Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

1 viewsValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página893

Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página893

Uploaded by

franzmartiniiCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Health Imaging and Informatics (CIIP) Study Guide TOCDocument5 pagesHealth Imaging and Informatics (CIIP) Study Guide TOCShriekanth IyerNo ratings yet

- CH 07Document99 pagesCH 07baldoewszxc80% (5)

- 1.hair Loss Blueprint ReviewDocument2 pages1.hair Loss Blueprint ReviewJunior GomesNo ratings yet

- Habib Oil Complete ProjectDocument20 pagesHabib Oil Complete ProjectNadeem73% (15)

- Prject Report Financial Statement of NestleDocument14 pagesPrject Report Financial Statement of NestleSumia Hoque NovaNo ratings yet

- Index: Accounting Changes and Error Corrections (FASDocument16 pagesIndex: Accounting Changes and Error Corrections (FASSilvana ValenciaNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página888Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página888franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página897Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página897franzmartiniiNo ratings yet

- Index: Accounting For Dummies (Tracy), 1Document10 pagesIndex: Accounting For Dummies (Tracy), 1ananthkrishnan18No ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página892Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página892franzmartiniiNo ratings yet

- ch07 Lecture Notes 1Document95 pagesch07 Lecture Notes 1micolleNo ratings yet

- Frank Wood's Business Accounting (PDFDrive - Com) - 42 PDFDocument9 pagesFrank Wood's Business Accounting (PDFDrive - Com) - 42 PDFlordNo ratings yet

- Amazon Com Inc (Amzn) : $ in MillionsDocument12 pagesAmazon Com Inc (Amzn) : $ in MillionsKrutika PhutaneNo ratings yet

- 2017 L3 Cumulative IndexDocument62 pages2017 L3 Cumulative IndexNicholas H. WuNo ratings yet

- CH 07Document99 pagesCH 07baldoewszxcNo ratings yet

- Partnership Formation, Operation, and Change in Ownership: Summary of Items by TopicDocument676 pagesPartnership Formation, Operation, and Change in Ownership: Summary of Items by TopicAera GarcesNo ratings yet

- V Processes: ProcessDocument1 pageV Processes: ProcesssalmanNo ratings yet

- IFSA Income StatementDocument2 pagesIFSA Income StatementYaesnavy ParamesvaranNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página889Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página889franzmartiniiNo ratings yet

- Walt Disney Co., Consolidated Statement of Cash FlowsDocument2 pagesWalt Disney Co., Consolidated Statement of Cash FlowsDion ParamartaNo ratings yet

- INDEXDocument1 pageINDEXnaga naveenNo ratings yet

- Condensed Consolidated Income StatementDocument26 pagesCondensed Consolidated Income StatementIhdaNo ratings yet

- Balance Sheet Bien HechoDocument21 pagesBalance Sheet Bien HechoRicardo PuyolNo ratings yet

- Sunway Berhad Comparative Income StatementDocument16 pagesSunway Berhad Comparative Income StatementYaesnavy ParamesvaranNo ratings yet

- MA by Kayode FatounbiDocument586 pagesMA by Kayode Fatounbisharonroseauthor1No ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página895Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página895franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página890Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página890franzmartiniiNo ratings yet

- 2016 Adira Finance Annual ReportDocument610 pages2016 Adira Finance Annual ReportHendra GuntoroNo ratings yet

- DRAFT ERP Fit-Gap Matrix-Vendor Scorecard 1119 FinalDocument162 pagesDRAFT ERP Fit-Gap Matrix-Vendor Scorecard 1119 FinalMOORTHY.KENo ratings yet

- Standalone Financials CompressedDocument119 pagesStandalone Financials CompressednitinNo ratings yet

- Krsnaa Diagnostics PVT LTD - v2Document67 pagesKrsnaa Diagnostics PVT LTD - v2HariharanNo ratings yet

- Cash Flow Statement For Group and SegmentsDocument2 pagesCash Flow Statement For Group and Segmentstry6y6hmhbNo ratings yet

- Corporate ReportingDocument8 pagesCorporate ReportingFarhana HaqueNo ratings yet

- Balance Sheet Summary Cash Flow Summary: (AED M) 2014 2015 (AED M) 2014Document18 pagesBalance Sheet Summary Cash Flow Summary: (AED M) 2014 2015 (AED M) 2014Mohammad ElabedNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página894Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página894franzmartiniiNo ratings yet

