Professional Documents

Culture Documents

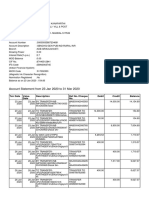

Task 1 Financial Accounting

Task 1 Financial Accounting

Uploaded by

ScribdTranslationsCopyright:

Available Formats

You might also like

- MATH 108X - Savings & Loans Project (Vehicle Option)Document25 pagesMATH 108X - Savings & Loans Project (Vehicle Option)Boy of SteelNo ratings yet

- IBEX Global Parañaque SWOT AnalysisDocument2 pagesIBEX Global Parañaque SWOT AnalysisPUPT-JMA VP for AuditNo ratings yet

- Solution Manual For Financial Accounting 6th Canadian Edition by LibbyDocument29 pagesSolution Manual For Financial Accounting 6th Canadian Edition by Libbya84964899475% (4)

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuideNo ratings yet

- Actg1 - Chapter 3Document37 pagesActg1 - Chapter 3Reynaleen Agta100% (1)

- 27 Sequence of Total 1-1-40a Form of 175af5Document2 pages27 Sequence of Total 1-1-40a Form of 175af5PawPaul MccoyNo ratings yet

- 1 - Intro To Financial AccountingDocument20 pages1 - Intro To Financial AccountingChaarLeene SusanöNo ratings yet

- Account Form: Glossary For CMA Part 2Document42 pagesAccount Form: Glossary For CMA Part 2ajithsubramanianNo ratings yet

- Andrea Carolina Gonzalez RinconDocument3 pagesAndrea Carolina Gonzalez RinconedwinNo ratings yet

- Example of Accounting ConceptsDocument3 pagesExample of Accounting ConceptsGio BurburanNo ratings yet

- Terminology Asset: Share CapitalDocument8 pagesTerminology Asset: Share CapitalHenna HussainNo ratings yet

- Accounting - : Basic Terms in Accounting - 1. TransactionDocument14 pagesAccounting - : Basic Terms in Accounting - 1. TransactionKaran Singh RathoreNo ratings yet

- 2 Accounting Work BookDocument89 pages2 Accounting Work Bookrachel rankuNo ratings yet

- CHAPTER 3 The Accounting Equation and The Double-Entry System (Module)Document14 pagesCHAPTER 3 The Accounting Equation and The Double-Entry System (Module)Chona MarcosNo ratings yet

- Accounting-II-MID SEMESTER-QUES BANK-2019Document13 pagesAccounting-II-MID SEMESTER-QUES BANK-2019dhruvdalal63No ratings yet

- Financial Tools (Me Encanta)Document9 pagesFinancial Tools (Me Encanta)KajoeraNo ratings yet

- FINANCIAL ACCOUNTING - Alternative Material 16.06.2020Document35 pagesFINANCIAL ACCOUNTING - Alternative Material 16.06.2020AllandexNo ratings yet

- Acctg Lesson - Day 1Document7 pagesAcctg Lesson - Day 1Novelyn Hiso-anNo ratings yet

- Full Download PDF of Financial Accounting Libby 7th Edition Solutions Manual All ChapterDocument19 pagesFull Download PDF of Financial Accounting Libby 7th Edition Solutions Manual All Chapterpopsoidjeric90100% (4)

- Fundamentals of AccountingDocument7 pagesFundamentals of AccountingDengdit Akol100% (1)

- Fabm1 Lesson 2Document21 pagesFabm1 Lesson 2JoshuaNo ratings yet

- Accounting Concepts and PrinciplesDocument5 pagesAccounting Concepts and PrinciplesMahmud Abdullahi SarkiNo ratings yet

- Business VocabularyDocument2 pagesBusiness VocabularyLiza BazileviciNo ratings yet

- SITXFIN002 Interpret Financial InformationDocument12 pagesSITXFIN002 Interpret Financial Informationsampath lewkeNo ratings yet

- Majid 12 3762 1 Accounting Principles and ConceptsDocument5 pagesMajid 12 3762 1 Accounting Principles and ConceptsHasnain BhuttoNo ratings yet

- El Atmani Fatima Zahra - FI.CCA TERME EN ANGLAISDocument6 pagesEl Atmani Fatima Zahra - FI.CCA TERME EN ANGLAISFATIMA ZAHRA EL ATMANINo ratings yet

- Basics of Accounting and Book KeepingDocument16 pagesBasics of Accounting and Book KeepingPuneet Dhupar100% (1)

- Accounting ConceptsDocument5 pagesAccounting ConceptsAakanksha ThodupunooriNo ratings yet

