Professional Documents

Culture Documents

Management Accounting Exercise Material

Management Accounting Exercise Material

Uploaded by

ScribdTranslationsOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Management Accounting Exercise Material

Management Accounting Exercise Material

Uploaded by

ScribdTranslationsCopyright:

Available Formats

NATIONAL UNIVERSITY OF ASUNCION

SCHOOL OF ECONOMICS

MANAGEMENT ACCOUNTING

Application exercise.

UNIT II

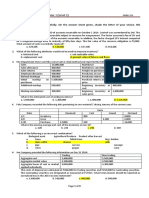

1. Classification of Industrial Company Costs

The MARGLOBE company manufactures canned tomatoes, in two different sizes. Below

is a list of some of the expenses registered in the month of March:

1) Rental of factory premises

2) Depreciation of furniture and office equipment

3) Document collection expenses

4) Buying tomatoes

5) Depreciation of production machinery

6) Purchase of packaging

7) Salaries of the company's administrative staff

8) Maintenance and repairs of machinery

9) Interest paid on loans

10) Value Added Tax

11) Purchase of a new machine for the factory

12) Consumption of preservative chemicals

13) MOD bonuses for production

14) Salary of the production manager

15) Commissions paid on sales

16) Purchase of a new machine for the administrative office

17) Monthly salary of machine operators

18) Maintenance of the factory premises

19) Discount of customer documents

20) Administrative office telephone account

21) Consumption of tomatoes

22) Document collection expenses

Classify the expenses from the previous list, writing next to each item the initials of the

type of cost or expense that corresponds: fixed cost (CF), variable cost (CV), direct

cost (CD), indirect cost (CI ), fixed expense (GF), variable expense (GV), administrative

expense (GA), financial expense (GN), sales and distribution expenses (GD) or none of

the above (X).

2. Classification of costs and tables.

Dr. Graciela Marecos 1

Lic. Cynthia Egusquiza

NATIONAL UNIVERSITY OF ASUNCION

SCHOOL OF ECONOMICS

MANAGEMENT ACCOUNTING

Classify the following items into Cost, Expense, Loss or Asset and when possible,

classify them into Direct or Indirect and Fixed and Variable. If more than one

alternative is valid, assign all the ones you consider most predominant.

1) Purchase of raw materials

2) Power consumption

3) Direct labor

4) Fuel consumption- Delivery vehicles

5) Telephone- monthly bill

6) Industrial water consumption

7) Billing staff

8) Acquisition of machinery

9) Depreciation of production machinery

10) Painting of the factory premises

11) Computer installation

12) Removal of deposit materials

13) Consumption of various materials in administration

14) General accounting staff

15) Cost accounting staff

16) Administration Fees

17) Industrial director fees

18) Depreciation of the company property

19) Consumption of raw materials

20) Acquisition of packaging

21) Deterioration of raw materials due to neglect

22) Paid sick staff time

23) Application of insulating material on the factory premises

24) Building remodeling

3. Classification of costs and expenses.

Dr. Graciela Marecos 2

Lic. Cynthia Egusquiza

NATIONAL UNIVERSITY OF ASUNCION

SCHOOL OF ECONOMICS

MANAGEMENT ACCOUNTING

The company Sal Yodada SA manufactures salt enriched with iodine, in different sizes

and presentations. The company has two departments: Preparation and Packaging.

The product is distributed by order. Below, a list of the company's expenses is detailed

and you are asked to classify them as follows: Fixed Costs (CF), Variable Costs (CV),

Direct Costs (CD), Indirect Costs (IC), Fixed Expenses (GF), Variable Expenses (GV),

Administrative Expenses (GA), Financial Expenses (GF), Distribution and Sales

Expenses (GDV) or none of the above (X).

Items

1) Warehouse rental for finished products

2) Cash purchase of new machinery

3) Iodine consumption

4) Monthly salary of a machinist

5) Payment of interest on a loan

6) Social bonuses for workers

7) Machine depreciation

8) Commercial Manager Salary

9) Purchase of a vehicle for distribution

10) Fuel consumption of machines

11) Vehicle fuel consumption

12) Salary of the delivery vehicle driver

13) Production Manager Salary

14) Repayment of loan capital

15) Electricity consumption for machines

16) Depreciation of administrative offices

17) Administrative secretary salary

18) Piece-rate salary of packers

19) Salt consumption

4. Classification of Industrial Company Costs.

Porter Company manufactures furniture, including tables. Below is a selection of costs:

1) The wooden tables cost G 100,000 each

Dr. Graciela Marecos 3

Lic. Cynthia Egusquiza

NATIONAL UNIVERSITY OF ASUNCION

SCHOOL OF ECONOMICS

MANAGEMENT ACCOUNTING

2) Tables assembled by workers have a salary cost of G

40,000 per table

3) The workers who assemble the tables are supervised by a

factory supervisor, who is paid G 25,000,000 per year

4) Electricity costs are G 2,000 Gs per machine-hour. It takes

four machine hours to produce one table

5) The depreciation cost of the machines to manufacture the

tables amounts to G 10,000,000 per year

6) The salary of the president of Porter Company is G

100,000,000 per year

7) Porter Company spends G250,000,000 per year to

advertise its products

8) Sellers are paid G 30,000 commission for the sale of each

table

9) Instead of producing tables, Porter Company could rent

the factory floor space in exchange for an income of G

50,000,000 per year

Is required:

Classify these costs according to the different cost terms seen in the chapter. Carefully

study the classification of each cost.

5. Classification of Industrial Company Costs.

The Administrator of the Graphics “Graficos y Cia.” is considering the need to carry out

a correct classification of the expenses incurred periodically, and for this purpose it has

provided the following list from which it must be identified whether they correspond to:

Costs – Expenses – Income

Direct – Indirect

Fixed - Variable

Administrative – Financial – Commercial

1. Fees paid to graphic designers, which are standard

monthly amounts.

2. Illustration paper consumption, according to the

details recorded in the records of the raw materials

warehouse

3. Purchase of inks, of different colors and for 3

processes where this material is required. For 2

months of work.

4. Payment of fuel receipts, of the accountability of

the company's collectors.

5. Estimation of the monthly depreciation fee for

machines: guillotines and die-cutting machines.

6. Acquisition and payment to a service provider, for

three matrices for the same number of specific jobs.

7. Commissions paid on sales to company promoters.

8. Estimation of the depreciation rate of the vehicle

intended for the activities of the General

Management.

6. Classification of Service Company Costs

Dr. Graciela Marecos 4

Lic. Cynthia Egusquiza

NATIONAL UNIVERSITY OF ASUNCION

SCHOOL OF ECONOMICS

MANAGEMENT ACCOUNTING

UNIVIAJES is a wholesale company that sells vacation packages to Europe from Latin

America; These packages include round trip tickets, hotel, breakfast and excursions.

As a work system, UNIVIAJES organizes promotional groups for hotels and retail travel

agencies, which are led by a team of 5 specialists (four salespeople and a group

leader). Each contracted seller is paid G 40, per package sold; The group leaders are

professionals on the UNIVIAJES staff and receive a monthly salary of G 3,000.

Considering the volume of transactions carried out by the company, it was possible to

obtain an important reserve in their name from suppliers, including monthly

settlements based on the quotas actually used.

Analyzing the changes recorded in the total costs and expenses of UNIVIAJES as the

number of vacation packages sold changes, classify the following items.

Costs / Fixed/ Direct /

Items Expenses Variable Indirect

Rent payment for administrative and

commercial offices

Prints used to promote the different travel

packages.

Fees paid to promotion group leader

Commissions paid to each group of sellers on

completed sales

Fuel cost of the vehicle used to transport

passengers from their home to the airport.

Monthly transfer to the account of the airline

used to transport passengers.

Fixed salary of the receptionist

7. Classification of Service Company Costs.

The collection company Nexos SA is in charge of calling and collecting debtors as the

documents delivered by clients accrue. For this purpose, it has a staff of 5 secretaries

in charge of making telephone calls, 2 collectors who carry out visits to debtors, 1

accountant who performs the functions of Administrator and Accountant at the same

time, and 1 orderly to perform the functions of Administrative and Accounting

Assistant. They rent an office in Asunción, since the coverage area is the Central

Department.

The office was equipped with six telephone lines with their respective consoles, air

conditioning, etc. Likewise, motorcycles were purchased for each of the collectors,

through a bank loan worth G 15,000,000.

