Professional Documents

Culture Documents

Page_56

Page_56

Uploaded by

ah94194567Copyright:

Available Formats

You might also like

- O-Udtdtarontuthdeparnent of Revenue,: R-3, 94Ty-IDocument2 pagesO-Udtdtarontuthdeparnent of Revenue,: R-3, 94Ty-Id69451559No ratings yet

- REPLYDocument4 pagesREPLYVishal DwivediNo ratings yet

- Drc-01a 10bpopk6312p1zo Chandu Kumar Chaudhary 2019-20Document1 pageDrc-01a 10bpopk6312p1zo Chandu Kumar Chaudhary 2019-20Rahul KumarNo ratings yet

- Ward 20 2 2019-20 07EPCPS5037C1ZZ 0 20240510 031521 820Document11 pagesWard 20 2 2019-20 07EPCPS5037C1ZZ 0 20240510 031521 820Vishal DwivediNo ratings yet

- GST LatestAmendments Issues 01072023Document85 pagesGST LatestAmendments Issues 01072023Selvakumar MuthurajNo ratings yet

- DownloadDocument2 pagesDownloadetosangrur1No ratings yet

- GSTR-3B Vs GSTR 1 Mismatch - Rule 88C Perspective - Taxguru - inDocument4 pagesGSTR-3B Vs GSTR 1 Mismatch - Rule 88C Perspective - Taxguru - inRamkumar SNo ratings yet

- Attachment 1Document2 pagesAttachment 1khabrilaalNo ratings yet

- Document - 2023-11-01T135525.395Document1 pageDocument - 2023-11-01T135525.39502-Ashfaque Ahmed MNo ratings yet

- Patanjali Arogya Kendra 2018-19Document5 pagesPatanjali Arogya Kendra 2018-19tuensangnagaland2018No ratings yet

- NF Order ZD330523079501L 20230517040905Document4 pagesNF Order ZD330523079501L 20230517040905Boomi BalanNo ratings yet

- Annexure To Form GST Drc-07: 21AAVCS9861M1ZF S.N.S. Industrial Works Private LimitedDocument5 pagesAnnexure To Form GST Drc-07: 21AAVCS9861M1ZF S.N.S. Industrial Works Private LimitedBiswajit MishraNo ratings yet

- Asmt 10 1920Document69 pagesAsmt 10 1920Prashant ZawareNo ratings yet

- Heavy Penalties for Petty defaults in GSTDocument2 pagesHeavy Penalties for Petty defaults in GST53samsenNo ratings yet

- 484b6 Impact Wrong Type of Tax Paid and Wrong Claim of ItcDocument5 pages484b6 Impact Wrong Type of Tax Paid and Wrong Claim of Itc15211 alok AnandNo ratings yet

- DRC 01 ReplyDocument5 pagesDRC 01 Replyrameshbara.rksNo ratings yet

- DRC07 Order ZD0904243947024 20240426083906Document4 pagesDRC07 Order ZD0904243947024 20240426083906mohd.samadNo ratings yet

- Ram NameDocument2 pagesRam NameStock PsychologistNo ratings yet

- TaxesDocument2 pagesTaxesRameshNadarNo ratings yet

- Form GST ASMT - 11 - NNNNNDocument2 pagesForm GST ASMT - 11 - NNNNNGovindNo ratings yet

- Shree Suleshvari EnterpriseDocument4 pagesShree Suleshvari EnterpriseDIVISION4 MAHESANANo ratings yet

- DRC07 Order ZD181223066048F 20231231023238Document4 pagesDRC07 Order ZD181223066048F 20231231023238tuensangnagaland2018No ratings yet

- TVL. PSARGUNAM - 2022-23 - ASMT-10Document2 pagesTVL. PSARGUNAM - 2022-23 - ASMT-10lekhankan.taxNo ratings yet

- Qrmp-Scheme NovDocument2 pagesQrmp-Scheme NovVishwanath HollaNo ratings yet

- Penalties Under GST: Nature of Default Penalty RemarksDocument3 pagesPenalties Under GST: Nature of Default Penalty RemarksHumanyu KabeerNo ratings yet

