Professional Documents

Culture Documents

Bibhuti Sahu Salary 2024

Bibhuti Sahu Salary 2024

Uploaded by

bibhutisahu23Copyright:

Available Formats

You might also like

- CMA Part 1 Hock Essay QuestionsDocument74 pagesCMA Part 1 Hock Essay QuestionsAbhishek Goyal100% (5)

- Payslip For The Month of January 2023: CRM Services India Private LimitedDocument1 pagePayslip For The Month of January 2023: CRM Services India Private Limitednaman porwalNo ratings yet

- Ganpact CompanyDocument1 pageGanpact CompanyAsmin Sultana Ahmed100% (1)

- Merrill Lynch 2007 Analyst Valuation TrainingDocument74 pagesMerrill Lynch 2007 Analyst Valuation TrainingJose Garcia100% (22)

- Teleperformance Global Services Private Limited: Payslip For The Month of December 2021Document1 pageTeleperformance Global Services Private Limited: Payslip For The Month of December 2021gajala jamirNo ratings yet

- Corporate Loan OriginationDocument37 pagesCorporate Loan Originationk_adhikary67% (3)

- 5 Year Financial PlanDocument20 pages5 Year Financial PlanNKITDOSHI100% (1)

- 1-990737546 - IRTSPL - 30011929-Pooja YTD - Dec2023Document4 pages1-990737546 - IRTSPL - 30011929-Pooja YTD - Dec2023Sandeep PatilNo ratings yet

- Profit Sheet Illuminati Arun Bhatt 2021-22 2Document94 pagesProfit Sheet Illuminati Arun Bhatt 2021-22 2Karan singhNo ratings yet

- Payslip For The Month of March 2024Document1 pagePayslip For The Month of March 2024LalitNo ratings yet

- May PaySlipDocument1 pageMay PaySlipmandeepsingh157157157No ratings yet

- Faruk Mohmmed Patel Salary 2023Document1 pageFaruk Mohmmed Patel Salary 2023Faruk PatelNo ratings yet

- Altruist Technologies Pvt. LTD.: Personal DetailsDocument1 pageAltruist Technologies Pvt. LTD.: Personal DetailsDeepak kumar M R100% (1)

- Earnings Deductions: B9 Beverages LimitedDocument1 pageEarnings Deductions: B9 Beverages LimitedStark Satindra SunnyNo ratings yet

- Accountin Principals Task 2Document15 pagesAccountin Principals Task 2Thivya KrishnanNo ratings yet

- Teleperformance Global Business Private Limited: Full and Final Settlement - December 2023Document3 pagesTeleperformance Global Business Private Limited: Full and Final Settlement - December 2023touheedahmed8269No ratings yet

- Business Plan: Pfs 3233 - EntreprenuershipDocument19 pagesBusiness Plan: Pfs 3233 - EntreprenuershipAre DamNo ratings yet

- SalarySlipwithTaxDetailsDocument1 pageSalarySlipwithTaxDetailsNilesh GopnarayanNo ratings yet

- Salary Slip DecDocument1 pageSalary Slip Decdefinetrading2022.coNo ratings yet

- A Arumugam SCRDocument5 pagesA Arumugam SCRFCI DONo ratings yet

- 240520072547-Payroll Report April 2024Document10 pages240520072547-Payroll Report April 2024Aquula AlinNo ratings yet

- Sales Forecast & Cost of Sales - NaometDocument3 pagesSales Forecast & Cost of Sales - NaometErnest Mohau SomolekaeNo ratings yet

- Employee DataDocument1 pageEmployee DataSubhankar DasNo ratings yet

- Salary Slip NovDocument1 pageSalary Slip Novdefinetrading2022.coNo ratings yet

- Profit & Loss Account of Reliance Industries - in Rs. Cr.Document9 pagesProfit & Loss Account of Reliance Industries - in Rs. Cr.Mansi DeokarNo ratings yet

- Salary SlipDocument1 pageSalary Sliprichard parkerNo ratings yet

- AugustDocument2 pagesAugustravinakhanhifiNo ratings yet

- Teleperformance Global Services Private Limited: Payslip For The Month of November 2021Document1 pageTeleperformance Global Services Private Limited: Payslip For The Month of November 2021gajala jamir100% (2)

- Bal of Payments Standart eDocument86 pagesBal of Payments Standart eDien DangNo ratings yet

