Professional Documents

Culture Documents

Index

Index

Uploaded by

Harsh pRAJAPATICopyright:

Available Formats

You might also like

- Advac 2 Prelims 1 - PALACIODocument4 pagesAdvac 2 Prelims 1 - PALACIOPinky DaisiesNo ratings yet

- GM 1927 01 Project PlanDocument1 pageGM 1927 01 Project Planmark100% (2)

- Materials Management ManualDocument198 pagesMaterials Management ManualNaveen Bansal100% (1)

- Example: Newco Investment Recommendations by Ryland HamletDocument4 pagesExample: Newco Investment Recommendations by Ryland HamletRyland Hamlet100% (8)

- Chapter 4 - Statement of Comprehensive Income: Problem 4-1 (AICPA Adapted)Document14 pagesChapter 4 - Statement of Comprehensive Income: Problem 4-1 (AICPA Adapted)Asi Cas Jav100% (1)

- CA FINAL DT Revisions MAY-23 Exams by BBDocument3 pagesCA FINAL DT Revisions MAY-23 Exams by BBKunal BhatnagarNo ratings yet

- ICAB Assurance Past Question AnalysisDocument1 pageICAB Assurance Past Question AnalysisErfan Saleh AcaNo ratings yet

- Important Questions For DT May Nov 22 - Bhanwar BoranaDocument3 pagesImportant Questions For DT May Nov 22 - Bhanwar BoranaasdNo ratings yet

- Revise DT in 1Document2 pagesRevise DT in 1Riddhi ModiNo ratings yet

- Atc (Atmp v16 飛航管理程序)Document470 pagesAtc (Atmp v16 飛航管理程序)hugolin0126No ratings yet

- Study Outline-Ge02 Management Accounting Study Outline-Ge02 Management AccountingDocument2 pagesStudy Outline-Ge02 Management Accounting Study Outline-Ge02 Management Accountingmehedi gmatNo ratings yet

- Revise DT in 1Document2 pagesRevise DT in 1Murari AgrahariNo ratings yet

- 30.11.2022. Joint Mineplan PAMA-KJA 2023Document19 pages30.11.2022. Joint Mineplan PAMA-KJA 2023developement.kidecoNo ratings yet

- SFM Ambiguous and Imp Sum ListDocument4 pagesSFM Ambiguous and Imp Sum Listrahul.modi18No ratings yet

- 1T01728 ModelDocument2 pages1T01728 ModelAnurag GuptaNo ratings yet

- Payment Section Taxpayer - NTN Taxpayer - Cnic Taxpayer - Name Taxpayer - City Taxpayer - AddressDocument14 pagesPayment Section Taxpayer - NTN Taxpayer - Cnic Taxpayer - Name Taxpayer - City Taxpayer - AddressWasimNo ratings yet

- !SMA Paper AnalysisDocument2 pages!SMA Paper AnalysisAli ArshadNo ratings yet

- 2C00256G7Document5 pages2C00256G7BhaveshNo ratings yet

- 2C00446Document18 pages2C00446BhaveshNo ratings yet

- Marks CalculatorDocument6 pagesMarks CalculatorPickup ZacNo ratings yet

- 1T00828Document407 pages1T00828Nabeel KarvinkarNo ratings yet

- 101A/1 1234567-9 Asif Ali Sheikh Islamabad Islamabad Individual 1 1Document15 pages101A/1 1234567-9 Asif Ali Sheikh Islamabad Islamabad Individual 1 1Muhammad JunaidNo ratings yet

- Epayments Import Template Adjustable Oct-21Document14 pagesEpayments Import Template Adjustable Oct-21WasimNo ratings yet

- Fa21 CveDocument2 pagesFa21 CveMuhammad MateenNo ratings yet

- EPayments Import TemplateDocument13 pagesEPayments Import TemplateSaddam HaiderNo ratings yet

- List of As-Built Drawings (Civil) : S/N Doc. / Dwg. No. Doc. / Dwg. TitleDocument16 pagesList of As-Built Drawings (Civil) : S/N Doc. / Dwg. No. Doc. / Dwg. Titleأبو أنس البرعصيNo ratings yet

- CF STATUS 21-Oct-2022Document8 pagesCF STATUS 21-Oct-2022Anwar MuhammadNo ratings yet

