Professional Documents

Culture Documents

Chap 8 - Cash Flow Statement (Questions)

Chap 8 - Cash Flow Statement (Questions)

Uploaded by

Mazhar AzizOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chap 8 - Cash Flow Statement (Questions)

Chap 8 - Cash Flow Statement (Questions)

Uploaded by

Mazhar AzizCopyright:

Available Formats

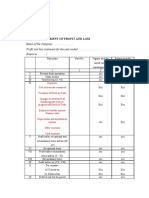

Chapter - 8 IAS 7: STATEMENT OF CASH FLOWS – QUESTIONS (1)

-------------- Cash flow format -----------

[Indirect method]

Company name

Statement of cash flows

For the year ended -----------------

Rs.’000 Rs.’000

Cash flow from operating activities:

Profit before tax (W-1) XXX

Add: Depreciation / Impairment loss (W-3) XXX

Loss on disposal of asset (W-3, W-6, W-12) XXX

Revaluation loss (P&L) XXX

Interest expense/Finance cost (W-4) XXX

Bad debt expense (W-5) [Note-1] XXX

Fair value loss on investment property (W-6) XXX

Less: Interest / investment income (W-7) (XXX)

Dividend income (W-8) (XXX)

Fair value gain on investment property (W-6) (XXX)

Grant income (W-9) (XXX)

Revaluation loss reversal (P&L) (XXX)

Profit on sale of asset (W-3, W-6, W-12) (XXX)

Operating profit before working capital changes: XXX

(Increase) / Decrease in debtors [Note-1] (XXX) / XXX

(Increase) / Decrease in stocks (XXX) / XXX

(Increase) / Decrease in advances [Note-2] (XXX) / XXX

(Increase) / Decrease in prepayments (XXX) / XXX

Increase / (Decrease) in creditors XXX / (XXX)

Increase / (Decrease) in accruals XXX / (XXX)

Cash generated from operations XXX

Tax paid (W-10) (XXX)

Interest paid (W-4) (XXX)

Dividend received (W-8) XXX

Interest received (W-7) XXX

Cash inflow / (Outflow) from operating activities (A) XXX

Cash flow from investing activities:

Purchase of PPE (W-3) (XXX)

Sale of PPE / Insurance claim received (W-3) XXX

Purchase of investment property (W-6) (XXX)

Sale of investment property (W-6) XXX

Expenditure on capital WIP (W-11) (XXX)

Long term deposits (XXX)

Govt. grant received (W-9) XXX

Govt. grant repaid (W-9) (XXX)

Purchase of investment (W-12) (XXX)

Sale of investment (W-12) XXX

Cash inflow / (outflow) from investing activities (B) XXX

Cash flow from financing activities:

Issue of shares (W-13) XXX

Dividend paid (W-2) (XXX)

Proceeds from loan (W-14) XXX

Repayment / redemption of loan (W-14) (XXX)

Cash inflow / (outflow) from financing activities (C) XXX

Net cash inflow / (outflow) during the year (A + B + C) XXX

Cash and cash equivalents at start of year XXX

Cash and cash equivalents at end of year XXX

Nasir Abbas FCA

Chapter - 8 IAS 7: STATEMENT OF CASH FLOWS – QUESTIONS (2)

CASH AND CASH EQUIVALENTS:

Opening Closing

Cash in hand XXX XXX

Bank balance XXX XXX

Bank overdraft / running finance (XXX) (XXX)

Short term investments XXX XXX

XXX XXX

EXAM NOTES:

1. Increase / decrease in debtors can be calculated in one of the following two ways:

(a) Movement in gross debtors (as done in above format)

= closing gross debtors + bad debt written off during the year – opening gross debtors

(b) Movement in net debtors

= closing debtors (net of provision) – opening debtors (net of provision)

Tips:

• If (b) is used then bad debt expense line will not appear in adjustments to profit before tax

• (a) is more practically used treatment however (b) is also acceptable in exams

2. Changes in all current assets and current liabilities are shown in this section except for followings:

(i) cash and cash equivalents

(ii) tax assets and liabilities

(iii) Dividend payable and receivable

(iv) Interest payable and receivable

(v) Any other asset or liability which is shown under investing or financing activities e.g. short term finance,

investment, payable for purchase of a PPE and current portion of loan etc.

Above items may be hidden in other current assets or liabilities (e.g. interest payable may be hidden in

“accrued expenses”). In this case exclude above items first while calculating working capital changes.

3. IAS 7 allows to show: Under Under

Dividend received Operating activities OR Investing activities

Interest received Operating activities Investing activities

Dividend paid Operating activities OR Financing activities

Interest paid Operating activities Financing activities

Workings

W–1 Profit before tax

Retained earnings

Cash dividend declared (W-2) XXX Open. Balance XXX

Bonus dividend XXX PAT XXX

Transfer to general reserve XXX Transfer from revaluation surplus XXX

Clos. Balance XXX

PBT = PAT + Tax expense (W-10)

W–2 Dividend paid

Dividend payable

Cash dividend paid XXX Open. Balance XXX

Clos. Balance XXX Cash dividend declared XXX

Note - Even if there is no information regarding dividend paid / declared in other information do not forget to prepare

“Retained earnings” account as it may give cash dividend declared as a balancing figure on debit side.

Nasir Abbas FCA

Chapter - 8 IAS 7: STATEMENT OF CASH FLOWS – QUESTIONS (3)

W–3 PPE

(i) PPE carried at cost / revalued amount:

PPE

Open. Balance (Cost / Revalued amount) XXX Disposal (Cost / Revalued amount) XXX

Revaluation (upwards) XXX Revaluation (downwards) XXX

Transfer from capital WIP (W-11) XXX Transfer to investment property (W-6) XXX

Transfer from investment property (W-6) XXX Clos. Balance (Cost / Revalued amount) XXX

Addition:

Cash XXX

Non cash XXX

Examples of non-cash additions – Trade in allowance and credit purchase.

Accumulated depreciation & impairment loss

Disposal (Acc. Dep) XXX Open. Balance XXX

Clos. Balance XXX Depreciation XXX

Impairment loss XXX

PPE Disposal

Cost / Revalued amount XXX Accumulated depreciation XXX

Profit on disposal XXX Sale price / Insurance claim XXX

Trade in allowance XXX

Loss on disposal XXX

(ii) PPE carried at NBV

PPE at NBV

Open. Balance (NBV) XXX Disposal (NBV) XXX

Revaluation (upwards) XXX Revaluation (downwards) XXX

Transfer from capital WIP XXX Depreciation XXX

Transfer from investment property XXX Transfer to investment property XXX

Addition: Impairment loss XXX

Cash XXX Clos. Balance (NBV) XXX

Non cash XXX

PPE Disposal

NBV XXX Sale price / Insurance claim OR XXX

Profit on disposal XXX Trade in allowance XXX

Loss on disposal XXX

Note – While working for PPE, do not forget to prepare accounts for “Capital WIP” and “Revaluation surplus”

W–4 Interest expense / paid

Interest payable

Interest paid XXX Open. Balance XXX

Clos. Balance XXX Interest expense for the year XXX

Nasir Abbas FCA

Chapter - 8 IAS 7: STATEMENT OF CASH FLOWS – QUESTIONS (4)

W–5 Bad debt expense

Provision for doubtful debts

Bad debts written off XXX Opening balance XXX

Closing balance XXX Bad debt expense for the year XXX

W–6 Investment property (carried at fair value model)