- Payslip 2023 2024 4 h112231215 KNOAH 230506 200245 1Document2 pagesPayslip 2023 2024 4 h112231215 KNOAH 230506 200245 1raziamirza900No ratings yet

- Taerea Del BabasDocument4 pagesTaerea Del BabasOscar Daniel Garcia LopezNo ratings yet

- January'2023Document1 pageJanuary'2023s siddhikiNo ratings yet

- PramodDocument2 pagesPramodVidya InstituteNo ratings yet

- Khilji Bhai 23-24Document3 pagesKhilji Bhai 23-24Div-IX Ankleshwar Vad-IINo ratings yet

- Combined DataDocument2 pagesCombined Datagagu2210No ratings yet

- Employee DataDocument1 pageEmployee DataSyed Abu TalibNo ratings yet

- Pt. People Intelligence Indonesia: Payslip PayslipDocument1 pagePt. People Intelligence Indonesia: Payslip PayslipdanirajasalandNo ratings yet

- DENO of JAN-20 (Recovered)Document104 pagesDENO of JAN-20 (Recovered)Harry JackNo ratings yet

- Ar MisDocument35 pagesAr MisNARUTONo ratings yet

- Employee DataDocument1 pageEmployee DataAmit BhargavaNo ratings yet

- idrPrintSummaryOct 20 BankDocument1 pageidrPrintSummaryOct 20 BankMd Moinul Islan TotoNo ratings yet

- 1635: Mr. Indraneel Nallam: HDFC Bank: Asstt. Executive: 50100302280063: REC-DEL-Human Resource-PersonnelDocument2 pages1635: Mr. Indraneel Nallam: HDFC Bank: Asstt. Executive: 50100302280063: REC-DEL-Human Resource-Personnelindraneel120No ratings yet

- A.E Budhapara Zone, Raipur: Solar Roof Top:-Export Consumption:0 Export Purchase Amount:0.00 SD Interest 0Document2 pagesA.E Budhapara Zone, Raipur: Solar Roof Top:-Export Consumption:0 Export Purchase Amount:0.00 SD Interest 0CA Deepak ValechaNo ratings yet

- Teleperformance Global Services Private Limited: Payslip For The Month of January 2022Document1 pageTeleperformance Global Services Private Limited: Payslip For The Month of January 2022gajala jamir67% (3)

- Manpower Status Report For Month of June 09: Sr. No Category Department Permanent Temporary Head CountDocument25 pagesManpower Status Report For Month of June 09: Sr. No Category Department Permanent Temporary Head CountAbhilash MohapatraNo ratings yet

- RBL Bank Ltd. Employees' Provident Fund: PF Claim Payment Voucher As OnDocument1 pageRBL Bank Ltd. Employees' Provident Fund: PF Claim Payment Voucher As OnJabez KirubakaranNo ratings yet

- SalarySlipwithTaxDetailsDocument1 pageSalarySlipwithTaxDetailsabhigopal444No ratings yet

- Kuppusamy SCRDocument5 pagesKuppusamy SCRFCI DONo ratings yet

- Automobile Industry: An Overview: Submission byDocument32 pagesAutomobile Industry: An Overview: Submission byshubham tikekarNo ratings yet

- Stagii An 24-10-2023 14 36Document1 pageStagii An 24-10-2023 14 36Costel TurmacNo ratings yet

- Amit Agarwal BankingDocument6 pagesAmit Agarwal BankingPreetam JainNo ratings yet

- Salary & Reliving LetterDocument6 pagesSalary & Reliving LetterYash ShettyNo ratings yet

- Randheer Yadav PayslipDocument1 pageRandheer Yadav Payslippankaj yadavNo ratings yet

- Wa0023.Document2 pagesWa0023.ManiNo ratings yet

- Zaib - Altaf - Naik - Payslip - July - 2022 (1) NewDocument2 pagesZaib - Altaf - Naik - Payslip - July - 2022 (1) Newzuber shaikhNo ratings yet

- Balance Pla To Be DepositedDocument2 pagesBalance Pla To Be DepositeddalveersinghNo ratings yet

