Professional Documents

Culture Documents

IAS 33 (Basic EPS) - Class Practice (Questions)

IAS 33 (Basic EPS) - Class Practice (Questions)

Uploaded by

Mazhar AzizOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IAS 33 (Basic EPS) - Class Practice (Questions)

IAS 33 (Basic EPS) - Class Practice (Questions)

Uploaded by

Mazhar AzizCopyright:

Available Formats

IAS 33 [Basic EPS] – QUESTIONS (1)

PRACTICE QUESTIONS

Question No. 1

Qureshi Ltd (QL) had an issued share capital of 2000 shares on January 1, 2016. During the year following share issuestook

place:

On April 1, 2016 QL issued 1000 shares against cash at full market price.

On July 1, 2016 QL made a bonus issue of 1 for 5.

On November 1, 2016 QL made a right issue of 1 for 3 at an exercise price of Rs. 18 per share when market price wasRs.

24 per share.

Net profit before tax and profit after tax for the year were Rs. 540,000 and Rs. 420,000 respectively.

Required:

Calculate basic earnings per share for 2016.

Question No. 2

Yasir Ltd (YL) is a listed company. Following financial information relates to years ending December 31, 2016 and 2015:

2016 (Rs.) 2015 (Rs.)

Profit before tax 175,000 120,000

Taxation:

Current tax expense 20,000 29,000

Deferred tax expense / (income) 12,000 (11,000)

Share capital (Rs. 10 each) 150,000 100,000

10% redeemable preference shares 240,000 200,000

12% irredeemable preference shares 80,000 80,000

YL made following equity transactions:

On July 1, 2015 YL issued 4,000 shares at full market price.

On July 1, 2016 YL made a right issue of 1 for 5 at an exercise price of Rs. 20 per share when market price was Rs. 30per

share.

On December 1, 2016 YL made a 25% bonus issue.

Required:

Calculate basic earnings per share for 2016 and 2015 as well as restated EPS for 2015.

Question No. 3

Gallant Ltd (GL) had an issued share capital of 5,000 shares of Rs. 10 each on January 1, 2016. During the year followingshare

transactions took place:

On April 1, 2016 GL issued 1,000 shares against cash at full market price.

On April 30, 2016 ordinary shares were split and each Rs. 10 face value existing share was replaced with two Rs. 5 face

value new shares.

On November 1, 2016 GL made a bonus issue of 1 for 4.Net profit after tax for the year was Rs. 250,000.

Required:

Calculate basic earnings per share for 2016.

Question No. 4

Super Ltd (SL) had an issued share capital of 4,000 shares of Rs. 10 each on January 1, 2016. During the year followingshare

transactions took place:

On July 1, 2016 SL issued 2,000 shares against cash at full market price.

On September 30, 2016 ordinary shares were consolidated and every three Rs. 10 face value existing shares were

replaced with one Rs. 30 face value new share.

On December 1, 2016 SL made a right issue of 1 for 4 at a discount of Rs. 3 per share on current market price of Rs.45

per share.

Net profit after tax for the year 2016 was Rs. 100,000. Basic EPS as reported in 2015 was Rs. 16 per share.

Required:

Calculate basic earnings per share for 2016 and restated earnings per share for 2015.

NASIR ABBAS FCA

IAS 33 [Basic EPS] – QUESTIONS (2)

Question No. 5

Prema Ltd (PL) acquired 70% shares of Anhaar Ltd (AL) on January 1, 2016. Following information relates to both

companies for the year ending December 31, 2016:

PL (Rs.) AL (Rs.)

Profit after tax 240,000 180,000

Share capital (Rs. 10 each) 75,000 60,000

Retained earnings 990,000 625,000

PL made following equity transactions during 2016:

On July 1, 2016 PL issued 2,000 shares at full market price.

On November 1, 2016 PL made a right issue of 1 for 4 at an exercise price of Rs. 25 per share when market price wasRs.

30 per share.

On January 12, 2017 PL made a bonus issue of 1 for 5. Financial statements for the year 2016 were authorized in February

2017.

Required:

Calculate basic earnings per share for 2016 to be reported on consolidated income statement for 2016.

Question No. 6

Style Ltd (SL) has an issued share capital of 6,000 shares of Rs. 10 each on December 31, 2016. During the year 2016

following share transactions took place:

On March 1, 2016 SL made a bonus of 1 for 6.

On July 1, 2016 SL issued 1,500 shares at full market price.

On November 30, 2016 SL made a right issue of 1 for 5 at an exercise price of Rs. 24 per share when cum-right market

price was Rs. 30 per share.

