Professional Documents

Culture Documents

Wonderful Advice

Wonderful Advice

Uploaded by

djxqmnxptonxpsjxunCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Wonderful Advice

Wonderful Advice

Uploaded by

djxqmnxptonxpsjxunCopyright:

Available Formats

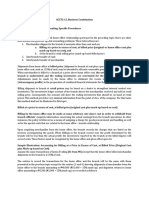

Chart 1: Distribution of Investments by Geography and Industry

Cash Telecoms & Cable

Cash 19% 8%

19% United States

Norway 4% 29% Comp Serv and

OA

6% Leisure & Ent

20%

Hong Kong 20% South Africa

6%

Malaysia Thailand Media &

6% 8% Hotels & Real

United Kingdom

Publishing Consumer Dur & Estate 17%

8% 23% Finance

7%

Source: Marathon Asset Management

The fund has a profit on eighteen of its twenty-one investments compared to average purchase

price. For those shares that have fallen we have bought more. This reminds us of “A Little

Wonderful Advice” Fred Schwed gives in his book “Where are the customers yachts?”

(recommended reading for those with a healthy disdain for Wall Street and its practices as

well as an interest in post-boom psychology).

“When there is a stock-market boom, and everyone is scrambling for common stocks, take

all your common stocks and sell them. Take the proceeds and buy conservative bonds. No

doubt the stocks you sold will go higher. Pay no attention to this – just wait for the

depression which will come sooner or later. When this depression – or panic – becomes a

national catastrophe, sell out the bonds (perhaps at a loss) and buy back the stocks. No

doubt the stocks will go lower still. Again, pay no attention. Wait for the next boom.

Continue to repeat this operation as long as you live, and you’ll have the pleasure of dying

rich”.

The operative phrase here is “pay no attention”. This is not easily done. Many investors are

professionally required to “pay attention” to the latest trend for fear of missing out (pay

attention and be invested!). The dysfunctionality of the short-term investor was neatly

described to us recently by a fellow long term value investor. Imagine, he said, that you knew

with 100% certainty of outcome, that on January 1 st next year a company would come by some

good fortune, perhaps a government contract or license award, which would result in the price

of the share quickly rising tenfold. You and I would buy the shares today and wait. However,

to the short-term investor the utility of this piece of information would be nought until after

this year is ended. This is because he feels he is required to perform this quarter, next and by

year end through fear that sub-par performance might cost him his job. A share which may be

flat for the balance of the year is therefore of no use to him. This tale illustrates the dominant

dynamic in the markets today: investment time frames are very compressed, and few investors

it seems bother to assess the real value of a business but instead respond to the latest data

point to determine share price direction. This is momentum investing and is the mechanism

by which expensive shares become very expensive, just as cheap shares may become very

cheap. In the above example both sets of investors may even have privately agreed that the

share in question was an outstanding investment, but only one would have bought. You can

bank on us being the buyer.

10

You might also like

- Larry Williams Forecast 2019 ReportDocument71 pagesLarry Williams Forecast 2019 Reportwahib msyah100% (2)

- A Playing Card Reader S Notebook PDFDocument20 pagesA Playing Card Reader S Notebook PDFTarotbyleamarie100% (11)

- Celcom JanDocument2 pagesCelcom JanThee Suh ShyanNo ratings yet

- LCCI LEVEL 1&2 TextbookDocument100 pagesLCCI LEVEL 1&2 TextbookJohn Sue Han100% (3)

- Mulukanoor Women's Mutually Aided Milk Producers' CooperativeDocument21 pagesMulukanoor Women's Mutually Aided Milk Producers' CooperativeSri HimajaNo ratings yet

- Loccitane QuestionsDocument2 pagesLoccitane QuestionsMarat SafarliNo ratings yet

- The Financial Detective ASLIDocument5 pagesThe Financial Detective ASLIAntonius CliffSetiawanNo ratings yet

- Why The Soft Market Should BeDocument8 pagesWhy The Soft Market Should BenfanfloridaNo ratings yet

