Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

0 viewsBusiness and Transfer Taxation by Banggawan

Business and Transfer Taxation by Banggawan

Uploaded by

wktxlsrkfCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Business and Transfer Taxation by BanggawanDocument38 pagesBusiness and Transfer Taxation by BanggawanBryan Orbina Fruto67% (24)

- VAT - CPA Reviewer in Taxation - Enrico D. Tabag PDFDocument103 pagesVAT - CPA Reviewer in Taxation - Enrico D. Tabag PDFDGAENo ratings yet

- Restaurant Management SystemDocument4 pagesRestaurant Management SystemMansi ChaturvediNo ratings yet

- Vat Exempt SalesDocument4 pagesVat Exempt SalesEmma Mariz GarciaNo ratings yet

- Memorandum of Agreement-Gsi Rev1Document5 pagesMemorandum of Agreement-Gsi Rev1Melvin Jones100% (1)

- Business Taxation: - Back To BasicDocument56 pagesBusiness Taxation: - Back To BasicWearIt Co.No ratings yet

- Business Taxation: - Back To BasicDocument56 pagesBusiness Taxation: - Back To BasicWearIt Co.No ratings yet

- Business TaxesDocument98 pagesBusiness TaxesAbigailRefamonteNo ratings yet

- Vat-Exempt Transactions (Under TRAIN Law)Document2 pagesVat-Exempt Transactions (Under TRAIN Law)Fabiano JoeyNo ratings yet

- VAT Exempt TransactionsDocument4 pagesVAT Exempt TransactionsAndehl AguinaldoNo ratings yet

- Business and Transfer Taxes: Vat On ImportationDocument23 pagesBusiness and Transfer Taxes: Vat On ImportationAngelo Delos SantosNo ratings yet

- Whether Donation Is Taxable/Nontaxable Zero Rated/VAT Exempt/VAT Taxable 2 Problems On Donation 2 Problems On VATDocument7 pagesWhether Donation Is Taxable/Nontaxable Zero Rated/VAT Exempt/VAT Taxable 2 Problems On Donation 2 Problems On VATJape PreciaNo ratings yet

- Business & Transfer Taxation: Rex B. Banggawan, Cpa, MbaDocument38 pagesBusiness & Transfer Taxation: Rex B. Banggawan, Cpa, Mbajustine reine cornicoNo ratings yet

- Zero - Rated Sales: 0% VAT - Output VATDocument5 pagesZero - Rated Sales: 0% VAT - Output VATNerish PlazaNo ratings yet

- Exempt Sale of Goods ch4Document2 pagesExempt Sale of Goods ch4Marionne GNo ratings yet

- Introduction To Business Taxation, Exclusions and Other Percentage TaxDocument20 pagesIntroduction To Business Taxation, Exclusions and Other Percentage TaxDharel GannabanNo ratings yet

- Income Tax PowerpointDocument258 pagesIncome Tax PowerpointShara LynNo ratings yet

- Tax Notes Midterms PDFDocument27 pagesTax Notes Midterms PDFTae TaeNo ratings yet

- Bustax Chapter 8 PDFDocument11 pagesBustax Chapter 8 PDFPineda, Paula MarieNo ratings yet

- M3 Exempt Sales of Goods Properties & ServicesDocument27 pagesM3 Exempt Sales of Goods Properties & ServicesAlicia FelicianoNo ratings yet

- Business Taxes: Certified Accounting Technician NIAT Office 2015Document33 pagesBusiness Taxes: Certified Accounting Technician NIAT Office 2015Anonymous Lz2qH7No ratings yet

- Adzu Tax02 A Learning Packet 2 Value Added TaxDocument9 pagesAdzu Tax02 A Learning Packet 2 Value Added TaxJustine Paul Pangasi-an100% (1)

- Value Added Tax: A. Business TaxesDocument3 pagesValue Added Tax: A. Business TaxesNerish PlazaNo ratings yet

- Output Vat Zero-Rated Sales ch8Document3 pagesOutput Vat Zero-Rated Sales ch8Marionne GNo ratings yet

- Vat Exempt Transactions: Page 3 of 6Document4 pagesVat Exempt Transactions: Page 3 of 6Lei Anne GatdulaNo ratings yet

- Business Taxation: Rex B. Banggawan, Cpa, MbaDocument50 pagesBusiness Taxation: Rex B. Banggawan, Cpa, MbaAllyson VillalobosNo ratings yet