Net profit after tax for the year 2016 was Rs. 120,000 (comprising of Rs. 100,000 from continuing operations and Rs. 20,000

from discontinued operations) and preference dividend declared on irredeemable preference shares amounts toRs. 30,000.

Required:

Calculate basic earnings per share for 2016.

Question No. 7

The following information pertains to the financial statements of Home Dynamics Limited (HDL), a listed company, for theyear

ended 31 December 2016:

(i) Profit after tax for the year:

Rs. in million

Profit from continuing operations – net of tax 765

Profit from discontinued operations – net of tax 155

Profit after tax 920

(ii) Shareholders’ equity as on 1 January 2016 comprised of:

10 million ordinary shares of Rs. 10 each, having market value of Rs. 25 each.

4 million cumulative preference shares of Rs. 10 each entitled to a cumulative dividend at 10%.

(iii) On 31 March 2016, HDL announced 40% right shares to its ordinary shareholders at Rs. 25 per share. The entitlement

date of right shares was 31 May 2016. The market price per share immediately before the announcement date and

entitlement date was Rs. 28 and Rs. 32 respectively.

(iv) On 2 August 2016, HDL announced 20% bonus issue. The entitlement date of bonus shares was 31 August 2016.

(v) On 1 February 2017, the board of directors announced 20% cash dividend and 10% bonus issue being the final

dividend to the ordinary shareholders and 10% cash dividend for preference shareholders.

Required:

Calculate basic earnings per share for inclusion in HDL’s financial statements for the year ended 31 December 2016. Showall

relevant calculations. (10)

(Q-1, Spring 2017)

NASIR ABBAS FCA

You might also like

- Test Bank Chapter 2 - FinmanDocument11 pagesTest Bank Chapter 2 - FinmanMark FloresNo ratings yet

- Consolidated FS QuizDocument4 pagesConsolidated FS QuizCattleya0% (2)

- AFA IIPl III Question Dec 2016Document4 pagesAFA IIPl III Question Dec 2016HossainNo ratings yet

- Project On NJ India Invest PVT LTDDocument77 pagesProject On NJ India Invest PVT LTDrajveerpatidar69% (26)

- D8 EpsDocument5 pagesD8 EpsKani Utsini DimaNo ratings yet

- Cfap-1 AfrDocument5 pagesCfap-1 AfrsdfasNo ratings yet

- Chapter 15 QB Q5 SolutionDocument5 pagesChapter 15 QB Q5 SolutionRichard SibekoNo ratings yet

- D6 EpsDocument5 pagesD6 EpsKani Utsini DimaNo ratings yet

- UntitledDocument18 pagesUntitledAlok TiwariNo ratings yet

- FM MTP Question Paper Nov 19Document6 pagesFM MTP Question Paper Nov 19sriramakrishnajayamNo ratings yet

- AS-20 QuestionDocument7 pagesAS-20 QuestionDeepthi R TejurNo ratings yet

- Audit of SheDocument3 pagesAudit of ShegbenjielizonNo ratings yet

- Exercises On Basic EPS (Part II)Document2 pagesExercises On Basic EPS (Part II)Chrystelle Gail LiNo ratings yet

- Eps Tutorial QuestionsDocument15 pagesEps Tutorial QuestionsCostantine Andrew Jr.No ratings yet

- Ias 33 Earnings Per Share Review QuestionsDocument6 pagesIas 33 Earnings Per Share Review Questionsabuumgweno1803No ratings yet

- Ind AS 33 - EPS - QuestionsDocument3 pagesInd AS 33 - EPS - QuestionsKashika AgarwalNo ratings yet

- Acce 312 Kassie Ltd. QP - 1Document2 pagesAcce 312 Kassie Ltd. QP - 1PETER MABASSONo ratings yet

- ASS2 Q2 2018 IIB Final PDFDocument3 pagesASS2 Q2 2018 IIB Final PDFLaurenNo ratings yet

- Lecture # 58Document5 pagesLecture # 58HussainNo ratings yet

- June 2016 - QuestionsDocument8 pagesJune 2016 - Questionsnasir_m68No ratings yet

- IFRS 5 Final 10112023 094140amDocument6 pagesIFRS 5 Final 10112023 094140amSidra MumtazNo ratings yet

- Revision Exam Questions and Marking GuidesDocument11 pagesRevision Exam Questions and Marking GuidesAamir SaeedNo ratings yet

- ARM - FAR 1 Mock For March 2024 With Solution - FinalDocument26 pagesARM - FAR 1 Mock For March 2024 With Solution - FinalTooba MaqboolNo ratings yet

- Test 5-ConsolidationDocument3 pagesTest 5-ConsolidationAli OptimisticNo ratings yet

