Professional Documents

Culture Documents

Task 3 - "Working Capital Management"

Task 3 - "Working Capital Management"

Uploaded by

ScribdTranslationsOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Task 3 - "Working Capital Management"

Task 3 - "Working Capital Management"

Uploaded by

ScribdTranslationsCopyright:

Available Formats

Task No.

3: “Working Capital Management”

1. Calculate the Current Assets with the following information:

A group of FOUR (4) doctors decide to create the Medo Plus SA Pain Medical

Center, dedicated to the treatment of pain, for which each one contributes:

$300,000 dollars in cash and buys $30,000 dollars in furniture, each doctor gives

the percentage they corresponds.

With the cash he opens an account of $900,000 dollars at BBVA Continental

They purchase 2,000 pain treatment kits in cash at a price of $10 each.

In that first month they serve 50 Rímac insurance patients, each patient pays 20%

of the pain treatment, the treatment has a value of 100 dollars, the difference will

be considered an account receivable

An ultrasound machine to perform infiltrations has been purchased with a 2-year

(1) bank loan at a price of $50,000 dollars.

Salaries of 200 dollars were paid

Rentals 100 dollars

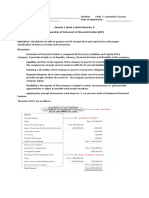

Unitary

Income Amount Total Unit cost Amount Total

Input $ 300,000.00 4 $ 1,200,000.00 furniture $ 30,000.00

BANK $ 900,000.00

kit $ 10.00 2000 $ 20,000.00

Cash $ 250,000.00

Initial Total Final Total

$ 1,200,000.00 $ 1,200,000.00

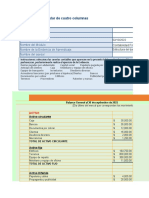

Current assets are those considered cash, cash equivalents, inventories, other

liquid assets, etc.

Current Assets = Cash + Cash Equivalents + Inventories + Accounts Receivable +

Marketable Securities + Prepaid Expenses + Other Liquid Assets.

AC = Cash + Furniture + Negotiable Securities (Kit) + Accounts Receivable +

Advance Payment

AC = $250,000 + $30,000 + $20,000 + $4,000 + $1,000 = $305,000

2. Available Current Assets

Available Current Assets: These are cash on hand, cash in bank and

temporary investments.

ACD = $900,000.00

3. Realizable Current Assets:

These assets are those that are expected to be converted into cash or cash

equivalents in the course of their operation.

Kit Stock: 2,000

Unit Price: $10

Realizable Current Assets = 2,000 + $10

ACR = $2,000.00

Conclusions:

The importance of knowing these aspects of our economic activity allows us to

evaluate the viability and liquidity of the company, thus avoiding errors that

could affect our accounting.

BIBLIOGRAPHY:

1. USM. Module III Operational Administration of the Company- Cited

December 18, 2022. http://online.fliphtml5.com/cjpy/yawu/#p=1

You might also like

- AHM13e - Chapter 01 - Key To EOC Problems and CasesDocument14 pagesAHM13e - Chapter 01 - Key To EOC Problems and CasesArunesh SN100% (1)

- Ch2 TB Moodle 20201030Document6 pagesCh2 TB Moodle 20201030Wang JukNo ratings yet

- Tugas ForumDocument4 pagesTugas Forumarif budi hermansahNo ratings yet

- FarDocument8 pagesFarnivea gumayagay71% (7)

- Akl P4.3 & P4.4Document18 pagesAkl P4.3 & P4.4Dhivena JeonNo ratings yet

- Corporate Finance Practice Problems: Jeter Corporation Income Statement For The Year Ended 31, 2001Document9 pagesCorporate Finance Practice Problems: Jeter Corporation Income Statement For The Year Ended 31, 2001Eunice NanaNo ratings yet

- General Accounting 2Document5 pagesGeneral Accounting 2Rheu ReyesNo ratings yet

