Professional Documents

Culture Documents

Illustrative Problems Non Discounted Techniques

Illustrative Problems Non Discounted Techniques

Uploaded by

animeilaaaaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Illustrative Problems Non Discounted Techniques

Illustrative Problems Non Discounted Techniques

Uploaded by

animeilaaaaCopyright:

Available Formats

ILLUSTRATIVE PROBLEMS - NON DISCOUNTED TECHNIQUES

JANE BUS LINER INC. is planning to install vending machines with a cost of 300,000. It is

estimated that these vending machines will generate annual sales of 20,000 cups with price of

P10 per cup. Cash variable cost amounted to P4 cup while cash fixed cost are expected to be at

50,000 per year. The estimated economic useful life of the vending machine would be 5 years

with a salvage value of 50,000 and depreciated using straight line method. JBL Inc is subject to

20% income tax rate.

REQUIRED:

1. Determine the payback period.

2. Determine the accounting rate of return based on:

a. Original investment

b. Average investment

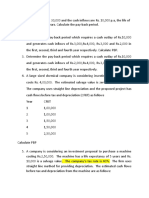

Jean Company purchased a new machine on January 1, 2024 for 180,000 with an estimated

useful life of 5 years and a salvage value of 10,000. The machine will be depreciated using

straight line method. The machine is expected to produce the following cash flow from

operations, net of income taxes:

YEAR AMOUNT

1 60,000

2 70,000

3 80,000

4 70,000

5 60,000

The new machine’s salvage value is 20,000 in years 1 and 2, and 15,000 in years 3 and 4.

REQUIRED:

1. Determine the payback period.

2. Determine the bail out period.

You might also like

- Question of Capital BudgetingDocument7 pagesQuestion of Capital Budgeting29_ramesh170100% (2)

- 2 Illustrative Problems Non Discounted TechniquesDocument3 pages2 Illustrative Problems Non Discounted TechniquesanimeilaaaaNo ratings yet

- Capital BudgetingDocument2 pagesCapital BudgetingEdmon ManalotoNo ratings yet

- Capital Budgeting Decisions - NON DISCOUNTING TECHNIQUESDocument2 pagesCapital Budgeting Decisions - NON DISCOUNTING TECHNIQUESPreethi VNo ratings yet

- Capital Budgeting For MSC Finance Basic Revision SumsDocument5 pagesCapital Budgeting For MSC Finance Basic Revision SumskimjethaNo ratings yet

- FM - Assignment 2 (Capital Budgeting) - 2019-2021Document3 pagesFM - Assignment 2 (Capital Budgeting) - 2019-2021dangerous saif100% (1)

- Capital Budgeting Class AssignmentDocument1 pageCapital Budgeting Class AssignmentAbdul Motaleb SaikiaNo ratings yet

- Capital Budgeting 1Document3 pagesCapital Budgeting 1maha SriNo ratings yet

- Assignment Problems On Cap BudDocument3 pagesAssignment Problems On Cap BudSunil TripathiNo ratings yet

- Mock TestDocument7 pagesMock TestShivaji hariNo ratings yet

- NPV SumsDocument2 pagesNPV SumsSunitha RamNo ratings yet

- Quiz On Cap BudgDocument3 pagesQuiz On Cap BudgjjjjjjjjNo ratings yet

- Capital Budgeting ProblemsDocument2 pagesCapital Budgeting Problemsvijayadarshini vNo ratings yet

- Test Series: October, 2020 Mock Test Paper Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingDocument7 pagesTest Series: October, 2020 Mock Test Paper Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingAruna RajappaNo ratings yet

- Cap BudgetingggDocument3 pagesCap BudgetingggSiva SankariNo ratings yet

- Fundamentals of Financial Management All Questions Are Compulsory Students Have To Upload The Scanned Solution On TEAMSDocument3 pagesFundamentals of Financial Management All Questions Are Compulsory Students Have To Upload The Scanned Solution On TEAMSlolik soli100% (1)

- Sem4 qp2Document2 pagesSem4 qp2iyerchandraNo ratings yet

- 10 Capital Budgetting Techniques of Evolution PDFDocument57 pages10 Capital Budgetting Techniques of Evolution PDFVishesh GuptaNo ratings yet

- Perunthalaivar Kamarajar Arts College Department of Commerce Practice Set - 1 Management Accounting - IiDocument4 pagesPerunthalaivar Kamarajar Arts College Department of Commerce Practice Set - 1 Management Accounting - IiAlbert JulieNo ratings yet

- Chap 5Document1 pageChap 5duyanhhh20103No ratings yet

- Capital BudgetingDocument4 pagesCapital BudgetingShaji Kutty0% (1)

- Capital Budgeting-ProblemsDocument5 pagesCapital Budgeting-ProblemsUday Gowda50% (2)

- Financial Management - II CA QPDocument4 pagesFinancial Management - II CA QPSivaramkrishna KasilingamNo ratings yet

