Professional Documents

Culture Documents

Feb23 Reliefs & Rebate_answer

Feb23 Reliefs & Rebate_answer

Uploaded by

Nur MunierahCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Feb23 Reliefs & Rebate_answer

Feb23 Reliefs & Rebate_answer

Uploaded by

Nur MunierahCopyright:

Available Formats

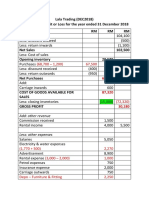

Computation of Income Tax Payable for Aliff & Alisya for YA 2022

Aliff Alisya

Section 4(a)

Restaurant business

Adjusted business income 115,000

(-) CA – current year (12,500)

(-) BA (3,000)

Statutory business income 99,500

Section 4(b)

Salary [6,500 x 12] 78,000

Section 4(c)

Interest on bond issued by government (exempted) Nil

Section 4(d)

Royalty 27,000

Less: Para 32A exemption (12,000) 15,000

Rental:

Bungalow Nil

Semi-detached house:

Rental income (700 x 9) 6,300

(-) Allowable expenses

Quit rent (300 x 9/12) (225)

Renovation cost Nil

Advertising cost Nil

Adjusted rental income 6,075

Section 4(e)

Annuity from late father’s estate (1,000 x 12) 12,000

Section 4(f)

Honorarium from industrial talk 700

AGGREGATE INCOME 99,775 111,500

Less: Approved Donation:

Donation of dialysis machine (18,000)

Cash donation to project of national interest (15,000) (11,150)

(restricted to 10% x 111,500 = 11,150)

TOTAL INCOME 81,775 100,350

TOTAL INCOME 81,775 100,350

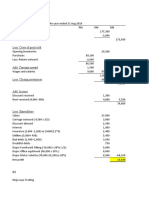

Less: Reliefs

Personal relief (9,000) (9,000)

Child Relief - Eldest (8,000)

Youngest (2,000)

Life Insurance - Aliff (2,700)

Life Insurance – Alisya 4,800 (3,000)

(max RM3,000)

Life Insurance - children Nil

EPF (11% x 78,000 = 8,580) max 4,000 (4,000)

Medical expenses – parents(12,000/2) (6,000)

Wheelchair (3,700)

SOCSO 500 (max 350) (350)

Lifestyle relief - Aliff (2,500)

Tablet and laptop 6,700

Additional warranty cost Books Nil

and magazines 1,500

(max 2,500) 8,200

Lifestyle relief – Alisya

Sport equipment 1,800

Gym membership 900 (2,500)

Healthy life style -sport equipment (200)

Transit cost - child care centre Nil

CHARGEABLE INCOME 53,525 75,650

Tax payable:

Tax on the first RM50,000 1,500

Tax on the next RM3,525 x 11% 387.75

Tax on the first RM70,000 3,700

Tax on the next RM5,650 x 19% 1,073.50

1,887.75 4,773.50

Less: Rebate

Zakat (2,500) (6,000)

NET INCOME TAX PAYABLE Nil Nil

You might also like

- An Introduction To TattvasDocument13 pagesAn Introduction To TattvasTemple of the stars83% (6)

- Lala Trading DEC2018 - SOPL & SOFP DEC2018 AFTER ADJUSTMENTDocument3 pagesLala Trading DEC2018 - SOPL & SOFP DEC2018 AFTER ADJUSTMENTAFIQ RAFIQIN RAHMADNo ratings yet

- Computation of Chargeable Income Tax - AnswerDocument2 pagesComputation of Chargeable Income Tax - Answerathirah jamaludinNo ratings yet

- Problem 9-30Document15 pagesProblem 9-30Lê Chấn PhongNo ratings yet

- AliDocument38 pagesAliAzam JamalNo ratings yet

- Courier Service AgreementDocument1 pageCourier Service AgreementSabu ThomasNo ratings yet

