Professional Documents

Culture Documents

Matthew F Kennelly Financial Disclosure Report For 2010

Matthew F Kennelly Financial Disclosure Report For 2010

Uploaded by

Judicial Watch, Inc.Copyright:

Available Formats

You might also like

- Flumist Case StudyDocument22 pagesFlumist Case StudyDeva Prayag0% (1)

- 2161 DocsDocument133 pages2161 DocsJudicial Watch, Inc.83% (12)

- 1878 001Document17 pages1878 001Judicial Watch, Inc.100% (5)

- Robert S Lasnik Financial Disclosure Report For 2010Document7 pagesRobert S Lasnik Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Susan O Mollway Financial Disclosure Report For 2010Document7 pagesSusan O Mollway Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Simeon T Lake Financial Disclosure Report For 2010Document9 pagesSimeon T Lake Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Irma E Gonzalez Financial Disclosure Report For 2010Document8 pagesIrma E Gonzalez Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Dennis F Saylor IV Financial Disclosure Report For 2010Document9 pagesDennis F Saylor IV Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- William A Pepper Financial Disclosure Report For 2010Document22 pagesWilliam A Pepper Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Robert B Propst Financial Disclosure Report For 2010Document7 pagesRobert B Propst Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- David M Lawson Financial Disclosure Report For 2010Document20 pagesDavid M Lawson Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- James C Cacheris Financial Disclosure Report For 2010Document7 pagesJames C Cacheris Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Samuel Conti Financial Disclosure Report For 2010Document7 pagesSamuel Conti Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Kermit E Bye Financial Disclosure Report For 2006Document7 pagesKermit E Bye Financial Disclosure Report For 2006Judicial Watch, Inc.No ratings yet

- Timothy B Dyk Financial Disclosure Report For 2010Document12 pagesTimothy B Dyk Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Barbara Keenan Financial Disclosure Report For 2010Document22 pagesBarbara Keenan Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Ron Clark Financial Disclosure Report For 2010Document14 pagesRon Clark Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- John A Houston Financial Disclosure Report For 2010Document7 pagesJohn A Houston Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Lawrence H Silberman Financial Disclosure Report For 2010Document7 pagesLawrence H Silberman Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Paul V Niemeyer Financial Disclosure Report For 2010Document7 pagesPaul V Niemeyer Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Royce C Lamberth Financial Disclosure Report For 2010Document6 pagesRoyce C Lamberth Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Henry C Morgan JR Financial Disclosure Report For 2009Document7 pagesHenry C Morgan JR Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- William R Furgeson Financial Disclosure Report For 2010Document9 pagesWilliam R Furgeson Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Patricia A Seitz Financial Disclosure Report For 2010Document7 pagesPatricia A Seitz Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- John F Keenan Financial Disclosure Report For 2010Document6 pagesJohn F Keenan Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Stanley R Chesler Financial Disclosure Report For 2010Document9 pagesStanley R Chesler Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Stephen M McNamee Financial Disclosure Report For 2010Document12 pagesStephen M McNamee Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Michael A Chagares Financial Disclosure Report For 2010Document6 pagesMichael A Chagares Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- J A McNamara Financial Disclosure Report For 2010Document10 pagesJ A McNamara Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Sandra D OConnor Financial Disclosure Report For 2010Document20 pagesSandra D OConnor Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Richard Linn Financial Disclosure Report For 2010Document18 pagesRichard Linn Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Deborah K Chasanow Financial Disclosure Report For 2010Document20 pagesDeborah K Chasanow Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Thad Heartfield Financial Disclosure Report For 2010Document18 pagesThad Heartfield Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Stephen Anderson Financial Disclosure Report For 2010Document7 pagesStephen Anderson Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Joseph F Anderson JR Financial Disclosure Report For 2010Document7 pagesJoseph F Anderson JR Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Michael R Murphy Financial Disclosure Report For 2010Document6 pagesMichael R Murphy Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- William T Moore JR Financial Disclosure Report For 2010Document20 pagesWilliam T Moore JR Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Brian S Miller Financial Disclosure Report For 2010Document6 pagesBrian S Miller Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Harold L Murphy Financial Disclosure Report For 2010Document7 pagesHarold L Murphy Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- David G Campbell Financial Disclosure Report For 2010Document11 pagesDavid G Campbell Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Scott O Wright Financial Disclosure Report For 2010Document6 pagesScott O Wright Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Loretta A Preska Financial Disclosure Report For 2010Document14 pagesLoretta A Preska Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- William H Barbour JR Financial Disclosure Report For 2010Document14 pagesWilliam H Barbour JR Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Financial Disclosure Report For Calendar Year 2010: I. PositionsDocument10 pagesFinancial Disclosure Report For Calendar Year 2010: I. PositionsJudicial Watch, Inc.No ratings yet

