauf

Department of Agricultural, Environmental and Development Economics

Ohio State University

January 26, 2021

farmdoc daily (11): 12

Recommended citation format: Schnitkey, G., K. Swanson, C. Zulauf, and N. Paulson. “Revised 2020 and

2021 Crop Budgets Indicate Higher Returns.” farmdoc daily (11): 12, Department of Agricultural and

Consumer Economics, University of Illinois at Urbana-Champaign, January 26, 2021.

Permalink: https://farmdocdaily.illinois.edu/2021/01/release-of-the-2021-crop-insurance-decision-tool.html

Publications on farmdoc giving 2020 and 2021 returns for Illinois grain crops have been revised since

their last release in October 2020. Three changes have been made: 1) corn and soybean prices for 2020

and 2021 have been increased, 2) additional Federal-aid resulting from COVID-19 has been included,

and 3) many non-land costs for 2021 have been increased. The 2021 Illinois Crop Budgets are available

at this link. Historical costs are included in a farmdoc publication called Revenue and Costs for Illinois

Grain Crops which is available from this link.

2020 Returns

Table 1 shows revenue and costs for crops grown in central Illinois on high-productivity farmland. Returns

are shown for corn and soybeans for three years: 2019, 2020, and 2021. The 2019 values are summaries

from farms enrolled in Illinois Farm Business Farm Management (FBFM). Historic returns back to 2014 for

the central-high region — and for northern, central-low, and Southern Illinois regions — are available in

the publication entitled Revenues and Costs for Illinois Grain Crops (link). Results for 2020 are

projections as FBFM has not produced summaries for 2020. Similarly, 2021 values are projections.

We request all readers, electronic media and others follow our citation guidelines when re-posting articles

from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of

Illinois copyright and intellectual property rights. For a detailed statement, please see the University of

Illinois Copyright Information and Policies here.

1 farmdoc daily January 26, 2021

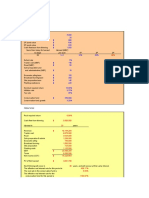

Table 1. Corn and Soybean Returns, Central Illinois, High-Productivity Farmland

Corn Soybeans

2019 2020P 2021P 2019 2020P 2021P

Yield per acre 208 228 217 64 72 68

Price per bu $3.65 $4.25 $4.00 $8.58 $11.20 $10.50

Crop revenue $759 $969 $868 $549 $806 $714

ARC/PLC 10 0 0 10 0 0

Ad hoc Federal payments 110 68 0 94 45 0

Crop insurance proceeds 14 0 0 9 0 0

Gross revenue $893 $1,037 $868 $662 $852 $714

Fertilizers 154 130 135 45 40 44

Pesticides 76 75 76 46 45 45

Seed 114 115 116 73 73 74

Drying 22 15 15 0 0 0

Storage 15 15 15 8 8 8

Crop insurance 22 22 24 15 15 16

Total direct costs $403 $372 $381 $187 $181 $187

Machine hire/lease 16 16 16 14 14 14

Utilities 5 5 5 5 5 5

Machine repair 26 24 24 23 19 21

Fuel and oil 17 15 14 15 13 12

Light vehicle 1 1 1 1 1 1

Mach. depreciation 63 63 63 55 54 55

Total power costs $128 $124 $123 $113 $106 $108

Hired labor 18 18 18 17 17 17

Building repair and rent 6 6 6 5 5 5

Building depreciation 11 11 11 10 10 10

Insurance 9 9 9 11 11 11

Misc 9 9 9 9 9 9

Interest (non-land) 22 22 23 20 20 21

Total overhead costs $75 $75 $76 $72 $72 $73

Total non-land costs $606 $571 $580 $372 $359 $368

Operator and land return $287 $466 $288 $290 $493 $346

Land costs 275 275 275 275 275 275

Farmer return $12 $191 $13 $15 $218 $71

For 2020, the projected corn yield is 228 bushels per acre, the corn price is $4.25 per bushel, resulting in

$969 per acre in crop revenue. This $4.25 corn price is $.25 per bushel higher than the price used in the

October 2020 Revenue and Costs for Illinois Grain Crops publication. The higher price reflects the large

increases in corn prices that have been occurring in recent months. That price will vary across farms

depending on the timing of marketing. Corn revenue also includes $68 of other ad hoc Federal payments

related to the Coronavirus Food Assistance Program (CFAP). The $68 includes payments for:

1. The second round of CFAP, which were $.23 per bushel times the actual production History yield

(210 bushels per acre) in Figure 1.

