Professional Documents

Culture Documents

Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página868

Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página868

Uploaded by

franzmartiniiCopyright:

Available Formats

You might also like

- Original PDF Microeconomics 13th Edition by Michael Parkin PDFDocument51 pagesOriginal PDF Microeconomics 13th Edition by Michael Parkin PDFmonica.bass495100% (45)

- DanitaCronkhite1 MT 482 Assignment Unit 7Document10 pagesDanitaCronkhite1 MT 482 Assignment Unit 7leeyaa aNo ratings yet

- Toys R Us Bankruptcy CaseDocument2 pagesToys R Us Bankruptcy CaseIan GreyNo ratings yet

- Aragon WhitepaperDocument39 pagesAragon WhitepaperluandroNo ratings yet

- Basic Consideration in MasDocument8 pagesBasic Consideration in Masrelatojr25No ratings yet

- MBF 22007Document21 pagesMBF 22007Charles MarkeyNo ratings yet

- Statement of Cash Flow - Thorstved CoDocument5 pagesStatement of Cash Flow - Thorstved Cotun ibrahimNo ratings yet

- Income Statement (In MLN.) : Roic - Ai - AfiDocument11 pagesIncome Statement (In MLN.) : Roic - Ai - AfiJoshua LeeNo ratings yet

- RSM IFRS Listed Exploration and Mining Limited - Annual Report - 31122022Document69 pagesRSM IFRS Listed Exploration and Mining Limited - Annual Report - 31122022AlfiNo ratings yet

- Balance Sheet: Annual DataDocument4 pagesBalance Sheet: Annual DataJulie RayanNo ratings yet

- Cervecería Nacional - FinanzasDocument39 pagesCervecería Nacional - FinanzasLuismy VacacelaNo ratings yet

- Audited Financial Statements 201912 PublicationDocument1 pageAudited Financial Statements 201912 PublicationfogempabafaustinaNo ratings yet

- ACCA SBR Mar-20 FightingDocument34 pagesACCA SBR Mar-20 FightingThu Lê HoàiNo ratings yet

- REVISION Qs FADocument12 pagesREVISION Qs FAhannah ispandiNo ratings yet

- Statement of Cash Flows: AS 31 DEC 2015Document6 pagesStatement of Cash Flows: AS 31 DEC 2015Arif AmsyarNo ratings yet

- Aspen Colombiana Sas (Colombia) : SourceDocument5 pagesAspen Colombiana Sas (Colombia) : SourceCatalina Echeverry AldanaNo ratings yet

- New Data Provided - : Millions of US DollarsDocument1 pageNew Data Provided - : Millions of US DollarsEngr ShahzadNo ratings yet

- Análisis Fundamental: USD in Millions Except Per Share Data. 2014 2015 2016 2017 2018Document8 pagesAnálisis Fundamental: USD in Millions Except Per Share Data. 2014 2015 2016 2017 2018andusotoNo ratings yet

- Walgreens Boots Alliance, Inc. and Subsidiaries: Capitalize STMT of Op Lease ReclassDocument7 pagesWalgreens Boots Alliance, Inc. and Subsidiaries: Capitalize STMT of Op Lease ReclassHiếu Nguyễn Minh HoàngNo ratings yet

- Balance y EstadoDocument12 pagesBalance y EstadoAlder RamirezNo ratings yet

- Eramet Annual Consolidated Financial Statements at 31december2020Document90 pagesEramet Annual Consolidated Financial Statements at 31december2020hyenadogNo ratings yet

- Glassware FsDocument3 pagesGlassware FsWaleed ShafeiNo ratings yet

- Avidesa Mac Pollo S A (Colombia)Document18 pagesAvidesa Mac Pollo S A (Colombia)Batfori clucksNo ratings yet

- q1 Ifrs Usd Earnings ReleaseDocument26 pagesq1 Ifrs Usd Earnings Releaseashokdb2kNo ratings yet

- Hong Fok Corporation Limited: Revenue (Note 1)Document8 pagesHong Fok Corporation Limited: Revenue (Note 1)Theng RogerNo ratings yet

- CBSValuationChallenge InvestorsDocument60 pagesCBSValuationChallenge InvestorsVkNo ratings yet

- LVMH Valuation Project 2Document398 pagesLVMH Valuation Project 2A.B Limited EditionNo ratings yet