- Jobstreet Mar2014Document14 pagesJobstreet Mar2014suksesNo ratings yet

- Particulars (INR in Crores) FY2015A FY2016A FY2017A FY2018ADocument5 pagesParticulars (INR in Crores) FY2015A FY2016A FY2017A FY2018AhbyhNo ratings yet

- EOG ResourcesDocument16 pagesEOG ResourcesAshish PatwardhanNo ratings yet

- Hanan FMDocument5 pagesHanan FMmahamamir012No ratings yet

- GHFHDocument1 pageGHFHsufyanbutt952No ratings yet

- Adani Enterprises Limited: Consolidated Statement of Cash FlowsDocument14 pagesAdani Enterprises Limited: Consolidated Statement of Cash Flowsshahin selkarNo ratings yet

- FS & RatiosDocument18 pagesFS & RatiosRehan RajaNo ratings yet

- UntitledDocument4 pagesUntitledKiran NaiduNo ratings yet

- Quarterly Highlights 2nd Quarter FY 2079-80 (Published)Document5 pagesQuarterly Highlights 2nd Quarter FY 2079-80 (Published)baijumuskan417No ratings yet

- Enterprise Valuation of BEACON Pharmaceuticals Limited: Submitted ToDocument35 pagesEnterprise Valuation of BEACON Pharmaceuticals Limited: Submitted ToMD.Thariqul Islam 1411347630No ratings yet

- HSC Báo Cáo Tài ChínhDocument8 pagesHSC Báo Cáo Tài ChínhNgọc Dương Thị BảoNo ratings yet

- Purefoods Financial Statements 2018-2021Document8 pagesPurefoods Financial Statements 2018-2021Kyle Denise Castillo VelascoNo ratings yet

- 2017 q1 Pro Forma FinancialDocument9 pages2017 q1 Pro Forma FinancialMahoy SamNo ratings yet

- Be Innovative in A Challenging Era: Annual ReportDocument214 pagesBe Innovative in A Challenging Era: Annual ReportbanyuajiyudhaNo ratings yet

- BALANCE SHEET As Per 31st March 2020: Particulars Current AssestsDocument6 pagesBALANCE SHEET As Per 31st March 2020: Particulars Current AssestsPrafful VyasNo ratings yet

- Exide Pakistan Limited: Five Year Financial AnalysisDocument13 pagesExide Pakistan Limited: Five Year Financial AnalysisziaNo ratings yet

- Spreads-Natasha Sales Marketing Corp-2022 AFSDocument7 pagesSpreads-Natasha Sales Marketing Corp-2022 AFSAmino BenitoNo ratings yet

- VTP Asset Management RatioDocument3 pagesVTP Asset Management RatioKimanh TranNo ratings yet

- IMT CeresDocument9 pagesIMT CeressukhvindertaakNo ratings yet

- Company Law Complete Book June-23Document596 pagesCompany Law Complete Book June-23vanshikanegibtsNo ratings yet

- Tek Düzen Hesap Plani (The Uniform Chart of Accounts)Document14 pagesTek Düzen Hesap Plani (The Uniform Chart of Accounts)dinaNo ratings yet

- Rosine China Holdings Limited - ExcelDocument116 pagesRosine China Holdings Limited - ExcelRobert ManjoNo ratings yet

- Alkem LabroriesDocument17 pagesAlkem LabroriesMukesh kumar singh BoraNo ratings yet

- Projected Financial StatementsDocument2 pagesProjected Financial StatementsRobert Dominic GonzalesNo ratings yet

- Business Plan - Manila Broadcasting Company Andaya, Bagcal, Chy, Navato, Pili, Viernes Projected Financial StatementsDocument2 pagesBusiness Plan - Manila Broadcasting Company Andaya, Bagcal, Chy, Navato, Pili, Viernes Projected Financial StatementsRobert Dominic GonzalesNo ratings yet

- Business Plan - Manila Broadcasting Company Andaya, Bagcal, Chy, Navato, Pili, Viernes Projected Financial StatementsDocument2 pagesBusiness Plan - Manila Broadcasting Company Andaya, Bagcal, Chy, Navato, Pili, Viernes Projected Financial StatementsRobert Dominic GonzalesNo ratings yet

