Professional Documents

Culture Documents

QBE People and Remuneration Committee Charter

QBE People and Remuneration Committee Charter

Uploaded by

Jiezel EstebeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

QBE People and Remuneration Committee Charter

QBE People and Remuneration Committee Charter

Uploaded by

Jiezel EstebeCopyright:

Available Formats

______________________________________________________

QBE INSURANCE GROUP LIMITED

People & Remuneration Committee Charter

Nature of committee: People & Remuneration Committee

Owner: Company Secretary

Approval: Board

Approval date: 11 June 2020

Status: Final

QBE Insurance Group Limited 1

Introduction

The People & Remuneration Committee (“Committee”) is established by the

Board of Directors (“Board”) of QBE Insurance Group Limited (“Company”).

1. Role

The role of the Committee is to assist the Board in overseeing major people and

remuneration practices of the Company and its controlled entities.

The Committee may:

a) make recommendations to the Board on the employment arrangements of the

Group Chief Executive Officer (“Group CEO”) and for any executives

reporting to the Group CEO;

b) make recommendations to the Board on the remuneration of any other

persons or categories of persons covered by the QBE Group Remuneration

Policy;

c) make recommendations to the Board on the remuneration of the non-

executive directors; and

d) make recommendations to the Board on QBE’s target culture and actions to

affect culture change.

In carrying out this role, the Committee will consider the matters outlined in

Section 5.

The Committee may decide matters within its scope, except for matters it

believes the Board should decide or the prudential standards of the Australian

Prudential Regulation Authority (“APRA”) require the Board to decide.

It is not intended the Committee should assume any of management’s

responsibilities in these areas.

2. Composition

The Committee will be comprised of a minimum of three members as determined

by the Board. All members must be non-executive directors. A majority of the

members of the Committee must be independent.

No alternates will be permitted unless agreed by the Committee Chairman at a

meeting of the Committee.

The Chairman of the Committee will be appointed by the Board and must be an

independent non-executive director of the Board.

A Company Secretary of the Board will act as Secretary to the Committee. The

composition of the Committee is to be reviewed at least annually as part of the

Board performance assessment.

The Chairman of the QBE Risk & Capital Committee will be a member of the

Committee.

3. Authority

The Committee has the authority as delegated within this Charter to:

QBE Insurance Group Limited 2

______________________________________________________

• investigate any activity within its Charter;

• obtain all information necessary for the performance of the Committee’s role

as set out in this Charter;

• access the Group Executive, People & Change, executives and other

employees, and any external parties including the external auditor as

required for the performance of the Committee’s role as set out in this

Charter, including to seek additional information and explanation during its

meetings;

• appoint specialist independent third-party advisers, legal, accounting or other

consultants, to independently advise the Committee; and

• attend relevant external training courses after consent from the Chairman of

the Company and in accordance with the Non-Executive Director Continuing

Development Program.

4. Scope

The Committee is responsible for:

Remuneration arrangements – senior executives

a) at least annually, recommending to the Board the entitlements under at-risk

incentive schemes for the Group CEO and for any executives reporting to that

position;

b) at least annually, recommending to the Board the total remuneration (fixed

and at-risk) of the Group CEO and of executives reporting to that position,

such remuneration including base pay, at risk cash and deferred equity

incentives (including shares and options), pension/superannuation and other

benefits;

c) at least annually, approving the total remuneration of any other persons, or

categories of persons not covered by 5 (e) and 5 (f):

i. who have been specified in writing by APRA;

ii. whose activities may in the Committee’s opinion affect the financial

soundness of the organisation; or

iii. as required by the QBE Group Remuneration Policy.

d) recommending to the Board any termination payments to be made to the

Group CEO and approving any to be made to executives reporting to that

position;

e) evaluating and making recommendations to the Board on the performance of

the Group CEO and for any executives reporting to that position, in light of

agreed financial targets and performance goals, informed by risk assessment

outcomes;

f) recommending to the Board any specific employment arrangements of the

Group CEO and approving any specific employment contracts of executives

reporting to that position, in each case in addition to remuneration;

Remuneration arrangements – non-executive directors

g) recommending to the Board remuneration arrangements for non-executive

directors;

QBE Insurance Group Limited 3

Incentive plans

h) reviewing the design of new and amended at-risk incentive schemes - cash

and deferred equity awards (including hurdles and targets);

