Professional Documents

Culture Documents

Tax Obligations Matrix - Determine The Type of Tax Obligations of A Company in Accordance With The Legal Regime

Tax Obligations Matrix - Determine The Type of Tax Obligations of A Company in Accordance With The Legal Regime

Uploaded by

ScribdTranslationsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Obligations Matrix - Determine The Type of Tax Obligations of A Company in Accordance With The Legal Regime

Tax Obligations Matrix - Determine The Type of Tax Obligations of A Company in Accordance With The Legal Regime

Uploaded by

ScribdTranslationsCopyright:

Available Formats

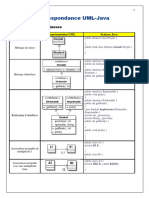

TYPE OF TAX OBLIGATIONS

COMPANIES

Natural person merchant Income tax taxpayer Property tax Industry and commerce tax Income tax

withholding: If you are a merchant and your income exceeds 30,000 UVT

VAT: It can belong to the simplified or common regime

sole proprietorship The sales tax will govern if only the redevelopment of the activity

constitutes a generating event for that tax, which could include real estate

if it has not been expressly excluded, the assets where it is appropriate as a

limited liability company with tax obligations.

Income tax

Property tax

Tax of industry and commerce

Tax auditor: Necessary in some cases

VAT: They can belong to the common regime

Simplified joint stock They are agents for the withholding of the source of income titles, VAT,

company Ica among others, also issuing invoices, property taxes, keeping accounting

and having a tax auditor for the amount of income or assets.

Collective society Collective, limited liability, limited liability and ordinary mining

companies are subject only to the basic income tax, with the special rates

that are subsequently indicated, without prejudice to the fact that the

partners of such companies, as persons other than the society, pay the tax

that corresponds to them on their shares of profits and on their social

contributions, which are determined in the manner established in this Law.

Value added tax VAT

Income tax for equity believes

National consumption tax

Tax of industry and commerce

The generating event of the ICA

Anonymous society The Income and Complementary Tax (Casual Earnings), the Value Added

Tax (VAT), the Stamp Tax, the Tax on Financial Liens, and the Wealth

Tax and the advance collection called “Withholding at Source”.

The same applies to the tax aspects of the simplified joint-stock company,

especially with respect to the liability of the company and the partners.

Liability Company Ltd. It is their obligation from the articles of incorporation as well as from the

economic activity of the same, in which they must present, like any

company, corporate taxes and their annual accounts, depending on the type

of activity.

Simple Limited They have to keep accounting, tax receipts, annual income tax return, have

Partnership a record of operations, have an inventory system as the partner will

contribute to what must be paid in the company.

Partnership limited by As it is commercial in nature like the others, the partners will be in charge

shares of the administration of the company and will be personally responsible for

the social debts since the capitalist is different.

Non-profit entities They are legally constituted legal entities where profits or surpluses are not

reimbursed, nor distributed as such in which depending on whether it is in

a special tax regime, it will give 20% of the income tax and

complementary

1. What is the importance of payment of obligations for Colombia?

taxes?

It is important since with the contributions provided by each citizen to help guarantee

fiscal sustainability as well as the provision of public goods that all

citizens need, such as the construction of infrastructure works such as

roads, schools, hospitals, security, justice, parks, etc.

Any country needs resources for its operation to guarantee sustainability.

state prosecutor.

2. What types of tax obligations are handled in Colombia?

Special contribution for administration of justice

Tax on financial movements

Wealth tax

Income tax and complementary special regime

Income tax and complementary ordinary regime

Income and assets

Withholding at source as income

National stamp duty withholding

Withholding at source in sales tax

Customs user

Common regime sales

Simplified regime sales

Big taxpayer

Exogenous informant

Retaining author

Obligation to invoice excluded goods or services for income

Currency buying and selling professionals

Transfer pricing

Producer of exempt goods or services

Obtaining NIT

Declare entry or exit from the country of foreign currency or legal currency

Obligation to declare on behalf of third parties

Sales retention agent

Consolidated transfer pricing statement

Individual transfer pricing declaration

You might also like

- Movie Recommendation SystemDocument41 pagesMovie Recommendation SystemSowmya Srinivasan100% (3)