- Epf EpsDocument1 pageEpf Epsmukulgusain2407No ratings yet

- Salary Slip SepDocument1 pageSalary Slip Sepdefinetrading2022.coNo ratings yet

- Salary Slip JulDocument1 pageSalary Slip Juldefinetrading2022.coNo ratings yet

- GeneratePdftax AspxDocument2 pagesGeneratePdftax AspxShiva KumarNo ratings yet

- STAT SALARII APRILIE - CopieDocument1 pageSTAT SALARII APRILIE - CopieBianca C. MariaNo ratings yet

- Mughal Innovations QRDocument1 pageMughal Innovations QRasharusmaniNo ratings yet

- Cartradeexchange Solutions Private LimitedDocument2 pagesCartradeexchange Solutions Private LimitedAJEET KUMARNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Macroeconomic Aims and Policies and Trade 5 June 2012 (Students)Document21 pagesMacroeconomic Aims and Policies and Trade 5 June 2012 (Students)ragul96No ratings yet

- Risk and Return Analysis of Equity Mutual FundDocument90 pagesRisk and Return Analysis of Equity Mutual Fundmajid_khan_4No ratings yet

- Tax ProblemsDocument14 pagesTax Problemsrav dano100% (1)

- Nike Pitchbook FinalDocument17 pagesNike Pitchbook FinalDhivya PriyaNo ratings yet

- I. Household Sector As An Institutional Sector in NationalDocument11 pagesI. Household Sector As An Institutional Sector in NationalJaqueline PadillaNo ratings yet

- Assignment #3 Spring 2020 SolutionDocument7 pagesAssignment #3 Spring 2020 SolutionIdrisNo ratings yet

- Q.Dividend PolicyDocument2 pagesQ.Dividend PolicyHaris HasanNo ratings yet

- Modern Advanced Accounting in Canada Canadian 7th Edition Hilton Solutions Manual DownloadDocument84 pagesModern Advanced Accounting in Canada Canadian 7th Edition Hilton Solutions Manual DownloadHassan Mccoy100% (23)

- ICMA Questions Apr 2011Document55 pagesICMA Questions Apr 2011Asadul HoqueNo ratings yet

- A Summer Training Report On HDFC LifeDocument47 pagesA Summer Training Report On HDFC LifeRishi Raj75% (8)

- Handout - 02 - Subsequent TransactionsDocument3 pagesHandout - 02 - Subsequent TransactionsPrincess NozalNo ratings yet

- JPM Guide To The Markets August Q3Document71 pagesJPM Guide To The Markets August Q3Alex BragaNo ratings yet

- CH 13Document77 pagesCH 13Mohammed SamyNo ratings yet

- Chapter - 4 Income of Other Persons Included in Assessees Total IncomeDocument34 pagesChapter - 4 Income of Other Persons Included in Assessees Total IncomeAnanthvasanthaNo ratings yet

- On January 1 2017 Frederiksen Inc S Stockholders Equity Category AppearedDocument1 pageOn January 1 2017 Frederiksen Inc S Stockholders Equity Category AppearedMiroslav GegoskiNo ratings yet

- Wealth CreationDocument28 pagesWealth CreationMike RobertsonNo ratings yet

- Corporate Finance Cheat SheetDocument1 pageCorporate Finance Cheat SheetbaronfgfNo ratings yet

- COGS Data FlowDocument4 pagesCOGS Data FlowerhariiNo ratings yet

- Shakarganj Mills LimitedDocument24 pagesShakarganj Mills LimitedNouman KhanNo ratings yet

- PaymentDocument1 pagePaymentakshNo ratings yet

- In The Court of Commissioner Department of Trade & Taxes Govt. of NCT of Delhi Vyapar Bhavan, New DelhiDocument2 pagesIn The Court of Commissioner Department of Trade & Taxes Govt. of NCT of Delhi Vyapar Bhavan, New DelhiYatra ShuklaNo ratings yet

- Joint ArrangementDocument3 pagesJoint ArrangementAlliah Mae AcostaNo ratings yet

- Jaiib Accfinance MCQDocument11 pagesJaiib Accfinance MCQmedical officer Phc Amala VNo ratings yet

- Acca Dip Ifr Practice Revision Kit 2017Document314 pagesAcca Dip Ifr Practice Revision Kit 2017Chippu AnhNo ratings yet

- Advanced Accounting Chapter 20Document12 pagesAdvanced Accounting Chapter 20LJ AggabaoNo ratings yet

- Tax-119-Madrigal VS RaffertyDocument2 pagesTax-119-Madrigal VS RaffertyJoesil Dianne SempronNo ratings yet

Bibhuti Sahu Salary 2024

Bibhuti Sahu Salary 2024

Uploaded by

bibhutisahu23Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bibhuti Sahu Salary 2024

Bibhuti Sahu Salary 2024

Uploaded by

bibhutisahu23Copyright:

Available Formats

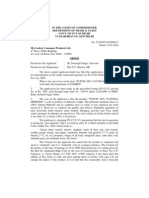

Cars24 Services Pvt ltd.

