Professional Documents

Culture Documents

SBI Contra Fund

SBI Contra Fund

Uploaded by

Gaurav RajCopyright:

Available Formats

You might also like

- CIBILDocument14 pagesCIBILGaurav RajNo ratings yet

- Statement NewDocument2 pagesStatement NewabhiramNo ratings yet

- Cost Audit Report CRA 3 (In Excel)Document50 pagesCost Audit Report CRA 3 (In Excel)MOORTHYNo ratings yet

- SBI Large & Midcap FundDocument1 pageSBI Large & Midcap FundGaurav RajNo ratings yet

- Factsheet 1710581747733Document1 pageFactsheet 1710581747733mvkulkarni5No ratings yet

- Statistics# 1 Year 5 Year Since Inception: Sector Representation FundamentalsDocument2 pagesStatistics# 1 Year 5 Year Since Inception: Sector Representation FundamentalsSahil KumarNo ratings yet

- Factsheet NIFTY200 Quality30Document2 pagesFactsheet NIFTY200 Quality30Rajesh KumarNo ratings yet

- Factsheet NIFTY100 ESG IndexDocument2 pagesFactsheet NIFTY100 ESG IndexTash KentNo ratings yet

- Factsheet NIFTY Alpha Quality Value Low-Volatility 30Document2 pagesFactsheet NIFTY Alpha Quality Value Low-Volatility 30drsubramanianNo ratings yet

- Factsheet NIFTY LargeMidcap 250 IndexDocument2 pagesFactsheet NIFTY LargeMidcap 250 Indexrahulojha123No ratings yet

- Morningstarreport 20230114061338Document1 pageMorningstarreport 20230114061338hkratheeNo ratings yet

- Fundcard: HSBC Brazil FundDocument4 pagesFundcard: HSBC Brazil FundChittaNo ratings yet

- Nifty100 Quality30 PDFDocument2 pagesNifty100 Quality30 PDFGita ThoughtsNo ratings yet

- Nifty100 Quality30Document2 pagesNifty100 Quality30sujay.gorain.76No ratings yet

- Ind Nifty FMCGDocument2 pagesInd Nifty FMCGSinghNo ratings yet

- MIEF-factsheet 230320 152602Document3 pagesMIEF-factsheet 230320 152602ryanbud96No ratings yet

- Factsheet NIFTY Quality Low-Volatility 30Document2 pagesFactsheet NIFTY Quality Low-Volatility 30Aswin PoomangalathNo ratings yet

- Ind Nifty Midcap50Document2 pagesInd Nifty Midcap50SumitNo ratings yet

- Factsheet Nifty100 Alpha30Document2 pagesFactsheet Nifty100 Alpha30sumonNo ratings yet

- ABSL Commodity EquityDocument14 pagesABSL Commodity EquityArmstrong CapitalNo ratings yet

- Fact SheetDocument1 pageFact SheetSumit GiriNo ratings yet

- DPTC CMF C P16995 Client 31052023 MonDocument8 pagesDPTC CMF C P16995 Client 31052023 Monsiddhant jainNo ratings yet

- Factsheet NiftyFinancialServicesExBankDocument2 pagesFactsheet NiftyFinancialServicesExBankpatsan007No ratings yet

- Factsheet NIFTY LargeMidcap 250 IndexDocument2 pagesFactsheet NIFTY LargeMidcap 250 IndexSrikanth VgNo ratings yet

- MORNINGSTARDocument5 pagesMORNINGSTARhectorhernandez5576No ratings yet

- Factsheet NiftyMidcap150Momentum50Document2 pagesFactsheet NiftyMidcap150Momentum50Jose CANo ratings yet

- MF COMPARISON - Large & Mid 2Document3 pagesMF COMPARISON - Large & Mid 2Rajkumar GNo ratings yet

- Factsheet Nifty500 Multicap 50 25 25 IndexDocument2 pagesFactsheet Nifty500 Multicap 50 25 25 Indexramayogi somuNo ratings yet

- Ind Nifty FMCGDocument2 pagesInd Nifty FMCGSUMITNo ratings yet

- Nifty Liquid 15Document2 pagesNifty Liquid 15Pavan SalianNo ratings yet

- Axis Triple Advantage FundDocument1 pageAxis Triple Advantage FundseshadriNo ratings yet