According to the records for the month of July 2004, the result of your first month of

negotiations was as follows, classify the items:

Dr. Graciela Marecos 5

Lic. Cynthia Egusquiza

NATIONAL UNIVERSITY OF ASUNCION

SCHOOL OF ECONOMICS

MANAGEMENT ACCOUNTING

Salary of secretaries – operators: g 610,000 each

Electricity: G 120,000 (20% corresponds to the administrative offices)

Motorcycle fuel: G 110,000 each

Assistant salary: G 450,000

General Manager Salary: G 1,500,000

Office rental: G 500,000 (40% occupied by offices and the rest by consoles)

Interest on loan: G 350,000

Office Supplies: G 198,000

Collectors' commissions: 3.5% on collections

Telephone consumption: G 422,500 (average per line)

8. Preparation of the Income Statement.

The company Carburadores SA has the following data corresponding to the month of

August (in thousands of guaraníes):

Sales 122.850

Production cost

direct labor 32.400

Indirect materials 2.560

Indirect labor 8.450

Machinery depreciation 3.490

Factory rental 4.200

Firewood for the boilers 1.200

Electric power factory 1.900

Factory maintenance and cleaning 5.800

Raw material purchases 61.400

Stock valuation as of July 31:

Raw Materials 18.400

Products in process 8.200

Finished products 19.800

Stock valuation as of August 31:

Raw Materials 31.200

Products in process 7.430

Finished products 25.600

Determine:

a) The production cost of the period (CPP)

b) The cost of finished production (CPA)

c) The cost of production sold (CPV)

d) The prime cost

e) The conversion cost

f) The gross profit

Dr. Graciela Marecos 6

Lic. Cynthia Egusquiza

NATIONAL UNIVERSITY OF ASUNCION

SCHOOL OF ECONOMICS

MANAGEMENT ACCOUNTING

9. Commercial Company Income Statement.

MONITORES is a company that is dedicated to the import and marketing of electrical

items. After its first year in the market, the Directors are eager to know the results

achieved. To do this, they have the following information (in G):

Merchandise Stocks:

Initial: 392,000

Final: 464,000

Merchandise Purchases: 742,000

Marketing Expenses: 72,000

Administration Expenses: 23,000

Financial Expenses: 34,200

Sales: 961,000

Prepare the income statement, taking into account that the income tax is 20% of the

profit.

10. Income Statement Commercial Company.

The SANCO company buys rice wholesale and distributes it without carrying out any

transformation process. The first two years of operation recorded the following figures

(in G):

1st year 2nd year

Purchases of merchandise 48.400 41.600

Administrative expenses 1.320 1.380

Distribution and Sales Expenses 4.320 4.750

Financial expenses 2.160 2.260

Sales 49.200 59.040

Initial Stock of Finished Products —0— 7.840

Final Stock of Finished Products 7.840 —0—

Prepare the Income Statements of the SANCO Company.

11. Income Statement.

Commercial NAILIL, provides the following information in G.

Initial Final

Merchandise stocks 196.000 232.000

Purchases of merchandise 371.000

Administrative expenses 11.000

Distribution and sales expenses 36.000

Financial expenses 18.000

Sales 410.000

Make an Income Statement.

12. Industrial Company Income Statement.

Dr. Graciela Marecos 7

Lic. Cynthia Egusquiza

NATIONAL UNIVERSITY OF ASUNCION

SCHOOL OF ECONOMICS

MANAGEMENT ACCOUNTING

La Casona Company currently manufactures and sells tiles and bricks; It wants to have

a monthly results report in order to periodically monitor operations. To do this, provide

the following data.

* Income:

Total Cash Invoices: G 78,350,000.

* Expenditures:

Factory workers' daily wage: G 17,600,000.

Material purchases: G 35,600,000.

Salesperson salary: G 2. 500.000.

Depreciation of machinery: G 3,600,000.

Basic Factory Services: G 1,200,000.

Basic Office Services: G 800,000.

Advertising: G 3,500,000.

Administrative salaries: G 4. 600.000.

Social Benefits on Remunerations: 25.5%

Indirect Materials: G 1,800,000.

Maintenance of mixing machines: G 450,000.

* Inventories

Initial Final

Raw material G 8,600,000 G 13,900,000

Products in process G 1,200,000 G 1. 850.000

Finished products G2,300,000 G 2,085,000

Make an Income Statement.

13. Production cost of the period, finished and sold.

A goods producing company has the following information extracted from the

accounting books:

Raw materials purchased in the month G500,000

Return of raw materials in the same month 20%

Labor paid in the month G 600,000

Indirect manufacturing costs incurred in the month G400,000

Calculate the values.

a) Production cost in the month

b) Cost of finished production in the month

c) Cost of production sold in the month

The aforementioned calculations are requested for each of the following alternatives.

1- There were no beginning or ending inventories of finished products or products

in progress or raw materials.

2- The initial stock of raw materials was G 120,000 in the month, there were no

other beginning or ending inventories.

3- The initial stock of raw materials was G 120. 000 and the end of G 150.00;

There were no initial or final stocks of finished products or products in

progress.

4- The initial stock of raw materials was G 120,000, the initial inventory of

products in progress was G 180. 000, the ending inventory of finished goods

was G 200,000 and there were no other beginning or ending inventories.

Dr. Graciela Marecos 8

Lic. Cynthia Egusquiza

NATIONAL UNIVERSITY OF ASUNCION

SCHOOL OF ECONOMICS

MANAGEMENT ACCOUNTING

5- The beginning inventory of finished products was G 300,000, the beginning

inventory of products in progress was G 160,000, and the ending inventory of

products in progress was G 200. 000 and there were no other beginning or

ending inventories.

6- The beginning inventory of work in progress was G200,000, the beginning

inventory of finished goods was G800,000, and the ending inventory of work in

process was G220. 000 and the ending inventory of raw materials of G 70,000

and there were no other beginning or ending inventories.

7- The initial stock of raw materials was G 150,000 and the final stock was G

220,000; The initial inventory of products in progress was G 170. 000 and the

final was G 230,000; The initial inventory of finished products was G 130,000

and the final inventory was G 190. 000.

14- Determination of costs.

The following information corresponds to the company Rustica SA (in G).

Direct materials 25.000

Indirect Materials 5.000

direct labor 30.000

Indirect labor 4.500

Indirect manufacturing costs 15.000

Calculate: * Prime cost * Conversion cost * Product cost.

15- Determination of costs.

Chensson makes wallets. The following information is available for the period ending

December 31, 2xxx

Materials used in production G 82,000, of which G 72,000 was considered indirect

materials.

Manufacturing labor cost for period G 71. 500 of which G 12,000 correspond to indirect

labor.

Indirect manufacturing costs due to factory depreciation G 50. 000

Selling, general and administrative expenses G 62,700.

Units completed during the period 18,000

Calculate: * Prime cost * Conversion cost * Product cost * Period cost

16. Production Cost.

The company “El Volcán SA” presents the following cost table expressed in G for the

production of 2,000 units of an article called “A”, for a certain month, it is as follows:

cost class Total cost Unit cost

Variable cost 640.000 320

Fixed structure costs 1.240.000 620

Fixed operating costs 800.000 400

Dr. Graciela Marecos 9

Lic. Cynthia Egusquiza

NATIONAL UNIVERSITY OF ASUNCION

SCHOOL OF ECONOMICS

MANAGEMENT ACCOUNTING

Total 2.680.000 1.340

Fixed operating costs increase by G200,000 for every additional 1,000 units of

production. Indeed, for the production of 3,000 units it would be G 1,000,000; for

4,000 units G 1,200,000, etc.

It is requested to calculate the cost for a production of 1,800 and 3,500 units.

17. Income Statement

Pita and Company produced 75,000 units in the year ending December 31, 2xxx. There

were no units in process at the beginning or end of the period. The cost of the

manufactured items was G 300,000

During the year the following occurred:

59,000 units were sold at G 5 each; It is still expected to sell 14,000 units. 2,000

defective units were found.

There was no beginning inventory of finished goods. Prepare an income statement for

Pita.

18. Determine income, expenses and loss.

Magnetic began activities on January 1, 2xxx. The following transactions took place

during the month of January.

Amount Price by unit

Description buys sale Compa Cost of

cost G sale G

Machine For pressures 3 2 500 800

Machine For abdominal 5 3 400 700

exercises

Machine For leg pressure 6 2 600 1.000

Machine For arm exercises 4 0 200 --------

The machines for practicing arm exercises were found defective. Since the

manufacturer of these machines has gone out of business and they cannot be

returned, they will be discarded as worthless.