- QAQC Weld Book PIPING & SUPPORT & (Above Ground, Under Ground) LUHAIS PROJECT Rev 4 (11-5-2022)Document13 pagesQAQC Weld Book PIPING & SUPPORT & (Above Ground, Under Ground) LUHAIS PROJECT Rev 4 (11-5-2022)Anwar QaisNo ratings yet

- Form Nl-1-B-Ra Periodic DisclosuresDocument1 pageForm Nl-1-B-Ra Periodic DisclosuresNilesh DawandeNo ratings yet

- Cub Test ReportDocument6 pagesCub Test Reportibrahim hegazyNo ratings yet

- Haier LCD L42v6-A8kDocument21 pagesHaier LCD L42v6-A8kluis_alessandrinNo ratings yet

- Contractor Tax 474560Document16 pagesContractor Tax 474560Kashif NiaziNo ratings yet

- 2C00446Document4 pages2C00446Anurag KhadeNo ratings yet

- Module 2:production Function & Market StructureDocument116 pagesModule 2:production Function & Market Structure727822TPMB005 ARAVINTHAN.SNo ratings yet

- Most Expected Topics For Exams Income Tax & GSTDocument5 pagesMost Expected Topics For Exams Income Tax & GSTronit.srcom22641No ratings yet

- PJ68 - Qty Calculation Sheet - Peso Approved DRG Basis-HKS 2Document2 pagesPJ68 - Qty Calculation Sheet - Peso Approved DRG Basis-HKS 2PJ-68 Site GAIL VijaipurNo ratings yet

- 1T00918Document2 pages1T00918Clovis MachadoNo ratings yet

- Document Transmittal To Black Cat - Dn80Document2 pagesDocument Transmittal To Black Cat - Dn80Joseph PerezNo ratings yet

- Drawing 217-7908 Valve Gp-Solenoid & ManifoldDocument2 pagesDrawing 217-7908 Valve Gp-Solenoid & Manifolddenny palimbungaNo ratings yet

- MechDocument1 pageMechadnan.yaseenNo ratings yet

- Volume 2 - BBDocument355 pagesVolume 2 - BBavinashkives21No ratings yet

- Filtre Hyd 160KDocument4 pagesFiltre Hyd 160KYapi YapiNo ratings yet

- Fci Result 2012Document13 pagesFci Result 2012Sunil PatelNo ratings yet

- Sub-Station Marpara SL - NO. Drawing NameDocument10 pagesSub-Station Marpara SL - NO. Drawing NameAsim GoraiNo ratings yet

- 1T00718 PDFDocument1,399 pages1T00718 PDFDhaval BhadeNo ratings yet

- Accounting ManuelDocument1,061 pagesAccounting ManuelthenjhomebuyerNo ratings yet

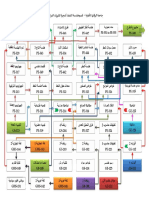

- شجرة المقررات الدراسيةDocument2 pagesشجرة المقررات الدراسيةAll NnNo ratings yet

- Capital District Hotel Wright Account Statement (GC-10)Document1 pageCapital District Hotel Wright Account Statement (GC-10)Albany Times UnionNo ratings yet

- Grupo Rotativo330c InternoDocument2 pagesGrupo Rotativo330c InternoEckard GuendelNo ratings yet

- 1T00738ADocument1,729 pages1T00738Anirajstraight10No ratings yet

- Income Tax Jurisdictions Chart - New Revised On 2015Document6 pagesIncome Tax Jurisdictions Chart - New Revised On 2015Ca T.SANKARAMURTHYNo ratings yet

- Answer Key - GG: Geology and Geophysics: Q.No. Session Que - Type Sec. Name Key MarksDocument3 pagesAnswer Key - GG: Geology and Geophysics: Q.No. Session Que - Type Sec. Name Key MarksOIL INDIANo ratings yet

- 2C00456U7Document13 pages2C00456U7Sandhya TiwariNo ratings yet

- Past Paper Analysis Company LawDocument1 pagePast Paper Analysis Company LawInam Ul Haq MinhasNo ratings yet

- FC SCA SCB SCC Scab Scac SCBC Scabc Sctotal Scerror DMSDocument2 pagesFC SCA SCB SCC Scab Scac SCBC Scabc Sctotal Scerror DMScristinaNo ratings yet

- 2C00532Document990 pages2C00532sumeet kanojiaNo ratings yet

- Prayagraj City Micro PlanDocument161 pagesPrayagraj City Micro PlanAnusha Kant100% (1)