- Ind Nifty Midcap50Document2 pagesInd Nifty Midcap50Samriddh DhareshwarNo ratings yet

- ValueResearchFundcard TataRetirementSavingsFund ModeratePlan DirectPlan 2019jul15Document4 pagesValueResearchFundcard TataRetirementSavingsFund ModeratePlan DirectPlan 2019jul15Ankit ShuklaNo ratings yet

- Tatton Tracker Active Quarterly Report Oct-Dec 19Document6 pagesTatton Tracker Active Quarterly Report Oct-Dec 19Danny DawsonNo ratings yet

- Ffs BondahcfDocument1 pageFfs BondahcfTanWeiKangNo ratings yet

- Factsheet NIFTY Alpha Low-Volatility 30Document2 pagesFactsheet NIFTY Alpha Low-Volatility 30Aswin PoomangalathNo ratings yet

- Portfolio Characteristics: Since Inception 5 Years 1 Year QTD Ytd Index Returns (%)Document2 pagesPortfolio Characteristics: Since Inception 5 Years 1 Year QTD Ytd Index Returns (%)Atul KaulNo ratings yet

- Factsheet Nifty Consumer DurablesDocument2 pagesFactsheet Nifty Consumer DurablesUMANG KHUNTNo ratings yet

- Essel Regular Savings Fund GrowthDocument1 pageEssel Regular Savings Fund GrowthYogi173No ratings yet

- Factsheet Nifty200 Momentum30Document2 pagesFactsheet Nifty200 Momentum30Umesh ThawareNo ratings yet

- Fundcard: Franklin India Focused Equity Fund - Direct PlanDocument4 pagesFundcard: Franklin India Focused Equity Fund - Direct PlanAnonymous cPS4htyNo ratings yet

- ValueResearchFundcard UTIMultiAssetFund DirectPlan 2018nov02Document4 pagesValueResearchFundcard UTIMultiAssetFund DirectPlan 2018nov02ravisankarNo ratings yet

- ValueResearchFundcard HDFCDynamicPERatioFundofFunds RegularPlan 2018may26Document4 pagesValueResearchFundcard HDFCDynamicPERatioFundofFunds RegularPlan 2018may26Aadhil BashaNo ratings yet

- Nifty50 Value20Document2 pagesNifty50 Value20shahid aliNo ratings yet

- 9 Factsheet - Nifty - Consumer - DurablesDocument2 pages9 Factsheet - Nifty - Consumer - DurablesKapilSahuNo ratings yet

- Ind Nifty Midcap 150Document2 pagesInd Nifty Midcap 150Kushal BnNo ratings yet

- Factsheet NIFTY Quality Low-Volatility 30Document2 pagesFactsheet NIFTY Quality Low-Volatility 30Rajesh KumarNo ratings yet

- Factsheet Nifty100 Alpha30Document2 pagesFactsheet Nifty100 Alpha30Aswin PoomangalathNo ratings yet

- Portfolio Characteristics: Since Inception 5 Years 1 Year QTD Ytd Index Returns (%)Document2 pagesPortfolio Characteristics: Since Inception 5 Years 1 Year QTD Ytd Index Returns (%)G gfgjNo ratings yet

- HDFC Momentum150 FundDocument2 pagesHDFC Momentum150 Fundkrishnakumar kichaNo ratings yet

- Factsheet NiftyMidSmallHealthCareDocument2 pagesFactsheet NiftyMidSmallHealthCareAvinash BaldiNo ratings yet

- Ind Nifty RealtyDocument2 pagesInd Nifty RealtyParth AsnaniNo ratings yet

- Factsheet Nifty Consumer DurablesDocument2 pagesFactsheet Nifty Consumer Durablesdohare41No ratings yet

- Factsheet NiftyEVNewAgeAutomotiveDocument2 pagesFactsheet NiftyEVNewAgeAutomotiveramayogi somuNo ratings yet

- Ind Nifty FMCGDocument2 pagesInd Nifty FMCGDharmendra Singh GondNo ratings yet

- ICICI Prudential PMS Largecap Portfolio: A Series Under "Diversified" Portfolio"Document3 pagesICICI Prudential PMS Largecap Portfolio: A Series Under "Diversified" Portfolio"laurieNo ratings yet