- Basic Features of Financial AccountingDocument3 pagesBasic Features of Financial AccountingmaggievscaNo ratings yet

- PPSAS SummaryDocument9 pagesPPSAS SummaryJ JaNo ratings yet

- BBddFY Business AccountingDocument24 pagesBBddFY Business AccountingMehul KumarNo ratings yet

- FR & FasDocument195 pagesFR & FasPrerana SharmaNo ratings yet

- Accounting Concepts and ConventionsDocument40 pagesAccounting Concepts and ConventionsAmrita TatiaNo ratings yet

- Financial Accounting Libby 7th Edition Solutions ManualDocument5 pagesFinancial Accounting Libby 7th Edition Solutions ManualJennifer Winslow100% (42)

- Basic Accounting ModuleDocument4 pagesBasic Accounting ModuleHazel Joy Batocail100% (1)

- Anglais s1Document9 pagesAnglais s1JassNo ratings yet

- Substance Over Form Study NotesDocument2 pagesSubstance Over Form Study Notesarnoldsch2008100% (1)

- Double Entry Bookkeeping Debiting Crediting Accounting Equation Accounting Information System Specialized Journals Adjusting EntriesDocument3 pagesDouble Entry Bookkeeping Debiting Crediting Accounting Equation Accounting Information System Specialized Journals Adjusting Entrieswesternwound82No ratings yet

- Sample of Asset-Office Land, Equiptment, Cash, MachinesDocument29 pagesSample of Asset-Office Land, Equiptment, Cash, MachinesMaria Cludet NayveNo ratings yet

- Basic DefinitionsDocument5 pagesBasic DefinitionsHamza KhaliqNo ratings yet

- A. Under Statement of Financial Position: Typical Account Titles UsedDocument6 pagesA. Under Statement of Financial Position: Typical Account Titles UsedAshlyn MaeNo ratings yet

- BACNTHIDocument3 pagesBACNTHIFaith CalingoNo ratings yet

- Accounting Concept or Principles PDFDocument3 pagesAccounting Concept or Principles PDFRoshan RamkhalawonNo ratings yet

- Assets Liabilities and EquityDocument19 pagesAssets Liabilities and EquityTiyas KurniaNo ratings yet

- Basic FinanceDocument67 pagesBasic Financesoref49920No ratings yet

- The Concept of AccountingDocument5 pagesThe Concept of AccountingA YoungeNo ratings yet

- Acconting TermsDocument3 pagesAcconting TermsTapan Kumar MishraNo ratings yet

- Discussion QuestionsDocument8 pagesDiscussion QuestionsLuis JoseNo ratings yet

- Accounting 1Document3 pagesAccounting 1Byezid LimonNo ratings yet

- Definition of AccountingDocument16 pagesDefinition of AccountingPutrie Maamor MidtimbangNo ratings yet

- Bcom QbankDocument13 pagesBcom QbankIshaNo ratings yet

- AccountingDocument1 pageAccountingMikaela AgustinNo ratings yet

- CHAPTER ONE PrinDocument15 pagesCHAPTER ONE Prinbelaybekele88No ratings yet

- Accounting BasicsDocument6 pagesAccounting BasicsanishtomanishNo ratings yet

- Accounting Principles & Practices An Overview DefinitionDocument10 pagesAccounting Principles & Practices An Overview DefinitionRibka MerachNo ratings yet

- This Is The Final Trial Balance Prepared To Test The Equality of The Accounts After Posting The Adjusting Ang Closing EntriesDocument4 pagesThis Is The Final Trial Balance Prepared To Test The Equality of The Accounts After Posting The Adjusting Ang Closing EntriesGraciela InacayNo ratings yet

- What Is Accounting ?: PDF HandoutDocument5 pagesWhat Is Accounting ?: PDF Handoutshreya partiNo ratings yet

- About Us: "All The Goodness You Deserve!"Document4 pagesAbout Us: "All The Goodness You Deserve!"Ja NinNo ratings yet

- Generally Accepted Accounting PrinciplesDocument18 pagesGenerally Accepted Accounting PrinciplesScribdTranslationsNo ratings yet

- Uses of Accounting Information and The Financial StatementsDocument15 pagesUses of Accounting Information and The Financial StatementsSweta KumariNo ratings yet

- Glossary of Accounting TermsDocument3 pagesGlossary of Accounting TermsGauchoJuniorNo ratings yet

- Summary Chapter 6 Accounting For Managers - Paul M. CollierDocument4 pagesSummary Chapter 6 Accounting For Managers - Paul M. CollierMarina_1995No ratings yet

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- Abbreviated File-Process Case 01 Marco A. and CounterclaimDocument25 pagesAbbreviated File-Process Case 01 Marco A. and CounterclaimScribdTranslationsNo ratings yet