- 2M00156UDocument115 pages2M00156UKrishna PandeyNo ratings yet

- LATIHANDocument5 pagesLATIHANBudi SantosoNo ratings yet

- LATIHANDocument5 pagesLATIHANBudi SantosoNo ratings yet

- Dalmau Nagar Panchayat Interception/Diversion of Drains and Sewage Treatment Scheme, District - Raibareli IndexDocument2 pagesDalmau Nagar Panchayat Interception/Diversion of Drains and Sewage Treatment Scheme, District - Raibareli IndexTechnowisdom ConsultantsNo ratings yet

- Imperial Power and Regional Trade: The Caribbean Basin InitiativeFrom EverandImperial Power and Regional Trade: The Caribbean Basin InitiativeNo ratings yet

- Chapter 7. Risk and Return Student VersionDocument5 pagesChapter 7. Risk and Return Student VersionTú UyênNo ratings yet

- Share Based Compensation LectureDocument2 pagesShare Based Compensation LectureKimberly AsuncionNo ratings yet

- Accounting For Managers: Module - 1Document31 pagesAccounting For Managers: Module - 1Madhu RakshaNo ratings yet

- Warrants and Convertibles: Mcgraw-Hill/IrwinDocument25 pagesWarrants and Convertibles: Mcgraw-Hill/IrwinAkif MahmoodNo ratings yet

- SapmDocument87 pagesSapmpriya031No ratings yet

- 02 Toy World ExhibitsDocument16 pages02 Toy World ExhibitsYo shuk singhNo ratings yet

- Reliance BP Mobility LimitedDocument63 pagesReliance BP Mobility LimitedMaheshNo ratings yet

- When Dilution Funders Act As DealersDocument17 pagesWhen Dilution Funders Act As DealersRobert HammondNo ratings yet

- MAS01Document19 pagesMAS01andzie09876No ratings yet

- Simulated Midterm Exam - Cost Accounting PDFDocument13 pagesSimulated Midterm Exam - Cost Accounting PDFMarcus MonocayNo ratings yet

- Kamayo Travel and ToursDocument31 pagesKamayo Travel and ToursJay ArNo ratings yet

- Chapter 3 CVPDocument37 pagesChapter 3 CVPfekadeNo ratings yet

- Q 211 Centipede PDFDocument2 pagesQ 211 Centipede PDFboke layNo ratings yet

- Chapter12 ExercisesDocument6 pagesChapter12 ExercisesCharis ElNo ratings yet

- Alteration & Reduction of Share CapitalDocument5 pagesAlteration & Reduction of Share CapitalHasnain MahmoodNo ratings yet

- Chapter 3 - 2013 EdDocument21 pagesChapter 3 - 2013 EdJean PaladaNo ratings yet

- Project EvalutionDocument18 pagesProject EvalutionCherukupalli Gopala KrishnaNo ratings yet

- Rules of The Stock Market GameDocument1 pageRules of The Stock Market Gamemimi96No ratings yet

- Pt. Lpin 2017-2018Document96 pagesPt. Lpin 2017-2018Dedew RistyaNo ratings yet

- Food Truck Financial Model Excel Template v1.8Document77 pagesFood Truck Financial Model Excel Template v1.8hanswuytsNo ratings yet

- 02 Worksheet 1Document1 page02 Worksheet 1Laisan SantosNo ratings yet

- Project FormatDocument43 pagesProject Formatsukumaran321No ratings yet

- FinMan Module 3 FS, Cash Flow and TaxesDocument10 pagesFinMan Module 3 FS, Cash Flow and Taxeserickson hernanNo ratings yet

- Roularta Summary Initiation Research Report by Emerald 151014Document11 pagesRoularta Summary Initiation Research Report by Emerald 151014api-237440801No ratings yet

- Accounts Paper 1Document2 pagesAccounts Paper 1Amisha RamsundarsinghNo ratings yet

- Kunci Jawaban Rapi Tailor ExcelDocument11 pagesKunci Jawaban Rapi Tailor ExcelGhaida AmaliaNo ratings yet

Index

Index

Uploaded by

Harsh pRAJAPATICopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Index

Index

Uploaded by

Harsh pRAJAPATICopyright:

Available Formats

Past paper MTP RTP

Particulars

May-24 Nov-23 May-23 Apr-24 Mar-24 Oct-23 Sep-23 Apr-23 Mar-23 May-24 Nov-23 May-23

Basic Concepts Q-16/197

Q-4(b)/135 Q-20/198

Q-2(a)(i)/46 Q-5(a)/135 Q-25/202

Capital Gains Q-2/5 Q-2(a)(ii)/46 Q-2(a)/92 Q-2(a)/104 Q-2(a)/114 Q-15/145

Income from Other Sources

Tax on VDA

Tax on Dividend Q-2(ii)/6

Tax in case of Liquidation & Buy back

Tax in case of Amalgamation & Demerger

Profits and Gains of Business or Profession Q-1/78

comprehensive sums Q-2(a)/79 Q-17/197

Q-1/2 Q-1/16 Q-1/41 Q-6(b)(ii)/84 Q-1/91 Q-1/103 Q-1/113 Q-1/122 Q-1/132 Q-14/144 Q-16/174 Q-22/200

ICDS

Assessment of Trusts and Institutions, Political

Parties and Other Special Entities

Taxation of Firm and LLP

Taxation of AOP and BOI

Taxation of Business Trust

Taxation of Investment Fund Q-15/173

Taxation of Securitization Trust

MAT Q-2(a)/21 Q-2(a)/133

AMT

Deduction u/s. 10AA Q-4(b)/57 Q-6(a)/97 Q-6©/136 Q-21/199

Transfer Pricing Q-4(b)/30 Q-4(a)/82 Q-3(b)/94 Q-6(c)/ 108 Q+4(b)/125 Q-20/148 Q-24(ii)/202

Non-resident Taxation Q-3(b)/106 Q-2(b)/114 Q-23/201

Q-2(b)/7 Q-2(b)/22 Q-2(b)/79 Q-4(c)/95 Q-5©(ii)/108 Q-5(b)/116 Q-2(b)/124 Q-24(i)/202

Double Taxation Relief Q-3(b)/9 Q-2(b)/47 Q-22/177

Q-4(b)/11 Q-3(b)/26 Q-3(b)/51 Q-3©/81 Q-2(b)/93 Q-2(b)/105 Q-5©/117 Q-6©/126 Q-2(b)/133 Q-19/147 Q-23/179

Advance Rulings Q-6(b)/15 Q-6©/85 Q-6©/98 Q-5©(i)/107 Q-3(b)(i)/115 Q-3(b)(i)/124 Q-3(b)(i)/134

Equalisation levy Q-5(b)/34 Q-5(b)/63 Q-3(b)(ii)/115 Q-3(b)(ii)/124 Q-3(b)(ii)/134 Q-24/178

Overview of Model Tax Conventions Q-5(b)/13 Q-4(c)/106 Q-25/178

Application and Interpretation of Tax Treaties

Q-6(b)/69 Q-6(b)&©/117 Q-5©/126 Q-5©/135

Base Erosion and Profit Shifting Q-6(b)/38 Q-5(b)/97

FTC rule

Conversion of Foreign Income

Q-14,17/172

Advance Tax, TDS and TCS Q-4(a)/10 Q-4(a)/29 Q-4(a)/57 Q-4(a)/81 Q-4(a)/106 Q-4(a)/116 Q-4(a)/125 Q-4(a)/134 Q-18/176

Assessment Procedure

Q-4(b)/106 Q-20/176 Q-18/198

Q-6(a)(ii)/37 Q-4(b)/95 Q-5(a) and (b)/107 Q-5(a)&(b)/116 Q-5/125 Q-5(b)/135 Q-17/146 Q-21/176 Q-19/198

Appeals and Revision Q-6(a)/136 Q-16/146

Dispute Resolution

Miscellaneous Provisions

Penalties and Prosecution Q-6(a)(iii)/37 Q-4(a)/95

The Black Money Act Q-18/147

Deductions u/c. VI-A Q-2(a)/113

Clubbing of Income

Set-off and C/f. of Income

GAAR Q-6(a)(i)/37 Q-6(a)/83 Q-6(b)/126

Taxation of Trust and Institutions Q-3(a)/8 Q-3(a)/26 Q-3(a)/51 Q-3(a) and (b)/80 Q-3(a)/94 Q-3(a)/105 Q-3(a)/115 Q-3(a)/124 Q-3(a)/133