- Consolidated Balance Sheet For Hindustan Unilever LTDDocument11 pagesConsolidated Balance Sheet For Hindustan Unilever LTDMohit ChughNo ratings yet

- Class Day Test BSC Finance Year 2Document5 pagesClass Day Test BSC Finance Year 2Revatee HurilNo ratings yet

- CFM Term Paper PresentationDocument34 pagesCFM Term Paper PresentationjavoleNo ratings yet

- Updated Excel Case StudyDocument4 pagesUpdated Excel Case Studydheerajvish1995No ratings yet

- NIVS. 2009 SAIC Filing TranslatedDocument3 pagesNIVS. 2009 SAIC Filing Translatedwensley2001No ratings yet

- FA AssignmentDocument21 pagesFA AssignmentMuzammil khanNo ratings yet

- Infosys: Balance SheetDocument6 pagesInfosys: Balance SheetchiragNo ratings yet

- Cashflow Tutorial 2Document1 pageCashflow Tutorial 2Tadiwa ZamaniNo ratings yet

- Total Comprehensive Income For The Year 6667Document20 pagesTotal Comprehensive Income For The Year 6667Raj MishraNo ratings yet

- Comparative FSDocument4 pagesComparative FSSuper GenerationNo ratings yet

- RSM IFRS Listed Practical Limited - Annual Report - 31122022Document67 pagesRSM IFRS Listed Practical Limited - Annual Report - 31122022kazimkorogluNo ratings yet

- Cash Flow - Tinh Tien Thu Tu Thanh LyDocument2 pagesCash Flow - Tinh Tien Thu Tu Thanh LyLink KhánhNo ratings yet

- FS - G.P Tech - 2079-80Document11 pagesFS - G.P Tech - 2079-80ANISH KAFLENo ratings yet

- FinanzasDocument12 pagesFinanzasYamilet Maria InquillaNo ratings yet

- Access Full Year Financials 2020 WebDocument2 pagesAccess Full Year Financials 2020 WebFuaad DodooNo ratings yet

- RSM IFRS Listed Comprehensive Limited - Annual Report - 31122022Document80 pagesRSM IFRS Listed Comprehensive Limited - Annual Report - 31122022AlfiNo ratings yet

- Cash Flow Statement Cashflows From Operations Cash Receipts From CustomersDocument16 pagesCash Flow Statement Cashflows From Operations Cash Receipts From CustomersAfruza Akter MunniNo ratings yet

- Individual Assignment 3 - Tran Thi Quynh Nhi - 47k22.1Document4 pagesIndividual Assignment 3 - Tran Thi Quynh Nhi - 47k22.1Trần Thị Quỳnh NhiNo ratings yet

- Case Cos Min SolutionDocument19 pagesCase Cos Min SolutionRoche ChenNo ratings yet

- Reading Financial Statements: Balance Sheet of Burns Ltd. (In TEUR) 31 Dec 20X5 31 Dec 20X4 Non-Current AssetsDocument5 pagesReading Financial Statements: Balance Sheet of Burns Ltd. (In TEUR) 31 Dec 20X5 31 Dec 20X4 Non-Current AssetsSaransh ReuNo ratings yet

- Bed FS - 7879Document11 pagesBed FS - 7879Menuka SiwaNo ratings yet

- Consolidation Model - Exercise 1Document7 pagesConsolidation Model - Exercise 1subhash dalviNo ratings yet

- Adb Fin Statement - Dec 2020 - Final 2Document2 pagesAdb Fin Statement - Dec 2020 - Final 2Fuaad DodooNo ratings yet

- Corporate Financial Reporting & Analysis: Preparing and Understanding Balance SheetDocument32 pagesCorporate Financial Reporting & Analysis: Preparing and Understanding Balance SheetMansi aggarwal 171050No ratings yet

- Cash Flow Questions RucuDocument5 pagesCash Flow Questions RucuWalton Jr Kobe TZNo ratings yet

- Axis Bank 1Document3 pagesAxis Bank 1Mayank RelanNo ratings yet

- Financial Statements 2022 CACEIS GroupDocument18 pagesFinancial Statements 2022 CACEIS GroupElio AseroNo ratings yet

- Financials 1219051-21.09.20Document6 pagesFinancials 1219051-21.09.20Eduardo FélixNo ratings yet