- Retirement Instructions Unemployment PorvenirDocument6 pagesRetirement Instructions Unemployment PorvenirScribdTranslationsNo ratings yet

- Natural History of Parkinson's DiseaseDocument49 pagesNatural History of Parkinson's DiseaseScribdTranslationsNo ratings yet

- Chapter X. Precision Shooting From Naval Air PlatformsDocument24 pagesChapter X. Precision Shooting From Naval Air PlatformsScribdTranslationsNo ratings yet

- History and Evolution of Reciprocating MotorsDocument32 pagesHistory and Evolution of Reciprocating MotorsScribdTranslationsNo ratings yet

- Application of Copper Sulfate in AquacultureDocument2 pagesApplication of Copper Sulfate in AquacultureScribdTranslationsNo ratings yet

- Reading Comprehension and Contextual Vocabulary Exercises 4th Middle #8.Document5 pagesReading Comprehension and Contextual Vocabulary Exercises 4th Middle #8.ScribdTranslationsNo ratings yet

- SYLLABUS Mechanical Drawing 2Document7 pagesSYLLABUS Mechanical Drawing 2ScribdTranslationsNo ratings yet

- Ethnicity, Language and IdentityDocument4 pagesEthnicity, Language and IdentityScribdTranslationsNo ratings yet

- Musical Instruments of EuropeDocument3 pagesMusical Instruments of EuropeScribdTranslationsNo ratings yet

- iTEP in - House PDFDocument12 pagesiTEP in - House PDFScribdTranslationsNo ratings yet

- Tourist PlanningDocument39 pagesTourist PlanningScribdTranslationsNo ratings yet

- Application of Regulations in The Financial SystemDocument74 pagesApplication of Regulations in The Financial SystemScribdTranslationsNo ratings yet

- Boxing PDFDocument49 pagesBoxing PDFScribdTranslationsNo ratings yet

- Comparative Table of Rationalism and EmpiricismDocument7 pagesComparative Table of Rationalism and EmpiricismScribdTranslationsNo ratings yet

- Sixth Grade Reading Comprehension AssessmentDocument8 pagesSixth Grade Reading Comprehension AssessmentScribdTranslationsNo ratings yet

- Project On Electricity For ChildrenDocument13 pagesProject On Electricity For ChildrenScribdTranslationsNo ratings yet

- Practical Work The Familiar PDFDocument1 pagePractical Work The Familiar PDFScribdTranslationsNo ratings yet

- Legal Aspects GuatemalaDocument20 pagesLegal Aspects GuatemalaScribdTranslationsNo ratings yet

- 5th Grade Plan - Block 4 GeographyDocument12 pages5th Grade Plan - Block 4 GeographyScribdTranslationsNo ratings yet

- PH Portfolio Recovery ProposalDocument3 pagesPH Portfolio Recovery ProposalScribdTranslationsNo ratings yet

- Driver's Manual in TexasDocument109 pagesDriver's Manual in TexasScribdTranslationsNo ratings yet

- Expo22 Daily ExperienceDocument6 pagesExpo22 Daily ExperienceScribdTranslationsNo ratings yet

- Chemistry Laboratory Report 1Document14 pagesChemistry Laboratory Report 1ScribdTranslationsNo ratings yet

- Types of Banks Based On OwnershipDocument2 pagesTypes of Banks Based On OwnershipScribdTranslationsNo ratings yet

- Applied StatisticsDocument209 pagesApplied StatisticsScribdTranslationsNo ratings yet

- Examples of Operant ConditioningDocument1 pageExamples of Operant ConditioningScribdTranslationsNo ratings yet

- Event Security ProtocolDocument7 pagesEvent Security ProtocolScribdTranslationsNo ratings yet

- Vibrational Sound Therapy ManualDocument12 pagesVibrational Sound Therapy ManualScribdTranslationsNo ratings yet

- Security of Accounting Information SystemsDocument2 pagesSecurity of Accounting Information SystemsScribdTranslationsNo ratings yet

- DocxDocument33 pagesDocxGray Javier0% (1)

- Political Economy NotesDocument4 pagesPolitical Economy NotesJames LosariaNo ratings yet

- ECO701 Economics and The Business Environment Coursework 1 - June 23Document4 pagesECO701 Economics and The Business Environment Coursework 1 - June 23Ghazaal HassanzadehNiriNo ratings yet

- Medical Device Regulatory Requirements FDocument26 pagesMedical Device Regulatory Requirements Fmd edaNo ratings yet