Benefits

i) reviewing and monitoring the management of defined benefit pension

schemes including the appropriateness of investment strategies after

consideration by the Investment Committee, funding status and strategies to

wind up or de-risk schemes;

j) as principal employer, approving all rule amendments relating to benefits for

Group sponsored pension schemes and superannuation plans except those

required by statute;

Culture and talent management

k) monitoring the effectiveness of the talent strategy and culture programs to

achieve the strategies of QBE;

l) monitoring the effectiveness of QBE’s diversity and inclusion strategy, policy

and practices with a focus on QBE’s commitment to being a diverse and

inclusive workplace;

m) reviewing and recommending to the Board for approval, measurable

objectives for achieving gender diversity in the composition of its senior

executives and workforce generally;

n) monitoring the effectiveness of, and recommending to the Board for approval,

QBE’s executive succession plan and associated development plans for

senior executives to enable QBE to achieve its strategic goals over the long-

term;

Governance and disclosure

o) receiving from the Board the Charter for the Committee and assess its

performance against that Charter and otherwise;

p) regularly reviewing and where appropriate, making recommendations to the

Board on the QBE Group Remuneration Policy, including an assessment of

the Remuneration Policy’s effectiveness, compliance with the requirements

of APRA Prudential Standard CPS 510 and alignment with QBE’s target

culture, values, strategic objectives and risk appetite;

q) reviewing the reward structure (including incentive schemes) of certain

employees of APRA-regulated entities (such as risk and financial control

employees) in accordance with the APRA prudential standards covering the

governance of remuneration;

r) considering the draft annual remuneration report;

Other

s) undertaking any special projects either delegated by the Board or as part of

its responsibilities, as deemed necessary by the Committee; and

t) referring matters to either the Board or another Committee.

The Committee may deal with the above matters as required.

The Committee will arrange for effective coordination with other committees on

matters which also relate to their responsibilities.

QBE Insurance Group Limited 4

______________________________________________________

Management is responsible for preparing and presenting to the Committee

regular reports and other information on all matters about which the Committee

should be informed. Management will also escalate in a timely manner material

new or heightened risks for consideration by the Committee.

5. Meetings

The Committee will meet at least four times a year and more frequently as required.

Meetings are to be scheduled such that they are generally held prior to the

meetings of the Board of the Company. Any Committee member or the Secretary

may call a meeting.

A quorum for meetings will be two Committee members, including the Chairman.

Decisions will be made by a majority of directors present and voting.

All non-executive directors of the Board have a standing invitation to attend each

meeting.

The Group CEO and Group Executive, People & Change, will each have a standing

invitation to attend each meeting, subject to exclusion at the discretion of the

Committee Chairman as may be necessary from time to time.

The Committee may invite other members of management to assist in its

discussions (except those concerning their own remuneration).

The Chairman may call a special meeting on their own motion or will do so if

requested by any Committee member, the Group CEO or Group Executive, People

& Change.

The Committee may address time-sensitive matters outside of the usual meeting

cycle. Where the matter is of an urgent nature, the Committee provides delegation

for decision making to the Chairman of the Committee or in their absence the

Deputy Chairman of the Committee. Depending on the materiality, it may also be

referred to Chairman or Deputy Chairman of the Board.

The Committee may meet without management.

A notice of each meeting confirming the date, time, venue and agenda will be

forwarded to each member of the Committee prior to the date of the next meeting.

The notice for members will include relevant supporting documentation for agenda

items to be discussed.

6. Reporting

The Secretary will prepare and circulate minutes of meetings of the Committee to

all Committee members within a reasonable time after each meeting.

The Chairman will report to the Board as appropriate on matters reviewed and/or

recommended and/or approved by the Committee and any other areas within the

Committee’s scope. All directors of the Board of the Company will receive a copy

of the minutes of the Committee meetings and may request a copy of its papers.

7. Access

The members of the Committee must be available upon reasonable notice to meet

with relevant regulators if requested to do so.

The Committee has free and unfettered access to:

QBE Insurance Group Limited 5

i. QBE’s senior executives; and

ii. risk and financial control personnel and other parties, both internal

and external

including to seek additional information and explanation during its meetings. The

Group Executive, People & Change has free and unfettered access to the

Committee Chairman.

8. Review

The Committee will review this Charter every two years and recommend any

proposed amendments to the Board for approval.