- Annual Report 2019Document4 pagesAnnual Report 2019Rahman GafarNo ratings yet

- Tutorial 5Document26 pagesTutorial 5Krrish BosamiaNo ratings yet

- 2019FY Anual ResultDocument48 pages2019FY Anual ResultJ. BangjakNo ratings yet

- Module 3-Separate & Consolidated Financial Statements - Subsequent To Date of AcquisitionDocument10 pagesModule 3-Separate & Consolidated Financial Statements - Subsequent To Date of AcquisitionApril Ross TalipNo ratings yet

- CFS Baf 1 CpaDocument6 pagesCFS Baf 1 CpaErnest NyangiNo ratings yet

- CLWY Q3 2019 FinancialsDocument3 pagesCLWY Q3 2019 FinancialskdwcapitalNo ratings yet

- Jeronimo Martins Colombia S.A.S. (Colombia)Document6 pagesJeronimo Martins Colombia S.A.S. (Colombia)LAURA VALENTINA PEREZ RODRIGUEZNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página860Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página860franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página863Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página863franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página866Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página866franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página862Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página862franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página880Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página880franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página865Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página865franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página876Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página876franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página871Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página871franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página870Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página870franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página888Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página888franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página882Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página882franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página872Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página872franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página867Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página867franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página864Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página864franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página877Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página877franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página879Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página879franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página883Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página883franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página874Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página874franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página869Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página869franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página875Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página875franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página885Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página885franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página859Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página859franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página861Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página861franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página878Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página878franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página887Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página887franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página892Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página892franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página858Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página858franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página891Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página891franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página873Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página873franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página886Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página886franzmartiniiNo ratings yet

- Account Determination - Assign GL Account - SCNDocument8 pagesAccount Determination - Assign GL Account - SCNAnupama JampaniNo ratings yet

- Tom Barrett's Plan To Create Wisconsin JobsDocument67 pagesTom Barrett's Plan To Create Wisconsin JobsBarrettForWisconsinNo ratings yet

- CIR Vs Algue, Inc.Document1 pageCIR Vs Algue, Inc.AngelNo ratings yet

- A Research Project Report: A Preference of Small Investors Towards Various InvestmentDocument87 pagesA Research Project Report: A Preference of Small Investors Towards Various InvestmentMaster PrintersNo ratings yet

- US Internal Revenue Service: p4163Document134 pagesUS Internal Revenue Service: p4163IRSNo ratings yet

- Etsy Seller Census CADocument16 pagesEtsy Seller Census CAAlfred YangaoNo ratings yet

- Modes of Transfer of Immovable Property - Sale and Gift By: Divyansh HanuDocument11 pagesModes of Transfer of Immovable Property - Sale and Gift By: Divyansh HanuLatest Laws Team100% (1)

- 2316Document1 page2316FedsNo ratings yet

- Financial Literacy SyllabusDocument3 pagesFinancial Literacy SyllabusMaanik RoyNo ratings yet

- Reliance Retail Limited: Sr. No. Item Name Hsn/Sac Qty Price/Unit Discount ValueDocument3 pagesReliance Retail Limited: Sr. No. Item Name Hsn/Sac Qty Price/Unit Discount ValuemukeshNo ratings yet

- Topic: Tax Laws and Implementing Rules and RegulationsDocument2 pagesTopic: Tax Laws and Implementing Rules and RegulationsChariNo ratings yet

- (Based On Presumed Data) File No.: 2-14349 Ddo: (000015) Accounts Officer Dte of TransportDocument2 pages(Based On Presumed Data) File No.: 2-14349 Ddo: (000015) Accounts Officer Dte of TransportD S PNo ratings yet

- Budget 2022-23Document14 pagesBudget 2022-23ATUL JHUNJHUNWALANo ratings yet

- Carol Info - Exit LOF and FormDocument24 pagesCarol Info - Exit LOF and FormAmigo GraciosoNo ratings yet

- Slip GajiDocument1 pageSlip Gajiwildanrn61No ratings yet

- South Africa'S Covid-19 Rescue Package ScorecardDocument5 pagesSouth Africa'S Covid-19 Rescue Package ScorecardRasigan MaharajhNo ratings yet

- Mansa Building CaseDocument5 pagesMansa Building CaseshreeshNo ratings yet

- U.P. Land Law AssignmentDocument23 pagesU.P. Land Law Assignmentutkarsh misraNo ratings yet

- Project Offer For Civil Enginnering FirmDocument3 pagesProject Offer For Civil Enginnering FirmShane BondNo ratings yet

