Professional Documents

Culture Documents

Professional Indemnity Proposal Form_0

Professional Indemnity Proposal Form_0

Uploaded by

Mahesh BCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Professional Indemnity Proposal Form_0

Professional Indemnity Proposal Form_0

Uploaded by

Mahesh BCopyright:

Available Formats

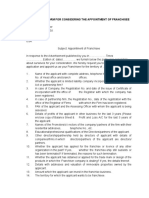

UNITED INDIA INSURANCE COMPANY LIMITED

REGD & HEAD OFFICE NO 24 WHITES ROAD CHENNAI – 600 014

PROPOSAL FORM FOR PROFESSIONAL INDEMNITY INSURANCE

1. a) Name of Proposer (in full) a)

b) Address b)

c) Telephone Number c)

2. When was the Firm/ Company established?

3. a) In which type of profession is the Proposer mainly engaged? a)

Give full details.

b) Apart from the above, is there any other professional work b)

which the Proposer undertakes? If so, give details.

4. a) Does the Proposer conduct business from offices other than the a)

above? If so, please state the full address (es) of all such

offices. b)

b) Is there a Partner / Director in full time attendance at every

office?

5. Please give the following particulars for each Partner / Director:

Professional How long in practice as Partner /

Full Name Age Date

Qualifications Director

6. a) What establishment does the Proposer maintain to carry on a)

professional work?

b) Does the Proposer engage the services of professionally b)

qualified persons such as Chartered Accountants, Engineers

etc.?

c) Are they the Proposer’s full time employees? c)

7. Please state the total number of a)

Partners / Directors a)

b) Staff other than Typist and Office Boys (Officers, Apprentices, b)

Articled Clerks etc., should be separately shown).

c) Typists and Office Boys c)

8. Has the Proposer or have the Proposer’s predecessors in business

discharged or is the Proposer contemplating the discharge of any

employee for

a) Any negligent act, error or omission

b) Any dishonest, fraudulent, criminal or malicious conduct? if a)

so, give full details b)

9. Is the Proposer now or ever been insured against professional

indemnity risks? If so, state with what Company or Companies?

10. a) Has any one made any claim for breach of professional duty a)

against the Proposer or the Proposer’s predecessors in business

or against any Partner / Director individually or has the

Proposer any reason to suspect that such a claim could be made?

If so, give full particulars.

b) Give below particulars of all professional indemnity claims made

by the Proposer or the Proposer’s predecessors in business

during the past five years. b)

Amount

Year No. of Events No. of Insurers Amount to be recovered Rs.

recovered Rs.

19

19

19

19

19

11. Is there any other information material to the risk in

the Proposer’s possession? If so, give full details.

12. Has any insurer previously granted a cover in respect

of the risk proposed for insurance? if so, please state

a) Name of the insurer

b) The period of insurance a)

b)

13. Has any insurer in respect of any professional

indemnity cover

a) Declined a proposal from the Proposer or from

the Proposer’s predecessors in business, or a)

b) Cancelled or declined to renew any policy, or

c) Demanded an increased rate, or b)

d) Required special terms to insure or grant any c)

renewal? d)

14. Amount of indemnity required

a) Any one event or series of events arising out of a)

any one cause.

b) All events during the period of insurance. b)

15. Period of Insurance From To

16. Does the Proposer wish to extend the policy to cover a)

a) Dishonest, fraudulent, criminal or malicious acts

of employees in relation to the Proposer’s

Professional work b)

b) Loss of or damage to documents? [What will be

the greatest value at risk at any one time?]

if so, i.

i. State the amount to the insured under each ii.

ii. Give details of any claim(s) or loss(es) under

the extension (s) required

I / we hereby declare that the above statements and answers are true and compete and that no material

fact has been with-held, mis-stated or mis-represented and I / we agree that this proposal and declaration

shall be the basis of the contract between me/us and ------------------------------ whose standard policy for

the Insurance proposed is acceptable to me/us.

Place:

Date : Signature of the Proposer

(A partner / Director of the Firm / Company must sign this proposal form) Note:

The liability of the Company does not commence until the proposal has been accepted by the

Company and the premium paid.

WHO CAN DERIVE BENEFITS FROM THIS COVER?

Professional Indemnity Insurance Policies are effected by professionals e.g. Solicitors,

Accountants, Doctors against liability to pay damage to their clients due to their negligence in the

performance of their professional duties.

WHAT IS THE COVER AVAILABLE?

The Company agrees to indemnify the insured against any claim for damages for breach of

professional duties which may be made against him during the currency of the Policy due to any

negligent act error or omission committed either by the insured or on behalf of the insured in their

Professional Capacity.