- Sri Ram Tech Asmt-10 Cto Sec 2021-22-9Document1 pageSri Ram Tech Asmt-10 Cto Sec 2021-22-9Sunil KumarNo ratings yet

- Reply To Communication For Payment Before Issue of SCNDocument2 pagesReply To Communication For Payment Before Issue of SCNCAAniketGangwalNo ratings yet

- WS51H883AS0716 - 01-Apr-2019TO30-Apr-2019Document1 pageWS51H883AS0716 - 01-Apr-2019TO30-Apr-2019Avineet SadaniNo ratings yet

- Maa Laxmi Hardware 2019-20Document4 pagesMaa Laxmi Hardware 2019-20surendrasharmaofficeNo ratings yet

- Hc-Allows-Errros in ITC Availment in Tax Head - Rectification-Of-Gstr-3b-After-Expiry-Of-Statutory-Time-LimitDocument3 pagesHc-Allows-Errros in ITC Availment in Tax Head - Rectification-Of-Gstr-3b-After-Expiry-Of-Statutory-Time-LimitychichghareNo ratings yet

- Nation: MarketDocument9 pagesNation: MarketDebashis MitraNo ratings yet

- Digitally Proceedings of P Hanumantharao & Sons 2018-19 S-73Document31 pagesDigitally Proceedings of P Hanumantharao & Sons 2018-19 S-73CTOAUDIT1 BLYNo ratings yet

- GST (Payment of Tax) FinalDocument6 pagesGST (Payment of Tax) FinalDARK KING GamersNo ratings yet

- PWC News Alert 24 December 2020 Cbic Issues Notifications Amending Key ProvisionsDocument4 pagesPWC News Alert 24 December 2020 Cbic Issues Notifications Amending Key Provisionsjsncitycentralmall12No ratings yet

- Draft Reply For DRC 01Document5 pagesDraft Reply For DRC 01Rahul GoelNo ratings yet

- 2.reverse Charge MechanismDocument66 pages2.reverse Charge MechanismchariNo ratings yet

- Draft Audit Report XIVDocument11 pagesDraft Audit Report XIVTradingideas2456No ratings yet

- GST RFD-01 - 37AABCJ1299A1ZS - EXPWOP - 201904 - FormDocument3 pagesGST RFD-01 - 37AABCJ1299A1ZS - EXPWOP - 201904 - FormkotisanampudiNo ratings yet

- Atlantic Ro Feb 22Document1 pageAtlantic Ro Feb 22Ambati Madhava ReddyNo ratings yet

- DRC07 Order ZD0704240448938 20240420014439Document4 pagesDRC07 Order ZD0704240448938 20240420014439aman.corpvidhyaNo ratings yet

- GST Notices and CompliancesDocument7 pagesGST Notices and CompliancesSubhash VishwakarmaNo ratings yet

- 15.09.2023 Reg. Submission GST Difference in RA - 09 - Reg.Document3 pages15.09.2023 Reg. Submission GST Difference in RA - 09 - Reg.manohar meenaNo ratings yet

- Judicial Rulings BY ABHAY DESAIDocument27 pagesJudicial Rulings BY ABHAY DESAIPiyush PatelNo ratings yet

- Mismatch in Tax Liabilities-No Longer A Factual ConcernDocument4 pagesMismatch in Tax Liabilities-No Longer A Factual ConcernKunwarbir Singh lohatNo ratings yet

- GST Amdts Part 2Document5 pagesGST Amdts Part 2amankhurana0910No ratings yet

- GST Automated NoticesDocument6 pagesGST Automated NoticesMaunik ParikhNo ratings yet

- Recent Developments in GSTDocument27 pagesRecent Developments in GSTAravindNo ratings yet

- Summary of Significant CTA Decisions (February 2011)Document2 pagesSummary of Significant CTA Decisions (February 2011)ShaneBeriñaImperialNo ratings yet

- GST UpdatesDocument10 pagesGST Updatesswati.gargchdNo ratings yet

- TapanDocument6 pagesTapanDebashis MitraNo ratings yet

- Citibank Nigeria Limited v. Lagos State Internal Revenue Service - Composition of Gross Income For Consolidated Relief Allowance - PedaboDocument3 pagesCitibank Nigeria Limited v. Lagos State Internal Revenue Service - Composition of Gross Income For Consolidated Relief Allowance - PedaboAkinloluwa TokedeNo ratings yet