- FM 101 SG 2Document5 pagesFM 101 SG 2Kezia GwynethNo ratings yet

- Taxation Chapter 5 - 8Document117 pagesTaxation Chapter 5 - 8Hồng Hạnh NguyễnNo ratings yet

- Income TaxDocument39 pagesIncome TaxNadine LumanogNo ratings yet

- Borja, John Kayle. Taxation of CorporationDocument4 pagesBorja, John Kayle. Taxation of CorporationJohn Kayle BorjaNo ratings yet

- Chapter 16 Taxation 2018 PDFDocument63 pagesChapter 16 Taxation 2018 PDFNeo WilliamNo ratings yet

- TAPL Gia BìnhDocument3 pagesTAPL Gia BìnhAurelion SolNo ratings yet

- Chapter 10 - 20240408 - 103855 - 0000Document23 pagesChapter 10 - 20240408 - 103855 - 0000marilyntuyan16No ratings yet

- Are There Any Restrictions On Foreign Shareholders?Document4 pagesAre There Any Restrictions On Foreign Shareholders?lauraNo ratings yet

- Principles of Business TaxationDocument10 pagesPrinciples of Business TaxationMuhammad Yasir GondalNo ratings yet

- Advanced AccountingDocument191 pagesAdvanced AccountingSalih AkadarNo ratings yet

- Taxation ProjectDocument14 pagesTaxation ProjectrahulkoduvanNo ratings yet

- DTTL Tax Argentinahighlights 2019 PDFDocument7 pagesDTTL Tax Argentinahighlights 2019 PDFadripilitaNo ratings yet

- Income Tax On IndividualsDocument25 pagesIncome Tax On IndividualsMohammadNo ratings yet

- Basic Income Taxation of Corporations in PhilippinesDocument7 pagesBasic Income Taxation of Corporations in PhilippinesMae Katherine Grande Lumbria100% (1)

- Module 6 Income Taxes For Corporations - Part 1Document12 pagesModule 6 Income Taxes For Corporations - Part 1Maricar DimayugaNo ratings yet

- Taxation of Corporations:: Allowable DeductionsDocument39 pagesTaxation of Corporations:: Allowable DeductionsMaria Paz GanotNo ratings yet

- 6.TAX 3A - Unit 6 Companies DistributionsDocument16 pages6.TAX 3A - Unit 6 Companies DistributionsHilary ChisokoNo ratings yet

- Regular Income TaxationDocument12 pagesRegular Income TaxationMa. Alessandra BautistaNo ratings yet

- Chapter 13 ADocument22 pagesChapter 13 AAdmNo ratings yet

- TAXATION Level 300Document52 pagesTAXATION Level 300Bosz icon DyliteNo ratings yet

- Income Tax On Individuals and Tax RatesDocument25 pagesIncome Tax On Individuals and Tax RatesmmhNo ratings yet

- Module 1: Income Tax PrinciplesDocument18 pagesModule 1: Income Tax PrinciplesJun MagallonNo ratings yet

- Business Taxation 1Document6 pagesBusiness Taxation 1Cordial, Kyle Deen S.J.No ratings yet

- Topic-1 Taxation of Business IncomeDocument23 pagesTopic-1 Taxation of Business IncomeMohamedNo ratings yet

- EN USA Investorenhandbuch 120514 10Document13 pagesEN USA Investorenhandbuch 120514 10RaghaNo ratings yet

- Brown and Beige Aesthetic Modern Group Project PresentationDocument16 pagesBrown and Beige Aesthetic Modern Group Project PresentationforgorontaloNo ratings yet

- Taxation A2Document6 pagesTaxation A2Thanh VânNo ratings yet

- ERG TAX 7.0 CorporationDocument22 pagesERG TAX 7.0 CorporationRiyo Mae MagnoNo ratings yet

- DTTL Tax Bangladeshhighlights 2016Document3 pagesDTTL Tax Bangladeshhighlights 2016অরণ্য আহমেদNo ratings yet

- Virtuzone UAE Corporate Tax Guide 2023 01HAP6KCMTNDB2MMB804TF57V8-1Document11 pagesVirtuzone UAE Corporate Tax Guide 2023 01HAP6KCMTNDB2MMB804TF57V8-1Innocent MundaNo ratings yet