- Tax Consequences: No Output Tax Allowed and Seller IsDocument12 pagesTax Consequences: No Output Tax Allowed and Seller IsXerez SingsonNo ratings yet

- Module 1 & 2: at The End of This Topic, We Should Be Able To Learn The FollowingDocument33 pagesModule 1 & 2: at The End of This Topic, We Should Be Able To Learn The FollowingAlicia FelicianoNo ratings yet

- Subject To Vat (Nccidactee) : (Contribution Per Member P15,000 - VAT, Electric Cooperatives - VAT)Document13 pagesSubject To Vat (Nccidactee) : (Contribution Per Member P15,000 - VAT, Electric Cooperatives - VAT)Michael AquinoNo ratings yet

- Async 2022 VAT UPDATEDocument8 pagesAsync 2022 VAT UPDATEBogs QuitainNo ratings yet

- Business TaxesDocument47 pagesBusiness TaxesJoyce MorganNo ratings yet

- VAT Exempt SalesDocument5 pagesVAT Exempt SalesNEstandaNo ratings yet

- Business TaxesDocument23 pagesBusiness Taxesrayjoshua12No ratings yet

- vat exemptionDocument2 pagesvat exemptiontmiss5461No ratings yet

- Donors and VatDocument179 pagesDonors and VatGlino ClaudioNo ratings yet

- Sec. 109 VAT Exempt TransactionsDocument2 pagesSec. 109 VAT Exempt TransactionsDis Cat100% (1)

- Tax Ch6 VAT BinaluyoDocument6 pagesTax Ch6 VAT Binaluyomavrhyck.21No ratings yet

- Intro To Business TaxesDocument4 pagesIntro To Business TaxesHyascintheNo ratings yet

- 12 Value Added Taxes 1Document91 pages12 Value Added Taxes 1Vince ManahanNo ratings yet

- Value Added Tax ModuleDocument11 pagesValue Added Tax ModuleDaniella RachoNo ratings yet

- Political Economy ReviewerDocument10 pagesPolitical Economy ReviewerRaymon D'Lostreyes BadongenNo ratings yet

- ALL ABOUT VALUE ADDED TAX - Mamalateo 2014POWERMAXDocument37 pagesALL ABOUT VALUE ADDED TAX - Mamalateo 2014POWERMAXjohn apostolNo ratings yet

- VAT Exempt SalesDocument29 pagesVAT Exempt SalesNEstandaNo ratings yet

- Subject To VAT Subject To VAT 3) Real Property Utilized For Socialized Housing VAT ExemptDocument32 pagesSubject To VAT Subject To VAT 3) Real Property Utilized For Socialized Housing VAT ExemptNikka SanzNo ratings yet

- Lecture 5 - 2023Document39 pagesLecture 5 - 2023Lê Thiên Giang 2KT-19No ratings yet

- Tax3. Lecture 1 - Value Added Tax SCDocument40 pagesTax3. Lecture 1 - Value Added Tax SCsuzyshii 888No ratings yet

- Class 12th Macroeconomics National Income Accounting NoteesDocument106 pagesClass 12th Macroeconomics National Income Accounting Noteesishankishan8888No ratings yet

- Transfer and Business Taxation - MIDTERMDocument14 pagesTransfer and Business Taxation - MIDTERMYvette Pauline JovenNo ratings yet

- VAT Exempt SalesDocument14 pagesVAT Exempt SalesJuvanni SantosNo ratings yet

- Business TaxesDocument20 pagesBusiness TaxesAnime ScreenshotsNo ratings yet

- VALUE ADDED TAX ModuleDocument12 pagesVALUE ADDED TAX ModuleAngela VecinoNo ratings yet

- Tax Notes FinalDocument40 pagesTax Notes FinalKris LaraNo ratings yet

- Cottage Industries and VATDocument8 pagesCottage Industries and VATAdib TasnimNo ratings yet

- Exempt Versus Zero Rated TransactionsDocument20 pagesExempt Versus Zero Rated TransactionsRachel Pepito BaladjayNo ratings yet

- VAT Exempt Transactions (TRAIN Law)Document2 pagesVAT Exempt Transactions (TRAIN Law)Pau SantosNo ratings yet