Investment property

Open. Balance (Fair value) XXX Disposal (Carrying amount) XXX

Fair value gain XXX Fair value loss XXX

Transfer from PPE XXX Transfer to PPE XXX

Addition XXX Clos. Balance (Fair value) XXX

Disposal

Carrying amount XXX Sale price XXX

Profit on disposal XXX Loss on disposal XXX

W–7 Interest income / Interest received

Interest receivable

Open. Balance XXX Interest received XXX

Interest income for the year XXX Clos. Balance XXX

W–8 Dividend income / Dividend received

Dividend receivable

Open. Balance XXX Dividend received XXX

Dividend income for the year XXX Clos. Balance XXX

W–9 Government grant (deferred income method)

Govt. grant

Taken to income XXX Open. Balance (non current) XXX

Grant repaid during the year XXX Open. Balance (current) XXX

Clos. Balance (current) XXX Grant received during the year XXX

Clos. Balance (non current) XXX

W – 10 Tax

Tax

Open. Balance (Advance tax) XXX Open. Balance (tax payable) XXX

Tax paid XXX Tax expense XXX

Clos. Balance (tax payable) XXX Clos. Balance (Advance tax) XXX

W – 11 Capital work-in-progress

Capital work in progress

Open. Balance (Cost) XXX Transfer to fixed assets XXX

Expenditure on capital WIP XXX Clos. Balance (Cost) XXX

Nasir Abbas FCA

Chapter - 8 IAS 7: STATEMENT OF CASH FLOWS – QUESTIONS (5)

W – 12 Investments

Investment at cost

Open. Balance (Cost) XXX Disposal (Cost) XXX

Addition XXX Clos. Balance (Cost) XXX

Disposal

Cost XXX Sale price XXX

Profit on disposal XXX Loss on disposal XXX

W –13 Capital

Share capital

Closing balance XXX Opening balance XXX

Right issue / New issue (cash) XXX

Non-cash issue (e.g. purchase of PPE) XXX

Bonus issue XXX

Share premium

Closing balance XXX Opening balance XXX

Bonus issue (only if issued out of premium) XXX Right issue / New issue (cash) XXX

Non-cash issue (e.g. purchase of PPE) XXX

Note – Bonus issue is by default made out of retained earnings (i.e. bonus dividend)

W –14 Loans

Loans

Loan repaid (principal only) XXX Open. Balance (current + non current) XXX

Clos. Balance (current + non current) XXX New loan XXX

[Direct method]

Company name

Statement of cash flows

For the year ended -----------------

Rs.’000’ Rs.’000’

Cash flow from operating activities:

Receipts from customers (W-1) XXX

Other receipts (e.g. rent received) XXX

Payments to suppliers (W-2) (XXX)

Payment for other operating expenses (W-3) (XXX)

Cash generated from operations XXX

``

``

``

Remaining format after “cash generated from operations” is exactly

same as Indirect method

``

``

``

Nasir Abbas FCA

Chapter - 8 IAS 7: STATEMENT OF CASH FLOWS – QUESTIONS (6)

W–1 Receipts from customers

Customers / Debtors

Opening balance (Gross) XXX Bad debts written off XXX

Sales (Total) XXX Receipts (balancing) XXX

Closing balance (Gross) XXX

W–2 Payments to suppliers

Creditors

Payments (balancing) XXX Opening creditors (Note) XXX

Closing creditors (Note) XXX Purchases (from COS a/c) XXX

Note – If accrued interest is included, then exclude it first before using here.

Cost of sales / Inventory

Opening stock XXX Cost of sales (Note) XXX

Purchases (balancing) XXX Closing balance XXX

Note – If depreciation is included, then exclude it first before using here.

W–3 Payment for other operating expenses

Operating expenses

Rs.’000’ Rs.’000’

Opening advances & prepayments (Note-1) XXX Opening accrued expenses (Note-2) XXX

Payments (balancing) XXX Operating expenses (Note-3) XXX

Closing accrued expenses (Note-2) XXX Closing advances & prepayments (Note-1) XXX

Notes:

1. If advance income tax is included, then exclude it first before using here.

2. If accrued interest is included, then exclude it first before using here.

3. Operating expenses = Admin expenses + Distribution cost + Other expenses – Depreciation – Amortization

– Bad debt expense – Impairment loss – loss on disposal of asset – Fair value loss on investment property –

Revaluation loss (P&L)

Nasir Abbas FCA

Chapter - 8 IAS 7: STATEMENT OF CASH FLOWS – QUESTIONS (7)

QUESTIONS

QUESTION NO. 1

Following balances have been extracted from balance sheets of a limited company as at:

June 30, 2017 June 30, 2016

-------------- Rs. -------------

Share capital 1,200,000 800,000

Share premium 200,000 120,000

Retained earnings 2,050,000 1,450,000

Dividend payable 75,000 50,000

Tax payable 32,000 26,000

Additional information:

1) Tax paid during 2017 was Rs. 42,500.

2) Dividend paid during 2017 was Rs. 100,000.

Required:

Calculate “cash inflow from issue of shares” and “profit before tax” for the year ended June 30, 2017.

QUESTION NO. 2

Following balances have been extracted from balance sheets of a limited company as at:

Dec 31, 2017 Dec 31, 2016

-------------- Rs. -------------

Property, plant and equipment 1,820,000 1,450,000

Revaluation surplus 163,000 140,000

Capital work in progress 270,000 550,000

Additional information relating to year 2017:

1) Depreciation for the amount to Rs. 425,000.

2) Transfer from revaluation surplus to retained earnings during the year was Rs. 15,000.

3) Expenditure of Rs. 140,000 was incurred on capital work-in-progress during the year.

4) During the year a machine costing Rs. 240,000 was sold at a profit of Rs. 18,000. Accumulated depreciation of

machine at the time of disposal was Rs. 75,000. There was no other disposal during the year.

Required:

Calculate “cash inflow from sale of PPE” and “cash outflow from purchase of PPE” for the year ending December 31, 2017.

QUESTION NO. 3

Following balances have been extracted from balance sheets of a limited company as at:

Dec 31, 2017 Dec 31, 2016

-------------- Rs. -------------

Share capital 310,000 250,000

Share premium 120,000 90,000

Long term loan 225,000 200,000

Dividend payable 22,000 15,000

Additional information relating to year 2017:

1) Total principal repayments of loan made during the year were Rs. 55,000.

2) Dividend of Rs. 40,000 was declared during the year.

Required:

Prepare “cashflow from financing activities” section of cash flow statement for the year ended December 31, 2017.

Nasir Abbas FCA

Chapter - 8 IAS 7: STATEMENT OF CASH FLOWS – QUESTIONS (8)

QUESTION No. 4

Following information pertains to Dahl Limited (DL):

Summarised statement of financial position as at 31 December 2021

2021 2020 2021 2020

Rs. in million Rs. in million

Share capital 11.0 10.0 Property, plant and equipment 18.7 10.6

Retained earnings 32.9 33.8 Working capital other than cash 24.5 17.8

Revaluation surplus 4.0 - Cash 4.7 15.4

47.9 43.8 47.9 43.8

Additional information:

(i) Final dividend was paid in respect of year 2020 amounting to Rs. 3.4 million.

(ii) Additions to property, plant and equipment during the year amounted toRs. 14 million.