- C Corporations Are Separately Taxable Entities and File A Corporate Tax Return, ReportingDocument2 pagesC Corporations Are Separately Taxable Entities and File A Corporate Tax Return, ReportingAlex MercadoNo ratings yet

- Company TaxDocument23 pagesCompany TaxCyndy NgwenNo ratings yet

- International Tax: Portugal Highlights 2019Document6 pagesInternational Tax: Portugal Highlights 2019Swastik GroverNo ratings yet

- Taxation of CorporationsDocument73 pagesTaxation of CorporationsMAWIIINo ratings yet

- Taxation of CorporationsDocument73 pagesTaxation of CorporationsMAWIIINo ratings yet

- Pratical Tax Guide 2022Document19 pagesPratical Tax Guide 2022levis BilossiNo ratings yet

- TaxDocument11 pagesTaxmnoor13245mnNo ratings yet

- Tax 301 Chapter 3 Part 1-1Document19 pagesTax 301 Chapter 3 Part 1-1Christine Merry AbionNo ratings yet

- Basis For Comparison Accounting Profit Taxable ProfitDocument5 pagesBasis For Comparison Accounting Profit Taxable ProfitKaif UddinNo ratings yet

- 04 CorporationsDocument76 pages04 Corporationsjustine reine cornicoNo ratings yet

- Taxation 101Document11 pagesTaxation 101kevinalumasaNo ratings yet

- Module 2. Topic 2Document5 pagesModule 2. Topic 2RaiNo ratings yet

- LokeshDocument3 pagesLokeshTaha MerchantNo ratings yet

- Income and Business TaxationDocument21 pagesIncome and Business TaxationFrance Jacob B. EscopeteNo ratings yet

- Business Profit TaxDocument14 pagesBusiness Profit TaxbabuNo ratings yet

- 5 Income Tax On Estates Trusts Partnerships Joint Ventures and CoDocument4 pages5 Income Tax On Estates Trusts Partnerships Joint Ventures and CoConcerned CitizenNo ratings yet

- Corp TaxDocument4 pagesCorp TaxMaster GTNo ratings yet

- Deloitte CN Tax Tap0382020 en 200806Document21 pagesDeloitte CN Tax Tap0382020 en 200806PREET KANOOGANo ratings yet

- Advance Chapter OneDocument42 pagesAdvance Chapter OneSolomon Abebe100% (4)

- Chapter 7: Introduction To Regular Income TaxDocument5 pagesChapter 7: Introduction To Regular Income TaxArna Kaira Kjell DiestraNo ratings yet

- 07 - CLWTAXN Notes On Income TaxationDocument10 pages07 - CLWTAXN Notes On Income TaxationMichael Allen RodrigoNo ratings yet

- CH 6 Business and Tax Laws1Document49 pagesCH 6 Business and Tax Laws1PUTTU GURU PRASAD SENGUNTHA MUDALIARNo ratings yet

- DTTL Tax Spainhighlights 2020Document9 pagesDTTL Tax Spainhighlights 2020Росен Атанасов-ЕжкоNo ratings yet

- DTTL Tax Colombiahighlights 2015Document4 pagesDTTL Tax Colombiahighlights 2015MikailOpintoNo ratings yet

- Vietnam 2018Document28 pagesVietnam 2018Nga LiugongNo ratings yet

- PF Chapter - 4Document66 pagesPF Chapter - 4Bona IbrahimNo ratings yet

- The Tax Organization System: The Federal Inland Revenue Authority /FIRADocument46 pagesThe Tax Organization System: The Federal Inland Revenue Authority /FIRAYoseph KassaNo ratings yet

- Tax Savings Strategies for Small Businesses: A Comprehensive Guide For 2024From EverandTax Savings Strategies for Small Businesses: A Comprehensive Guide For 2024No ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Natural History of Parkinson's DiseaseDocument49 pagesNatural History of Parkinson's DiseaseScribdTranslationsNo ratings yet

- Tourist PlanningDocument39 pagesTourist PlanningScribdTranslationsNo ratings yet

- Abbreviated File-Process Case 01 Marco A. and CounterclaimDocument25 pagesAbbreviated File-Process Case 01 Marco A. and CounterclaimScribdTranslationsNo ratings yet