- FY23 CIP Full BlackandWhite FullBook Updated 17jan2022Document717 pagesFY23 CIP Full BlackandWhite FullBook Updated 17jan2022Steve BohnelNo ratings yet

- Standardised PPT On GST: Indirect Taxes Committee The Institute of Chartered Accountants of IndiaDocument28 pagesStandardised PPT On GST: Indirect Taxes Committee The Institute of Chartered Accountants of IndiashyamNo ratings yet

- Law Commission Report No. 12 - Income Tax Act 1922Document496 pagesLaw Commission Report No. 12 - Income Tax Act 1922Latest Laws Team0% (1)

- ROBIN Hood ExamDocument2 pagesROBIN Hood ExamMuhibUrRasoolNo ratings yet

- Marketing Plan Karachi Tobacco CompanyDocument41 pagesMarketing Plan Karachi Tobacco CompanyAhmad Ladhani100% (1)

- Interpretation of Statutes PsdaDocument10 pagesInterpretation of Statutes PsdaPranya AroraNo ratings yet

- Stamp Duty Ready RecknorDocument14 pagesStamp Duty Ready RecknorLamar MillerNo ratings yet

- 94-02 Individual Income Tax - QuestionnaireDocument20 pages94-02 Individual Income Tax - QuestionnaireSilver LilyNo ratings yet

Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página868

Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página868

Uploaded by

franzmartiniiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página868

Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página868

Uploaded by

franzmartiniiCopyright:

Available Formats

848

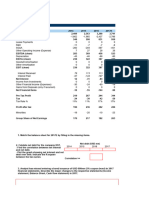

EXHIBIT H.7 Costco: Reorganized Deferred Taxes

$ million

As reported Reorganized

2017 2018 2019 2017 2018 2019

Deferred-tax assets Operating deferred-tax assets, net of liabilities

Equity compensation 109 72 74 Equity compensation 109 72 74

Deferred income/membership fees 167 136 180 Deferred income/membership fees 167 136 180

Foreign tax credit carryforward — — 65 Accrued liabilities and reserves 647 484 566

Accrued liabilities and reserves 647 484 566 Property and equipment (747) (478) (677)

Other 18 — — Merchandise inventories (252) (175) (187)

Total deferred-tax assets 941 692 885 Valuation allowance — — (76)

Operating deferred-tax assets, net of liabilities (76) 39 (120)

Valuation allowance — — (76)

Total net deferred-tax assets 941 692 809 Nonoperating deferred-tax assets, net of liabilities

Other assets 18 — —

Deferred-tax liabilities Foreign-branch deferreds — — (69)

Property and equipment (747) (478) (677) Other liabilities — (40) (21)

Merchandise inventories (252) (175) (187) Nonoperating deferred-tax assets, net of liabilities 18 (40) (90)

Foreign-branch deferreds — — (69)

Other — (40) (21) Tax loss carryforwards

Total deferred-tax liabilities (999) (693) (954) Foreign tax credit carryforward — — 65

Deferred-tax assets, net of liabilities (58) (1) (145) Deferred-tax assets, net of liabilities (58) (1) (145)

You might also like

- Original PDF Microeconomics 13th Edition by Michael Parkin PDFDocument51 pagesOriginal PDF Microeconomics 13th Edition by Michael Parkin PDFmonica.bass495100% (45)

- DanitaCronkhite1 MT 482 Assignment Unit 7Document10 pagesDanitaCronkhite1 MT 482 Assignment Unit 7leeyaa aNo ratings yet

- Toys R Us Bankruptcy CaseDocument2 pagesToys R Us Bankruptcy CaseIan GreyNo ratings yet

- Aragon WhitepaperDocument39 pagesAragon WhitepaperluandroNo ratings yet

- Basic Consideration in MasDocument8 pagesBasic Consideration in Masrelatojr25No ratings yet

- MBF 22007Document21 pagesMBF 22007Charles MarkeyNo ratings yet

- Statement of Cash Flow - Thorstved CoDocument5 pagesStatement of Cash Flow - Thorstved Cotun ibrahimNo ratings yet

- Income Statement (In MLN.) : Roic - Ai - AfiDocument11 pagesIncome Statement (In MLN.) : Roic - Ai - AfiJoshua LeeNo ratings yet