(iii) Tax expense for the year amounted to Rs. 2.4 million. Tax payable as at31 December 2021 amounted

to Rs. 1 million (2020: Rs. 0.2 million)

Required:

Prepare DL’s statement of cash flows for the year ended 31 December 2021. (08)

[Spring 2022, Q-2]

QUESTION No. 5

Following are the extracts from the financial statements of Saguaro Limited (SL) for the year ended 30 June 2021:

Statement of financial position as on 30 June 2021

2021 2020 2021 2020

Assets Rs. in million Equity & liabilities Rs. in million

Operating fixed assets 820 848 Share capital (Rs. 10 each) 700 500

Accumulated depreciation (300) (262) Share discount (40) -

Capital WIP 84 - Retained earnings 220 315

Inventories 274 245 Long term loans 175 210

Trade receivables 177 204 Trade payables 180 130

Insurance claim - 31 Accrued expenses 48 43

Advance to supplier 78 60 Current portion of loans 43 40

Cash and bank balances 193 112

1,326 1,238 1,326 1,238

Statement of comprehensive income for the year ending 30 June 2021

Rs. million

Sales 757

Cost of sales (485)

Gross profit 272

Operating expenses (310)

Gain on disposal of equipment 17

Loss before interest (21)

Other information:

(i) SL declared a final dividend of 10% on 30 September 2020 which was paid in December 2020.

(ii) 20 million shares were issued in May 2021.

(iii) Insurance claim was related to plant and machinery destroyed in April 2020. The plant had cost and book value of

Rs. 63 million and Rs. 42 million respectively.

(iv) During the year, SL disposed of equipment having cost and net book value of Rs. 75 million and Rs. 35 million

respectively.

(v) Current portion of long-term loans include accrued interest of Rs. 5 million. (2020: Rs. 1 million)

(vi) Trade payables include an amount of Rs. 14 million payable against capital work in progress.

Nasir Abbas FCA

Chapter - 8 IAS 7: STATEMENT OF CASH FLOWS – QUESTIONS (9)

Required:

Prepare SL’s statement of cash flows for the year ended 30 June 2021. (16)

[Autumn 2021, Q-6]

QUESTION No. 6

Statement of financial position of Taxila Limited (TL) as on 30 June 2020 is as follows:

Statement of financial position as on 30 June 2020

2020 2019 2020 2019

Assets Rs. in million Equity & liabilities Rs. in million

Property, plant and equipment 1,619 1,200 Share capital (Rs. 100 each) 1,200 800

Investment property 290 120 Share premium 290 150

Stock in trade 205 180 Retained earnings 260 90

Trade receivables 342 291 Revaluation surplus 215 200

Prepayments & other receivables 14 20 Long term loans 367 445

Short term investment 60 48 Trade & other payables 144 120

Cash and bank balance 24 6 Current maturity of loan 78 60

2,554 1,865 2,554 1,865

Additional information:

(i) Equipment having fair value of Rs. 240 million was acquired by issuing 2 million shares.

(ii) As a result of revaluation carried out on 30 June 2020, property, plant and equipment was increased by Rs. 80

million out of which Rs. 35 million was credited to profit and loss account.

(iii) During the year, fully depreciated items of property, plant and equipment costing Rs. 36 million were sold for Rs.

8 million out of which Rs. 3 million is still outstanding.

(iv) Depreciation on property, plant and equipment for the year amounted to Rs. 290 million.

(v) An investment property was acquired for Rs. 180 million. TL applies cost model for subsequent measurement of

its investment property.

(vi) Financial charges for the year amounted to Rs. 45 million. Trade and other payables include accrued financial

charges of Rs. 12 million (2019: Rs. 17 million).

(vii) Short-term investments amounting to Rs. 35 million are readily convertible to cash (2019: Rs. 20 million).

Investment income for the year amounted to Rs. 6 million.

Required:

Prepare TL’s statement of cash flows for the year ended 30 June 2020 in accordance with the requirements of IFRS. (17)

[Autumn 2020, Q-6]

QUESTION No. 7

You are working as Finance Manager in Broad Peak Limited (BPL). Faraz has recently joined BPL as an internee for three

months. You have asked him to develop an understanding of the statement of cash flows. After going through few

statements, he has raised the following queries:

(i) Depreciation is not a cash flow but was still appearing as an addition in the statement of cash flows.

(ii) In the statement of cash flows of a competitor, interest paid was shown as a financing activity but BPL showed it

in operating activities.

(iii) BPL purchased inventories throughout the year but total purchases of inventory were not shown in the

statement. However, only decrease in inventory was added.

(iv) Cash and bank balance in the statement of financial position was not in agreement with the opening and closing

balances at the end of statement of cash flows.

Required:

Briefly answer the queries raised by Faraz. (08)

[Spring 2020, Q-2]

Nasir Abbas FCA

Chapter - 8 IAS 7: STATEMENT OF CASH FLOWS – QUESTIONS (10)

QUESTION No. 8

Following are the extracts from the financial statements of Sunday Traders Limited (STL) for the year ended 30 June 2019:

Statement of financial position as on 30 June 2019

2019 2018 2019 2018

Assets Rs. in million Equity & liabilities Rs. in million

Property, plant and equipment 8,555 7,240 Share capital (Rs. 10 each) 4,650 3,450

Investment property 1,800 1,120 Share premium 1,600 1,240

Stock in trade 4,800 4,500 Retained earnings 1,652 (655)

Prepayments 184 268 Long term loans 6,024 6,523

Trade receivables 3,800 3,600 Trade payables 3,422 5,390

Cash 194 480 Contract liability 250 40

Accrued liabilities 310 180

Interest payable 135 110

Current maturity of loan 850 700

Provision for taxation 440 230

19,333 17,208 19,333 17,208

Statement of profit or loss for the year ended 30 June 2019

Rs. in million

Sales 29,700

Cost of sales (15,750)

Gross profit 13,950

Distribution cost (6,185)

Administrative cost (2,302)

Other income 404

Profit before interest and tax 5,867

Interest expense (1,210)

Profit before tax 4,657

Tax expense (1,150)

Profit after tax 3,507

Additional information:

(i) 72% of sales were made on credit.

(ii) Depreciation expense for the year amounted to Rs. 750 million which was charged to distribution and

administrative cost in the ratio of 3:1.

(iii) Distribution cost includes:

• Rs. 40 million in respect of loss on disposal of equipment. The written down value at the time of disposal

was Rs. 152 million.

• impairment loss on vehicles amounting to Rs. 24 million.

(iv) Loan instalments (including interest) of Rs. 1,984 million were paid during the year.

(v) Other income comprises of:

• increase in fair value of investment property amounting to Rs. 220 million.

• rent received from investment property amounting to Rs. 184 million.

(vi) During the year, STL issued right shares at premium.

Required:

Prepare STL’s statement of cash flows for the year ended 30 June 2019 using direct method. (19)

[Autumn 2019, Q-5]

QUESTION NO. 9

Junior Accountant of Drum Limited has prepared the following statement of cash flows for the year ended 31 December

2018:

Statement of cash flows

Rs.’000

Cash flow from operating activities

Increase in retained earnings 1,360

Increase in dividend payable 200

Increase in net trade receivables (100)

Nasir Abbas FCA

Chapter - 8 IAS 7: STATEMENT OF CASH FLOWS – QUESTIONS (11)

Increase in interest accrued 50

1,510

Cash flow from investing activities

Increase in land and building (2,600)

Increase in equipment (1,550)

Decrease in inventory 400

Decrease in tax payable (60)

(3,810)

Cash flow from financing activities

Increase in share capital and premium 2,350

Decrease in long term loan (1,000)

Increase in trade and other payables 600

1,950

Decrease in cash balance during the year (350)

Opening cash balance 450

Closing cash balance 100

Junior Accountant informed you that he has taken the difference of opening and closing balances of each balance sheet

item and classified each difference as either operating, investing or financing cash flows. He further informed that the

statement is tied up with the cash balances appearing in the balance sheet. He has ignored the following information:

(i) Depreciation on building and equipment amounted to Rs. 480,000 and Rs. 810,000 respectively.