- Retirement Instructions Unemployment PorvenirDocument6 pagesRetirement Instructions Unemployment PorvenirScribdTranslationsNo ratings yet

- Ethnicity, Language and IdentityDocument4 pagesEthnicity, Language and IdentityScribdTranslationsNo ratings yet

- SYLLABUS Mechanical Drawing 2Document7 pagesSYLLABUS Mechanical Drawing 2ScribdTranslationsNo ratings yet

- Chapter X. Precision Shooting From Naval Air PlatformsDocument24 pagesChapter X. Precision Shooting From Naval Air PlatformsScribdTranslationsNo ratings yet

- Application of Copper Sulfate in AquacultureDocument2 pagesApplication of Copper Sulfate in AquacultureScribdTranslationsNo ratings yet

- History and Evolution of Reciprocating MotorsDocument32 pagesHistory and Evolution of Reciprocating MotorsScribdTranslationsNo ratings yet

- Boxing PDFDocument49 pagesBoxing PDFScribdTranslationsNo ratings yet

- Musical Instruments of EuropeDocument3 pagesMusical Instruments of EuropeScribdTranslationsNo ratings yet

- 5th Grade Plan - Block 4 GeographyDocument12 pages5th Grade Plan - Block 4 GeographyScribdTranslationsNo ratings yet

- Comparative Table of Rationalism and EmpiricismDocument7 pagesComparative Table of Rationalism and EmpiricismScribdTranslationsNo ratings yet

- Reading Comprehension and Contextual Vocabulary Exercises 4th Middle #8.Document5 pagesReading Comprehension and Contextual Vocabulary Exercises 4th Middle #8.ScribdTranslationsNo ratings yet

- Practical Work The Familiar PDFDocument1 pagePractical Work The Familiar PDFScribdTranslationsNo ratings yet

- PH Portfolio Recovery ProposalDocument3 pagesPH Portfolio Recovery ProposalScribdTranslationsNo ratings yet

- Sixth Grade Reading Comprehension AssessmentDocument8 pagesSixth Grade Reading Comprehension AssessmentScribdTranslationsNo ratings yet

- Legal Aspects GuatemalaDocument20 pagesLegal Aspects GuatemalaScribdTranslationsNo ratings yet

- Project On Electricity For ChildrenDocument13 pagesProject On Electricity For ChildrenScribdTranslationsNo ratings yet

- iTEP in - House PDFDocument12 pagesiTEP in - House PDFScribdTranslationsNo ratings yet

- Application of Regulations in The Financial SystemDocument74 pagesApplication of Regulations in The Financial SystemScribdTranslationsNo ratings yet

- Driver's Manual in TexasDocument109 pagesDriver's Manual in TexasScribdTranslationsNo ratings yet

- Security of Accounting Information SystemsDocument2 pagesSecurity of Accounting Information SystemsScribdTranslationsNo ratings yet

- Types of Banks Based On OwnershipDocument2 pagesTypes of Banks Based On OwnershipScribdTranslationsNo ratings yet

- Examples of Operant ConditioningDocument1 pageExamples of Operant ConditioningScribdTranslationsNo ratings yet

- Expo22 Daily ExperienceDocument6 pagesExpo22 Daily ExperienceScribdTranslationsNo ratings yet

- Applied StatisticsDocument209 pagesApplied StatisticsScribdTranslationsNo ratings yet

- Chemistry Laboratory Report 1Document14 pagesChemistry Laboratory Report 1ScribdTranslationsNo ratings yet

- Event Security ProtocolDocument7 pagesEvent Security ProtocolScribdTranslationsNo ratings yet

- Vibrational Sound Therapy ManualDocument12 pagesVibrational Sound Therapy ManualScribdTranslationsNo ratings yet

- 2 BHK Price List & Floor PlanDocument1 page2 BHK Price List & Floor PlanRajesh K SinghNo ratings yet

- Lownds CFPB 2 of 3Document1,098 pagesLownds CFPB 2 of 3Judicial Watch, Inc.No ratings yet

- Neutral Host Models in 4G & 5G Architecture: Dr. Wenbing Yao VP, Business Development & PartnershipsDocument17 pagesNeutral Host Models in 4G & 5G Architecture: Dr. Wenbing Yao VP, Business Development & PartnershipscopslockNo ratings yet