- Steven J McAuliffe Financial Disclosure Report For 2010Document15 pagesSteven J McAuliffe Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- William J Ditter JR Financial Disclosure Report For 2010Document7 pagesWilliam J Ditter JR Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- William B Enright Financial Disclosure Report For 2010Document6 pagesWilliam B Enright Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Ment Ira de Financial Disclosure Report For 2010Document12 pagesMent Ira de Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Sharon Prost Financial Disclosure Report For 2010Document9 pagesSharon Prost Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Harry Lee Hudspeth Financial Disclosure Report For 2010Document7 pagesHarry Lee Hudspeth Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- William L Garwood Financial Disclosure Report For 2010Document15 pagesWilliam L Garwood Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- David S Doty Financial Disclosure Report For 2010Document7 pagesDavid S Doty Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Henry F Floyd Financial Disclosure Report For 2010Document6 pagesHenry F Floyd Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Charles R Breyer Financial Disclosure Report For 2010Document8 pagesCharles R Breyer Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Jeffrey S Sutton Financial Disclosure Report For 2010Document8 pagesJeffrey S Sutton Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Donald W Molloy Financial Disclosure Report For 2010Document6 pagesDonald W Molloy Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Martha C Daughtrey Financial Disclosure Report For 2010Document8 pagesMartha C Daughtrey Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Procter R Hug JR Financial Disclosure Report For 2010Document8 pagesProcter R Hug JR Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- John P Bailey Financial Disclosure Report For 2010Document7 pagesJohn P Bailey Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- John Antoon Financial Disclosure Report For 2010Document8 pagesJohn Antoon Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Alan D Lourie Financial Disclosure Report For 2010Document7 pagesAlan D Lourie Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Finance Fundamentals for Nonprofits: Building Capacity and SustainabilityFrom EverandFinance Fundamentals for Nonprofits: Building Capacity and SustainabilityNo ratings yet

- 11 1271 1451347Document29 pages11 1271 1451347david_stephens_29No ratings yet

- 1488 09032013Document262 pages1488 09032013Judicial Watch, Inc.100% (1)

- CC 081213 Dept 14 Lapp LDocument38 pagesCC 081213 Dept 14 Lapp LJudicial Watch, Inc.No ratings yet

- Gitmo Freezer Inspection ReportsDocument4 pagesGitmo Freezer Inspection ReportsJudicial Watch, Inc.No ratings yet

- Stamped ComplaintDocument4 pagesStamped ComplaintJudicial Watch, Inc.No ratings yet

- Stamped Complaint 2Document5 pagesStamped Complaint 2Judicial Watch, Inc.No ratings yet

- State Dept 13-951Document4 pagesState Dept 13-951Judicial Watch, Inc.No ratings yet

- SouthCom Water Safety ProductionDocument30 pagesSouthCom Water Safety ProductionJudicial Watch, Inc.No ratings yet

- Gitmo Freezer Inspection ReportsDocument4 pagesGitmo Freezer Inspection ReportsJudicial Watch, Inc.No ratings yet

- July 2007 BulletinDocument23 pagesJuly 2007 BulletinJudicial Watch, Inc.No ratings yet

- JTF GTMO Water Safety App W ExhDocument13 pagesJTF GTMO Water Safety App W ExhJudicial Watch, Inc.No ratings yet

- CVR LTR SouthCom Water Safety ProductionDocument2 pagesCVR LTR SouthCom Water Safety ProductionJudicial Watch, Inc.No ratings yet

- July 2006Document24 pagesJuly 2006Judicial Watch, Inc.No ratings yet

- Cover Letter To Requester Re Response Documents130715 - 305994Document2 pagesCover Letter To Requester Re Response Documents130715 - 305994Judicial Watch, Inc.No ratings yet

- June 2004Document17 pagesJune 2004Judicial Watch, Inc.No ratings yet

- Model UNDocument2 pagesModel UNJudicial Watch, Inc.No ratings yet

- December 2005Document7 pagesDecember 2005Judicial Watch, Inc.No ratings yet

- 13-1150 Responsive Records 2 - RedactedDocument29 pages13-1150 Responsive Records 2 - RedactedJudicial Watch, Inc.No ratings yet

- LAUSD Semillas AckDocument1 pageLAUSD Semillas AckJudicial Watch, Inc.No ratings yet

- December 2005 Bulletin 2Document14 pagesDecember 2005 Bulletin 2Judicial Watch, Inc.No ratings yet

- STAMPED ComplaintDocument4 pagesSTAMPED ComplaintJudicial Watch, Inc.No ratings yet

- September 2004Document24 pagesSeptember 2004Judicial Watch, Inc.No ratings yet

- Atlanta IntraregionalDocument4 pagesAtlanta IntraregionalJudicial Watch, Inc.No ratings yet

- 13-1150 Response Re Judicial WatchDocument1 page13-1150 Response Re Judicial WatchJudicial Watch, Inc.No ratings yet

- Market StructureDocument40 pagesMarket StructureSreerama MurthyNo ratings yet

- Chap 4 CVDDocument126 pagesChap 4 CVDMichael KaoNo ratings yet

- Bi 937976Document10 pagesBi 937976Sankalp SrivastavaNo ratings yet

- Human Resources Strategy and Analysis - Case 1 - Siemens Builds A Strategy-Oriented HR SystemDocument2 pagesHuman Resources Strategy and Analysis - Case 1 - Siemens Builds A Strategy-Oriented HR SystemSole NavarreteNo ratings yet