- Consolidated Workpaper (Intercompany Sales of Inventory, Plant Assets) (100 Points)Document1 pageConsolidated Workpaper (Intercompany Sales of Inventory, Plant Assets) (100 Points)Yumi ShiwaNo ratings yet

- PRELIM Quiz 1 Cash, CE, PCF, Bank ReconDocument8 pagesPRELIM Quiz 1 Cash, CE, PCF, Bank ReconApril Faye de la CruzNo ratings yet

- Week 5 Class SolutionsDocument28 pagesWeek 5 Class SolutionsBriar RoseNo ratings yet

- M6 Post-TaskDocument9 pagesM6 Post-TaskMarielle SisonNo ratings yet

- Company Valuation ExerciseDocument7 pagesCompany Valuation ExerciseJavokhir AslamovNo ratings yet

- Exercise 1Document3 pagesExercise 1ScribdTranslationsNo ratings yet

- Book 1Document14 pagesBook 1by ScribdNo ratings yet

- New Microsoft Excel WorksheetDocument2 pagesNew Microsoft Excel WorksheetKeresha WilliamsNo ratings yet

- Chap 1 - Acc Equation Exercises - STDocument17 pagesChap 1 - Acc Equation Exercises - STKim NganNo ratings yet

- Quiz 1: Introduction To Accounting NameDocument4 pagesQuiz 1: Introduction To Accounting NameWilliam YangNo ratings yet

- FIN427 Home Work 02 AnswerDocument4 pagesFIN427 Home Work 02 AnswerB M Rakib HassanNo ratings yet

- This Study Resource Was: Current Asset - Cash & Cash Equivalents CompositionsDocument2 pagesThis Study Resource Was: Current Asset - Cash & Cash Equivalents CompositionsKim TanNo ratings yet

- BizCafe Team6 A3 DeliverableB CSBA1010 S4Document6 pagesBizCafe Team6 A3 DeliverableB CSBA1010 S4Ivneet KaurNo ratings yet

- Date Account Titles and Explanations DebitDocument16 pagesDate Account Titles and Explanations DebitPamela AbenirNo ratings yet

- Finals Quiz No. 1 AnswersDocument4 pagesFinals Quiz No. 1 AnswersMergierose DalgoNo ratings yet

- PR Advance 1 Problem 10-7 Statement of AffairsDocument4 pagesPR Advance 1 Problem 10-7 Statement of AffairsReynaldi100% (1)

- Credit Sales $10,000,000 Accounts Receivable 3,000,000 Allowance For Doubtful Accounts 50,000Document11 pagesCredit Sales $10,000,000 Accounts Receivable 3,000,000 Allowance For Doubtful Accounts 50,000rahul ambatiNo ratings yet

- IA Activity 1Document13 pagesIA Activity 1Sunghoon SsiNo ratings yet

- Documents - Tips 9-45Document8 pagesDocuments - Tips 9-45BlackBunny103No ratings yet

- Drill Corporate LiquidationDocument3 pagesDrill Corporate LiquidationElizabeth DumawalNo ratings yet

- Accounting 423 Professor Kang: Practice Problems For Chapter 2 Consolidation of Financial StatementsDocument14 pagesAccounting 423 Professor Kang: Practice Problems For Chapter 2 Consolidation of Financial StatementsJoel Christian MascariñaNo ratings yet

- Mid Term ExamDocument6 pagesMid Term ExamWaizin KyawNo ratings yet

- InstructionsDocument7 pagesInstructionsGarp BarrocaNo ratings yet

- Intermediate AccountingDocument17 pagesIntermediate AccountingHershey PadrigoneNo ratings yet

- Group 1Document2 pagesGroup 1Niro MadlusNo ratings yet

- Dumasig - Unit 1 - Cash and Cash EquivalentsDocument7 pagesDumasig - Unit 1 - Cash and Cash Equivalentscherryzza bation100% (1)

- Material - Gestión Financiera - Cash Flow Forecasting (Unsolved)Document6 pagesMaterial - Gestión Financiera - Cash Flow Forecasting (Unsolved)jessicaNo ratings yet