- Summary Prospectus Tradewale Managed Fund 022019Document8 pagesSummary Prospectus Tradewale Managed Fund 022019hyenadogNo ratings yet

- Bruce Packard Weekly Commentary 04 140920Document8 pagesBruce Packard Weekly Commentary 04 140920bruce packardNo ratings yet

- Basics of REITDocument9 pagesBasics of REITRoyce ZhanNo ratings yet

- Not The Absolute Return Letter 071010Document5 pagesNot The Absolute Return Letter 071010J. Stethers WhiteNo ratings yet

- Asset Markets NotesDocument317 pagesAsset Markets NotesRon KurtzbardNo ratings yet

- BancassuranceDocument7 pagesBancassuranceWimoko FxNo ratings yet

- The Fourth Industrial Revolution Is Here-Are You Ready?: Key FindingsDocument12 pagesThe Fourth Industrial Revolution Is Here-Are You Ready?: Key FindingsEdouard Francis Dufour DarbellayNo ratings yet

- Collective Insights: Minutes From Our Morning MeetingDocument2 pagesCollective Insights: Minutes From Our Morning Meetingapi-63645244No ratings yet

- Horwath HTL European Hotels and Chains Report 2017Document88 pagesHorwath HTL European Hotels and Chains Report 2017neli00No ratings yet

- Gmo Quarterly Letter Q4 2018Document17 pagesGmo Quarterly Letter Q4 2018Stirling AdelhelmNo ratings yet

- 2010 Real Estate Investment Outlook: A Special Research ReportDocument4 pages2010 Real Estate Investment Outlook: A Special Research ReportCRE ConsoleNo ratings yet

- Завдання сімейна освіта 10 класDocument10 pagesЗавдання сімейна освіта 10 класКил НилNo ratings yet

- International Portfolio ManagementDocument9 pagesInternational Portfolio ManagementGaurav KumarNo ratings yet

- Detailed Tables Are Provided in The Appendix at The EndDocument9 pagesDetailed Tables Are Provided in The Appendix at The Endanil1820No ratings yet

- Caught Between Armageddon and Irrational Exuberance: Stop Press ....Document4 pagesCaught Between Armageddon and Irrational Exuberance: Stop Press ....FirstEquityLtdNo ratings yet

- Crypto Fund Report Q2 2021Document26 pagesCrypto Fund Report Q2 2021Viviane BocalonNo ratings yet

- TBills and Chill Most of The TimeDocument6 pagesTBills and Chill Most of The TimeJuliano VieiraNo ratings yet

- Third Point Q3 2019 LetterDocument13 pagesThird Point Q3 2019 LetterZerohedge100% (2)

- Dynamic Asset Allocation in A Changing WorldDocument3 pagesDynamic Asset Allocation in A Changing WorldAnna WheelerNo ratings yet

- Kovitz Newsletter 2016-12-31Document18 pagesKovitz Newsletter 2016-12-31superinvestorbulletiNo ratings yet

- Investor Update: April 2017 - Strictly Private & ConfidentialDocument22 pagesInvestor Update: April 2017 - Strictly Private & ConfidentialІгор МартьяновNo ratings yet

- Sea Fas 2016 Global FX SurveyDocument22 pagesSea Fas 2016 Global FX SurveyMd. Al MamunNo ratings yet

- Q1 2018 - Investor LetterDocument4 pagesQ1 2018 - Investor Letterbillroberts981No ratings yet

- Renaissance: European Retail Banking An Opportunity For ADocument22 pagesRenaissance: European Retail Banking An Opportunity For AataktosNo ratings yet

- State of Indian Stock Markets and Indian Businesses Mar 08Document5 pagesState of Indian Stock Markets and Indian Businesses Mar 08subodh_purohit7258No ratings yet

- IJRAR1AQP062Document6 pagesIJRAR1AQP062littleasiangirl22No ratings yet

- Whitepaper-Institutional-2020-Sqb-En Swiss QuoteDocument18 pagesWhitepaper-Institutional-2020-Sqb-En Swiss QuotemtimbangeNo ratings yet

