Professional Documents

Culture Documents

Chapter 9 hw

Chapter 9 hw

Uploaded by

nn943993Copyright:

Available Formats

You might also like

- LWUA Water Rates ManualDocument48 pagesLWUA Water Rates ManualAmmar Aguinaldo Rodriguez74% (23)

- Chapter 3 ExercisesDocument3 pagesChapter 3 ExercisesLê Chấn PhongNo ratings yet

- PR Week 5 CVPDocument3 pagesPR Week 5 CVPAyhuNo ratings yet

- Solution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 11Document44 pagesSolution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 11jasperkennedy089% (28)

- Jarlsberg Cheese Company Has Developed A New Cheese Slicer Called Slim SlicerDocument5 pagesJarlsberg Cheese Company Has Developed A New Cheese Slicer Called Slim SlicerDeniseNo ratings yet

- Management Accounting Individual AssignmentDocument10 pagesManagement Accounting Individual AssignmentendalNo ratings yet

- Volka Market Segmentation (Repaired)Document43 pagesVolka Market Segmentation (Repaired)muqaddas waseem40% (5)

- Decentralization and PricingDocument38 pagesDecentralization and PricingFidelina CastroNo ratings yet

- Welcome: We Belong To "Group-6"Document26 pagesWelcome: We Belong To "Group-6"Rifat LimonNo ratings yet

- PRICINGDocument25 pagesPRICINGJulianne Lopez EusebioNo ratings yet

- Cost Volume Profit (CVP) AnalysisDocument12 pagesCost Volume Profit (CVP) AnalysisShan rNo ratings yet

- Exercise C2Document13 pagesExercise C2Nhựt AnhNo ratings yet

- General Pricing Approaches Final (By Bilal)Document19 pagesGeneral Pricing Approaches Final (By Bilal)Bilal100% (10)

- Cost-Volume-Profit Analysis: A Managerial Planning Tool: Discussion QuestionsDocument48 pagesCost-Volume-Profit Analysis: A Managerial Planning Tool: Discussion QuestionsParth GandhiNo ratings yet

- Accounting & Control: Cost ManagementDocument38 pagesAccounting & Control: Cost ManagementMosha MochaNo ratings yet

- Level 6 - Calculating CostsDocument2 pagesLevel 6 - Calculating Costsdilan123.patelNo ratings yet

- Presentasi AdvancedDocument7 pagesPresentasi AdvancedFeeling GoodNo ratings yet

- Mowen 2ce Solutions - ch04Document48 pagesMowen 2ce Solutions - ch04Matthew TesfayeNo ratings yet

- Ch19 - Guan CM - AISEDocument38 pagesCh19 - Guan CM - AISELydia WulandariNo ratings yet

- ACCT Exam 2 Study GuideDocument12 pagesACCT Exam 2 Study GuideNhan TranNo ratings yet

- Solutions To ProblemsDocument5 pagesSolutions To ProblemsFajar KhanNo ratings yet

- ACC Worksheet 4Document16 pagesACC Worksheet 4amar.jaf17No ratings yet

- CVP Multiple Product DiscussionDocument5 pagesCVP Multiple Product DiscussionheyheyNo ratings yet

- Cost-Volume-Profit (CVP) AnalysisDocument19 pagesCost-Volume-Profit (CVP) AnalysisObeng CliffNo ratings yet

- Pricing Decisions PDFDocument4 pagesPricing Decisions PDFAnonymous 3yqNzCxtTzNo ratings yet

- Session 4 Cost-Volume-Profit (CVP) AnalysisDocument46 pagesSession 4 Cost-Volume-Profit (CVP) Analysischloe lamxdNo ratings yet

- Target Costing and Consumer Profitability AnalysisDocument32 pagesTarget Costing and Consumer Profitability AnalysisMuhammad AsadNo ratings yet