- WS 6 Preparation of SFPDocument5 pagesWS 6 Preparation of SFPEricel MonteverdeNo ratings yet

- Chapter - 1Document23 pagesChapter - 1Kumar AmitNo ratings yet

- #6 Money Supply 1Document21 pages#6 Money Supply 1jikhulNo ratings yet

- Practice Problem in Cash ReceivableDocument5 pagesPractice Problem in Cash ReceivableJernalynne AvellanaNo ratings yet

- Asynchronous Statement of Financial Position XYZ CompanyDocument5 pagesAsynchronous Statement of Financial Position XYZ CompanyDiana Fernandez MagnoNo ratings yet

- Exercise 2 Trial Balance BookDocument7 pagesExercise 2 Trial Balance BookScribdTranslationsNo ratings yet

- BalanceDocument4 pagesBalanceEleazar Pérez DíazNo ratings yet

- Acca - FaDocument22 pagesAcca - Fak61.2214810058No ratings yet

- Module 2 - Handout 1 Business ComDocument6 pagesModule 2 - Handout 1 Business ComRosemarie AlcantaraNo ratings yet

- Cash and Cash Equivalents Module Answer KeyDocument26 pagesCash and Cash Equivalents Module Answer KeyMarianne ElemosNo ratings yet

- Chapter 3 ReviewDocument11 pagesChapter 3 ReviewGultayaz khanNo ratings yet

- Date Transaction: 1. Journalize and Post To The LedgerDocument5 pagesDate Transaction: 1. Journalize and Post To The LedgerArlyn Ragudos BSA1No ratings yet

- Practice Exam Chapters 1-5 (2) Solutions: Problem IDocument4 pagesPractice Exam Chapters 1-5 (2) Solutions: Problem IAtif RehmanNo ratings yet

- A5 Activity 2 Capital Maintenance and Transaction Approach StudentsDocument17 pagesA5 Activity 2 Capital Maintenance and Transaction Approach StudentsJOY MARIE RONATONo ratings yet

- Review Quiz Inter1Document9 pagesReview Quiz Inter1Vanessa vnssNo ratings yet

- Avance Libro MayorDocument16 pagesAvance Libro MayorSERGIO RICARDO MENDOZA ALFARONo ratings yet

- DocxDocument7 pagesDocxSaoxalo ONo ratings yet

- This Study Resource Was: Managerial Accounting Lesson 9 Homework Name Hemant SahDocument3 pagesThis Study Resource Was: Managerial Accounting Lesson 9 Homework Name Hemant SahMagdy Abd El-FattahNo ratings yet

- Latihan Soal Akl CH 1 Dan 2Document12 pagesLatihan Soal Akl CH 1 Dan 2DheaNo ratings yet

- MC Worksheet-3 (DICKY IRAWAN - C1I017051)Document5 pagesMC Worksheet-3 (DICKY IRAWAN - C1I017051)DICKY IRAWAN 1No ratings yet

- p4 2Document5 pagesp4 2Ernike SariNo ratings yet

- Intermediate Accounting 1 Quiz 1Document4 pagesIntermediate Accounting 1 Quiz 1Manuel MagadatuNo ratings yet

- Financial Statements and Adjusting EntriesDocument4 pagesFinancial Statements and Adjusting EntriesALI ZAFAR� LIAQAT UnknownNo ratings yet

- HARD ROCK COMPANY Statement of Financial PositionDocument3 pagesHARD ROCK COMPANY Statement of Financial PositionJade Lykarose Ochavillo GalendoNo ratings yet

- Requirement No. 1: PROBLEM NO. 1 - Peso CorporationDocument13 pagesRequirement No. 1: PROBLEM NO. 1 - Peso CorporationDreiu EsmeleNo ratings yet

- Natural History of Parkinson's DiseaseDocument49 pagesNatural History of Parkinson's DiseaseScribdTranslationsNo ratings yet

- Abbreviated File-Process Case 01 Marco A. and CounterclaimDocument25 pagesAbbreviated File-Process Case 01 Marco A. and CounterclaimScribdTranslationsNo ratings yet