(ii) During the year, an equipment costing Rs. 560,000 and having a book value of Rs. 310,000 was sold for Rs.

440,000.

(iii) Provision for doubtful debts was increased by Rs. 140,000.

(iv) Dividend amounting to Rs. 700,000 was paid during the year.

(v) Interest and tax expenses for the year amounted to Rs. 378,000 and Rs. 650,000 respectively.

(vi) Trade and other payables as at 31 December 2018 included Rs. 950,000 for purchase of land and building.

Required:

Prepare statement of cash flows for the year ended 31 December 2018, in accordance with IAS 7 ‘Statement of Cash

Flows’ using indirect method. (14)

(Spring 2019 Q.7)

QUESTION NO. 10

Following information pertains to Nadir Limited:

Extract from statement of profit or loss for the year ended 31 December 2017

Rs. in ‘000

Profit before taxation 8,955

Taxation (2,945)

Profit after taxation 6,010

Extract from statement of financial position as on 31 December 2017

2017 2016 2017 2016

Equity and liabilities Assets

--- Rs. in ‘000 --- ---- Rs. in ‘000 ---

Share capital 12,400 10,000 PPE – net book value 21,400 15,800

Share premium 1,400 - Current assets:

Retained earnings 13,450 12,440 Stock-in-trade 5,600 5,750

Surplus on revaluation 4,000 - Trade receivables – net 6,840 4,446

Non-current liabilities: Other receivables 2,385 800

Long-term loans 4,100 5,000 Cash & bank 2,355 3,204

Current liabilities:

Trade payables 1,900 1,400

Accruals & other payables 680 660

Tax liability 650 500

38,580 30,000 38,580 30,000

Nasir Abbas FCA

Chapter - 8 IAS 7: STATEMENT OF CASH FLOWS – QUESTIONS (12)

Other information:

(i) Shares issued during the year were as follows:

• 10% bonus shares in March 2017.

• Right shares in July 2017.

(ii) During the year, a plant costing Rs. 9,500,000 and having a book value of Rs. 5,200,000 was disposed of for Rs.

4,800,000 of which Rs. 1,800,000 are still outstanding.

(iii) Depreciation for the year amounted to Rs. 7,350,000.

(iv) Financial charges for the year amounted to Rs. 1,100,000. Accrued financial charges as on 31 December 2017

amounted to Rs. 112,000 (2016: Rs. 48,000).

(v) Provision for doubtful trade receivables is maintained at 5%.

Required:

Prepare statement of cash flows for the year ended 31 December 2017, in accordance with IAS 7 ‘Statement of Cash

Flows’ using indirect method. (15)

(Spring 2018 Q.3)

QUESTION NO. 11

Following are the extracts from the financial statements of Universal Limited (UL) for the year ended 30 June 2017:

Statement of financial position as on 30 June 2017

2017 2016 2017 2016

Assets Rs. in ‘000 Equity & liabilities Rs. in ‘000

Property, plant and 158,500 120,000 Share capital (Rs. 10 each) 175,000 150,000

equipment

Stock in trade 58,000 45,000 Retained earnings 54,434 21,500

Trade receivables 68,000 56,000 Revaluation surplus 10,000 -

Cash 39,434 48,000 Debentures (Rs. 100 each) 18,000 20,000

Interest payable 1,000 2,500

Trade payables 42,000 39,000

Accrued liabilities 20,000 18,000

Unearned maintenance 2,000 4,000

Provision for taxation 1,500 14,000

323,934 269,000 323,934 269,000

Statement of profit or loss for the year ended 30 June 2017

Rs. in '000’

Sales 273,000

Cost of sales (187,500)

Gross profit 85,500

Operating expenses (46,766)

Other income 11,200

Profit before interest and tax 49,934

Interest expense (2,000)

Profit before tax 47,934

Tax expense (15,000)

Profit after tax 32,934

Additional information:

(i) 60% of sales were made on credit.

(ii) UL maintains a provision for doubtful receivables at 6%. During the year, trade receivables of Rs. 7 million were

written off.

(iii) Depreciation expense for the year was Rs. 22.5 million. 70% of the depreciation was charged to cost of sales.

(iv) Other income comprises of:

▪ gain of Rs. 3 million on disposal of vehicles for Rs. 12 million;

▪ maintenance income of Rs. 8 million; and

▪ discount of Rs. 10 per debenture which were redeemed during the year.

Required:

Prepare UL’s statement of cash flows for the year ended 30 June 2017 using direct method. (15)

(FAR II Q-1, Autumn 2017)

Nasir Abbas FCA

Chapter - 8 IAS 7: STATEMENT OF CASH FLOWS – QUESTIONS (13)

QUESTION NO. 12

The statement of financial position of Liaquat Limited as at 31 December 2016 is as follows:

2016 2015 2016 2015

Equity and liabilities Assets

------- Rupees ------- ------- Rupees -------

Share capital 9,200,000 9,000,000 Freehold land 4,778,400 6,600,000

Share premium 1,346,832 1,000,000 Building – WDV 5,057,600 4,171,200

Retained earnings 3,391,228 3,665,280 Vehicle – WDV 600,000 800,000

Long term loan 1,000,000 1,000,000 Equipment – WDV 1,643,100 2,112,000

Short term loan 1,331,200 1,531,200 Capital WIP 1,478,400 1,821,600

Accounts payable 417,120 694,320 Long term deposits 580,800 448,800

Accrued interest 105,600 63,360 Inventory 685,608 320,628

Accounts receivable 1,273,272 595,452

Cash 694,800 84,480

16,791,980 16,954,160 16,791,980 16,954,160

The following information has been extracted from income statement:

Rupees

Depreciation expenses 932,500

Finance cost 141,872

Gain on sale of fixed assets (net) 98,960

Net profit before tax 1,525,948

Additional information:

(i) Details of gain on sale of fixed assets are as follows:

Rupees

Gain on sale of freehold land 168,960

Loss on disposal of equipment due to fire (70,000)

98,960

The loss on disposal of equipment represents the WDV of the equipment. The amount of insurance claim

received, amounting to Rs. 30,000 was erroneously credited to accumulated depreciation.

(ii) Repairs to building amounting to Rs. 50,000 were erroneously debited to building account on 31 December 2016.

(iii) Transfers from capital work in progress to building amounted to Rs. 1,200,000.

Required:

Prepare statement of cash flows for the year ended 31 December 2016, in accordance with IAS – 7 using indirect method.