- Swiggy DFDocument2 pagesSwiggy DFhemanth1234No ratings yet

- Aino Communique 111th Edition Jan 2023 PDFDocument14 pagesAino Communique 111th Edition Jan 2023 PDFSwathi JainNo ratings yet

- CA Ashish Chaudhary 1Document30 pagesCA Ashish Chaudhary 1sonapakhi nandyNo ratings yet

- Eturns: This Chapter Will Equip You ToDocument52 pagesEturns: This Chapter Will Equip You ToShowkat MalikNo ratings yet

- Reply 18-19Document2 pagesReply 18-19news24into7into365No ratings yet

- GST Compliance BookletDocument60 pagesGST Compliance Bookletnnitinsharma87No ratings yet

- Bharat Sanchar Nigam Limited: Telephone Bill/Tax InvoiceDocument1 pageBharat Sanchar Nigam Limited: Telephone Bill/Tax InvoicevirendramehraNo ratings yet

Page_56

Page_56

Uploaded by

ah94194567Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Page_56

Page_56

Uploaded by

ah94194567Copyright:

Available Formats

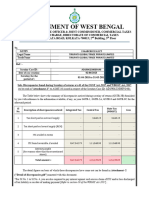

Trade Name: AL-QAWI ENTERPRISES

GSTIN: 01CIZPM5898K1Z8

Sub: Mismatch between ITC claimed in GSTR-3B and ITC accrued in GSTR-2A/2B

for the F.Y 2019-20.

Consequent upon the scrutiny of your returns filed for the year 2019-20, it has

been observed that the ITC claimed in GSTR-3B is higher than the ITC available in

GSTR-2A in your case. The excess ITC availed, being in violation of section 36(4) of J&K

GST Act 2017 warrants proceedings for determination & realization of same along with

interest & penalty. Therefore, on account of ITC mismatch, following liability of tax,

interest and penalty becomes due to you.

(Amount in Rs.)

Discrepancy/

Penalty/ Late

Mismatch Act Tax Interest Total

Fee

involved

GSTR3B Vs IGST 0 0 0 0

GSTR-2A/2B CGST 78001 57721 7800 143522

ITC Mismatch

SGST 78001 57721 7800 143522

• Penalty may vary, subject to payment of Tax and Interest within the timeline as given in the law.

You are hereby directed to make immediate settlement of above-mentioned liability

through DRC-03 or explain the reasons for the aforesaid discrepancies in the FORM

DRC-06, along with substantial proof/ documentary evidence in concurrence with

your claim within thirty days of the issuance of SCN. If no explanation is received by

the aforesaid date, it will be presumed that you have nothing to say in the matter and

Order in the Form-DRC-07 shall be issued under relevant provisions of GST Act 2017.

Sd/-

State Taxes Officer

Circle Baramulla-I

You might also like

- O-Udtdtarontuthdeparnent of Revenue,: R-3, 94Ty-IDocument2 pagesO-Udtdtarontuthdeparnent of Revenue,: R-3, 94Ty-Id69451559No ratings yet

- REPLYDocument4 pagesREPLYVishal DwivediNo ratings yet

- Drc-01a 10bpopk6312p1zo Chandu Kumar Chaudhary 2019-20Document1 pageDrc-01a 10bpopk6312p1zo Chandu Kumar Chaudhary 2019-20Rahul KumarNo ratings yet

- Ward 20 2 2019-20 07EPCPS5037C1ZZ 0 20240510 031521 820Document11 pagesWard 20 2 2019-20 07EPCPS5037C1ZZ 0 20240510 031521 820Vishal DwivediNo ratings yet

- GST LatestAmendments Issues 01072023Document85 pagesGST LatestAmendments Issues 01072023Selvakumar MuthurajNo ratings yet