- Heat Flow in The Region Bounded Internally by A Circular Cylinder. - Jaeger 1942Document6 pagesHeat Flow in The Region Bounded Internally by A Circular Cylinder. - Jaeger 1942Gabriel SaavedraNo ratings yet

- Organizational Conflict PDFDocument182 pagesOrganizational Conflict PDFCindy LauraNo ratings yet

- MIS Techmax (Searchable)Document64 pagesMIS Techmax (Searchable)hell noNo ratings yet

- HTML Basic - : 4 ExamplesDocument2 pagesHTML Basic - : 4 ExamplesBhupender KumawatNo ratings yet

- Water-Wise Water ParkDocument7 pagesWater-Wise Water Parkapi-353567032No ratings yet

- MD30C User's ManualDocument17 pagesMD30C User's ManualAMIR GHASEMINo ratings yet

- Chapter 10 (Stalling)Document5 pagesChapter 10 (Stalling)Marufa Kamal LabonnoNo ratings yet

- Faq SastraDocument2 pagesFaq SastraParthasarathi LsNo ratings yet

- 1&2) Diploma in Manufacturing Engineering - Learn & EarnDocument72 pages1&2) Diploma in Manufacturing Engineering - Learn & EarnDarshan GohelNo ratings yet

- Introduction To Color SpacesDocument4 pagesIntroduction To Color Spacesabdullah saifNo ratings yet

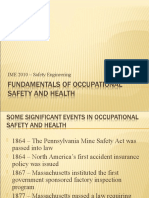

- Safety Engineering Module 1Document16 pagesSafety Engineering Module 1Kevin O'BrienNo ratings yet

- MY CBLM-finalDocument39 pagesMY CBLM-finalFreman ManuelNo ratings yet

- 174 - 13 UREA PDF - 28-Euro Procedure SheetDocument2 pages174 - 13 UREA PDF - 28-Euro Procedure SheetP VijayaNo ratings yet

- C Krishniah Chetty and Sons PVT LTD Vs Deepali Co IC2021260822165535114COM17947Document27 pagesC Krishniah Chetty and Sons PVT LTD Vs Deepali Co IC2021260822165535114COM17947adityaNo ratings yet

- Logical Reasoning and Analytical Ability Statement and Courses of ActionDocument10 pagesLogical Reasoning and Analytical Ability Statement and Courses of ActionIAS EXAM PORTALNo ratings yet

- Why Is Communication Important To The Management of The RanchDocument2 pagesWhy Is Communication Important To The Management of The RanchMehak GuptaNo ratings yet

- Signal Sampling: - Sampling Is Converting A Signal Into A Signal - CategoriesDocument57 pagesSignal Sampling: - Sampling Is Converting A Signal Into A Signal - Categoriesimranchaudhry12No ratings yet

- Phpmyadmin Web Application Security AssessmentDocument16 pagesPhpmyadmin Web Application Security AssessmentybNo ratings yet

- Client Registration Form: IndividualDocument23 pagesClient Registration Form: IndividualAshutosh IndNo ratings yet

- How To Install Mask-Rcnn For Nvidia GpuDocument19 pagesHow To Install Mask-Rcnn For Nvidia GpuDr. Mohamed Abdur RahmanNo ratings yet

- Illustrated Everyday Expressions 2 PDFDocument193 pagesIllustrated Everyday Expressions 2 PDFFrancisco Antonio López Revelles100% (12)

- RPT - LODR Sixth Amendment Final PPT 19.11.2021Document43 pagesRPT - LODR Sixth Amendment Final PPT 19.11.2021hareshmsNo ratings yet

- Supplier Guidelines - v2 PDFDocument64 pagesSupplier Guidelines - v2 PDFsidNo ratings yet

- Seamless Casing and Tubing Nipponsteel Ver PDFDocument18 pagesSeamless Casing and Tubing Nipponsteel Ver PDFMehdi SoltaniNo ratings yet

- Abraline PDFDocument32 pagesAbraline PDFAmel DurakovicNo ratings yet

Matthew F Kennelly Financial Disclosure Report For 2010

Matthew F Kennelly Financial Disclosure Report For 2010

Uploaded by

Judicial Watch, Inc.Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Matthew F Kennelly Financial Disclosure Report For 2010

Matthew F Kennelly Financial Disclosure Report For 2010

Uploaded by

Judicial Watch, Inc.Copyright:

Available Formats

AO I0 Rev.