2 farmdoc daily January 26, 2021

2. The third round of CFAP of $20 per acre authorized in December’s Consolidation Appropriation Act.

These payments have not been received but are authorized.

The first round of CFAP was paid on 2019 production and is included in the $110 per acre of ad hoc

Federal payments in 2019.

Total revenue for corn is projected at $1,037 per acre. Subtracting off $571 of non-land cost gives $466 of

operator and land return. Operator and land return provides payments both to the farmer and landowner.

Table 1 includes land costs of $275 per acre, representing the average cash rent for high-productivity

farmland in central Illinois. Given this average cash rent, the farmer return is $191 per acre.

For 2020, the projected soybean yield is 72 bushels per acre, the soybean price is $11.20 per bushel,

giving crop revenue of $806 per acre. The $11.20 price is $1.25 higher than the price used in the October

2020 Revenue and Costs for Illinois Grain Crops publication. There are $45 per acre in CFAP payments

related to two rounds:

1. The second round of CFAP, which were $.40 per bushel times the actual production History yield (63

bushels per acre) in Table 1.

2. The third round of CFAP of $20 per acre authorized in December’s Consolidation Appropriation ace.

These payments have not been received but are authorized.

Total revenue is $852 per acre. Given $369 in non-land costs and $275 in cash rent, farmer returns for

soybeans are projected at $218 per acre.

2021 Returns

For 2021 projections, a corn price of $4.00 per bushel and a soybean price of $10.50 per bushel are

used. These prices are substantially higher than in October budgets ($3.55 for corn and $9.45 for

soybeans). These higher prices are close to bids for fall delivery of grain. Yields are at trend levels: 217

bushels per acre for corn and 68 bushels per acre for soybeans. Revenues are not included for ARC/PLC

payments or Ad hoc Federal programs.

3 farmdoc daily January 26, 2021

Fertilizer costs have been increased, as fertilizer prices have increased in recent months. For example,

anhydrous ammonia prices now are near $500 per ton after being in the $415 per ton range in the fall of

2020.

Historical Perspectives

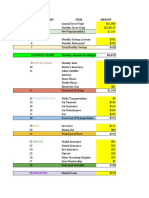

Figure 1 shows the projected 2020 and 2021 compared to historical returns. The 2020 operator and land

return for corn is projected at $466 per acre. The last time corn returns exceeded $466 per acre was in

2021, when returns were $630 per acre. From 2013 to 2019, corn returns averaged $253 per acre, well

below the 2019 projected return. The 2019 projected return is $89 per acre above the average 2013-2019

average return.

The 2020 operator and land return for soybeans is projected is $493 per acre, the highest return in history

in central Illinois (see Figure 1). The average soybean return from 2013 to 2019 is $333 per acre, well

below the 2021 projected return.

The operator and land return for corn in 2021 is projected at $288 per acre. This 2021 projected in $35

above the 2013-2019 average of $253 per acre. The soybean return is projected at $346 per acre, $35

higher than the 2013-2019 average of $333 per acre.

Price Changes

Much of the higher returns now being projected are due to price increases. Prices have increased

dramatically since August 2020, as is illustrated by the cash prices for central Illinois shown in Figure 2.

Corn prices increased from near $3.00 in August to over $5.00 in January. Soybean prices have

increased from near $8.50 per bushel in August to $13.50 in January.

Based on these price increases and current levels of futures contracts on the Chicago Mercantile

Exchange, projected levels of $4.00 per bushel for corn and $10.50 per bushel for soybeans are

appropriate for 2021. Of course, large changes in 2021 prices can occur, as is illustrated by price swings

in 2020. Lower prices likely would be associated with large crops in Brazil and the United States.

Conversely, short crops could lead to higher prices. Demand factors obviously will have an impact on

prices as well.

4 farmdoc daily January 26, 2021

Summary

Price increases and continued announcements of ad hoc Federal payments have led to higher estimates

of revenues and returns in 2020. Incomes in 2020 could be well above average for many farms in Illinois.

The above returns do not include proceeds from the Paycheck Protection Program (PPP) and the

Economic Injury Disaster Loans (EDIL), programs administered by the Small Business Administration

(SBA) program. For participating farmers, those programs will add to cash flow.

There also appears to be a reason for optimism for 2021 returns. Of course, much can change between

now and harvest in 2021.