- Unit - I: Introduction To Business &Document128 pagesUnit - I: Introduction To Business &Vamsi KrishnaNo ratings yet

- Initial Off-Take Agreement Signed With Leading European Tungsten RefinerDocument2 pagesInitial Off-Take Agreement Signed With Leading European Tungsten RefinerKOMATSU SHOVELNo ratings yet

- Energy Economics Schwarz-2018Document433 pagesEnergy Economics Schwarz-2018Mirwanto Sidabutar100% (1)

- Fsa 9QDocument23 pagesFsa 9Qpriyanshu.goel1710No ratings yet

- Property Maintenance (House Cleaning)Document4 pagesProperty Maintenance (House Cleaning)deejaymee0No ratings yet

- AtulDocument3 pagesAtulYatin ChopraNo ratings yet

- Module 1: Concepts: Chapters 1, 2, 7, 8 & 11:216-222Document185 pagesModule 1: Concepts: Chapters 1, 2, 7, 8 & 11:216-222Bao AnhNo ratings yet

- RPIIMSDocument16 pagesRPIIMSRiya LokhandeNo ratings yet

- Management Theory & Global Management (Slides)Document30 pagesManagement Theory & Global Management (Slides)JayNo ratings yet

- Peng (2002) Towards An Institution-Based View PDFDocument17 pagesPeng (2002) Towards An Institution-Based View PDFJanypher MarcelaNo ratings yet

- Employee Benefits Exercises-ANSWERSDocument12 pagesEmployee Benefits Exercises-ANSWERSfaye pantiNo ratings yet

- Financial Key Performance Indicators of Jio Infocomm: K P Ezhil MaranDocument8 pagesFinancial Key Performance Indicators of Jio Infocomm: K P Ezhil MaranShreyansh JainNo ratings yet

- Swetha Kunapuli - Offer Letter - PGP-DSBADocument5 pagesSwetha Kunapuli - Offer Letter - PGP-DSBAswetha kunapuliNo ratings yet

- Agarwal Daniel Naik 2004Document44 pagesAgarwal Daniel Naik 2004Juliana TessariNo ratings yet

- Muktsar Punjab LBDocument1 pageMuktsar Punjab LBSatkar GarmentNo ratings yet

- GST Refund 26102015 NewDocument30 pagesGST Refund 26102015 NewNikhil SinghalNo ratings yet

- Shopping - Cashless PaymentsDocument24 pagesShopping - Cashless PaymentsMei Shuen CheamNo ratings yet

- Chapter 1-SolutionsDocument14 pagesChapter 1-SolutionsPrince CalicaNo ratings yet

- Mba Project Final ReportDocument17 pagesMba Project Final ReportSubalakshmiNo ratings yet

- 23 Jan To 31mar 2020 Sbi Suresh StateDocument12 pages23 Jan To 31mar 2020 Sbi Suresh Stateravi lingamNo ratings yet

- MigrationObjects OP enDocument1,122 pagesMigrationObjects OP enmitesh aher100% (2)

- CPCCOM1013 PresentationDocument58 pagesCPCCOM1013 PresentationSana DuraniNo ratings yet

- Zurich Mia FactsheetDocument2 pagesZurich Mia FactsheetVenkatesh KNo ratings yet

Task 1 Financial Accounting

Task 1 Financial Accounting

Uploaded by

ScribdTranslationsOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Task 1 Financial Accounting

Task 1 Financial Accounting

Uploaded by

ScribdTranslationsCopyright:

Available Formats

1

9- Why is the FISCO interested in financial information?

You need financial information as a basis for calculating taxes, or corroboration of

their exact payment. Furthermore, to verify that there is no evasion or money

laundering, if this exists they must pay for it.

10- List seven indirect users of financial information.

Investors, lenders, employees, financiers, clients, the general public, suppliers,

chambers of commerce.

11- Outline the basic theory of financial accounting.

12- Point out that it should be understood by basic concepts of

financial accounting.

They are the result of the interrelation of the environment with the accounting

process. These concepts are the foundation of the accounting principles generally

accepted today and also serve as a basis for the development of other principles

also derived from environmental characteristics, those adopted by accounting

experts in the country are: Going business, economic measurement , period,

Measurement in terms of money, Accumulation, Accrual, Prices, Estimates,

Relative importance, Substance rather than form, and financial statements.

13- Write an example of the basic concept of financial accounting called

accounting entity.

2

The Salvadoran entity, ADEXA, SA incurred the expense for the acquisition of a

vehicle, of which the entity will only have to give it the necessary use to be able to

use it, in transporting personnel, in which the shareholders will not have rights over

said vehicle.