(12)

{Spring 2017, Q # 6}

QUESTION NO. 13

Following are the extracts from income statement of Quality Engineering Limited (QEL) for the year ended 31 December

2015 and its statement of financial position as at that date, together with some additional information:

Income statement for the year ended 31 December 2015

Rs. In ‘000’

Profit from operations 6,402

Other income 1,357

Interest expense (100)

Profit before tax 7,659

Income tax expense (1,376)

Profit for the year 6,283

Statement of financial position as at 31 December 2015

2015 2014 Assets 2015 2014

Equity and liabilities

--- Rs. In ‘000’--- Non-current assets --- Rs. In ‘000’---

Share capital 9,000 7,000 Property, plant and equipment 19,628 11,845

Share premium 5,219 3,703 Investments 7,645 6,498

Un-appropriated profit 10,652 6,697 27,273 18,343

Revaluation surplus 2,676 1,911

Nasir Abbas FCA

Chapter - 8 IAS 7: STATEMENT OF CASH FLOWS – QUESTIONS (14)

10% bank loan 6,000 -

Current liabilities Current assets

Trade and other payables 3,337 4,953 Inventories 4,642 3,073

Income tax payable 1,300 994 Trade and other receivables 2,273 3,865

Bank overdraft - 27 Cash and bank 3,996 4

4,637 5,974 10,911 6,942

38,184 25,285 38,184 25,285

Additional information:

(i) During the year, movements in property, plant and equipment include:

• Depreciation amounting to Rs. 5,280,000.

• Machinery having a carrying amount of Rs. 2,481,000 was sold for Rs. 3,440,000.

• Factory building was revalued from a carrying amount of Rs. 5,963,000 to Rs. 8,000,000.

• An office building which had previously been revalued, was sold at its carrying amount of Rs. 2,599,000.

(ii) Cash dividends paid in December 2015 and November 2014 were Rs. 3.6 million and Rs. 2.4 million respectively.

(iii) Trade debts written off during the year amounted to Rs. 200,000. The provision for bad debts as at 31 December

2015 was Rs. 400,000 (2014: Rs. 550,000)

(iv) The interest on bank loan is payable on 30th June every year. The bank loan was received on 1 November 2015.

Interest for two months has been accrued and included in trade and other payables.

(v) Other income includes investment income of Rs. 398,000. As at 31 December 2015, trade and other receivables

included investment income receivable amounting to Rs. 96,000 (2014: Rs. 80,000).

Required:

Prepare a statement of cash flows for QEL for the year ended 31 December 2015, using the indirect method.

(18)

{Spring 2016, Q # 6 amended}

QUESTION No. 14

(a) List the elements of financial statements. (02)

(b) Following is the draft balance sheet of XYZ Limited as at 31 December 2014 which was prepared by its

accountant:

Rs. in Rs. in

Assets Equities and liabilities

million million

Leasehold land – cost 250 Capital 1,000

Leasehold land – acc. depreciation (200) Accumulated profit 1,816

Building – cost 1,000 Long term bank loan 200

Building – acc. depreciation (500) Trade payables 228

Machinery – cost 1,750 Income tax payable 85

Machinery – accumulated depreciation (1,150) Accrued interest 13

Long term deposit 70

Stocks 910

Account receivables – net of provision 361

Cash and bank 851

3,342 3,342

Additional information:

(i) Profit before tax and income tax expenses for the year amounted to Rs. 275 million and Rs. 13 million

respectively.

(ii) Balances as at 31 December 2013 were as under:

Rs. in million

Stock 703

Account receivables – net of provision 418

Cash and bank 243

Trade payables 150

Income tax payable 80

Long term deposit 70

The company follows a policy of maintaining provision for bad debts equal to 5% of account receivables.

Nasir Abbas FCA

Chapter - 8 IAS 7: STATEMENT OF CASH FLOWS – QUESTIONS (15)

(iii) The bank loan was obtained on 1 January 2014 and carries interest @ 9% per annum.

(iv) XYZ uses straight line method for depreciation. Rates of depreciation are as under:

Leasehold land 2%

Building 5%

Machinery 10%

Full month’s depreciation is provided in the month of acquisition but no depreciation is charged in the

month of disposal. Depreciation for the year 2014 has already been provided.

On review the CFO has discovered the following:

• A machine with list price of Rs. 50 million was purchased on 1 January 2014. An amount of Rs.

30 million had been paid in cash whereas Rs. 20 million were adjusted against trade-in of a

machine costing Rs. 40 million and having a book value of Rs. 25 million. The transaction was

recorded by debiting the plant and machinery account by Rs. 30 million i.e. the net amount

paid to the supplier.

• One of the company's customers became bankrupt during the year. Rs. 5 million out of total

debt of Rs. 25 million were recovered from him. Balance has to be written off.

Required:

Prepare a statement of cash flow as at 31 December 2014. (20)

{Spring 2015, Q # 4}

QUESTION No. 15

Sky Limited (SL) commenced its business on 1 July 2013 by purchasing the business of Moon Enterprises for a

consideration of Rs. 60 million. The following information has been extracted from its financial statements for the year

ended 30 June 2014.

Particulars Debit Credit

Rs. in million

Sales 172

Cost of sales 80

Operating and selling expenses 40

Bad debt expense 6

Loss on settlement of insurance claim 2

Finance charges paid 8

Taxation expense 15

Closing stock in trade 10

Trade receivables 28

Provision for doubtful debts 6

Trade payables 20

Provision for taxation (net of payments) 1

Property, plant and equipment - WDV 105

Additional information:

(i) At the time of acquisition, the assets and liabilities were valued as under:

Rs. in million

Property, plant and equipment 52

Stock in trade 4

Trade receivables 8

Trade payables 12

(ii) During the year, SL incurred a capital expenditure of Rs. 70 million.

(iii) Loss on settlement of insurance claim relates to a car which was destroyed in an accident. Its cost and written

down value at the time of accident was Rs. 5 million and Rs. 4 million respectively. There were no other disposals

during the year.

Required:

Prepare operating activities section of the statement of cash flows for the year ended 30 June 2014 using the direct

method in accordance with the International Financial Reporting Standards. (11)

(FAR II Q-4, Autumn 2014)

Nasir Abbas FCA

Chapter - 8 IAS 7: STATEMENT OF CASH FLOWS – QUESTIONS (16)

QUESTION No. 16

Galaxy Limited commenced its business on 1 January 2013 by issuing shares as follows:

• Rs. 50 million against cash

• Rs. 25 million against purchase of building

• Rs. 1.4 million against purchase of vehicle

Following is the summarised Trial Balance for 1st year as of 31 December 2013:

Debit Credit

Particulars

Rs. in million

Sales 136.00

Cost of sales (including depreciation expense of Rs. 9 million) 83.50

Operating and selling expenses (including depreciation expense of Rs. 6.25 million) 37.30

Miscellaneous income (net of loss of Rs. 0.35 on settlement of total loss claim) 0.50

Finance charges 2.50

Taxation expense 6.00

Cash and bank balances 5.00

Bank overdraft 23.00

Accounts receivable 18.00

Provision for doubtful debts 0.90

Closing inventory 10.00

Accounts payable 14.00

Interest payable 1.20

Provision for taxation (net of payments) 1.00

Share capital 76.40

Dividend paid 2.45

12% Long term loan payable 25.00

Property, plant and equipment 128.25

Accumulated depreciation 15.00

293.00 293.00

Settlement of the insurance claim pertained to an accident of a new car costing Rs. 1.8 million and having a depreciation

charge of Rs. 0.25 million for the period in use. No bad debts were written off during the year.

Required:

Prepare a statement of cash flow for the year ended 31 December 2013. (13)

{Spring 2014, Q # 7 amended}

QUESTION No. 17

The following balances were extracted from the financial statements of Spanish Limited for the years ended 30 June 2012

and 2013.