Calculate for the month of January:

a) the total income

b) total expense (cost of goods sold)

c) the total loss

19. Production cost of the period, finished and sold.

“A La Lona SA”

The company “A La Lona SA” that manufactures jeans pants, presents the following

data in G in its records:

Fabrics in stock as of 11/01/07 250.000

Fabrics in stock as of 11/30/07 80.000

Fabric purchases of the period amounted to 2.200.000

The initial stock of finished jeans was 1,200 units at 350 each

Dr. Graciela Marecos 10

Lic. Cynthia Egusquiza

NATIONAL UNIVERSITY OF ASUNCION

SCHOOL OF ECONOMICS

MANAGEMENT ACCOUNTING

The final stock of finished jeans was 800 units

The Direct Labor paid in the period was 1.000.000

The Indirect Manufacturing Costs were 927.000

15,000 jeans were sold for an amount of 11.250.000

REQUESTED:

Determine 1) Production cost of the period 2) Cost of finished products 3) Gross sales

profit

20. Production cost of the period, finished and sold.

The company “Costosísimo SA” has the following information:

Initial inventory of raw materials G200,000

Raw material purchases G 920,000

direct labor G 310,000

Initial inventory of products in process G210,000

Consumption of raw materials G 680,000

Manufacturing indirect cost for the month G 1,040,000

Initial inventory of finished products G 100,000

Final inventory of products in process G 156,000

Sales of the month (2000 ua G 700 each) G 1,400,000

Final inventory of finished products G90,000

REQUESTED:

Determine 1) Production cost of the period 2) Cost of finished products 3) Gross sales

profit 4) Prime Cost 5) Conversion Cost

21. Cost of production for the period, completed and sold.

The following data were taken from the accounting of an industrial company, for a

certain period:

Initial stock of raw materials G 3. 000

Raw material purchases G 57. 000

Final stock of raw materials G4,000

Labor and social charges G42,000

factory load G22,000

Initial existence of product in process G12,000

Final existence of products in process G8,700

Initial stock of finished products G 6,450

Final stock of finished products: 20 units

Production completed in the period: 300 units

The company uses the FIFO method to cost its products.

It is requested to calculate the production cost of the period, the cost of finished

products and the cost of products sold.

22. Consumption of raw materials.

Imaginaria SA establishes a policy of valuing its inventories using the UEPS method.

He bought a batch of 100 units at G 10 each.

Dr. Graciela Marecos 11

Lic. Cynthia Egusquiza

NATIONAL UNIVERSITY OF ASUNCION

SCHOOL OF ECONOMICS

MANAGEMENT ACCOUNTING

On the second opportunity, he bought 200 units at G 15 each.

The records indicate that there were no losses, shrinkage, theft, or waste. The raw

material consumed was 180 units. There were no initial and final inventories. Calculate

the cost of the raw materials consumed.

Unit IV-V-VI

23- Consumption of materials.

The BARRÖ company wants to know the cost of its only material used in production,

for this purpose the relevant data is attached in order to carry out the corresponding

calculations:

Initial stock of 200 kg. at G 1,500 x kg

06/10/x1 Purchase of 500 kg. at G 1,550 x kg.

06/15/x1 Consumption of 400 kg.

06/20/x1 Consumption of 200 kg.

06/22/x1 Purchase of 350 kg. at G 1,600 x kg,

06/26/x1 Consumption of 220 kg.

To calculate the cost, develop the inventory sheet and propose the entries

corresponding to the item, using the methods: FIFO

24- Consumption of materials.

The University photocopier keeps an efficient inventory of the sheets used to provide

its services. Below are the operations that affected the recently closed month and that

you will have to use to prepare said Sheet Sheet:

08/01/x1 Buy 20 reams at G 12. 500 each

08/06/x1 Consumption 15 reams

08/08/x1 Consumption 3 reams

08/12/x1 Buy 20 reams at G 13,000 each

08/25/x1 Consumption 12 reams

1) Prepare the corresponding file under the FIFO method

2) Make the corresponding entries.

25. Record in the Journal.

Casa Fiesta was established on September 29, 2xxx

The president of the company provided the following data related to the inventory of

materials for use in the month of February:

February 2 Cash purchase of 1,000 units of direct materials at a cost of G 20

each and 30 units of indirect materials at G 5 each.

February 5 400 units of direct materials were used in production.

February 20th 10 units of indirect materials were used in production.

Record the previous transactions in the journal.

26. Recording in the journal and calculation of materials used.

Dr. Graciela Marecos 12

Lic. Cynthia Egusquiza

NATIONAL UNIVERSITY OF ASUNCION

SCHOOL OF ECONOMICS

MANAGEMENT ACCOUNTING

The president of Mayo SA provided the following data related to the company's paper

pulp inventories for the month of January. The company evaluates its ending inventory

using the FIFO method.

January 1 Initial inventory, 1000 Kg of paper pulp at a cost of G 0.50 per

Kg.

January 10 It is purchased, 300 Kg. AG 0.55 each kg

January 16 300 kg were used

26 of January 750 kg were used

January 28 400 kg were purchased at G 0.60 per kg

January 31 350 kg were used

All purchases are made in cash.

a) Record the previous transactions in the journal.

b) Calculate the cost of the materials used.

27. Consumption of materials.

The following information related to the materials inventory account was provided by

SHEILA Corporation, who used a perpetual inventory system:

Initial balance G 100,000

Additional debits added to the account during the period G300,000

The ending balance exceeded the beginning balance in G 20.

000

Calculate the cost of materials used.

28. Record in the Journal.

Manufactura Pilar SA uses a periodic system and provides the following data:

Cost of materials used G 12. 000

Purchase of materials G15,000

Available material G 19,000

Calculate by how much the ending materials inventory exceeded the beginning

materials inventory.

29. Labor

A company recently adopted an incentive plan, factory workers are paid G 0.75 per

unit produced with a guaranteed minimum wage of G 200 per week ending May 19,

2xxx, the following is a report on employee productivity for the ending week. All

workers have worked 40 hours a week.

Weekly summary.

Name Units produced

J. Medina 240

M. Jimenez 275

TO. Vargas 250

V. Rivera 285

R. See 225

S. Caceres 265

Total 1.540

1. Calculate the gross salaries for each employee.

Dr. Graciela Marecos 13

Lic. Cynthia Egusquiza

NATIONAL UNIVERSITY OF ASUNCION

SCHOOL OF ECONOMICS

MANAGEMENT ACCOUNTING

2. What quantity should be charged to work in process inventory.

3. What amount should be charged to manufacturing overhead costs.

4. Record in journal.

30. Labor.

One entity in particular has had an incentive plan in place in recent years. Factory

workers are paid G2. 25 per unit produced with a guaranteed minimum wage of G 175

per week. Below is the report on the productivity of each of them for the week ending

September 21, 2xxx. All employees worked 40 hours a week.

Weekly summary

Name of the employee Units produced

Francisco Chimelli 72

Marcos Dominguez 80

Gregory Duchene 78

Nisvaldo Grimaldy 82

Roberto Soto 68

Sergio Britos 73

Total 453

a) Calculate gross salaries for each employee

b) What quantity should be charged to work in process inventory.

c) What amount should be charged to manufacturing overhead costs?

31. Labor Cost.

The Industrial Azucarera Paraguaya SA Company currently has an important Human

Resources structure in the Production Department, which is why it wants you to show

it a payroll system in order to settle salaries monthly, and to do so it provides you with

the following data:

There are two production departments: Mixing and Assembly

We worked in two shifts: the first from 7:00 a.m. to 12:00 p.m. and 1:30 p.m. to

5:00 p.m., the second from 12:00 p.m. to 4:00 p.m. and 5:00 p.m. to 9:00 p.m.

In the 1st shift, 10 technical operators work and in the 2nd shift, 13 assistants

work.

Technicians earn G 9,000 per hour and assistants G 5,500 per hour.

In a month there are 26 working days.

In addition to salaries, social benefits must be considered, which represent 25% of

salaries.

1. Determine the total labor cost, by employee category.

2. Make the relevant entry knowing that 60% corresponds to direct labor and the rest

to indirect labor. (take this information into account only for the seat).

32. Labor Cost.

Corporación Mercantil is a manufacturing company that has two work teams, the first

is from 7:00 a.m. to 4:00 p.m. And the second from 4:00 p.m. to 12:00 p.m., in each

of them 40 workers with category A and 20 workers with category B work.

Dr. Graciela Marecos 14

Lic. Cynthia Egusquiza

NATIONAL UNIVERSITY OF ASUNCION

SCHOOL OF ECONOMICS

MANAGEMENT ACCOUNTING

The hourly rates are: G 9,000 per hour for category A and G 7,500 per hour for

category B. They work 25 days a month.

The company pays 25% of salaries as social benefits. (Amount that must be added to

the value mentioned above)

Determine the total cost of direct labor, indirect labor.

Make the relevant entry.

33. Indirect manufacturing costs.

Olga y Cia has provided the following information on indirect manufacturing costs and

production levels:

Normal capacity 350,000 units

Expected capacity 310,000 units

Fixed costs G 610,000

Variable costs G 1.76 per unit

Calculate the application rate of manufacturing indirect costs based on production units

for normal capacity and expected actual capacity.

34. Indirect manufacturing costs.

Assume the following information for Lola & Cia (all figures are estimates).

Indirect manufacturing costs G425,000

Production units 500.000

Direct materials costs G 1,000,000

Direct labor cost G 1,500,000

Direct labor hours 250.000

Machine hours 110.000

Calculate the manufacturing overhead application rate for this company based on the

following:

a) Production unit d) Direct material costs

b) Direct labor costs c) Direct labor hours

e) Hours – Machine

35. Indirect manufacturing costs.

The distribution of indirect manufacturing costs is the most complicated task for

Compañía Luna Blanca SA, since they do not know how to do it. Therefore it provides

you

information related to the sector, so that you can propose a calculation system.