1/2011

FINANCIAL DISCLOSURE REPORT FOR CALENDAR YEAR 2010

2. Court or Organization Northern District of Illinois

5a. Report Type (check appropriate type)

Report Required by the Ethics in Government Act of 1978 (5 U.S.C. app. 101-111)

1. Person Reporting (last name, first, middle initial) Kennclly, Matthew F.

4. Title (Article 111 judges indicate active or senior status; magistrate judges indicate full-or part-time)

3. Date of Report 05/09/2011 6. Reporting Period 01/01/2010 to 12/31/2010

Nomination, [] Initial

Date [] Annual [] Final

United States District Judge

5b. [] Amended Report

7. Chambers or Office Address United States District Court 219 South Dearborn Street Chicago, Illinois 60604

8. On the basis of the information contained in this Report and any modifications pertaining thereto, it is, in my opinion, in compliance with applicable laws and regulations. Reviewing Officer Date

IMPORTANT NOTES: The instructions accompanying this form must be followetL Complete all parts,

checking the NONE box for each part where yoa have no reportable information. Sign on last page.

I. POSITI ON S. ~Repo.ing individuul o.ly; see ~. 9-13 of filing instructions.)

~

NONE (No reportable positions.) POSITION

1. Director Director Director Director

NAME OF ORGANIZATION/ENTITY

Lawyers Club of Chicago (bar organization) Richard Linn American Inn of Court (bar organization) Federal Bar Assocation, Chicago Chapter (bar organization) HFS Chicago Scholars (not for profit scholarship fund)

2. 3. 4. 5.

II. AGREEMENTS. (Reponi.g individual only; seepp. 14-16 of filing instructions.)

[~] NONE (No reportable agreements.)

DATE PARTIES AND TERMS

Kennellv, Matthew F.

FINANCIAL DISCLOSURE REPORT Page 2 of 7

Name of Person Reporting Kennelly, Matthew F.

Date of Report 05/09/2011

III. NON-INVESTMENT INCOME. tRepo.ing individual andspouse; seepp. 17-24 of filing instructions.)

A. Filers Non-lnvestment Income [~] NONE (No reportable non-investment income.) DATE_ SOURCE AND TYPE

INCOME (yours, not spouses)

2. 3. 4.

B. Spouse s Non-Investment Income - if you were marr:ed during anyport:on of the reportmg year, complete thts sectwn.

(Dollar amount not required except for honoraria.)

NONE (No reportable non-investment income.)

DATE

1.2010 2. 3. 4.

SOURCE AND TYPE City of Evanston, Illinois

IV. REIMBURSEMENTS - transportation, lodging, food, entertainment.

(Includes those to spouse and dependent children; see pp. 25-27 of filing instructions.)

[~]

NONE (No reportable reimbursements.) SOURCE DATES 10/20/2010 10/21/2010 10/21/2010 10/21/2010

LOCATION

New York City, NY

PURPOSE speaker at seminar

ITEMS PAID OR PROVIDED transportation, food & lodging

transportation, food & lodging

i.

American Conference Institute Assn. of Intellectual Properly Lawyers of America

2.

Washington, DC

speaker at seminar

FINANCIAL DISCLOSURE REPORT Page 3 of 7

Name of Person Reporting Kennelly, Matthew F.

Date of Report 05/09/201 l

V. GIFTS. anelndes those to spouse a.a dependent children; see pp. 28-31 of filing instructions.)

D NONE (No reportable gifts.)

SOURCE

Union League Club of Chicago

DESCRIPTION

Privilege holder (< dues than member; privilege of using facilities standard fees)

VALUE $ 1,800

3.

4.

5.

VI. LIABILITIES. a.eludes those olspouse and depe.dent children; see pp. 32-33 offiling instructions.)

NONE (No reportable liabilities.)

CREDITOR

1. 2. 3. 4. 5.

DESCRIPTION

VALUE CODE

FINANCIAL DISCLOSURE REPORT Page 4 of 7

Name of Person Reporting Kennelly, Matthew F.

Date of Report 05/09/2011

VII. INVE STMENTS and TRUSTS -income, value, transactions (Includes those of spouse and dependent children; see pp. 34-60 of filing instructlonx)

NONE (No reportable income, assets, or transactions.)

Description of Assets lncome during

(including trust assets) Place "(x)" after each asset exempt from prior disclosure

reporting period (2) (l) Amount Type (e.g., Code l div., rent, (A-H) or int.)

Gross value at end of reporting period (l) (2) Value Value Code 2 Method (J-P) Code 3 (Q-W) M M M M M L L T T T T

Transactions during reporting period

(l) Type (e.g., buy, sell, redemption) (2) (3) Date Value mm/dd/yy Code 2 (J-P) (4) Gain Code 1 (A-H) (5) Identity of buyer/seller (if private transaction)

Amer. Funds Growth Fund of America rout. fund 2. 3. 4. 5. 6. 7. 8. 9. 10. I I. 12. 13. 14. 15.

16. 17.