QBE Insurance Group Limited 6

You might also like

- CH 4 & 5 Extra Practic Summer 2023Document9 pagesCH 4 & 5 Extra Practic Summer 2023Ruth KatakaNo ratings yet

- Retired Free Supply FormDocument8 pagesRetired Free Supply Formmwmalhr6654No ratings yet

- 06 A Mortality ProfitDocument6 pages06 A Mortality ProfitKimondo King100% (1)

- Hong Kong Exchanges and Clearing Limited Terms of Reference and Modus Operandi OF The Remuneration CommitteeDocument4 pagesHong Kong Exchanges and Clearing Limited Terms of Reference and Modus Operandi OF The Remuneration CommitteeALNo ratings yet

- Nomination and Remuneration Policy OF Infosys LimitedDocument7 pagesNomination and Remuneration Policy OF Infosys LimitedShubham BishtNo ratings yet

- ASG-People-and-Remuneration-Committee-Charter 190620Document7 pagesASG-People-and-Remuneration-Committee-Charter 190620Jiezel EstebeNo ratings yet

- Compensation Committee MandateDocument4 pagesCompensation Committee MandateJafar FikratNo ratings yet

- Compensation Committee Charter As of October 25,2023Document7 pagesCompensation Committee Charter As of October 25,2023Jiezel EstebeNo ratings yet

- QCOM Master HR and Compensation Committee Charter (As Approved 5-16-23)Document4 pagesQCOM Master HR and Compensation Committee Charter (As Approved 5-16-23)rmaleem084No ratings yet

- Nomination Remuneration PolicyDocument6 pagesNomination Remuneration PolicyAbesh DebNo ratings yet

- DOCN Compensation Committee CharterDocument4 pagesDOCN Compensation Committee CharterJohn PeterNo ratings yet

- Duolingo Compensation and Leadership Committee Charter As of February 13 2024Document5 pagesDuolingo Compensation and Leadership Committee Charter As of February 13 2024Juan HurtadoNo ratings yet

- LB - Nomination and Remuneration Committee CharterDocument7 pagesLB - Nomination and Remuneration Committee Chartereka andhika surjadiNo ratings yet

- Stockland HR Committee CharterDocument2 pagesStockland HR Committee CharterAli HusnaenNo ratings yet

- Compensation and Management Development Committee CharterDocument4 pagesCompensation and Management Development Committee CharterKenneth BurnettNo ratings yet

- HR and Compensation Committee CharterDocument3 pagesHR and Compensation Committee CharterozlemNo ratings yet

- Board CharterDocument4 pagesBoard Chartert34kwoodNo ratings yet

- Establishing Clear Roles and Responsibilities of The BoardDocument9 pagesEstablishing Clear Roles and Responsibilities of The BoardcarlaNo ratings yet

- SDHB Corporate Governance Report 2019Document43 pagesSDHB Corporate Governance Report 2019deepkisorNo ratings yet

- Risk Committee MandateDocument4 pagesRisk Committee MandateJafar FikratNo ratings yet

- QBEM Board CharterDocument9 pagesQBEM Board CharterSS CORPORATE SERVICESNo ratings yet

- Human Resources and Remuneration Committee CharterDocument4 pagesHuman Resources and Remuneration Committee CharterShahzad SalimNo ratings yet

- QBE Investment Committee Charter 9 October 2019Document4 pagesQBE Investment Committee Charter 9 October 2019Jiezel EstebeNo ratings yet

- Nomination and Remuneration Policy - FinalDocument15 pagesNomination and Remuneration Policy - FinalNathaNo ratings yet

- CG - Week 2 - Group 7Document27 pagesCG - Week 2 - Group 7Hadila Franciska StevanyNo ratings yet

- Appointment Independent DirectorDocument10 pagesAppointment Independent DirectorSubhasis RoyNo ratings yet

- Accenture Compensation CommitteeDocument5 pagesAccenture Compensation CommitteeMohammad Hossein VaghefNo ratings yet

- Establishing Board CommitteesDocument9 pagesEstablishing Board CommitteescarlaNo ratings yet

- SCCPSTE-MPC (Succession Planning Committee Charter)Document13 pagesSCCPSTE-MPC (Succession Planning Committee Charter)Jovito LimotNo ratings yet

- Board Mandate enDocument6 pagesBoard Mandate enamvcivilNo ratings yet

- Board Terms of Reference enDocument4 pagesBoard Terms of Reference enYan Myo ZawNo ratings yet

- QBE Risk and Capital Committee CharterDocument7 pagesQBE Risk and Capital Committee CharterJiezel EstebeNo ratings yet