- Abdul Wasay Roll No 53. Sec ADocument51 pagesAbdul Wasay Roll No 53. Sec AMuhammad Hammad RajputNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página860Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página860franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página863Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página863franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página866Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página866franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página862Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página862franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página880Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página880franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página865Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página865franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página876Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página876franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página871Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página871franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página870Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página870franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página861Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página861franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página882Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página882franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página868Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página868franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página867Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página867franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página864Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página864franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página885Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página885franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página878Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página878franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página883Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página883franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página872Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página872franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página874Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página874franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página877Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página877franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página859Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página859franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página869Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página869franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página879Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página879franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página875Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página875franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página892Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página892franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página888Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página888franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página887Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página887franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página873Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página873franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página858Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página858franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página891Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página891franzmartiniiNo ratings yet

- MCS - Delhi-NCR Moot (Compiled)Document13 pagesMCS - Delhi-NCR Moot (Compiled)adarsh walavalkarNo ratings yet

- SITXHRM002 Roster Staff Student Guide V1.1 1 .Docx 1 PDFDocument91 pagesSITXHRM002 Roster Staff Student Guide V1.1 1 .Docx 1 PDFNicolas EscobarNo ratings yet

- Group 3 MKT330Document28 pagesGroup 3 MKT330MD. MOWDUD HASAN LALON 1632830630No ratings yet

- HI LO Flows 04 03Document1 pageHI LO Flows 04 03Vijaita Vikas GandhiNo ratings yet

- A Geographical Analysis of Cashewnut Processing Industry Maharashtra PDFDocument24 pagesA Geographical Analysis of Cashewnut Processing Industry Maharashtra PDFRahul PatilNo ratings yet

- Reviewer in Economic DevelopmentDocument25 pagesReviewer in Economic DevelopmentFeane LamasanNo ratings yet

- Name of The Trade - Turner - 4 Semester NSQF - Module 1 - Introduction To CNCDocument20 pagesName of The Trade - Turner - 4 Semester NSQF - Module 1 - Introduction To CNCKewal SahuNo ratings yet

- Enterprise AI Transformation in 2024Document128 pagesEnterprise AI Transformation in 2024avinashr139No ratings yet

- Chapter 18 Bond Fundamentals & ValuationDocument76 pagesChapter 18 Bond Fundamentals & ValuationShahriar PhenomenallNo ratings yet

- Shopper Marketig DiageoDocument54 pagesShopper Marketig DiageoftelenaNo ratings yet

- Unit 10Document3 pagesUnit 10Husam Nusair100% (1)

- The Power of Media and InformationDocument17 pagesThe Power of Media and InformationEajay RosumanNo ratings yet

- Summer Internship Project 1Document53 pagesSummer Internship Project 1Karishma Bisht100% (1)

- T Fraser, Motif and Meath Cash Flow QuestionsDocument5 pagesT Fraser, Motif and Meath Cash Flow Questionschalah DeriNo ratings yet

- Ridi Antyaningrum - KapulagaDocument8 pagesRidi Antyaningrum - KapulagaridiantyaningrumNo ratings yet

- Practice+Test OverviewDocument2 pagesPractice+Test OverviewJuaymah MarieNo ratings yet

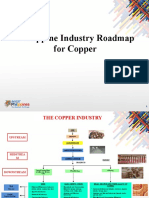

- Philippine Industry Roadmap For CopperDocument21 pagesPhilippine Industry Roadmap For CopperJun VelosoNo ratings yet

- PB Xii Economics 2023-24Document7 pagesPB Xii Economics 2023-24nhag720207No ratings yet

- Narration Jun-12 Jun-13 Jun-14 Jun-15 Mar-16 Mar-17 Mar-18 Mar-19 Mar-20 Mar-21 Trailing Best Case Worst CaseDocument9 pagesNarration Jun-12 Jun-13 Jun-14 Jun-15 Mar-16 Mar-17 Mar-18 Mar-19 Mar-20 Mar-21 Trailing Best Case Worst Casejatan keniaNo ratings yet

- Provisions Relevant To Women R.A. 11054Document23 pagesProvisions Relevant To Women R.A. 11054Kevin LavinaNo ratings yet

- 62af37535921f Consulting Live Project ProgramDocument13 pages62af37535921f Consulting Live Project Programaman03921201721No ratings yet