Exceptions of the Policy are:

a) Libel or Slander.

b) Loss of documents.

c) Consequential loss.

d) Losses suffered out of fraudulent act of employees.

Section 41 of Insurance Act, 1938 – Prohibition of Rebates

a. No person shall allow or offer to allow either directly or indirectly as an inducement to any person to take out or renew

or continue insurance in respect of any kind of risk relating to lives or property in India, any rebate of the whole or part

of the commission payable or any rebate of the premium shown on the policy, nor shall any person taking out or

renewing or continuing a policy accept any rebate, except such rebate as may be allowed in accordance with the

prospectus or tables of the Insurers.

b. Any person making default in complying with the provisions of this section shall be punishable with fine which may

extend to ten lakh rupees.

You might also like

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- Test Bank For Principles of Risk Management and Insurance 14th Edition George e Rejda Michael Mcnamara William RabelDocument18 pagesTest Bank For Principles of Risk Management and Insurance 14th Edition George e Rejda Michael Mcnamara William RabelDana Harding100% (38)

- C12 Study 4: Anatomy of A Property Policy: Overview: Answer KeyDocument5 pagesC12 Study 4: Anatomy of A Property Policy: Overview: Answer KeyStef CNo ratings yet

- Customized EOI TemplateDocument6 pagesCustomized EOI TemplateNickel7No ratings yet

- Public Liability - Application Form1Document3 pagesPublic Liability - Application Form1PUNTA LWA PROPERTIESNo ratings yet

- Blackwater Proposal 2013Document12 pagesBlackwater Proposal 2013Blackwater Agency0% (1)

- PROFESSIONAL INDEMNITY Proposal FormDocument4 pagesPROFESSIONAL INDEMNITY Proposal FormErnestNo ratings yet

- Error and Omissions Policy Proposal FormDocument2 pagesError and Omissions Policy Proposal FormNarender Anand0% (1)

- Proposal Form Professoinal IndemnityDocument4 pagesProposal Form Professoinal Indemnitym_dattaiasNo ratings yet

- Branch / Divisional OfficeDocument7 pagesBranch / Divisional Officervlnth_prabhuNo ratings yet

- Professional Liability Proposal Form - EditableDocument4 pagesProfessional Liability Proposal Form - EditableJun FalconNo ratings yet

- Fidelity Guarantee Insurance Proposal Form: Proposer DetailsDocument5 pagesFidelity Guarantee Insurance Proposal Form: Proposer Detailsm_dattaiasNo ratings yet

- Cgu Miscellaneous Professional Indemnity Insurance ProposalDocument8 pagesCgu Miscellaneous Professional Indemnity Insurance ProposalNguyen Hong HaNo ratings yet

- Miscellaneous Professional Indemnity Proposal Form: Category %Document5 pagesMiscellaneous Professional Indemnity Proposal Form: Category %Sonali AgarwalNo ratings yet

- Proposal Public Liability - Non Indus.Document2 pagesProposal Public Liability - Non Indus.m_dattaiasNo ratings yet

- Professional IndemnityDocument7 pagesProfessional IndemnitywanNo ratings yet

- Ngles Prop FormDocument4 pagesNgles Prop FormSatish MnvNo ratings yet

- Doctor's Indemnity Proposal FormDocument5 pagesDoctor's Indemnity Proposal FormPriyank guptaNo ratings yet

- Special AuditorDocument8 pagesSpecial Auditormahima vermaNo ratings yet

- Application Form For Financial Assistance Under The New Entrepreneurship - Cum-Enterprise Development Scheme (Needs)Document8 pagesApplication Form For Financial Assistance Under The New Entrepreneurship - Cum-Enterprise Development Scheme (Needs)Vinoth Kumar RajagopalNo ratings yet

- PI - All Risks - ArchitectsDocument3 pagesPI - All Risks - ArchitectsPhilip ONo ratings yet

- Professional Indemnity Insurance Form - LyhourDocument5 pagesProfessional Indemnity Insurance Form - Lyhourwea010No ratings yet

- RFBT Quiz No.3Document4 pagesRFBT Quiz No.3Clarice GonzalesNo ratings yet

- Office Use OnlyDocument3 pagesOffice Use OnlyDeep RajNo ratings yet

- Personal Questionnaire and Declaration Form 2019 - 3Document15 pagesPersonal Questionnaire and Declaration Form 2019 - 3lacatancopycentreNo ratings yet