- RSM IFRS Listed Exploration and Mining Limited - Annual Report - 31122022Document69 pagesRSM IFRS Listed Exploration and Mining Limited - Annual Report - 31122022AlfiNo ratings yet

- Balance Sheet: Annual DataDocument4 pagesBalance Sheet: Annual DataJulie RayanNo ratings yet

- Cervecería Nacional - FinanzasDocument39 pagesCervecería Nacional - FinanzasLuismy VacacelaNo ratings yet

- Audited Financial Statements 201912 PublicationDocument1 pageAudited Financial Statements 201912 PublicationfogempabafaustinaNo ratings yet

- ACCA SBR Mar-20 FightingDocument34 pagesACCA SBR Mar-20 FightingThu Lê HoàiNo ratings yet

- REVISION Qs FADocument12 pagesREVISION Qs FAhannah ispandiNo ratings yet

- Statement of Cash Flows: AS 31 DEC 2015Document6 pagesStatement of Cash Flows: AS 31 DEC 2015Arif AmsyarNo ratings yet

- Aspen Colombiana Sas (Colombia) : SourceDocument5 pagesAspen Colombiana Sas (Colombia) : SourceCatalina Echeverry AldanaNo ratings yet

- New Data Provided - : Millions of US DollarsDocument1 pageNew Data Provided - : Millions of US DollarsEngr ShahzadNo ratings yet

- Análisis Fundamental: USD in Millions Except Per Share Data. 2014 2015 2016 2017 2018Document8 pagesAnálisis Fundamental: USD in Millions Except Per Share Data. 2014 2015 2016 2017 2018andusotoNo ratings yet

- Walgreens Boots Alliance, Inc. and Subsidiaries: Capitalize STMT of Op Lease ReclassDocument7 pagesWalgreens Boots Alliance, Inc. and Subsidiaries: Capitalize STMT of Op Lease ReclassHiếu Nguyễn Minh HoàngNo ratings yet

- Balance y EstadoDocument12 pagesBalance y EstadoAlder RamirezNo ratings yet

- Eramet Annual Consolidated Financial Statements at 31december2020Document90 pagesEramet Annual Consolidated Financial Statements at 31december2020hyenadogNo ratings yet

- Glassware FsDocument3 pagesGlassware FsWaleed ShafeiNo ratings yet

- Avidesa Mac Pollo S A (Colombia)Document18 pagesAvidesa Mac Pollo S A (Colombia)Batfori clucksNo ratings yet

- q1 Ifrs Usd Earnings ReleaseDocument26 pagesq1 Ifrs Usd Earnings Releaseashokdb2kNo ratings yet

- Hong Fok Corporation Limited: Revenue (Note 1)Document8 pagesHong Fok Corporation Limited: Revenue (Note 1)Theng RogerNo ratings yet

- CBSValuationChallenge InvestorsDocument60 pagesCBSValuationChallenge InvestorsVkNo ratings yet

- LVMH Valuation Project 2Document398 pagesLVMH Valuation Project 2A.B Limited EditionNo ratings yet

- Consolidated Balance Sheet For Hindustan Unilever LTDDocument11 pagesConsolidated Balance Sheet For Hindustan Unilever LTDMohit ChughNo ratings yet

- Class Day Test BSC Finance Year 2Document5 pagesClass Day Test BSC Finance Year 2Revatee HurilNo ratings yet

- CFM Term Paper PresentationDocument34 pagesCFM Term Paper PresentationjavoleNo ratings yet

- Updated Excel Case StudyDocument4 pagesUpdated Excel Case Studydheerajvish1995No ratings yet

- NIVS. 2009 SAIC Filing TranslatedDocument3 pagesNIVS. 2009 SAIC Filing Translatedwensley2001No ratings yet

- FA AssignmentDocument21 pagesFA AssignmentMuzammil khanNo ratings yet

- Infosys: Balance SheetDocument6 pagesInfosys: Balance SheetchiragNo ratings yet

- Cashflow Tutorial 2Document1 pageCashflow Tutorial 2Tadiwa ZamaniNo ratings yet

- Total Comprehensive Income For The Year 6667Document20 pagesTotal Comprehensive Income For The Year 6667Raj MishraNo ratings yet

- Comparative FSDocument4 pagesComparative FSSuper GenerationNo ratings yet

- RSM IFRS Listed Practical Limited - Annual Report - 31122022Document67 pagesRSM IFRS Listed Practical Limited - Annual Report - 31122022kazimkorogluNo ratings yet