- VAT NotesDocument8 pagesVAT NotesFayie De LunaNo ratings yet

- Tax 30222Document5 pagesTax 30222Ronariza BondocNo ratings yet

- Business ComDocument10 pagesBusiness Comjaneldelosreyes321No ratings yet

- TaxationDocument8 pagesTaxationChelsie BarreraNo ratings yet

- Donors and VatDocument179 pagesDonors and VatLayca Clarice Germino BrimbuelaNo ratings yet

- Business Transactions: VAT-Exempt and OPT-Exempt TransactionsDocument1 pageBusiness Transactions: VAT-Exempt and OPT-Exempt TransactionsLhorene Hope DueñasNo ratings yet

- Canadian International Taxation: Income Tax Rules for ResidentsFrom EverandCanadian International Taxation: Income Tax Rules for ResidentsNo ratings yet

- Human Resource CHAP 5Document1 pageHuman Resource CHAP 5wktxlsrkfNo ratings yet

- CostCon - Chapter 1Document2 pagesCostCon - Chapter 1wktxlsrkfNo ratings yet

- Intacc 3 - InterimDocument1 pageIntacc 3 - InterimwktxlsrkfNo ratings yet

- CostCon - Chapter 1Document1 pageCostCon - Chapter 1wktxlsrkfNo ratings yet

- CostCon - Chapter 1Document1 pageCostCon - Chapter 1wktxlsrkfNo ratings yet

- CostCon - Chapter 1Document2 pagesCostCon - Chapter 1wktxlsrkfNo ratings yet

- AFAR - QuickyDocument27 pagesAFAR - QuickywktxlsrkfNo ratings yet

- UCC MockBoardExam 2021 RFBT 100Document17 pagesUCC MockBoardExam 2021 RFBT 100Nah HamzaNo ratings yet

- Gestión Finan S12Document87 pagesGestión Finan S12Joseba OtaolaNo ratings yet

- Acccob3 Ra1 PDFDocument13 pagesAcccob3 Ra1 PDFKimi SantosNo ratings yet

- Growth ProspectDocument231 pagesGrowth ProspectTakangNixonEbotNo ratings yet

- Draft Subscription Agreement 27.01.22Document27 pagesDraft Subscription Agreement 27.01.22hedayet ullahNo ratings yet

- Performance Appraisal TemplateDocument9 pagesPerformance Appraisal Templateapi-301792844No ratings yet

- TheDocument12 pagesThecoolcat_bokaNo ratings yet

- Eva Deo-ReportDocument21 pagesEva Deo-ReportAthulya SajithNo ratings yet

- Sevvanthi Business Plan Development - 1Document33 pagesSevvanthi Business Plan Development - 1vsbarat89No ratings yet

- SEDEX - 2022ENZAA417943041-S-21 Apparels Ltd.-9007376-Periodic-SMETA-2 Pillar - ReportDocument77 pagesSEDEX - 2022ENZAA417943041-S-21 Apparels Ltd.-9007376-Periodic-SMETA-2 Pillar - ReportKazi Abdullah All MamunNo ratings yet

- Shelf Ready Packaging Toolkit 2017Document29 pagesShelf Ready Packaging Toolkit 2017Diep NguyenNo ratings yet

- Household Products LimitedDocument12 pagesHousehold Products LimitedAbhi KothariNo ratings yet

- CMA Class 1 A FDocument58 pagesCMA Class 1 A FRithesh KNo ratings yet

- Blackbook Project On Research On Credit Risk ManagementDocument97 pagesBlackbook Project On Research On Credit Risk Management998730372657% (7)

- Latihan Soal Consolidation of SOFP Dan SOPLDocument4 pagesLatihan Soal Consolidation of SOFP Dan SOPLRaihan Nabilah AzaliNo ratings yet

- Multi Sports FacilityDocument7 pagesMulti Sports FacilityDivyanshu ShekharNo ratings yet

- Is Mid Term Revision 2024 AnswersDocument15 pagesIs Mid Term Revision 2024 AnswersAhmed Abo nNo ratings yet

- Principles of Finance-Course-Orientation-Material v.2Document7 pagesPrinciples of Finance-Course-Orientation-Material v.2Justine Ashley SavetNo ratings yet

- Vision and Mission of National SavingsDocument1 pageVision and Mission of National SavingszumurdNo ratings yet

- 512 Case 1Document5 pages512 Case 1vikas singhNo ratings yet

- RMC No. 9-2023 Annex BDocument2 pagesRMC No. 9-2023 Annex BSean AndersonNo ratings yet