COURT ARMED MAINTENA DEPOSIT TOTAL

NCE

Indirect Materials 14.000 13.000 1.700 1.200 29.900

Electrical Energy -

Factory 16.000

Indirect labor

Factory Insurance 22.000

Machinery 7.000

Dr. Graciela Marecos 15

Lic. Cynthia Egusquiza

NATIONAL UNIVERSITY OF ASUNCION

SCHOOL OF ECONOMICS

MANAGEMENT ACCOUNTING

Depreciation

14.000

Total G 88.900

The statistical information that accompanies the Indirect Costs table is the following:

COURT ARMED MAINTENAN DEPOSIT

CE

Hours, man 6.000 4.000 2.000 400

Surface (m2) 500 200 100 300

Machinery Value (G) 1.600.00 600.000 150.000 60.000

Machine Hours

Value of Stored 0 900 200 60

Inputs (G)

1.500 15.000 4.500 ---

40.000

The costs, times and manufacturing volume, by product, were as follows:

PRODUCT A PRODUCT B PRODUCT C

MP Cost (G) 25.000 18.000 22.000

MOD Cost (G) 18.000 21.000 16.000

Dep. Cote (Hs.

Machine.) 1.750 2.250 1.500

Armed Dept. (Hrs.

Machine) 1.750 1.250 1.500

Production Volume

(units) 2.500 3.000 2.000

1. Calculate the Indirect Costs that must be allocated to each product using the direct

secondary distribution method.

2. Calculate the total production costs by product.

3. Make journal entries.

36. Indirect manufacturing costs.

FOOD INDUSTRY SA

The following is the information for production order no. 2002,

*units to be produced 100,000

*start date March 1

*ends March 31/06

1. Raw materials are purchased on credit with invoice no. 012 to suppliers del norte

Ltda. for a value of G 3,000,000, freight for a value of G 100,400 and insurance costs

for a value of G 93,120, commercial discount of 3.45% for raw materials.

2. Raw material worth G 3000 is transferred to the production plant

3. The factory payroll amounted to G 1,304,120 and deductions were made.

Dr. Graciela Marecos 16

Lic. Cynthia Egusquiza

NATIONAL UNIVERSITY OF ASUNCION

SCHOOL OF ECONOMICS

MANAGEMENT ACCOUNTING

4. The payroll is distributed as follows: G 1,014,000 As direct labor excluding social

benefits and social security, this value includes transportation assistance for G

102,000.

5. This value also includes the unproductive time of direct personnel and idle time,

which is equivalent to G 65,900.

6. The actual indirect manufacturing costs excluding the above are as follows:

depreciation of plant buildings G 125,000 Depreciation of plant equipment G 75,000

Utilities G 90,940,

7. Applied manufacturing overhead costs are calculated at 80% of the direct labor cost

8. Sales were G 7,700,000

9. Sales expenses total G 500,000

10. Administration expenses total G 300,000

11. The beginning inventories are as follows Inventory of finished products 814,500

Inventory of products in process 319,200 Inventory of raw materials 707,100

All Accounting is required. Registration in T accounts Cost statement Income statement

37. Indirect manufacturing costs.

COMESTRIBLES LA ROSA SA RC, whose main activity is the production of saltin-type

cookies, has the following information for the month of October 2004

Budgeted indirect manufacturing costs G 2,100,000

1. It is planned to produce 100 boxes of 200 units each.

2. The ending inventory of finished goods is 20 boxes.

3. The initial inventory is 30 boxes with a unit cost of G 13,000, of which G 6. 500 are fixed

4. The initial inventory of materials is G 2,224,000

5. 1050 kilos of flour are purchased, at G 1,200 kilo, freight value G 600

6. 1400 kilos of butter are purchased at a rate of G 1,000 kilo, freight value G 35.

9. 1500 kilos of sugar are purchased at a rate of G 450 kilo.

10. labor is paid at G 100 per unit, work performed by four operators actual working hours

215

11. Actual manufacturing overhead costs are detailed below Leases G 600 Depreciation G

200 Materials Indirect G 20 per unit Indirect Labor G 22.5 per case

12. The sales price is calculated based on the cost of the manufactured products, with a

profit of 35%

All Accounting is required.

38. Indirect manufacturing costs.

Helena Corporation applies manufacturing indirect costs using the following rates:

Department G x MOD Time Actual MOD Hours

Had 3.10 7.600

Tissue 6.04 11.000

Print 0.85 2.200

The actual indirect costs for the period were G 91,900.

Prepare journal entries for the application of applied manufacturing overhead costs.

Assume that the corporation uses underapplied or overapplied manufacturing overhead

accounts when closing applied manufacturing overhead. Use T account.

39- Indirect manufacturing costs

Santiago SA has the following information regarding real and applied indirect

manufacturing costs.

Control of indirect manufacturing costs G30,500

Dr. Graciela Marecos 17

Lic. Cynthia Egusquiza

NATIONAL UNIVERSITY OF ASUNCION

SCHOOL OF ECONOMICS

MANAGEMENT ACCOUNTING

Applied manufacturing indirect costs G 39. 700

The applied manufacturing indirect costs appear in the following accounts:

Cost of items sold G32,000

Final Inventory of Work in Process G3,500

Final Inventory of Finished Goods G4,200

a) Allocate underapplied or overapplied manufacturing overhead costs to those

accounts distorted by the use of an incorrect manufacturing overhead application rate.

b) Prepare the entry at the end of the period.

UNIT VII

40. Costs for work orders.

Letras SA is a printer that operates according to the request of its clients. Use the job

order costing system.

The following data summarizes operations with production for the month of June.

a) Materials purchased on credit G 317,500

b) Materials and labor used:

Materials G G labor

OT 101 45.000 27.000

OT 102 29.500 20.000

OT 103 39.900 14.500

OT 104 59.500 38.000

OT 105 32.500 19.000

OT 106 12.500 8.500

Not individualized 6.800 5.000

to orders

c) Miscellaneous indirect costs, credit G 60. 250

d) Depreciation of machinery and equipment G 17,500

e) The indirect cost rate is 70% of the direct labor cost.

f) The completed works were OT: 101,102,103 and 105.

g) Work orders 101, 102 and 103 were dispatched and clients were invoiced for G

129,500; G 70,550 and G 111,950, respectively.

Instructions:

1- Make general journal entries for summary operations for the month of

June.

2- Open T accounts and wholesale those corresponding to products in

process and finished products.

3- Prepare a list of unfinished work orders and verify if it agrees with the

major.

4- Prepare a list of completed work orders in stock and reconcile them with

the general ledger account balance.

41. Cost per Work Orders.

Confectiones Real SRL wants you to prepare the Work Order related to the

manufacture of 10 jackets, for which the following inputs were used

Fabric: 1.60 meters. per garment, at G 20. 000 the mt.

Closure: 1 per garment, at G 1,800 unit

Cord: 0.7 meters. to G 1,500 mt.

Dr. Graciela Marecos 18

Lic. Cynthia Egusquiza

NATIONAL UNIVERSITY OF ASUNCION

SCHOOL OF ECONOMICS

MANAGEMENT ACCOUNTING

Cutter Remuneration: G 10,000 garment

Seamstress Remuneration: G 8,500 garment.

Indirect Costs: 30% of the cost of direct materials is allocated.

Determine the total cost of the Order and the price to be set taking into account that

30% of the intended profit must be charged.

42. Cost per Work Orders

The industrial firm “Todo Madera” is dedicated to the manufacture of furniture

according to special requests from its clients. Your cost accounting department has

provided the following information, corresponding to five OTs for the month of August.

1- Cedar woods sent to production during the month:

for order No. 10 G 1,350,000

No. 11 G 1,480,000

No. 12 G 1,650,000

No. 13 G 1,550,000

No. 14 G 1,320,000

2- From the recapitulation of the individual time sheets the following distribution

of direct labor emerged.

for order No. 10 250 hours to G 1,500 per hour

No. 11 500 hours to G2,500 per hour

No. 12 1,300 hours to G2,000 per hour

No. 13 730 hours to G 1,800 per hour

No. 14 750 hours to G 1,750 per hour

3- The indirect manufacturing costs are distributed among the OTs based on G

2,500 per hour of direct labor, with the actual indirect costs for the month of

June being the sum of G 11,000,000.

4- OT No. 10 was started in the month of May, accumulating in said month the

following costs:

a) Raw materials G300,000

b) Labor G90,000

c) Factory load G 150,000

5- OT No. 14 was left unfinished at the end of the month

6- OT No. 10, 11 and 12 were sent and invoiced to the client, with a margin of

25% on the production price.

Requested:

Determine the cost of each of the work orders.