- PDL Final ExamDocument5 pagesPDL Final ExamRenzNo ratings yet

- IOB42986Chennai Circle Public NoticeDocument8 pagesIOB42986Chennai Circle Public Noticegangapuram aravindNo ratings yet

- IC38 Model Question Paper # 4Document8 pagesIC38 Model Question Paper # 4Gokul100% (1)

- Boiler Insurance Policy - Proposal FormDocument4 pagesBoiler Insurance Policy - Proposal FormAnjali SinghNo ratings yet

- Consultancy Agreement TemplateDocument6 pagesConsultancy Agreement TemplatemyevNo ratings yet

- (O) Amani AgreementDocument9 pages(O) Amani AgreementfearshieldytNo ratings yet

- Protection & Indemnity: Proposal FormDocument8 pagesProtection & Indemnity: Proposal Formmonica ellaNo ratings yet

- Form Irda Agents VaDocument2 pagesForm Irda Agents VarenganathanNo ratings yet

- ACE Advantage: Miscellaneous Professional Liability ApplicationDocument8 pagesACE Advantage: Miscellaneous Professional Liability ApplicationtonyNo ratings yet

- Audit)Document2 pagesAudit)Atif RazzaqNo ratings yet

- Proposal Form For The Insurance of Neon Signs And/or HoardingsDocument3 pagesProposal Form For The Insurance of Neon Signs And/or Hoardingsm_dattaiasNo ratings yet

- Etiqa Individual Application FormDocument4 pagesEtiqa Individual Application FormHihiNo ratings yet

- AUDITING THEORY Quiz No. 3Document3 pagesAUDITING THEORY Quiz No. 3ROB101512No ratings yet

- Psa Challenge #6Document18 pagesPsa Challenge #6clarencerclacioNo ratings yet

- Appendix C-Bidder Offer FormDocument15 pagesAppendix C-Bidder Offer FormGarth GilmourNo ratings yet

- Word Copy of Application For Empanelment of Stock AuditorsDocument7 pagesWord Copy of Application For Empanelment of Stock AuditorsRita RathoreNo ratings yet

- Form 1Document2 pagesForm 1Suvradeep DasNo ratings yet

- Medium Works Tender FormDocument2 pagesMedium Works Tender FormRobertoNo ratings yet

- The New India Assurance Company Limited: Head Office: 87, M G Road, Fort, Mumbai-400001Document4 pagesThe New India Assurance Company Limited: Head Office: 87, M G Road, Fort, Mumbai-400001anshuNo ratings yet

- RFBT Final ExamDocument8 pagesRFBT Final ExamClarice GonzalesNo ratings yet

- Short Form Offer FormDocument3 pagesShort Form Offer FormRobertoNo ratings yet

- MCQ Cfas - 2Document12 pagesMCQ Cfas - 2Koko LaineNo ratings yet

- Consultancy Agreement - SimranDocument6 pagesConsultancy Agreement - SimransiddharthNo ratings yet

- Agent'S Confidential Report / Moral Hazard ReportDocument2 pagesAgent'S Confidential Report / Moral Hazard ReportshahnawazNo ratings yet

- Financial Q-5.6Document2 pagesFinancial Q-5.6Dushyant SaxenaNo ratings yet

- Solutions - Summer Exam 2019 PDFDocument56 pagesSolutions - Summer Exam 2019 PDFaliakhtar02No ratings yet

- Code of Ethics (Q&A)Document46 pagesCode of Ethics (Q&A)Rosario Garcia Catugas0% (1)

- Proposal Form For Burglary InsuranceDocument4 pagesProposal Form For Burglary InsuranceNayan TrivediNo ratings yet

- ParCor Answer Key To QuestionsDocument9 pagesParCor Answer Key To QuestionsJayson J. ManlangitNo ratings yet

- Ashwini NDA SignedDocument8 pagesAshwini NDA SignedAshwini ChavanNo ratings yet

- Employment Agreement (Deed)Document6 pagesEmployment Agreement (Deed)amanullahNo ratings yet

- Application Form For Considering The Appointment of FranchiseeDocument2 pagesApplication Form For Considering The Appointment of FranchiseeVIRTUAL WORLDNo ratings yet

- OTL Exam D Answer KeyDocument15 pagesOTL Exam D Answer Keypatrick MuyayaNo ratings yet

- Public Liability Under ActDocument2 pagesPublic Liability Under ActDurga Pradeep BandigaNo ratings yet

- OSCAR Proposal Form: Section I. Proposer DetailsDocument3 pagesOSCAR Proposal Form: Section I. Proposer DetailsBob KmnNo ratings yet