14- What is the circumstance that causes the basic concept of financial

accounting called a going concern to disappear?

When an entity is interrupted by extraordinary events, which impact the objective of

remaining in operation for the company over time, proceeding to the dissolution

and liquidation process.

15- Identify two basic concepts of financial accounting that identify and

delimit the economic entity.

Accounting entity: It is a basic concept of financial accounting that is responsible

for identifying and delimiting the economic entity.

Prices: Financial accounting is measured based on the exchange prices of

economic resources and economic obligations. There are multiple concepts of the

expression exchange prices; In such a way that it is necessary to decide on prices

that are relevant to its uses.

16- Write three basic concepts of financial accounting that quantify the

company's operations.

Historical value: known as the historical cost of assets, it is the amount of cash or

cash equivalents paid, or the fair value of the consideration given to acquire the

asset at the time of its acquisition. For liabilities, the historical cost is the amount of

cash or cash equivalents received or the fair value of non-monetary assets

received in exchange for the obligation at the time it is incurred, or in some

circumstances (e.g. For example, income taxes), the amounts of cash or cash

equivalents expected to be paid to settle the liability in the ordinary course of

business. Amortized historical cost is the historical cost of an asset or liability plus

or minus the portion of its historical cost previously recognized as an expense or

income.

Fair value: is the amount for which an asset can be exchanged, or a liability

cancelled, between an interested and duly informed buyer and seller, who carry out

a transaction under conditions of mutual independence.

Accrual basis: It means that Income is considered in the period in which it is

earned (regardless of when it is collected), and Expenses are considered when it is

contracted for something (regardless of its payment). In accordance with the

3

accrual basis of accounting, items will be recognized as assets, liabilities, equity,

income or expenses when they satisfy the definitions and recognition criteria for

those items.

You might also like

- MATH 108X - Savings & Loans Project (Vehicle Option)Document25 pagesMATH 108X - Savings & Loans Project (Vehicle Option)Boy of SteelNo ratings yet

- IBEX Global Parañaque SWOT AnalysisDocument2 pagesIBEX Global Parañaque SWOT AnalysisPUPT-JMA VP for AuditNo ratings yet

- Solution Manual For Financial Accounting 6th Canadian Edition by LibbyDocument29 pagesSolution Manual For Financial Accounting 6th Canadian Edition by Libbya84964899475% (4)

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuideNo ratings yet

- Actg1 - Chapter 3Document37 pagesActg1 - Chapter 3Reynaleen Agta100% (1)

- 27 Sequence of Total 1-1-40a Form of 175af5Document2 pages27 Sequence of Total 1-1-40a Form of 175af5PawPaul MccoyNo ratings yet

- 1 - Intro To Financial AccountingDocument20 pages1 - Intro To Financial AccountingChaarLeene SusanöNo ratings yet

- Account Form: Glossary For CMA Part 2Document42 pagesAccount Form: Glossary For CMA Part 2ajithsubramanianNo ratings yet

- Andrea Carolina Gonzalez RinconDocument3 pagesAndrea Carolina Gonzalez RinconedwinNo ratings yet

- Example of Accounting ConceptsDocument3 pagesExample of Accounting ConceptsGio BurburanNo ratings yet

- Terminology Asset: Share CapitalDocument8 pagesTerminology Asset: Share CapitalHenna HussainNo ratings yet

- Accounting - : Basic Terms in Accounting - 1. TransactionDocument14 pagesAccounting - : Basic Terms in Accounting - 1. TransactionKaran Singh RathoreNo ratings yet

- 2 Accounting Work BookDocument89 pages2 Accounting Work Bookrachel rankuNo ratings yet

- CHAPTER 3 The Accounting Equation and The Double-Entry System (Module)Document14 pagesCHAPTER 3 The Accounting Equation and The Double-Entry System (Module)Chona MarcosNo ratings yet

- Accounting-II-MID SEMESTER-QUES BANK-2019Document13 pagesAccounting-II-MID SEMESTER-QUES BANK-2019dhruvdalal63No ratings yet

- Financial Tools (Me Encanta)Document9 pagesFinancial Tools (Me Encanta)KajoeraNo ratings yet

- FINANCIAL ACCOUNTING - Alternative Material 16.06.2020Document35 pagesFINANCIAL ACCOUNTING - Alternative Material 16.06.2020AllandexNo ratings yet

- Acctg Lesson - Day 1Document7 pagesAcctg Lesson - Day 1Novelyn Hiso-anNo ratings yet

- Full Download PDF of Financial Accounting Libby 7th Edition Solutions Manual All ChapterDocument19 pagesFull Download PDF of Financial Accounting Libby 7th Edition Solutions Manual All Chapterpopsoidjeric90100% (4)