Journalize the following operations.

a) Reopening of the cost accounts for the initial inventory of work in process for

OT No. 10.

b) Allocation of the cost of the MP, MO and CIF of the OT.

c) Accounting for variations between real and applied.

d) Accounting for finished production.

e) Sales accounting.

f) Accounting for sales costs.

g) Accounting for variations.

43. Costs for Work Orders.

Printers Duarte & Cia., uses a job order costing system. The following data summarizes

operations with last month's production:

Dr. Graciela Marecos 19

Lic. Cynthia Egusquiza

NATIONAL UNIVERSITY OF ASUNCION

SCHOOL OF ECONOMICS

MANAGEMENT ACCOUNTING

a) Materials purchased on credit, G 59,820

b) Requirements for materials and labor used:

Materials G G Labor

OT N°1 12.150 9.540

OT N°2 3.480 2.048

OT N°3 12.200 7.820

OT N°4 2.020 452

OT N°5 8.100 3.020

OT N°6 2.060 1.540

For factory use 430 680

Without identifying

yourself to OT's

c) Indirect manufacturing costs incurred on credit, G 4,270

d) Depreciation of machinery and equipment, G 5. 640.

e) The indirect cost rate is 25% of the direct labor cost.

f) Completed work orders: 1,2,4 and 6.

g) The work orders dispatched to clients and invoiced were:

OT N°1 G 28,500

OT N°2 G 8,000

OT N°4 G 3,100

Instructions.

1- Make general journal entries for the operations summarized above.

2- Open T accounts for work in process and finished goods and transfer the journal

entries to the ledger, identifying the dates by letters.

3- Enter the account balances at the end of the month.

4- Prepare a list of unfinished work orders to reconcile with the respective ledger

account balances.

5- Prepare a list of completed work orders to reconcile with the respective general

ledger account balance.

44. Cost per Work Orders.

Gardenia SA wishes to implement the Cost Determination System through Work

Orders, and for this purpose it provides you with the following data:

Work: manufacturing 100 pairs of Guillermina model shoes, and 200 pairs of fine-

toe shoes.

Start Date: May 15, 20x1

Completion date: May 28, 20x1

Manufacturing hours: 48 hours.

Client: Gacel

Direct material costs

Guillerminas Fine point

Dept. Cutting G 1,500,000 G 3,200,000

Dept. sewing G 100,000 G 195,000

Dept. determination G80,000 G 180,000

Dept. Packaging G 120,000 G 240,000

Direct Labor Costs

Dr. Graciela Marecos 20

Lic. Cynthia Egusquiza

NATIONAL UNIVERSITY OF ASUNCION

SCHOOL OF ECONOMICS

MANAGEMENT ACCOUNTING

Guillerminas Fine point

Dept. Cutting G800,000 G 1,700,000

Dept. sewing G250,000 G 610,000

Dept. determination G350,000 G 600,000

Dept. Packaging G 100,000 G 180,000

Indirect Manufacturing Costs

The estimated indirect costs for the year total G 168,000,000, taking into account that

they are distributed to each Work Order based on the available capacity, under normal

production conditions, which represents 2,800 hours per year.

45. Cost per Work Orders.

Mr. Matías CAREAGA was the owner of a metallurgical company, but due to his

advanced age, Mr. CAREAGA decided to convert it into a small but fruitful service

company. He liquidates the metallurgical company, but decides to keep two bending

machines and three employees to care for the machines. The work system of the new

company consists of renting the machines to other metallurgists.

A client requests a quote to rent one of the machines for a period of 8 days, for

bending drain gutters. The following information is available to prepare the order

budget:

- The operating cost of the machine is G 150,000 / day

- The exclusive assistance of an operator will be required, whose working hours

will be from 7:30 a.m. to 6:00 p.m., with an intermediate break between 12:00

p.m. and 1:30 p.m.; The hourly wage of this operator is G 5,000 / hour, to

which 30% will be added for social benefits.

Determine the rental price of the machine, per hour and the total price of the contract,

in such a way that it includes 4% to cover Direct Taxes and a profit of 20%, both on

the price.

UNIT VIII

46. Cost per Process.

"The Fox"

This is the production of an article in two consecutive processes, without materials

being incorporated in the second process - there are initial and final inventories of

partially manufactured production.

ARTICLE “THE FOX”

Process No. 1

Initial Inventory: 1000 liters with the following percentages of progress and costs.

Items % progress Units Unit costs Total cost

Equivalents equivalents

Raw material 100 1.000 20,00 20.000

Labour 60 600 8,00 4.800

Indirect charges 60 600 15,00 9.000

G 43.00 G 33,800

Costs incurred in the period (process No. 1);

-Raw Materials: 40,000 liters mat. “A” to G 16 G 640,000

25,000 kilos mat. “B” to G 25 G 625,000 G 1,265,000

-Labour: 50,000 hours at G 10.- G500,000

Dr. Graciela Marecos 21

Lic. Cynthia Egusquiza

NATIONAL UNIVERSITY OF ASUNCION

SCHOOL OF ECONOMICS

MANAGEMENT ACCOUNTING

-Indirect charges: G 950,000

G 2,715,000

Production completed and transferred to the next process: 60,000 liters.

Final inventory: 3,000 liters; with the following by hundreds of progress.

- Raw material 80% (because part of the “B” material has not been

required)

-Labor 50%

-Indirect charges 50%

Process No. 2

Initial inventory: 5,000 liters, with the following percentages of progress and costs:

Items % progress Units Costs for Total cost

Equivalents equivalent units

Semi-product 100 5.000 44.00 220.000

“X” (received

from the

previous process

(replaces the

raw material of

process No. 2))

Labour 50 2.500 10.00 25.000

Indirect charges 40 2.000 68.00 136.000

G122.00 G 381,000

Costs incurred in the second process (conversion only) G 4,720,000

Labour 80,000 hours at G 9.00 G 720,000

Indirect charges G 4,000,000

Production completed in the second process and transferred to the finished products

warehouse: 59,000 liters

Final inventory: 4,000 liters with the following percentages of progress:

It is requested:

1) Determination of computable processed production

2) Calculation of the unit cost of computable processed production

3) Calculation of the cost of the final inventory of production in process

47. Cost per Process.

The costs of department C of the IMPREX company show the following figure.

DEPARTMENT C

Cost transferred from previous department G 4,500,000

Labor cost G 1,200,000

Factory load cost G800,000

Department Total G 6,500,000

The department's production data indicates the following data:

Production received from previous department 1,200 units

Finished production in the department 850 units

Production in process, 50% 320 units

Normal loss in the apartment 30 units

It is requested to calculate the departmental unit cost

48. Cost per process or department.

Dr. Graciela Marecos 22

Lic. Cynthia Egusquiza

NATIONAL UNIVERSITY OF ASUNCION

SCHOOL OF ECONOMICS

MANAGEMENT ACCOUNTING

The accumulated costs of company XYZ, during the period corresponding to the month

of June 2xxx, show the following figures:

Raw Materials - Department A G 5,200,000

Labor - Department A G800,000

Labor – Department B G 600,000

Labor – Department C G400,000

Labor – Transportation Service G 420,000

Labor – Workshop Services G300,000

Labor – Common Costs G 360,000

Factory Load – Department A G 340,000

Factory Load – Department B G 280,000

Factory Load – Department C G 320,000

Factory Load – Transportation Service G 240,000

Factory Load – Workshop Service G200,000

Factory Load – Common Costs G 180,000

Total accumulated costs for the month G 9,640,000

The company's costing policy indicates the following procedures:

a) Common costs are distributed to cost centers based on labor cost.

b) The cost of the workshop service is distributed to the other centers based on

the actual hours used for said service by each of them, which in the month of

June were as follows: Department. A: 200 hours; Dept. B: 144 hours; Dept. C:

96 hours, and Transportation Service: 360 hours

c) The transportation service is used 40% for the transportation of raw materials

and the remaining 60% for the distribution of finished products.

It is requested: to form the cost distribution table by departments.

49. Cost per Process.

The REFEMESA company is dedicated to the assembly of ceiling fans, and has two

departments: Assembly and Finishing. In the past month, the following production

figures were recorded:

Dept. Assembly Dept. Finishing

Unit movement:

Entered into the process (u. ing) 8.000 6.000

Terminated and transferred (u. 6.000 5.000

term) 2.000 1.000

In process, at the end of the month 50% 70%

(ugh)

Completion Degree

Production costs G

Direct materials 10.000 0

direct labor 6.500 3.505

Indirect manufacturing costs 9.520 1.512

Calculate the cost of each unit produced, as well as the value of the transferred and in-

process production of each department.

50. Cost per Process.

Dr. Graciela Marecos 23

Lic. Cynthia Egusquiza

NATIONAL UNIVERSITY OF ASUNCION

SCHOOL OF ECONOMICS

MANAGEMENT ACCOUNTING

The CONDOR clothing company has decided to implement a rigorous costing system to

be able to exercise good control over product stocks, as well as their valuation. To do

this, it has collected the following information corresponding to the month of January:

Movement of units.