- Adaptive Multi RateDocument16 pagesAdaptive Multi RateRogelio HernandezNo ratings yet

- The 60 MM Diameter Solid Shaft Is Subjected To The... PDFDocument3 pagesThe 60 MM Diameter Solid Shaft Is Subjected To The... PDFxy2h5bjs27No ratings yet

- TV Ole 2020Document1 pageTV Ole 2020david floresNo ratings yet

- MAN 2866le-Parts-ManualDocument129 pagesMAN 2866le-Parts-ManualGiovanniJara67% (3)

- Definition and Objective of AuditDocument7 pagesDefinition and Objective of AuditZednem JhenggNo ratings yet

- Emd-Mi927 IntercoolerDocument8 pagesEmd-Mi927 IntercoolerVictor Raul Tobosque MuñozNo ratings yet

- Chapter 11Document9 pagesChapter 11Joshua GuerreroNo ratings yet

- Kuliah 1 Elaun Bangunan Industri (Industrial Building Allowances)Document28 pagesKuliah 1 Elaun Bangunan Industri (Industrial Building Allowances)MUHAMMAD ZAWAWI BIN AYUP100% (1)

- Introduction To Surface EngineeringDocument31 pagesIntroduction To Surface Engineeringlogeshboy007No ratings yet

- Chase: Eventhough This Case Shows How Campany Hires and Layoffs Strategy Would Work Best Due To Unstable Demand ForcestDocument3 pagesChase: Eventhough This Case Shows How Campany Hires and Layoffs Strategy Would Work Best Due To Unstable Demand ForcestCristhian ValverdeNo ratings yet

- Punjab PoliceDocument20 pagesPunjab Policevinod512793No ratings yet

- Tri 21 DMP 002Document3 pagesTri 21 DMP 002adi sihombingNo ratings yet

- Allie Brown: Southern Paws Pet Grooming, Cordele, GA. - BatherDocument2 pagesAllie Brown: Southern Paws Pet Grooming, Cordele, GA. - Batherapi-548153301No ratings yet

- Berea College B Ed FP Teaching SubmissionDocument520 pagesBerea College B Ed FP Teaching SubmissionGbengaNo ratings yet

- Gender Informality and PovertyDocument15 pagesGender Informality and Povertygauravparmar1No ratings yet

- SLIM Sparse Linear Methods For Top-N Recommender SystemsDocument10 pagesSLIM Sparse Linear Methods For Top-N Recommender SystemsfcrkudxujdemptrdapNo ratings yet

- Vehicle Suspension Modeling NotesDocument25 pagesVehicle Suspension Modeling Notesahmetlutfu100% (2)

- David M. Kroenke's: Database ProcessingDocument25 pagesDavid M. Kroenke's: Database ProcessingasalajalagiNo ratings yet

- 5.1079 Compromise Agreement (Arwin) v1.1Document3 pages5.1079 Compromise Agreement (Arwin) v1.1Aldrin LeynesNo ratings yet

- 8 - Correspondance UML-JAVADocument3 pages8 - Correspondance UML-JAVAoussama sfiriNo ratings yet

- AralPan9 q2 Mod10 Ang-Pamilihan-V5Document29 pagesAralPan9 q2 Mod10 Ang-Pamilihan-V5Wizly Von Ledesma TanduyanNo ratings yet

- CO2 Supply Agreement - A-ZDocument13 pagesCO2 Supply Agreement - A-ZEslam A. FahmyNo ratings yet

- Steel-Concrete Composites Beams Considering Shear Slip EffectDocument23 pagesSteel-Concrete Composites Beams Considering Shear Slip EffectAnnisa Prita MelindaNo ratings yet

- 1631 - Eu - 0911 - 064739 - Dpa M Cle RJ45B 48 PDFDocument2 pages1631 - Eu - 0911 - 064739 - Dpa M Cle RJ45B 48 PDFIrving GuatemalaNo ratings yet

- Manulife Smart Call Call MenuDocument1 pageManulife Smart Call Call MenuNazreen AmirdeenNo ratings yet

- 74 HCT 148Document11 pages74 HCT 148Merényi OszkárNo ratings yet