- An Individual Assignment For Acc2 For MGMT2Document123 pagesAn Individual Assignment For Acc2 For MGMT2Amanuel GirmaNo ratings yet

- Agenda:: A Little More Vocabulary C-V-P Analysis Thursday's Class Group Problem SolvingDocument33 pagesAgenda:: A Little More Vocabulary C-V-P Analysis Thursday's Class Group Problem SolvingApoorvNo ratings yet

- Management Accounting ServicesDocument5 pagesManagement Accounting ServicesEmma Mariz GarciaNo ratings yet

- FM Chapter 8 PDFDocument6 pagesFM Chapter 8 PDFSuzanne AcostaNo ratings yet

- Priciples of Marketing by Philip Kotler and Gary Armstrong: PricingDocument25 pagesPriciples of Marketing by Philip Kotler and Gary Armstrong: PricingFrandy Karundeng100% (1)

- Solution Manual Managerial Accounting Hansen Mowen 8th Editions CH 11Document44 pagesSolution Manual Managerial Accounting Hansen Mowen 8th Editions CH 11kkamjonginnNo ratings yet

- CH 08A (Empty)Document6 pagesCH 08A (Empty)Riley CareNo ratings yet

- Materi Amb CH 8Document73 pagesMateri Amb CH 8Sri HaryantiNo ratings yet

- Assignment Questions CVP AmendedDocument4 pagesAssignment Questions CVP AmendedReynaldo BurgosNo ratings yet

- CHAPTER 2 - Key Measures and RelationshipsDocument27 pagesCHAPTER 2 - Key Measures and RelationshipsAYEZZA SAMSONNo ratings yet

- BROWN SHOE COMPANY-solution-icampusDocument2 pagesBROWN SHOE COMPANY-solution-icampuspoggiolilaureNo ratings yet

- Cost Volume Profit Analysis: F. M. KapepisoDocument19 pagesCost Volume Profit Analysis: F. M. KapepisosimsonNo ratings yet

- COSTMAN - MidtermDocument23 pagesCOSTMAN - MidtermHoney MuliNo ratings yet

- Tutorial 1 - SolutionsDocument14 pagesTutorial 1 - SolutionsLijing CheNo ratings yet

- Pricing Products and Services: Per Unit TotalDocument3 pagesPricing Products and Services: Per Unit TotalSherwin Francis MendozaNo ratings yet

- 3 Mas Answer KeyDocument25 pages3 Mas Answer KeyAngelie0% (1)

- CVP AnalysisDocument8 pagesCVP AnalysisEricka Mae AntiolaNo ratings yet

- 1chapter 7-Cost Volume-Profit Relationship and Break-Even AnalysisDocument4 pages1chapter 7-Cost Volume-Profit Relationship and Break-Even AnalysisShenedy Lauresta QuizanaNo ratings yet

- CVP Analysis - CVP CVP Analysis - CVPDocument10 pagesCVP Analysis - CVP CVP Analysis - CVPels ems100% (1)

- Session 3Document17 pagesSession 3SylvesterNo ratings yet

- Strat Cost CVP Analysis PDFDocument14 pagesStrat Cost CVP Analysis PDFA. HanifahNo ratings yet

- Costing MethodsDocument79 pagesCosting MethodsemmaNo ratings yet

- Attempt-1: The Company's Accountant Used A Denominator of Budgeted Machine Hours For The Current Accounting PeriodDocument18 pagesAttempt-1: The Company's Accountant Used A Denominator of Budgeted Machine Hours For The Current Accounting Periodpragadeeshwaran100% (2)

- F5-CVP-1 AccaDocument10 pagesF5-CVP-1 AccaAmna HussainNo ratings yet

- Advanced Management AccountingDocument14 pagesAdvanced Management AccountingZain ul AbidinNo ratings yet

- Economics of The BusinessDocument2 pagesEconomics of The BusinessMd. Anowar MorshedNo ratings yet

- Chapter 1 Final ExamDocument9 pagesChapter 1 Final ExamTheresa TimonanNo ratings yet