Units in process as of 01/01: 400

Degree of completion as of 01/01: 60%

Value of production in process as of 01/01: Gs 10,200

Units completed in the month of January: Gs 3,200

Units in process as of 01/31: 500

Degree of completion as of 01/31: 50%

Production cost

Materials Gs 95,300

Direct labor Gs 58,500

Indirect manufacturing costs Gs 29,100

Other data for the month of January:

Stock value of finished products as of 01/01: Gs 25,280, equivalent to 460 units (the

value of the finished units was calculated by the FIFO method)

Units sold: 3,200

Sale price: Gs 75/unit

The factory has a single production department, from which products are transferred

directly to the stock of finished products.

a) Calculate the cost of each unit manufactured, and the value of finished and in-

process production for the month of January, using the FIFO method.

b) Determine the gross profit for the month of January.

51. Costs by process or department.

In a company that uses the cost system by process or departments.

At the end of a certain period, the following cost structure was found:

Centers Production Dept. of Services

Department

Classes TO b Yo II

Raw Materials 50.000

Labour 20.000 12.000 8.000 6.000

Factory Load 12.000 8.000 7.500 5.800

Common Costs.

Costs Services II 5.000

Costs Services I 7.000

Total 12.000

It is requested:

a) Distribute the common costs used to the method you consider convenient.

b) The Dept. Service I uses 30% of Service II and this 20% of Service I.

Determine the costs of both service departments and then distribute to the production

departments as follows:

1- The costs of the department. of Services II to the departments. From production A

and B in 50% and 50%.

2- The costs of the department. of Services I to the departments. Of production A and

B in a ratio of 60% and 40% respectively.

c) Determine the total cost per production department.

52. Costs by process or department.

Dr. Graciela Marecos 24

Lic. Cynthia Egusquiza

NATIONAL UNIVERSITY OF ASUNCION

SCHOOL OF ECONOMICS

MANAGEMENT ACCOUNTING

The overall cost of the Department. B from a company that operates the departmental

cost system, shows the following figures:

Cost transferred from Department A G 2. 250.000

Cost of the Department.

- Labour G 817,920

- Factory Load G 752,600

The production received in the Department was 3,000 units of semi-finished products

at G 750.

In this department. 2,700 units were completed and 280 units remained in

process with 50% completion. There was a loss of 20 units, which is considered

normal.

Complete the following production table:

OVERALL COST UNIT COST

Cost transferred from the Department. TO ………………………

………………………..

Loss adjustments ……………………… ………………………..

Adjusted cost ……………………… ………………………..

Department cost

Labour ………………………. ………………………...

factory load ………………………. …………………………

Total Department Cost ………………………… …………………………..

………………………… …………………………..

UNIT IX

53. Joint Production

The food products industry “Alterosa SA” consumed 4,000,000 liters of milk in the year

2xxx, in the production of cheese and butter. The price per liter of milk was G 4 (unit

price).

The total production for the year was 400,000 kg of cheese and 50,000 kg of butter.

The joint costs for the year in addition to raw materials were G 3,590,000. There will

still be other specific costs for each product.

Specific costs of butter.

Labour G 100,000

Packaging G25,000

Indirect costs G250,000

Cheese-specific costs.

Labour G 2,000,000

Packaging G80. 000

Indirect costs G800,000

Calculate the total and unit cost of the cheese and butter based on the market value,

knowing that the sales prices for the finished products are:

Dr. Graciela Marecos 25

Lic. Cynthia Egusquiza

NATIONAL UNIVERSITY OF ASUNCION

SCHOOL OF ECONOMICS

MANAGEMENT ACCOUNTING

Butter G 80 per kg, Cheese G 120 per kg.

54. Joint Production.

“Arturitos SRL”

The company “Arturitos SRL” produces a product in 4 forms of presentation: A, B, C

and D; and in the manufacturing process, waste material is produced that becomes a

by-product. Its commercial value is estimated at G 7.50 per kg.

Appropriate cost:

Raw material 150,000

Labor 70,000

factory load 100.000

G 320,000

The total production was discriminated as follows:

At 3,600 Kg

B 3,100 Kg.

C 1,900 Kg.

D 1,240 Kg.

Discard 1,660 Kg .

11,500 Kg

The normal sales prices per kg of product in the market are:

AG 50

BG 48

CG 42

DG 40

There are proportional marketing costs that amount to 5% of the sales amounts.

REQUESTED:

Assign the costs of each product, assuming the following alternative criteria:

1. Consider the sale of discards as extraordinary income for the period in which it is

sold.

2. Consider discard as a by-product whose net commercial value is credited to the cost

of the main products.

3. Idem 2, but assuming that the discard is only marketed after an additional specific

sub-production process that represents G 5,000 per fixed month

55. Joint Production.

“Naranjada SA”

The company “Naranjada SA” buys orange essential oil. From the treatment of this oil,

four products are produced:

OIL “A”

“B” OIL

“C” OIL

“D” OIL

The joint production cost was G 1,200. - the liter.

The company has the following information:

Product Production in Sales unit Cost Dec. after the Dept.

liters value G separation G

"TO" 1.000 2.000. - 600. -

“B” 300 600. - 200. -

“C” 300 300. - 200. -

Dr. Graciela Marecos 26

Lic. Cynthia Egusquiza

NATIONAL UNIVERSITY OF ASUNCION

SCHOOL OF ECONOMICS

MANAGEMENT ACCOUNTING

“D” 50 100. - -------------

1.650

There are no initial and final inventories of products in progress.

REQUESTED:

1) Determine the cost of products “A”, “B”, “C” and “D”. For resolution, use the

conventional relative value of sales method to attribute sales to joint costs.

2) Determine the cost of products “A”, “B”, “C” and “D” considering “C” and “D” as by-

products. For resolution use the inverse cost method.

56. Joint Production.

Piedra Buena is a ceramic that makes bricks with 2, 3 and 6 holes. The raw materials

used and labor costs amounted to G6,000,000.

The quantity of 2-hole bricks was 35,000 units with a weight of 1.5 kilograms.

With 4 holes 50,000 units with a weight of 2 kilograms.

With 6 holes, 30,000 units with a weight of 3 kilograms.

In addition, there are other costs identified for each of the products and they are as

follows:

For brick with 2 holes it is G 280,000

For brick with 4 holes it is G 320,000

For brick with 6 holes it is G 160,000

It is requested to determine the unit cost of each of the products.

57. Joint Production.

Doña Angela is a company that manufactures dairy products. It requires determining

the production cost of 200 cc, 400 cc and 600 cc yogurt. It is not possible to define the

cost of real consumption of the raw materials used, as well as the cost of labor. These

together amount to G 2,500,000. It produces the same quantity as for the month,

which was 5,000 units for each product. The market sale price of each product is as

follows:

200 cc yogurt G 500, 400 cc yogurt G 900, 600 cc yogurt G 1,200.

When the relative value method of the product in the market is applied, it determines

the unitary value of each one.

UNIT

58. Direct and absorption costing.

The “Violines Afinados SA” industry began its production in October 2xxx, and had the

following movement:

Production Sale

October 8.000 unit 7.000 unit

November 16.000 unit 7.000 unit

December 4.000 unit 14.000 unit

Raw materials and indirect materials are the company's only variable costs and were

respectively G 2,560,000 and G 440,000 in October. Variable expenses and sales

totaled G 74 per unit and each violin is sold G 1. 080.

Your cost and fixed expense per month have been as follows:

Labour G 3. 500.000

Equipment depreciation G 112,000

Factory rental G50,000

Dr. Graciela Marecos 27

Lic. Cynthia Egusquiza

NATIONAL UNIVERSITY OF ASUNCION

SCHOOL OF ECONOMICS

MANAGEMENT ACCOUNTING

Miscellaneous factory costs G 916,000

Administrative Salaries G870,000

Propaganda G 716,000

Calculate the result and final stock of each month by the variable costing method and

absorption costing using the FIFO method (FIFO)

59. Direct and Absorption Costing.

Seller is dedicated to the manufacture and sale of Troculas. For a volume of 3,500

units, it has budgeted fixed production costs of G 7,000.- and G 1,200.- for marketing.

Each trocula is sold for G 20.- and its total unit production cost is G 6.-. During the

year 20X0, no initial inventory of exchange goods was recorded, 3,400 units were

manufactured and 3,300 were sold. While in 20X1 3,600 were manufactured and 3,700

were sold.

It is requested:

Prepare the Income Statement using the absorption costing methodology for the two

years and by reconciliation determine the result through variable costing.

60. Direct and Absorption Costing.

Manufacturas del Oriente SA is interested in comparing the net profits

corresponding to two periods. Below is the company's operating data:

Period 1 Period 1

Real Production (units)

Sales (units) 30.000 25.000

Unit Sales Price G 25.000 30.000

Variable Costs per unit G: 15 15

Direct materials 1,5

Direct labor 2,5

c. YO. Manufacturing Variables 2,0

Total Unit Variable Cost G 6 6

Fixed manufacturing overhead costs (G 120.000 120.000

4.0 per unit)

Administration and sales expenses G (all 50.000 60.000

fixed)

61. Direct and adsorption costing.

An Industry that produces a single product has the following movements.