- R03 Quality Objectives and Action PlansDocument6 pagesR03 Quality Objectives and Action PlansMhyra BellezaNo ratings yet

- Team PRTC Aud-Finpb - 5.21Document14 pagesTeam PRTC Aud-Finpb - 5.21NananananaNo ratings yet

- Mba I Accounting For Management (14mba13) NotesDocument58 pagesMba I Accounting For Management (14mba13) NotesAnonymous 4lXDgDUkQ100% (2)

- Annex 19Document2 pagesAnnex 19hetalsangoiNo ratings yet

- Price and Output Determination Under Monopolistic OnDocument13 pagesPrice and Output Determination Under Monopolistic OnShoaib Ahmed KhosoNo ratings yet

- Multiple Choice Questions PearsonDocument3 pagesMultiple Choice Questions Pearsonmunirft100% (1)

- Politicas Ambiente Laboral AP12-EV04Document4 pagesPoliticas Ambiente Laboral AP12-EV04Caro ureña morenoNo ratings yet

Business and Transfer Taxation by Banggawan

Business and Transfer Taxation by Banggawan

Uploaded by

wktxlsrkf0 ratings0% found this document useful (0 votes)

0 views1 pageOriginal Title

Business and Transfer Taxation by Banggawan (2)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

0 views1 pageBusiness and Transfer Taxation by Banggawan

Business and Transfer Taxation by Banggawan

Uploaded by

wktxlsrkfCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

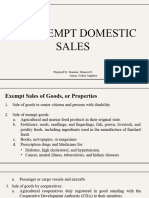

In short…

Exempt consumptions are: “A/M HERE RI2CS QT”

Exempt consumptions: a detailed look

● A/M food products –

- “In original state” means unprocessed foods for human consumption

- Food of things for ultimate human consumption

- Agricultural contract growers/millers

● Hospital services – within hospital, except:

- Sales of medicine

- Services of professionals

● Employment – this is not a business

● Regional Area Headquarter of Multinational company – this is not business

● Educational services – schools accredited by CHED, TESDA and or Dep-Ed

● Real Properties

- Sale of real properties

➔ by non-dealers (casual sale)

➔ By dealers of:

➢ low-cost housing units (P180,000 and P450,000)

➢ socialized housing units (P750,000)

➢ residential lots (P1,919,500)

➢ residential dwellings (P3,199,200)

- Lease of residence – rental per unit per month do not exceed P12,800

● International/Domestic sea or air carriers

- Sale/importation/lease – aircraft, sea vessels, machineries, equipments and spare parts

● Cooperatives – all cooperatives of any forms so long as with a CGS, except electric cooperatives

● Quasi-Importation

- Importation of personal, household effects and professional instruments belonging to non residents

coming to settle in the Philippines

- Importation of fuel or supplies by persons engaged in international transport operations

THE VAT ON IMPORTATION

- All importations not falling under exempt importation under A/M HERE RI2CS QT are subject to 12% VAT on

landed cost

BUSINESS TAXATION

The Business Concept: “HABITUAL ENGAGEMENT IN A COMMERCIAL ACTIVITY.”

What business tax to pay?

- List of services/entities specifically subject to percentage taxes (BICAP FLOW)

- Other sellers of goods or services are VATABLE

Mnemonics: BICAP FLOW

- Banks

- International carriers

- Common carriers

- Certain amusement places

- PSE sales

- Franchises

- Life Insurance

- Overseas Communication

- Winnings

What is VATABLE?

- “Vatable” means subject to the VAT on sales if the person is VAT-registered or VAT registrable.

- A VAT-registrable person is a person who exceeded the VAT threshold

-

You might also like

- Business and Transfer Taxation by BanggawanDocument38 pagesBusiness and Transfer Taxation by BanggawanBryan Orbina Fruto67% (24)

- VAT - CPA Reviewer in Taxation - Enrico D. Tabag PDFDocument103 pagesVAT - CPA Reviewer in Taxation - Enrico D. Tabag PDFDGAENo ratings yet

- Restaurant Management SystemDocument4 pagesRestaurant Management SystemMansi ChaturvediNo ratings yet

- Vat Exempt SalesDocument4 pagesVat Exempt SalesEmma Mariz GarciaNo ratings yet

- Memorandum of Agreement-Gsi Rev1Document5 pagesMemorandum of Agreement-Gsi Rev1Melvin Jones100% (1)