B C C C B B C C A A A A A

Dividend Dividend Dividend Dividend Dividend Dividend Dividend Dividend Dividend Dividend Dividend Dividend Interest None None

Amer. Funds Fundamental Investors mut. fund Amer. Funds Investment Co. of America mut. fund Amer. Funds Europacific Growth Fund rout. ~ fund Amer. Funds New Perspective rout. fund Amer. Funds Smallcap World Fund rout. fund MFS Municipal Bond Fund mut. fund Amer. Funds Tax Exempt Bond Fund of Amer. rnut. fund Baird Insured Deposit - money mkt. fund Dreyfuslnsured Deposit - money mkt. fund Fidelity Cash Reserves - money mkt. fund Fidelity Growth & Income mut. fund JP Morgan Chasebank accounts JP Morgan Chase checking account U.S. Savings Bonds

Amer. Funds AMCAP Fund mut. fund (IRA) Amer. Funds Growth Fund of Amer. 1nut. fund (IRA)

Sold J M K J Buy

07/19/10 J 07/19/10 J

A A

Dividend Dividend

L K

T T

I. Income Gain C0dcs: (See Columns B I and D41 2. Value Codes (See (olumnsCI and D3) 3. Value Method (odes (See Column C2)

A =$1.000 or less F =$50.001 - $100.OOU 3 ~$15,OO0 or less N ~$250.001 - $500,000 13 k $25.U00.OUl - $50.000.000 O ~ Appraisal U =[took Vahlc

B =$1,001 - $2.500 G ~$ 100.001 - $1,000.000 K =$15,001 - $50.000 O $500.001 - $1,000,000 R Cost (Real Estale Only) V ." Olhcr

C =$2,501 - $5,000 H I ~$1.000,001 - $5,000,000 L =$50.001 - $ 100,000 PI =$1,000,001 - $5,000,000 P4 =More than $50,000.000 S =Assessment W =Estimalcd

D $5,001-$15,000 H2 =More than $5,000,000 M $100,001-$250.000 P2 =$5,000,001 - $25,000,000 T-Cash Market

E =$15,001 - $50.000

FINANCIAL DISCLOSURE REPORT Page 5 of 7

Name of Person Reporting Kennelly, Matthew F.

Date of Report 05/09/2011

VII. INVESTMENTS and TRUSTS -income, value, transactions (Includes those of spouse and dependent children; see pp. 34-60 of filing instructions.)

---] NONE (No reportable income, assets, or transactions.)

A. Description of Assets (including trust assets) Place "(X)" after each asset exempt from prior disclosure B. Income during reporting period (l) (2) Amount Type (e.g., Code 1 div., rent, (A-H) or int.) C. Gross value at end of reporting period (l) Value Code 2 (J-P) (2) Value Method Code 3 (Q-W) T T T T T T T T T T Sold J M T T Buy 0) Type (e.g., buy, sell, redemption) Transactions during reporting period (2) (3) (4) Date Value Gain mm/dd/yy Code 2 Code I (J-P) (A-H)

Identity of buyer/seller (if private transaction)

18. 19. 20. 2 I. 22. 23. 24. 25. 26. 27. 28. 29. 30. 31.

Amer. Funds Investment Co. ofAmer, mut. fund (IRA) Amer. Funds Wash. Mut. Investors mut. fund (IRA) Amer. Funds Europacific Growth Fund rout. fund (IRA) Amer. Funds Smallcap World Fund mut. fund (IRA) Amer. Funds Bond Fund of America mut. fund (IRA) Amer. Centry Heritage Fund mut. fund (IRA) Frank Russell Real Estate Secs Fund rout fund (IRA) Amer. Century Small Cap Orth mut. fund (IRA) (name change) Amer. Funds High Income Trust mut. fund (IRA) Amer. Funds Capital World Fund bond fund (IRA) Baird Insured Deposit money mkt fund (IRA) Dreyfuslnsured Deposit money mkt fund (IRA) Northwestern Mutual ExtraOrdinary Life ins. policy

A B B B D

Dividend Dividend Dividend Dividend Dividend None

K K M M N M M M L M

Dividend None

C C

Dividend Dividend None

07/19/10 07/19/10

J J

A D

Dividend Dividend

32. 33.

34.

I. Income Gain Codes: ( See Columns B I and D4) 2. Value Codes (See (olunans (1 and D3) 3. Value Method (odes (Scc Column C2)

A =$ 1.000 or less F =$50.001 - $ I ~O.000 J =$15.000 or bess N :=$250,001 - $500,000 P3 - $25.000,001 - $50,000.000 O -Appraisal U -Book Value

B =$1,001 - $2.500 G =$ 100,001 - $1.000.000 K = $15.001 - $50.000 O ~$500.001 - $1,000.000 R =Cost (Real Estale Only) V =Other

C =$2.501 - $5,000 H I =$1,000,001 - $5,000,000 L =$50.001 - $ 100.000 PI =$1.000,001 - $5,000,000 P4 =More than $50,000,000 S =Asscssmcnt W =Estimated

D =$5.001 - $15.000 H2 =More than $5.000,000 M =$ 100.001 - $250,000 P2 =$5,!)00,001 - $25,000,000 T =Cash Market

E =$15.001 - $50.000

FINANCIAL DISCLOSURE REPORT Page 6 of 7

Name of Person Reporting Kennelly, Matthew F.

Date of Report 05/09/2011

VIII. ADDITIONAL INFORMATION OR EXPLANATIONS.

Gifts: Following my appointment in 1999, I was accorded "privilege holder" status at the Union League Club of Chicago. This is non-membership status that entitles the privilege holder to use club facilities at the standard rates for club members. The reported value consists of the approximate difference between my monthly dues and those charged to members.

