Professional Documents

Culture Documents

laws (gjh) 2014

laws (gjh) 2014

Uploaded by

AADITYA POPATCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

laws (gjh) 2014

laws (gjh) 2014

Uploaded by

AADITYA POPATCopyright:

Available Formats

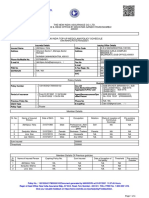

Licensed to :- Dipesh Andharia [Client Code :- 3850]

LAWS(GJH)-2014-8-283

HIGH COURT OF GUJARAT

Coram : BHASKAR BHATTACHARYA J.

Decided On : August 28, 2014

Appeal Type : First Appeal No.3288 of 2007

Final Verdict : Appeal dismissed

Appellant(s) :

Tata Motors Limited (Tata Finance Ltd )

Respondent(s) :

Kapilaben Wd/O Decd Pravin Bhai Keshurbhai Chauhan

Advocate(s) :

CHUDGAR, Mohsin Hakim, M.T.M.HAKIM, SUNIL B PARIKH

Equivalent Citation :

LAWS(GJH)-2014-8-283, ACJ-2016-0-825, ACC-2016-2-610, GCD-2014-3-2714, AAC-

2015-0-321, RCR(CIVIL)-2014-64-70

Referred Judgement(s) :

- Mohan Benefit Pvt Limited Vs. Kachraji Raymalji, [1997 0 ACJ 1438] [Referred To]

- Godavari Finance Co Vs. Degala Satyanarayanamma, [2008 5 SCC 107] [Referred To]

- Bank Of Baroda Vs. Rabari Bachubhai Hirabhai, [1986 1 GLR 144] [Referred To]

Referred Act(s) :

- Motor Vehicles Act, 1988, S.173, S.2(30)

Headnote:

A. MOTOR VEHICLES ACT, 1988 - S.173 - Appeals, S.2(30) - Definitions - The present

appellant being dissatisfied with the said order impleading it as additional respondent

preferred a Special Civil Application before this Court but a learned single Judge of this

Court dismissed such Special Civil Application holding that it was not a fit case for

interference because the added opponent will not be aggrieved in any manner unless it is

established on evidence at the final hearing that at the time of accident, the vehicle was in

possession of the financier. - Mr.Chudgar, the learned advocate appearing on behalf of the

appellant, has vehemently contended before this Court that the tribunal below committed

substantial error of law in holding that his client jointly and severally was liable to pay the

awarded sum, notwithstanding the fact that his client was merely a financier and not the

owner of the vehicle. - Mr.Hakim, the learned counsel appearing on behalf of the claimants

Page 1 of 5 Copyright © 2024 by Regent Computronics Private Limited (www.the-laws.com)

Licensed to :- Dipesh Andharia [Client Code :- 3850]

has, on the other hand, opposed the aforesaid contention of Mr.Chudgar and has, by relying

upon the definition of 'owner' as contained in Section 2 (30) of the Motor Vehicles Act,

contended that once the financier has been made party, a duty is cast upon the financier to

show that even according to the definition of 'owner' in Section 2 (30) of the Act, in the facts

of the present case it has no liability. - As regards the decision of the Supreme Court in the

case of Godavari Finance Company relied upon by Mr.Chudgar, from paragraph 7 of the

judgment where the Supreme Court quoted the reasoning of the tribunal, it appears that in

the said case the financier took specific plea that the vehicle was under the control of the

purchaser, the respondent no.2 therein, and, in such circumstances, the Supreme Court held

that by virtue of the finance agreement, the financier had no liability. - On consideration of

the entire materials on record, I find that, in the facts of the present case, the tribunal rightly

held the financier was liable in absence of the specific denial on its part that it was not in

possession of the vehicle at the relevant point of time or that it had no liability to insure the

vehicle against third party risk and even to the sole witness of the claimant in cross-

examination, no suggestion was given that it was not in possession of the vehicle.