Office Address : Indore , Madhya Pradesh, India

Income Tax Computation For FY 2024-25

Business Unit : C2B

Employee Name:Bibhuti sahu Employee Type:Permanent Employee Code:34543 Pan Number:EXYPS0313H

External Designation: Territory Manager (CSPL_C2B_Ret_Rgnl_Ret_Core_TM) Sub - Department: Regional Retail Core Date of Joining: 2nd November, 2023

Provident Fund: GNGGN13722940000031011 ESIC Number: N.A. Current Office Location: Indore

Particulars April-2024 May-2024 June-2024 July-2024 August-2024 September-2024 October-2024 November-2024 December-2024 January-2025 February-2025 March-2025 Total

Basic 38500 41250 39875 0 0 0 0 0 0 0 0 0 119625

Basic Arrears 665 2750 0 0 0 0 0 0 0 0 0 0 3415

HRA 19250 20625 19938 0 0 0 0 0 0 0 0 0 59813

HRA Arrears 333 1375 0 0 0 0 0 0 0 0 0 0 1708

Special 23519 25199 24359 0 0 0 0 0 0 0 0 0 73077

Allowance

Special Allowance 406 1680 0 0 0 0 0 0 0 0 0 0 2086

Arrears

Total Extra 12000 5900 0 0 0 0 0 0 0 0 0 0 17900

Payments

Total 94673 98779 84172 0 0 0 0 0 0 0 0 0 277624

-- --

Deduction --

Provident Fund 1800 1800 1800 0 0 0 0 0 0 0 0 0 5400

Professional Tax 208 208 208 0 0 0 0 0 0 0 0 0 624

80D - Health 491 491 491 0 0 0 0 0 0 0 0 0 1473

Insurance Self

Cancellation 0 1000 0 0 0 0 0 0 0 0 0 0 1000

Charges Deduction

TDS 6695 6437 0 0 0 0 0 0 0 0 0 0 13132

Total 9194 9936 2499 0 0 0 0 0 0 0 0 0 21629

DETAILS OF SALARY PAID AND ANY OTHER INCOME AND TAX DEDUCTED

Gross Salary 259724

Total Extra Payments 17900

Total Gross Salary (Current Employer) 277624

Total Gross Salary 277624

Less CTC Reimbursements

Total Reimbursments 0

Gross Income after Deduction and Reimbursements 277624

Less exemption under Section 10

Total Section 10 Exemptions 0

Total amount of Salary received after Section 10 277624

Less: Deductions under section 16

Standard deduction under section 16(ia) 50000

Total amount of deductions under section 16 50000

Income chargeable under the head "Salaries" 227624

Add: Income from Other Sources

A. Income/Loss from house property

Total for Income/Loss from house property 0

B. Other Sources

Total from Other Sources 0

Gross Total Income 227624

Total Chapter-VIA Declared value Qualified Value Deductible Value

Section 80C,80CCC,80CCD

Section 80TT

Total Chapter-VIA Total 0 0

Net Taxable Income 227624

Net Taxable Income (Rounded to Next 10) 227630

Income Tax on Net Taxable Income (Before Rebate U/s 87A) 0

Rebate (U/s 87A) 0

Income Tax After Rebate (u/s 87A)/Marginal Relief under New Tax Regime 0

Raw Surcharge 0

Marginal Relief 0

Add Edn Cess + Health Cess @ 4% 0

Net Tax Payable (A) 0

Previous Employer TDS (B) 0

Outside Tax / Advance Tax (C) 0

Tax Deducted till Date by Current Employer (D) 13132

Shortfall in tax deduction(+) / Excess tax deduction(-) (-) 13132

Note: This is a Computer Generated Slip and does not require signature.