- Blank 8Document3 pagesBlank 8Gurbean TiwanaNo ratings yet

- FY20 Corporate Governance StatementDocument24 pagesFY20 Corporate Governance StatementJiezel EstebeNo ratings yet

- Diversity Policy 08 2023Document2 pagesDiversity Policy 08 2023colortherapystoreNo ratings yet

- Investment Committee CharterDocument5 pagesInvestment Committee CharterTeofel John Alvizo PantaleonNo ratings yet

- 13 Board Charter ASTRO 2Document9 pages13 Board Charter ASTRO 2Nur's KitchenNo ratings yet

- CG Report 2020Document46 pagesCG Report 2020Gan ZhiHanNo ratings yet

- Corporate GovernanceDocument7 pagesCorporate GovernancePayalmalikNo ratings yet

- ATNI WebDoc 5692Document3 pagesATNI WebDoc 5692Roberto PayaNo ratings yet

- Accenture Compensation CommitterilDocument5 pagesAccenture Compensation CommitterilUday ChavanNo ratings yet

- SMEC Board CharterDocument10 pagesSMEC Board ChartermohsinNo ratings yet

- QBE Audit Committee CharterDocument6 pagesQBE Audit Committee CharterJiezel EstebeNo ratings yet

- Risk Committee Terms of Reference PurposeDocument5 pagesRisk Committee Terms of Reference Purposeaqiilah subrotoNo ratings yet

- Corporate Governance GuidelinesDocument4 pagesCorporate Governance Guidelines_erosalesNo ratings yet

- QBE Nomination Committee CharterDocument2 pagesQBE Nomination Committee CharterJiezel EstebeNo ratings yet

- 4.5. Compensation Committee CharterDocument1 page4.5. Compensation Committee CharterMohamed El-najjarNo ratings yet

- Nova Minerals LTD - Corporate GovernanceDocument40 pagesNova Minerals LTD - Corporate GovernanceEli BernsteinNo ratings yet

- Board Mandate Mar 8 - 2023Document5 pagesBoard Mandate Mar 8 - 2023RAUL SEBASTIAN CAJASNo ratings yet

- QBE Operations Technology Committee Charter 9 October 2019Document4 pagesQBE Operations Technology Committee Charter 9 October 2019Jiezel EstebeNo ratings yet

- Marvell Technology Group Ltd. Executive Compensation Committee Charter (As Revised April 19, 2013)Document5 pagesMarvell Technology Group Ltd. Executive Compensation Committee Charter (As Revised April 19, 2013)JenniferChenNo ratings yet

- E.4.4 - AR Page 438-439Document2 pagesE.4.4 - AR Page 438-439Muhammad AatNo ratings yet

- FIIT-JEE Nomination and Remuneration PolicyDocument8 pagesFIIT-JEE Nomination and Remuneration PolicymsujoyNo ratings yet

- Corporate Governance GuidelinesDocument9 pagesCorporate Governance GuidelinesKenneth BurnettNo ratings yet

- Nomination and Remuneration PolicyDocument7 pagesNomination and Remuneration PolicyShwetank SinghNo ratings yet

- Nomination and Corporate Governance Committee Charter As of October 2022Document4 pagesNomination and Corporate Governance Committee Charter As of October 2022Jiezel EstebeNo ratings yet

- HUTCHMED (China) Limited: Remuneration Committee - Terms of ReferenceDocument6 pagesHUTCHMED (China) Limited: Remuneration Committee - Terms of Referencewilliam zengNo ratings yet

- Manish SanilDocument14 pagesManish SanilJagruti AcharyaNo ratings yet

- Corporate Governance Risk Assessment Committee CharterDocument4 pagesCorporate Governance Risk Assessment Committee Charterbrothmass0kNo ratings yet

- Terms of Reference Job Evaluation and Performance Management ExerciseDocument4 pagesTerms of Reference Job Evaluation and Performance Management ExerciseLouise DLNo ratings yet

- QianHu AR FS07Document129 pagesQianHu AR FS07costie86No ratings yet

- Board Committees: Rajnish Jindal Asst. Professor Symbiosis Law School, NOIDADocument50 pagesBoard Committees: Rajnish Jindal Asst. Professor Symbiosis Law School, NOIDAsana khanNo ratings yet

- Corporate Governance - Effective Performance Evaluation of the BoardFrom EverandCorporate Governance - Effective Performance Evaluation of the BoardNo ratings yet