- DownloadDocument2 pagesDownloadetosangrur1No ratings yet

- GSTR-3B Vs GSTR 1 Mismatch - Rule 88C Perspective - Taxguru - inDocument4 pagesGSTR-3B Vs GSTR 1 Mismatch - Rule 88C Perspective - Taxguru - inRamkumar SNo ratings yet

- Attachment 1Document2 pagesAttachment 1khabrilaalNo ratings yet

- Document - 2023-11-01T135525.395Document1 pageDocument - 2023-11-01T135525.39502-Ashfaque Ahmed MNo ratings yet

- Patanjali Arogya Kendra 2018-19Document5 pagesPatanjali Arogya Kendra 2018-19tuensangnagaland2018No ratings yet

- NF Order ZD330523079501L 20230517040905Document4 pagesNF Order ZD330523079501L 20230517040905Boomi BalanNo ratings yet

- Annexure To Form GST Drc-07: 21AAVCS9861M1ZF S.N.S. Industrial Works Private LimitedDocument5 pagesAnnexure To Form GST Drc-07: 21AAVCS9861M1ZF S.N.S. Industrial Works Private LimitedBiswajit MishraNo ratings yet

- Asmt 10 1920Document69 pagesAsmt 10 1920Prashant ZawareNo ratings yet

- Heavy Penalties for Petty defaults in GSTDocument2 pagesHeavy Penalties for Petty defaults in GST53samsenNo ratings yet

- 484b6 Impact Wrong Type of Tax Paid and Wrong Claim of ItcDocument5 pages484b6 Impact Wrong Type of Tax Paid and Wrong Claim of Itc15211 alok AnandNo ratings yet

- DRC 01 ReplyDocument5 pagesDRC 01 Replyrameshbara.rksNo ratings yet

- DRC07 Order ZD0904243947024 20240426083906Document4 pagesDRC07 Order ZD0904243947024 20240426083906mohd.samadNo ratings yet

- Ram NameDocument2 pagesRam NameStock PsychologistNo ratings yet

- TaxesDocument2 pagesTaxesRameshNadarNo ratings yet

- Form GST ASMT - 11 - NNNNNDocument2 pagesForm GST ASMT - 11 - NNNNNGovindNo ratings yet

- Shree Suleshvari EnterpriseDocument4 pagesShree Suleshvari EnterpriseDIVISION4 MAHESANANo ratings yet

- DRC07 Order ZD181223066048F 20231231023238Document4 pagesDRC07 Order ZD181223066048F 20231231023238tuensangnagaland2018No ratings yet

- TVL. PSARGUNAM - 2022-23 - ASMT-10Document2 pagesTVL. PSARGUNAM - 2022-23 - ASMT-10lekhankan.taxNo ratings yet

- Qrmp-Scheme NovDocument2 pagesQrmp-Scheme NovVishwanath HollaNo ratings yet

- Penalties Under GST: Nature of Default Penalty RemarksDocument3 pagesPenalties Under GST: Nature of Default Penalty RemarksHumanyu KabeerNo ratings yet

- Sri Ram Tech Asmt-10 Cto Sec 2021-22-9Document1 pageSri Ram Tech Asmt-10 Cto Sec 2021-22-9Sunil KumarNo ratings yet

- Reply To Communication For Payment Before Issue of SCNDocument2 pagesReply To Communication For Payment Before Issue of SCNCAAniketGangwalNo ratings yet

- WS51H883AS0716 - 01-Apr-2019TO30-Apr-2019Document1 pageWS51H883AS0716 - 01-Apr-2019TO30-Apr-2019Avineet SadaniNo ratings yet

- Maa Laxmi Hardware 2019-20Document4 pagesMaa Laxmi Hardware 2019-20surendrasharmaofficeNo ratings yet

- Hc-Allows-Errros in ITC Availment in Tax Head - Rectification-Of-Gstr-3b-After-Expiry-Of-Statutory-Time-LimitDocument3 pagesHc-Allows-Errros in ITC Availment in Tax Head - Rectification-Of-Gstr-3b-After-Expiry-Of-Statutory-Time-LimitychichghareNo ratings yet