Powered by TCPDF (www.tcpdf.org)

You might also like

- CMA Part 1 Hock Essay QuestionsDocument74 pagesCMA Part 1 Hock Essay QuestionsAbhishek Goyal100% (5)

- Payslip For The Month of January 2023: CRM Services India Private LimitedDocument1 pagePayslip For The Month of January 2023: CRM Services India Private Limitednaman porwalNo ratings yet

- Ganpact CompanyDocument1 pageGanpact CompanyAsmin Sultana Ahmed100% (1)

- Merrill Lynch 2007 Analyst Valuation TrainingDocument74 pagesMerrill Lynch 2007 Analyst Valuation TrainingJose Garcia100% (22)

- Teleperformance Global Services Private Limited: Payslip For The Month of December 2021Document1 pageTeleperformance Global Services Private Limited: Payslip For The Month of December 2021gajala jamirNo ratings yet

- Corporate Loan OriginationDocument37 pagesCorporate Loan Originationk_adhikary67% (3)

- 5 Year Financial PlanDocument20 pages5 Year Financial PlanNKITDOSHI100% (1)

- 1-990737546 - IRTSPL - 30011929-Pooja YTD - Dec2023Document4 pages1-990737546 - IRTSPL - 30011929-Pooja YTD - Dec2023Sandeep PatilNo ratings yet

- Profit Sheet Illuminati Arun Bhatt 2021-22 2Document94 pagesProfit Sheet Illuminati Arun Bhatt 2021-22 2Karan singhNo ratings yet

- Payslip For The Month of March 2024Document1 pagePayslip For The Month of March 2024LalitNo ratings yet

- May PaySlipDocument1 pageMay PaySlipmandeepsingh157157157No ratings yet

- Faruk Mohmmed Patel Salary 2023Document1 pageFaruk Mohmmed Patel Salary 2023Faruk PatelNo ratings yet

- Altruist Technologies Pvt. LTD.: Personal DetailsDocument1 pageAltruist Technologies Pvt. LTD.: Personal DetailsDeepak kumar M R100% (1)

- Earnings Deductions: B9 Beverages LimitedDocument1 pageEarnings Deductions: B9 Beverages LimitedStark Satindra SunnyNo ratings yet

- Accountin Principals Task 2Document15 pagesAccountin Principals Task 2Thivya KrishnanNo ratings yet

- Teleperformance Global Business Private Limited: Full and Final Settlement - December 2023Document3 pagesTeleperformance Global Business Private Limited: Full and Final Settlement - December 2023touheedahmed8269No ratings yet

- Business Plan: Pfs 3233 - EntreprenuershipDocument19 pagesBusiness Plan: Pfs 3233 - EntreprenuershipAre DamNo ratings yet

- SalarySlipwithTaxDetailsDocument1 pageSalarySlipwithTaxDetailsNilesh GopnarayanNo ratings yet

- Salary Slip DecDocument1 pageSalary Slip Decdefinetrading2022.coNo ratings yet

- A Arumugam SCRDocument5 pagesA Arumugam SCRFCI DONo ratings yet

- 240520072547-Payroll Report April 2024Document10 pages240520072547-Payroll Report April 2024Aquula AlinNo ratings yet

- Sales Forecast & Cost of Sales - NaometDocument3 pagesSales Forecast & Cost of Sales - NaometErnest Mohau SomolekaeNo ratings yet

- Employee DataDocument1 pageEmployee DataSubhankar DasNo ratings yet

- Salary Slip NovDocument1 pageSalary Slip Novdefinetrading2022.coNo ratings yet

- Profit & Loss Account of Reliance Industries - in Rs. Cr.Document9 pagesProfit & Loss Account of Reliance Industries - in Rs. Cr.Mansi DeokarNo ratings yet

- Salary SlipDocument1 pageSalary Sliprichard parkerNo ratings yet

- AugustDocument2 pagesAugustravinakhanhifiNo ratings yet

- Teleperformance Global Services Private Limited: Payslip For The Month of November 2021Document1 pageTeleperformance Global Services Private Limited: Payslip For The Month of November 2021gajala jamir100% (2)

- Bal of Payments Standart eDocument86 pagesBal of Payments Standart eDien DangNo ratings yet