- July 31, 2019: Portfolio CharacteristicsDocument2 pagesJuly 31, 2019: Portfolio CharacteristicsVenkata Ramana PothulwarNo ratings yet

- Midcap FactsheetDocument2 pagesMidcap FactsheetShubhashish SaxenaNo ratings yet

- Quant Multi Asset FundDocument1 pageQuant Multi Asset Fundarian2026No ratings yet

- Ind Nifty 500Document2 pagesInd Nifty 500VIGNESH RKNo ratings yet

- Factsheet Nifty Consumer DurablesDocument2 pagesFactsheet Nifty Consumer DurablesAvinash BaldiNo ratings yet

- SBI Large & Midcap FundDocument1 pageSBI Large & Midcap FundGaurav RajNo ratings yet

- GST Bill vidyasagar 2Document1 pageGST Bill vidyasagar 2Gaurav RajNo ratings yet

- invoice AIR FRYERDocument1 pageinvoice AIR FRYERGaurav RajNo ratings yet

- SBI Life at different rates smart PrivilegeDocument1 pageSBI Life at different rates smart PrivilegeGaurav RajNo ratings yet

- Case Study QuestionsDocument3 pagesCase Study QuestionsGaurav RajNo ratings yet

- Iridium FailureDocument4 pagesIridium FailureGaurav RajNo ratings yet

- Evaluation Matrix Summer Internship ProjectsDocument1 pageEvaluation Matrix Summer Internship ProjectsGaurav RajNo ratings yet

- Useful Resources RPG InternshipDocument3 pagesUseful Resources RPG InternshipGaurav RajNo ratings yet

- Useful Resources ICICI InternshipDocument4 pagesUseful Resources ICICI InternshipGaurav RajNo ratings yet

- Useful Resources GroupDiscussionDocument3 pagesUseful Resources GroupDiscussionGaurav RajNo ratings yet

- Useful Resources - HT Media Internship IntreviewDocument4 pagesUseful Resources - HT Media Internship IntreviewGaurav RajNo ratings yet

- Ajmal Ahmed's ResumeDocument1 pageAjmal Ahmed's ResumeAjmal AhmedNo ratings yet

- VIII. Consideration of Internal ControlDocument15 pagesVIII. Consideration of Internal ControlKrizza MaeNo ratings yet

- Duration 2 Hours Max Marks 70Document25 pagesDuration 2 Hours Max Marks 70AgANo ratings yet

- Forex DraftDocument9 pagesForex DraftDevang DesaiNo ratings yet

- Primer On Train LawDocument8 pagesPrimer On Train LawVeronica ChanNo ratings yet

- 5.1 Learning Objective 5-1: Chapter 5 Short-Term Investments & ReceivablesDocument74 pages5.1 Learning Objective 5-1: Chapter 5 Short-Term Investments & ReceivablesSeanNo ratings yet

- Nominal and Real Interest RatesDocument6 pagesNominal and Real Interest RatesGeromeNo ratings yet

- Tugas PiutangDocument6 pagesTugas Piutangmelvina siregarNo ratings yet

- Define Progressive, Regressive and Proportional TaxesDocument3 pagesDefine Progressive, Regressive and Proportional TaxesSyedShahmeerRazaNo ratings yet

- Contoh Format QuotationDocument1 pageContoh Format QuotationBenjaminOmar100% (1)

- AG Sumary ENG 2074 5Document102 pagesAG Sumary ENG 2074 5Balram ChaudharyNo ratings yet

- B326 Course StructureDocument16 pagesB326 Course StructureAyeshaNo ratings yet

- Equity Research Interview Questions PDFDocument5 pagesEquity Research Interview Questions PDFAkanksha Ajit DarvatkarNo ratings yet

- First Time Adoption of Ind As 101Document3 pagesFirst Time Adoption of Ind As 101vignesh_vikiNo ratings yet

- Abbottabad Audit 2013Document39 pagesAbbottabad Audit 2013Lila GulNo ratings yet

- Simple InterestDocument8 pagesSimple Interestsathish14singhNo ratings yet

- Tally With GST Workshop Jan 2023 QuestionDocument3 pagesTally With GST Workshop Jan 2023 QuestionAryan GuptaNo ratings yet

- EoI RFQ For Development of Visakhapatnam Metro Rail ProjectDocument91 pagesEoI RFQ For Development of Visakhapatnam Metro Rail Projectkmmanoj1968No ratings yet