Exempt Income

Tax Audit and Ethical Compliances Q-6(b)/97

Tonnage Taxation

Remaining Case-laws and concepts

Ethics Q-6(1)(a)/13 Q-6(b)(i)/84

General questions or not classifiable Q-5(a)/12 Q-5(a)/61 Q-6(a) and (b) /

Q-6(a)(ii) Q-5(a)/32 Q-6(a)/68 Q-5(a)/82 Q-5(a)/96 108 Q-6(a)/117 Q-6(a)/126 Q-6(b)/136 Q-19/176

You might also like

- Advac 2 Prelims 1 - PALACIODocument4 pagesAdvac 2 Prelims 1 - PALACIOPinky DaisiesNo ratings yet

- GM 1927 01 Project PlanDocument1 pageGM 1927 01 Project Planmark100% (2)

- Materials Management ManualDocument198 pagesMaterials Management ManualNaveen Bansal100% (1)

- Example: Newco Investment Recommendations by Ryland HamletDocument4 pagesExample: Newco Investment Recommendations by Ryland HamletRyland Hamlet100% (8)

- Chapter 4 - Statement of Comprehensive Income: Problem 4-1 (AICPA Adapted)Document14 pagesChapter 4 - Statement of Comprehensive Income: Problem 4-1 (AICPA Adapted)Asi Cas Jav100% (1)

- CA FINAL DT Revisions MAY-23 Exams by BBDocument3 pagesCA FINAL DT Revisions MAY-23 Exams by BBKunal BhatnagarNo ratings yet

- ICAB Assurance Past Question AnalysisDocument1 pageICAB Assurance Past Question AnalysisErfan Saleh AcaNo ratings yet

- Important Questions For DT May Nov 22 - Bhanwar BoranaDocument3 pagesImportant Questions For DT May Nov 22 - Bhanwar BoranaasdNo ratings yet

- Revise DT in 1Document2 pagesRevise DT in 1Riddhi ModiNo ratings yet

- Atc (Atmp v16 飛航管理程序)Document470 pagesAtc (Atmp v16 飛航管理程序)hugolin0126No ratings yet

- Study Outline-Ge02 Management Accounting Study Outline-Ge02 Management AccountingDocument2 pagesStudy Outline-Ge02 Management Accounting Study Outline-Ge02 Management Accountingmehedi gmatNo ratings yet

- Revise DT in 1Document2 pagesRevise DT in 1Murari AgrahariNo ratings yet

- 30.11.2022. Joint Mineplan PAMA-KJA 2023Document19 pages30.11.2022. Joint Mineplan PAMA-KJA 2023developement.kidecoNo ratings yet

- SFM Ambiguous and Imp Sum ListDocument4 pagesSFM Ambiguous and Imp Sum Listrahul.modi18No ratings yet

- 1T01728 ModelDocument2 pages1T01728 ModelAnurag GuptaNo ratings yet

- Payment Section Taxpayer - NTN Taxpayer - Cnic Taxpayer - Name Taxpayer - City Taxpayer - AddressDocument14 pagesPayment Section Taxpayer - NTN Taxpayer - Cnic Taxpayer - Name Taxpayer - City Taxpayer - AddressWasimNo ratings yet

- !SMA Paper AnalysisDocument2 pages!SMA Paper AnalysisAli ArshadNo ratings yet

- 2C00256G7Document5 pages2C00256G7BhaveshNo ratings yet

- 2C00446Document18 pages2C00446BhaveshNo ratings yet

- Marks CalculatorDocument6 pagesMarks CalculatorPickup ZacNo ratings yet

- 1T00828Document407 pages1T00828Nabeel KarvinkarNo ratings yet

- 101A/1 1234567-9 Asif Ali Sheikh Islamabad Islamabad Individual 1 1Document15 pages101A/1 1234567-9 Asif Ali Sheikh Islamabad Islamabad Individual 1 1Muhammad JunaidNo ratings yet

- Epayments Import Template Adjustable Oct-21Document14 pagesEpayments Import Template Adjustable Oct-21WasimNo ratings yet

- Fa21 CveDocument2 pagesFa21 CveMuhammad MateenNo ratings yet

- EPayments Import TemplateDocument13 pagesEPayments Import TemplateSaddam HaiderNo ratings yet

- List of As-Built Drawings (Civil) : S/N Doc. / Dwg. No. Doc. / Dwg. TitleDocument16 pagesList of As-Built Drawings (Civil) : S/N Doc. / Dwg. No. Doc. / Dwg. Titleأبو أنس البرعصيNo ratings yet