- Payslip 2023 2024 4 h112231215 KNOAH 230506 200245 1Document2 pagesPayslip 2023 2024 4 h112231215 KNOAH 230506 200245 1raziamirza900No ratings yet

- Taerea Del BabasDocument4 pagesTaerea Del BabasOscar Daniel Garcia LopezNo ratings yet

- January'2023Document1 pageJanuary'2023s siddhikiNo ratings yet

- PramodDocument2 pagesPramodVidya InstituteNo ratings yet

- Khilji Bhai 23-24Document3 pagesKhilji Bhai 23-24Div-IX Ankleshwar Vad-IINo ratings yet

- Combined DataDocument2 pagesCombined Datagagu2210No ratings yet

- Employee DataDocument1 pageEmployee DataSyed Abu TalibNo ratings yet

- Pt. People Intelligence Indonesia: Payslip PayslipDocument1 pagePt. People Intelligence Indonesia: Payslip PayslipdanirajasalandNo ratings yet

- DENO of JAN-20 (Recovered)Document104 pagesDENO of JAN-20 (Recovered)Harry JackNo ratings yet

- Ar MisDocument35 pagesAr MisNARUTONo ratings yet

- Employee DataDocument1 pageEmployee DataAmit BhargavaNo ratings yet

- idrPrintSummaryOct 20 BankDocument1 pageidrPrintSummaryOct 20 BankMd Moinul Islan TotoNo ratings yet

- 1635: Mr. Indraneel Nallam: HDFC Bank: Asstt. Executive: 50100302280063: REC-DEL-Human Resource-PersonnelDocument2 pages1635: Mr. Indraneel Nallam: HDFC Bank: Asstt. Executive: 50100302280063: REC-DEL-Human Resource-Personnelindraneel120No ratings yet

- A.E Budhapara Zone, Raipur: Solar Roof Top:-Export Consumption:0 Export Purchase Amount:0.00 SD Interest 0Document2 pagesA.E Budhapara Zone, Raipur: Solar Roof Top:-Export Consumption:0 Export Purchase Amount:0.00 SD Interest 0CA Deepak ValechaNo ratings yet

- Teleperformance Global Services Private Limited: Payslip For The Month of January 2022Document1 pageTeleperformance Global Services Private Limited: Payslip For The Month of January 2022gajala jamir67% (3)

- Manpower Status Report For Month of June 09: Sr. No Category Department Permanent Temporary Head CountDocument25 pagesManpower Status Report For Month of June 09: Sr. No Category Department Permanent Temporary Head CountAbhilash MohapatraNo ratings yet

- RBL Bank Ltd. Employees' Provident Fund: PF Claim Payment Voucher As OnDocument1 pageRBL Bank Ltd. Employees' Provident Fund: PF Claim Payment Voucher As OnJabez KirubakaranNo ratings yet

- SalarySlipwithTaxDetailsDocument1 pageSalarySlipwithTaxDetailsabhigopal444No ratings yet

- Kuppusamy SCRDocument5 pagesKuppusamy SCRFCI DONo ratings yet

- Automobile Industry: An Overview: Submission byDocument32 pagesAutomobile Industry: An Overview: Submission byshubham tikekarNo ratings yet

- Stagii An 24-10-2023 14 36Document1 pageStagii An 24-10-2023 14 36Costel TurmacNo ratings yet

- Amit Agarwal BankingDocument6 pagesAmit Agarwal BankingPreetam JainNo ratings yet

- Salary & Reliving LetterDocument6 pagesSalary & Reliving LetterYash ShettyNo ratings yet

- Randheer Yadav PayslipDocument1 pageRandheer Yadav Payslippankaj yadavNo ratings yet

- Wa0023.Document2 pagesWa0023.ManiNo ratings yet

- Zaib - Altaf - Naik - Payslip - July - 2022 (1) NewDocument2 pagesZaib - Altaf - Naik - Payslip - July - 2022 (1) Newzuber shaikhNo ratings yet

- Balance Pla To Be DepositedDocument2 pagesBalance Pla To Be DepositeddalveersinghNo ratings yet

- Epf EpsDocument1 pageEpf Epsmukulgusain2407No ratings yet

- Salary Slip SepDocument1 pageSalary Slip Sepdefinetrading2022.coNo ratings yet

- Salary Slip JulDocument1 pageSalary Slip Juldefinetrading2022.coNo ratings yet

- GeneratePdftax AspxDocument2 pagesGeneratePdftax AspxShiva KumarNo ratings yet

- STAT SALARII APRILIE - CopieDocument1 pageSTAT SALARII APRILIE - CopieBianca C. MariaNo ratings yet