- Business Taxation: - Back To BasicDocument56 pagesBusiness Taxation: - Back To BasicWearIt Co.No ratings yet

- Business Taxation: - Back To BasicDocument56 pagesBusiness Taxation: - Back To BasicWearIt Co.No ratings yet

- Business TaxesDocument98 pagesBusiness TaxesAbigailRefamonteNo ratings yet

- Vat-Exempt Transactions (Under TRAIN Law)Document2 pagesVat-Exempt Transactions (Under TRAIN Law)Fabiano JoeyNo ratings yet

- VAT Exempt TransactionsDocument4 pagesVAT Exempt TransactionsAndehl AguinaldoNo ratings yet

- Business and Transfer Taxes: Vat On ImportationDocument23 pagesBusiness and Transfer Taxes: Vat On ImportationAngelo Delos SantosNo ratings yet

- Whether Donation Is Taxable/Nontaxable Zero Rated/VAT Exempt/VAT Taxable 2 Problems On Donation 2 Problems On VATDocument7 pagesWhether Donation Is Taxable/Nontaxable Zero Rated/VAT Exempt/VAT Taxable 2 Problems On Donation 2 Problems On VATJape PreciaNo ratings yet

- Business & Transfer Taxation: Rex B. Banggawan, Cpa, MbaDocument38 pagesBusiness & Transfer Taxation: Rex B. Banggawan, Cpa, Mbajustine reine cornicoNo ratings yet

- Zero - Rated Sales: 0% VAT - Output VATDocument5 pagesZero - Rated Sales: 0% VAT - Output VATNerish PlazaNo ratings yet

- Exempt Sale of Goods ch4Document2 pagesExempt Sale of Goods ch4Marionne GNo ratings yet

- Introduction To Business Taxation, Exclusions and Other Percentage TaxDocument20 pagesIntroduction To Business Taxation, Exclusions and Other Percentage TaxDharel GannabanNo ratings yet

- Income Tax PowerpointDocument258 pagesIncome Tax PowerpointShara LynNo ratings yet

- Tax Notes Midterms PDFDocument27 pagesTax Notes Midterms PDFTae TaeNo ratings yet

- Bustax Chapter 8 PDFDocument11 pagesBustax Chapter 8 PDFPineda, Paula MarieNo ratings yet

- M3 Exempt Sales of Goods Properties & ServicesDocument27 pagesM3 Exempt Sales of Goods Properties & ServicesAlicia FelicianoNo ratings yet

- Business Taxes: Certified Accounting Technician NIAT Office 2015Document33 pagesBusiness Taxes: Certified Accounting Technician NIAT Office 2015Anonymous Lz2qH7No ratings yet

- Adzu Tax02 A Learning Packet 2 Value Added TaxDocument9 pagesAdzu Tax02 A Learning Packet 2 Value Added TaxJustine Paul Pangasi-an100% (1)

- Value Added Tax: A. Business TaxesDocument3 pagesValue Added Tax: A. Business TaxesNerish PlazaNo ratings yet

- Output Vat Zero-Rated Sales ch8Document3 pagesOutput Vat Zero-Rated Sales ch8Marionne GNo ratings yet

- Vat Exempt Transactions: Page 3 of 6Document4 pagesVat Exempt Transactions: Page 3 of 6Lei Anne GatdulaNo ratings yet

- Business Taxation: Rex B. Banggawan, Cpa, MbaDocument50 pagesBusiness Taxation: Rex B. Banggawan, Cpa, MbaAllyson VillalobosNo ratings yet

- Tax Consequences: No Output Tax Allowed and Seller IsDocument12 pagesTax Consequences: No Output Tax Allowed and Seller IsXerez SingsonNo ratings yet

- Module 1 & 2: at The End of This Topic, We Should Be Able To Learn The FollowingDocument33 pagesModule 1 & 2: at The End of This Topic, We Should Be Able To Learn The FollowingAlicia FelicianoNo ratings yet

- Subject To Vat (Nccidactee) : (Contribution Per Member P15,000 - VAT, Electric Cooperatives - VAT)Document13 pagesSubject To Vat (Nccidactee) : (Contribution Per Member P15,000 - VAT, Electric Cooperatives - VAT)Michael AquinoNo ratings yet

- Async 2022 VAT UPDATEDocument8 pagesAsync 2022 VAT UPDATEBogs QuitainNo ratings yet