- CF STATUS 21-Oct-2022Document8 pagesCF STATUS 21-Oct-2022Anwar MuhammadNo ratings yet

- QAQC Weld Book PIPING & SUPPORT & (Above Ground, Under Ground) LUHAIS PROJECT Rev 4 (11-5-2022)Document13 pagesQAQC Weld Book PIPING & SUPPORT & (Above Ground, Under Ground) LUHAIS PROJECT Rev 4 (11-5-2022)Anwar QaisNo ratings yet

- Form Nl-1-B-Ra Periodic DisclosuresDocument1 pageForm Nl-1-B-Ra Periodic DisclosuresNilesh DawandeNo ratings yet

- Cub Test ReportDocument6 pagesCub Test Reportibrahim hegazyNo ratings yet

- Haier LCD L42v6-A8kDocument21 pagesHaier LCD L42v6-A8kluis_alessandrinNo ratings yet

- Contractor Tax 474560Document16 pagesContractor Tax 474560Kashif NiaziNo ratings yet

- 2C00446Document4 pages2C00446Anurag KhadeNo ratings yet

- Module 2:production Function & Market StructureDocument116 pagesModule 2:production Function & Market Structure727822TPMB005 ARAVINTHAN.SNo ratings yet

- Most Expected Topics For Exams Income Tax & GSTDocument5 pagesMost Expected Topics For Exams Income Tax & GSTronit.srcom22641No ratings yet

- PJ68 - Qty Calculation Sheet - Peso Approved DRG Basis-HKS 2Document2 pagesPJ68 - Qty Calculation Sheet - Peso Approved DRG Basis-HKS 2PJ-68 Site GAIL VijaipurNo ratings yet

- 1T00918Document2 pages1T00918Clovis MachadoNo ratings yet

- Document Transmittal To Black Cat - Dn80Document2 pagesDocument Transmittal To Black Cat - Dn80Joseph PerezNo ratings yet

- Drawing 217-7908 Valve Gp-Solenoid & ManifoldDocument2 pagesDrawing 217-7908 Valve Gp-Solenoid & Manifolddenny palimbungaNo ratings yet

- MechDocument1 pageMechadnan.yaseenNo ratings yet

- Volume 2 - BBDocument355 pagesVolume 2 - BBavinashkives21No ratings yet

- Filtre Hyd 160KDocument4 pagesFiltre Hyd 160KYapi YapiNo ratings yet

- Fci Result 2012Document13 pagesFci Result 2012Sunil PatelNo ratings yet

- Sub-Station Marpara SL - NO. Drawing NameDocument10 pagesSub-Station Marpara SL - NO. Drawing NameAsim GoraiNo ratings yet

- 1T00718 PDFDocument1,399 pages1T00718 PDFDhaval BhadeNo ratings yet

- Accounting ManuelDocument1,061 pagesAccounting ManuelthenjhomebuyerNo ratings yet

- شجرة المقررات الدراسيةDocument2 pagesشجرة المقررات الدراسيةAll NnNo ratings yet

- Capital District Hotel Wright Account Statement (GC-10)Document1 pageCapital District Hotel Wright Account Statement (GC-10)Albany Times UnionNo ratings yet

- Grupo Rotativo330c InternoDocument2 pagesGrupo Rotativo330c InternoEckard GuendelNo ratings yet

- 1T00738ADocument1,729 pages1T00738Anirajstraight10No ratings yet

- Income Tax Jurisdictions Chart - New Revised On 2015Document6 pagesIncome Tax Jurisdictions Chart - New Revised On 2015Ca T.SANKARAMURTHYNo ratings yet

- Answer Key - GG: Geology and Geophysics: Q.No. Session Que - Type Sec. Name Key MarksDocument3 pagesAnswer Key - GG: Geology and Geophysics: Q.No. Session Que - Type Sec. Name Key MarksOIL INDIANo ratings yet

- 2C00456U7Document13 pages2C00456U7Sandhya TiwariNo ratings yet

- Past Paper Analysis Company LawDocument1 pagePast Paper Analysis Company LawInam Ul Haq MinhasNo ratings yet

- FC SCA SCB SCC Scab Scac SCBC Scabc Sctotal Scerror DMSDocument2 pagesFC SCA SCB SCC Scab Scac SCBC Scabc Sctotal Scerror DMScristinaNo ratings yet