- Management Information System of SBIDocument18 pagesManagement Information System of SBIReddy67% (3)

- Emerging Trends in Real Estate (2020) - PWCDocument100 pagesEmerging Trends in Real Estate (2020) - PWCHirokiNo ratings yet

- Financial Accounting NotesDocument12 pagesFinancial Accounting Notesmathiaschacha21No ratings yet

- CanlasDocument7 pagesCanlasAyenGaileNo ratings yet

- Quiz#2 - Accounting and FinanceDocument11 pagesQuiz#2 - Accounting and Financew.nursejatiNo ratings yet

- Chapter IV Gross Income NotesDocument5 pagesChapter IV Gross Income NotesJasmin AlapagNo ratings yet

- Municipal Accounting 6Document33 pagesMunicipal Accounting 6Marius Buys0% (1)

- Religare Project ReportDocument36 pagesReligare Project Reportsonu050480% (5)

- E Pratibha19Document1 pageE Pratibha19Anonymous lqsJIe6l5No ratings yet

- Inventory Cost & Decision TreeDocument12 pagesInventory Cost & Decision Treeaastha124892823No ratings yet

SBI Contra Fund

SBI Contra Fund

Uploaded by

Gaurav RajCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SBI Contra Fund

SBI Contra Fund

Uploaded by

Gaurav RajCopyright:

Available Formats

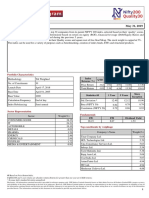

SBI Contra Fund (Regular Plan)

PRODUCT RISK RATING 3 Contra

31-May-2023

No of

Fund Manager Dinesh Balachandran 77

Holdings

1 Year 3 Years

Expense Category Category

Category benchmark S&P BSE 500 TRI 1.85 Fund Fund

Ratio (%) benchmark benchmark

Month-end AUM in Inception Sharpe Ratio 1.38 0.54 2.23 1.39

10,565 6-May-05

Rs. Crs* Date Volatility (Std Dev) 10.56% 12.35% 14.62% 15.40%

Performance Section Calendar Year Performance %

Trailing Point to Point Category Peer Group 60

Fund

Returns (%) benchmark Average 49.9

50

3 months 8.11 8.92 7.65

40 36.0

6 months 4.21 -0.83 1.71 31.6 30.6

1 year 22.48 12.85 16.05 30

18.4

3 years 43.15 27.95 29.58 20 15.2

12.8

5 years 16.34 12.58 10.79 10 6.2

2.4 4.1 4.8 5.9

Inception 16.10 NA 13.64

0

Rolling Return Performance (%) YTD 2022 2021 2020

3 years 20.19 15.35 13.24

5 years 11.43 12.85 12.24 Fund Category benchmark Peer Group

Returns less than 1 year are absolute, while > = 1 year are annualised

Peer Group Average represented by Value Fund universe

Market Cap Classification (% to NAV) Trailing SIP Performance (based on monthly investment of Rs 10000)

1 year 3 years 5 years 10 years

Cash and others Large Cap Investment value (Rs)

YTD 20.68% 6.25 2.39 38.34%4.05 Fund 133,004 535,618 1,108,582 2,900,695

2022 12.76 4.77 5.87 Category benchmark 127,971 452,457 889,419 2,482,082

2021 49.92 31.63 36.03

2020 Small-Cap 30.60 18.41 15.16 SIP Returns (%)

Mid-Cap

19.79% 21.19% Fund 20.79 27.64 24.84 16.83

Category benchmark 12.61 15.45 15.76 13.92

Top 5 Holdings * Sector Allocation (% to NAV) *

Company Name % to NAV

GAIL (India) Ltd. 3.69 Financials 19.6

21.0

ICICI Bank Ltd. 2.82

Industrials 10.1

Equitas Small Finance Bank Ltd. 2.45 8.4

HDFC Bank Ltd. 2.20 Utilities 9.5

Axis Bank Ltd. 2.17 9.8

Materials 9.2

Total Top 05 13.33 7.9

Health Care 6.7

4.5

0 5 10 15 20 25

May-23 3 Months Ago (Feb'23)

