Professional Documents

Culture Documents

Sip Initial Plan

Sip Initial Plan

Uploaded by

Swapnil Mitra0 ratings0% found this document useful (0 votes)

0 views4 pagesInitial plan for summer internship

Original Title

SIP INITIAL PLAN

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentInitial plan for summer internship

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

0 views4 pagesSip Initial Plan

Sip Initial Plan

Uploaded by

Swapnil MitraInitial plan for summer internship

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 4

INITIAL PLAN

Organization- Finoability(WFH)

Name: Swapnil Mitra Reg No: 23PGDM113

Phone No.: 8218695557 E-Mail Id:

swapnil.23pgdm113@mdim.ac.in

I. Internship Program Details:

Title: Equity Research & Portfolio Management

1. Develop skills in equity research, portfolio

management, and financial planning through a

remote internship.

2. Gain hands-on experience in financial planning,

wealth management, and investment analysis.

3. Gain exposure to derivative markets and swing

trading strategies

4. Participate in live projects focused on financial

planning and mutual fund analysis.

Area: Finance

Objectives: Gain hands-on experience in equity research,

portfolio management, and financial planning.

Develop a strong understanding of fundamental

and technical analysis techniques.

Learn to assess client needs and risk tolerance to

recommend suitable investment strategies.

Gain practical knowledge of asset allocation and

portfolio construction.

Enhance communication and interpersonal skills

through client interaction (optional, depending on the

internship structure).

Project Outcomes: Through a combination of project-based learning,

case study discussions, and exposure to various

financial instruments, I will gain practical skills in:

Financial Planning & Wealth

Management: Creating financial plans and

managing investments for clients.

Mutual Funds: Understanding different

types of mutual funds and their applications.

Investment Analysis: Utilizing fundamental

and technical analysis to evaluate companies

and the overall market.

Portfolio Construction: Building

diversified portfolios with various asset

classes based on risk tolerance and

investment goals.

Risk Management: Identifying and

mitigating potential risks associated with

different investment strategies.

Derivative Markets & Swing Trading

(Optional): Gaining introductory knowledge

of derivative instruments and swing trading

strategies through dedicated courses (subject

to completion for sales target).

Methodology: Active participation in live projects on

financial planning and mutual funds.

Contributing to discussions and analysis of

case studies.

Conducting research and applying

fundamental and technical analysis

techniques.

Assisting in the development and

management of client portfolios (optional,

depending on the internship structure).

Completing online courses on derivative

markets and swing trading (optional, subject

to completion for sales target).

Completion of assigned projects on financial

planning and mutual funds.

Insights and contributions to case study

discussions.

Research reports based on fundamental and

technical analysis.

A well-diversified sample portfolio

(optional, depending on the internship

structure).

Completion certificates for derivative

markets and swing trading courses

(optional).

Timeline-

This internship will take place over a two-month

period

(May-June). First 2 weeks dedicated to learning

stock market fundamentals and key financial terms

with few assignments and projects. Then achieving

sales targets for two financial courses (deadlines:

May 20th and May 31st).Then delve into deeper

study of Equity Research & Portfolio Management

through:

Live projects (financial planning, mutual

funds)

Case study discussions

Advanced analysis (fundamental &

technical)

Potential portfolio construction

Plan of Action: Phase 1: Initial Learning & Sales Focus (First 4

Weeks)

Weeks 1-2:

o Devour foundational stock market

knowledge and key financial terms

through self-directed learning and

provided resources.

o Familiarize yourself with the

internship program structure and

expectations.

Weeks 3-4:

o Prioritize achieving the sales target

of Rs. 28,000 for Piyush Sir's course

on derivative markets.

o Alongside sales efforts, begin

exploring Equity Research &

Portfolio Management concepts

through assigned readings, online

resources, or introductory modules.

Phase 2: Advanced Studies & Project Work (Mid

May - July)

Sales Deadlines:

o May 20th: Achieve sales target for

the first course (derivative markets).

o May 31st: Achieve sales target for

the second course (swing trading).

Deep Dive into Equity Research &

Portfolio Management:

o Live Projects: Actively participate

in the assigned live projects on

financial planning and mutual funds.

o Case Studies: Engage in discussions

and apply theoretical knowledge to

real-world scenarios presented in

case studies.

o Advanced Analysis: Conduct in-

depth research and apply

fundamental and technical analysis

techniques to real companies and

market data.

o Potential Portfolio Construction:

If applicable, work on building a

sample portfolio based on the

knowledge gained throughout the

internship.

Ongoing Activities:

Communication & Networking: Maintain

open communication with the internship

supervisor and seek guidance when needed.

Build professional relationships with

colleagues and mentors within the program.