- AT Reviewer Part III (Questions and Answer) PDFDocument48 pagesAT Reviewer Part III (Questions and Answer) PDFVictor RamirezNo ratings yet

- FPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)From EverandFPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)No ratings yet

- Sample Contract For Chipping RFPDocument11 pagesSample Contract For Chipping RFPWinniejanes nyabokeNo ratings yet

- ZNA Appetite GuideDocument126 pagesZNA Appetite GuideAmlan Kumar SahuNo ratings yet

- Medical Indemnity InsuranceDocument2 pagesMedical Indemnity InsuranceSandeep Bansal100% (1)

- C5 - PCI 2014 ManualDocument46 pagesC5 - PCI 2014 ManualThandabantu MagengeleleNo ratings yet

- Compulsory Motor Vehicle Liability Insurance (Cmvli)Document34 pagesCompulsory Motor Vehicle Liability Insurance (Cmvli)Eryl Yu100% (2)

- U I N - IRDAN115CP0017V01201920 Misc 10: Premium Break Up (RS.) Premium (RS.)Document11 pagesU I N - IRDAN115CP0017V01201920 Misc 10: Premium Break Up (RS.) Premium (RS.)Antaryami PradhanNo ratings yet

- Request For Proposal (RFP)Document15 pagesRequest For Proposal (RFP)Aurora AnghelNo ratings yet

- Model Solar Rooftop Lease AgreementDocument17 pagesModel Solar Rooftop Lease Agreementprakrut1234No ratings yet

- Felix Clauss, JR., Thomas R. Clauss and Anna M. Clauss, T/a Felix Clauss and Sons v. American Insurance Company and Paul Rumer and City of Philadelphia, 287 F.2d 873, 3rd Cir. (1961)Document5 pagesFelix Clauss, JR., Thomas R. Clauss and Anna M. Clauss, T/a Felix Clauss and Sons v. American Insurance Company and Paul Rumer and City of Philadelphia, 287 F.2d 873, 3rd Cir. (1961)Scribd Government DocsNo ratings yet

- GD RV Rental Contract BlankDocument4 pagesGD RV Rental Contract BlankTawny FernandezNo ratings yet

- Proposal Fiber Optic Network Management & Operation ServicesDocument26 pagesProposal Fiber Optic Network Management & Operation Servicesfauzi djawasNo ratings yet

- Contract AgreementDocument8 pagesContract Agreementmarvin100% (1)

- Week 11 - Employee Incentives & Benefits AssignDocument3 pagesWeek 11 - Employee Incentives & Benefits AssignAishwarrya NanthakumarNo ratings yet

- 2021.08.24 Parkhill FS - EMS Demolition Docs - FinalDocument331 pages2021.08.24 Parkhill FS - EMS Demolition Docs - FinalTony ParkNo ratings yet

- Insurance Requirements in ContractsDocument229 pagesInsurance Requirements in ContractsbgmladicNo ratings yet

- ID Car & Declaration PageDocument3 pagesID Car & Declaration Pagejesusmorales6215No ratings yet

- Torts 3rdDocument54 pagesTorts 3rdMaFatimaP.LeeNo ratings yet

- Consumers' Insurance Literacy: Literature Review, Conceptual Definition, and Approach For A Measurement InstrumentDocument18 pagesConsumers' Insurance Literacy: Literature Review, Conceptual Definition, and Approach For A Measurement InstrumentKrutika sutarNo ratings yet

- Offshore Contracts 1 PDFDocument126 pagesOffshore Contracts 1 PDFAnver SherifNo ratings yet

- Fidelity 2006 Alta Lenders Policy - SampleDocument12 pagesFidelity 2006 Alta Lenders Policy - SampleBrenda ReedNo ratings yet

- Vehicle Insurance Management SystemDocument92 pagesVehicle Insurance Management Systemeyob.abate.legesse0% (1)

- Purchase Airbus 330 NeoDocument10 pagesPurchase Airbus 330 NeoTria Amalia AtiKaNo ratings yet

- Redefining Insurance: The Future AheadDocument39 pagesRedefining Insurance: The Future AheadSutapta MukherjeeNo ratings yet

- ActuariesDocument54 pagesActuariesbiu01100% (8)

- Motor Insurance DissertationDocument5 pagesMotor Insurance DissertationDoMyCollegePaperJackson100% (1)

- Adverse Inference - 1Document22 pagesAdverse Inference - 1ZaminNo ratings yet

- Document 588372663738Document1 pageDocument 588372663738JacobNo ratings yet