5 farmdoc daily January 26, 2021

You might also like

- Mini Case Chapter 7 Bunyan Lumber LLCDocument9 pagesMini Case Chapter 7 Bunyan Lumber LLCricky setiawan100% (2)

- Dickson, Gordon - Computers Don't ArgueDocument10 pagesDickson, Gordon - Computers Don't Arguetherealmrz100% (1)

- Hitungan Kuis 7 Bunyan - Lumber - CaseDocument15 pagesHitungan Kuis 7 Bunyan - Lumber - Caserica100% (1)

- Ranking Illinois Schools PerformanceDocument1 pageRanking Illinois Schools PerformanceKevin HaasNo ratings yet

- Chalice WinesDocument42 pagesChalice Winesdk.asal6361No ratings yet

- IMTT LookbookDocument24 pagesIMTT LookbookMelike84No ratings yet

- Red Line Extension Coalition Stationary RLEC NEWS LETTER October 2018 FINALDocument2 pagesRed Line Extension Coalition Stationary RLEC NEWS LETTER October 2018 FINALLevoisNo ratings yet

- Estimated Costs of Crop Production in Iowa - 2017: Ag Decision MakerDocument13 pagesEstimated Costs of Crop Production in Iowa - 2017: Ag Decision MakerChristian MuñozNo ratings yet

- Cop Crop ProductionDocument20 pagesCop Crop Productiongalaxy guoNo ratings yet

- Crops: Cost of ProductionDocument16 pagesCrops: Cost of ProductionFatma KatotoNo ratings yet

- Economics of A Small Premium WineryDocument5 pagesEconomics of A Small Premium WineryIshan RastogiNo ratings yet

- ExecSum AveBook2022WebDocument5 pagesExecSum AveBook2022Webjose miguel baezNo ratings yet

- Estimated Costs of Crop Production in Iowa - 2018: Ag Decision MakerDocument13 pagesEstimated Costs of Crop Production in Iowa - 2018: Ag Decision MakerBruno Santos de MirandaNo ratings yet

- Farm AccountsDocument3 pagesFarm AccountsMitchell VieiraNo ratings yet

- Cop Beef FeedlotfinishingDocument18 pagesCop Beef Feedlotfinishinganthonius70No ratings yet

- GreenhouseTomatoBudget2018 InteractiveFinalDocument37 pagesGreenhouseTomatoBudget2018 InteractiveFinalEduardo GalindoNo ratings yet

- Cincinnati FY 2023 Budget PresentationDocument12 pagesCincinnati FY 2023 Budget PresentationWVXU NewsNo ratings yet

- Storage Futures Study Reeds Bess Costs DataDocument127 pagesStorage Futures Study Reeds Bess Costs DataAlbert Casian AlanisNo ratings yet

- Introduction To Record Keeping PDFDocument4 pagesIntroduction To Record Keeping PDFÏťž ÄbïNo ratings yet

- 2024 Truth in Taxation PresentationDocument19 pages2024 Truth in Taxation PresentationinforumdocsNo ratings yet

- Guidelines For Estimating 2018: Aquaculture Production CostsDocument16 pagesGuidelines For Estimating 2018: Aquaculture Production CostsboonyongchiraNo ratings yet

- Budgeting Project - This Way Up ManufacturingDocument7 pagesBudgeting Project - This Way Up Manufacturingapi-664527836No ratings yet

- Aug. 17 2021 East Grand Forks Greenway FeesDocument9 pagesAug. 17 2021 East Grand Forks Greenway FeesJoe BowenNo ratings yet

- Preliminary Residents' Society Budget - Oaken ResidencesDocument2 pagesPreliminary Residents' Society Budget - Oaken Residencestangbinbin2007No ratings yet

- Estimated Costs of Crop Production in Iowa-2023: Ag Decision MakerDocument13 pagesEstimated Costs of Crop Production in Iowa-2023: Ag Decision Makeramberhahn571No ratings yet

- 2014-453 CPE 173 Community Seed Production (001-125) (066-125)Document60 pages2014-453 CPE 173 Community Seed Production (001-125) (066-125)ابوايمن العمراني ايمنNo ratings yet

- Utah Tax Commission Revenue ReportDocument7 pagesUtah Tax Commission Revenue ReportThe Salt Lake TribuneNo ratings yet

- Guidelines For Estimating: Beef Cow-Calf Production CostsDocument24 pagesGuidelines For Estimating: Beef Cow-Calf Production CostsEd ZNo ratings yet

- Calculated Earned ValueDocument12 pagesCalculated Earned ValuebeahfeacinNo ratings yet

