Professional Documents

Culture Documents

Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página895

Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página895

Uploaded by

franzmartinii0 ratings0% found this document useful (0 votes)

2 views1 pageOriginal Title

Valuation Measuring and Managing the Value of Companies by Tim Koller, Marc Goedhart, David Wessels-página895

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

2 views1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página895

Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página895

Uploaded by

franzmartiniiCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

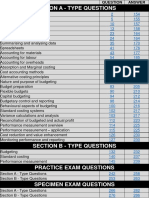

INDEX 875

Restructuring reserves, 233 relationship to growth and cash

Retirement liabilities, unfunded, 190, flow, 29–33

457–465 stability of, 148–152

Return on assets (ROA), 240 stock returns, 106–107

Return on invested capital (ROIC), 18– Return on new invested capital

19, 20–21, 127–154, 239–247, 294 (RONIC), 288, 289, 294, 298

alternative measures of, 483–491 Revenue forecasting, 265–267

cash flow return on investment Revenue growth, 155–172. See also

(CFROI), 485–490 Growth

analyzing analyzing, 247–253

goodwill and acquired accounting changes and

intangibles, 241–242 irregularities, 251–253

balancing with growth, 24–25 currency effects, 248–249

capitalizing expenses investments, mergers and acquisitions, 249–250

467–475 from attracting new customers, 161

capital-light business models, and balance with ROIC, 155

475–478 decay analysis, 171–172

competitive advantage and, 131–139 decomposing, 251–253

cost and capital efficiency and digital initiatives, 95–96

advantages, 135 drivers of, 156–158

decay analysis, 150–152 empirical analysis, 167–172

decomposing, 242–247 and ESG, 86–87

defined, 49–50, 205 historical trends, 168–169

differences across industries, 144–148 from increasing market share, 161

drivers of, 128–131 from new product development,

effect of acquisitions on, 152 160

empirical analysis, 141–152 from persuading existing customers

equaling IRR, 484–485 to buy more product, 160–161

focus on high- vs. low-ROIC projecting, 186–188

companies, 28 rates across industries, 169–170

in forecasting, 262, 281 sustaining, 163–167, 171–172

in high-growth companies, 717–718 through acquisitions, 162–163

historic trends, 141–142 through incremental innovation,

interaction between growth and, 161

27–29, 36–40 through price increases, 162

and length of product life cycle, 139 through product pricing and

line item analysis, 244–245 promotion, 161–162

managerial implications, 36–40 transition probability, 172–173

operating analysis, 245–247 and value creation, 158–163

persistence by industries, 148–149 value of major types of, 159

production outsourcing and, 477–478 variation in, by industry, 157

and product renewal potential, variation in, over product life cycle,

140–141 139

projecting, 186–188 volatile, by industry, 169

You might also like

- Penman - Financial Statement Analysis and SecurDocument371 pagesPenman - Financial Statement Analysis and SecurAndreyZinchenko100% (4)

- Deacc506 23241 1Document2 pagesDeacc506 23241 1Sants ShadyNo ratings yet

- Itr 2022-2023Document1 pageItr 2022-2023Deepak ThangamaniNo ratings yet

- 1.hair Loss Blueprint ReviewDocument2 pages1.hair Loss Blueprint ReviewJunior GomesNo ratings yet

- PenmanDocument8 pagesPenmanvinaymathewNo ratings yet

- AQ NotesDocument4 pagesAQ Notesjamesrodriguez1097No ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página890Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página890franzmartiniiNo ratings yet

- Index: Accounting For Dummies (Tracy), 1Document10 pagesIndex: Accounting For Dummies (Tracy), 1ananthkrishnan18No ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página883Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página883franzmartiniiNo ratings yet

- Finding Alphas - 2019 - Tulchinsky - IndexDocument12 pagesFinding Alphas - 2019 - Tulchinsky - Indexjakubschwarz1412No ratings yet