- Personal IncomeDocument3 pagesPersonal IncomeSITI HAMIZAH HAMZAHNo ratings yet

- Tax267 Ex1Document4 pagesTax267 Ex1SITI NUR DIANA SELAMATNo ratings yet

- Tax267 Ex3Document4 pagesTax267 Ex3SITI NUR DIANA SELAMATNo ratings yet

- Q: No: 45 (KAPLAN) Hapsburg Consolidated Statement of Financial Position: - Non - Current AssetsDocument4 pagesQ: No: 45 (KAPLAN) Hapsburg Consolidated Statement of Financial Position: - Non - Current AssetszarimanufacturingNo ratings yet

- T4Q - TaxationDocument4 pagesT4Q - Taxation吕仙姿No ratings yet

- Final PB Exam - Answers - SolutionsDocument10 pagesFinal PB Exam - Answers - SolutionsJazehl ValdezNo ratings yet

- Salary Mock Solution - March-24Document2 pagesSalary Mock Solution - March-24syedameerhamza762No ratings yet

- Final Test - AnswersDocument6 pagesFinal Test - Answersnguyễn hiềnNo ratings yet

- Answer 1 - Blue Bill CorporationDocument2 pagesAnswer 1 - Blue Bill CorporationRheu ReyesNo ratings yet

- RM RM RM Net Sales: Less: Cost of Goods SoldDocument2 pagesRM RM RM Net Sales: Less: Cost of Goods SoldDESIREE DESSY MAIDI STUDENTNo ratings yet

- CH 10 Incomplete RecordsDocument27 pagesCH 10 Incomplete RecordsPawan Poynauth0% (1)

- CPAR B94 FAR Final PB Exam - Answers - SolutionsDocument8 pagesCPAR B94 FAR Final PB Exam - Answers - SolutionsJazehl ValdezNo ratings yet

- Tax Test-2 Solution S24Document3 pagesTax Test-2 Solution S24jackaslam062No ratings yet

- In Class Exercise - Personal TaxDocument3 pagesIn Class Exercise - Personal TaxNur AsnadirahNo ratings yet

- CAF 2 Spring 2023Document8 pagesCAF 2 Spring 2023murtazahamza721No ratings yet

- Final Exam Far1Document4 pagesFinal Exam Far1Chloe CatalunaNo ratings yet

- Less: Cost of Goods Sold: Capital ExpenditureDocument3 pagesLess: Cost of Goods Sold: Capital Expenditurefahim tusarNo ratings yet

- Solution NIngDocument3 pagesSolution NIngfahim tusarNo ratings yet

- Diagnostic Level 3 AccountingDocument17 pagesDiagnostic Level 3 AccountingRobert CastilloNo ratings yet

- Perry - SolutionsDocument4 pagesPerry - SolutionsCharles TuazonNo ratings yet

- Solution Tax667 - Dec 2018Document8 pagesSolution Tax667 - Dec 2018Zahiratul Qamarina100% (1)

- Tax667 - SS Feb 2023Document13 pagesTax667 - SS Feb 2023hilman100% (2)

- Thumbs UpDocument4 pagesThumbs Upwasif ahmedNo ratings yet

- Final PB FAR Batch 7 Sept 2023Document38 pagesFinal PB FAR Batch 7 Sept 2023Leo M. SalibioNo ratings yet

- Questionn 3-Dec 2018Document4 pagesQuestionn 3-Dec 2018GIROLYDIA EDDYNo ratings yet

- Timber City SolutionDocument2 pagesTimber City Solutionthabomasasa4No ratings yet

- FAR Final Preboard SolutionsDocument6 pagesFAR Final Preboard SolutionsVillanueva, Mariella De VeraNo ratings yet

- Answer Exercise 1Document2 pagesAnswer Exercise 1MUHAMMAD SYAZWAN MAZLANNo ratings yet

- Far Module 21 27Document61 pagesFar Module 21 27ryanNo ratings yet

- 10 One Step Closing ProcessDocument4 pages10 One Step Closing ProcessShahin AlamNo ratings yet

- Module 2Document81 pagesModule 2Arra StypayhorliksonNo ratings yet

- Answer Revision SetDocument3 pagesAnswer Revision Setathirah jamaludinNo ratings yet