- Nation: MarketDocument9 pagesNation: MarketDebashis MitraNo ratings yet

- Digitally Proceedings of P Hanumantharao & Sons 2018-19 S-73Document31 pagesDigitally Proceedings of P Hanumantharao & Sons 2018-19 S-73CTOAUDIT1 BLYNo ratings yet

- GST (Payment of Tax) FinalDocument6 pagesGST (Payment of Tax) FinalDARK KING GamersNo ratings yet

- PWC News Alert 24 December 2020 Cbic Issues Notifications Amending Key ProvisionsDocument4 pagesPWC News Alert 24 December 2020 Cbic Issues Notifications Amending Key Provisionsjsncitycentralmall12No ratings yet

- Draft Reply For DRC 01Document5 pagesDraft Reply For DRC 01Rahul GoelNo ratings yet

- 2.reverse Charge MechanismDocument66 pages2.reverse Charge MechanismchariNo ratings yet

- Draft Audit Report XIVDocument11 pagesDraft Audit Report XIVTradingideas2456No ratings yet

- GST RFD-01 - 37AABCJ1299A1ZS - EXPWOP - 201904 - FormDocument3 pagesGST RFD-01 - 37AABCJ1299A1ZS - EXPWOP - 201904 - FormkotisanampudiNo ratings yet

- Atlantic Ro Feb 22Document1 pageAtlantic Ro Feb 22Ambati Madhava ReddyNo ratings yet

- DRC07 Order ZD0704240448938 20240420014439Document4 pagesDRC07 Order ZD0704240448938 20240420014439aman.corpvidhyaNo ratings yet

- GST Notices and CompliancesDocument7 pagesGST Notices and CompliancesSubhash VishwakarmaNo ratings yet

- 15.09.2023 Reg. Submission GST Difference in RA - 09 - Reg.Document3 pages15.09.2023 Reg. Submission GST Difference in RA - 09 - Reg.manohar meenaNo ratings yet

- Judicial Rulings BY ABHAY DESAIDocument27 pagesJudicial Rulings BY ABHAY DESAIPiyush PatelNo ratings yet

- Mismatch in Tax Liabilities-No Longer A Factual ConcernDocument4 pagesMismatch in Tax Liabilities-No Longer A Factual ConcernKunwarbir Singh lohatNo ratings yet

- GST Amdts Part 2Document5 pagesGST Amdts Part 2amankhurana0910No ratings yet

- GST Automated NoticesDocument6 pagesGST Automated NoticesMaunik ParikhNo ratings yet

- Recent Developments in GSTDocument27 pagesRecent Developments in GSTAravindNo ratings yet

- Summary of Significant CTA Decisions (February 2011)Document2 pagesSummary of Significant CTA Decisions (February 2011)ShaneBeriñaImperialNo ratings yet

- GST UpdatesDocument10 pagesGST Updatesswati.gargchdNo ratings yet

- TapanDocument6 pagesTapanDebashis MitraNo ratings yet

- Citibank Nigeria Limited v. Lagos State Internal Revenue Service - Composition of Gross Income For Consolidated Relief Allowance - PedaboDocument3 pagesCitibank Nigeria Limited v. Lagos State Internal Revenue Service - Composition of Gross Income For Consolidated Relief Allowance - PedaboAkinloluwa TokedeNo ratings yet

- Swiggy DFDocument2 pagesSwiggy DFhemanth1234No ratings yet

- Aino Communique 111th Edition Jan 2023 PDFDocument14 pagesAino Communique 111th Edition Jan 2023 PDFSwathi JainNo ratings yet

- CA Ashish Chaudhary 1Document30 pagesCA Ashish Chaudhary 1sonapakhi nandyNo ratings yet

- Eturns: This Chapter Will Equip You ToDocument52 pagesEturns: This Chapter Will Equip You ToShowkat MalikNo ratings yet

- Reply 18-19Document2 pagesReply 18-19news24into7into365No ratings yet

- GST Compliance BookletDocument60 pagesGST Compliance Bookletnnitinsharma87No ratings yet

- Bharat Sanchar Nigam Limited: Telephone Bill/Tax InvoiceDocument1 pageBharat Sanchar Nigam Limited: Telephone Bill/Tax InvoicevirendramehraNo ratings yet