B. As indicated earlier, the tribunal below, on consideration of the materials on record, held the

owner of the vehicle as well as the financier jointly and severally were liable to pay the

awarded sum as it was not covered by any insurance policy. - On consideration of the entire

materials on record, I find that, in the facts of the present case, the tribunal rightly held the

financier was liable in absence of the specific denial on its part that it was not in possession of

the vehicle at the relevant point of time or that it had no liability to insure the vehicle against

third party risk and even to the sole witness of the claimant in cross-examination, no

suggestion was given that it was not in possession of the vehicle.

C. 17. - It appears that by virtue of an order passed by this Court, the appellant had deposited

the entire amount before the tribunal, and except 5% as well as periodical interest on the

entire amount being permitted to be withdrawn by the claimants, the balance amount is lying

in fixed deposit.

Judgment :

(1.) This appeal under Section 173 of the Motor Vehicles Act is at the instance of a financier and is

directed against the award dated 16th December 2005 passed by the Motor Accident Claims Tribunal

(Main) Vadodara, in Motor Accident Claims Petition No.970 of 1993 thereby awarding compensation

of Rs. 2,50,400/- with interest at the rate of 9% p.a. from the date of filing of the claim petition till

realization with a specific finding that the amount to be paid by the owner and the financier of the

vehicle bearing registration No.GJ-1U-7952 as the other vehicle was driven by the victim himself and

he had 20% negligence and an amount to that extent was deducted from the amount of compensation.

(2.) The claimants filed the claim application by making the owner of the vehicle driven by the victim

and its insurer, the National Insurance Company, as opponent nos.1 and 2 and the driver and owner of

Page 2 of 5 Copyright © 2024 by Regent Computronics Private Limited (www.the-laws.com)

Licensed to :- Dipesh Andharia [Client Code :- 3850]

the other vehicle were opponent nos. 3 and 4. Subsequently, name of the driver of the other vehicle

was deleted and, on an application filed by the claimant, Tata Finance Company, the appellant before

this Court, was made additional respondent being respondent no. 5 as it appears from the RC book that

the other vehicle was financed by the Tata Finance Company under the agreement of hypothecation.

(3.) The present appellant being dissatisfied with the said order impleading it as additional respondent

preferred a Special Civil Application before this Court but a learned single Judge of this Court

dismissed such Special Civil Application holding that it was not a fit case for interference because the

added opponent will not be aggrieved in any manner unless it is established on evidence at the final

hearing that at the time of accident, the vehicle was in possession of the financier.

(4.) It further appears from the record that, after such addition, the financier did not file any written

statement asserting that it was not in possession of the vehicle.

(5.) As indicated earlier, the tribunal below, on consideration of the materials on record, held the

owner of the vehicle as well as the financier jointly and severally were liable to pay the awarded sum

as it was not covered by any insurance policy.

(6.) Mr.Chudgar, the learned advocate appearing on behalf of the appellant, has vehemently

contended before this Court that the tribunal below committed substantial error of law in holding that

his client jointly and severally was liable to pay the awarded sum, notwithstanding the fact that his

client was merely a financier and not the owner of the vehicle. Mr.Chudgar contends the claimant

failed to prove that his client was in actual possession of the vehicle and, thus, there was no

justification of drawing adverse presumption against his client when it is the primary duty of the

claimant to prove that his client was the owner of the vehicle. According to Mr.Chudgar, by virtue of

the definition of 'owner' mentioned in Section 2 (30) of the Motor Vehicles Act, his client does not

become automatically the owner unless it is established that by virtue of agreement of hypothecation

his client is in actual possession of the vehicle. In support of his submission, Mr.Chudgar relies upon

the decision of the Supreme Court in the case of Godavari Finance Company v. Digala

Satyanarayanamma and Others, 2008 5 SCC 107 and also a decision of Division Bench of this Court

in the case of Bank of Baroda v. Rabari Bachubhai Hirabhai, 1986 1 GLR 144.

(7.) Mr.Hakim, the learned counsel appearing on behalf of the claimants has, on the other hand,

opposed the aforesaid contention of Mr.Chudgar and has, by relying upon the definition of 'owner' as

contained in Section 2 (30) of the Motor Vehicles Act, contended that once the financier has been

made party, a duty is cast upon the financier to show that even according to the definition of 'owner' in

Section 2 (30) of the Act, in the facts of the present case it has no liability. In other words, according

to Mr.Hakim, a duty is cast upon the financier to show that though the vehicle was hypothecated, it has

no liability in the case by virtue of the admitted hypothecation and for not producing the document of

hypothecation, the tribunal below rightly took adverse presumption against the financier. In support of

his contention, Mr.Hakim relies upon the decision of the Supreme Court in the case of Mohan Benefit

Private Limited v. Kachraji Raymalji and Others, 1997 ACJ 1438.