- PRF How Buyers Find The Home They PurchaseDocument3 pagesPRF How Buyers Find The Home They Purchaseapi-33593200No ratings yet

- UK Mid-Market PE Review: Our Perspective On Private Equity Activity During 2020Document50 pagesUK Mid-Market PE Review: Our Perspective On Private Equity Activity During 2020xen101No ratings yet

- Why Are Markets Rising?: WebinarDocument4 pagesWhy Are Markets Rising?: WebinarRanjan BeheraNo ratings yet

- Horwath HTL Asian Chains ReportDocument58 pagesHorwath HTL Asian Chains ReportRushabh ShahNo ratings yet

- Third Point Q4 Investor Letter FinalDocument12 pagesThird Point Q4 Investor Letter FinalZerohedge100% (3)

- Reits:: Real Wealth MachineDocument4 pagesReits:: Real Wealth MachineSara MohamedNo ratings yet

- Seco HedgeFunds TruthsMyths PDFDocument39 pagesSeco HedgeFunds TruthsMyths PDFpradeep equityNo ratings yet

- Preqin Private Equity Investor Survey Oct2010Document9 pagesPreqin Private Equity Investor Survey Oct2010http://besthedgefund.blogspot.comNo ratings yet

- Semper Vic Partners Letter 2020-Q1 PDFDocument14 pagesSemper Vic Partners Letter 2020-Q1 PDFlauchihinNo ratings yet

- Final PresentationDocument43 pagesFinal PresentationrohitbatraNo ratings yet

- Top 100 Cashflow MarketsDocument13 pagesTop 100 Cashflow MarketsDante PietrantoniNo ratings yet

- Macquarie Atlas - March 2017Document5 pagesMacquarie Atlas - March 2017Kunqi ZhangNo ratings yet

- 2014 Strategy ReportDocument139 pages2014 Strategy Reportsude naz ivgenNo ratings yet

- Fintech Emerging Don of Financial ServicesDocument23 pagesFintech Emerging Don of Financial Servicesavinash singhNo ratings yet

- SageOne Investor Memo Aug 2020 PDFDocument10 pagesSageOne Investor Memo Aug 2020 PDFjohnthomastNo ratings yet

- Derivatives Market Structure 2020 PRINT.20 2012 PDFDocument16 pagesDerivatives Market Structure 2020 PRINT.20 2012 PDFlaurence34No ratings yet

- Oxford Business Plan Pg8Document1 pageOxford Business Plan Pg8sladurantayeNo ratings yet

- PWC Study A Major Shift For Shopping How Digital Trends Are Transforming Customer Behaviour in EuropeDocument24 pagesPWC Study A Major Shift For Shopping How Digital Trends Are Transforming Customer Behaviour in EuropechopperNo ratings yet

- Tech Crunch Private Company Presentation q2!7!22 10Document4 pagesTech Crunch Private Company Presentation q2!7!22 10byrneseyeviewNo ratings yet

- Thesis Real Estate BubbleDocument7 pagesThesis Real Estate BubbleAndrew Parish100% (2)

- Fund FactsDocument3 pagesFund FactsraulNo ratings yet

- Practice Midterm Bus331 SpringDocument3 pagesPractice Midterm Bus331 SpringJavan OdephNo ratings yet

- Market Haven Monthly 2011 JanuaryDocument10 pagesMarket Haven Monthly 2011 JanuaryMarketHavenNo ratings yet

- EndowmentDocument2 pagesEndowmentNelab HaidariNo ratings yet

- Stock Market Investing for Beginners: And Intermediate. Learn to Generate Passive Income with Investing, Stock Trading, Day Trading Stock. Useful for Cryptocurrency. Great to Listen in a Car!From EverandStock Market Investing for Beginners: And Intermediate. Learn to Generate Passive Income with Investing, Stock Trading, Day Trading Stock. Useful for Cryptocurrency. Great to Listen in a Car!No ratings yet

- Investing for Beginners: Steps to Financial FreedomFrom EverandInvesting for Beginners: Steps to Financial FreedomRating: 4.5 out of 5 stars4.5/5 (3)