Notes

Exit load of the fund: (Period 0 days to 365 days) 1%

Market cap classification - Top 100 stocks based on market cap is considered as largecap, next top 150 stocks is considered as midcap

and all stocks below that is small-cap

Source: CRISIL

Disclaimer

The report and information contained herein is of confidential nature and meant only for the selected recipient and should not be altered in any way, transmitted to, copied or distributed, in any manner and form, to any other person or to the media or reproduced in any form, without

prior written approval of State Bank of India. The material in this document/report is based on facts, figures and information that are obtained from publicly available media or other sources believed to be reliable and hence considered true, correct, reliable and accurate but State Bank of

India does not guarantee or represent (expressly or impliedly) that the same are true, correct, reliable and accurate, not misleading or as to its genuineness, fitness for the purpose intended and it should not be relied upon as such. State Bank of India does not in any way through this

material solicit any offer for purchase, sale or entering into any financial transaction/commodities/products of any financial instrument dealt in this material. All recipients of this material should before dealing and or transacting in any of the products referred to in this material make their

own investigation, and seek appropriate professional advice

Prospective investors and others are cautioned and should be alert that any forward-looking statements are not predictions and may be subject to change without providing any notice. Actual results may differ materially from those suggested by the forward looking statements due to

risks or uncertainties associated with our expectations with respect to, but not limited to, exposure to market risks, general economic and political conditions in India and other countries globally, which have an impact on our services and / or investments, the monetary and interest

policies of India, inflation, deflation, unanticipated turbulence in interest rates, foreign exchange rates, equity prices or other rates or prices, the performance of the financial markets in India and globally, changes in domestic and foreign laws, regulations and taxes and changes in

competition in the industry. By their nature, certain market risk disclosures are only estimates and could be materially different from what actually occurs in the future. As a result, actual future gains or losses could materially differ from those that have been estimated.

State Bank of India (including its subsidiaries) and any of its officers directors, personnel and employees, shall not liable for any loss, damage of any nature, including but not limited to direct, indirect, punitive, special, exemplary, consequential, as also any loss of profit in any way arising

from the use of this material in any manner and any action on decision taking to buy, sale, invest, subscribe or entering into any contract for any financial product or services.

The recipient alone shall be fully responsible/ are liable for any decision taken on the basis of this material. The investments discussed in this material may not be suitable for all investors. Any person subscribing to or investing in any product/financial instruments should do so on the basis

of and after verifying the terms attached to such product/financial instrument. Financial products and instruments, are subject to market risks and yields may fluctuate depending on various factors affecting capital/debt markets. Please note that past performance of the financial products

and instruments does not necessarily indicate the future prospects and performance thereof. Such past performance may or may not be sustained in future. State Bank of India (including its subsidiaries) or its officers, directors, personnel and employees, including persons involved in the

preparation or issuance of this material may; (a) from time to time, have long or short positions in, and buy or sell the securities mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation in the financial

instruments/products/commodities discussed herein or act as advisor or lender / borrower in respect of such securities/financial instruments/products/commodities or have other potential conflict of interest with respect to any recommendation and related information and opinions. The

said persons may have acted upon and/or in a manner which is in conflict with the information contained here. Purchase of any Insurance product by a Bank's Customer, is purely voluntary in nature and is not linked to any other facility from the Bank. Mutual Fund and all Financial

investments are subject to market risks. Please read the offer document and scheme related information carefully before investing.

You might also like

- CIBILDocument14 pagesCIBILGaurav RajNo ratings yet

- Statement NewDocument2 pagesStatement NewabhiramNo ratings yet

- Cost Audit Report CRA 3 (In Excel)Document50 pagesCost Audit Report CRA 3 (In Excel)MOORTHYNo ratings yet

- SBI Large & Midcap FundDocument1 pageSBI Large & Midcap FundGaurav RajNo ratings yet

- Factsheet 1710581747733Document1 pageFactsheet 1710581747733mvkulkarni5No ratings yet

- Statistics# 1 Year 5 Year Since Inception: Sector Representation FundamentalsDocument2 pagesStatistics# 1 Year 5 Year Since Inception: Sector Representation FundamentalsSahil KumarNo ratings yet

- Factsheet NIFTY200 Quality30Document2 pagesFactsheet NIFTY200 Quality30Rajesh KumarNo ratings yet

- Factsheet NIFTY100 ESG IndexDocument2 pagesFactsheet NIFTY100 ESG IndexTash KentNo ratings yet