- Fundamentals of AccountingDocument7 pagesFundamentals of AccountingDengdit Akol100% (1)

- Fabm1 Lesson 2Document21 pagesFabm1 Lesson 2JoshuaNo ratings yet

- Accounting Concepts and PrinciplesDocument5 pagesAccounting Concepts and PrinciplesMahmud Abdullahi SarkiNo ratings yet

- Business VocabularyDocument2 pagesBusiness VocabularyLiza BazileviciNo ratings yet

- SITXFIN002 Interpret Financial InformationDocument12 pagesSITXFIN002 Interpret Financial Informationsampath lewkeNo ratings yet

- Majid 12 3762 1 Accounting Principles and ConceptsDocument5 pagesMajid 12 3762 1 Accounting Principles and ConceptsHasnain BhuttoNo ratings yet

- El Atmani Fatima Zahra - FI.CCA TERME EN ANGLAISDocument6 pagesEl Atmani Fatima Zahra - FI.CCA TERME EN ANGLAISFATIMA ZAHRA EL ATMANINo ratings yet

- Basics of Accounting and Book KeepingDocument16 pagesBasics of Accounting and Book KeepingPuneet Dhupar100% (1)

- Accounting ConceptsDocument5 pagesAccounting ConceptsAakanksha ThodupunooriNo ratings yet

- Basic Features of Financial AccountingDocument3 pagesBasic Features of Financial AccountingmaggievscaNo ratings yet

- PPSAS SummaryDocument9 pagesPPSAS SummaryJ JaNo ratings yet

- BBddFY Business AccountingDocument24 pagesBBddFY Business AccountingMehul KumarNo ratings yet

- FR & FasDocument195 pagesFR & FasPrerana SharmaNo ratings yet

- Accounting Concepts and ConventionsDocument40 pagesAccounting Concepts and ConventionsAmrita TatiaNo ratings yet

- Financial Accounting Libby 7th Edition Solutions ManualDocument5 pagesFinancial Accounting Libby 7th Edition Solutions ManualJennifer Winslow100% (42)

- Basic Accounting ModuleDocument4 pagesBasic Accounting ModuleHazel Joy Batocail100% (1)

- Anglais s1Document9 pagesAnglais s1JassNo ratings yet

- Substance Over Form Study NotesDocument2 pagesSubstance Over Form Study Notesarnoldsch2008100% (1)

- Double Entry Bookkeeping Debiting Crediting Accounting Equation Accounting Information System Specialized Journals Adjusting EntriesDocument3 pagesDouble Entry Bookkeeping Debiting Crediting Accounting Equation Accounting Information System Specialized Journals Adjusting Entrieswesternwound82No ratings yet

- Sample of Asset-Office Land, Equiptment, Cash, MachinesDocument29 pagesSample of Asset-Office Land, Equiptment, Cash, MachinesMaria Cludet NayveNo ratings yet

- Basic DefinitionsDocument5 pagesBasic DefinitionsHamza KhaliqNo ratings yet

- A. Under Statement of Financial Position: Typical Account Titles UsedDocument6 pagesA. Under Statement of Financial Position: Typical Account Titles UsedAshlyn MaeNo ratings yet

- BACNTHIDocument3 pagesBACNTHIFaith CalingoNo ratings yet

- Accounting Concept or Principles PDFDocument3 pagesAccounting Concept or Principles PDFRoshan RamkhalawonNo ratings yet

- Assets Liabilities and EquityDocument19 pagesAssets Liabilities and EquityTiyas KurniaNo ratings yet

- Basic FinanceDocument67 pagesBasic Financesoref49920No ratings yet

- The Concept of AccountingDocument5 pagesThe Concept of AccountingA YoungeNo ratings yet

- Acconting TermsDocument3 pagesAcconting TermsTapan Kumar MishraNo ratings yet

- Discussion QuestionsDocument8 pagesDiscussion QuestionsLuis JoseNo ratings yet

- Accounting 1Document3 pagesAccounting 1Byezid LimonNo ratings yet

- Definition of AccountingDocument16 pagesDefinition of AccountingPutrie Maamor MidtimbangNo ratings yet

- Bcom QbankDocument13 pagesBcom QbankIshaNo ratings yet

- AccountingDocument1 pageAccountingMikaela AgustinNo ratings yet

- CHAPTER ONE PrinDocument15 pagesCHAPTER ONE Prinbelaybekele88No ratings yet

- Accounting BasicsDocument6 pagesAccounting BasicsanishtomanishNo ratings yet

- Accounting Principles & Practices An Overview DefinitionDocument10 pagesAccounting Principles & Practices An Overview DefinitionRibka MerachNo ratings yet