Page 3 of 5 Copyright © 2024 by Regent Computronics Private Limited (www.the-laws.com)

Licensed to :- Dipesh Andharia [Client Code :- 3850]

(8.) Mr.Parikh, the learned counsel appearing on behalf of the insurance company of the vehicle

driven by the victim did not make any submission as his client has not been fastened with any liability.

(9.) Therefore, the only question that falls for my determination in this appeal is whether the tribunal

below in the facts of the present case was justified in holding the financier liable for compensation

jointly and severally with the purchaser of the vehicle.

(10.) After hearing the learned counsel for the parties and after going through the materials on record

it appears that initially the financier was not made party and from the RC book of the offending

vehicle the fact that the same is hypothecated to the appellant before this Court being disclosed, the

claimant decided to make the financier a party. As pointed out earlier by this Court in the Special Civil

Application filed by the financier against the order impleading it as a party, the liability of the

financier will be decided at the time of hearing depending upon the fact whether the financier was in

actual possession of the vehicle.

(11.) In spite of being added as the respondent, for the reason best known to the financier, it decided

not to file any written statement asserting that by virtue of the agreement of hypothecation it was not

in actual possession of the vehicle and the entire liability should be with the owner. In the present case,

the owner has also not come forward to disclose any document of hypothecation.

(12.) In such circumstances, in my view, the tribunal was justified in drawing adverse presumption

against the appellant for not disclosing the document of hypothecation and at the same time for not

denying its liability in spite of the fact the financier was made a party.

(13.) I am at one with Mr.Hakim that the best evidence as to the liability of the financier as well as the

actual purchaser of the vehicle was the document of hypothecation, which would disclose the liability

of the parties and which was within the special knowledge of the parties to the document of

hypothecation and a third party is not supposed to know such fact. In such circumstances, if both the

purchaser and the financier decide not to produce the document in question there was no wrong on the

part of the tribunal below in holding them jointly and severally liable to pay compensation when

admittedly there was no valid insurance of that vehicle at the time of the accident. The document of

hypothecation would disclose whether the liability to insure the vehicle against third party accident

was upon the financier.

(14.) In the case of Mohan Benefit Private Limited v. Kachraji Raymalji and Others , in a

circumstance similar to the one of the present case, the Supreme Court pointed out that had the

document which reflected the true relationship between the financier and the purchaser been produced,

they would have exploded the case of the appellant viz. the financier and consequently, adverse

inference drawn by the High Court in that case was justified.

(15.) As regards the decision of the Supreme Court in the case of Godavari Finance Company relied

upon by Mr.Chudgar, from paragraph 7 of the judgment where the Supreme Court quoted the

reasoning of the tribunal, it appears that in the said case the financier took specific plea that the vehicle

was under the control of the purchaser, the respondent no.2 therein, and, in such circumstances, the

Page 4 of 5 Copyright © 2024 by Regent Computronics Private Limited (www.the-laws.com)

Licensed to :- Dipesh Andharia [Client Code :- 3850]

Supreme Court held that by virtue of the finance agreement, the financier had no liability. In the case

before me, after being added as the respondent no written statement has been filed asserting that the

financier was not in possession of the vehicle or that it had no liability to take the burden of insurance

and, in such circumstances, the principle laid down by the Supreme Court in the case of Godavari

Finance Company cannot have any application. So far the other decision of the Division Bench of this

Court in the case of Bank of Baroda v. Rabari Bachubhai Hirabhai is concerned, it appears that the

Division Bench in the said decision did not take into consideration the definition of 'owner' in the

Motor Vehicles Act and simply discussed the doctrine of Hypothecation and on that basis came to the

conclusion that by mere hypothecation the creditor does not become liable for the liability of the actual

owner and the said decision relied upon Corpus Juris Secundum (Volume XLII) and also Halsbury's

Laws of England (Fourth Edition) at page 438 (paragraph 635). In my view, having regard to the

definition of 'owner' made in Section 2(30) of the Motor Vehicles Act the possession of the financier is

to be considered not on the basis of ordinary doctrine of pledge or hypothecation but according to the

provision of the Act in question as interpreted by the Supreme Court in the above two decisions.