- Factsheet NIFTY Alpha Quality Value Low-Volatility 30Document2 pagesFactsheet NIFTY Alpha Quality Value Low-Volatility 30drsubramanianNo ratings yet

- Factsheet NIFTY LargeMidcap 250 IndexDocument2 pagesFactsheet NIFTY LargeMidcap 250 Indexrahulojha123No ratings yet

- Morningstarreport 20230114061338Document1 pageMorningstarreport 20230114061338hkratheeNo ratings yet

- Fundcard: HSBC Brazil FundDocument4 pagesFundcard: HSBC Brazil FundChittaNo ratings yet

- Nifty100 Quality30 PDFDocument2 pagesNifty100 Quality30 PDFGita ThoughtsNo ratings yet

- Nifty100 Quality30Document2 pagesNifty100 Quality30sujay.gorain.76No ratings yet

- Ind Nifty FMCGDocument2 pagesInd Nifty FMCGSinghNo ratings yet

- MIEF-factsheet 230320 152602Document3 pagesMIEF-factsheet 230320 152602ryanbud96No ratings yet

- Factsheet NIFTY Quality Low-Volatility 30Document2 pagesFactsheet NIFTY Quality Low-Volatility 30Aswin PoomangalathNo ratings yet

- Ind Nifty Midcap50Document2 pagesInd Nifty Midcap50SumitNo ratings yet

- Factsheet Nifty100 Alpha30Document2 pagesFactsheet Nifty100 Alpha30sumonNo ratings yet

- ABSL Commodity EquityDocument14 pagesABSL Commodity EquityArmstrong CapitalNo ratings yet

- Fact SheetDocument1 pageFact SheetSumit GiriNo ratings yet

- DPTC CMF C P16995 Client 31052023 MonDocument8 pagesDPTC CMF C P16995 Client 31052023 Monsiddhant jainNo ratings yet

- Factsheet NiftyFinancialServicesExBankDocument2 pagesFactsheet NiftyFinancialServicesExBankpatsan007No ratings yet

- Factsheet NIFTY LargeMidcap 250 IndexDocument2 pagesFactsheet NIFTY LargeMidcap 250 IndexSrikanth VgNo ratings yet

- MORNINGSTARDocument5 pagesMORNINGSTARhectorhernandez5576No ratings yet

- Factsheet NiftyMidcap150Momentum50Document2 pagesFactsheet NiftyMidcap150Momentum50Jose CANo ratings yet

- MF COMPARISON - Large & Mid 2Document3 pagesMF COMPARISON - Large & Mid 2Rajkumar GNo ratings yet

- Factsheet Nifty500 Multicap 50 25 25 IndexDocument2 pagesFactsheet Nifty500 Multicap 50 25 25 Indexramayogi somuNo ratings yet

- Ind Nifty FMCGDocument2 pagesInd Nifty FMCGSUMITNo ratings yet

- Nifty Liquid 15Document2 pagesNifty Liquid 15Pavan SalianNo ratings yet

- Axis Triple Advantage FundDocument1 pageAxis Triple Advantage FundseshadriNo ratings yet

- Ind Nifty Midcap50Document2 pagesInd Nifty Midcap50Samriddh DhareshwarNo ratings yet

- ValueResearchFundcard TataRetirementSavingsFund ModeratePlan DirectPlan 2019jul15Document4 pagesValueResearchFundcard TataRetirementSavingsFund ModeratePlan DirectPlan 2019jul15Ankit ShuklaNo ratings yet

- Tatton Tracker Active Quarterly Report Oct-Dec 19Document6 pagesTatton Tracker Active Quarterly Report Oct-Dec 19Danny DawsonNo ratings yet

- Ffs BondahcfDocument1 pageFfs BondahcfTanWeiKangNo ratings yet

- Factsheet NIFTY Alpha Low-Volatility 30Document2 pagesFactsheet NIFTY Alpha Low-Volatility 30Aswin PoomangalathNo ratings yet

- Portfolio Characteristics: Since Inception 5 Years 1 Year QTD Ytd Index Returns (%)Document2 pagesPortfolio Characteristics: Since Inception 5 Years 1 Year QTD Ytd Index Returns (%)Atul KaulNo ratings yet

