Professional Documents

Culture Documents

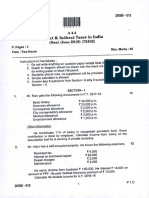

PGBP ALL Adjustments - CA Amit Mahajan (1)

PGBP ALL Adjustments - CA Amit Mahajan (1)

Uploaded by

Parth SarafCopyright:

Available Formats

You might also like

- Bank Guarantee Swift Mt760 Sample 2Document1 pageBank Guarantee Swift Mt760 Sample 2Божидар Денев100% (1)

- 2015UniformEvaluation PaperIII PDFDocument26 pages2015UniformEvaluation PaperIII PDFAdayyat M.No ratings yet

- Sapp - KPMG Entrance Test Answer PDFDocument11 pagesSapp - KPMG Entrance Test Answer PDFTran Pham Quoc ThuyNo ratings yet

- Activity Final Tax On Passive IncomeDocument7 pagesActivity Final Tax On Passive IncomeElla Marie Lopez100% (2)

- P6MYS 2012 Dec ADocument15 pagesP6MYS 2012 Dec AFakhrul Azman NawiNo ratings yet

- Net Business IncomeDocument21 pagesNet Business IncomedonawajNo ratings yet

- LU5 WorkbookDocument16 pagesLU5 Workbookprowess222No ratings yet

- Profit and Gains of Business or Profession (PGBP) : Dr. Sonam Topgay BhutiaDocument8 pagesProfit and Gains of Business or Profession (PGBP) : Dr. Sonam Topgay BhutiaUmesh SharmaNo ratings yet

- Screenshot 2023-03-28 at 9.42.11 AMDocument38 pagesScreenshot 2023-03-28 at 9.42.11 AMKinza NawazNo ratings yet

- CFAP 5 Winter 2021Document7 pagesCFAP 5 Winter 2021Faltu BatNo ratings yet

- TAXATION: Improperly Accumulated Earnings Tax (IAET) 2020 Improperly Accumulated Earnings Tax (IAET)Document7 pagesTAXATION: Improperly Accumulated Earnings Tax (IAET) 2020 Improperly Accumulated Earnings Tax (IAET)YashNo ratings yet

- Aggregation of Income, Set Off or Carry Forward of Losses: After Studying This Chapter, You Would Be Able ToDocument31 pagesAggregation of Income, Set Off or Carry Forward of Losses: After Studying This Chapter, You Would Be Able ToSivasankariNo ratings yet

- Corporate Tax Planning & Management Mid Term Assessment-1 Maximum Marks: 20 Duration: 9:30 AM-11:00 AMDocument3 pagesCorporate Tax Planning & Management Mid Term Assessment-1 Maximum Marks: 20 Duration: 9:30 AM-11:00 AMChirag JainNo ratings yet

- Solved Past Papers Income Tax Numericals of ICMAP STAGE IV - (2003 TO 2015)Document45 pagesSolved Past Papers Income Tax Numericals of ICMAP STAGE IV - (2003 TO 2015)muneeb razaNo ratings yet

- Mr. Zulfiqar Computation of Taxable Income For Tax Year 2009 RupeesDocument5 pagesMr. Zulfiqar Computation of Taxable Income For Tax Year 2009 Rupeesmeelas123No ratings yet

- IcaiDocument12 pagesIcaibasanisujithNo ratings yet

- Txmwi 2019 Jun ADocument9 pagesTxmwi 2019 Jun AangaNo ratings yet

- Chapter 11Document42 pagesChapter 11Bashu GuragainNo ratings yet

- Add: Depreciation As Per Books: © The Institute of Chartered Accountants of IndiaDocument15 pagesAdd: Depreciation As Per Books: © The Institute of Chartered Accountants of IndiaShubham KumarNo ratings yet

- IPCC Mock Test Taxation - Only Solution - 25.09.2018Document12 pagesIPCC Mock Test Taxation - Only Solution - 25.09.2018KaustubhNo ratings yet

- Advanced Taxation: Page 1 of 8Document8 pagesAdvanced Taxation: Page 1 of 8Muhammad Usama SheikhNo ratings yet

- 1 Accounting For Taxation: Section OverviewDocument36 pages1 Accounting For Taxation: Section Overviewsimran jeswaniNo ratings yet

- Provident FundDocument9 pagesProvident Fundmohammed umairNo ratings yet

- 30 - 09 - Final AccountsDocument40 pages30 - 09 - Final Accountssachin lanjewarNo ratings yet

- Examiner Comments-Summer 2017Document12 pagesExaminer Comments-Summer 2017Mahendar BhojwaniNo ratings yet