- Acc. For D.M. MQP April 2021Document4 pagesAcc. For D.M. MQP April 2021Rohith RNo ratings yet

- Capital BudgetingDocument21 pagesCapital BudgetingBISHAL ROYNo ratings yet

- 620669c280570504de6f585f Office DocumentDocument3 pages620669c280570504de6f585f Office DocumentParas RastogiNo ratings yet

- Financial Maths II TUTORIALSDocument18 pagesFinancial Maths II TUTORIALSPelah Wowen DanielNo ratings yet

- 2accounting Questions Nov Dec 2019 CL PDFDocument3 pages2accounting Questions Nov Dec 2019 CL PDFRazib Das RaazNo ratings yet

- Capital Budgeting Problems 1Document5 pagesCapital Budgeting Problems 1Juber AhamadNo ratings yet

- Numericals On Capital Budgeting TechniquesDocument5 pagesNumericals On Capital Budgeting TechniquesKritikaNo ratings yet

- Mefa Question BankDocument6 pagesMefa Question BankShaik ZubayrNo ratings yet

- Exercise 8 (11 Jan 2023)Document2 pagesExercise 8 (11 Jan 2023)Teo ShengNo ratings yet

- Corrporate ModelDocument10 pagesCorrporate Modelnithinjoseph562005No ratings yet

- Jaya College of Arts and Science Department of ManagDocument4 pagesJaya College of Arts and Science Department of ManagMythili KarthikeyanNo ratings yet

- CH 3 - ProblemsDocument7 pagesCH 3 - ProblemsEspace NuvemNo ratings yet

- Investment DecisionsDocument4 pagesInvestment DecisionsDevadutt M.SNo ratings yet

- Capital Budgeting Exercise1Document14 pagesCapital Budgeting Exercise1rohini jha0% (1)

- Investment Decisions Problems 2Document5 pagesInvestment Decisions Problems 2MussaNo ratings yet

- Capital BudgetingDocument9 pagesCapital BudgetingAnoop SinghNo ratings yet

- Sunil Panda Commerce Classes (SPCC) Accounts Term 2 Day 1 Home Work For PracticeDocument2 pagesSunil Panda Commerce Classes (SPCC) Accounts Term 2 Day 1 Home Work For PracticeHarsh MishraNo ratings yet

- A-3 Capital BudgetingDocument4 pagesA-3 Capital BudgetingUTkarsh DOgraNo ratings yet

- Capital Budgeting ActivityDocument2 pagesCapital Budgeting ActivityKrNo ratings yet

- ) of The Two Projects and Suggest Which of The Two Projects Should Be Accepted Assuming A Discount Rate of 10%Document4 pages) of The Two Projects and Suggest Which of The Two Projects Should Be Accepted Assuming A Discount Rate of 10%kfbhgikNo ratings yet

- Corporate Accounting Imp QuestionsDocument10 pagesCorporate Accounting Imp QuestionsbalachandranharipriyaNo ratings yet

- Capital Budgeting CW FMPDocument6 pagesCapital Budgeting CW FMPSufyan Ashraf100% (1)

- Capital Budgeting ExercisesDocument5 pagesCapital Budgeting ExercisesSophia ManglicmotNo ratings yet

- HW3MGT517Document3 pagesHW3MGT517Jaya PaudwalNo ratings yet

- Cap BudgetDocument20 pagesCap Budgetprachik87No ratings yet

- Tax H Question 2021Document3 pagesTax H Question 2021Aporupa BarNo ratings yet

- Unit 2 Problem SheetDocument9 pagesUnit 2 Problem SheetTejas ArgulewarNo ratings yet

- Answer ALL The Questions (10 2 20) Answer ALL The Questions (10 2 20) Answer ALL The Questions (10 2 20)Document4 pagesAnswer ALL The Questions (10 2 20) Answer ALL The Questions (10 2 20) Answer ALL The Questions (10 2 20)Harish KapoorNo ratings yet

- Ent 2Document4 pagesEnt 2lubaajamesNo ratings yet

- Numericals On Capital BudgetingDocument3 pagesNumericals On Capital BudgetingRevati ShindeNo ratings yet

- FM Capital Budgeting SumsDocument4 pagesFM Capital Budgeting SumsRahul GuptaNo ratings yet

- Test Series: August, 2018 Mock Test Paper - 1 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws & International TaxationDocument6 pagesTest Series: August, 2018 Mock Test Paper - 1 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws & International TaxationRobinxyNo ratings yet

- Practical Q - To PracticeDocument4 pagesPractical Q - To PracticeArjun JadhavNo ratings yet

- Capital Budgeting: Prepared By:-Priyanka GohilDocument44 pagesCapital Budgeting: Prepared By:-Priyanka GohilSunil PillaiNo ratings yet

- Investment Appraisal/capital Investment: Page 1 of 20Document20 pagesInvestment Appraisal/capital Investment: Page 1 of 20parwez_0505No ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet