Professional Documents

Culture Documents

2020_04_NOVEMBER_PART-2_MEMORANDUM_ESTATES

2020_04_NOVEMBER_PART-2_MEMORANDUM_ESTATES

Uploaded by

nosipholethaboCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2020_04_NOVEMBER_PART-2_MEMORANDUM_ESTATES

2020_04_NOVEMBER_PART-2_MEMORANDUM_ESTATES

Uploaded by

nosipholethaboCopyright:

Available Formats

ADMISSION EXAMINATION

ESTATES

PART 2

4 NOVEMBER 2020

MEMORANDUM

PLEASE NOTE THAT THE GUIDELINE ANSWERS TO PREVIOUS PAPERS MAY NOT BE

A CORRECT REFLECTION OF THE LAW AND/OR PRACTICE AT THE MOMENT OF

READING.

NOTE TO EXAMINER: THIS GUIDELINE RECORDS THE VIEWS OF THE DRAFTERS. THERE MAY

BE JUSTIFIABLE VARIATIONS IN PRACTICE WHICH ARE BROUGHT OUT IN

THE ANSWERS. WHEN THIS HAPPENS THE EXAMINER SHOULD APPLY HIS

DISCRETION IN MARKING THE ANSWER.

QUESTION 1 [59]

First and Final Liquidation and Distribution Account in the Estate of the Late A (Identity No. 601214

5185 08 7) [1] married in Community of Property to B (Identity No. 650419 0123 08 5) [1] who died

on 13 March 2019 [1].

Master’s Reference No. 6714/2019 [1]

LIQUIDATION ACCOUNT

ASSETS

IMMOVABLE PROPERTY

Erf 2124 Ethekweni, Registration

Division ET Province of Kwazulu

Natal in extent 1000 (One Thousand)

Square metres

Held under Deed of Transfer No. T 1217/84 [1]

At valuation (1) 1 700 000,00 [1]

Awarded as per the Distribution Account [1]

MOVABLE PROPERTY

Honda Ballade – ND 662-144

At valuation (2) 260 000,00 [1]

House hold contents at valuation (3) 160 000,00 [1]

Awarded as per the Distribution Account [1]

Capitec fixed deposit Account No.

0014217X (4) 500 000,00 [1]

LAW SOCIETY OF SOUTH AFRICA

LEGAL EDUCATION AND DEVELOPMENT [L.E.A.D]™ 1

Interest accrued up to date of death 11 000,00 [1]

Style Bank : Account No. 334982/Y (5) 16 780,00 [1]

Proceeds of Standard Bank Insurance

Policy No. 1146922 (6) 66 000,00 [1]

Proceeds of Old Mutual Insurance

Policy No. OM62174 (7) 850 000,00 [1]

Proceeds of Sale of shares in

XYZ (Pty) Ltd 90 000,00 [1]

Proceeds of sale of shares in PQR

Limited (8) 9 000,00 [1]

---------------------

Total Assets 3 662 780,00

LIABILITIES

Administration Expenses (9) 30 000,00 [1]

Master’s fees (maximum) (10) 7 000,00 [1]

Executor’s fees (3.5% of 3 662 780,00) (11) 128 197,30 [1]

Absa bond (12) 570 000,00 [1]

Standard Bank Credit Card (13) 66 000,00 [1]

SARS final assessment (14) 19 700,00 [1]

-------------------------

Total liabilities 820 897,30 [1]

Balance available for distribution 2 841 882,70

-------------------------

3 662 780,00

==============

RECAPITULATION STATEMENT

Cash and assets reduced to cash

(Items 4,5,6,7, 8 and 9) 1 542 780,00[2]

Liabilities 820 897,30[1]

Surplus 721 882,70[1]

-------------------------------------------------

1 542 780,00 1 542 780,00

============================

LAW SOCIETY OF SOUTH AFRICA

LEGAL EDUCATION AND DEVELOPMENT [L.E.A.D]™ 2

DISTRIBUTION ACCOUNT

Balance available for distribution 2 841 882,70[1]

Awarded to B Surviving spouse:

one half by virtue of her marriage in

community of property 1 420 941,35[1]

and the other half in terms of

Clause 1.1 of the Will [1]

read together with section 2C(1) of

the Wills Act 7 of 1953, as amended [1] 1 420 941,35[1]

The above award is made up of:

Immovable Property – 1 700 000,00 [1]

Movable Property – 420 000,00 [1]

Cash surplus - 721 882,70[1]

------------------------------------------------------

2 841 882,70 2 841 882,70

==============================

INCOME AND EXPENDITURE ACCOUNT

Interest on Fixed Deposit with Capitec Bank 6 000,00 [1]

Interest on Bond in favour of Absa Bank 4 000,00 [1]

Executors fees 6% 360,00 [1]

Balance awarded to B as sole heir [1] 1 640,00 [1]

----------------------------------------------------

6 000,00 6 000,00

=============================

FIDUCIARY ASSETS ACCOUNT

None NIL [1]

ESTATE DUTY ADDENDUM

Assets of the deceased as per

the Liquidation Account 3 662 780,00 [1]

LAW SOCIETY OF SOUTH AFRICA

LEGAL EDUCATION AND DEVELOPMENT [L.E.A.D]™ 3

LESS Adjustment on valuation of shares

in XYZ 4 000,00 [1]

Proceed of Standard Bank Policy 66 000,00 [1]

Proceeds of Old Mutual Policy 850 000,00 [1] 920 000,00

----------------------------------------------------------

2 742 780,00

LESS surviving spouses ½ share 1 371 390,00 [1]

-------------------------

1 371 390,00

ADD deemed property

Standard Bank Policy 66 000,00 [1]

Old Mutual Policy 850 000,00 [1]

Sanlam Policy 2 000 000,00 [1]

Momentum Policy 961 840,00 [2] 3 877 840,00

----------------------------------------------------------------

Gross value of Estate 5 249 230,00

LESS ½ liabilities 820 897,30 410 448,65 [1]

Section 4(q) :

Sanlam Policy 2 000 000,00 [1]

Inheritance 1 420 941,35 [1] 3 831 390,00

---------------------------------------------------------------------------------------

Net value of Estate 1 417 840,00

LESS rebate in terms of Section 4A 3 500 000,00 [1]

------------------------

Dutiable Amount NIL [1]

===============

Therefore no Estate Duty payable.

---------------------------------------------------------------------------------------------------------------------------

EXECUTOR’S CERTIFICATE

I, the undersigned declare that this final account is to the best of my

knowledge and belief a true and proper account of the liquidation and distribution of the estate[1]

and all assets and income collected subsequent to the date of death to the date of this account have

been disclosed thereon. [1]

____________________

EXECUTOR

LAW SOCIETY OF SOUTH AFRICA

LEGAL EDUCATION AND DEVELOPMENT [L.E.A.D]™ 4

QUESTION 2 [20]

Zanele, the wife is entitled to half share of the joint estate by virtue of the marriage in community of

property in the amount of R1 488 000.00 [1]

The deceased’s half share of R1 488 000.00 devolves as follows:

If the unborn child is born alive, Zanele, Andy, Daniel, Caroline, Rose and the unborn child (nasciturus

rule) are the intestate heirs. [1]

Zanele inherits a child’s share or R250 000.00 whichever amount is the greater. [1]

A child’s share amounts to R1 488 000.00 ÷ 6 = R248 000.00 [1]

Zanele will therefore inherit the greater amount of R250 000.00 [1]

The descendants inherit the remainder thereof of R1 238 000.00 [1] in terms of Section 1(1)(c)(ii) of the

Intestate Succession Act as follows:

Since Andy murdered Paul, Andy does not inherit (die bloedige hand erf niet) [1]

In terms of section 1(7) of the Intestate Succession Act, Ben will inherit Andy’s share in the amount of

R247 600.00 [1]

As Caroline has renounced her inheritance, the surviving spouse Zanele receives her (Caroline’s)

portion in terms of section 1(6) of the Intestate Succession Act in the amount of R247 600.00 [1] and

will therefore inherit a total amount of R497 600.00 [1]

Rose will inherit the amount of R247 600.00 [1]

Daniel will inherit the amount of R247 600.00 [1]

The unborn child will also inherit the amount of R247 600.00 [1]

If the unborn child is not born alive, then

A child’s share will amount to R1 488 000.00 ÷ 5 = R297 600.00 [1]

Zanele will therefore inherit the child’s share in the amount of R297 600.00 [1]

As Caroline has renounced her inheritance, the surviving spouse Zanele receives her (Caroline’s)

portion in terms of section 1(6) of the Intestate Succession Act in the amount of R297 600.00 and

will therefore inherit a total amount of R595 200.00 [1]

Ben, Daniel and Rose will each inherit R297 600.00 [1]

Eric and Judy will not inherit anything because descendants inherit before ascendants [1]

Letta Ntuli will not inherit anything because she was not formally adopted by Paul [1]

Dennis and George will not inherit by way of representation as their parents are still alive [1]

QUESTION 3 [18]

LAST WILL AND TESTAMENT

I, PAMELA MALI (born SOSIBA) a divorcee, hereby revoke, cancel and annual all and any

testamentary acts and / or disposition heretofore made by me, either jointly or singly and declare this

to be my last will and Testament. [1]

LAW SOCIETY OF SOUTH AFRICA

LEGAL EDUCATION AND DEVELOPMENT [L.E.A.D]™ 5

1.

I bequeath my entire estate to my 3 children per stipes [2].

2.

I nominate and appoint JACK MABASO, a practising Attorney of the firm MABASO & ASSOCIATES

to be the Executor of my estate [1], and if he does not survive me then I appoint any remaining

partner of the firm MABASO & ASSOCIATES to be the Executor of the estate [1]. I grant my

Executor the power of assumption [1]. I direct that my said Executor shall not be required to give

security [1].

3.

I direct that a receipt signed by the guardian in respect of any loose assets bequeathed to a minor

beneficiary shall be sufficient to discharge my Executor and the Master of the High Court [1]. I direct

that the guardian shall be exempted from the provision of security.

4.

I nominate and appoint STEWART and JULIA SOSIBA, presently of NO 28 FULLAM STREET,

CONSTANTIA, PORT ELIZABETH, or the survivor of them to be the guardians on any of my minor

children should they survive me [1]. If the said STEWART and JULIA SONJI do not survive me I

hereby appoint BONGI SOSIBA to be the guardian of my minor children [1]. I direct that the said

guardians shall not be required to furnish security in that capacity to the Master of the High Court

[1].

5.

All bequest in terms of this Will and / or any codicil thereto shall be excluded from Community of

Property [1]. A receipt signed by a married beneficiary without the assistance of his / her spouse

shall be sufficient discharge to my Executor [1].

SIGNED AT PORT ELIZABETH on the 12th June 2020 in the presence of the undersigned witnesses

who were present and signing at the same time and in the presence of each other [2].

AS WITNESSES _______________________

TESTATRIX [1].

1. [1].

2. [1].

QUESTION 4 [3]

(1) Masters representative does not have to open a Bank Account – Section 28 [1].

(2) does not have to place statutory notices. Section 29 and 35(5) [1].

(3) need not to lodge a liquidation and distribution account Section 35 [1].

TOTAL: [100]

LAW SOCIETY OF SOUTH AFRICA

LEGAL EDUCATION AND DEVELOPMENT [L.E.A.D]™ 6

You might also like

- Volume II, Sweet - Maxwell - S Chitty On Contracts Sweet (2017)Document2,851 pagesVolume II, Sweet - Maxwell - S Chitty On Contracts Sweet (2017)Jaswin100% (1)

- Chapter 16 Sol 2020 WKDocument53 pagesChapter 16 Sol 2020 WKVu Khanh LeNo ratings yet

- What Is The Legal Definition of A PersonDocument78 pagesWhat Is The Legal Definition of A PersonZoSo Zeppelin100% (4)

- Memorial For The AppellantDocument32 pagesMemorial For The AppellantaakankshaNo ratings yet

- 2015_18-AUGUST_PART-2_MEMORANDUMDocument9 pages2015_18-AUGUST_PART-2_MEMORANDUMnosipholethaboNo ratings yet

- 2021_19-OCTOBER_PART-2_ANSWERSDocument6 pages2021_19-OCTOBER_PART-2_ANSWERSnosipholethaboNo ratings yet

- 2016_9-FEBRUARY_PART-2_MEMORANDUMDocument6 pages2016_9-FEBRUARY_PART-2_MEMORANDUMnosipholethaboNo ratings yet

- 2015_10-FEBRUARY_PART-2_MEMORANDUMDocument10 pages2015_10-FEBRUARY_PART-2_MEMORANDUMnosipholethaboNo ratings yet

- Management Accounts For The Year 2017 Opermin Zambia LTD OKOKOKOKDocument7 pagesManagement Accounts For The Year 2017 Opermin Zambia LTD OKOKOKOKJcaldas AponteNo ratings yet

- p7sgp 2011 Dec QDocument10 pagesp7sgp 2011 Dec QamNo ratings yet

- Schedules To Balance SheetDocument8 pagesSchedules To Balance SheetHimanshu YadavNo ratings yet

- Petra Answer 21221Document5 pagesPetra Answer 21221wedu nchiniNo ratings yet

- CFAP 4 Winter 2023Document15 pagesCFAP 4 Winter 2023MuhammadNaumanNo ratings yet

- F6mwi 2011 Jun ADocument9 pagesF6mwi 2011 Jun AangaNo ratings yet

- 1.cash Flow From Operating ActivitiesDocument5 pages1.cash Flow From Operating ActivitiesRajesh GuptaNo ratings yet

- LC032GLP000EVDocument16 pagesLC032GLP000EVrianrocheNo ratings yet

- Bab VII - Soal2 Dan Solusi No. 7.07 N 7.08Document8 pagesBab VII - Soal2 Dan Solusi No. 7.07 N 7.08Adilla KhulaidahNo ratings yet

- Zahur Cotton Mills LTD 2001Document11 pagesZahur Cotton Mills LTD 2001Prince AdyNo ratings yet

- Accountancy Set 2 MsDocument8 pagesAccountancy Set 2 MsPiyush HazraNo ratings yet

- Fin Acc n6 Int. Exam 2017 s2 MGDocument7 pagesFin Acc n6 Int. Exam 2017 s2 MGprofessional accountantsNo ratings yet

- 57096bos46250finalnew p1 A PDFDocument18 pages57096bos46250finalnew p1 A PDFAayush LaddhaNo ratings yet

- Self Study Solutions Chapter 13Document11 pagesSelf Study Solutions Chapter 13ggjjyy0% (1)

- Financial Accounting PrinciplesDocument6 pagesFinancial Accounting Principlessyed abbasNo ratings yet

- Financial Accounting N 6 Test MG 2nd Semester 2017Document8 pagesFinancial Accounting N 6 Test MG 2nd Semester 2017professional accountantsNo ratings yet

- I Fitness Venture StandaloneDocument15 pagesI Fitness Venture StandaloneThe keyboard PlayerNo ratings yet

- ACG211E Test 1 Suggested SolutionDocument5 pagesACG211E Test 1 Suggested Solutionsphesihlemkhize1204No ratings yet

- JayathDocument5 pagesJayathJayaprakash JayathNo ratings yet

- Sahodaya Model Solution SET 2Document9 pagesSahodaya Model Solution SET 2Nitin KumarNo ratings yet

- Fr342. Afr (Al-I) Solution Cma May-2023 Exam.Document6 pagesFr342. Afr (Al-I) Solution Cma May-2023 Exam.practice78222No ratings yet

- Ial As May 23 MSDocument25 pagesIal As May 23 MSchaku spikyNo ratings yet

- Chapter 4 Accounting For Business Combinations SolmanDocument16 pagesChapter 4 Accounting For Business Combinations SolmanCharlene Bolandres100% (1)

- INclass 2&3-2013a-1Document4 pagesINclass 2&3-2013a-1Ferdnance ChekaiNo ratings yet

- Advanced Financial AccountingDocument17 pagesAdvanced Financial Accountingtassnimemad12No ratings yet

- Suggested Answer CAP II December 2016Document88 pagesSuggested Answer CAP II December 2016Nirmal ShresthaNo ratings yet

- L19 RC Problems On ROI and EVADocument8 pagesL19 RC Problems On ROI and EVAapi-3820619100% (2)

- ACCOUNTANCY SET 1 MS - DocxDocument6 pagesACCOUNTANCY SET 1 MS - DocxPiyush HazraNo ratings yet

- Test 3 2019 MemoDocument5 pagesTest 3 2019 MemoKoti KatishiNo ratings yet

- Question ADV GMDocument6 pagesQuestion ADV GMsherlockNo ratings yet

- FAR570 GROUP PROJECT KedahDocument12 pagesFAR570 GROUP PROJECT KedahAmmarNo ratings yet

- LC032ALP000EVDocument32 pagesLC032ALP000EVAttia FatimaNo ratings yet

- Group - I Paper - 1 Accounting V2 Chapter 2 PDFDocument56 pagesGroup - I Paper - 1 Accounting V2 Chapter 2 PDFShrinivas GirnarNo ratings yet

- BPI - FinaliziranoDocument13 pagesBPI - FinaliziranoSead DzananovicNo ratings yet

- AnswersDocument9 pagesAnswersEsha DasNo ratings yet

- Financial Instruments - Suggested AnswersDocument10 pagesFinancial Instruments - Suggested Answerspratikdubey9586No ratings yet

- FA2 Spring 2011 Suggested SolutionDocument6 pagesFA2 Spring 2011 Suggested Solutionaqsa_22inNo ratings yet

- Investment Accounts: Question 1Document2 pagesInvestment Accounts: Question 1Rehan PathanNo ratings yet

- 7110 Principles of Acounts: MARK SCHEME For The October/November 2006 Question PaperDocument6 pages7110 Principles of Acounts: MARK SCHEME For The October/November 2006 Question Papermstudy123456No ratings yet

- Cash Budget:: Hampton Freeze Inc. Cash Budget For The Year Ended December 31, 2009Document11 pagesCash Budget:: Hampton Freeze Inc. Cash Budget For The Year Ended December 31, 2009renakwokNo ratings yet

- 5th Sem Accounts Previous Year PapersDocument25 pages5th Sem Accounts Previous Year PapersViratNo ratings yet

- FAC3761 - Exam Prep - Mock Question Paper - Suggested SolutionDocument9 pagesFAC3761 - Exam Prep - Mock Question Paper - Suggested SolutionRene EngelbrechtNo ratings yet

- Chapter 4 Governmental AccountingDocument5 pagesChapter 4 Governmental Accountingmohamad ali osmanNo ratings yet

- Cap II Group I RTP Dec2023Document84 pagesCap II Group I RTP Dec2023pratyushmudbhari340No ratings yet

- ACC601 Assignment 2 Solutions: Part A: Short AnswersDocument4 pagesACC601 Assignment 2 Solutions: Part A: Short AnswersnabihahNo ratings yet

- Perpetual Bank: ReceivablesDocument13 pagesPerpetual Bank: ReceivablesYes ChannelNo ratings yet

- Practice Questions - Ratio AnalysisDocument2 pagesPractice Questions - Ratio Analysissaltee100% (5)

- Opensys An20200518a2 1Document17 pagesOpensys An20200518a2 1Nor FarizalNo ratings yet

- Chap 2Document47 pagesChap 2ADITYA JAIN100% (1)

- Test Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: AccountingDocument12 pagesTest Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: Accountingsunil1287No ratings yet

- CAF 5 Spring 2022Document7 pagesCAF 5 Spring 2022Zia Ur RahmanNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- 2016_9-FEBRUARY_PART-2_MEMORANDUMDocument6 pages2016_9-FEBRUARY_PART-2_MEMORANDUMnosipholethaboNo ratings yet

- 2015_18-AUGUST_PART-2_MEMORANDUMDocument9 pages2015_18-AUGUST_PART-2_MEMORANDUMnosipholethaboNo ratings yet

- 2015_10-FEBRUARY_PART-2_MEMORANDUMDocument10 pages2015_10-FEBRUARY_PART-2_MEMORANDUMnosipholethaboNo ratings yet

- 2021_19-OCTOBER_PART-2_ANSWERSDocument6 pages2021_19-OCTOBER_PART-2_ANSWERSnosipholethaboNo ratings yet

- Legal Service AgreementDocument2 pagesLegal Service Agreementgmrp gmpNo ratings yet

- BondsDocument2 pagesBondsShanthakumar NivoshanNo ratings yet

- Procedure For Winding Up of Company-1 2Document4 pagesProcedure For Winding Up of Company-1 2Umang KatochNo ratings yet

