Professional Documents

Culture Documents

Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página872

Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página872

Uploaded by

franzmartiniiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página872

Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página872

Uploaded by

franzmartiniiCopyright:

Available Formats

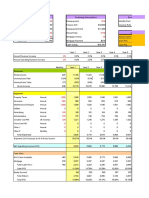

EXHIBIT H.

11 Costco: Balance Sheet Forecast Ratios

Working capital in days; all other accounts in %

852

Historical Forecast

2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 Forecast Ratio

Working capital

Operating cash 20.2 14.5 16.3 18.7 22.6 7.3 7.3 7.3 7.3 7.3 7.3 7.3 7.3 7.3 7.3 Days in revenues

Receivables, net 3.8 3.8 4.1 4.3 3.7 3.7 3.7 3.7 3.7 3.7 3.7 3.7 3.7 3.7 3.7 Days in merchandise cost

Merchandise inventories 32.2 31.8 32.1 32.7 31.3 31.3 31.3 31.3 31.3 31.3 31.3 31.3 31.3 31.3 31.3 Days in revenues

Other current assets 0.7 0.8 0.8 0.8 2.7 2.7 2.7 2.7 2.7 2.7 2.7 2.7 2.7 2.7 2.7 Days in revenues

Accounts payable 32.5 27.0 31.3 33.3 32.1 32.1 32.1 32.1 32.1 32.1 32.1 32.1 32.1 32.1 32.1 Days in merchandise cost

Accrued salaries and benefits 7.8 8.1 7.6 7.7 7.6 7.6 7.6 7.6 7.6 7.6 7.6 7.6 7.6 7.6 7.6 Days in revenues

Accrued member rewards 2.6 2.7 2.7 2.7 2.8 2.8 2.8 2.8 2.8 2.8 2.8 2.8 2.8 2.8 2.8 Days in revenues

Deferred membership fees 4.0 4.2 4.2 4.2 4.1 4.1 4.1 4.1 4.1 4.1 4.1 4.1 4.1 4.1 4.1 Days in revenues

Other current liabilities 5.3 6.1 7.4 7.5 9.0 9.0 9.0 9.0 9.0 9.0 9.0 9.0 9.0 9.0 9.0 Days in revenues

Long-term assets and liabilities

Property, plant, and equipment 13.3 14.4 14.1 13.9 13.7 13.7 13.7 13.7 13.7 13.7 13.7 13.7 13.7 13.7 13.7 % of revenues

Capitalized operating leases 1.9 2.0 2.0 1.8 1.6 1.6 1.6 1.6 1.6 1.6 1.6 1.6 1.6 1.6 1.6 % of revenues

Other assets 0.5 0.6 0.5 0.4 0.4 0.4 0.4 0.4 0.4 0.4 0.4 0.4 0.4 0.4 0.4 % of revenues

Other liabilities 0.4 0.4 0.4 0.4 0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.3 % of revenues

Debt and capital leases1

Current portion of long-term debt 19.9 19.9 1.2 1.3 23.5 13.2 13.2 12.0 10.7 12.3 14.1 12.6 12.5 12.4 12.4 % of total debt

Current portion of capital leases 0.2 0.2 0.1 0.1 0.4 0.2 0.2 0.2 0.2 0.2 0.2 0.2 0.2 0.2 0.2 % of total debt

Long-term debt 75.5 73.4 93.4 93.0 70.7 81.2 81.0 82.3 83.5 82.0 80.1 81.7 81.8 81.9 81.8 % of total debt

Capital leases 4.4 6.6 5.3 5.6 5.5 5.5 5.7 5.5 5.5 5.5 5.5 5.6 5.5 5.5 5.5 % of total debt

Debt and capital leases 100.0 100.0 100.0 100.0 100.0 100.0 100.0 100.0 100.0 100.0 100.0 100.0 100.0 100.0 100.0

Equity accounts2

Stock-based compensation 0.3 0.4 0.4 0.4 0.4 0.4 0.4 0.4 0.4 0.4 0.4 0.4 0.4 0.4 0.4 % of revenues

Stock options exercised 0.1 — — — — — — — — — — — — — — % of revenues

Release of vested restricted stock units 0.1 0.1 0.1 0.2 0.2 0.2 0.2 0.2 0.2 0.2 0.2 0.2 0.2 0.2 0.2 % of revenues

Dividends 120.5 31.7 147.3 29.9 28.9 64.4 64.4 64.4 64.4 64.4 64.4 64.4 64.4 64.4 64.4 % of net income

1 The sum of debt and debt equivalents, inclusive of leases, is forecast as a fixed percentage of projected enterprise value, using a target debt-to-value ratio. Total debt is split between debt and capital leases and between current and long-term, based

on a 5-year historical average.