- This Is The Final Trial Balance Prepared To Test The Equality of The Accounts After Posting The Adjusting Ang Closing EntriesDocument4 pagesThis Is The Final Trial Balance Prepared To Test The Equality of The Accounts After Posting The Adjusting Ang Closing EntriesGraciela InacayNo ratings yet

- What Is Accounting ?: PDF HandoutDocument5 pagesWhat Is Accounting ?: PDF Handoutshreya partiNo ratings yet

- About Us: "All The Goodness You Deserve!"Document4 pagesAbout Us: "All The Goodness You Deserve!"Ja NinNo ratings yet

- Generally Accepted Accounting PrinciplesDocument18 pagesGenerally Accepted Accounting PrinciplesScribdTranslationsNo ratings yet

- Uses of Accounting Information and The Financial StatementsDocument15 pagesUses of Accounting Information and The Financial StatementsSweta KumariNo ratings yet

- Glossary of Accounting TermsDocument3 pagesGlossary of Accounting TermsGauchoJuniorNo ratings yet

- Summary Chapter 6 Accounting For Managers - Paul M. CollierDocument4 pagesSummary Chapter 6 Accounting For Managers - Paul M. CollierMarina_1995No ratings yet

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- Abbreviated File-Process Case 01 Marco A. and CounterclaimDocument25 pagesAbbreviated File-Process Case 01 Marco A. and CounterclaimScribdTranslationsNo ratings yet

- Retirement Instructions Unemployment PorvenirDocument6 pagesRetirement Instructions Unemployment PorvenirScribdTranslationsNo ratings yet

- Natural History of Parkinson's DiseaseDocument49 pagesNatural History of Parkinson's DiseaseScribdTranslationsNo ratings yet

- Chapter X. Precision Shooting From Naval Air PlatformsDocument24 pagesChapter X. Precision Shooting From Naval Air PlatformsScribdTranslationsNo ratings yet

- History and Evolution of Reciprocating MotorsDocument32 pagesHistory and Evolution of Reciprocating MotorsScribdTranslationsNo ratings yet

- Application of Copper Sulfate in AquacultureDocument2 pagesApplication of Copper Sulfate in AquacultureScribdTranslationsNo ratings yet

- Reading Comprehension and Contextual Vocabulary Exercises 4th Middle #8.Document5 pagesReading Comprehension and Contextual Vocabulary Exercises 4th Middle #8.ScribdTranslationsNo ratings yet

- SYLLABUS Mechanical Drawing 2Document7 pagesSYLLABUS Mechanical Drawing 2ScribdTranslationsNo ratings yet

- Ethnicity, Language and IdentityDocument4 pagesEthnicity, Language and IdentityScribdTranslationsNo ratings yet

- Musical Instruments of EuropeDocument3 pagesMusical Instruments of EuropeScribdTranslationsNo ratings yet

- iTEP in - House PDFDocument12 pagesiTEP in - House PDFScribdTranslationsNo ratings yet

- Tourist PlanningDocument39 pagesTourist PlanningScribdTranslationsNo ratings yet

- Application of Regulations in The Financial SystemDocument74 pagesApplication of Regulations in The Financial SystemScribdTranslationsNo ratings yet

- Boxing PDFDocument49 pagesBoxing PDFScribdTranslationsNo ratings yet

- Comparative Table of Rationalism and EmpiricismDocument7 pagesComparative Table of Rationalism and EmpiricismScribdTranslationsNo ratings yet

- Sixth Grade Reading Comprehension AssessmentDocument8 pagesSixth Grade Reading Comprehension AssessmentScribdTranslationsNo ratings yet

- Project On Electricity For ChildrenDocument13 pagesProject On Electricity For ChildrenScribdTranslationsNo ratings yet

- Practical Work The Familiar PDFDocument1 pagePractical Work The Familiar PDFScribdTranslationsNo ratings yet

- Legal Aspects GuatemalaDocument20 pagesLegal Aspects GuatemalaScribdTranslationsNo ratings yet

- 5th Grade Plan - Block 4 GeographyDocument12 pages5th Grade Plan - Block 4 GeographyScribdTranslationsNo ratings yet

- PH Portfolio Recovery ProposalDocument3 pagesPH Portfolio Recovery ProposalScribdTranslationsNo ratings yet

- Driver's Manual in TexasDocument109 pagesDriver's Manual in TexasScribdTranslationsNo ratings yet

- Expo22 Daily ExperienceDocument6 pagesExpo22 Daily ExperienceScribdTranslationsNo ratings yet