(16.) On consideration of the entire materials on record, I find that, in the facts of the present case, the

tribunal rightly held the financier was liable in absence of the specific denial on its part that it was not

in possession of the vehicle at the relevant point of time or that it had no liability to insure the vehicle

against third party risk and even to the sole witness of the claimant in cross-examination, no

suggestion was given that it was not in possession of the vehicle.

(17.) The appeal is, thus, dismissed. No order as to costs.

(18.) It appears that by virtue of an order passed by this Court, the appellant had deposited the entire

amount before the tribunal, and except 5% as well as periodical interest on the entire amount being

permitted to be withdrawn by the claimants, the balance amount is lying in fixed deposit. The appeal

having been dismissed, the entire amount lying in the fixed deposits should be returned to the

claimants and, accordingly, the tribunal is directed to return the amount to the claimants, however,

after expiry of one month from today. Let the lower Court record be sent back immediately.

Page 5 of 5 Copyright © 2024 by Regent Computronics Private Limited (www.the-laws.com)

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Auto Insurance Coverage Summary This Is A Copy of Your Declarations PageDocument3 pagesAuto Insurance Coverage Summary This Is A Copy of Your Declarations PageMorenita ParelesNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Biprime Devoted Health Pitch DeckDocument11 pagesBiprime Devoted Health Pitch DeckTestNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Aia A201Document48 pagesAia A201Mark Hattersley100% (1)

- WO - Masonry and Plaster (Built Up Area Basis)Document13 pagesWO - Masonry and Plaster (Built Up Area Basis)CgpscAspirant67% (3)

- Chapter 2 - Cost Terms, Concepts and ClassificationsDocument55 pagesChapter 2 - Cost Terms, Concepts and ClassificationsMarriel Fate CullanoNo ratings yet

- RAPTAKOS BRETT AND COMPANY LIMITED vs. Ganesh PropertyDocument35 pagesRAPTAKOS BRETT AND COMPANY LIMITED vs. Ganesh PropertyAADITYA POPATNo ratings yet

- Supression of Material Fact - Ground of Rejection of PlaintDocument7 pagesSupression of Material Fact - Ground of Rejection of PlaintAADITYA POPATNo ratings yet

- T Arivandandam vs. T.V. Satyapal and Anr. 1977 Air SC 2421Document30 pagesT Arivandandam vs. T.V. Satyapal and Anr. 1977 Air SC 2421AADITYA POPATNo ratings yet

- Rukmabai VS Lala LaxminarayanDocument32 pagesRukmabai VS Lala LaxminarayanAADITYA POPATNo ratings yet

- Telecom Project AadityaDocument23 pagesTelecom Project AadityaAADITYA POPATNo ratings yet

- FMR Project AadityaDocument21 pagesFMR Project AadityaAADITYA POPATNo ratings yet

- Law of Corporate Governance SyallabusDocument3 pagesLaw of Corporate Governance SyallabusAADITYA POPATNo ratings yet

- Final Internship ReportDocument23 pagesFinal Internship ReportAADITYA POPATNo ratings yet

- LST Project AadityaDocument24 pagesLST Project AadityaAADITYA POPATNo ratings yet

- Taxation Law IIDocument4 pagesTaxation Law IIAADITYA POPATNo ratings yet

- Revised B&I Project PDFDocument18 pagesRevised B&I Project PDFAADITYA POPATNo ratings yet

- Law On Corporate FinanceDocument4 pagesLaw On Corporate FinanceAADITYA POPATNo ratings yet

- Aaditya Popat: Law StudentDocument2 pagesAaditya Popat: Law StudentAADITYA POPATNo ratings yet