- Factsheet Nifty Consumer DurablesDocument2 pagesFactsheet Nifty Consumer DurablesUMANG KHUNTNo ratings yet

- Essel Regular Savings Fund GrowthDocument1 pageEssel Regular Savings Fund GrowthYogi173No ratings yet

- Factsheet Nifty200 Momentum30Document2 pagesFactsheet Nifty200 Momentum30Umesh ThawareNo ratings yet

- Fundcard: Franklin India Focused Equity Fund - Direct PlanDocument4 pagesFundcard: Franklin India Focused Equity Fund - Direct PlanAnonymous cPS4htyNo ratings yet

- ValueResearchFundcard UTIMultiAssetFund DirectPlan 2018nov02Document4 pagesValueResearchFundcard UTIMultiAssetFund DirectPlan 2018nov02ravisankarNo ratings yet

- ValueResearchFundcard HDFCDynamicPERatioFundofFunds RegularPlan 2018may26Document4 pagesValueResearchFundcard HDFCDynamicPERatioFundofFunds RegularPlan 2018may26Aadhil BashaNo ratings yet

- Nifty50 Value20Document2 pagesNifty50 Value20shahid aliNo ratings yet

- 9 Factsheet - Nifty - Consumer - DurablesDocument2 pages9 Factsheet - Nifty - Consumer - DurablesKapilSahuNo ratings yet

- Ind Nifty Midcap 150Document2 pagesInd Nifty Midcap 150Kushal BnNo ratings yet

- Factsheet NIFTY Quality Low-Volatility 30Document2 pagesFactsheet NIFTY Quality Low-Volatility 30Rajesh KumarNo ratings yet

- Factsheet Nifty100 Alpha30Document2 pagesFactsheet Nifty100 Alpha30Aswin PoomangalathNo ratings yet

- Portfolio Characteristics: Since Inception 5 Years 1 Year QTD Ytd Index Returns (%)Document2 pagesPortfolio Characteristics: Since Inception 5 Years 1 Year QTD Ytd Index Returns (%)G gfgjNo ratings yet

- HDFC Momentum150 FundDocument2 pagesHDFC Momentum150 Fundkrishnakumar kichaNo ratings yet

- Factsheet NiftyMidSmallHealthCareDocument2 pagesFactsheet NiftyMidSmallHealthCareAvinash BaldiNo ratings yet

- Ind Nifty RealtyDocument2 pagesInd Nifty RealtyParth AsnaniNo ratings yet

- Factsheet Nifty Consumer DurablesDocument2 pagesFactsheet Nifty Consumer Durablesdohare41No ratings yet

- Factsheet NiftyEVNewAgeAutomotiveDocument2 pagesFactsheet NiftyEVNewAgeAutomotiveramayogi somuNo ratings yet

- Ind Nifty FMCGDocument2 pagesInd Nifty FMCGDharmendra Singh GondNo ratings yet

- ICICI Prudential PMS Largecap Portfolio: A Series Under "Diversified" Portfolio"Document3 pagesICICI Prudential PMS Largecap Portfolio: A Series Under "Diversified" Portfolio"laurieNo ratings yet

- July 31, 2019: Portfolio CharacteristicsDocument2 pagesJuly 31, 2019: Portfolio CharacteristicsVenkata Ramana PothulwarNo ratings yet

- Midcap FactsheetDocument2 pagesMidcap FactsheetShubhashish SaxenaNo ratings yet

- Quant Multi Asset FundDocument1 pageQuant Multi Asset Fundarian2026No ratings yet

- Ind Nifty 500Document2 pagesInd Nifty 500VIGNESH RKNo ratings yet

- Factsheet Nifty Consumer DurablesDocument2 pagesFactsheet Nifty Consumer DurablesAvinash BaldiNo ratings yet

- SBI Large & Midcap FundDocument1 pageSBI Large & Midcap FundGaurav RajNo ratings yet

- GST Bill vidyasagar 2Document1 pageGST Bill vidyasagar 2Gaurav RajNo ratings yet

- invoice AIR FRYERDocument1 pageinvoice AIR FRYERGaurav RajNo ratings yet

- SBI Life at different rates smart PrivilegeDocument1 pageSBI Life at different rates smart PrivilegeGaurav RajNo ratings yet

- Case Study QuestionsDocument3 pagesCase Study QuestionsGaurav RajNo ratings yet