- Amount To Be Included in Income (Sec. 9) : Particulars: Inclusion Reason To Include or Not IncludeDocument2 pagesAmount To Be Included in Income (Sec. 9) : Particulars: Inclusion Reason To Include or Not IncludeBashu GuragainNo ratings yet

- HW 20 June 2020 Name: Mohamad Fidri Bin Shamsudin Class: Atx-C Lecturer: Ms NabilahDocument12 pagesHW 20 June 2020 Name: Mohamad Fidri Bin Shamsudin Class: Atx-C Lecturer: Ms NabilahPutera IzwanNo ratings yet

- Paper - 4: Taxation Section A: Income TaxDocument24 pagesPaper - 4: Taxation Section A: Income TaxChhaya JajuNo ratings yet

- Session 8 - Final Accounts - Practice ProblemsDocument16 pagesSession 8 - Final Accounts - Practice ProblemsanandakumarNo ratings yet

- Solved Question Paper For November 2018 EXAM (New Syllabus)Document21 pagesSolved Question Paper For November 2018 EXAM (New Syllabus)Ravi PrakashNo ratings yet

- Chapter 2 Capsule SessionDocument40 pagesChapter 2 Capsule SessionKshitishNo ratings yet

- IT II AnswerDocument4 pagesIT II AnswerChandhini RNo ratings yet

- Tax SuggestedDocument28 pagesTax SuggestedHemaNo ratings yet

- TAX 06 - RIT Gross IncomeDocument3 pagesTAX 06 - RIT Gross IncomeEdith DalidaNo ratings yet

- CAF 06 - TaxationDocument7 pagesCAF 06 - TaxationKhurram ShahzadNo ratings yet

- Applied Taxation ACCT 370: Rabia SaleemDocument23 pagesApplied Taxation ACCT 370: Rabia Saleemsultan siddiquiNo ratings yet

- The Accounting Cycle: Reporting Financial ResultsDocument8 pagesThe Accounting Cycle: Reporting Financial ResultsOmar KhanNo ratings yet

- Indirect MethodDocument34 pagesIndirect MethodHacker SKNo ratings yet

- Paper 4 Studycafe - inDocument28 pagesPaper 4 Studycafe - inApeksha ChilwalNo ratings yet

- DT Nov 2022 PaperDocument26 pagesDT Nov 2022 PaperPoonam Sunil Lalwani LalwaniNo ratings yet

- Aggregation of IncomeDocument30 pagesAggregation of Incomeraja naiduNo ratings yet

- Ryan RemsDocument56 pagesRyan Remsmimi supasNo ratings yet

- Suggested Nov 2019Document23 pagesSuggested Nov 2019just Konkan thingsNo ratings yet

- Exam Practice ReviewDocument9 pagesExam Practice ReviewSafi NurulNo ratings yet

- Wa0039.Document14 pagesWa0039.abdulraqeeb alareqiNo ratings yet

- Fund Flow StatementDocument21 pagesFund Flow StatementPGNo ratings yet

- Session 8 - Gross Income - Inclusions and ExclusionsDocument12 pagesSession 8 - Gross Income - Inclusions and ExclusionsMitzi WamarNo ratings yet

- Notes - ACCTG 114 - 04 26 - 04 28 2022Document13 pagesNotes - ACCTG 114 - 04 26 - 04 28 2022Janna Mari FriasNo ratings yet

- (I) (B) (Ii) (D) (Iii) (D) (Iv) (C) (V) (A) (Vi) (C) (Vii) (A) (Viii) (D) (Ix) (C) (X) (C)Document8 pages(I) (B) (Ii) (D) (Iii) (D) (Iv) (C) (V) (A) (Vi) (C) (Vii) (A) (Viii) (D) (Ix) (C) (X) (C)santosh palNo ratings yet

- Equipment Shall Be ExcludedDocument2 pagesEquipment Shall Be ExcludedKatherine MagpantayNo ratings yet

- Profits Tax Computation Illustration 2023S - Suggested Answers Ver2Document2 pagesProfits Tax Computation Illustration 2023S - Suggested Answers Ver2何健珩No ratings yet

- PDF Document E64dfec87bb0 1Document75 pagesPDF Document E64dfec87bb0 120BRM051 Sukant SNo ratings yet

- 8.special Tax Rates of Companies & MATDocument22 pages8.special Tax Rates of Companies & MATMuthu nayagamNo ratings yet

- Suggested Jan 2021Document25 pagesSuggested Jan 2021just Konkan thingsNo ratings yet

- Aggregation of Income, Set-Off and Carry Forward of LossesDocument18 pagesAggregation of Income, Set-Off and Carry Forward of LossesJoseph SalidoNo ratings yet