Time Management: Effectively manage

your time to balance sales efforts, project

work, and personal learning goals.

Reflection & Learning: Regularly reflect

on your progress, identify areas for

improvement.

Faculty Mentor- Dr Debaditya Mohanti

II. Organizational Details (If applicable):

Name: Finoability Pvt. Ltd.

Address: East India Works,19,RN Mukherjee Road, Esplanade,BBD Bagh,

Kolkata, West Bengal 700001

Tel Nos: 9051935342

Area of Business: Financial consulting

Name & Designation of the Mr. Piyush Agarwal

Head of the Organization: CO-FOUNDER & MANAGING DIRECTOR

III. Company Guide Contact Information (If applicable):

Name: Mr. Piyush Agarwal

Designation: Managing Director

Mobile No: 9051935342

E-mail: piyush@finoability.com

You might also like

- Chevrolet Cruze 2013 Repair ManualDocument8,212 pagesChevrolet Cruze 2013 Repair ManualPattinson Abel100% (16)

- Project Study ImmersionDocument33 pagesProject Study ImmersionCarla Alipio - LabawanNo ratings yet

- Bus 321: Strategic Business Management and Consulting SkillsDocument3 pagesBus 321: Strategic Business Management and Consulting SkillsangaNo ratings yet

- Portfolio Management and Investment DecisionDocument49 pagesPortfolio Management and Investment Decisionuditasinha85% (13)

- Syllabus Portfolio AUNDocument6 pagesSyllabus Portfolio AUNThu ThuNo ratings yet

- Credit Suisse IWM Summer Associate ProgramDocument1 pageCredit Suisse IWM Summer Associate ProgramWilson Guillaume ZhouNo ratings yet

- Information Risk Assessment Handbook 0.05 PDFDocument11 pagesInformation Risk Assessment Handbook 0.05 PDFJose Carlos Laura RamirezNo ratings yet

- The Accellion Service Guarantee: Group 6Document11 pagesThe Accellion Service Guarantee: Group 6Jyotsna GautamNo ratings yet

- Course Title: Financial Markets and PracticeDocument1 pageCourse Title: Financial Markets and PracticeRuchi KashyapNo ratings yet

- Course Outline - Investment Management - IIM Ranchi - 2018Document7 pagesCourse Outline - Investment Management - IIM Ranchi - 2018Ankit BhardwajNo ratings yet

- IAPMDocument7 pagesIAPMrossNo ratings yet

- Investment Manager - Spider ManagementDocument2 pagesInvestment Manager - Spider ManagementMarshay HallNo ratings yet

- Master in Finance CourseDocument9 pagesMaster in Finance CourseHanh NguyenNo ratings yet

- Iapm SyllabusDocument5 pagesIapm SyllabusAshish SinghNo ratings yet

- DBA 5005 Strategic Investment and Financing DecisionsDocument263 pagesDBA 5005 Strategic Investment and Financing DecisionsShrividhyaNo ratings yet

- Capital Markets 2020-30Document6 pagesCapital Markets 2020-30Andres Saavedra CameranoNo ratings yet

- Syllabus AssetManagementDocument1 pageSyllabus AssetManagementmarapopsqNo ratings yet

- Course Syllabus: Fall 2021Document7 pagesCourse Syllabus: Fall 2021Karim GhaddarNo ratings yet

- IIM Calcutta Brochure 30 DecDocument13 pagesIIM Calcutta Brochure 30 DecSandeep SinghNo ratings yet

- Brochure - Investment Strategies Online - 08-07-2022 - V22Document14 pagesBrochure - Investment Strategies Online - 08-07-2022 - V22Κομμουνιστικο ΣχέδιοNo ratings yet

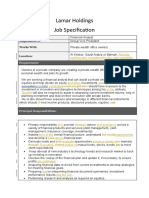

- Lamar Holdings - Job Specification - Financial Analyst - 8 Nov 20Document3 pagesLamar Holdings - Job Specification - Financial Analyst - 8 Nov 20abhinavg_9No ratings yet

- Syllabus Course Description: Courses/default - HTMLDocument4 pagesSyllabus Course Description: Courses/default - HTMLHayder KedirNo ratings yet

- Sanjivani College of Engineering (An Autonomous Institute) MBA DepartmentDocument6 pagesSanjivani College of Engineering (An Autonomous Institute) MBA DepartmentAkash PawarNo ratings yet

- PM1Document3 pagesPM1hardikjain1819No ratings yet

- VCPEDocument131 pagesVCPEsheetalmundada1803No ratings yet

- CTA Program DetailsDocument3 pagesCTA Program DetailsJennylyn BNo ratings yet

- Lexicon SAPM SyllabusDocument4 pagesLexicon SAPM SyllabusPushkarajNo ratings yet