- Cash Flow - Tinh Tien Thu Tu Thanh LyDocument2 pagesCash Flow - Tinh Tien Thu Tu Thanh LyLink KhánhNo ratings yet

- FS - G.P Tech - 2079-80Document11 pagesFS - G.P Tech - 2079-80ANISH KAFLENo ratings yet

- FinanzasDocument12 pagesFinanzasYamilet Maria InquillaNo ratings yet

- Access Full Year Financials 2020 WebDocument2 pagesAccess Full Year Financials 2020 WebFuaad DodooNo ratings yet

- RSM IFRS Listed Comprehensive Limited - Annual Report - 31122022Document80 pagesRSM IFRS Listed Comprehensive Limited - Annual Report - 31122022AlfiNo ratings yet

- Cash Flow Statement Cashflows From Operations Cash Receipts From CustomersDocument16 pagesCash Flow Statement Cashflows From Operations Cash Receipts From CustomersAfruza Akter MunniNo ratings yet

- Individual Assignment 3 - Tran Thi Quynh Nhi - 47k22.1Document4 pagesIndividual Assignment 3 - Tran Thi Quynh Nhi - 47k22.1Trần Thị Quỳnh NhiNo ratings yet

- Case Cos Min SolutionDocument19 pagesCase Cos Min SolutionRoche ChenNo ratings yet

- Reading Financial Statements: Balance Sheet of Burns Ltd. (In TEUR) 31 Dec 20X5 31 Dec 20X4 Non-Current AssetsDocument5 pagesReading Financial Statements: Balance Sheet of Burns Ltd. (In TEUR) 31 Dec 20X5 31 Dec 20X4 Non-Current AssetsSaransh ReuNo ratings yet

- Bed FS - 7879Document11 pagesBed FS - 7879Menuka SiwaNo ratings yet

- Consolidation Model - Exercise 1Document7 pagesConsolidation Model - Exercise 1subhash dalviNo ratings yet

- Adb Fin Statement - Dec 2020 - Final 2Document2 pagesAdb Fin Statement - Dec 2020 - Final 2Fuaad DodooNo ratings yet

- Corporate Financial Reporting & Analysis: Preparing and Understanding Balance SheetDocument32 pagesCorporate Financial Reporting & Analysis: Preparing and Understanding Balance SheetMansi aggarwal 171050No ratings yet

- Cash Flow Questions RucuDocument5 pagesCash Flow Questions RucuWalton Jr Kobe TZNo ratings yet

- Axis Bank 1Document3 pagesAxis Bank 1Mayank RelanNo ratings yet

- Financial Statements 2022 CACEIS GroupDocument18 pagesFinancial Statements 2022 CACEIS GroupElio AseroNo ratings yet

- Financials 1219051-21.09.20Document6 pagesFinancials 1219051-21.09.20Eduardo FélixNo ratings yet

- Annual Report 2019Document4 pagesAnnual Report 2019Rahman GafarNo ratings yet

- Tutorial 5Document26 pagesTutorial 5Krrish BosamiaNo ratings yet

- 2019FY Anual ResultDocument48 pages2019FY Anual ResultJ. BangjakNo ratings yet

- Module 3-Separate & Consolidated Financial Statements - Subsequent To Date of AcquisitionDocument10 pagesModule 3-Separate & Consolidated Financial Statements - Subsequent To Date of AcquisitionApril Ross TalipNo ratings yet

- CFS Baf 1 CpaDocument6 pagesCFS Baf 1 CpaErnest NyangiNo ratings yet

- CLWY Q3 2019 FinancialsDocument3 pagesCLWY Q3 2019 FinancialskdwcapitalNo ratings yet

- Jeronimo Martins Colombia S.A.S. (Colombia)Document6 pagesJeronimo Martins Colombia S.A.S. (Colombia)LAURA VALENTINA PEREZ RODRIGUEZNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página860Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página860franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página863Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página863franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página866Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página866franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página862Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página862franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página880Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página880franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página865Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página865franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página876Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página876franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página871Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página871franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página870Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página870franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página888Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página888franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página882Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página882franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página872Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página872franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página867Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página867franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página864Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página864franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página877Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página877franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página879Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página879franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página883Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página883franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página874Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página874franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página869Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página869franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página875Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página875franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página885Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página885franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página859Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página859franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página861Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página861franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página878Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página878franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página887Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página887franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página892Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página892franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página858Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página858franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página891Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página891franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página873Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página873franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página886Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página886franzmartiniiNo ratings yet