- Group 2 CVP RelationDocument40 pagesGroup 2 CVP RelationJeejohn Sodusta0% (1)

- Addl Prob REL CostDocument6 pagesAddl Prob REL Costjeongjeongwoo28No ratings yet

- 04 Review Problem - CVP AnalysisDocument3 pages04 Review Problem - CVP AnalysisIzzahIkramIllahi100% (1)

- 04 Review Problem - CVP AnalysisDocument3 pages04 Review Problem - CVP AnalysisIzzahIkramIllahiNo ratings yet

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- CPA Review Notes 2019 - BEC (Business Environment Concepts)From EverandCPA Review Notes 2019 - BEC (Business Environment Concepts)Rating: 4 out of 5 stars4/5 (9)

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Acccob3 HW7Document12 pagesAcccob3 HW7Jenine Yamson100% (1)

- Fundamentals of Marketing: Final ProjectDocument24 pagesFundamentals of Marketing: Final Projectمحمد عبداللہ چوہدریNo ratings yet

- Big 5 Banks in Canada and The BrokersDocument15 pagesBig 5 Banks in Canada and The BrokersKrîzèllê B. MëndòzâNo ratings yet

- Marketing GE 4PSDocument16 pagesMarketing GE 4PSsouravNo ratings yet

- BTQS 3034 - Measurement of Civil Engineering Works LECTURE 1bDocument54 pagesBTQS 3034 - Measurement of Civil Engineering Works LECTURE 1bsatera99No ratings yet

- Vancouver Public Aquarium CasestudyDocument8 pagesVancouver Public Aquarium CasestudyayeshajamilafridiNo ratings yet

- Business Plan Sample Pharmacy PDFDocument26 pagesBusiness Plan Sample Pharmacy PDFBeverly Caaya100% (1)

- Marketing Mix of SamsungDocument4 pagesMarketing Mix of SamsungReal MeNo ratings yet

- Naveen Agarwal (16035) CO5 Assignment Artificial IntelligenceDocument3 pagesNaveen Agarwal (16035) CO5 Assignment Artificial Intelligencesahil9mohd2013No ratings yet

- Mktg. Lndia: Greenhouse PVTDocument13 pagesMktg. Lndia: Greenhouse PVTRoshniNo ratings yet

- Proton & Perodua 4S Mix Marketing - XFINAL 11.1.2024Document46 pagesProton & Perodua 4S Mix Marketing - XFINAL 11.1.2024mujahidpoyoNo ratings yet

- Bba1 (R) RMKT SG v8.4 e FDocument201 pagesBba1 (R) RMKT SG v8.4 e FLight MediaNo ratings yet

- F - 307 Term Paper On Idea Generation & Develop A Business PlanDocument36 pagesF - 307 Term Paper On Idea Generation & Develop A Business PlanMahmudurTopuNo ratings yet

- Marketing Mix Strategies of Selected Restaurants in Vigan City, Ilocos SurDocument2 pagesMarketing Mix Strategies of Selected Restaurants in Vigan City, Ilocos SurKent De PeraltaNo ratings yet

- Chapter 3.3 Break-Even AnalysisDocument5 pagesChapter 3.3 Break-Even AnalysislojainNo ratings yet

- MBAFT-6105 Final BookDocument251 pagesMBAFT-6105 Final BookapurvgaurNo ratings yet

- 2012 KPMG Nigeria Banking Industry Customer Satisfaction Survey Final PDFDocument32 pages2012 KPMG Nigeria Banking Industry Customer Satisfaction Survey Final PDFShadowfax_uNo ratings yet

- S4HANA2022 Pre-Configured Tax Codes EN FRDocument21 pagesS4HANA2022 Pre-Configured Tax Codes EN FRsamyNo ratings yet

- 10 Responsibility Accounting Transfer Pricing (MAS by Roque)Document4 pages10 Responsibility Accounting Transfer Pricing (MAS by Roque)Lee Suarez100% (1)