2013 2012

---------Rs. in 000---------

Sales 60,000 40,000

Interest expense 27 30

Profit after tax 7,800 4,800

Property, plant and equipment – cost 10,000 9,000

– accumulated depreciation 1,000 900

Stock in trade 6,970 6,800

Trade debtors 9,000 8,000

Provision for doubtful debts 500 360

Trade creditors 5,000 4,700

Accrued expenses 300 -

Interest payable 12 14

Income tax payable 55 38

Additional information

• New machine costing Rs. 1,800,000 was purchased during the year. A machine with a carrying amount of Rs.

200,000 was sold for Rs. 250,000

Nasir Abbas FCA

Chapter - 8 IAS 7: STATEMENT OF CASH FLOWS – QUESTIONS (17)

• The tax rate applicable to the company is 35%.

Required:

Prepare operating activities section of the statement of cash flows for the year ended 30 June 2013 using the Direct

Method. Show all necessary workings. (15)

(FAR II Q-3, Autumn 2013)

QUESTION No. 18

A summary of revenues and expenses of AB Limited for the year ended 30 June 2013 is given below:

Rupees

Sales 2,345,000

Cost of goods manufactured and sold (1,624,000)

Gross profit 721,000

Selling, general and administrative expenses (509,000)

Net income before income tax 212,000

Income tax (90,000)

Net income 122,000

Net changes in working capital items for the year ended 30 June 2013 were as follows: Net changes

Dr. Cr.

Cash 32,000

Trade receivables (net) 74,000

Inventories 105,000

Prepaid expenses (selling and general) 6,000

Accrued expenses 15,000

Income tax payable 28,000

Trade payables 90,000

Depreciation for the year amounted to Rs. 68,000.

Required:

Prepare a cash flow statement for the year ended 30 June 2013. (07)

{Autumn 2013, Q # 7 amended}

QUESTION No. 19

The balance sheet of Amin Limited as at 31 August 2011 is as follows:

2011 2010 2011 2010

-------- Rs.’000 ----- -------- Rs.’000 -----

Equity Fixed assets – book value 15,172 12,346

Share capital 15,450 10,000

Retained earnings 17,983 17,942

33,433 27,942

Current liabilities Current assets

Short term finance 1,845 1,216 Investments 4,911 -

Creditors 3,457 2,850 Stock-in-trade 12,178 14,950

Dividend payable 700 400 Trade debts – net 6,732 4,887

Bank 442 225

6,002 4,466 24,263 20,062

39,435 32,408 39,435 32,408

The following information is also available: Rs.’000

Profit during the year ended 31 August 2011 3,161

Accumulated depreciation on fixed assets – 31 August 2010 5,605

Accumulated depreciation on fixed assets – 31 August 2011 7,470

Provision for bad debts – 31 August 2010 385

Provision for bad debts – 31 August 2011 484

During the year fixed assets costing Rs. 1,500,000 with a book value of Rs. 867,000 were sold for Rs.

1,284,000.

Required:

Prepare a cash flow statement for the year ended 31 August 2011. Show necessary workings. (13)

{Autumn 2011, Q # 2 amended}

Nasir Abbas FCA

Chapter - 8 IAS 7: STATEMENT OF CASH FLOWS – QUESTIONS (18)

QUESTION No. 20

Junaid Janjua Limited has provided you the following balance sheet and income statement.

Balance Sheet as on December 31, 2010

2010 2009

Rupees

Cash 145,000 32,000

Accounts receivable 280,000 104,000

Long-term investments 220,000 170,000

Inventory 424,000 200,000

Prepaid insurance 24,000 36,000

Office supplies 14,000 7,000

Land 1,810,000 2,500,000

Building 2,800,000 2,300,000

Accumulated depreciation (890,000) (720,000)

Equipment 1,200,000 1,150,000

Accumulated depreciation (380,000) (350,000)

Total assets 5,647,000 5,429,000

Accounts payable 158,000 263,000

Wages payable 40,000 24,000

Short-term loans 580,000 580,000

Long-term loans 985,000 1,160,000

Share capital 1,100,000 1,000,000

Retained earnings 2,784,000 2,402,000

Total liabilities and equity 5,647,000 5,429,000

Income Statement for the year ended December 31, 2010

Rupees

Sales revenue 9,280,000

Cost of goods sold (6,199,000)

Gross margin 3,081,000

Operating expenses

Selling expenses 634,000

Administrative expenses 1,348,000

Depreciation expenses 230,000

2,212,000

Income from operations 869,000

Other revenues/expenses

Gain on sale of land 64,000

Gain on sale of long term investment 32,000

Loss on sale of equipment (15,000)

81,000

Net income 950,000

Notes :

(a) Part of the long term loan amounting to Rs. 100,000 was settled by issuing ordinary shares.

(b) Long term investments costing Rs. 100,000 were sold during the year.

(c) Depreciation charged during the year on equipment amounted to Rs. 60,000. Equipment having a book value of

Rs. 75,000 was sold during the year.

Required:

Prepare a cash flow statement for the year ended December 31, 2010. (14)

{Spring 2011, Q # 4 amended}

Nasir Abbas FCA

Chapter - 8 IAS 7: STATEMENT OF CASH FLOWS – QUESTIONS (19)

QUESTION No. 21

The balance sheets of Sakhawat Hussain Limited as at December 31, 2009 and 2008 are as follows:

2009 2008

Rupees

Current assets 4,750,000 2,850,000

Investments 2,600,000 2,500,000

Fixed assets 9,750,000 9,600,000

Accumulated depreciation (2,950,000) (2,450,000)

14,150,000 12,500,000

Current liabilities 1,850,000 1,450,000

Income tax liability 200,000 150,000

Share capital 11,000,000 10,000,000

Accumulated profits 1,100,000 900,000

14,150,000 12,500,000

Other information for the year 2009 is as follows:

(i) Investments costing Rs. 250,000 were sold for Rs. 320,000.

(ii) Fully depreciated furniture costing Rs. 200,000 was written-off.

(iii) Fixed assets costing Rs. 960,000 with a net book value of Rs. 160,000 were sold for Rs. 250,000.

(iv) Income tax amounting to Rs. 180,000 was paid in September 2009.

(v) Cash dividend amounting to Rs. 1,200,000 was paid during the year.

(vi) 20% of the opening and closing balances of current assets are represented by cash.

Required:

Prepare cash flow statement for the year ended December 31, 2009. (11)

{Spring 2010, Q # 7 amended}

QUESTION No. 22

The comparative balance sheets as at December 31st of Moosani Limited show the following information:

2008 2007

Rupees

Cash 5,200 41,400

Accounts receivable 31,700 21,500

Inventory 25,000 19,400

Investments - 16,900

Furniture 80,000 64,000

Equipment 86,000 43,000

227,900 206,200

Allowance for doubtful debts 6,500 9,700

Accumulated depreciation – equipment 24,000 18,000

Accumulated depreciation – furniture 8,000 15,000

Trade creditors 10,800 6,500

Accrued expenses 4,300 10,800

Bills payable 6,500 8,600

Long term loans 31,800 53,800

Share capital 100,000 80,000

Retained earnings 36,000 3,800

227,900 206,200

Additional data related to 2008 is as follows:

(i) Equipment that had costed Rs. 23,000 and was 40% depreciated at the time of disposal was sold for Rs.

6,500.

(ii) On January 1, 2008, the furniture was completely destroyed by a fire. Proceeds received from the

insurance company amounted to Rs. 60,000.