- Problem Ratio 2022Document1 pageProblem Ratio 2022Mohd shariqNo ratings yet

- Class Example Companies 2023Document2 pagesClass Example Companies 2023NjabuloNo ratings yet

- Kazeem Muyideen Aat, Aca Page - 10Document2 pagesKazeem Muyideen Aat, Aca Page - 10Umar AbdulkabirNo ratings yet

- Problems EPSDocument3 pagesProblems EPShukaNo ratings yet

- Accounting 22 2016Document10 pagesAccounting 22 2016Thulani NdlovuNo ratings yet

- Valuation of Goodwill Class NotesDocument4 pagesValuation of Goodwill Class NotesRajesh NangaliaNo ratings yet

- ACCT10002 Tutorial 8 ExercisesDocument5 pagesACCT10002 Tutorial 8 ExercisesJING NIENo ratings yet

- Problems On Retained EarningsDocument2 pagesProblems On Retained EarningsDecereen Pineda RodriguezaNo ratings yet

- Retained EarningsDocument9 pagesRetained EarningsCamille GarciaNo ratings yet

- Acc 512 Assign 2022Document6 pagesAcc 512 Assign 2022abearkeyanNo ratings yet

- Mittal Commerce Classes Intermediate - Mock Test (GI-1, GI-2, GI-3, VI-1, SI-1, VDI-1)Document6 pagesMittal Commerce Classes Intermediate - Mock Test (GI-1, GI-2, GI-3, VI-1, SI-1, VDI-1)Shubham KuberkarNo ratings yet

- Statement of Cash Flow Set-3Document5 pagesStatement of Cash Flow Set-3vdj kumarNo ratings yet

- Mozammil 029Document4 pagesMozammil 029Iqbal Shan LifestyleNo ratings yet

- 2018-12 ICMAB FL 001 PAC Year Question December 2018Document3 pages2018-12 ICMAB FL 001 PAC Year Question December 2018Mohammad ShahidNo ratings yet

- Roll No : NOTE: 1Document8 pagesRoll No : NOTE: 1Anonymous yPWi8p3KkANo ratings yet

- CFAP 1 AFR Winter 2018 PDFDocument6 pagesCFAP 1 AFR Winter 2018 PDFRabin DhakalNo ratings yet

- CA Inter MTP 2 M'19 PDFDocument149 pagesCA Inter MTP 2 M'19 PDFSunitha SuniNo ratings yet

- 54940bosmtpsr2 Inter p1 QDocument6 pages54940bosmtpsr2 Inter p1 QAryan GurjarNo ratings yet

- Financial Planning and Pro Forma Statements Simplistic Approach Part 2Document17 pagesFinancial Planning and Pro Forma Statements Simplistic Approach Part 2ishaNo ratings yet

- Valuation of Goodwill 3Document2 pagesValuation of Goodwill 3Yash MaheswariNo ratings yet

- 2017 JuneDocument16 pages2017 JuneHsaung HaymarnNo ratings yet

- Birla Institute of Technology and Science, PilaniDocument4 pagesBirla Institute of Technology and Science, PilaniArjun Jaideep BhatnagarNo ratings yet

- QUIZ AKL (D4-FEB Unpad)Document2 pagesQUIZ AKL (D4-FEB Unpad)Laksmi Banowati Sadmoko HadiNo ratings yet

- 5 Cash Flow StatementDocument8 pages5 Cash Flow Statementsunil.h68 SunilNo ratings yet

- Financial StatementDocument15 pagesFinancial StatementPankaj SharmaNo ratings yet

- Cash BudgetDocument4 pagesCash BudgetSANDEEP SINGH0% (1)

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument7 pagesQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerHarsh KumarNo ratings yet

- Advanced Financial Reporting Tutorial Questions. (4) DocxDocument3 pagesAdvanced Financial Reporting Tutorial Questions. (4) Docxsmlingwa100% (1)

- Module-2 Sample Question PaperDocument18 pagesModule-2 Sample Question PaperRay Ch100% (1)

- Financial Statement AnalysisDocument2 pagesFinancial Statement AnalysisAsad Rehman100% (1)

- Monthly Test - Acc. Aug 2020Document5 pagesMonthly Test - Acc. Aug 2020akash debbarmaNo ratings yet

- Revision Test Paper CAP III June 2020Document233 pagesRevision Test Paper CAP III June 2020Roshan PanditNo ratings yet