- Application of Copper Sulfate in AquacultureDocument2 pagesApplication of Copper Sulfate in AquacultureScribdTranslationsNo ratings yet

- Ethnicity, Language and IdentityDocument4 pagesEthnicity, Language and IdentityScribdTranslationsNo ratings yet

- Chapter X. Precision Shooting From Naval Air PlatformsDocument24 pagesChapter X. Precision Shooting From Naval Air PlatformsScribdTranslationsNo ratings yet

- Retirement Instructions Unemployment PorvenirDocument6 pagesRetirement Instructions Unemployment PorvenirScribdTranslationsNo ratings yet

- Musical Instruments of EuropeDocument3 pagesMusical Instruments of EuropeScribdTranslationsNo ratings yet

- Project On Electricity For ChildrenDocument13 pagesProject On Electricity For ChildrenScribdTranslationsNo ratings yet

- SYLLABUS Mechanical Drawing 2Document7 pagesSYLLABUS Mechanical Drawing 2ScribdTranslationsNo ratings yet

- Practical Work The Familiar PDFDocument1 pagePractical Work The Familiar PDFScribdTranslationsNo ratings yet

- 5th Grade Plan - Block 4 GeographyDocument12 pages5th Grade Plan - Block 4 GeographyScribdTranslationsNo ratings yet

- History and Evolution of Reciprocating MotorsDocument32 pagesHistory and Evolution of Reciprocating MotorsScribdTranslationsNo ratings yet

- Tourist PlanningDocument39 pagesTourist PlanningScribdTranslationsNo ratings yet

- Sixth Grade Reading Comprehension AssessmentDocument8 pagesSixth Grade Reading Comprehension AssessmentScribdTranslationsNo ratings yet

- Boxing PDFDocument49 pagesBoxing PDFScribdTranslationsNo ratings yet

- Reading Comprehension and Contextual Vocabulary Exercises 4th Middle #8.Document5 pagesReading Comprehension and Contextual Vocabulary Exercises 4th Middle #8.ScribdTranslationsNo ratings yet

- Comparative Table of Rationalism and EmpiricismDocument7 pagesComparative Table of Rationalism and EmpiricismScribdTranslationsNo ratings yet

- iTEP in - House PDFDocument12 pagesiTEP in - House PDFScribdTranslationsNo ratings yet

- PH Portfolio Recovery ProposalDocument3 pagesPH Portfolio Recovery ProposalScribdTranslationsNo ratings yet

- Legal Aspects GuatemalaDocument20 pagesLegal Aspects GuatemalaScribdTranslationsNo ratings yet

- Expo22 Daily ExperienceDocument6 pagesExpo22 Daily ExperienceScribdTranslationsNo ratings yet

- Application of Regulations in The Financial SystemDocument74 pagesApplication of Regulations in The Financial SystemScribdTranslationsNo ratings yet

- Driver's Manual in TexasDocument109 pagesDriver's Manual in TexasScribdTranslationsNo ratings yet

- Vibrational Sound Therapy ManualDocument12 pagesVibrational Sound Therapy ManualScribdTranslationsNo ratings yet

- Applied StatisticsDocument209 pagesApplied StatisticsScribdTranslationsNo ratings yet

- Chemistry Laboratory Report 1Document14 pagesChemistry Laboratory Report 1ScribdTranslationsNo ratings yet

- Examples of Operant ConditioningDocument1 pageExamples of Operant ConditioningScribdTranslationsNo ratings yet

- Security of Accounting Information SystemsDocument2 pagesSecurity of Accounting Information SystemsScribdTranslationsNo ratings yet

- Types of Banks Based On OwnershipDocument2 pagesTypes of Banks Based On OwnershipScribdTranslationsNo ratings yet

- Event Security ProtocolDocument7 pagesEvent Security ProtocolScribdTranslationsNo ratings yet

- Classical Theory PDFDocument24 pagesClassical Theory PDFRadhika Malakar100% (1)

- CIMA Introduction To NLPDocument4 pagesCIMA Introduction To NLPsambrefoNo ratings yet