- TAX667 CT SS NOV 2023 - AmmendedDocument4 pagesTAX667 CT SS NOV 2023 - Ammendedxfs5k9m8stNo ratings yet

- Individual AssignmentDocument22 pagesIndividual AssignmentEda LimNo ratings yet

- Solution Lecture 4 Part 2: Financial Statement With Adjustments Question 1 (A) AdjustmentsDocument7 pagesSolution Lecture 4 Part 2: Financial Statement With Adjustments Question 1 (A) AdjustmentsIsyraf Hatim Mohd TamizamNo ratings yet

- Format For TaxationDocument4 pagesFormat For TaxationSITI NURFARHANA AB RAZAKNo ratings yet

- Statement of Cash Flows ADocument7 pagesStatement of Cash Flows ABabylyn NavarroNo ratings yet

- SS Tutorial 2Document2 pagesSS Tutorial 2Nur PasilaNo ratings yet

- Chapter 3 PDFDocument15 pagesChapter 3 PDFJay BrockNo ratings yet

- RecFin AnswerKeySolutionsDocument3 pagesRecFin AnswerKeySolutionsHannah Jane UmbayNo ratings yet

- 06 Notes Receivable Sec 2 MCPDocument3 pages06 Notes Receivable Sec 2 MCPkyle mandaresioNo ratings yet

- P12-1 Dan P 12-5 - Ak KeuanganDocument2 pagesP12-1 Dan P 12-5 - Ak KeuanganNenna SadukNo ratings yet

- TTC 2024 Accounting Free Pre SolutionDocument59 pagesTTC 2024 Accounting Free Pre Solutionfinnduffy8No ratings yet

- Module 2 Ver 3.1Document81 pagesModule 2 Ver 3.1Akira Marantal Valdez100% (1)

- Santos - Solution FinalsDocument3 pagesSantos - Solution FinalsIan SantosNo ratings yet

- Individual Chargeable Income (Section 4a To 4d) Tax Computation FormatDocument1 pageIndividual Chargeable Income (Section 4a To 4d) Tax Computation FormatHaananth SubramaniamNo ratings yet

- Solutions Consolidation-FormattedDocument22 pagesSolutions Consolidation-FormattedShehrozSTNo ratings yet

- Test 2 Jan2023 - Tapah Q2 FS SSDocument4 pagesTest 2 Jan2023 - Tapah Q2 FS SSNajmuddin AzuddinNo ratings yet

- Tutorial 12Document15 pagesTutorial 12lkaixin 02No ratings yet

- Corporate ReportingDocument5 pagesCorporate ReportingZANGINA Nicholas NaaniNo ratings yet

- Answer Keys For Midterm Exam PART 2Document3 pagesAnswer Keys For Midterm Exam PART 2Angel MaghuyopNo ratings yet

- 20 Two Step Closing ProcessDocument4 pages20 Two Step Closing ProcessShahin AlamNo ratings yet

- How To Fill Up Tax Return FormDocument19 pagesHow To Fill Up Tax Return Formmukulful2008100% (4)

- Question One's Answer: MR Nass Tax Computation For The Year of Assessment 2008Document6 pagesQuestion One's Answer: MR Nass Tax Computation For The Year of Assessment 2008Smith AkanchawaNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Warid Telecom ReportDocument49 pagesWarid Telecom ReporthusnainjafriNo ratings yet

- Présentation XanLite 2020 ENDocument18 pagesPrésentation XanLite 2020 ENJ.DoeNo ratings yet

- Astronomy - 12 - 15 - 18 - 5 - 6 KeyDocument11 pagesAstronomy - 12 - 15 - 18 - 5 - 6 Keykalidindi_kc_krishnaNo ratings yet

- BHC - Shakib AhmedDocument3 pagesBHC - Shakib AhmedDaniel CrumpNo ratings yet

- Asimakopulos, A. (1975) - A Kaleckian Theory of Income Distribution. Canadian Journal of Economics, 313-333.Document22 pagesAsimakopulos, A. (1975) - A Kaleckian Theory of Income Distribution. Canadian Journal of Economics, 313-333.lcr89No ratings yet