Nasir Abbas FCA

Chapter - 8 IAS 7: STATEMENT OF CASH FLOWS – QUESTIONS (20)

(iii) Investments were sold at Rs. 7,500 above their cost.

(iv) Cash dividend amounting to Rs. 180,000 was paid during 2008.

Required:

Prepare cash flow statement for the year ended December 31, 2008. (12)

{Spring 2009, Q # 3 amended}

QUESTION No. 23

Financial statements of Data Limited are as follows:

30 June 2018 30 June 2017

Rs “000” Rs “000”

Non-current assets

Fixed assets 161,300 160,500

Investments 20,500 12,200

Current assets

Stock in trade 34,200 36,600

Short term investments 1,500 2,300

Trade debts 25,500 18,700

Prepayments 2,700 3,000

Cash and bank 4,100 -

249,800 233,300

Equity and liability

Share Capital 66,000 56,000

Retained earnings 100,100 83,900

Revaluation reserve – land & Building 8,000 3,000

174,100 142,900

Non-current liabilities

Bank loan 20,300 22,500

Government grant 10,000 -

Current liabilities

Trade payables 20,400 35,100

Government grant 2,000 -

Accrued expenses 23,000 28,800

Overdraft - 4,000

249,800 233,300

Additional information:

(i) Provision for doubtful debt at 30 June 2018 was Rs 1.2 million (2017: Rs 1.7 million).

(ii) During the year total payment of 7.6 million was made to bank against loan (including interest).

(iii) Dividend of Rs. 36 million was declared and paid during the year.

(iv) Government grant recognized as income for the year amounts to Rs. 2.5 million.

(v) Interest and tax expense for the year was Rs. 3.5 million and Rs 20.1 million respectively.

(vi) Accrued expenses include interest payable of Rs 1.1 million (2017: Rs 0.4 million) and tax payable of Rs 4.5

million (2017: Rs 3 million).

(vii) Following is the details of fixed assets:

30 June 2018 30 June 2017

Rs “000” Rs “000”

Land and building 88,700 85,200

Plant and machinery 65,600 67,300

Intangibles 7,000 8,000

161,300 160,500

Renovation of building of Rs 3 million was capitalized during the year. Depreciation expense of land & building

and plant and machinery was Rs 4.5 million and 6.5 million respectively for the year just ended. Few machines

having net book value of Rs. 5,200,000 were sold at profit of Rs 500,000.

Required:

Prepare statement of cash flows using indirect method as per IAS-7 for 2018. (15)

Nasir Abbas FCA

You might also like

- FABM 2 Module 1 Review of Basic Accounting PDFDocument8 pagesFABM 2 Module 1 Review of Basic Accounting PDFJOHN PAUL LAGAO100% (3)

- Micro Notes On A2 IAL AccountingDocument15 pagesMicro Notes On A2 IAL AccountingRajibul Haque Shumon100% (3)

- Preparation of Financial Statement For A Sole TraderDocument8 pagesPreparation of Financial Statement For A Sole TraderDebbie Debz100% (3)

- Cashflow (Consolidated) - Class NotesDocument5 pagesCashflow (Consolidated) - Class NotesShaheryar ShahidNo ratings yet

- Cash Flow StatementDocument16 pagesCash Flow Statementrajesh337masssNo ratings yet

- Cash FlowDocument5 pagesCash FlowSirdar MukodzaniNo ratings yet

- (Accaglobalbox - Blogspot.com) Consolidation and Cash FLows SBR CompleteDocument12 pages(Accaglobalbox - Blogspot.com) Consolidation and Cash FLows SBR Completets tanNo ratings yet

- XXXX XXX XXX XXX XXX XXX XXXDocument3 pagesXXXX XXX XXX XXX XXX XXX XXXIzaya -kunNo ratings yet

- Limited Liability Partnership (LLP)Document10 pagesLimited Liability Partnership (LLP)sejal ambetkarNo ratings yet

- SUBJECT:-Management Accounting Unit II: Fund Flow StatementDocument12 pagesSUBJECT:-Management Accounting Unit II: Fund Flow Statementganeshteggihalli7022No ratings yet

- Cash Flow StatementDocument5 pagesCash Flow StatementDebaditya SenguptaNo ratings yet

- Ias 7: Cashflow Statements: Format - Indirect MethodDocument3 pagesIas 7: Cashflow Statements: Format - Indirect MethodrjmandiaNo ratings yet

- Direct MethodDocument2 pagesDirect MethodZazaBasriNo ratings yet

- Accountancy All FormulaDocument23 pagesAccountancy All FormulaThe Unknown vlogger100% (1)

- Cash Flow Statement - IFRS - EN-GBDocument2 pagesCash Flow Statement - IFRS - EN-GBDaniela DeCandiaNo ratings yet

- Cash Flow Statement FormateDocument3 pagesCash Flow Statement FormatesatyaNo ratings yet

- Fund Flow - RevisedDocument11 pagesFund Flow - RevisedModhish NothumanNo ratings yet

- Socf FormatDocument2 pagesSocf FormatkhaiNo ratings yet

- Public Sector Accounting and ReportingDocument9 pagesPublic Sector Accounting and Reportingsunkanmi4890No ratings yet

- Computation Format For Individual Tax Liability For The Year of Assessment 20XXDocument4 pagesComputation Format For Individual Tax Liability For The Year of Assessment 20XXMiera FrnhNo ratings yet

- CF NotesDocument2 pagesCF NotesNurin NadhirahNo ratings yet

- Computation Format For Individual Tax Liability For The Year of Assessment 20XXDocument4 pagesComputation Format For Individual Tax Liability For The Year of Assessment 20XXannastasia luyah100% (1)

- Cash Flow Statement - FormatDocument2 pagesCash Flow Statement - FormatHassan AsgharNo ratings yet

- Module 4 - Specific Inclusions Lecture Notes-3Document31 pagesModule 4 - Specific Inclusions Lecture Notes-3Sphephelo MbhamalyNo ratings yet

- Psa VDocument5 pagesPsa Vsunkanmi4890No ratings yet

- 9 - IAS 7 SummaryDocument2 pages9 - IAS 7 Summaryhuzaifa.sami96No ratings yet

- Accounting FormatsDocument21 pagesAccounting FormatsAsima ZubairNo ratings yet

- Chapter 21 IAS 1Document4 pagesChapter 21 IAS 1Chandan SamalNo ratings yet

- Cash Flows StatementsDocument4 pagesCash Flows StatementsMae-shane SagayoNo ratings yet

- Cash Flow Statements6Document28 pagesCash Flow Statements6kimuli FreddieNo ratings yet

- Cash Flow Statement Mcqs With AnswerDocument25 pagesCash Flow Statement Mcqs With Answermahesh patilNo ratings yet

- Proforma of Vertical IncomeDocument2 pagesProforma of Vertical IncomeBheemeswar ReddyNo ratings yet

- AC 102 Financial Statements FormatsDocument5 pagesAC 102 Financial Statements FormatsBendroza MelatosiNo ratings yet

- SOLVED - IAS 7 Statement of Cash FlowsDocument16 pagesSOLVED - IAS 7 Statement of Cash FlowsMadu maduNo ratings yet

- Ias 1-Presentation of Financial StatementsDocument21 pagesIas 1-Presentation of Financial StatementsChumani GqadaNo ratings yet

- Chapter 9 Ptx1033/Personal TaxDocument10 pagesChapter 9 Ptx1033/Personal TaxNUR ALEEYA MAISARAH BINTI MOHD NASIR (AS)No ratings yet