- 3 s2.0 B9780750677356500182 MainDocument11 pages3 s2.0 B9780750677356500182 MainAmbrocio Mamani CutipaNo ratings yet

- IndexDocument15 pagesIndexramajeetNo ratings yet

- Business Analytics For Managers Taking Business Intelligence Beyond ReportingDocument19 pagesBusiness Analytics For Managers Taking Business Intelligence Beyond ReportingmustamuNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página888Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página888franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página887Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página887franzmartiniiNo ratings yet

- HFPMP IndexDocument11 pagesHFPMP IndeximmigrationwatchersNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página897Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página897franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página889Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página889franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página894Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página894franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página881Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página881franzmartiniiNo ratings yet

- MeaDocument1,448 pagesMeaAkshay PabbathiNo ratings yet

- BUSINESS POLICY and Strategic Management ContentsDocument11 pagesBUSINESS POLICY and Strategic Management ContentsHiriappa Bullapur50% (2)

- The A-Z of Management Concepts and ModelsDocument441 pagesThe A-Z of Management Concepts and ModelsPrashant100% (5)

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página892Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página892franzmartiniiNo ratings yet

- Index - 2017 - Building The Agile EnterpriseDocument12 pagesIndex - 2017 - Building The Agile EnterpriseMadalina Maria PanaNo ratings yet

- 7089-Article Text-13902-2-10-20210315Document19 pages7089-Article Text-13902-2-10-20210315dazzielingzNo ratings yet

- Annual Report RefDocument344 pagesAnnual Report RefgsrrealtyhydNo ratings yet

- Index - Handbook of Hospitality Marketing ManagementDocument5 pagesIndex - Handbook of Hospitality Marketing Managementlcy58134No ratings yet

- Horngrens Cost Accounting 16Th Edition PDF Full Chapter PDFDocument53 pagesHorngrens Cost Accounting 16Th Edition PDF Full Chapter PDFmsayikoyo100% (5)

- Index: Accounting Changes and Error Corrections (FASDocument16 pagesIndex: Accounting Changes and Error Corrections (FASSilvana ValenciaNo ratings yet

- Strategie: Villanova School Ofbusiness Villanova UniversityDocument6 pagesStrategie: Villanova School Ofbusiness Villanova UniversitygauravNo ratings yet

- 3 s2.0 B9780750679664500184 MainDocument13 pages3 s2.0 B9780750679664500184 MainMuhammad SyahrulNo ratings yet

- Sample 11830Document16 pagesSample 11830Aayush ZambadNo ratings yet

- GHAIL Annual Report 2022Document261 pagesGHAIL Annual Report 2022redhuntergaming177No ratings yet

- Technology: Salary & Employment ForecastDocument6 pagesTechnology: Salary & Employment ForecastpawanlalitsharmaNo ratings yet

- Gunasekaran 1994Document15 pagesGunasekaran 1994jvanandhNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página893Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página893franzmartiniiNo ratings yet

- MA Exam KitDocument304 pagesMA Exam KitAKSHAJ PRAKASHNo ratings yet

- Operations Strategymod1Document209 pagesOperations Strategymod1Siddharth MohapatraNo ratings yet

- EBOOK Horngrens Cost Accounting 16Th Edition Ebook PDF Download Full Chapter PDF KindleDocument61 pagesEBOOK Horngrens Cost Accounting 16Th Edition Ebook PDF Download Full Chapter PDF Kindlebilly.benson797100% (49)

- Horngrens Cost Accounting Version Full Chapter PDFDocument53 pagesHorngrens Cost Accounting Version Full Chapter PDFmsayikoyo100% (4)

- ContentsDocument24 pagesContentssandiswa.k23No ratings yet

- Striving Ahead Rekindling Hope: The Chief Executive's 2018 Policy AddressDocument103 pagesStriving Ahead Rekindling Hope: The Chief Executive's 2018 Policy Addresssilver lauNo ratings yet