2 Excess cash is paid out over 5 years. Remaining cash flow is used to repurchase shares.

You might also like

- DanitaCronkhite1 MT 482 Assignment Unit 7Document10 pagesDanitaCronkhite1 MT 482 Assignment Unit 7leeyaa aNo ratings yet

- CH 04Document56 pagesCH 04Hiền AnhNo ratings yet

- FIN254 Assignment# 1Document6 pagesFIN254 Assignment# 1Zahidul IslamNo ratings yet

- Aligarh MovementDocument30 pagesAligarh MovementHumza Zahid100% (2)

- ACC 345 7-1 Final Project Milestone Three Final Statement Analysis and Valuation ReportDocument19 pagesACC 345 7-1 Final Project Milestone Three Final Statement Analysis and Valuation ReportKelly JohnsonNo ratings yet

- 3.5GHz - RRU5818 Technical Specifications (V100R017C10 - Draft A)Document20 pages3.5GHz - RRU5818 Technical Specifications (V100R017C10 - Draft A)elesoporteNo ratings yet

- Tutorial 2 QuestionsDocument4 pagesTutorial 2 Questionsguan junyanNo ratings yet

- A&R Articles of Incorporation - Hunters Ridge Phase 5 & 6 - 20170825Document5 pagesA&R Articles of Incorporation - Hunters Ridge Phase 5 & 6 - 20170825James WallsNo ratings yet

- Seniors and Housing-Ministerial Orders and PoliciesDocument300 pagesSeniors and Housing-Ministerial Orders and PoliciesUnited Conservative Party CaucusNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página871Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página871franzmartiniiNo ratings yet

- Research Problem Michael Franco AccountingDocument5 pagesResearch Problem Michael Franco AccountingMichael FrancoNo ratings yet

- Sanitärtechnik Eisenberg GMBH - FinancialsDocument2 pagesSanitärtechnik Eisenberg GMBH - Financialsin_daHouseNo ratings yet

- Private Company Financials Balance Sheet: Xchanging Software Europe LimitedDocument1 pagePrivate Company Financials Balance Sheet: Xchanging Software Europe Limitedprabhav2050No ratings yet

- 3 Companies CS - Calculations 2022Document27 pages3 Companies CS - Calculations 2022shubhangi.jain582No ratings yet

- FY2018 (12m) FY2017 (12m) FY2016 (12m) FY2015 (12m) FY2014 (12m) FY2013 (12m) FY2012 (12m)Document1 pageFY2018 (12m) FY2017 (12m) FY2016 (12m) FY2015 (12m) FY2014 (12m) FY2013 (12m) FY2012 (12m)Divyank JyotiNo ratings yet

- 2A FS Analysis Exercises 2022Document5 pages2A FS Analysis Exercises 2022Alyssa Tolcidas0% (1)

- 3 Statement Model - BlankDocument6 pages3 Statement Model - BlankAina Michael100% (1)

- WDC ModelDocument14 pagesWDC ModelthevalueguyNo ratings yet

- Spring 2009 NBA 5060 Lectures 9 - Pro Forma Financial Statements & Forecasting IIDocument10 pagesSpring 2009 NBA 5060 Lectures 9 - Pro Forma Financial Statements & Forecasting IIbat0oNo ratings yet

- EBS300420A enDocument80 pagesEBS300420A enNeculai CristianNo ratings yet

- 539770228.xls Sources and Uses (2) 1Document5 pages539770228.xls Sources and Uses (2) 1prati gumrNo ratings yet

- TVS Motors Live Project Final 2Document39 pagesTVS Motors Live Project Final 2ritususmitakarNo ratings yet

- Financial Spreadsheet KOSONGAN FinalDocument7 pagesFinancial Spreadsheet KOSONGAN FinalDwi PermanaNo ratings yet

- CaseDocument4 pagesCaseteklay asmelashNo ratings yet

- Landmark CaseDocument22 pagesLandmark CaseLauren KlaassenNo ratings yet

- KISANGHAR1000000Document15 pagesKISANGHAR1000000Suresh VarmaNo ratings yet

- Basic Rental Analysis WorksheetDocument8 pagesBasic Rental Analysis WorksheetGleb petukhovNo ratings yet

- Name: - : ST ND RDDocument7 pagesName: - : ST ND RDChichinadze TakoNo ratings yet

- Ey Aarsrapport 2021 22 25Document1 pageEy Aarsrapport 2021 22 25Ronald RunruilNo ratings yet

- Theory & Practice of Financial Management Faraz Naseem Sunday, April 19th, 2020Document12 pagesTheory & Practice of Financial Management Faraz Naseem Sunday, April 19th, 2020Hassaan KhalidNo ratings yet