- Bowling ClubDocument68 pagesBowling ClubBILLU100% (1)

- Sales Cloud Full Exam 78 AnswersDocument39 pagesSales Cloud Full Exam 78 AnswersTinotenda ChonziNo ratings yet

- LYNIFER Business PlanDocument56 pagesLYNIFER Business PlanCALVINS OJWANGNo ratings yet

- Acca Ma1 CH 3.Document11 pagesAcca Ma1 CH 3.Muhammad Haris AbbasNo ratings yet

- Spotify Music Streaming PlatformDocument6 pagesSpotify Music Streaming PlatformBilal SohailNo ratings yet

- Munnukka 2005Document11 pagesMunnukka 2005Cori LinNo ratings yet

- Tea PresentationDocument38 pagesTea PresentationAradhya100% (1)

- Vishal Mega MartDocument6 pagesVishal Mega MartPRABHAT SINGHNo ratings yet

- SVT Case Study AnalysisDocument35 pagesSVT Case Study AnalysisDhikshith BalajiNo ratings yet

Chapter 9 hw

Chapter 9 hw

Uploaded by

nn943993Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 9 hw

Chapter 9 hw

Uploaded by

nn943993Copyright:

Available Formats

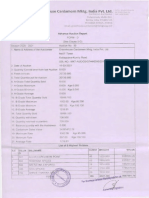

Chapter 9: Pricing Homework

Target Cost: Cheesin’ Company has developed a new ultra-thin cheese slicer using

nanotechnology. Given market research, the company believes it can charge $200 for the

-

product. However, recent prototypes of the slicer are costing the company $220. The company

thinks that by using cheaper materials it can reduce the product’s cost substantially. Cheesin’

Company wishes to earn a return on 30% of the selling price.

1.) Compute the target cost of the new cheese slicer.

x 200 $60 00

profit %

= .

Desired = 30

Market price - desired profit

$200 -

160- 0

2.) When is the target costing method helpful in deciding whether to produce a specific product?

Total in this case helps the company

costing of $140 per unit for

set

to a cust

target

ultra thin cheese slicer

.

the new

Cost-Plus: Cassie Company makes electronic greeting cards. The following information is

available for their anticipated annual volume of 30,000 units.

Per Unit Total

Direct materials $17

Direct labor $8

Variable manufacturing overhead $11

Fixed manufacturing overhead $300,000 = 30 , 000 = $10

Variable selling & administrative expenses $4

[

Fixed selling & administrative expenses $150,000 - 30 , 000 = $5

The company uses a 40% markup percentage on total cost.

1.) Compute the total cost per unit.

(17+ 8 + 11 +10 + 4+ 5) = $55

2.) Using the cost-plus method, compute the selling price for the

product.

1) Cost + Markup = Sales

price

477

$55 140 % + 55) =

~

$ 22

You might also like

- LWUA Water Rates ManualDocument48 pagesLWUA Water Rates ManualAmmar Aguinaldo Rodriguez74% (23)

- Chapter 3 ExercisesDocument3 pagesChapter 3 ExercisesLê Chấn PhongNo ratings yet

- PR Week 5 CVPDocument3 pagesPR Week 5 CVPAyhuNo ratings yet

- Solution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 11Document44 pagesSolution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 11jasperkennedy089% (28)

- Jarlsberg Cheese Company Has Developed A New Cheese Slicer Called Slim SlicerDocument5 pagesJarlsberg Cheese Company Has Developed A New Cheese Slicer Called Slim SlicerDeniseNo ratings yet

- Management Accounting Individual AssignmentDocument10 pagesManagement Accounting Individual AssignmentendalNo ratings yet

- Volka Market Segmentation (Repaired)Document43 pagesVolka Market Segmentation (Repaired)muqaddas waseem40% (5)