FINANCIAL DISCLOSURE REPORT Page 7 of 7

Name of Person Reporting Kennelly, Matthew F.

Date of Report 05/09/201 I

IX. CERTIFICATION.

I certify that all information given above (including information pertaining to my spouse and minor or dependent children, if any) is accurate, true, and complete to the best of my knowledge and belief, and that any information not reported was ~vithheld because it met applicable statutory provisions permitting non-disclosure. I further certify that earned income from outside employment and honoraria and the acceptance of gifts which have been reported are in compliance with the provisions of 5 U.S.C. app. 501 et. seq., 5 U.S.C. 7353, and Judicial Conference regulations.

Signature: S/Matthew F. Kennelly

NOTE: ANY INDIVIDUAL WHO KNOVVINGLY AND WILFULLY FALSIFIES OR FAILS TO FILE THIS REPORT MAY BE SUBJECT TO CIVIL AND CRIMINAL SANCTIONS (5 U.S.C. app. 104)

Committee on Financial Disclosure Administrative Office of the United States Courts Suite 2-301 One Columbus Circle, N.E. Washington, D.C. 20544

You might also like

- Flumist Case StudyDocument22 pagesFlumist Case StudyDeva Prayag0% (1)

- 2161 DocsDocument133 pages2161 DocsJudicial Watch, Inc.83% (12)

- 1878 001Document17 pages1878 001Judicial Watch, Inc.100% (5)

- Robert S Lasnik Financial Disclosure Report For 2010Document7 pagesRobert S Lasnik Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Susan O Mollway Financial Disclosure Report For 2010Document7 pagesSusan O Mollway Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Simeon T Lake Financial Disclosure Report For 2010Document9 pagesSimeon T Lake Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Irma E Gonzalez Financial Disclosure Report For 2010Document8 pagesIrma E Gonzalez Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Dennis F Saylor IV Financial Disclosure Report For 2010Document9 pagesDennis F Saylor IV Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- William A Pepper Financial Disclosure Report For 2010Document22 pagesWilliam A Pepper Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Robert B Propst Financial Disclosure Report For 2010Document7 pagesRobert B Propst Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- David M Lawson Financial Disclosure Report For 2010Document20 pagesDavid M Lawson Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- James C Cacheris Financial Disclosure Report For 2010Document7 pagesJames C Cacheris Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Samuel Conti Financial Disclosure Report For 2010Document7 pagesSamuel Conti Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Kermit E Bye Financial Disclosure Report For 2006Document7 pagesKermit E Bye Financial Disclosure Report For 2006Judicial Watch, Inc.No ratings yet

- Timothy B Dyk Financial Disclosure Report For 2010Document12 pagesTimothy B Dyk Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Barbara Keenan Financial Disclosure Report For 2010Document22 pagesBarbara Keenan Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Ron Clark Financial Disclosure Report For 2010Document14 pagesRon Clark Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- John A Houston Financial Disclosure Report For 2010Document7 pagesJohn A Houston Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Lawrence H Silberman Financial Disclosure Report For 2010Document7 pagesLawrence H Silberman Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Paul V Niemeyer Financial Disclosure Report For 2010Document7 pagesPaul V Niemeyer Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Royce C Lamberth Financial Disclosure Report For 2010Document6 pagesRoyce C Lamberth Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Henry C Morgan JR Financial Disclosure Report For 2009Document7 pagesHenry C Morgan JR Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- William R Furgeson Financial Disclosure Report For 2010Document9 pagesWilliam R Furgeson Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Patricia A Seitz Financial Disclosure Report For 2010Document7 pagesPatricia A Seitz Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- John F Keenan Financial Disclosure Report For 2010Document6 pagesJohn F Keenan Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Stanley R Chesler Financial Disclosure Report For 2010Document9 pagesStanley R Chesler Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Stephen M McNamee Financial Disclosure Report For 2010Document12 pagesStephen M McNamee Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Michael A Chagares Financial Disclosure Report For 2010Document6 pagesMichael A Chagares Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- J A McNamara Financial Disclosure Report For 2010Document10 pagesJ A McNamara Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Sandra D OConnor Financial Disclosure Report For 2010Document20 pagesSandra D OConnor Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Richard Linn Financial Disclosure Report For 2010Document18 pagesRichard Linn Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Deborah K Chasanow Financial Disclosure Report For 2010Document20 pagesDeborah K Chasanow Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Thad Heartfield Financial Disclosure Report For 2010Document18 pagesThad Heartfield Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Stephen Anderson Financial Disclosure Report For 2010Document7 pagesStephen Anderson Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Joseph F Anderson JR Financial Disclosure Report For 2010Document7 pagesJoseph F Anderson JR Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Michael R Murphy Financial Disclosure Report For 2010Document6 pagesMichael R Murphy Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- William T Moore JR Financial Disclosure Report For 2010Document20 pagesWilliam T Moore JR Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Brian S Miller Financial Disclosure Report For 2010Document6 pagesBrian S Miller Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Harold L Murphy Financial Disclosure Report For 2010Document7 pagesHarold L Murphy Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- David G Campbell Financial Disclosure Report For 2010Document11 pagesDavid G Campbell Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Scott O Wright Financial Disclosure Report For 2010Document6 pagesScott O Wright Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Loretta A Preska Financial Disclosure Report For 2010Document14 pagesLoretta A Preska Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- William H Barbour JR Financial Disclosure Report For 2010Document14 pagesWilliam H Barbour JR Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Financial Disclosure Report For Calendar Year 2010: I. PositionsDocument10 pagesFinancial Disclosure Report For Calendar Year 2010: I. PositionsJudicial Watch, Inc.No ratings yet