- Mughal Innovations QRDocument1 pageMughal Innovations QRasharusmaniNo ratings yet

- Cartradeexchange Solutions Private LimitedDocument2 pagesCartradeexchange Solutions Private LimitedAJEET KUMARNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Macroeconomic Aims and Policies and Trade 5 June 2012 (Students)Document21 pagesMacroeconomic Aims and Policies and Trade 5 June 2012 (Students)ragul96No ratings yet

- Risk and Return Analysis of Equity Mutual FundDocument90 pagesRisk and Return Analysis of Equity Mutual Fundmajid_khan_4No ratings yet

- Tax ProblemsDocument14 pagesTax Problemsrav dano100% (1)

- Nike Pitchbook FinalDocument17 pagesNike Pitchbook FinalDhivya PriyaNo ratings yet

- I. Household Sector As An Institutional Sector in NationalDocument11 pagesI. Household Sector As An Institutional Sector in NationalJaqueline PadillaNo ratings yet

- Assignment #3 Spring 2020 SolutionDocument7 pagesAssignment #3 Spring 2020 SolutionIdrisNo ratings yet

- Q.Dividend PolicyDocument2 pagesQ.Dividend PolicyHaris HasanNo ratings yet

- Modern Advanced Accounting in Canada Canadian 7th Edition Hilton Solutions Manual DownloadDocument84 pagesModern Advanced Accounting in Canada Canadian 7th Edition Hilton Solutions Manual DownloadHassan Mccoy100% (23)

- ICMA Questions Apr 2011Document55 pagesICMA Questions Apr 2011Asadul HoqueNo ratings yet

- A Summer Training Report On HDFC LifeDocument47 pagesA Summer Training Report On HDFC LifeRishi Raj75% (8)

- Handout - 02 - Subsequent TransactionsDocument3 pagesHandout - 02 - Subsequent TransactionsPrincess NozalNo ratings yet

- JPM Guide To The Markets August Q3Document71 pagesJPM Guide To The Markets August Q3Alex BragaNo ratings yet

- CH 13Document77 pagesCH 13Mohammed SamyNo ratings yet

- Chapter - 4 Income of Other Persons Included in Assessees Total IncomeDocument34 pagesChapter - 4 Income of Other Persons Included in Assessees Total IncomeAnanthvasanthaNo ratings yet

- On January 1 2017 Frederiksen Inc S Stockholders Equity Category AppearedDocument1 pageOn January 1 2017 Frederiksen Inc S Stockholders Equity Category AppearedMiroslav GegoskiNo ratings yet

- Wealth CreationDocument28 pagesWealth CreationMike RobertsonNo ratings yet

- Corporate Finance Cheat SheetDocument1 pageCorporate Finance Cheat SheetbaronfgfNo ratings yet

- COGS Data FlowDocument4 pagesCOGS Data FlowerhariiNo ratings yet

- Shakarganj Mills LimitedDocument24 pagesShakarganj Mills LimitedNouman KhanNo ratings yet

- PaymentDocument1 pagePaymentakshNo ratings yet

- In The Court of Commissioner Department of Trade & Taxes Govt. of NCT of Delhi Vyapar Bhavan, New DelhiDocument2 pagesIn The Court of Commissioner Department of Trade & Taxes Govt. of NCT of Delhi Vyapar Bhavan, New DelhiYatra ShuklaNo ratings yet

- Joint ArrangementDocument3 pagesJoint ArrangementAlliah Mae AcostaNo ratings yet

- Jaiib Accfinance MCQDocument11 pagesJaiib Accfinance MCQmedical officer Phc Amala VNo ratings yet

- Acca Dip Ifr Practice Revision Kit 2017Document314 pagesAcca Dip Ifr Practice Revision Kit 2017Chippu AnhNo ratings yet

- Advanced Accounting Chapter 20Document12 pagesAdvanced Accounting Chapter 20LJ AggabaoNo ratings yet

- Tax-119-Madrigal VS RaffertyDocument2 pagesTax-119-Madrigal VS RaffertyJoesil Dianne SempronNo ratings yet