- Business TaxesDocument47 pagesBusiness TaxesJoyce MorganNo ratings yet

- VAT Exempt SalesDocument5 pagesVAT Exempt SalesNEstandaNo ratings yet

- Business TaxesDocument23 pagesBusiness Taxesrayjoshua12No ratings yet

- vat exemptionDocument2 pagesvat exemptiontmiss5461No ratings yet

- Donors and VatDocument179 pagesDonors and VatGlino ClaudioNo ratings yet

- Sec. 109 VAT Exempt TransactionsDocument2 pagesSec. 109 VAT Exempt TransactionsDis Cat100% (1)

- Tax Ch6 VAT BinaluyoDocument6 pagesTax Ch6 VAT Binaluyomavrhyck.21No ratings yet

- Intro To Business TaxesDocument4 pagesIntro To Business TaxesHyascintheNo ratings yet

- 12 Value Added Taxes 1Document91 pages12 Value Added Taxes 1Vince ManahanNo ratings yet

- Value Added Tax ModuleDocument11 pagesValue Added Tax ModuleDaniella RachoNo ratings yet

- Political Economy ReviewerDocument10 pagesPolitical Economy ReviewerRaymon D'Lostreyes BadongenNo ratings yet

- ALL ABOUT VALUE ADDED TAX - Mamalateo 2014POWERMAXDocument37 pagesALL ABOUT VALUE ADDED TAX - Mamalateo 2014POWERMAXjohn apostolNo ratings yet

- VAT Exempt SalesDocument29 pagesVAT Exempt SalesNEstandaNo ratings yet

- Subject To VAT Subject To VAT 3) Real Property Utilized For Socialized Housing VAT ExemptDocument32 pagesSubject To VAT Subject To VAT 3) Real Property Utilized For Socialized Housing VAT ExemptNikka SanzNo ratings yet

- Lecture 5 - 2023Document39 pagesLecture 5 - 2023Lê Thiên Giang 2KT-19No ratings yet

- Tax3. Lecture 1 - Value Added Tax SCDocument40 pagesTax3. Lecture 1 - Value Added Tax SCsuzyshii 888No ratings yet

- Class 12th Macroeconomics National Income Accounting NoteesDocument106 pagesClass 12th Macroeconomics National Income Accounting Noteesishankishan8888No ratings yet

- Transfer and Business Taxation - MIDTERMDocument14 pagesTransfer and Business Taxation - MIDTERMYvette Pauline JovenNo ratings yet

- VAT Exempt SalesDocument14 pagesVAT Exempt SalesJuvanni SantosNo ratings yet

- Business TaxesDocument20 pagesBusiness TaxesAnime ScreenshotsNo ratings yet

- VALUE ADDED TAX ModuleDocument12 pagesVALUE ADDED TAX ModuleAngela VecinoNo ratings yet

- Tax Notes FinalDocument40 pagesTax Notes FinalKris LaraNo ratings yet

- Cottage Industries and VATDocument8 pagesCottage Industries and VATAdib TasnimNo ratings yet

- Exempt Versus Zero Rated TransactionsDocument20 pagesExempt Versus Zero Rated TransactionsRachel Pepito BaladjayNo ratings yet

- VAT Exempt Transactions (TRAIN Law)Document2 pagesVAT Exempt Transactions (TRAIN Law)Pau SantosNo ratings yet

- VAT NotesDocument8 pagesVAT NotesFayie De LunaNo ratings yet

- Tax 30222Document5 pagesTax 30222Ronariza BondocNo ratings yet

- Business ComDocument10 pagesBusiness Comjaneldelosreyes321No ratings yet

- TaxationDocument8 pagesTaxationChelsie BarreraNo ratings yet

- Donors and VatDocument179 pagesDonors and VatLayca Clarice Germino BrimbuelaNo ratings yet

- Business Transactions: VAT-Exempt and OPT-Exempt TransactionsDocument1 pageBusiness Transactions: VAT-Exempt and OPT-Exempt TransactionsLhorene Hope DueñasNo ratings yet

- Canadian International Taxation: Income Tax Rules for ResidentsFrom EverandCanadian International Taxation: Income Tax Rules for ResidentsNo ratings yet

- Human Resource CHAP 5Document1 pageHuman Resource CHAP 5wktxlsrkfNo ratings yet