- Decentralization and PricingDocument38 pagesDecentralization and PricingFidelina CastroNo ratings yet

- Welcome: We Belong To "Group-6"Document26 pagesWelcome: We Belong To "Group-6"Rifat LimonNo ratings yet

- PRICINGDocument25 pagesPRICINGJulianne Lopez EusebioNo ratings yet

- Cost Volume Profit (CVP) AnalysisDocument12 pagesCost Volume Profit (CVP) AnalysisShan rNo ratings yet

- Exercise C2Document13 pagesExercise C2Nhựt AnhNo ratings yet

- General Pricing Approaches Final (By Bilal)Document19 pagesGeneral Pricing Approaches Final (By Bilal)Bilal100% (10)

- Cost-Volume-Profit Analysis: A Managerial Planning Tool: Discussion QuestionsDocument48 pagesCost-Volume-Profit Analysis: A Managerial Planning Tool: Discussion QuestionsParth GandhiNo ratings yet

- Accounting & Control: Cost ManagementDocument38 pagesAccounting & Control: Cost ManagementMosha MochaNo ratings yet

- Level 6 - Calculating CostsDocument2 pagesLevel 6 - Calculating Costsdilan123.patelNo ratings yet

- Presentasi AdvancedDocument7 pagesPresentasi AdvancedFeeling GoodNo ratings yet

- Mowen 2ce Solutions - ch04Document48 pagesMowen 2ce Solutions - ch04Matthew TesfayeNo ratings yet

- Ch19 - Guan CM - AISEDocument38 pagesCh19 - Guan CM - AISELydia WulandariNo ratings yet

- ACCT Exam 2 Study GuideDocument12 pagesACCT Exam 2 Study GuideNhan TranNo ratings yet

- Solutions To ProblemsDocument5 pagesSolutions To ProblemsFajar KhanNo ratings yet

- ACC Worksheet 4Document16 pagesACC Worksheet 4amar.jaf17No ratings yet

- CVP Multiple Product DiscussionDocument5 pagesCVP Multiple Product DiscussionheyheyNo ratings yet

- Cost-Volume-Profit (CVP) AnalysisDocument19 pagesCost-Volume-Profit (CVP) AnalysisObeng CliffNo ratings yet

- Pricing Decisions PDFDocument4 pagesPricing Decisions PDFAnonymous 3yqNzCxtTzNo ratings yet

- Session 4 Cost-Volume-Profit (CVP) AnalysisDocument46 pagesSession 4 Cost-Volume-Profit (CVP) Analysischloe lamxdNo ratings yet

- Target Costing and Consumer Profitability AnalysisDocument32 pagesTarget Costing and Consumer Profitability AnalysisMuhammad AsadNo ratings yet

- An Individual Assignment For Acc2 For MGMT2Document123 pagesAn Individual Assignment For Acc2 For MGMT2Amanuel GirmaNo ratings yet

- Agenda:: A Little More Vocabulary C-V-P Analysis Thursday's Class Group Problem SolvingDocument33 pagesAgenda:: A Little More Vocabulary C-V-P Analysis Thursday's Class Group Problem SolvingApoorvNo ratings yet

- Management Accounting ServicesDocument5 pagesManagement Accounting ServicesEmma Mariz GarciaNo ratings yet

- FM Chapter 8 PDFDocument6 pagesFM Chapter 8 PDFSuzanne AcostaNo ratings yet

- Priciples of Marketing by Philip Kotler and Gary Armstrong: PricingDocument25 pagesPriciples of Marketing by Philip Kotler and Gary Armstrong: PricingFrandy Karundeng100% (1)

- Solution Manual Managerial Accounting Hansen Mowen 8th Editions CH 11Document44 pagesSolution Manual Managerial Accounting Hansen Mowen 8th Editions CH 11kkamjonginnNo ratings yet