- Original PDF Principles of Economics by Carlos Asarta PDFDocument41 pagesOriginal PDF Principles of Economics by Carlos Asarta PDFevelyn.thompson934100% (44)

- ColinDocument8 pagesColinGil EnriquezNo ratings yet

- 6: Corporate-Level Strategy 152: Strategic FocusDocument1 page6: Corporate-Level Strategy 152: Strategic FocusKavya GopakumarNo ratings yet

- Industry Economic Bulletin 2017Document197 pagesIndustry Economic Bulletin 2017muhammad AzharNo ratings yet

- Investor Day 2019 - Cairn Oil GasDocument43 pagesInvestor Day 2019 - Cairn Oil Gasmd.muneerNo ratings yet

- 1691747198210Document276 pages1691747198210irstarworkNo ratings yet

- Lucky Cement Limited Annual Report 2022corrected 1Document396 pagesLucky Cement Limited Annual Report 2022corrected 1Hamza AsifNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página886Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página886franzmartiniiNo ratings yet

- Ashutosh K. Gupta: MD & CeoDocument5 pagesAshutosh K. Gupta: MD & CeoNORTECH TRINITYNo ratings yet

- KM ManufacturingDocument54 pagesKM Manufacturingakrajaraj100% (1)

- Lucky Cement AR 2021 1Document360 pagesLucky Cement AR 2021 1Shah Rukh N. BashirNo ratings yet

- CA Final Audit Handwritten Charts New SyllabusDocument193 pagesCA Final Audit Handwritten Charts New Syllabuskumar pc100% (1)

- Annual Report 2017Document408 pagesAnnual Report 2017ghosthostNo ratings yet

- Employee Ownership and Employee Involvement at Work: Case StudiesDocument10 pagesEmployee Ownership and Employee Involvement at Work: Case StudieslearnerpranayNo ratings yet

- Sublimation For A PurposeDocument3 pagesSublimation For A PurposeMd. Zaidul IslamNo ratings yet

- Pricing for Profitability: Activity-Based Pricing for Competitive AdvantageFrom EverandPricing for Profitability: Activity-Based Pricing for Competitive AdvantageNo ratings yet

- Operational Profitability: Systematic Approaches for Continuous ImprovementFrom EverandOperational Profitability: Systematic Approaches for Continuous ImprovementNo ratings yet

- Business Process Mapping: How to improve customer experience and increase profitability in a post-COVID worldFrom EverandBusiness Process Mapping: How to improve customer experience and increase profitability in a post-COVID worldNo ratings yet

- Stock Valuation: An Essential Guide to Wall Street's Most Popular Valuation ModelsFrom EverandStock Valuation: An Essential Guide to Wall Street's Most Popular Valuation ModelsNo ratings yet

- A Study of the Supply Chain and Financial Parameters of a Small BusinessFrom EverandA Study of the Supply Chain and Financial Parameters of a Small BusinessNo ratings yet

- CFO Insights: Delivering High PerformanceFrom EverandCFO Insights: Delivering High PerformanceRating: 3 out of 5 stars3/5 (1)

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página860Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página860franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página863Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página863franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página866Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página866franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página862Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página862franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página880Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página880franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página865Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página865franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página876Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página876franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página871Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página871franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página870Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página870franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página861Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página861franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página882Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página882franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página868Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página868franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página867Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página867franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página864Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página864franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página885Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página885franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página878Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página878franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página883Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página883franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página872Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página872franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página874Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página874franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página877Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página877franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página859Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página859franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página869Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página869franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página879Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página879franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página875Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página875franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página892Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página892franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página888Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página888franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página887Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página887franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página873Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página873franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página858Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página858franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página891Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página891franzmartiniiNo ratings yet

- Document PreviewDocument1 pageDocument PreviewMD. Omar AliNo ratings yet

- Unit 1 The Evolution of Tourism Planning: 1.0 ObjectivesDocument8 pagesUnit 1 The Evolution of Tourism Planning: 1.0 Objectivesshreyash singhNo ratings yet