- Iridium FailureDocument4 pagesIridium FailureGaurav RajNo ratings yet

- Evaluation Matrix Summer Internship ProjectsDocument1 pageEvaluation Matrix Summer Internship ProjectsGaurav RajNo ratings yet

- Useful Resources RPG InternshipDocument3 pagesUseful Resources RPG InternshipGaurav RajNo ratings yet

- Useful Resources ICICI InternshipDocument4 pagesUseful Resources ICICI InternshipGaurav RajNo ratings yet

- Useful Resources GroupDiscussionDocument3 pagesUseful Resources GroupDiscussionGaurav RajNo ratings yet

- Useful Resources - HT Media Internship IntreviewDocument4 pagesUseful Resources - HT Media Internship IntreviewGaurav RajNo ratings yet

- Ajmal Ahmed's ResumeDocument1 pageAjmal Ahmed's ResumeAjmal AhmedNo ratings yet

- VIII. Consideration of Internal ControlDocument15 pagesVIII. Consideration of Internal ControlKrizza MaeNo ratings yet

- Duration 2 Hours Max Marks 70Document25 pagesDuration 2 Hours Max Marks 70AgANo ratings yet

- Forex DraftDocument9 pagesForex DraftDevang DesaiNo ratings yet

- Primer On Train LawDocument8 pagesPrimer On Train LawVeronica ChanNo ratings yet

- 5.1 Learning Objective 5-1: Chapter 5 Short-Term Investments & ReceivablesDocument74 pages5.1 Learning Objective 5-1: Chapter 5 Short-Term Investments & ReceivablesSeanNo ratings yet

- Nominal and Real Interest RatesDocument6 pagesNominal and Real Interest RatesGeromeNo ratings yet

- Tugas PiutangDocument6 pagesTugas Piutangmelvina siregarNo ratings yet

- Define Progressive, Regressive and Proportional TaxesDocument3 pagesDefine Progressive, Regressive and Proportional TaxesSyedShahmeerRazaNo ratings yet

- Contoh Format QuotationDocument1 pageContoh Format QuotationBenjaminOmar100% (1)

- AG Sumary ENG 2074 5Document102 pagesAG Sumary ENG 2074 5Balram ChaudharyNo ratings yet

- B326 Course StructureDocument16 pagesB326 Course StructureAyeshaNo ratings yet

- Equity Research Interview Questions PDFDocument5 pagesEquity Research Interview Questions PDFAkanksha Ajit DarvatkarNo ratings yet

- First Time Adoption of Ind As 101Document3 pagesFirst Time Adoption of Ind As 101vignesh_vikiNo ratings yet

- Abbottabad Audit 2013Document39 pagesAbbottabad Audit 2013Lila GulNo ratings yet

- Simple InterestDocument8 pagesSimple Interestsathish14singhNo ratings yet

- Tally With GST Workshop Jan 2023 QuestionDocument3 pagesTally With GST Workshop Jan 2023 QuestionAryan GuptaNo ratings yet

- EoI RFQ For Development of Visakhapatnam Metro Rail ProjectDocument91 pagesEoI RFQ For Development of Visakhapatnam Metro Rail Projectkmmanoj1968No ratings yet

- Management Information System of SBIDocument18 pagesManagement Information System of SBIReddy67% (3)

- Emerging Trends in Real Estate (2020) - PWCDocument100 pagesEmerging Trends in Real Estate (2020) - PWCHirokiNo ratings yet

- Financial Accounting NotesDocument12 pagesFinancial Accounting Notesmathiaschacha21No ratings yet

- CanlasDocument7 pagesCanlasAyenGaileNo ratings yet

- Quiz#2 - Accounting and FinanceDocument11 pagesQuiz#2 - Accounting and Financew.nursejatiNo ratings yet

- Chapter IV Gross Income NotesDocument5 pagesChapter IV Gross Income NotesJasmin AlapagNo ratings yet

- Municipal Accounting 6Document33 pagesMunicipal Accounting 6Marius Buys0% (1)

- Religare Project ReportDocument36 pagesReligare Project Reportsonu050480% (5)

- E Pratibha19Document1 pageE Pratibha19Anonymous lqsJIe6l5No ratings yet

- Inventory Cost & Decision TreeDocument12 pagesInventory Cost & Decision Treeaastha124892823No ratings yet