- Direct IndirectTaxesinIndia October2019 B B A WithCredits RegularJune-2017PatternSecondYearB B A E31C0FB4Document3 pagesDirect IndirectTaxesinIndia October2019 B B A WithCredits RegularJune-2017PatternSecondYearB B A E31C0FB4Mubin Shaikh NooruNo ratings yet

- Learning Unit 8 - Treatments of Dividends During ConsolidationDocument41 pagesLearning Unit 8 - Treatments of Dividends During ConsolidationThulani NdlovuNo ratings yet

- Dividend Received From A Domestic CompanyDocument9 pagesDividend Received From A Domestic Companyshiraz shabbirNo ratings yet

- Financial Management MidtermDocument4 pagesFinancial Management MidtermGrace Sinoy BastanteNo ratings yet

- Tax Dec 21 SugesstedDocument27 pagesTax Dec 21 SugesstedShailjaNo ratings yet

- Accounting Chapter 2Document19 pagesAccounting Chapter 2MUHAMMAD ZULHAIRI BIN ROSLI STUDENTNo ratings yet

- Learning Unit 9 Treatment of Preference Shares During ConsolidationDocument57 pagesLearning Unit 9 Treatment of Preference Shares During ConsolidationThulani NdlovuNo ratings yet

- Additional Questions On Financial Statements and Cash BookDocument5 pagesAdditional Questions On Financial Statements and Cash BookBoi NonoNo ratings yet

- FM_Formula_Chart_One_Page @CAInterLegendsDocument5 pagesFM_Formula_Chart_One_Page @CAInterLegendsParth SarafNo ratings yet

- Dividend Day 2Document14 pagesDividend Day 2Parth SarafNo ratings yet

- The Indian Contract Act, 1872Document64 pagesThe Indian Contract Act, 1872Parth SarafNo ratings yet

- FVFDDocument20 pagesFVFDParth SarafNo ratings yet

- FederalDocument15 pagesFederalNeil NitinNo ratings yet

- Tax AnswersDocument168 pagesTax AnswersukqrnnnjhfwsxqoykuNo ratings yet

- IT QuestionDocument3 pagesIT QuestionSathish SmartNo ratings yet

- Revenue Memorandum Circular No. 91-2012: Bureau of Internal RevenueDocument3 pagesRevenue Memorandum Circular No. 91-2012: Bureau of Internal RevenueHenson MontalvoNo ratings yet

- 12 Format of Mis For MFG ConcernDocument5 pages12 Format of Mis For MFG ConcernRaj Kothari MNo ratings yet

- xoIPV9pH45 PDFDocument1 pagexoIPV9pH45 PDFhalloarnabNo ratings yet

- Tax Invoice: Invoice Details Client DetailsDocument2 pagesTax Invoice: Invoice Details Client DetailsARUN M GOHILNo ratings yet

- WINRO154 BudgetLetterRequest - Semi MonthlyCashAssistanceBudgetCalculation - SNAPBudgetCalculationForCA&CA SSICases 585277954Document6 pagesWINRO154 BudgetLetterRequest - Semi MonthlyCashAssistanceBudgetCalculation - SNAPBudgetCalculationForCA&CA SSICases 585277954schwartzdaven7No ratings yet

- Table of Creditable Withholding Tax RatesDocument4 pagesTable of Creditable Withholding Tax RatesZandra Mari Dela PenaNo ratings yet

- Intacc All Mar 19Document4 pagesIntacc All Mar 19Mila MercadoNo ratings yet

- Chapter 3 - Seat Work - Assignment #3 - ACCOUNTING FOR GOVERNMENT AND NON - PROFIT ORGANIZATIONSDocument5 pagesChapter 3 - Seat Work - Assignment #3 - ACCOUNTING FOR GOVERNMENT AND NON - PROFIT ORGANIZATIONSDonise Ronadel SantosNo ratings yet

- The Finnerty Furniture Company A Manufacturer and Wholesaler of High QualityDocument2 pagesThe Finnerty Furniture Company A Manufacturer and Wholesaler of High QualityAmit PandeyNo ratings yet

- TCT Title Transfer and Annotation Steps: 1. Prepare The Documents: by This Time in Your Buying-A-PropertyDocument5 pagesTCT Title Transfer and Annotation Steps: 1. Prepare The Documents: by This Time in Your Buying-A-PropertysejinmaNo ratings yet

- The SolopreneurDocument6 pagesThe Solopreneurjun junNo ratings yet

- 2008 Form 990 Carpenter Charity FundDocument30 pages2008 Form 990 Carpenter Charity FundLatisha WalkerNo ratings yet

- Topic 7 Capital Structure & Dividend ImputationDocument53 pagesTopic 7 Capital Structure & Dividend Imputationsir bookkeeperNo ratings yet

- Outward Supply Replated - GST Audit 9C by CA Venugopal Gella - Ver1.0Document34 pagesOutward Supply Replated - GST Audit 9C by CA Venugopal Gella - Ver1.0Kishan M Mehta CoNo ratings yet

- Opening A Company in BangladeshDocument4 pagesOpening A Company in BangladeshSuhel Md RezaNo ratings yet

- Acca f6 2020 Lecture NotesDocument209 pagesAcca f6 2020 Lecture NotesMili sarkar0% (1)

- E Receipt - Cons 0614373464Document1 pageE Receipt - Cons 0614373464yaswanthkapoorNo ratings yet

- Amendments To IFRS 2 'Share-Based Payment'Document1 pageAmendments To IFRS 2 'Share-Based Payment'Rizshelle D. AlarconNo ratings yet

- Return: Return What Is GST ReturnDocument3 pagesReturn: Return What Is GST ReturnNagarjuna ReddyNo ratings yet

- FORM 210: For Tax Payment Through Treasury / BankDocument3 pagesFORM 210: For Tax Payment Through Treasury / BankVaibhavJoreNo ratings yet

- BSBMGT605B - Assessment Task 2Document7 pagesBSBMGT605B - Assessment Task 2Ghie MoralesNo ratings yet

- 5 Ibtx: Business TaxationDocument13 pages5 Ibtx: Business Taxationmonalisha mishraNo ratings yet

- I PSF 202122Document16 pagesI PSF 202122Preethi PachipulusuNo ratings yet

PGBP ALL Adjustments - CA Amit Mahajan (1)

PGBP ALL Adjustments - CA Amit Mahajan (1)

Uploaded by

Parth SarafCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PGBP ALL Adjustments - CA Amit Mahajan (1)

PGBP ALL Adjustments - CA Amit Mahajan (1)

Uploaded by

Parth SarafCopyright:

Available Formats

_List of all important adjustments

Bonus to employees Rs 60,000. Provision made on

Bonus paid to employees on 30.11.2019

31.03.2019 and was paid on 30.11.2019 after the due

1 L Not allowable as deduction being after the "due date" for filing the

date for filing the return .

o return of income

Assessee - Individual

Interest on private loan Rs 12,000 was paid by account

payee crossed cheque on 10.08.2018. Interest on private loan “12,000 paid

2 No tax was deducted at source. 30% disallowed without deduction of tax at source. Hence

Turnover of Raghav for the previous year 2018-19 also 30% is disallowed under section 40(a)(ia)

exceeded * 200 lakhs

Dividend received from Indian Companies (listed in

3 recognized stock exchange) received during the year Rs(IFOS

21,000

. . ‘ PPF - Exclude from P&L (LESS) PPF Interest - Exempt

4 PPF interest credited Rs 27,000 and savings bank

interest * 13,500 from UCO Bank Savings bank interest - Exclude from P&L . .

Savings bank account interest - IFOS

(LESS)

Salary paid to wife * 30,000 per month during the year Salary'tg M{Ife J.n g cess of F'-.Ie félr market

5 2018-19. (Reasonable monthly salary considering her |Excess amount of Rs 10,000 - Disallowed i lconsldermg P?er quallflsatlon and

qualification and experience is * 20,000 per month experienceggibegizal owed 10,000 x 12

! Section 40A(2)

6 Provision for doubful debts Disallowed

7 Depreciation as per Companies Act Disallowed

8 Depreciation as per Income Tax Allowed as deduction

9 Agricultural Income included in P&L Exclude from income (LESS)

10 Provision for income tax Disallowed

11 Income Tax paid Disallowed

12 GST paid Allowed as deduction

13 Interest paid on Income Tax Disallowed

14 Interest paid on GST or any tax other than income tax |Allowed as deduction

15 Expenses on issue of right shares Disallowed

16 Income tax refund received NEVER include in PGBP - add it to IFOS

Al mo'unF received

i by Reduce from PGEP A If not added to PGBP iincome -- NO EFF ECT

17 1. winning from lottory ADD to [FOS TO PGBP

2. Dividend from UTI Just add it to IFOS

Disall ti t but deduct

18 Car purchased shown in PnL dr side Disallowed as it is a cap expenditure s O‘_N e.n 1€ caramount but deduc

depreciation on that car

19 Repaid, maintenance of car Allowed as deduction

20 Value of benefits received from clients PGBP income

21 Incentives to articled assistants who cleared their ca Allowed/as deduction(u/s 37(1)

exams

Disallowed as deducti

22 Municipal taxes paid w.r.t. residential flat let out =2 owe. ehE

Reduce this from House Property

Why reduce? Because once we record

23 |Opening stock of Rs 10,000 ommitted to be recorded |Reduce from NP 10,000 as opening stock - dr side would go

up - which will result in reduction of profit

Why add? Because once we record 20,000

24 Closing stock of Rs 20,000 ommitted to be recorded |Add to NP as closing stock - cr side would go up - which

will result in increase in profit

Why add? Because once we remove 10,000

25 Opening stock of Rs 10,000 recorded by mistake Add to NP from opening stock - dr side would go down

which will result in increase in profit

Why reduce? Because once we remove

10,000 fi losing stock - cr sidk uld go

26 Closing stock of Rs 50,000 recorded by mistake Reduce from NP s S CREales. Y oulC &

down - which will result in reduction in

profit

Disallowed to the extent of that

27 Unreasonable amount paid to brother

unreasonableness u/s 40A(3)

28 Dry fruit packets given to important customers as Allowed as deduction - wholly and

advertisement exclusively for business

29 Expenses on expainsicn of ne?N business and proigt DISALLOWED - Capital Expenditure

was bandoned without creation of new asset

30 Payment of Rs 50,000 made to fishermn IN CASH ALLOWED - Rule 6DD

DISALLOWED - Allowed only fisherman

31 Payment of Rs 50,000 made to middleman to purchase |DIRECTLY - does not fall under 6DD - since

fish - IN CASH the amount is more than 10,000 -

DISALLOWED

32 Interest paid on loan taken for payment of income tax [DISALLOWED

33 Bad debts recovered Add to NP

34 Penalty paid for breach of law DISALLOWED

If | get a different contract better than the

35 Penalty paid for breach of Contract ALLOWED as deduction current one - | can take a call and cancel the

earlier contract. Thus, allowed

36 Payment made to Resident without deducting TDS 30% disallowed

b T 7 =

37 ayment made to Non-Resident without deducting 100% disallowed

TDS

AT

38 Payment made to Resident where TDS is deducted BUT] fi\LlfeV‘l/:s’Da&O'?D/nS) iss;r;ceg;lt):dvlaesf:f:;;tned

peid after end of FY but before due date of fiing ROl [C* i 8

T ” < -

Payment made to Resident where TDS is deducted HI?W’ (;I'lm'e l;ll d::Vd;ItEEN(_): flfll_;‘gsf "Ztfiltllie

39 after FY ends and also paid after end of FY but before |DISALLOWED Algwec oyt . - ol

due dste of filing ROI govt and NOT for deducting the TDS. TDS

2 should be deducted in FY itself

40 Payment of Rs 30,000 paid to a vendor IN CASH DISALLOWED Section 40A(3)

41 Payment of Rs 30,000 paid to a Transporter IN CASH |ALLOWED Limit is Rs 35,000

42 Expenses on issue of bonus shares ALLOWED

43 Loss by theft ALLOWED - RELATED TO BUSINESS

e . Reduce from NP

44 Dividend received Add to IFOS

45 FY 2021-22 - payment made without deducting tds FY 2021-22 - 30% disallowed

FY 2022-23 - tds deducted and deposited with govt FY 2022-23 - 70% allowed

46 Interest paid on delayed filing of GST returns ALLOWED

47 Interest paid on delayed filing of Income Tax returns [NOT ALLOWED

Motor card purchased and 50% used for personal Cost nc{t aAIIowed e &

48 PUFpGES Depreciation to the extent of 50% original

rate would be allowed

49 Provision for gratuity basis acturial valuation DISALLOWED

50 Interest paid to banks after end of FY but before due |ALLOWED even because payment was

date of filing ROl u/s 139(1) made before filing of ROI

51 Interest paid to banks after end of FY and after due DISALLOWED in the current FY but allowed

date of filing ROl u/s 139(1) in the next financial year

52 CSR expenditure DISALLOWED

53 Expenses on transfer of carbon credits DISALLOWED

54 llegal expenditure DISALLOWED

You might also like

- Bank Guarantee Swift Mt760 Sample 2Document1 pageBank Guarantee Swift Mt760 Sample 2Божидар Денев100% (1)

- 2015UniformEvaluation PaperIII PDFDocument26 pages2015UniformEvaluation PaperIII PDFAdayyat M.No ratings yet

- Sapp - KPMG Entrance Test Answer PDFDocument11 pagesSapp - KPMG Entrance Test Answer PDFTran Pham Quoc ThuyNo ratings yet

- Activity Final Tax On Passive IncomeDocument7 pagesActivity Final Tax On Passive IncomeElla Marie Lopez100% (2)

- P6MYS 2012 Dec ADocument15 pagesP6MYS 2012 Dec AFakhrul Azman NawiNo ratings yet

- Net Business IncomeDocument21 pagesNet Business IncomedonawajNo ratings yet

- LU5 WorkbookDocument16 pagesLU5 Workbookprowess222No ratings yet

- Profit and Gains of Business or Profession (PGBP) : Dr. Sonam Topgay BhutiaDocument8 pagesProfit and Gains of Business or Profession (PGBP) : Dr. Sonam Topgay BhutiaUmesh SharmaNo ratings yet

- Screenshot 2023-03-28 at 9.42.11 AMDocument38 pagesScreenshot 2023-03-28 at 9.42.11 AMKinza NawazNo ratings yet

- CFAP 5 Winter 2021Document7 pagesCFAP 5 Winter 2021Faltu BatNo ratings yet

- TAXATION: Improperly Accumulated Earnings Tax (IAET) 2020 Improperly Accumulated Earnings Tax (IAET)Document7 pagesTAXATION: Improperly Accumulated Earnings Tax (IAET) 2020 Improperly Accumulated Earnings Tax (IAET)YashNo ratings yet

- Aggregation of Income, Set Off or Carry Forward of Losses: After Studying This Chapter, You Would Be Able ToDocument31 pagesAggregation of Income, Set Off or Carry Forward of Losses: After Studying This Chapter, You Would Be Able ToSivasankariNo ratings yet

- Corporate Tax Planning & Management Mid Term Assessment-1 Maximum Marks: 20 Duration: 9:30 AM-11:00 AMDocument3 pagesCorporate Tax Planning & Management Mid Term Assessment-1 Maximum Marks: 20 Duration: 9:30 AM-11:00 AMChirag JainNo ratings yet

- Solved Past Papers Income Tax Numericals of ICMAP STAGE IV - (2003 TO 2015)Document45 pagesSolved Past Papers Income Tax Numericals of ICMAP STAGE IV - (2003 TO 2015)muneeb razaNo ratings yet

- Mr. Zulfiqar Computation of Taxable Income For Tax Year 2009 RupeesDocument5 pagesMr. Zulfiqar Computation of Taxable Income For Tax Year 2009 Rupeesmeelas123No ratings yet

- IcaiDocument12 pagesIcaibasanisujithNo ratings yet

- Txmwi 2019 Jun ADocument9 pagesTxmwi 2019 Jun AangaNo ratings yet

- Chapter 11Document42 pagesChapter 11Bashu GuragainNo ratings yet

- Add: Depreciation As Per Books: © The Institute of Chartered Accountants of IndiaDocument15 pagesAdd: Depreciation As Per Books: © The Institute of Chartered Accountants of IndiaShubham KumarNo ratings yet

- IPCC Mock Test Taxation - Only Solution - 25.09.2018Document12 pagesIPCC Mock Test Taxation - Only Solution - 25.09.2018KaustubhNo ratings yet

- Advanced Taxation: Page 1 of 8Document8 pagesAdvanced Taxation: Page 1 of 8Muhammad Usama SheikhNo ratings yet

- 1 Accounting For Taxation: Section OverviewDocument36 pages1 Accounting For Taxation: Section Overviewsimran jeswaniNo ratings yet

- Provident FundDocument9 pagesProvident Fundmohammed umairNo ratings yet

- 30 - 09 - Final AccountsDocument40 pages30 - 09 - Final Accountssachin lanjewarNo ratings yet

- Examiner Comments-Summer 2017Document12 pagesExaminer Comments-Summer 2017Mahendar BhojwaniNo ratings yet

- Amount To Be Included in Income (Sec. 9) : Particulars: Inclusion Reason To Include or Not IncludeDocument2 pagesAmount To Be Included in Income (Sec. 9) : Particulars: Inclusion Reason To Include or Not IncludeBashu GuragainNo ratings yet

- HW 20 June 2020 Name: Mohamad Fidri Bin Shamsudin Class: Atx-C Lecturer: Ms NabilahDocument12 pagesHW 20 June 2020 Name: Mohamad Fidri Bin Shamsudin Class: Atx-C Lecturer: Ms NabilahPutera IzwanNo ratings yet

- Paper - 4: Taxation Section A: Income TaxDocument24 pagesPaper - 4: Taxation Section A: Income TaxChhaya JajuNo ratings yet

- Session 8 - Final Accounts - Practice ProblemsDocument16 pagesSession 8 - Final Accounts - Practice ProblemsanandakumarNo ratings yet

- Solved Question Paper For November 2018 EXAM (New Syllabus)Document21 pagesSolved Question Paper For November 2018 EXAM (New Syllabus)Ravi PrakashNo ratings yet

- Chapter 2 Capsule SessionDocument40 pagesChapter 2 Capsule SessionKshitishNo ratings yet

- IT II AnswerDocument4 pagesIT II AnswerChandhini RNo ratings yet

- Tax SuggestedDocument28 pagesTax SuggestedHemaNo ratings yet

- TAX 06 - RIT Gross IncomeDocument3 pagesTAX 06 - RIT Gross IncomeEdith DalidaNo ratings yet

- CAF 06 - TaxationDocument7 pagesCAF 06 - TaxationKhurram ShahzadNo ratings yet

- Applied Taxation ACCT 370: Rabia SaleemDocument23 pagesApplied Taxation ACCT 370: Rabia Saleemsultan siddiquiNo ratings yet

- The Accounting Cycle: Reporting Financial ResultsDocument8 pagesThe Accounting Cycle: Reporting Financial ResultsOmar KhanNo ratings yet

- Indirect MethodDocument34 pagesIndirect MethodHacker SKNo ratings yet

- Paper 4 Studycafe - inDocument28 pagesPaper 4 Studycafe - inApeksha ChilwalNo ratings yet

- DT Nov 2022 PaperDocument26 pagesDT Nov 2022 PaperPoonam Sunil Lalwani LalwaniNo ratings yet

- Aggregation of IncomeDocument30 pagesAggregation of Incomeraja naiduNo ratings yet

- Ryan RemsDocument56 pagesRyan Remsmimi supasNo ratings yet

- Suggested Nov 2019Document23 pagesSuggested Nov 2019just Konkan thingsNo ratings yet

- Exam Practice ReviewDocument9 pagesExam Practice ReviewSafi NurulNo ratings yet

- Wa0039.Document14 pagesWa0039.abdulraqeeb alareqiNo ratings yet

- Fund Flow StatementDocument21 pagesFund Flow StatementPGNo ratings yet

- Session 8 - Gross Income - Inclusions and ExclusionsDocument12 pagesSession 8 - Gross Income - Inclusions and ExclusionsMitzi WamarNo ratings yet

- Notes - ACCTG 114 - 04 26 - 04 28 2022Document13 pagesNotes - ACCTG 114 - 04 26 - 04 28 2022Janna Mari FriasNo ratings yet

- (I) (B) (Ii) (D) (Iii) (D) (Iv) (C) (V) (A) (Vi) (C) (Vii) (A) (Viii) (D) (Ix) (C) (X) (C)Document8 pages(I) (B) (Ii) (D) (Iii) (D) (Iv) (C) (V) (A) (Vi) (C) (Vii) (A) (Viii) (D) (Ix) (C) (X) (C)santosh palNo ratings yet

- Equipment Shall Be ExcludedDocument2 pagesEquipment Shall Be ExcludedKatherine MagpantayNo ratings yet

- Profits Tax Computation Illustration 2023S - Suggested Answers Ver2Document2 pagesProfits Tax Computation Illustration 2023S - Suggested Answers Ver2何健珩No ratings yet

- PDF Document E64dfec87bb0 1Document75 pagesPDF Document E64dfec87bb0 120BRM051 Sukant SNo ratings yet

- 8.special Tax Rates of Companies & MATDocument22 pages8.special Tax Rates of Companies & MATMuthu nayagamNo ratings yet

- Suggested Jan 2021Document25 pagesSuggested Jan 2021just Konkan thingsNo ratings yet

- Aggregation of Income, Set-Off and Carry Forward of LossesDocument18 pagesAggregation of Income, Set-Off and Carry Forward of LossesJoseph SalidoNo ratings yet

- Direct IndirectTaxesinIndia October2019 B B A WithCredits RegularJune-2017PatternSecondYearB B A E31C0FB4Document3 pagesDirect IndirectTaxesinIndia October2019 B B A WithCredits RegularJune-2017PatternSecondYearB B A E31C0FB4Mubin Shaikh NooruNo ratings yet

- Learning Unit 8 - Treatments of Dividends During ConsolidationDocument41 pagesLearning Unit 8 - Treatments of Dividends During ConsolidationThulani NdlovuNo ratings yet

- Dividend Received From A Domestic CompanyDocument9 pagesDividend Received From A Domestic Companyshiraz shabbirNo ratings yet

- Financial Management MidtermDocument4 pagesFinancial Management MidtermGrace Sinoy BastanteNo ratings yet

- Tax Dec 21 SugesstedDocument27 pagesTax Dec 21 SugesstedShailjaNo ratings yet

- Accounting Chapter 2Document19 pagesAccounting Chapter 2MUHAMMAD ZULHAIRI BIN ROSLI STUDENTNo ratings yet

- Learning Unit 9 Treatment of Preference Shares During ConsolidationDocument57 pagesLearning Unit 9 Treatment of Preference Shares During ConsolidationThulani NdlovuNo ratings yet

- Additional Questions On Financial Statements and Cash BookDocument5 pagesAdditional Questions On Financial Statements and Cash BookBoi NonoNo ratings yet

- FM_Formula_Chart_One_Page @CAInterLegendsDocument5 pagesFM_Formula_Chart_One_Page @CAInterLegendsParth SarafNo ratings yet