- NWC PM Manual - Road Map NWC PM Manual - Road Map NWC PM Manual - Road MapDocument10 pagesNWC PM Manual - Road Map NWC PM Manual - Road Map NWC PM Manual - Road MapEng hassan hussienNo ratings yet

- Kristijan Krkač - Professional CV and Bibliography 1996-2023Document19 pagesKristijan Krkač - Professional CV and Bibliography 1996-2023kristijankrkac100% (1)

- Stat Module 2Document5 pagesStat Module 2Bernadette PascuaNo ratings yet

- AugsDocument1 pageAugskmrchetan94No ratings yet

- Yokohama Tire Vs Yokohama EUDocument3 pagesYokohama Tire Vs Yokohama EUJohnday MartirezNo ratings yet

- Bagia NurseryDocument12 pagesBagia Nurseryrock starNo ratings yet

Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página893

Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página893

Uploaded by

franzmartinii0 ratings0% found this document useful (0 votes)

1 views1 pageOriginal Title

Valuation Measuring and Managing the Value of Companies by Tim Koller, Marc Goedhart, David Wessels-página893

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

1 views1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página893

Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página893

Uploaded by

franzmartiniiCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

INDEX 873

Noncontrolling interests, 190–191, key concepts, 208–209

221, 354–355. See also in multiple business units, 402

Nonconsolidated subsidiaries for operating leases, 447–448

Nonequity claims, 180, 189–191, 335 Novartis, 598–599

Nonfinancial operating drivers,

281–282 Off-balance-sheet financing, 662–664

Nonfundamental investors, 101 One-time expenses, 427–428

Nonoperating assets, 216–218, 337– Operating analysis, 245–247

341 Operating cash flows, projecting/

discontinued operations, 342 testing, 637–638

excess cash and marketable Operating-cost productivity, 556

securities, 338 Operating expenses:

excess pension assets, 343 forecasting, 269

excess real estate, 342 separating from nonoperating

finance subsidiaries, 341–342 expenses, 427–428, 428–430

forecasting, 277–278 Operating leases, 234–236, 347, 443–455

identifying/valuing, 180, 189 accounting for, 444–446

loans to other companies, 341 alternative method for, 453–454

nonconsolidated subsidiaries, capitalized, 235–236

338–341 enterprise DCF model, 190

tax loss carryforwards, 343–344 enterprise valuation with, 446–448

Nonoperating expenses, 427–442 as form of debt, 446

amortization of acquired free cash flow, 448–449

intangibles, 432–435 incorporating into financial

asset write-offs, 433 projections, 449

defined, 335, 427 valuing, 453–454

gains/losses on sale of assets, 435 Operating margins:

intangibles, 432–435 in high-growth companies, 717–718

litigation charges, 434–435 and inflation, 499

one-time vs. ongoing, 427–428 Operating metrics, multiples of,

persistence of special items, 431 386–389

reorganizing income statement, 437 Operating taxes:

restructuring charges, 433–434 accrual-based, 419–421

separating from operating expenses, converting to operating cash taxes,

427–428, 428–430 419–423

special items, 431 deferred, 423–425

Nonoperating income, 232, 270–271 on reorganized balance sheet,

Nonoperating taxes, 232 423–424

NOPAT (net operating profit valuing, 424–425

aftertaxes), 213–214 determining, 413–419

calculating, 221–227 public statements, 415–417

continuing value and, 288–289, Walmart, 418–419

300–301 estimating, 224–226

defined, 49, 205, 206 forecasting, 272–273

You might also like

- Health Imaging and Informatics (CIIP) Study Guide TOCDocument5 pagesHealth Imaging and Informatics (CIIP) Study Guide TOCShriekanth IyerNo ratings yet

- CH 07Document99 pagesCH 07baldoewszxc80% (5)

- 1.hair Loss Blueprint ReviewDocument2 pages1.hair Loss Blueprint ReviewJunior GomesNo ratings yet

- Habib Oil Complete ProjectDocument20 pagesHabib Oil Complete ProjectNadeem73% (15)

- Prject Report Financial Statement of NestleDocument14 pagesPrject Report Financial Statement of NestleSumia Hoque NovaNo ratings yet