- Financial RportingDocument4 pagesFinancial RportingIrfanNo ratings yet

- Vidya Mandir Ind. PU College Accountancy 2 PUC Assessment 1-July 2020 Total Marks:30 Answer All QuestionsDocument2 pagesVidya Mandir Ind. PU College Accountancy 2 PUC Assessment 1-July 2020 Total Marks:30 Answer All QuestionsBlahjNo ratings yet

- Prashant'S Commerce Academy Fundamentals of PartnershipDocument3 pagesPrashant'S Commerce Academy Fundamentals of PartnershipMuskan TilokaniNo ratings yet

- Cash Flow StatementDocument7 pagesCash Flow StatementRheetwick Bharadwaj100% (1)

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Ind AS 33 HandoutDocument4 pagesInd AS 33 HandoutSiddhika AgrawalNo ratings yet

- Technical Study of Pharmaceutical StocksDocument4 pagesTechnical Study of Pharmaceutical StockssaravanawillbeNo ratings yet

- Beximco Accounting ProjectDocument44 pagesBeximco Accounting ProjectAmeer FerdousNo ratings yet

- Philippine Stock Exchange: Head, Disclosure DepartmentDocument15 pagesPhilippine Stock Exchange: Head, Disclosure DepartmentKarl Anthony Rigoroso MargateNo ratings yet

- Solutions To Problems: Smart/Gitman/Joehnk, Fundamentals of Investing, 12/e Chapter 3Document2 pagesSolutions To Problems: Smart/Gitman/Joehnk, Fundamentals of Investing, 12/e Chapter 3Rio Yow-yow Lansang CastroNo ratings yet

- Intermediaries, and Liquidity Supply: FulghieriDocument32 pagesIntermediaries, and Liquidity Supply: FulghieriStephanie Lynford TanhuecoNo ratings yet

- Local ArticlesDocument3 pagesLocal ArticlesRica Mae DacoyloNo ratings yet

- Chartink Scanner LinksDocument2 pagesChartink Scanner Linksakshaaymfsc1No ratings yet

- Stock Market UbdDocument25 pagesStock Market Ubdapi-355974187No ratings yet

- Technical Analysis PDFDocument15 pagesTechnical Analysis PDFdineshonline0% (1)

- S and C PDFDocument675 pagesS and C PDFRicardo Eiji TominagaNo ratings yet

- Aluation OF SharesDocument19 pagesAluation OF SharesSanthosh PrabhuNo ratings yet

- Fixed Income Fund Prospectus Full VersionDocument36 pagesFixed Income Fund Prospectus Full VersionshakibalamNo ratings yet

- Blueprint For Professional TradingDocument44 pagesBlueprint For Professional Tradingneha 3632No ratings yet

- Sek M Haniph 01042021 Till 31032022Document29 pagesSek M Haniph 01042021 Till 31032022Sujat KhanNo ratings yet

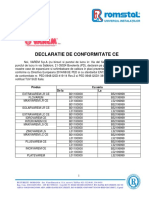

- Declaratie de Conformitate Ce: Cu Seria Produs de La LaDocument3 pagesDeclaratie de Conformitate Ce: Cu Seria Produs de La LaVasile Marian AdrianNo ratings yet

- Weekly Strategic Plan 03182013Document12 pagesWeekly Strategic Plan 03182013Bruce LawrenceNo ratings yet

- Instructor: Bernard Malamud: - Office: BEH 502Document36 pagesInstructor: Bernard Malamud: - Office: BEH 502kinaNo ratings yet

- R38 Dividends and Share Repurchases Basics Q BankDocument12 pagesR38 Dividends and Share Repurchases Basics Q BankAhmedNo ratings yet

- Weekly ArgusDocument66 pagesWeekly Argusjean pierreNo ratings yet

- Assessment of Risk Appetite To Invest in Mutual FundDocument39 pagesAssessment of Risk Appetite To Invest in Mutual FundLovely ShivnaniNo ratings yet

- EPW 12 August 2017Document58 pagesEPW 12 August 2017sameer bakshiNo ratings yet

- Astrology Intraday - Google SearchDocument1 pageAstrology Intraday - Google SearchAnonymous ScdwAputNo ratings yet

- EMPRESAS POLAR vs. BAVARIA, S.AACQUISITIONDocument31 pagesEMPRESAS POLAR vs. BAVARIA, S.AACQUISITIONbuffon100% (1)

- Electronic Trading SystemDocument31 pagesElectronic Trading SystemMd.abdul AzizNo ratings yet

- OutScanner - SFM Solved Compiler - Adish JainDocument545 pagesOutScanner - SFM Solved Compiler - Adish JainRakesh GopuNo ratings yet

- Share Prices 30 Sep 2011Document7 pagesShare Prices 30 Sep 2011Vincent RugutNo ratings yet