- Portfolio Management - Advanced (May 21, 2020)Document2 pagesPortfolio Management - Advanced (May 21, 2020)Via Commerce Sdn BhdNo ratings yet

- CourseOutline - Corporate FinanceDocument10 pagesCourseOutline - Corporate FinanceYaarbaileeNo ratings yet

- Sapm SyllbusDocument2 pagesSapm SyllbusAaditya JhaNo ratings yet

- Applied Project and Infrastructure FinanceDocument5 pagesApplied Project and Infrastructure FinanceNeelakandan SiavathanuNo ratings yet

- International Business Management MSc-2Document17 pagesInternational Business Management MSc-2Leonard Clay AidooNo ratings yet

- Certificate Course in Equity Portfolio Management: AcademyDocument7 pagesCertificate Course in Equity Portfolio Management: Academyarijit maityNo ratings yet

- FM 05Document3 pagesFM 05roshandd2001No ratings yet

- Capital Structures and Debt ProductsDocument4 pagesCapital Structures and Debt ProductsJimNo ratings yet

- BlackRock 2020-2021 Investments Job DescriptionDocument13 pagesBlackRock 2020-2021 Investments Job DescriptionNora PetruțaNo ratings yet

- IBS-Bangalore A REPORT ON "The Study of Research in Portfolio Management" ATDocument27 pagesIBS-Bangalore A REPORT ON "The Study of Research in Portfolio Management" ATsandeep guptaNo ratings yet

- Project Finance Set 2Document7 pagesProject Finance Set 2Titus ClementNo ratings yet

- Moodys CdmsDocument2 pagesMoodys CdmssaurabhanandsuccessNo ratings yet

- BBA IV Investment AnanalysisDocument9 pagesBBA IV Investment Ananalysisshubham JaiswalNo ratings yet

- Investing in Stock MarketsDocument2 pagesInvesting in Stock MarketsJobin George100% (1)

- Ahore Chool OF Conomics: Investments (FNC-402)Document8 pagesAhore Chool OF Conomics: Investments (FNC-402)muazNo ratings yet

- Gujarat Technological UniversityDocument4 pagesGujarat Technological UniversityAnisha KizhppulliNo ratings yet

- 2022 2023 Flexible MSC Programme Module ScheduleDocument2 pages2022 2023 Flexible MSC Programme Module ScheduleJeffrey YeeNo ratings yet

- Security Analysis and Portfolio Management: School of CommerceDocument74 pagesSecurity Analysis and Portfolio Management: School of CommerceashishNo ratings yet

- Financial Services Portfolio ManagementDocument21 pagesFinancial Services Portfolio ManagementManas GoliNo ratings yet

- Fundamentals of Project FinanceDocument4 pagesFundamentals of Project FinanceJimNo ratings yet

- B.Sc. Finance Program ObjectivesDocument8 pagesB.Sc. Finance Program Objectivessohamc596No ratings yet

- Strategic Finance Syllabus 2017Document9 pagesStrategic Finance Syllabus 2017Alifya ZahranaNo ratings yet

- Rise of Thematic Investing PDFDocument6 pagesRise of Thematic Investing PDFKirankumarNo ratings yet

- TCS-JD - R&iDocument1 pageTCS-JD - R&iarijitNo ratings yet

- Unit IDocument27 pagesUnit IAnonymous kp2fNmwNAUNo ratings yet

- Corporate Finance Course OutlineDocument6 pagesCorporate Finance Course OutlineHaroon Z. ChoudhryNo ratings yet

- Accounting Shenanigans y Lectura NICDocument17 pagesAccounting Shenanigans y Lectura NICJavierNo ratings yet

- Siddharth HRMDocument5 pagesSiddharth HRMSiddharthNo ratings yet

- Investment Banking CertificationDocument9 pagesInvestment Banking Certificationvictor andrésNo ratings yet

- M.Sc. Finance Program ObjectiveDocument3 pagesM.Sc. Finance Program ObjectiveMeet BhattiNo ratings yet

- Project Development CycleDocument2 pagesProject Development CycleTina ParkNo ratings yet

- Course Specification-MKTG-2401 - MSHDocument5 pagesCourse Specification-MKTG-2401 - MSHAbrar Alam ChowdhuryNo ratings yet

- Program of High DistinctionDocument2 pagesProgram of High DistinctiondeepakNo ratings yet

- The Certified Project Portfolio ManagerFrom EverandThe Certified Project Portfolio ManagerRating: 5 out of 5 stars5/5 (1)