- Steven J McAuliffe Financial Disclosure Report For 2010Document15 pagesSteven J McAuliffe Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- William J Ditter JR Financial Disclosure Report For 2010Document7 pagesWilliam J Ditter JR Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- William B Enright Financial Disclosure Report For 2010Document6 pagesWilliam B Enright Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Ment Ira de Financial Disclosure Report For 2010Document12 pagesMent Ira de Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Sharon Prost Financial Disclosure Report For 2010Document9 pagesSharon Prost Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Harry Lee Hudspeth Financial Disclosure Report For 2010Document7 pagesHarry Lee Hudspeth Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- William L Garwood Financial Disclosure Report For 2010Document15 pagesWilliam L Garwood Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- David S Doty Financial Disclosure Report For 2010Document7 pagesDavid S Doty Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Henry F Floyd Financial Disclosure Report For 2010Document6 pagesHenry F Floyd Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Charles R Breyer Financial Disclosure Report For 2010Document8 pagesCharles R Breyer Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Jeffrey S Sutton Financial Disclosure Report For 2010Document8 pagesJeffrey S Sutton Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Donald W Molloy Financial Disclosure Report For 2010Document6 pagesDonald W Molloy Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Martha C Daughtrey Financial Disclosure Report For 2010Document8 pagesMartha C Daughtrey Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Procter R Hug JR Financial Disclosure Report For 2010Document8 pagesProcter R Hug JR Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- John P Bailey Financial Disclosure Report For 2010Document7 pagesJohn P Bailey Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- John Antoon Financial Disclosure Report For 2010Document8 pagesJohn Antoon Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Alan D Lourie Financial Disclosure Report For 2010Document7 pagesAlan D Lourie Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Finance Fundamentals for Nonprofits: Building Capacity and SustainabilityFrom EverandFinance Fundamentals for Nonprofits: Building Capacity and SustainabilityNo ratings yet

- 11 1271 1451347Document29 pages11 1271 1451347david_stephens_29No ratings yet

- 1488 09032013Document262 pages1488 09032013Judicial Watch, Inc.100% (1)

- CC 081213 Dept 14 Lapp LDocument38 pagesCC 081213 Dept 14 Lapp LJudicial Watch, Inc.No ratings yet

- Gitmo Freezer Inspection ReportsDocument4 pagesGitmo Freezer Inspection ReportsJudicial Watch, Inc.No ratings yet

- Stamped ComplaintDocument4 pagesStamped ComplaintJudicial Watch, Inc.No ratings yet

- Stamped Complaint 2Document5 pagesStamped Complaint 2Judicial Watch, Inc.No ratings yet

- State Dept 13-951Document4 pagesState Dept 13-951Judicial Watch, Inc.No ratings yet

- SouthCom Water Safety ProductionDocument30 pagesSouthCom Water Safety ProductionJudicial Watch, Inc.No ratings yet

- Gitmo Freezer Inspection ReportsDocument4 pagesGitmo Freezer Inspection ReportsJudicial Watch, Inc.No ratings yet

- July 2007 BulletinDocument23 pagesJuly 2007 BulletinJudicial Watch, Inc.No ratings yet

- JTF GTMO Water Safety App W ExhDocument13 pagesJTF GTMO Water Safety App W ExhJudicial Watch, Inc.No ratings yet

- CVR LTR SouthCom Water Safety ProductionDocument2 pagesCVR LTR SouthCom Water Safety ProductionJudicial Watch, Inc.No ratings yet

- July 2006Document24 pagesJuly 2006Judicial Watch, Inc.No ratings yet

- Cover Letter To Requester Re Response Documents130715 - 305994Document2 pagesCover Letter To Requester Re Response Documents130715 - 305994Judicial Watch, Inc.No ratings yet

- June 2004Document17 pagesJune 2004Judicial Watch, Inc.No ratings yet

- Model UNDocument2 pagesModel UNJudicial Watch, Inc.No ratings yet

- December 2005Document7 pagesDecember 2005Judicial Watch, Inc.No ratings yet

- 13-1150 Responsive Records 2 - RedactedDocument29 pages13-1150 Responsive Records 2 - RedactedJudicial Watch, Inc.No ratings yet

- LAUSD Semillas AckDocument1 pageLAUSD Semillas AckJudicial Watch, Inc.No ratings yet