- Chemistry Laboratory Report 1Document14 pagesChemistry Laboratory Report 1ScribdTranslationsNo ratings yet

- Types of Banks Based On OwnershipDocument2 pagesTypes of Banks Based On OwnershipScribdTranslationsNo ratings yet

- Applied StatisticsDocument209 pagesApplied StatisticsScribdTranslationsNo ratings yet

- Examples of Operant ConditioningDocument1 pageExamples of Operant ConditioningScribdTranslationsNo ratings yet

- Event Security ProtocolDocument7 pagesEvent Security ProtocolScribdTranslationsNo ratings yet

- Vibrational Sound Therapy ManualDocument12 pagesVibrational Sound Therapy ManualScribdTranslationsNo ratings yet

- Security of Accounting Information SystemsDocument2 pagesSecurity of Accounting Information SystemsScribdTranslationsNo ratings yet

- DocxDocument33 pagesDocxGray Javier0% (1)

- Political Economy NotesDocument4 pagesPolitical Economy NotesJames LosariaNo ratings yet

- ECO701 Economics and The Business Environment Coursework 1 - June 23Document4 pagesECO701 Economics and The Business Environment Coursework 1 - June 23Ghazaal HassanzadehNiriNo ratings yet

- Medical Device Regulatory Requirements FDocument26 pagesMedical Device Regulatory Requirements Fmd edaNo ratings yet

- Unit - I: Introduction To Business &Document128 pagesUnit - I: Introduction To Business &Vamsi KrishnaNo ratings yet

- Initial Off-Take Agreement Signed With Leading European Tungsten RefinerDocument2 pagesInitial Off-Take Agreement Signed With Leading European Tungsten RefinerKOMATSU SHOVELNo ratings yet

- Energy Economics Schwarz-2018Document433 pagesEnergy Economics Schwarz-2018Mirwanto Sidabutar100% (1)

- Fsa 9QDocument23 pagesFsa 9Qpriyanshu.goel1710No ratings yet

- Property Maintenance (House Cleaning)Document4 pagesProperty Maintenance (House Cleaning)deejaymee0No ratings yet

- AtulDocument3 pagesAtulYatin ChopraNo ratings yet

- Module 1: Concepts: Chapters 1, 2, 7, 8 & 11:216-222Document185 pagesModule 1: Concepts: Chapters 1, 2, 7, 8 & 11:216-222Bao AnhNo ratings yet

- RPIIMSDocument16 pagesRPIIMSRiya LokhandeNo ratings yet

- Management Theory & Global Management (Slides)Document30 pagesManagement Theory & Global Management (Slides)JayNo ratings yet

- Peng (2002) Towards An Institution-Based View PDFDocument17 pagesPeng (2002) Towards An Institution-Based View PDFJanypher MarcelaNo ratings yet

- Employee Benefits Exercises-ANSWERSDocument12 pagesEmployee Benefits Exercises-ANSWERSfaye pantiNo ratings yet

- Financial Key Performance Indicators of Jio Infocomm: K P Ezhil MaranDocument8 pagesFinancial Key Performance Indicators of Jio Infocomm: K P Ezhil MaranShreyansh JainNo ratings yet

- Swetha Kunapuli - Offer Letter - PGP-DSBADocument5 pagesSwetha Kunapuli - Offer Letter - PGP-DSBAswetha kunapuliNo ratings yet

- Agarwal Daniel Naik 2004Document44 pagesAgarwal Daniel Naik 2004Juliana TessariNo ratings yet

- Muktsar Punjab LBDocument1 pageMuktsar Punjab LBSatkar GarmentNo ratings yet

- GST Refund 26102015 NewDocument30 pagesGST Refund 26102015 NewNikhil SinghalNo ratings yet

- Shopping - Cashless PaymentsDocument24 pagesShopping - Cashless PaymentsMei Shuen CheamNo ratings yet

- Chapter 1-SolutionsDocument14 pagesChapter 1-SolutionsPrince CalicaNo ratings yet

- Mba Project Final ReportDocument17 pagesMba Project Final ReportSubalakshmiNo ratings yet

- 23 Jan To 31mar 2020 Sbi Suresh StateDocument12 pages23 Jan To 31mar 2020 Sbi Suresh Stateravi lingamNo ratings yet

- MigrationObjects OP enDocument1,122 pagesMigrationObjects OP enmitesh aher100% (2)

- CPCCOM1013 PresentationDocument58 pagesCPCCOM1013 PresentationSana DuraniNo ratings yet

- Zurich Mia FactsheetDocument2 pagesZurich Mia FactsheetVenkatesh KNo ratings yet