- CH 08A (Empty)Document6 pagesCH 08A (Empty)Riley CareNo ratings yet

- Materi Amb CH 8Document73 pagesMateri Amb CH 8Sri HaryantiNo ratings yet

- Assignment Questions CVP AmendedDocument4 pagesAssignment Questions CVP AmendedReynaldo BurgosNo ratings yet

- CHAPTER 2 - Key Measures and RelationshipsDocument27 pagesCHAPTER 2 - Key Measures and RelationshipsAYEZZA SAMSONNo ratings yet

- BROWN SHOE COMPANY-solution-icampusDocument2 pagesBROWN SHOE COMPANY-solution-icampuspoggiolilaureNo ratings yet

- Cost Volume Profit Analysis: F. M. KapepisoDocument19 pagesCost Volume Profit Analysis: F. M. KapepisosimsonNo ratings yet

- COSTMAN - MidtermDocument23 pagesCOSTMAN - MidtermHoney MuliNo ratings yet

- Tutorial 1 - SolutionsDocument14 pagesTutorial 1 - SolutionsLijing CheNo ratings yet

- Pricing Products and Services: Per Unit TotalDocument3 pagesPricing Products and Services: Per Unit TotalSherwin Francis MendozaNo ratings yet

- 3 Mas Answer KeyDocument25 pages3 Mas Answer KeyAngelie0% (1)

- CVP AnalysisDocument8 pagesCVP AnalysisEricka Mae AntiolaNo ratings yet

- 1chapter 7-Cost Volume-Profit Relationship and Break-Even AnalysisDocument4 pages1chapter 7-Cost Volume-Profit Relationship and Break-Even AnalysisShenedy Lauresta QuizanaNo ratings yet

- CVP Analysis - CVP CVP Analysis - CVPDocument10 pagesCVP Analysis - CVP CVP Analysis - CVPels ems100% (1)

- Session 3Document17 pagesSession 3SylvesterNo ratings yet

- Strat Cost CVP Analysis PDFDocument14 pagesStrat Cost CVP Analysis PDFA. HanifahNo ratings yet

- Costing MethodsDocument79 pagesCosting MethodsemmaNo ratings yet

- Attempt-1: The Company's Accountant Used A Denominator of Budgeted Machine Hours For The Current Accounting PeriodDocument18 pagesAttempt-1: The Company's Accountant Used A Denominator of Budgeted Machine Hours For The Current Accounting Periodpragadeeshwaran100% (2)

- F5-CVP-1 AccaDocument10 pagesF5-CVP-1 AccaAmna HussainNo ratings yet

- Advanced Management AccountingDocument14 pagesAdvanced Management AccountingZain ul AbidinNo ratings yet

- Economics of The BusinessDocument2 pagesEconomics of The BusinessMd. Anowar MorshedNo ratings yet

- Chapter 1 Final ExamDocument9 pagesChapter 1 Final ExamTheresa TimonanNo ratings yet

- Group 2 CVP RelationDocument40 pagesGroup 2 CVP RelationJeejohn Sodusta0% (1)

- Addl Prob REL CostDocument6 pagesAddl Prob REL Costjeongjeongwoo28No ratings yet

- 04 Review Problem - CVP AnalysisDocument3 pages04 Review Problem - CVP AnalysisIzzahIkramIllahi100% (1)

- 04 Review Problem - CVP AnalysisDocument3 pages04 Review Problem - CVP AnalysisIzzahIkramIllahiNo ratings yet

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- CPA Review Notes 2019 - BEC (Business Environment Concepts)From EverandCPA Review Notes 2019 - BEC (Business Environment Concepts)Rating: 4 out of 5 stars4/5 (9)

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Acccob3 HW7Document12 pagesAcccob3 HW7Jenine Yamson100% (1)

- Fundamentals of Marketing: Final ProjectDocument24 pagesFundamentals of Marketing: Final Projectمحمد عبداللہ چوہدریNo ratings yet