- Index: Accounting Changes and Error Corrections (FASDocument16 pagesIndex: Accounting Changes and Error Corrections (FASSilvana ValenciaNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página888Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página888franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página897Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página897franzmartiniiNo ratings yet

- Index: Accounting For Dummies (Tracy), 1Document10 pagesIndex: Accounting For Dummies (Tracy), 1ananthkrishnan18No ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página892Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página892franzmartiniiNo ratings yet

- ch07 Lecture Notes 1Document95 pagesch07 Lecture Notes 1micolleNo ratings yet

- Frank Wood's Business Accounting (PDFDrive - Com) - 42 PDFDocument9 pagesFrank Wood's Business Accounting (PDFDrive - Com) - 42 PDFlordNo ratings yet

- Amazon Com Inc (Amzn) : $ in MillionsDocument12 pagesAmazon Com Inc (Amzn) : $ in MillionsKrutika PhutaneNo ratings yet

- 2017 L3 Cumulative IndexDocument62 pages2017 L3 Cumulative IndexNicholas H. WuNo ratings yet

- CH 07Document99 pagesCH 07baldoewszxcNo ratings yet

- Partnership Formation, Operation, and Change in Ownership: Summary of Items by TopicDocument676 pagesPartnership Formation, Operation, and Change in Ownership: Summary of Items by TopicAera GarcesNo ratings yet

- V Processes: ProcessDocument1 pageV Processes: ProcesssalmanNo ratings yet

- IFSA Income StatementDocument2 pagesIFSA Income StatementYaesnavy ParamesvaranNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página889Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página889franzmartiniiNo ratings yet

- Walt Disney Co., Consolidated Statement of Cash FlowsDocument2 pagesWalt Disney Co., Consolidated Statement of Cash FlowsDion ParamartaNo ratings yet

- INDEXDocument1 pageINDEXnaga naveenNo ratings yet

- Condensed Consolidated Income StatementDocument26 pagesCondensed Consolidated Income StatementIhdaNo ratings yet

- Balance Sheet Bien HechoDocument21 pagesBalance Sheet Bien HechoRicardo PuyolNo ratings yet

- Sunway Berhad Comparative Income StatementDocument16 pagesSunway Berhad Comparative Income StatementYaesnavy ParamesvaranNo ratings yet

- MA by Kayode FatounbiDocument586 pagesMA by Kayode Fatounbisharonroseauthor1No ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página895Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página895franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página890Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página890franzmartiniiNo ratings yet

- 2016 Adira Finance Annual ReportDocument610 pages2016 Adira Finance Annual ReportHendra GuntoroNo ratings yet

- DRAFT ERP Fit-Gap Matrix-Vendor Scorecard 1119 FinalDocument162 pagesDRAFT ERP Fit-Gap Matrix-Vendor Scorecard 1119 FinalMOORTHY.KENo ratings yet

- Standalone Financials CompressedDocument119 pagesStandalone Financials CompressednitinNo ratings yet

- Krsnaa Diagnostics PVT LTD - v2Document67 pagesKrsnaa Diagnostics PVT LTD - v2HariharanNo ratings yet

- Cash Flow Statement For Group and SegmentsDocument2 pagesCash Flow Statement For Group and Segmentstry6y6hmhbNo ratings yet

- Corporate ReportingDocument8 pagesCorporate ReportingFarhana HaqueNo ratings yet

- Balance Sheet Summary Cash Flow Summary: (AED M) 2014 2015 (AED M) 2014Document18 pagesBalance Sheet Summary Cash Flow Summary: (AED M) 2014 2015 (AED M) 2014Mohammad ElabedNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página894Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página894franzmartiniiNo ratings yet

- Jobstreet Mar2014Document14 pagesJobstreet Mar2014suksesNo ratings yet

- Particulars (INR in Crores) FY2015A FY2016A FY2017A FY2018ADocument5 pagesParticulars (INR in Crores) FY2015A FY2016A FY2017A FY2018AhbyhNo ratings yet

- EOG ResourcesDocument16 pagesEOG ResourcesAshish PatwardhanNo ratings yet

- Hanan FMDocument5 pagesHanan FMmahamamir012No ratings yet

- GHFHDocument1 pageGHFHsufyanbutt952No ratings yet

- Adani Enterprises Limited: Consolidated Statement of Cash FlowsDocument14 pagesAdani Enterprises Limited: Consolidated Statement of Cash Flowsshahin selkarNo ratings yet