- Dividend Day 2Document14 pagesDividend Day 2Parth SarafNo ratings yet

- The Indian Contract Act, 1872Document64 pagesThe Indian Contract Act, 1872Parth SarafNo ratings yet

- FVFDDocument20 pagesFVFDParth SarafNo ratings yet

- FederalDocument15 pagesFederalNeil NitinNo ratings yet

- Tax AnswersDocument168 pagesTax AnswersukqrnnnjhfwsxqoykuNo ratings yet

- IT QuestionDocument3 pagesIT QuestionSathish SmartNo ratings yet

- Revenue Memorandum Circular No. 91-2012: Bureau of Internal RevenueDocument3 pagesRevenue Memorandum Circular No. 91-2012: Bureau of Internal RevenueHenson MontalvoNo ratings yet

- 12 Format of Mis For MFG ConcernDocument5 pages12 Format of Mis For MFG ConcernRaj Kothari MNo ratings yet

- xoIPV9pH45 PDFDocument1 pagexoIPV9pH45 PDFhalloarnabNo ratings yet

- Tax Invoice: Invoice Details Client DetailsDocument2 pagesTax Invoice: Invoice Details Client DetailsARUN M GOHILNo ratings yet

- WINRO154 BudgetLetterRequest - Semi MonthlyCashAssistanceBudgetCalculation - SNAPBudgetCalculationForCA&CA SSICases 585277954Document6 pagesWINRO154 BudgetLetterRequest - Semi MonthlyCashAssistanceBudgetCalculation - SNAPBudgetCalculationForCA&CA SSICases 585277954schwartzdaven7No ratings yet

- Table of Creditable Withholding Tax RatesDocument4 pagesTable of Creditable Withholding Tax RatesZandra Mari Dela PenaNo ratings yet

- Intacc All Mar 19Document4 pagesIntacc All Mar 19Mila MercadoNo ratings yet

- Chapter 3 - Seat Work - Assignment #3 - ACCOUNTING FOR GOVERNMENT AND NON - PROFIT ORGANIZATIONSDocument5 pagesChapter 3 - Seat Work - Assignment #3 - ACCOUNTING FOR GOVERNMENT AND NON - PROFIT ORGANIZATIONSDonise Ronadel SantosNo ratings yet

- The Finnerty Furniture Company A Manufacturer and Wholesaler of High QualityDocument2 pagesThe Finnerty Furniture Company A Manufacturer and Wholesaler of High QualityAmit PandeyNo ratings yet

- TCT Title Transfer and Annotation Steps: 1. Prepare The Documents: by This Time in Your Buying-A-PropertyDocument5 pagesTCT Title Transfer and Annotation Steps: 1. Prepare The Documents: by This Time in Your Buying-A-PropertysejinmaNo ratings yet

- The SolopreneurDocument6 pagesThe Solopreneurjun junNo ratings yet

- 2008 Form 990 Carpenter Charity FundDocument30 pages2008 Form 990 Carpenter Charity FundLatisha WalkerNo ratings yet

- Topic 7 Capital Structure & Dividend ImputationDocument53 pagesTopic 7 Capital Structure & Dividend Imputationsir bookkeeperNo ratings yet

- Outward Supply Replated - GST Audit 9C by CA Venugopal Gella - Ver1.0Document34 pagesOutward Supply Replated - GST Audit 9C by CA Venugopal Gella - Ver1.0Kishan M Mehta CoNo ratings yet

- Opening A Company in BangladeshDocument4 pagesOpening A Company in BangladeshSuhel Md RezaNo ratings yet

- Acca f6 2020 Lecture NotesDocument209 pagesAcca f6 2020 Lecture NotesMili sarkar0% (1)

- E Receipt - Cons 0614373464Document1 pageE Receipt - Cons 0614373464yaswanthkapoorNo ratings yet

- Amendments To IFRS 2 'Share-Based Payment'Document1 pageAmendments To IFRS 2 'Share-Based Payment'Rizshelle D. AlarconNo ratings yet

- Return: Return What Is GST ReturnDocument3 pagesReturn: Return What Is GST ReturnNagarjuna ReddyNo ratings yet

- FORM 210: For Tax Payment Through Treasury / BankDocument3 pagesFORM 210: For Tax Payment Through Treasury / BankVaibhavJoreNo ratings yet

- BSBMGT605B - Assessment Task 2Document7 pagesBSBMGT605B - Assessment Task 2Ghie MoralesNo ratings yet

- 5 Ibtx: Business TaxationDocument13 pages5 Ibtx: Business Taxationmonalisha mishraNo ratings yet

- I PSF 202122Document16 pagesI PSF 202122Preethi PachipulusuNo ratings yet