Period Production Sales Final Existence

Yo 60.000 40.000 20.000

II 50.000 60.000 10.000

The characteristics of production costs are:

Variable costs and expenses

Raw material G 20/unit

Energy G 6/unit

Indirect materials G 4/unit

Total G 30/unit

Dr. Graciela Marecos 28

Lic. Cynthia Egusquiza

NATIONAL UNIVERSITY OF ASUNCION

SCHOOL OF ECONOMICS

MANAGEMENT ACCOUNTING

Variable expenses G 5 per unit sold

Fixed costs and expenses.

Labour G 1,300,000/year

Depreciation G 200,000/year

Rentals G 300,000/year

Miscellaneous G 100,000/year

Fixed expenses imposed G 200,000/year

Total G 2,100,000/year

Sale price G 75 per unit

The industry uses the FIFO method to value its existence.

Determine the result and the final existence by variable costing and by adsorption.

62. Result Chart.

The following data is available in relation to the operation of a company:

Sales G 4,000,000

Contribution margin G 1,600,000

Operative result G400,000

Calculate sales at the break-even point.

Dr. Graciela Marecos 29

Lic. Cynthia Egusquiza

You might also like

- Seminar 1 Scotia Health BriefDocument12 pagesSeminar 1 Scotia Health BriefHoàng Bảo Sơn100% (1)

- Exam281 20131Document10 pagesExam281 20131Jonathan Altamirano BurgosNo ratings yet

- Cost Accounting QuestionsDocument52 pagesCost Accounting QuestionsEych Mendoza67% (9)

- 2011-01-20 235608 Debra J Macchioni mt425 01 Unit 10 FinalDocument17 pages2011-01-20 235608 Debra J Macchioni mt425 01 Unit 10 FinalAnonymous dPyHoLNo ratings yet

- FM AssignmentDocument4 pagesFM AssignmentAnonymous s9cw5oy3100% (1)

- Analysis of Financial StatementsDocument49 pagesAnalysis of Financial Statementsnimra farooq0% (1)

- NFJPIA Region XII 8th Annual Regional Convention Mock Board ExaminationDocument49 pagesNFJPIA Region XII 8th Annual Regional Convention Mock Board ExaminationRonnel Tagalogon100% (1)

- Chapter 4 - Completing The ADocument153 pagesChapter 4 - Completing The APatricia Pantin100% (2)

- Acct 221 CH 14 HWDocument14 pagesAcct 221 CH 14 HWEnior FigueroaNo ratings yet

- Costing AssignmentDocument3 pagesCosting AssignmentSharath ReddyNo ratings yet

- Mangament AccountingDocument17 pagesMangament AccountingDue WellNo ratings yet

- 401Document7 pages401Justine Louise Bravo FerrerNo ratings yet

- Tutorial 4 5 - FA MA QuestionDocument6 pagesTutorial 4 5 - FA MA Questionyongjin95No ratings yet

- Homework AssignmentDocument11 pagesHomework AssignmentHenny DeWillisNo ratings yet

- Paper - 4: Cost Accounting and Financial Management Section A: Cost Accounting QuestionsDocument22 pagesPaper - 4: Cost Accounting and Financial Management Section A: Cost Accounting QuestionsSneha VermaNo ratings yet

- Questions AMADocument4 pagesQuestions AMAEnat EndawokeNo ratings yet

- Cost Accounting Tutorial Set OneDocument4 pagesCost Accounting Tutorial Set OneAmenyo eugeneNo ratings yet

- ACCA f5 - 2014 - Jun - QDocument7 pagesACCA f5 - 2014 - Jun - QGavin ChongNo ratings yet

- Managerial Accounting Final Assignment Fall I 2020: Manufacturing Costs: Marketing and Administrative ExpensesDocument13 pagesManagerial Accounting Final Assignment Fall I 2020: Manufacturing Costs: Marketing and Administrative ExpensesSyed Ahmer Hasnain JafferiNo ratings yet

- Acct1003 Midsemester Exam08-09 SOLUTIONSDocument7 pagesAcct1003 Midsemester Exam08-09 SOLUTIONSKimberly KangalooNo ratings yet

- Cost AccountingDocument2 pagesCost AccountingHoneyzelOmandamPonce100% (1)

- 2009-Management Accounting Main EQP and CommentariesDocument53 pages2009-Management Accounting Main EQP and CommentariesBryan Sing100% (1)

- ACC103 Assignment January 2019 IntakeDocument8 pagesACC103 Assignment January 2019 IntakeReina TrầnNo ratings yet

- Cost Accounting - Quiz 1Document5 pagesCost Accounting - Quiz 1alexissosing.cpaNo ratings yet

- 8508 Managerial AccountingDocument10 pages8508 Managerial AccountingHassan Malik100% (1)

- Chapter 10Document3 pagesChapter 10Michaela Francess Abrasado AbalosNo ratings yet

- Review Questions, Exercises and ProblemsDocument5 pagesReview Questions, Exercises and ProblemsChen HaoNo ratings yet

- Exam18Dez2015 2412MADocument10 pagesExam18Dez2015 2412MALabTec94No ratings yet

- CH 19 EOCDocument5 pagesCH 19 EOCilemana15No ratings yet

- ACT 5060 MidtermDocument20 pagesACT 5060 MidtermAarti JNo ratings yet

- As 462Document6 pagesAs 462ziabuttNo ratings yet

- Work Sheet AcctDocument5 pagesWork Sheet Acctaterefemelaku29No ratings yet

- F5 2013 Dec Q PDFDocument7 pagesF5 2013 Dec Q PDFcatcat1122No ratings yet

- Cost and Managerial Accounting I AssignmentDocument4 pagesCost and Managerial Accounting I AssignmentYared AddiseNo ratings yet

- Manufacturing AccountDocument15 pagesManufacturing Accountbalachmalik50% (2)

- ACC 210 - CH 19 EOC AssignmentDocument5 pagesACC 210 - CH 19 EOC Assignmentilemana15No ratings yet

- Modul Praktikum Akuntansi Manajerial IiDocument53 pagesModul Praktikum Akuntansi Manajerial IiMeila Dayani Adinata MeyNo ratings yet

- 11 Capital Expenditure N Revenue ExpenditureDocument4 pages11 Capital Expenditure N Revenue ExpenditureJosslin ThomasNo ratings yet

- Day 4 Chap 1 Rev. FI5 Ex PR PDFDocument7 pagesDay 4 Chap 1 Rev. FI5 Ex PR PDFJoannaNo ratings yet

- F5 CKT Mock1Document8 pagesF5 CKT Mock1OMID_JJNo ratings yet

- EXAM-223 1 To 3Document9 pagesEXAM-223 1 To 3Nicole KimNo ratings yet

- Cagayan State University - AndrewsDocument4 pagesCagayan State University - AndrewsWynie AreolaNo ratings yet

- 11 Capital Expenditure N Revenue ExpenditureDocument4 pages11 Capital Expenditure N Revenue ExpenditureElton AustinNo ratings yet

- Cost I Assignment 2023Document2 pagesCost I Assignment 2023danielnebeyat7No ratings yet

- t4 2008 Dec QDocument8 pagest4 2008 Dec QShimera RamoutarNo ratings yet

- Final Exam AkmenlanDocument12 pagesFinal Exam AkmenlanThomas DelongeNo ratings yet

- Tutorial Questions-SolvedDocument9 pagesTutorial Questions-SolvedRami RRKNo ratings yet

- 2-4 2004 Jun QDocument11 pages2-4 2004 Jun QAjay TakiarNo ratings yet

- Acca QNSDocument10 pagesAcca QNSIshmael OneyaNo ratings yet

- Prelim ExaminationDocument4 pagesPrelim ExaminationEllen Gold PalmaNo ratings yet

- Cost Ac Rante Chap 1Document17 pagesCost Ac Rante Chap 1Charlene Baldera0% (2)

- Acc101 Probset4Document7 pagesAcc101 Probset4Megan LoNo ratings yet

- Problem 1 (Cost Classification) : Cost Description Cost ObjectDocument4 pagesProblem 1 (Cost Classification) : Cost Description Cost ObjectMARY JUSTINE PAQUIBOTNo ratings yet

- Quiz For Finals For PrintingDocument4 pagesQuiz For Finals For PrintingPopol KupaNo ratings yet

- 9706 s16 QP 22 PDFDocument16 pages9706 s16 QP 22 PDFFarrukhsgNo ratings yet

- Illustrative Exercises On Cost Terms and BehaviorDocument7 pagesIllustrative Exercises On Cost Terms and BehaviorTherence LaguaNo ratings yet