- 5.12 CALCULATING AND INTERPRETING RISK RATIOS. Refer To The Financial Statement Data For Hasbro in Problem 4.23Document14 pages5.12 CALCULATING AND INTERPRETING RISK RATIOS. Refer To The Financial Statement Data For Hasbro in Problem 4.23Lê Thiên Giang 2KT-19No ratings yet

- Presentation 1Document9 pagesPresentation 1Zubair KhanNo ratings yet

- Yardeni - Stategist Handbook - 2019Document24 pagesYardeni - Stategist Handbook - 2019scribbugNo ratings yet

- Financial Modeling Mid-Term ExamDocument17 pagesFinancial Modeling Mid-Term ExamКамиль БайбуринNo ratings yet

- Black Gold - AnalysisDocument12 pagesBlack Gold - AnalysisAbdulrahman DhabaanNo ratings yet

- 3 Statement Modeling With Iterations SummaryDocument7 pages3 Statement Modeling With Iterations SummaryEmperor OverwatchNo ratings yet

- ApdfDocument4 pagesApdfyordanosgetahun887No ratings yet

- Taxation Trends in The European Union - 2012 165Document1 pageTaxation Trends in The European Union - 2012 165d05registerNo ratings yet

- Colgate Estados Financieros 2021Document3 pagesColgate Estados Financieros 2021Lluvia RamosNo ratings yet

- BDODocument6 pagesBDOVince Raphael MirandaNo ratings yet

- Nishat Mills Limited 1Document10 pagesNishat Mills Limited 1Abdul MoizNo ratings yet

- Parrino Corp Fin 5e PPT Ch04 ExtDocument61 pagesParrino Corp Fin 5e PPT Ch04 Exttrangnnhhs180588No ratings yet

- ANJ AR 2013 - English - Ykds3c20170321164338Document216 pagesANJ AR 2013 - English - Ykds3c20170321164338Ary PandeNo ratings yet

- 915 529 Supplement Landmark XLS ENGDocument32 pages915 529 Supplement Landmark XLS ENGPaco ColínNo ratings yet

- Diagnosing Profitability, Risk, and Growth: Hawawini & Viallet 1Document29 pagesDiagnosing Profitability, Risk, and Growth: Hawawini & Viallet 1Imelda Gonzalez MedinaNo ratings yet

- Prob - 13-4Document9 pagesProb - 13-4NavinNo ratings yet

- Financial Plan: Company NameDocument5 pagesFinancial Plan: Company NameJasmine Esguerra IgnacioNo ratings yet

- WorkingsDocument10 pagesWorkingsKi KiNo ratings yet

- Accountingfor Managers Assignment 2 Part-I: Is A Budget?Document9 pagesAccountingfor Managers Assignment 2 Part-I: Is A Budget?Amit SanglikarNo ratings yet

- SELFDocument7 pagesSELFSIDDHANT CHUGHNo ratings yet

- Forecasting Financial Statements StepsDocument7 pagesForecasting Financial Statements Stepspallavi thakurNo ratings yet

- Financial Statements For Jollibee Foods CorporationDocument8 pagesFinancial Statements For Jollibee Foods CorporationJ U D YNo ratings yet

- Fma17 Bericht enDocument192 pagesFma17 Bericht enjamesNo ratings yet

- RIAS Annual Financiel Account Statement 2019/20 1Document30 pagesRIAS Annual Financiel Account Statement 2019/20 1Leandro Mainumby Arapoty BorgesNo ratings yet

- AMT Geninterest STD 2018Document9 pagesAMT Geninterest STD 2018Mai SuwanchaiyongNo ratings yet

- ExhibitsDocument5 pagesExhibitsrameenNo ratings yet

- IB Bm2tr 3 Resources Answers7Document7 pagesIB Bm2tr 3 Resources Answers7Gabriel FungNo ratings yet

- Ey Aarsrapport 2021 22 15Document1 pageEy Aarsrapport 2021 22 15Ronald RunruilNo ratings yet

- Domestic and External DebtDocument9 pagesDomestic and External DebtYasir MasoodNo ratings yet

- Press Release For Immediate ReleaseDocument4 pagesPress Release For Immediate Releasepatburchall6278No ratings yet