- Oman Labour Law News AlertDocument6 pagesOman Labour Law News AlertmujeebmuscatNo ratings yet

- Goode&GulliferDocument72 pagesGoode&Gullifera lNo ratings yet

- LAW 102 - Group3 QuizDocument3 pagesLAW 102 - Group3 Quizsheii DayatanNo ratings yet

- Labor Midterms Magic NotesDocument50 pagesLabor Midterms Magic Notescmv mendozaNo ratings yet

- R.K. Arnold, MERS Admits BifurcationDocument2 pagesR.K. Arnold, MERS Admits BifurcationRichie CollinsNo ratings yet

- Pre Need Plans PPT NotesDocument3 pagesPre Need Plans PPT NotesReyniere AloNo ratings yet

- Documentary Stamps Tax Transaction / Document Rate Tax BaseDocument3 pagesDocumentary Stamps Tax Transaction / Document Rate Tax BaseMark AbraganNo ratings yet

- Dissolution Defined: A Partnership Is Characterized by Limited Life. A Partnership Is Dissolved When A Partner CeasesDocument2 pagesDissolution Defined: A Partnership Is Characterized by Limited Life. A Partnership Is Dissolved When A Partner CeasesVon Andrei MedinaNo ratings yet

- Georgi Velichkov Barbudev V EurocomDocument15 pagesGeorgi Velichkov Barbudev V EurocomRoberto Umaña GutiérrezNo ratings yet

- Abella Vs Heirs of FranciscaDocument10 pagesAbella Vs Heirs of FranciscaMary Andaya RealceNo ratings yet

- Part VII. Grievance Machinery Strikes LockoutsDocument5 pagesPart VII. Grievance Machinery Strikes LockoutsAnonymous MonweneeNo ratings yet

- 5 CHR01 Week 4 SlidesDocument33 pages5 CHR01 Week 4 SlidesfedaNo ratings yet

- Cat Forklift Gp40n1 To Dp55nm1 Schematic Operation Maintenance Manual Service Manual enDocument14 pagesCat Forklift Gp40n1 To Dp55nm1 Schematic Operation Maintenance Manual Service Manual enlarryowens100695djb99% (140)

- Insurance Law NotesDocument24 pagesInsurance Law NotesMaristela RegidorNo ratings yet

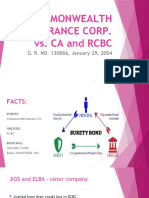

- COMMONWEALTH INSURANCE CORP vs. RCBCDocument14 pagesCOMMONWEALTH INSURANCE CORP vs. RCBCKê MilanNo ratings yet

- PDF A Study On Customer Satisfaction of Reliance Life InsuranceDocument57 pagesPDF A Study On Customer Satisfaction of Reliance Life InsuranceVillain SinghNo ratings yet

- 01 Dizon v. Gaborro, 83 SCRA 688 (1978)Document15 pages01 Dizon v. Gaborro, 83 SCRA 688 (1978)Marc VirtucioNo ratings yet

- Oblicon - Cochingyan Vs RB SuretyDocument1 pageOblicon - Cochingyan Vs RB SuretyChi Koy100% (1)

- Succession - Heirs of Reganon Vs Imperial 22 Scra 80Document3 pagesSuccession - Heirs of Reganon Vs Imperial 22 Scra 80Karla Marie Tumulak100% (2)

- 12 DIGEST G R No 165851 and G R No 168875 MANUEL CATINDIG Vs AURORADocument2 pages12 DIGEST G R No 165851 and G R No 168875 MANUEL CATINDIG Vs AURORAJonel L. SembranaNo ratings yet

- Business Law NotesDocument10 pagesBusiness Law Notessanthosh kumaranNo ratings yet

- Lampara de Hendidura Zeiss SL 115Document266 pagesLampara de Hendidura Zeiss SL 115Duban Guerrero100% (1)

- CRCACELATINTERMSDocument2 pagesCRCACELATINTERMSMariane MananganNo ratings yet

- Nicolas VdelnaciaDocument4 pagesNicolas VdelnaciaHollyhock MmgrzhfmNo ratings yet