- Uji Statistik T TEST: Mean N Std. Deviation Std. Error Mean Pair 1 Pre 4,15 27 1,064, 205 Post 2,30 27, 775, 149Document3 pagesUji Statistik T TEST: Mean N Std. Deviation Std. Error Mean Pair 1 Pre 4,15 27 1,064, 205 Post 2,30 27, 775, 149GUSNAN AFRIZALNo ratings yet

- Steel Material Table PDFDocument1 pageSteel Material Table PDFNathanNo ratings yet

- Chapter 3 Practice Problems Review and Assessment Solution 2 Use The V T Graph of The Toy Train in Figure 9 To Answer These QuestionsDocument52 pagesChapter 3 Practice Problems Review and Assessment Solution 2 Use The V T Graph of The Toy Train in Figure 9 To Answer These QuestionsAref DahabrahNo ratings yet

- DS PD Diagnostics System PD-TaD 62 BAURDocument4 pagesDS PD Diagnostics System PD-TaD 62 BAURAdhy Prastyo AfifudinNo ratings yet

- Submitted By:-ITM B-School, Kharghar .: Application of Maxima & MinimaDocument12 pagesSubmitted By:-ITM B-School, Kharghar .: Application of Maxima & MinimaDeepali KunjeerNo ratings yet

- Yoga For Modern Age - 1Document181 pagesYoga For Modern Age - 1GayathriNo ratings yet

- Divyesh ResumeDocument2 pagesDivyesh ResumeDivyeshNo ratings yet

- Sabrina Di Addario (2007)Document29 pagesSabrina Di Addario (2007)AbimNo ratings yet

- Language Planning and Placenaming in Australia by Flavia HodgesDocument21 pagesLanguage Planning and Placenaming in Australia by Flavia HodgesCyril Jude CornelioNo ratings yet

- 5E Lesson Plan Template: Replace These Directions With Your WorkDocument4 pages5E Lesson Plan Template: Replace These Directions With Your Workapi-583088531No ratings yet

- Meter Reading Details: Assam Power Distribution Company LimitedDocument1 pageMeter Reading Details: Assam Power Distribution Company LimitedPadum PatowaryNo ratings yet

- Heresite Corrosion ProtectionDocument2 pagesHeresite Corrosion ProtectionDANIEL PEREZNo ratings yet

- Affidavit of Loss - Bir.or - Car.1.2020Document1 pageAffidavit of Loss - Bir.or - Car.1.2020black stalkerNo ratings yet

- Motorcycle Parts Inventory Management System: AbstractDocument8 pagesMotorcycle Parts Inventory Management System: AbstractFayyaz Gulammuhammad100% (1)

- Moist Heat Sterilization Validation and Requalification STERISDocument4 pagesMoist Heat Sterilization Validation and Requalification STERISDany RobinNo ratings yet

- File ListDocument5 pagesFile ListanetaNo ratings yet

- BCA 103 - Mathematical Foundation of Computer SC - BCADocument274 pagesBCA 103 - Mathematical Foundation of Computer SC - BCAVetri SelvanNo ratings yet

- Activities Guide and Evaluation Rubric - Step 5 - Final Assessment - Open Objective TestDocument9 pagesActivities Guide and Evaluation Rubric - Step 5 - Final Assessment - Open Objective TestWendy JaramilloNo ratings yet

- Basic Rules and Tips in Group DiscussionsDocument2 pagesBasic Rules and Tips in Group Discussionssudarsanamma89% (9)

- Jemal Yahyaa Software Project Managemant Case Study PrintDocument30 pagesJemal Yahyaa Software Project Managemant Case Study Printjemal yahyaaNo ratings yet

- CDP 22 FinalDocument8 pagesCDP 22 FinalAnonymous GMUQYq8No ratings yet

- 921-Article Text-3249-1-10-20220601Document14 pages921-Article Text-3249-1-10-20220601YuliaNo ratings yet

- Microlearning Lesson Plan IntelDocument3 pagesMicrolearning Lesson Plan IntelAditi JadhavNo ratings yet