- CG (G) SynopsisDocument3 pagesCG (G) SynopsisAADITYA POPATNo ratings yet

- CL Synopsis (G)Document7 pagesCL Synopsis (G)AADITYA POPATNo ratings yet

- B&I Law SynopsisDocument6 pagesB&I Law SynopsisAADITYA POPATNo ratings yet

- CG SynopsisDocument4 pagesCG SynopsisAADITYA POPATNo ratings yet

- BIL ProjectDocument17 pagesBIL ProjectAADITYA POPATNo ratings yet

- Tips To Frame Lease or Rental AgreementDocument6 pagesTips To Frame Lease or Rental Agreementnaveen KumarNo ratings yet

- McCollum Hall RFP 0013-18 McCollum Hall SolicitationDocument58 pagesMcCollum Hall RFP 0013-18 McCollum Hall SolicitationNews-PressNo ratings yet

- Communication and InsuranceDocument12 pagesCommunication and InsuranceSamwel PoncianNo ratings yet

- Anant Gupta - Unit Linked Insurance Product-Insurance or InvestmentDocument19 pagesAnant Gupta - Unit Linked Insurance Product-Insurance or InvestmentAdi SetiyonoNo ratings yet

- Bakil Aliza-Q2Document2 pagesBakil Aliza-Q2ALIZA BAKILNo ratings yet

- Blastmax 50 EngDocument96 pagesBlastmax 50 EngIslenaGarciaNo ratings yet

- BLAW Contract of AgencyDocument23 pagesBLAW Contract of AgencySubramanyam NarasapuramNo ratings yet

- SolutionsDocument16 pagesSolutionsapi-3817072100% (2)

- Cca 1990-91Document314 pagesCca 1990-91Samples Ames PLLCNo ratings yet

- JN Devt Vs Phil ExportDocument19 pagesJN Devt Vs Phil ExportJasielle Leigh UlangkayaNo ratings yet

- Bank of Maharashtra: Application Form For Educational LoanDocument5 pagesBank of Maharashtra: Application Form For Educational Loanmandar_sumantNo ratings yet

- 131 General Lnsurance V NG Hua Double InsuranceDocument2 pages131 General Lnsurance V NG Hua Double InsuranceJovelan V. Escaño0% (1)

- Ict Contract - Instrument of AgreementDocument16 pagesIct Contract - Instrument of AgreementWidad Al HarthyNo ratings yet

- Testing As Per WRC Type 2Document30 pagesTesting As Per WRC Type 2hectox08No ratings yet

- The New India Assurance Co. Ltd. Registered & Head Office:87, Mahatma Gandhi Road, Mumbai 400001Document4 pagesThe New India Assurance Co. Ltd. Registered & Head Office:87, Mahatma Gandhi Road, Mumbai 400001Nitesh KherdekarNo ratings yet

- 002a Risk of Ruin SimulatorDocument4 pages002a Risk of Ruin Simulatorbeetho1990No ratings yet

- Public Safety Equipment, Supplies, Services and Repairs Statewide ContractDocument13 pagesPublic Safety Equipment, Supplies, Services and Repairs Statewide ContractTheoNo ratings yet

- Assignment: General Insurance Corporation of India (Gic)Document53 pagesAssignment: General Insurance Corporation of India (Gic)Rahul Kottompurath RadhakrishnanNo ratings yet

- A.10 CIAC Revised Rules of Procedure (NEW)Document30 pagesA.10 CIAC Revised Rules of Procedure (NEW)asdfghjkattNo ratings yet

- Accounting Sample ProblemsDocument9 pagesAccounting Sample Problemsjoong wanNo ratings yet

- Parkin Econ SM CH30 GeDocument22 pagesParkin Econ SM CH30 GeMuri SetiawanNo ratings yet

- Risk Management and InsuranceDocument64 pagesRisk Management and InsuranceMehak AhluwaliaNo ratings yet

- Calanoc v. Court of AppealsDocument1 pageCalanoc v. Court of AppealswuplawschoolNo ratings yet

- LIS82 Proof of Income Form PDFDocument2 pagesLIS82 Proof of Income Form PDFDEJAY MANICNo ratings yet

- Lecture 3 - MISTAKEDocument16 pagesLecture 3 - MISTAKEvivian5okaforNo ratings yet