- Classified Is and BSDocument1 pageClassified Is and BSSoumik MutsuddiNo ratings yet

- Notes Cash FlowDocument16 pagesNotes Cash FlowsamundeswaryNo ratings yet

- Formats of Income Statement, Balance Sheet & Cash Flow StatementDocument3 pagesFormats of Income Statement, Balance Sheet & Cash Flow StatementAli RazaNo ratings yet

- Vertical Balance SheetDocument14 pagesVertical Balance Sheetabhi82% (11)

- Fund Flow:: Working CapitalDocument19 pagesFund Flow:: Working CapitalAlex JayachandranNo ratings yet

- Statement of Cash FlowsDocument1 pageStatement of Cash FlowsAaron MushunjeNo ratings yet

- Topic 7 MFRS 107 Statement of Cash FlowsDocument21 pagesTopic 7 MFRS 107 Statement of Cash Flowsaisyahinafaryanis14No ratings yet

- Cash Flow AccountingDocument17 pagesCash Flow AccountingPrabir Kumer RoyNo ratings yet

- Format For Cash Flow Statement (Indirect Method)Document4 pagesFormat For Cash Flow Statement (Indirect Method)andreqwNo ratings yet

- cash flow statementDocument14 pagescash flow statementharshitsharma42069No ratings yet

- Cash Flow Statement Examples As Per Direct Method: Report Name Sap Report T-CodeDocument6 pagesCash Flow Statement Examples As Per Direct Method: Report Name Sap Report T-Codejainendra100% (1)

- Ipsas 2 - Cashflow Statements 1Document22 pagesIpsas 2 - Cashflow Statements 1Nyara MakurumidzeNo ratings yet

- Hand Outs - Statement of Cash FlowsDocument2 pagesHand Outs - Statement of Cash FlowsFrancez Anne GuanzonNo ratings yet

- Additional Notes-Statement of Cash FlowDocument13 pagesAdditional Notes-Statement of Cash FlowdaminbalqisNo ratings yet

- Pre Reading Material For Session 17 FA (Cash Flow)Document10 pagesPre Reading Material For Session 17 FA (Cash Flow)Rohit Roy100% (1)

- FFS Working NotesDocument3 pagesFFS Working NotesVignesh NarayananNo ratings yet

- Statement of Cash Flows TemplatesDocument1 pageStatement of Cash Flows TemplatesKana jillaNo ratings yet

- Cash Flow Statement (Format and Practical Problems)Document21 pagesCash Flow Statement (Format and Practical Problems)Ankit pattnaikNo ratings yet

- P2 NotesDocument13 pagesP2 NotesJayrick James AriscoNo ratings yet

- P2 NotesDocument13 pagesP2 NotesJayrick James AriscoNo ratings yet

- CF StatementDocument3 pagesCF StatementSukumarVenkataNo ratings yet

- Module 3Document22 pagesModule 3ANGEL ROBIN RCBSNo ratings yet

- Part Ii - Statement of Profit and LossDocument3 pagesPart Ii - Statement of Profit and LossSaumyajit DeyNo ratings yet

- Credit Rating Agency of IndiaDocument32 pagesCredit Rating Agency of Indiafederation110xNo ratings yet

- Joinpdf PDFDocument1,043 pagesJoinpdf PDFOwen Bawlor ManozNo ratings yet

- Gen Math 11 Exam 2nd FINAL PDFDocument3 pagesGen Math 11 Exam 2nd FINAL PDFBill VillonNo ratings yet

- Canadian School of Arts and Science National Grade Nine (9) Assessment Mathematics Project 2019Document12 pagesCanadian School of Arts and Science National Grade Nine (9) Assessment Mathematics Project 2019Trevor G. SamarooNo ratings yet

- Assignment 2Document2 pagesAssignment 2Zafar Farooq50% (2)

- Argumentative EssayDocument2 pagesArgumentative Essayapi-501580190No ratings yet

- Week 12 MMWDocument27 pagesWeek 12 MMWAllysa Paalan CervanciaNo ratings yet

- Basic Finance Module 4Document6 pagesBasic Finance Module 4shaina bongongolNo ratings yet

- Condonation or Remission of Debt: Extinguishment of ObligationsDocument3 pagesCondonation or Remission of Debt: Extinguishment of ObligationsRhos Bernadette Suico100% (2)

- Chapter-2 Time Value Analysis: Dr.M.Mariappan Centre For Hospital Management, SHSSDocument60 pagesChapter-2 Time Value Analysis: Dr.M.Mariappan Centre For Hospital Management, SHSSRutvi Shah RathiNo ratings yet

- Answer: Unsecured, Nonpriority ClaimsDocument5 pagesAnswer: Unsecured, Nonpriority ClaimsEleonora VinessaNo ratings yet

- Control Account QuestionsDocument6 pagesControl Account QuestionsJaneth Patrick100% (2)

- A. Simple Interest B. Compound Interest Simple Interest: Interest Is Simply The Price Paid For The Use of Borrowed MoneyDocument12 pagesA. Simple Interest B. Compound Interest Simple Interest: Interest Is Simply The Price Paid For The Use of Borrowed MoneyArcon Solite BarbanidaNo ratings yet

- Chap - 9 Book Keeping XI HALLDocument114 pagesChap - 9 Book Keeping XI HALLKirtee TiwariNo ratings yet

- Amortization On A Simple Interest MortgageDocument516 pagesAmortization On A Simple Interest MortgageamitNo ratings yet

- Modification of TermsDocument4 pagesModification of TermsStephanie Joy NogollosNo ratings yet

- MFRS132 Financial InstrumentsDocument49 pagesMFRS132 Financial InstrumentsAin YanieNo ratings yet

- Financial-Management 345Document1 pageFinancial-Management 345khurramNo ratings yet

- Fundamental of Accounting and Tally Prime Note1Document38 pagesFundamental of Accounting and Tally Prime Note1hitechcomputerinstitute05No ratings yet

- Far Drill2Document4 pagesFar Drill2Jung Hwan SoNo ratings yet

- Sole Trader ShipDocument14 pagesSole Trader ShipmubieNo ratings yet

- Final Assesment: I. Problem SolvingDocument12 pagesFinal Assesment: I. Problem SolvingKaren Nicole Borreo MaddelaNo ratings yet

- COMPARATIVE CALCULATOR DaburDocument3 pagesCOMPARATIVE CALCULATOR DaburVIJAY KUMARNo ratings yet

- SYJC - 16: Book - Keeping & AccountancyDocument8 pagesSYJC - 16: Book - Keeping & Accountancyharesh60% (5)

- Chapter 10 LiabilitiesDocument96 pagesChapter 10 LiabilitiesMohammad ali Hassan100% (2)

- ANSWER KEY - CHARLOTTE SERVICES - Classification of Account and Balances of The AccountsDocument11 pagesANSWER KEY - CHARLOTTE SERVICES - Classification of Account and Balances of The AccountsAnne MiguelNo ratings yet

- Project: Flying Cement CompanyDocument21 pagesProject: Flying Cement CompanyAleena IdreesNo ratings yet

- Unit 3 Week 12Document5 pagesUnit 3 Week 12Diego TrincadoNo ratings yet

- Chapter 3 - The Time Value of Money (Part I)Document20 pagesChapter 3 - The Time Value of Money (Part I)Arin ParkNo ratings yet

- Karakits ComapnyDocument5 pagesKarakits ComapnyAJNo ratings yet