- FS & RatiosDocument18 pagesFS & RatiosRehan RajaNo ratings yet

- UntitledDocument4 pagesUntitledKiran NaiduNo ratings yet

- Quarterly Highlights 2nd Quarter FY 2079-80 (Published)Document5 pagesQuarterly Highlights 2nd Quarter FY 2079-80 (Published)baijumuskan417No ratings yet

- Enterprise Valuation of BEACON Pharmaceuticals Limited: Submitted ToDocument35 pagesEnterprise Valuation of BEACON Pharmaceuticals Limited: Submitted ToMD.Thariqul Islam 1411347630No ratings yet

- HSC Báo Cáo Tài ChínhDocument8 pagesHSC Báo Cáo Tài ChínhNgọc Dương Thị BảoNo ratings yet

- Purefoods Financial Statements 2018-2021Document8 pagesPurefoods Financial Statements 2018-2021Kyle Denise Castillo VelascoNo ratings yet

- 2017 q1 Pro Forma FinancialDocument9 pages2017 q1 Pro Forma FinancialMahoy SamNo ratings yet

- Be Innovative in A Challenging Era: Annual ReportDocument214 pagesBe Innovative in A Challenging Era: Annual ReportbanyuajiyudhaNo ratings yet

- BALANCE SHEET As Per 31st March 2020: Particulars Current AssestsDocument6 pagesBALANCE SHEET As Per 31st March 2020: Particulars Current AssestsPrafful VyasNo ratings yet

- Exide Pakistan Limited: Five Year Financial AnalysisDocument13 pagesExide Pakistan Limited: Five Year Financial AnalysisziaNo ratings yet

- Spreads-Natasha Sales Marketing Corp-2022 AFSDocument7 pagesSpreads-Natasha Sales Marketing Corp-2022 AFSAmino BenitoNo ratings yet

- VTP Asset Management RatioDocument3 pagesVTP Asset Management RatioKimanh TranNo ratings yet

- IMT CeresDocument9 pagesIMT CeressukhvindertaakNo ratings yet

- Company Law Complete Book June-23Document596 pagesCompany Law Complete Book June-23vanshikanegibtsNo ratings yet

- Tek Düzen Hesap Plani (The Uniform Chart of Accounts)Document14 pagesTek Düzen Hesap Plani (The Uniform Chart of Accounts)dinaNo ratings yet

- Rosine China Holdings Limited - ExcelDocument116 pagesRosine China Holdings Limited - ExcelRobert ManjoNo ratings yet

- Alkem LabroriesDocument17 pagesAlkem LabroriesMukesh kumar singh BoraNo ratings yet

- Projected Financial StatementsDocument2 pagesProjected Financial StatementsRobert Dominic GonzalesNo ratings yet

- Business Plan - Manila Broadcasting Company Andaya, Bagcal, Chy, Navato, Pili, Viernes Projected Financial StatementsDocument2 pagesBusiness Plan - Manila Broadcasting Company Andaya, Bagcal, Chy, Navato, Pili, Viernes Projected Financial StatementsRobert Dominic GonzalesNo ratings yet

- Business Plan - Manila Broadcasting Company Andaya, Bagcal, Chy, Navato, Pili, Viernes Projected Financial StatementsDocument2 pagesBusiness Plan - Manila Broadcasting Company Andaya, Bagcal, Chy, Navato, Pili, Viernes Projected Financial StatementsRobert Dominic GonzalesNo ratings yet

- Abdul Wasay Roll No 53. Sec ADocument51 pagesAbdul Wasay Roll No 53. Sec AMuhammad Hammad RajputNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página860Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página860franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página863Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página863franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página866Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página866franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página862Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página862franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página880Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página880franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página865Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página865franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página876Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página876franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página871Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página871franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página870Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página870franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página861Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página861franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página882Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página882franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página868Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página868franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página867Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página867franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página864Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página864franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página885Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página885franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página878Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página878franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página883Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página883franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página872Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página872franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página874Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página874franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página877Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página877franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página859Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página859franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página869Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página869franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página879Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página879franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página875Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página875franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página892Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página892franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página888Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página888franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página887Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página887franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página873Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página873franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página858Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página858franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página891Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página891franzmartiniiNo ratings yet