- December 2005 Bulletin 2Document14 pagesDecember 2005 Bulletin 2Judicial Watch, Inc.No ratings yet

- STAMPED ComplaintDocument4 pagesSTAMPED ComplaintJudicial Watch, Inc.No ratings yet

- September 2004Document24 pagesSeptember 2004Judicial Watch, Inc.No ratings yet

- Atlanta IntraregionalDocument4 pagesAtlanta IntraregionalJudicial Watch, Inc.No ratings yet

- 13-1150 Response Re Judicial WatchDocument1 page13-1150 Response Re Judicial WatchJudicial Watch, Inc.No ratings yet

- Market StructureDocument40 pagesMarket StructureSreerama MurthyNo ratings yet

- Chap 4 CVDDocument126 pagesChap 4 CVDMichael KaoNo ratings yet

- Bi 937976Document10 pagesBi 937976Sankalp SrivastavaNo ratings yet

- Human Resources Strategy and Analysis - Case 1 - Siemens Builds A Strategy-Oriented HR SystemDocument2 pagesHuman Resources Strategy and Analysis - Case 1 - Siemens Builds A Strategy-Oriented HR SystemSole NavarreteNo ratings yet

- Heat Flow in The Region Bounded Internally by A Circular Cylinder. - Jaeger 1942Document6 pagesHeat Flow in The Region Bounded Internally by A Circular Cylinder. - Jaeger 1942Gabriel SaavedraNo ratings yet

- Organizational Conflict PDFDocument182 pagesOrganizational Conflict PDFCindy LauraNo ratings yet

- MIS Techmax (Searchable)Document64 pagesMIS Techmax (Searchable)hell noNo ratings yet

- HTML Basic - : 4 ExamplesDocument2 pagesHTML Basic - : 4 ExamplesBhupender KumawatNo ratings yet

- Water-Wise Water ParkDocument7 pagesWater-Wise Water Parkapi-353567032No ratings yet

- MD30C User's ManualDocument17 pagesMD30C User's ManualAMIR GHASEMINo ratings yet

- Chapter 10 (Stalling)Document5 pagesChapter 10 (Stalling)Marufa Kamal LabonnoNo ratings yet

- Faq SastraDocument2 pagesFaq SastraParthasarathi LsNo ratings yet

- 1&2) Diploma in Manufacturing Engineering - Learn & EarnDocument72 pages1&2) Diploma in Manufacturing Engineering - Learn & EarnDarshan GohelNo ratings yet

- Introduction To Color SpacesDocument4 pagesIntroduction To Color Spacesabdullah saifNo ratings yet

- Safety Engineering Module 1Document16 pagesSafety Engineering Module 1Kevin O'BrienNo ratings yet

- MY CBLM-finalDocument39 pagesMY CBLM-finalFreman ManuelNo ratings yet

- 174 - 13 UREA PDF - 28-Euro Procedure SheetDocument2 pages174 - 13 UREA PDF - 28-Euro Procedure SheetP VijayaNo ratings yet

- C Krishniah Chetty and Sons PVT LTD Vs Deepali Co IC2021260822165535114COM17947Document27 pagesC Krishniah Chetty and Sons PVT LTD Vs Deepali Co IC2021260822165535114COM17947adityaNo ratings yet

- Logical Reasoning and Analytical Ability Statement and Courses of ActionDocument10 pagesLogical Reasoning and Analytical Ability Statement and Courses of ActionIAS EXAM PORTALNo ratings yet

- Why Is Communication Important To The Management of The RanchDocument2 pagesWhy Is Communication Important To The Management of The RanchMehak GuptaNo ratings yet

- Signal Sampling: - Sampling Is Converting A Signal Into A Signal - CategoriesDocument57 pagesSignal Sampling: - Sampling Is Converting A Signal Into A Signal - Categoriesimranchaudhry12No ratings yet

- Phpmyadmin Web Application Security AssessmentDocument16 pagesPhpmyadmin Web Application Security AssessmentybNo ratings yet

- Client Registration Form: IndividualDocument23 pagesClient Registration Form: IndividualAshutosh IndNo ratings yet

- How To Install Mask-Rcnn For Nvidia GpuDocument19 pagesHow To Install Mask-Rcnn For Nvidia GpuDr. Mohamed Abdur RahmanNo ratings yet

- Illustrated Everyday Expressions 2 PDFDocument193 pagesIllustrated Everyday Expressions 2 PDFFrancisco Antonio López Revelles100% (12)

- RPT - LODR Sixth Amendment Final PPT 19.11.2021Document43 pagesRPT - LODR Sixth Amendment Final PPT 19.11.2021hareshmsNo ratings yet

- Supplier Guidelines - v2 PDFDocument64 pagesSupplier Guidelines - v2 PDFsidNo ratings yet

- Seamless Casing and Tubing Nipponsteel Ver PDFDocument18 pagesSeamless Casing and Tubing Nipponsteel Ver PDFMehdi SoltaniNo ratings yet

- Abraline PDFDocument32 pagesAbraline PDFAmel DurakovicNo ratings yet