- For HDFC ERGO General Insurance Company LTDDocument2 pagesFor HDFC ERGO General Insurance Company LTDPradeepNo ratings yet

- 1.c.JMMARKETS Trading Plan Free PDFDocument7 pages1.c.JMMARKETS Trading Plan Free PDFalanorules001No ratings yet

- Chief Content Officer Job Description SampleDocument4 pagesChief Content Officer Job Description Samplesantu13No ratings yet

- Instant Download Calculus Hybrid 10th Edition Larson Test Bank PDF Full ChapterDocument32 pagesInstant Download Calculus Hybrid 10th Edition Larson Test Bank PDF Full ChapterJosephCraiggmax100% (10)

- Agro ChemicalsDocument24 pagesAgro ChemicalsnikhiljainbemechNo ratings yet

- Mi 15122023Document30 pagesMi 15122023bdt131No ratings yet

- Payslip 20230417170111Document2 pagesPayslip 20230417170111Iragavan IndraNo ratings yet

- Code of EthicsDocument2 pagesCode of EthicsHimani sailabNo ratings yet

- Cognitivie Statman 2006Document10 pagesCognitivie Statman 2006Rudi PrasetyaNo ratings yet

- Assignment/ Tugasan - Integrated Case StudyDocument11 pagesAssignment/ Tugasan - Integrated Case StudySYARAH NURDIYANAH BINTI SAFRUDDIN STUDENTNo ratings yet

- Part I - Introduction To OSH SSS Duties & Amp Tasks - PPT Compatibility ModeDocument35 pagesPart I - Introduction To OSH SSS Duties & Amp Tasks - PPT Compatibility ModeMohd Farihan Bin Jamaludin0% (1)

- Dismantling, Removing and Transportation of 132kV/33kV Transformer From EFL's Cunningham Road Substation To EFL's Kinoya DepotDocument8 pagesDismantling, Removing and Transportation of 132kV/33kV Transformer From EFL's Cunningham Road Substation To EFL's Kinoya DepotElias RizkNo ratings yet

- METHODOLOGY EE-Hanger Support InstallationDocument4 pagesMETHODOLOGY EE-Hanger Support Installationjerrick raulNo ratings yet

- Hasbro Q3 2023 Earnings Management RemarksDocument9 pagesHasbro Q3 2023 Earnings Management RemarksDionnelle VillalobosNo ratings yet

- Transfer PricingDocument13 pagesTransfer PricingRaj Kumar Chakraborty100% (2)

- NSSF - Vacant Job Positions - November 2023Document53 pagesNSSF - Vacant Job Positions - November 2023johnfranc999No ratings yet

- Globalization in The Age of TrumpDocument17 pagesGlobalization in The Age of TrumpKyleNo ratings yet

- InvoiceDocument1 pageInvoicemrrohitmehta8No ratings yet

- Filipinas Port Services, Inc. v. NLRCDocument10 pagesFilipinas Port Services, Inc. v. NLRCAllyssa Jane RualloNo ratings yet

- Debit Credit Cards DBBLDocument11 pagesDebit Credit Cards DBBLImranNo ratings yet

- 09 Apr 2021: UPSC Exam Comprehensive News Analysis: A. GS 1 Related B. GS 2 RelatedDocument12 pages09 Apr 2021: UPSC Exam Comprehensive News Analysis: A. GS 1 Related B. GS 2 RelatedArpita Sen BhattacharyaNo ratings yet

- Andrew Gardner BrownDocument22 pagesAndrew Gardner BrownAna Carolina ZappaNo ratings yet

- Manual Solution 6-14Document5 pagesManual Solution 6-14Sohmono HendraiosNo ratings yet

- Experience Curve PricingDocument3 pagesExperience Curve PricingpoojaNo ratings yet