- Account Determination - Assign GL Account - SCNDocument8 pagesAccount Determination - Assign GL Account - SCNAnupama JampaniNo ratings yet

- Tom Barrett's Plan To Create Wisconsin JobsDocument67 pagesTom Barrett's Plan To Create Wisconsin JobsBarrettForWisconsinNo ratings yet

- CIR Vs Algue, Inc.Document1 pageCIR Vs Algue, Inc.AngelNo ratings yet

- A Research Project Report: A Preference of Small Investors Towards Various InvestmentDocument87 pagesA Research Project Report: A Preference of Small Investors Towards Various InvestmentMaster PrintersNo ratings yet

- US Internal Revenue Service: p4163Document134 pagesUS Internal Revenue Service: p4163IRSNo ratings yet

- Etsy Seller Census CADocument16 pagesEtsy Seller Census CAAlfred YangaoNo ratings yet

- Modes of Transfer of Immovable Property - Sale and Gift By: Divyansh HanuDocument11 pagesModes of Transfer of Immovable Property - Sale and Gift By: Divyansh HanuLatest Laws Team100% (1)

- 2316Document1 page2316FedsNo ratings yet

- Financial Literacy SyllabusDocument3 pagesFinancial Literacy SyllabusMaanik RoyNo ratings yet

- Reliance Retail Limited: Sr. No. Item Name Hsn/Sac Qty Price/Unit Discount ValueDocument3 pagesReliance Retail Limited: Sr. No. Item Name Hsn/Sac Qty Price/Unit Discount ValuemukeshNo ratings yet

- Topic: Tax Laws and Implementing Rules and RegulationsDocument2 pagesTopic: Tax Laws and Implementing Rules and RegulationsChariNo ratings yet

- (Based On Presumed Data) File No.: 2-14349 Ddo: (000015) Accounts Officer Dte of TransportDocument2 pages(Based On Presumed Data) File No.: 2-14349 Ddo: (000015) Accounts Officer Dte of TransportD S PNo ratings yet

- Budget 2022-23Document14 pagesBudget 2022-23ATUL JHUNJHUNWALANo ratings yet

- Carol Info - Exit LOF and FormDocument24 pagesCarol Info - Exit LOF and FormAmigo GraciosoNo ratings yet

- Slip GajiDocument1 pageSlip Gajiwildanrn61No ratings yet

- South Africa'S Covid-19 Rescue Package ScorecardDocument5 pagesSouth Africa'S Covid-19 Rescue Package ScorecardRasigan MaharajhNo ratings yet

- Mansa Building CaseDocument5 pagesMansa Building CaseshreeshNo ratings yet

- U.P. Land Law AssignmentDocument23 pagesU.P. Land Law Assignmentutkarsh misraNo ratings yet

- Project Offer For Civil Enginnering FirmDocument3 pagesProject Offer For Civil Enginnering FirmShane BondNo ratings yet

- FY23 CIP Full BlackandWhite FullBook Updated 17jan2022Document717 pagesFY23 CIP Full BlackandWhite FullBook Updated 17jan2022Steve BohnelNo ratings yet

- Standardised PPT On GST: Indirect Taxes Committee The Institute of Chartered Accountants of IndiaDocument28 pagesStandardised PPT On GST: Indirect Taxes Committee The Institute of Chartered Accountants of IndiashyamNo ratings yet

- Law Commission Report No. 12 - Income Tax Act 1922Document496 pagesLaw Commission Report No. 12 - Income Tax Act 1922Latest Laws Team0% (1)

- ROBIN Hood ExamDocument2 pagesROBIN Hood ExamMuhibUrRasoolNo ratings yet

- Marketing Plan Karachi Tobacco CompanyDocument41 pagesMarketing Plan Karachi Tobacco CompanyAhmad Ladhani100% (1)

- Interpretation of Statutes PsdaDocument10 pagesInterpretation of Statutes PsdaPranya AroraNo ratings yet

- Stamp Duty Ready RecknorDocument14 pagesStamp Duty Ready RecknorLamar MillerNo ratings yet

- 94-02 Individual Income Tax - QuestionnaireDocument20 pages94-02 Individual Income Tax - QuestionnaireSilver LilyNo ratings yet