- Rutendo KamukonoDocument3 pagesRutendo KamukonoHazel ChatsNo ratings yet

- Payroll Guidelines and FAQs - V1Document15 pagesPayroll Guidelines and FAQs - V1Shiva Kant VermaNo ratings yet

- 2.4.1 Office Manual IV - Vol. 1Document82 pages2.4.1 Office Manual IV - Vol. 1KuldipSonowalNo ratings yet

- 2020-08-21ready ReckonerDocument1 page2020-08-21ready ReckonerAnkit ChakrabortyNo ratings yet

- Benefits. by of Sales: 2020. SuperannuationDocument1 pageBenefits. by of Sales: 2020. SuperannuationArya RoshanNo ratings yet

- Burs Final Tax Table PDFDocument81 pagesBurs Final Tax Table PDFMoabiNo ratings yet

- Defined Benefit Plan (Exercises With Answers)Document3 pagesDefined Benefit Plan (Exercises With Answers)Jennifer AdvientoNo ratings yet

- Final Exam - Comprehensive - 10.24.16Document5 pagesFinal Exam - Comprehensive - 10.24.16YamateNo ratings yet

- Equirus Securities - Protean EGov - Initiating Coverage NoteDocument28 pagesEquirus Securities - Protean EGov - Initiating Coverage NoteinstiresmilanNo ratings yet

- PWWF-TS-Certificate From Head of Administration of EmployerDocument1 pagePWWF-TS-Certificate From Head of Administration of EmployerWaqas Lucky100% (1)

- p15t 2024Document70 pagesp15t 2024quintianNo ratings yet

- Finance: NAME:Hasan Mamudul 卡尔 Student ID:5086180123 Class:1801Document9 pagesFinance: NAME:Hasan Mamudul 卡尔 Student ID:5086180123 Class:1801mamudul hasan100% (1)

- New Loan Form WordDocument2 pagesNew Loan Form WordProvident Fund Bjmp67% (3)

- Full Download Test Bank For Investments Analysis and Behavior 1st Edition Hirschey PDF Full ChapterDocument36 pagesFull Download Test Bank For Investments Analysis and Behavior 1st Edition Hirschey PDF Full Chaptergomeerrorist.g9vfq6100% (19)

- Cfas Quiz Pas 19Document5 pagesCfas Quiz Pas 19Michaella NudoNo ratings yet

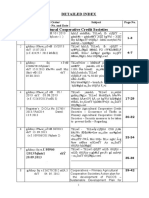

- Detailed Index: Sl. No. Government Order/ Registrar'Circular No. and Date Subject Page NoDocument11 pagesDetailed Index: Sl. No. Government Order/ Registrar'Circular No. and Date Subject Page NokalkibookNo ratings yet

- MCQs On Govt. Rules - Fundamental Rules & Supplementary Rules (FR & SR) 1Document15 pagesMCQs On Govt. Rules - Fundamental Rules & Supplementary Rules (FR & SR) 1PrasunEbongIndraniRoyNo ratings yet

- NTPC Circular - EPS 95 - Joint Option Form - 06.02.2023Document10 pagesNTPC Circular - EPS 95 - Joint Option Form - 06.02.2023Manjunaath S G GNo ratings yet

- National Pension System (Enps) - Subscriber Registration FormDocument8 pagesNational Pension System (Enps) - Subscriber Registration FormSasankNo ratings yet

- Ein Confirmation LetterDocument2 pagesEin Confirmation Lettereasylifehouse42No ratings yet

- Vijaya Bank Retirees (Circular-1)Document12 pagesVijaya Bank Retirees (Circular-1)Sudhakar JainNo ratings yet

- Current Liabilities AK IIDocument46 pagesCurrent Liabilities AK IIAyu FebryanggiNo ratings yet

- Inua Jamii Senior Citizens' Scheme: Main Lessons LearnedDocument6 pagesInua Jamii Senior Citizens' Scheme: Main Lessons LearnedreaganNo ratings yet

- Application To Start Family PensionDocument4 pagesApplication To Start Family PensionSabuj SarkarNo ratings yet

- Assignment No. 2 - Pension - Cunanan & ManlangitDocument3 pagesAssignment No. 2 - Pension - Cunanan & ManlangitCunanan, Malakhai JeuNo ratings yet

- Personal Tax PlanningDocument21 pagesPersonal Tax PlanningDhruv ChhabraNo ratings yet

- Book Sustainable Finance Chapter Kock en Lundberg HDocument23 pagesBook Sustainable Finance Chapter Kock en Lundberg HZain AmanNo ratings yet