- CostCon - Chapter 1Document2 pagesCostCon - Chapter 1wktxlsrkfNo ratings yet

- Intacc 3 - InterimDocument1 pageIntacc 3 - InterimwktxlsrkfNo ratings yet

- CostCon - Chapter 1Document1 pageCostCon - Chapter 1wktxlsrkfNo ratings yet

- CostCon - Chapter 1Document1 pageCostCon - Chapter 1wktxlsrkfNo ratings yet

- CostCon - Chapter 1Document2 pagesCostCon - Chapter 1wktxlsrkfNo ratings yet

- AFAR - QuickyDocument27 pagesAFAR - QuickywktxlsrkfNo ratings yet

- UCC MockBoardExam 2021 RFBT 100Document17 pagesUCC MockBoardExam 2021 RFBT 100Nah HamzaNo ratings yet

- Gestión Finan S12Document87 pagesGestión Finan S12Joseba OtaolaNo ratings yet

- Acccob3 Ra1 PDFDocument13 pagesAcccob3 Ra1 PDFKimi SantosNo ratings yet

- Growth ProspectDocument231 pagesGrowth ProspectTakangNixonEbotNo ratings yet

- Draft Subscription Agreement 27.01.22Document27 pagesDraft Subscription Agreement 27.01.22hedayet ullahNo ratings yet

- Performance Appraisal TemplateDocument9 pagesPerformance Appraisal Templateapi-301792844No ratings yet

- TheDocument12 pagesThecoolcat_bokaNo ratings yet

- Eva Deo-ReportDocument21 pagesEva Deo-ReportAthulya SajithNo ratings yet

- Sevvanthi Business Plan Development - 1Document33 pagesSevvanthi Business Plan Development - 1vsbarat89No ratings yet

- SEDEX - 2022ENZAA417943041-S-21 Apparels Ltd.-9007376-Periodic-SMETA-2 Pillar - ReportDocument77 pagesSEDEX - 2022ENZAA417943041-S-21 Apparels Ltd.-9007376-Periodic-SMETA-2 Pillar - ReportKazi Abdullah All MamunNo ratings yet

- Shelf Ready Packaging Toolkit 2017Document29 pagesShelf Ready Packaging Toolkit 2017Diep NguyenNo ratings yet

- Household Products LimitedDocument12 pagesHousehold Products LimitedAbhi KothariNo ratings yet

- CMA Class 1 A FDocument58 pagesCMA Class 1 A FRithesh KNo ratings yet

- Blackbook Project On Research On Credit Risk ManagementDocument97 pagesBlackbook Project On Research On Credit Risk Management998730372657% (7)

- Latihan Soal Consolidation of SOFP Dan SOPLDocument4 pagesLatihan Soal Consolidation of SOFP Dan SOPLRaihan Nabilah AzaliNo ratings yet

- Multi Sports FacilityDocument7 pagesMulti Sports FacilityDivyanshu ShekharNo ratings yet

- Is Mid Term Revision 2024 AnswersDocument15 pagesIs Mid Term Revision 2024 AnswersAhmed Abo nNo ratings yet

- Principles of Finance-Course-Orientation-Material v.2Document7 pagesPrinciples of Finance-Course-Orientation-Material v.2Justine Ashley SavetNo ratings yet

- Vision and Mission of National SavingsDocument1 pageVision and Mission of National SavingszumurdNo ratings yet

- 512 Case 1Document5 pages512 Case 1vikas singhNo ratings yet

- RMC No. 9-2023 Annex BDocument2 pagesRMC No. 9-2023 Annex BSean AndersonNo ratings yet

- R03 Quality Objectives and Action PlansDocument6 pagesR03 Quality Objectives and Action PlansMhyra BellezaNo ratings yet

- Team PRTC Aud-Finpb - 5.21Document14 pagesTeam PRTC Aud-Finpb - 5.21NananananaNo ratings yet

- Mba I Accounting For Management (14mba13) NotesDocument58 pagesMba I Accounting For Management (14mba13) NotesAnonymous 4lXDgDUkQ100% (2)

- Annex 19Document2 pagesAnnex 19hetalsangoiNo ratings yet

- Price and Output Determination Under Monopolistic OnDocument13 pagesPrice and Output Determination Under Monopolistic OnShoaib Ahmed KhosoNo ratings yet

- Multiple Choice Questions PearsonDocument3 pagesMultiple Choice Questions Pearsonmunirft100% (1)

- Politicas Ambiente Laboral AP12-EV04Document4 pagesPoliticas Ambiente Laboral AP12-EV04Caro ureña morenoNo ratings yet