- 120 Financial Statements and Ratio Analysis PDFDocument20 pages120 Financial Statements and Ratio Analysis PDFMohit WaniNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página860Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página860franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página863Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página863franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página866Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página866franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página862Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página862franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página880Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página880franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página865Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página865franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página876Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página876franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página871Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página871franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página870Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página870franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página888Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página888franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página882Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página882franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página868Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página868franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página867Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página867franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página864Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página864franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página877Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página877franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página879Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página879franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página883Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página883franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página874Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página874franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página869Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página869franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página875Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página875franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página885Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página885franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página859Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página859franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página861Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página861franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página878Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página878franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página887Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página887franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página892Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página892franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página858Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página858franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página891Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página891franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página873Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página873franzmartiniiNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página886Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página886franzmartiniiNo ratings yet

- Islamic Dream InterpretationsDocument2 pagesIslamic Dream InterpretationsoumermoNo ratings yet

- 59 Sta. Clara Homeowners' Asso. V Sps. Gaston, GR No. 141961, January 23, 2002Document7 pages59 Sta. Clara Homeowners' Asso. V Sps. Gaston, GR No. 141961, January 23, 2002Edgar Calzita AlotaNo ratings yet

- Legal Regulation of Cyber Crimes in IndiaDocument9 pagesLegal Regulation of Cyber Crimes in IndiaSwarnaprava DashNo ratings yet

- 086 NLR NLR V 65 K. PONNUDURAI Petitioner and D. S. SUMANAWEERA Sub Inspector of Police ResDocument2 pages086 NLR NLR V 65 K. PONNUDURAI Petitioner and D. S. SUMANAWEERA Sub Inspector of Police ResShehan emgNo ratings yet

- ILW LessonsDocument125 pagesILW LessonsKayleeNo ratings yet

- Lethal Discrimination 2: Repairing The Remedies For Racial Discrimination in Capital SentencingDocument51 pagesLethal Discrimination 2: Repairing The Remedies For Racial Discrimination in Capital SentencingRashi BakshNo ratings yet

- JsadjasjdpapdDocument15 pagesJsadjasjdpapdEmmanuel C. DumayasNo ratings yet

- Swift Corporates Presentations BankpaymentobligationDocument43 pagesSwift Corporates Presentations BankpaymentobligationNhân Trung LêNo ratings yet

- Rizal Commercial Banking Corp V ArroDocument2 pagesRizal Commercial Banking Corp V Arrocmv mendozaNo ratings yet

- Canara - Epassbook - 2024-03-27%2015 - 34 - 42.268968 2Document8 pagesCanara - Epassbook - 2024-03-27%2015 - 34 - 42.268968 2soumyanayak7876No ratings yet

- Tirumala Tirupati Devasthanams (Official Booking Portal)Document3 pagesTirumala Tirupati Devasthanams (Official Booking Portal)Vijayavital AcharNo ratings yet

- Shareholder Agreement TemplateDocument4 pagesShareholder Agreement TemplateKid CarlomagnoNo ratings yet

- Motion To Quash Bench Warrant NonfillableDocument2 pagesMotion To Quash Bench Warrant NonfillablecjNo ratings yet

- Ride Details Bill Details: Thanks For Travelling With Us, VasuDocument3 pagesRide Details Bill Details: Thanks For Travelling With Us, VasuShankar BabluNo ratings yet

- Network Defense (NetDef) Course Final Exam AnswersDocument37 pagesNetwork Defense (NetDef) Course Final Exam Answersmyturtle game01No ratings yet

- Astm A502 1976Document6 pagesAstm A502 1976dharlanuctcomNo ratings yet

- July 14: SF Gangbusters Break Italian Black-Market RingDocument24 pagesJuly 14: SF Gangbusters Break Italian Black-Market Ringjohn obrienNo ratings yet

- Chapter Eight: Termination of Official Relations (Acceptance of An Incompatible Office, Abandonment of Office)Document7 pagesChapter Eight: Termination of Official Relations (Acceptance of An Incompatible Office, Abandonment of Office)Anonymous CWcXthhZgxNo ratings yet

- Colgate Ratio Analysis WSM 2020 SolvedDocument17 pagesColgate Ratio Analysis WSM 2020 Solvedabi habudinNo ratings yet

- Affidavit of Disinterested PersonDocument1 pageAffidavit of Disinterested Personnoel adriaticoNo ratings yet

- Hisa PresentationDocument12 pagesHisa Presentationapi-631631105No ratings yet

- July 28th 2014Document58 pagesJuly 28th 2014Kamau GabrielNo ratings yet

- CCT - CCI Code of EthicsDocument2 pagesCCT - CCI Code of EthicsAvanca LouisNo ratings yet

- StoppardDocument6 pagesStoppardCharlie FuentesNo ratings yet

- JEEL Vol 10 Iss 1Document76 pagesJEEL Vol 10 Iss 1AkankshaNo ratings yet

- Police and Military RanksDocument3 pagesPolice and Military RanksKoenToeMastaNo ratings yet