- Grossman M. (1972) PDFDocument33 pagesGrossman M. (1972) PDFMichele DalenaNo ratings yet

- The Indonesian Coal Index (ICI) 2013 by ArgusDocument2 pagesThe Indonesian Coal Index (ICI) 2013 by ArgusFrily MarinaNo ratings yet

- Marketing Management Full Notes at MbaDocument308 pagesMarketing Management Full Notes at MbaBabasab Patil (Karrisatte)100% (1)

- Consumer and Producer SurplusDocument39 pagesConsumer and Producer SurplusShivanshu TrivediNo ratings yet

- Sears Online Layaway AgreementDocument2 pagesSears Online Layaway AgreementValarkNo ratings yet

- Sebi Act 1992Document12 pagesSebi Act 1992anupraipurNo ratings yet

- الانجليزية L1 /S2Document15 pagesالانجليزية L1 /S2Rabah SlimaniNo ratings yet

- P2 Mar2014 QPDocument20 pagesP2 Mar2014 QPjoelvalentinorNo ratings yet

- Unit I& II Practice ProblemsDocument6 pagesUnit I& II Practice ProblemsDee ShanNo ratings yet

- Community - Based - Procurement - Manual (Kalahi Cidss)Document210 pagesCommunity - Based - Procurement - Manual (Kalahi Cidss)Abby ReyesNo ratings yet

- Perfect Competition - PPTDocument20 pagesPerfect Competition - PPTDyuti Sinha0% (1)

- Research On Modern Implications Of: Pairs TradingDocument23 pagesResearch On Modern Implications Of: Pairs Tradinggabriel_87No ratings yet

- Manila Trading V TamarawDocument3 pagesManila Trading V TamarawParis LisonNo ratings yet

- REA-REB Reviewer 2021Document402 pagesREA-REB Reviewer 2021Jheovane Sevillejo LapureNo ratings yet

- CFO Macro12 PPT 19Document45 pagesCFO Macro12 PPT 19Pedro ValdiviaNo ratings yet

- GST Notes For Vi SemesterDocument55 pagesGST Notes For Vi SemesterNagashree RANo ratings yet

- The Planetary Fan - Astro AnalystDocument1 pageThe Planetary Fan - Astro AnalystGianniNo ratings yet

- Financial Policies & Accounting Procedures Manual - PAD ...Document60 pagesFinancial Policies & Accounting Procedures Manual - PAD ...JamalNo ratings yet

- Forecast Ets ExampleDocument12 pagesForecast Ets ExampleAbhinav PrakashNo ratings yet

- Packet 2 LP Problem Set 2Document11 pagesPacket 2 LP Problem Set 2Prince JainNo ratings yet

- Asia Pacific Fit-Out Cost Guide 2021/2022: ResearchDocument31 pagesAsia Pacific Fit-Out Cost Guide 2021/2022: ResearchhojunxiongNo ratings yet

- LESSON#1: Fundamentals of Managerial EconomicsDocument10 pagesLESSON#1: Fundamentals of Managerial Economicssonny saynoNo ratings yet

- Group ProjectDocument5 pagesGroup ProjectMelisa May Ocampo AmpiloquioNo ratings yet

- Helium 10 The Ultimate Product Research GuideDocument18 pagesHelium 10 The Ultimate Product Research GuideNazim AltafNo ratings yet

- Money in The Modern Economy An Introduction PDFDocument10 pagesMoney in The Modern Economy An Introduction PDFTharindu Dissanayake100% (1)

- Word Problems From Linear Equations and FormulasDocument1 pageWord Problems From Linear Equations and FormulasKisten KallistusNo ratings yet

- 18 Markets - Factors - ProductionDocument44 pages18 Markets - Factors - ProductionKaran GandhiNo ratings yet

- COST CONTROL FOOD PRODUCTION CONTROL ModuleDocument11 pagesCOST CONTROL FOOD PRODUCTION CONTROL ModuleAndy Porcalla Aguanta100% (1)