- FINANCIALSDocument7 pagesFINANCIALSAmmon BelyonNo ratings yet

- Copycooperative Financial Ratio Calculator 2011Document10 pagesCopycooperative Financial Ratio Calculator 2011pradhan13No ratings yet

- Farm Management - Land - Control UseDocument32 pagesFarm Management - Land - Control UseLuis ReisNo ratings yet

- Focus On Ag: Written by Kent Thiesse Farm Management Analyst and Senior Vice President, Minnstar BankDocument3 pagesFocus On Ag: Written by Kent Thiesse Farm Management Analyst and Senior Vice President, Minnstar BankFluenceMediaNo ratings yet

- f5 Short Notes MHADocument25 pagesf5 Short Notes MHAKlaus MIKENo ratings yet

- Agricultural CreditDocument3 pagesAgricultural CreditMayaz Muhammad MomshadNo ratings yet

- Leverage Buyout of Balrampur Chini Mills LimitedDocument16 pagesLeverage Buyout of Balrampur Chini Mills LimitedAarti KatochNo ratings yet

- Tugas Week 8Document6 pagesTugas Week 8Carissa WindyNo ratings yet

- A Case Analysis: Baldwin Bicycle CompanyDocument12 pagesA Case Analysis: Baldwin Bicycle CompanySamrat KaushikNo ratings yet

- Cop Swine FarrowfinishDocument24 pagesCop Swine FarrowfinishJose Jesus Martinez NunezNo ratings yet

- Generic Meat Plant Business PlanDocument34 pagesGeneric Meat Plant Business PlanSolid Work and Mechanical software TutorialNo ratings yet

- 2022 Crop ReportDocument12 pages2022 Crop ReportLakeCoNewsNo ratings yet

- Boyce A BudgetDocument4 pagesBoyce A Budgetapi-513816841No ratings yet

- Anderson Energy Announces 2010 Second Quarter Results: HighlightsDocument37 pagesAnderson Energy Announces 2010 Second Quarter Results: Highlightsikehenderson4879No ratings yet

- FS CHAP 5 TABLE Finaaaaal NaDocument6 pagesFS CHAP 5 TABLE Finaaaaal NaIvan SalvadorNo ratings yet

- 04 Super Projects ExhibitsDocument10 pages04 Super Projects ExhibitsYo shuk singhNo ratings yet

- Field 1 Field 2 Field 3 Field 4 Field 5 Income Per Acre: #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!Document8 pagesField 1 Field 2 Field 3 Field 4 Field 5 Income Per Acre: #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!traffasNo ratings yet

- Intrinsic Value CalculationDocument9 pagesIntrinsic Value Calculationmumbaideepika100% (1)

- USA Production MarketDocument56 pagesUSA Production MarketDeepak TirunagariNo ratings yet

- Oilseeds and Products Annual - Lagos - Nigeria - 04-01-2021Document22 pagesOilseeds and Products Annual - Lagos - Nigeria - 04-01-2021Kamil UsmanNo ratings yet

- Table 1Document2 pagesTable 1linkin soyNo ratings yet

- Bel Air BudgetDocument15 pagesBel Air BudgetelizabethNo ratings yet

- Agriculture & Fishery Development: Rice ProductionDocument29 pagesAgriculture & Fishery Development: Rice ProductionLGU Kidapawan CPDONo ratings yet

- Calculative Questions Chapter 10 Measuring A Nations IncomeDocument14 pagesCalculative Questions Chapter 10 Measuring A Nations IncomeVũ Hồng PhươngNo ratings yet

- Mini Budget ProjectDocument24 pagesMini Budget ProjectnewingtontigersharkNo ratings yet

- Goat Farming Cost BenefitDocument12 pagesGoat Farming Cost BenefitNadeemNo ratings yet

- Ch4 Spreadsheets Update 2 13Document19 pagesCh4 Spreadsheets Update 2 13Toàn ĐìnhNo ratings yet

- A Path Forward: Governor Ned LamontDocument35 pagesA Path Forward: Governor Ned LamontFOX 61 WebstaffNo ratings yet

- Irving Budget Update 2010-07-07Document22 pagesIrving Budget Update 2010-07-07Irving BlogNo ratings yet

- Cotton and Products Annual - Islamabad - Pakistan - PK2022-0002Document9 pagesCotton and Products Annual - Islamabad - Pakistan - PK2022-0002Mohammad AsimNo ratings yet