- Annual Report 2011 FinalDocument4 pagesAnnual Report 2011 FinalJosh FunderburkeNo ratings yet

- Wealth-Insight - Feb 2024Document84 pagesWealth-Insight - Feb 2024Premnath YadavNo ratings yet

- 2012-Noman TextileDocument3 pages2012-Noman TextileShahadat Hossain ShahinNo ratings yet

- 100 Corporations That Will Survive 100 YearsDocument3 pages100 Corporations That Will Survive 100 YearsjiddysurianiNo ratings yet

- Reasury Rash Ourse: by Jawwad Ahmed FaridDocument13 pagesReasury Rash Ourse: by Jawwad Ahmed FaridmohamedNo ratings yet

- M2 - Home Office and Branch Accounting - Specific ProceduresDocument15 pagesM2 - Home Office and Branch Accounting - Specific ProceduresJohn Michael A. PaclibareNo ratings yet

- 20200729181653final Exam Adm 3350 Part I PDFDocument5 pages20200729181653final Exam Adm 3350 Part I PDFaba brohaNo ratings yet

- Case Study On Punjab National Bank Fraud 2018Document19 pagesCase Study On Punjab National Bank Fraud 2018Ayush AgarwalNo ratings yet

- Empowering Women Through MicrofinancingDocument81 pagesEmpowering Women Through MicrofinancingSuraj DubeyNo ratings yet

- Sample Bar Questions With Answers ObliconDocument12 pagesSample Bar Questions With Answers ObliconJen Quilaquil - AlicanNo ratings yet

- Amendments To IFRS 2 'Share-Based Payment'Document1 pageAmendments To IFRS 2 'Share-Based Payment'Rizshelle D. AlarconNo ratings yet

- Present Values, The Objectives of The Firm, and Corporate GovernanceDocument31 pagesPresent Values, The Objectives of The Firm, and Corporate GovernanceTanvi KatariaNo ratings yet

- 11th January - Meetup Attendees ListDocument12 pages11th January - Meetup Attendees ListSalman ShaikhNo ratings yet

- The Financial Factors Influencing Cash Dividend Policy: A Sample of U.S. Manufacturing CompaniesDocument21 pagesThe Financial Factors Influencing Cash Dividend Policy: A Sample of U.S. Manufacturing CompaniesLiYi ChenNo ratings yet

- Easter Seals 37th Annual Golf Tournament Program BookDocument36 pagesEaster Seals 37th Annual Golf Tournament Program BookEasterSealsCapitalRegionNo ratings yet

- About Arya - AgDocument1 pageAbout Arya - AganuradhaNo ratings yet

- PEMEX Investor Presentation 2012Document63 pagesPEMEX Investor Presentation 2012Jaysonn KayNo ratings yet

- CV1 Shubhaditya Choudhary 61920460Document1 pageCV1 Shubhaditya Choudhary 61920460Harmandeep singhNo ratings yet

- Life Insurance CompanyDocument86 pagesLife Insurance CompanyVikash MauryaNo ratings yet

- TB 1 - AklanDocument5 pagesTB 1 - AklanKkaNo ratings yet

- Southwestern Ohio Steel CompanyDocument7 pagesSouthwestern Ohio Steel CompanyYudha Eka SamanthaNo ratings yet

- PPSCI vs. Equitable PCI BankDocument4 pagesPPSCI vs. Equitable PCI BankAnonymous oDPxEkdNo ratings yet

- Shree Balaji Textiles 24ADIFS4479G1ZR 2020-21: Name Gstin Financial YearDocument20 pagesShree Balaji Textiles 24ADIFS4479G1ZR 2020-21: Name Gstin Financial YearChutiya LodaNo ratings yet

- Econ NotesDocument8 pagesEcon NotesRonita ChatterjeeNo ratings yet

- Bcoc - 137 PDFDocument3 pagesBcoc - 137 PDFShiv KumarNo ratings yet

- Mortgage Payment Calculator - TD Canada TrustDocument3 pagesMortgage Payment Calculator - TD Canada TrustTomura ShigarakiNo ratings yet