- 2C00532Document990 pages2C00532sumeet kanojiaNo ratings yet

- Prayagraj City Micro PlanDocument161 pagesPrayagraj City Micro PlanAnusha Kant100% (1)

- 2M00156UDocument115 pages2M00156UKrishna PandeyNo ratings yet

- LATIHANDocument5 pagesLATIHANBudi SantosoNo ratings yet

- LATIHANDocument5 pagesLATIHANBudi SantosoNo ratings yet

- Dalmau Nagar Panchayat Interception/Diversion of Drains and Sewage Treatment Scheme, District - Raibareli IndexDocument2 pagesDalmau Nagar Panchayat Interception/Diversion of Drains and Sewage Treatment Scheme, District - Raibareli IndexTechnowisdom ConsultantsNo ratings yet

- Imperial Power and Regional Trade: The Caribbean Basin InitiativeFrom EverandImperial Power and Regional Trade: The Caribbean Basin InitiativeNo ratings yet

- Chapter 7. Risk and Return Student VersionDocument5 pagesChapter 7. Risk and Return Student VersionTú UyênNo ratings yet

- Share Based Compensation LectureDocument2 pagesShare Based Compensation LectureKimberly AsuncionNo ratings yet

- Accounting For Managers: Module - 1Document31 pagesAccounting For Managers: Module - 1Madhu RakshaNo ratings yet

- Warrants and Convertibles: Mcgraw-Hill/IrwinDocument25 pagesWarrants and Convertibles: Mcgraw-Hill/IrwinAkif MahmoodNo ratings yet

- SapmDocument87 pagesSapmpriya031No ratings yet

- 02 Toy World ExhibitsDocument16 pages02 Toy World ExhibitsYo shuk singhNo ratings yet

- Reliance BP Mobility LimitedDocument63 pagesReliance BP Mobility LimitedMaheshNo ratings yet

- When Dilution Funders Act As DealersDocument17 pagesWhen Dilution Funders Act As DealersRobert HammondNo ratings yet

- MAS01Document19 pagesMAS01andzie09876No ratings yet

- Simulated Midterm Exam - Cost Accounting PDFDocument13 pagesSimulated Midterm Exam - Cost Accounting PDFMarcus MonocayNo ratings yet

- Kamayo Travel and ToursDocument31 pagesKamayo Travel and ToursJay ArNo ratings yet

- Chapter 3 CVPDocument37 pagesChapter 3 CVPfekadeNo ratings yet

- Q 211 Centipede PDFDocument2 pagesQ 211 Centipede PDFboke layNo ratings yet

- Chapter12 ExercisesDocument6 pagesChapter12 ExercisesCharis ElNo ratings yet

- Alteration & Reduction of Share CapitalDocument5 pagesAlteration & Reduction of Share CapitalHasnain MahmoodNo ratings yet

- Chapter 3 - 2013 EdDocument21 pagesChapter 3 - 2013 EdJean PaladaNo ratings yet

- Project EvalutionDocument18 pagesProject EvalutionCherukupalli Gopala KrishnaNo ratings yet

- Rules of The Stock Market GameDocument1 pageRules of The Stock Market Gamemimi96No ratings yet

- Pt. Lpin 2017-2018Document96 pagesPt. Lpin 2017-2018Dedew RistyaNo ratings yet

- Food Truck Financial Model Excel Template v1.8Document77 pagesFood Truck Financial Model Excel Template v1.8hanswuytsNo ratings yet

- 02 Worksheet 1Document1 page02 Worksheet 1Laisan SantosNo ratings yet

- Project FormatDocument43 pagesProject Formatsukumaran321No ratings yet

- FinMan Module 3 FS, Cash Flow and TaxesDocument10 pagesFinMan Module 3 FS, Cash Flow and Taxeserickson hernanNo ratings yet

- Roularta Summary Initiation Research Report by Emerald 151014Document11 pagesRoularta Summary Initiation Research Report by Emerald 151014api-237440801No ratings yet

- Accounts Paper 1Document2 pagesAccounts Paper 1Amisha RamsundarsinghNo ratings yet

- Kunci Jawaban Rapi Tailor ExcelDocument11 pagesKunci Jawaban Rapi Tailor ExcelGhaida AmaliaNo ratings yet