- Big 5 Banks in Canada and The BrokersDocument15 pagesBig 5 Banks in Canada and The BrokersKrîzèllê B. MëndòzâNo ratings yet

- Marketing GE 4PSDocument16 pagesMarketing GE 4PSsouravNo ratings yet

- BTQS 3034 - Measurement of Civil Engineering Works LECTURE 1bDocument54 pagesBTQS 3034 - Measurement of Civil Engineering Works LECTURE 1bsatera99No ratings yet

- Vancouver Public Aquarium CasestudyDocument8 pagesVancouver Public Aquarium CasestudyayeshajamilafridiNo ratings yet

- Business Plan Sample Pharmacy PDFDocument26 pagesBusiness Plan Sample Pharmacy PDFBeverly Caaya100% (1)

- Marketing Mix of SamsungDocument4 pagesMarketing Mix of SamsungReal MeNo ratings yet

- Naveen Agarwal (16035) CO5 Assignment Artificial IntelligenceDocument3 pagesNaveen Agarwal (16035) CO5 Assignment Artificial Intelligencesahil9mohd2013No ratings yet

- Mktg. Lndia: Greenhouse PVTDocument13 pagesMktg. Lndia: Greenhouse PVTRoshniNo ratings yet

- Proton & Perodua 4S Mix Marketing - XFINAL 11.1.2024Document46 pagesProton & Perodua 4S Mix Marketing - XFINAL 11.1.2024mujahidpoyoNo ratings yet

- Bba1 (R) RMKT SG v8.4 e FDocument201 pagesBba1 (R) RMKT SG v8.4 e FLight MediaNo ratings yet

- F - 307 Term Paper On Idea Generation & Develop A Business PlanDocument36 pagesF - 307 Term Paper On Idea Generation & Develop A Business PlanMahmudurTopuNo ratings yet

- Marketing Mix Strategies of Selected Restaurants in Vigan City, Ilocos SurDocument2 pagesMarketing Mix Strategies of Selected Restaurants in Vigan City, Ilocos SurKent De PeraltaNo ratings yet

- Chapter 3.3 Break-Even AnalysisDocument5 pagesChapter 3.3 Break-Even AnalysislojainNo ratings yet

- MBAFT-6105 Final BookDocument251 pagesMBAFT-6105 Final BookapurvgaurNo ratings yet

- 2012 KPMG Nigeria Banking Industry Customer Satisfaction Survey Final PDFDocument32 pages2012 KPMG Nigeria Banking Industry Customer Satisfaction Survey Final PDFShadowfax_uNo ratings yet

- S4HANA2022 Pre-Configured Tax Codes EN FRDocument21 pagesS4HANA2022 Pre-Configured Tax Codes EN FRsamyNo ratings yet

- 10 Responsibility Accounting Transfer Pricing (MAS by Roque)Document4 pages10 Responsibility Accounting Transfer Pricing (MAS by Roque)Lee Suarez100% (1)

- Bowling ClubDocument68 pagesBowling ClubBILLU100% (1)

- Sales Cloud Full Exam 78 AnswersDocument39 pagesSales Cloud Full Exam 78 AnswersTinotenda ChonziNo ratings yet

- LYNIFER Business PlanDocument56 pagesLYNIFER Business PlanCALVINS OJWANGNo ratings yet

- Acca Ma1 CH 3.Document11 pagesAcca Ma1 CH 3.Muhammad Haris AbbasNo ratings yet

- Spotify Music Streaming PlatformDocument6 pagesSpotify Music Streaming PlatformBilal SohailNo ratings yet

- Munnukka 2005Document11 pagesMunnukka 2005Cori LinNo ratings yet

- Tea PresentationDocument38 pagesTea PresentationAradhya100% (1)

- Vishal Mega MartDocument6 pagesVishal Mega MartPRABHAT SINGHNo ratings yet

- SVT Case Study AnalysisDocument35 pagesSVT Case Study AnalysisDhikshith BalajiNo ratings yet