- Report ThirdQuarter Financials 2020 21Document30 pagesReport ThirdQuarter Financials 2020 21ferdous_ahmed_2No ratings yet

- Sales ForecastDocument3 pagesSales ForecastScribdTranslationsNo ratings yet

- Brentwood MH & RV ParkDocument14 pagesBrentwood MH & RV ParkNiranjan REDDY.KNo ratings yet

- Promoting Agrifood Sector Transformation in Bangladesh: Policy and Investment PrioritiesFrom EverandPromoting Agrifood Sector Transformation in Bangladesh: Policy and Investment PrioritiesNo ratings yet

- Food Outlook: Biannual Report on Global Food Markets: November 2022From EverandFood Outlook: Biannual Report on Global Food Markets: November 2022No ratings yet

- Hizo ResumeDocument1 pageHizo Resumeapi-438127449No ratings yet

- List of Adult Use Dispensaries - 12.31.19Document4 pagesList of Adult Use Dispensaries - 12.31.19KHQA News100% (1)

- Ushenko Book Proof OptDocument20 pagesUshenko Book Proof Optapi-287967566100% (1)

- NextGen IllinoisDocument24 pagesNextGen IllinoisRoosevelt Campus NetworkNo ratings yet

- Resume 2016Document1 pageResume 2016api-246227441No ratings yet

- Federal Inmates With Commutated SentencesDocument30 pagesFederal Inmates With Commutated Sentencessavannahnow.comNo ratings yet

- UntitledDocument22 pagesUntitledpichu javes0% (1)

- Joseph H. Molinaro: Isletown ANE Office HomeDocument16 pagesJoseph H. Molinaro: Isletown ANE Office HomeBhader KadeemNo ratings yet

- History of Pike County - Chase & Chapman 1881Document1,024 pagesHistory of Pike County - Chase & Chapman 1881bradNo ratings yet

- Gillenwater - Adult and Pediatric Urology 4th EdDocument1,564 pagesGillenwater - Adult and Pediatric Urology 4th EdRoxana Boloaga100% (1)

- Education ResumeDocument2 pagesEducation Resumesbere1006No ratings yet

- Senior Field Sales Account Manager in Chicago IL Resume Thomas PapanDocument2 pagesSenior Field Sales Account Manager in Chicago IL Resume Thomas PapanThomasPapanNo ratings yet

- Prologue Spring 2011 Vol 43 No 1Document76 pagesPrologue Spring 2011 Vol 43 No 1Prologue MagazineNo ratings yet

- Here Is The List of All US Universities For GRE Scores 260 PDFDocument12 pagesHere Is The List of All US Universities For GRE Scores 260 PDFমাহমুদ অর্ণবNo ratings yet

- Academic Administrator Marketing Fundraising in Carbondale IL Resume Marsha OliboniDocument3 pagesAcademic Administrator Marketing Fundraising in Carbondale IL Resume Marsha OliboniMarshaOliboniNo ratings yet

- Mergers May Rescue Declining Suburbs: Aaron M. RennDocument16 pagesMergers May Rescue Declining Suburbs: Aaron M. RennAnn DwyerNo ratings yet

- Illustrated Guide To The Treasures of America (Art Ebook) PDFDocument632 pagesIllustrated Guide To The Treasures of America (Art Ebook) PDFEstebanAbok100% (1)

- Kelly Moran's ResumeDocument2 pagesKelly Moran's ResumeKelly MoranNo ratings yet

- Austen Beaugureau ResumeDocument1 pageAusten Beaugureau Resumeapi-270359433No ratings yet

- Resume Nick Swedberg 090120Document2 pagesResume Nick Swedberg 090120api-293495403No ratings yet

- Attorney Litigation Manager Insurance in Chicago IL Resume William FlorianoDocument3 pagesAttorney Litigation Manager Insurance in Chicago IL Resume William FlorianoWilliamFloriano2No ratings yet

- 2012 Indiana Logistics Directory FINALDocument68 pages2012 Indiana Logistics Directory FINALUmk BhatNo ratings yet

- TM Clubs in ChicagoDocument24 pagesTM Clubs in ChicagovivektonapiNo ratings yet

- Julia ResumeDocument4 pagesJulia Resumeapi-237449900No ratings yet

- Description: Tags: 1215SCH0546Document402 pagesDescription: Tags: 1215SCH0546anon-852220No ratings yet

- Macys Inc Store ListingDocument57 pagesMacys Inc Store ListingSurya NarayananNo ratings yet