- How to Create and Maintain a Diversified Investment Portfolio: A Comprehensive Guide on Investment and Portfolio ManagementFrom EverandHow to Create and Maintain a Diversified Investment Portfolio: A Comprehensive Guide on Investment and Portfolio ManagementNo ratings yet

- Top 10 Risks in Telecommunications 2010: Internal Briefing For Ernst & Young's Audit TeamsDocument19 pagesTop 10 Risks in Telecommunications 2010: Internal Briefing For Ernst & Young's Audit TeamsEmil JabrailzadehNo ratings yet

- Risk and Risk ManagementDocument18 pagesRisk and Risk ManagementJyothi RameshNo ratings yet

- AUD CIS QuizDocument2 pagesAUD CIS QuizKath ONo ratings yet

- Final Microfinance Lending and Risk ManagementDocument241 pagesFinal Microfinance Lending and Risk ManagementSabelo100% (2)

- Permit To Work ProcedureDocument5 pagesPermit To Work ProceduresinghajitbNo ratings yet

- RPM AssignmentDocument8 pagesRPM AssignmentKealeboga Duece ThoboloNo ratings yet

- A Study On Investment Behaviour of Teachers With Special ReferenceDocument58 pagesA Study On Investment Behaviour of Teachers With Special ReferenceShoaib100% (1)

- Risk Based SurveilanceDocument170 pagesRisk Based SurveilanceEtanaNo ratings yet

- Climate Change Adaptation Planning: Risk Assessment For AirportsDocument118 pagesClimate Change Adaptation Planning: Risk Assessment For AirportsSnertNo ratings yet

- Filter Risk Assessment in Vaccine Processes Merck Life ScincesDocument34 pagesFilter Risk Assessment in Vaccine Processes Merck Life ScincesVijay Kumar NandagiriNo ratings yet

- National Resilience - EN (151-225)Document75 pagesNational Resilience - EN (151-225)jorge luis tejada cuelloNo ratings yet

- Omcl Management of ChangesDocument7 pagesOmcl Management of ChangesHans LeupoldNo ratings yet

- Sudh - 1407 - BSBINN601 Student Assessment Tasks V1.1 09-20Document41 pagesSudh - 1407 - BSBINN601 Student Assessment Tasks V1.1 09-20Kishor KhatriNo ratings yet

- Risk Assessment - Hot WorkDocument6 pagesRisk Assessment - Hot Workabdullah ashrafNo ratings yet

- Example Risk Assessment For Cold Storage Warehousing: Setting The SceneDocument6 pagesExample Risk Assessment For Cold Storage Warehousing: Setting The ScenesuremessyNo ratings yet

- The MMDA Is An Administrative Agency Created by RDocument10 pagesThe MMDA Is An Administrative Agency Created by RDeriq DavidNo ratings yet

- A Guide To The Well Aspects of The Offshore Installations and Wells (Design and Construction, Etc) Regulations 1996Document22 pagesA Guide To The Well Aspects of The Offshore Installations and Wells (Design and Construction, Etc) Regulations 1996Kris WilochNo ratings yet

- Intro To Disaster Readiness and Risk ReductionDocument20 pagesIntro To Disaster Readiness and Risk ReductionElmer TamayaoNo ratings yet

- Nebosh: Management of Health and Safety Unit Ig1Document5 pagesNebosh: Management of Health and Safety Unit Ig1Mohamed Abdullah0% (1)

- What Is Stop Work Authority (SWA) ?Document4 pagesWhat Is Stop Work Authority (SWA) ?Denny Kurniawan PrawiraNo ratings yet

- Rawlinson Etal, The Voice of Breast Cancer in Medicine & Bioethics 2006Document221 pagesRawlinson Etal, The Voice of Breast Cancer in Medicine & Bioethics 2006Luis GrailletNo ratings yet

- Psychiatry and The Control of Dangerousness: On The Apotropaic Function of The Term "Mental Illness" by Thomas SzaszDocument12 pagesPsychiatry and The Control of Dangerousness: On The Apotropaic Function of The Term "Mental Illness" by Thomas SzaszNicolas MartinNo ratings yet

- 1 Prospectus FinalDocument283 pages1 Prospectus FinalLaxmikant RathiNo ratings yet

- Man Sci Case Study FINALDocument19 pagesMan Sci Case Study FINALMai Mai VarelaNo ratings yet

- Risk AssessmentDocument38 pagesRisk AssessmentYasar arafat SHNo ratings yet

- Abnormal Psych Book NotesDocument26 pagesAbnormal Psych Book NotesMar PucilloNo ratings yet

- 7 Lessons For Leading in Crisis LeadersDocument11 pages7 Lessons For Leading in Crisis LeadersStateAsset OCMNo ratings yet