- MCS - Delhi-NCR Moot (Compiled)Document13 pagesMCS - Delhi-NCR Moot (Compiled)adarsh walavalkarNo ratings yet

- SITXHRM002 Roster Staff Student Guide V1.1 1 .Docx 1 PDFDocument91 pagesSITXHRM002 Roster Staff Student Guide V1.1 1 .Docx 1 PDFNicolas EscobarNo ratings yet

- Group 3 MKT330Document28 pagesGroup 3 MKT330MD. MOWDUD HASAN LALON 1632830630No ratings yet

- HI LO Flows 04 03Document1 pageHI LO Flows 04 03Vijaita Vikas GandhiNo ratings yet

- A Geographical Analysis of Cashewnut Processing Industry Maharashtra PDFDocument24 pagesA Geographical Analysis of Cashewnut Processing Industry Maharashtra PDFRahul PatilNo ratings yet

- Reviewer in Economic DevelopmentDocument25 pagesReviewer in Economic DevelopmentFeane LamasanNo ratings yet

- Name of The Trade - Turner - 4 Semester NSQF - Module 1 - Introduction To CNCDocument20 pagesName of The Trade - Turner - 4 Semester NSQF - Module 1 - Introduction To CNCKewal SahuNo ratings yet

- Enterprise AI Transformation in 2024Document128 pagesEnterprise AI Transformation in 2024avinashr139No ratings yet

- Chapter 18 Bond Fundamentals & ValuationDocument76 pagesChapter 18 Bond Fundamentals & ValuationShahriar PhenomenallNo ratings yet

- Shopper Marketig DiageoDocument54 pagesShopper Marketig DiageoftelenaNo ratings yet

- Unit 10Document3 pagesUnit 10Husam Nusair100% (1)

- The Power of Media and InformationDocument17 pagesThe Power of Media and InformationEajay RosumanNo ratings yet

- Summer Internship Project 1Document53 pagesSummer Internship Project 1Karishma Bisht100% (1)

- T Fraser, Motif and Meath Cash Flow QuestionsDocument5 pagesT Fraser, Motif and Meath Cash Flow Questionschalah DeriNo ratings yet

- Ridi Antyaningrum - KapulagaDocument8 pagesRidi Antyaningrum - KapulagaridiantyaningrumNo ratings yet

- Practice+Test OverviewDocument2 pagesPractice+Test OverviewJuaymah MarieNo ratings yet

- Philippine Industry Roadmap For CopperDocument21 pagesPhilippine Industry Roadmap For CopperJun VelosoNo ratings yet

- PB Xii Economics 2023-24Document7 pagesPB Xii Economics 2023-24nhag720207No ratings yet

- Narration Jun-12 Jun-13 Jun-14 Jun-15 Mar-16 Mar-17 Mar-18 Mar-19 Mar-20 Mar-21 Trailing Best Case Worst CaseDocument9 pagesNarration Jun-12 Jun-13 Jun-14 Jun-15 Mar-16 Mar-17 Mar-18 Mar-19 Mar-20 Mar-21 Trailing Best Case Worst Casejatan keniaNo ratings yet

- Provisions Relevant To Women R.A. 11054Document23 pagesProvisions Relevant To Women R.A. 11054Kevin LavinaNo ratings yet

- 62af37535921f Consulting Live Project ProgramDocument13 pages62af37535921f Consulting Live Project Programaman03921201721No ratings yet

- NWC PM Manual - Road Map NWC PM Manual - Road Map NWC PM Manual - Road MapDocument10 pagesNWC PM Manual - Road Map NWC PM Manual - Road Map NWC PM Manual - Road MapEng hassan hussienNo ratings yet

- Kristijan Krkač - Professional CV and Bibliography 1996-2023Document19 pagesKristijan Krkač - Professional CV and Bibliography 1996-2023kristijankrkac100% (1)

- Stat Module 2Document5 pagesStat Module 2Bernadette PascuaNo ratings yet

- AugsDocument1 pageAugskmrchetan94No ratings yet

- Yokohama Tire Vs Yokohama EUDocument3 pagesYokohama Tire Vs Yokohama EUJohnday MartirezNo ratings yet

- Bagia NurseryDocument12 pagesBagia Nurseryrock starNo ratings yet