- Sample Questions Part 2 - Feb08 (Web)Document15 pagesSample Questions Part 2 - Feb08 (Web)AccountingLegal AccountingLegalNo ratings yet

- F2 Mock 2Document12 pagesF2 Mock 2Areeba alyNo ratings yet

- Chapter 7 Financial EvaluationDocument16 pagesChapter 7 Financial EvaluationMersha KassayeNo ratings yet

- November 2018 Professional Examinations Management Accounting (Paper 2.2) Chief Examiner'S Report, Questions and Marking SchemeDocument20 pagesNovember 2018 Professional Examinations Management Accounting (Paper 2.2) Chief Examiner'S Report, Questions and Marking SchemeJoseph PhaustineNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Policies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportFrom EverandPolicies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportNo ratings yet

- Investments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsFrom EverandInvestments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsNo ratings yet

- Natural History of Parkinson's DiseaseDocument49 pagesNatural History of Parkinson's DiseaseScribdTranslationsNo ratings yet

- Abbreviated File-Process Case 01 Marco A. and CounterclaimDocument25 pagesAbbreviated File-Process Case 01 Marco A. and CounterclaimScribdTranslationsNo ratings yet

- Application of Copper Sulfate in AquacultureDocument2 pagesApplication of Copper Sulfate in AquacultureScribdTranslationsNo ratings yet

- Ethnicity, Language and IdentityDocument4 pagesEthnicity, Language and IdentityScribdTranslationsNo ratings yet

- Chapter X. Precision Shooting From Naval Air PlatformsDocument24 pagesChapter X. Precision Shooting From Naval Air PlatformsScribdTranslationsNo ratings yet

- Retirement Instructions Unemployment PorvenirDocument6 pagesRetirement Instructions Unemployment PorvenirScribdTranslationsNo ratings yet

- Musical Instruments of EuropeDocument3 pagesMusical Instruments of EuropeScribdTranslationsNo ratings yet

- Project On Electricity For ChildrenDocument13 pagesProject On Electricity For ChildrenScribdTranslationsNo ratings yet

- SYLLABUS Mechanical Drawing 2Document7 pagesSYLLABUS Mechanical Drawing 2ScribdTranslationsNo ratings yet

- Practical Work The Familiar PDFDocument1 pagePractical Work The Familiar PDFScribdTranslationsNo ratings yet

- 5th Grade Plan - Block 4 GeographyDocument12 pages5th Grade Plan - Block 4 GeographyScribdTranslationsNo ratings yet

- History and Evolution of Reciprocating MotorsDocument32 pagesHistory and Evolution of Reciprocating MotorsScribdTranslationsNo ratings yet

- Tourist PlanningDocument39 pagesTourist PlanningScribdTranslationsNo ratings yet

- Sixth Grade Reading Comprehension AssessmentDocument8 pagesSixth Grade Reading Comprehension AssessmentScribdTranslationsNo ratings yet

- Boxing PDFDocument49 pagesBoxing PDFScribdTranslationsNo ratings yet

- Reading Comprehension and Contextual Vocabulary Exercises 4th Middle #8.Document5 pagesReading Comprehension and Contextual Vocabulary Exercises 4th Middle #8.ScribdTranslationsNo ratings yet

- Comparative Table of Rationalism and EmpiricismDocument7 pagesComparative Table of Rationalism and EmpiricismScribdTranslationsNo ratings yet

- iTEP in - House PDFDocument12 pagesiTEP in - House PDFScribdTranslationsNo ratings yet

- PH Portfolio Recovery ProposalDocument3 pagesPH Portfolio Recovery ProposalScribdTranslationsNo ratings yet

- Legal Aspects GuatemalaDocument20 pagesLegal Aspects GuatemalaScribdTranslationsNo ratings yet

- Expo22 Daily ExperienceDocument6 pagesExpo22 Daily ExperienceScribdTranslationsNo ratings yet

- Application of Regulations in The Financial SystemDocument74 pagesApplication of Regulations in The Financial SystemScribdTranslationsNo ratings yet

- Driver's Manual in TexasDocument109 pagesDriver's Manual in TexasScribdTranslationsNo ratings yet

- Vibrational Sound Therapy ManualDocument12 pagesVibrational Sound Therapy ManualScribdTranslationsNo ratings yet

- Applied StatisticsDocument209 pagesApplied StatisticsScribdTranslationsNo ratings yet

- Chemistry Laboratory Report 1Document14 pagesChemistry Laboratory Report 1ScribdTranslationsNo ratings yet

- Examples of Operant ConditioningDocument1 pageExamples of Operant ConditioningScribdTranslationsNo ratings yet

- Security of Accounting Information SystemsDocument2 pagesSecurity of Accounting Information SystemsScribdTranslationsNo ratings yet

- Types of Banks Based On OwnershipDocument2 pagesTypes of Banks Based On OwnershipScribdTranslationsNo ratings yet

- Event Security ProtocolDocument7 pagesEvent Security ProtocolScribdTranslationsNo ratings yet

- "How Well Am I Doing?" Statement of Cash Flows: Mcgraw-Hill/IrwinDocument23 pages"How Well Am I Doing?" Statement of Cash Flows: Mcgraw-Hill/Irwinrayjoshua12No ratings yet

- 38 RfwrfwerDocument20 pages38 Rfwrfwerkareem abozeedNo ratings yet

- Section A Questions CVP AnalysisDocument3 pagesSection A Questions CVP Analysismaharajabby81No ratings yet

- Corporate Accounting Solved Mcqs Set 15Document6 pagesCorporate Accounting Solved Mcqs Set 15Bhupendra Gocher0% (1)

- Chapter 9 Cost of CapitalDocument39 pagesChapter 9 Cost of CapitalPapa ZolaNo ratings yet

- Cost and Management Accouting PDFDocument472 pagesCost and Management Accouting PDFMaxwell chanda100% (1)

- 7th Pylon Cup Final Round SGVDocument11 pages7th Pylon Cup Final Round SGVrcaa04No ratings yet

- Mathias Schmit-Document 4-Introduction To Financial Analysis (Cash Flow Statement)Document6 pagesMathias Schmit-Document 4-Introduction To Financial Analysis (Cash Flow Statement)mathieu652540No ratings yet

- Financial Management - PPT - 2011Document183 pagesFinancial Management - PPT - 2011ashpika100% (1)

- Translation of Financial Statements of Foreign AffiliatesDocument37 pagesTranslation of Financial Statements of Foreign AffiliateschristoperedwinNo ratings yet

- Research Report of Masood Roomi FabricDocument5 pagesResearch Report of Masood Roomi FabricWaqas AkramNo ratings yet

- Prequalifying Exam Level 2 3 Set B FSUU AccountingDocument9 pagesPrequalifying Exam Level 2 3 Set B FSUU AccountingRobert CastilloNo ratings yet

- Pre-Test Basic FinanceDocument3 pagesPre-Test Basic FinanceMoraya P. CacliniNo ratings yet

- BFF2140 TUTORIAL SET 04 - Additional Problem - SolutionsDocument12 pagesBFF2140 TUTORIAL SET 04 - Additional Problem - SolutionsTrung ĐàmNo ratings yet

- Management AccountingDocument18 pagesManagement AccountingmayankNo ratings yet

- Practice Set-Inventory (THEORY)Document5 pagesPractice Set-Inventory (THEORY)polxrixNo ratings yet

- ACCOUNT Tally Busy PDDDocument60 pagesACCOUNT Tally Busy PDDanime75031No ratings yet

- Adv Ac Case Based MCQs PSB @CAInterLegendsDocument27 pagesAdv Ac Case Based MCQs PSB @CAInterLegendsgouravsah2003No ratings yet

- CFAS Chapter 2-7 Conceptual FrameworkDocument3 pagesCFAS Chapter 2-7 Conceptual FrameworkKaren CaelNo ratings yet

- Shimingken Trading Co. Case StudyDocument7 pagesShimingken Trading Co. Case StudyJulia Oh100% (1)

- Dillutive Securities Earnings Per SharesDocument10 pagesDillutive Securities Earnings Per SharesRAden Altaf Wibowo PutraNo ratings yet

- E25-2 Compute Standard Materials Costs: InstructionsDocument32 pagesE25-2 Compute Standard Materials Costs: InstructionsAstha GoplaniNo ratings yet

- Analyisis Report Tesla Statement of ConditionDocument13 pagesAnalyisis Report Tesla Statement of ConditionAmel BarghutiNo ratings yet

- Accounting For Corporate Combinations and Associations Australian 7th Edition Arthur Solutions ManualDocument44 pagesAccounting For Corporate Combinations and Associations Australian 7th Edition Arthur Solutions ManualAdrianHayescgide100% (20)

- Dnyansagar Institute of Management and Research: NotesDocument77 pagesDnyansagar Institute of Management and Research: NotesPankaj KulkarniNo ratings yet

- Topic 1 - Inclass ActivitiesDocument4 pagesTopic 1 - Inclass Activitiescat chiNo ratings yet