Professional Documents

Culture Documents

Copy of Financial Accounting Cross Industry Analysis (1)(1)

Copy of Financial Accounting Cross Industry Analysis (1)(1)

Uploaded by

Hrishika GuptaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Copy of Financial Accounting Cross Industry Analysis (1)(1)

Copy of Financial Accounting Cross Industry Analysis (1)(1)

Uploaded by

Hrishika GuptaCopyright:

Available Formats

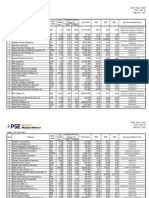

Cross Industry Analysis

Profit Margin Ratios

EBITDA MARGIN 2018 2019 2020 2021 2022

SAIL 5.01 5.81 1.87 20.54 18.71

JSPL 59.79 57.5 64.13 30.45

RINL -1.19 3.94 -11.12 6.61 11.29

JSW 15.48 19.5 12.04 22.38 24.2

Mid East Integrated Steels 28.46 17.18 4.92 -18.32 2.28

EBIT MARGIN 2018 2019 2020 2021 2022

SAIL -0.19 0.75 -4.22 14.61 14.58

JSPL 42.97 49.63 46.61 81.36 25.55

RINL -6.59 -1.28 -18.08 0.02 7.01

JSW 10.8 15.8 8.63 17.62 21.066

Mid East Integrated Steels 20.69 10.5 -12.4 -51.64 -26.69

EBT MARGIN 2018 2019 2020 2021 2022

SAIL -4.98 -3.96 -9.88 10.53 12.94

JSPL 29.09 38.8 34.25 73.51 21.86

RINL -12.99 -7.51 -27.6 -8.56 1.5

JSW 10.45 15.08 8.63 17.62 21.066

Mid East Integrated Steels

Net Profit Margin 2018 2019 2020 2021 2022

SAIL -4.59 -4.71 -5.65 6.45 11.3

JSPL 29.95 39.79 33.9 68.35 16.14

RINL -11.08 -2 -25.18 -5.53 3.16

JSW 10.525 15.08 8.6315 17.62 21.066

Mid East Integrated Steels

Asset Turnover Ratio 2018 2019 2020 2021 2022

SAIL 51.08 56.78 48.58 58.66 86.15

JSPL 0.58 0.82 0.34 0.45 0.67

RINL 0.45 0.57 0.45 0.55 0.85

JSW 7.955 0.7001 0.5126 0.52133 0.7179

Mid East Integrated Steels

Efficiency Ratio Liquidity Ratio

Per Day Sales 2018 2019 2020 2021 2022 Current Ratio

SAIL SAIL

JSPL JSPL

RINL 40.24 56.35 43.74 49.74 78.1 RINL

JSW 200.57 212.58 177.78 195.605 330.819 JSW

Mid East Integrated Steels Mid East Integrated Steels

Inventory Turnover Ratio 2018 2019 2020 2021 2022 Quick Ratio

SAIL SAIL

JSPL 5.61 6.05 4.77 5.81 7.02 JSPL

RINL 2.6 2.74 2.26 3.64 4.68 RINL

JSW 5.8131 5.33351 4.711 5.01 3.573 JSW

Mid East Integrated Steels 4.13 5.94 2.55 1.21 0.95 Mid East Integrated Steels

Day's Inventory 2018 2019 2020 2021 2022

SAIL

JSPL 65.02 60.35 76.52 62.8 52.02

RINL 140.6 133.4 161.4 100.27 78.02

JSW 97.303 102.131 72.845 77.4717 68.4351

Mid East Integrated Steels

Debtor's Turnover Ratio 2018 2019 2020 2021 2022

SAIL

JSPL 15.25 13 8.58 12.36 40.41

RINL 14.7 18.15 26.04 20.67 31.13

JSW 23.45 31.84 17.808 17.03 18.57

Mid East Integrated Steels

Days receivables 2018 2019 2020 2021 2022

SAIL

JSPL 23.94 28.08 42.52 29.53 9.03

RINL 24.83 20.11 14.02 17.66 11.72

JSW

Mid East Integrated Steels

Debt Equity Ratio 2018 2019 2020 2021 2022

SAIL

JSPL 1.272 1.102 0.978 0.697 0.348

RINL 2.17 2.62 6.55 9.69 5.52

JSW 0.933483 0.9258 0.828292 0.828918

Mid East Integrated Steels

Overall Performance Ratio

2018 2019 2020 2021 2022 ROTA 2018 2019

SAIL

0.74 0.63 0.69 1.05 1.38 JSPL 24.92 40.7

0.51 0.59 0.46 0.45 0.42 RINL -2.96 -0.73

0.800718 0.92766 1.0248 0.967 1.41704 JSW 0.0664 0.101

Mid East Integrated Steels

2018 2019 2020 2021 2022 ROE 2018 2019

SAIL

0.48 0.35 0.41 0.75 1 JSPL 27.06 49.67

0.33 0.42 0.34 0.26 0.3 RINL -19.65 -0.75

0.365 0.485 0.554 0.513 0.573 JSW 20.308 26.98007

Mid East Integrated Steels

ROCE 2018 2019

SAIL

JSPL 41.88 76.89

RINL -6.3 -1.47

JSW 0.0000171 0.113432

Mid East Integrated Steels

Valuation Ratio

2020 2021 2022 No. of outstanding shares 2018 2019 2020

SAIL

15.83 36.66 17.05 JSPL 48.35 48.4 51

-8.2 0.01 5.94 RINL 4,889,846,200 4,889,846,200 4,889,846,200

0.092 0.082229 0.125 JSW 2.4 5.32 3.01

Mid East Integrated Steels

2020 2021 2022 Book Value per Share 2018 2019 2020

SAIL

32.96 77.48 22.26 JSPL 637.44 652.01 614.91

-120.93 -44.34 28.62 RINL 15.68 15.03 6.62

17.57 27.79 55.488 JSW 125.4166 115.92 127.45

Mid East Integrated Steels

2020 2021 2022 Earning per Share 2018 2019 2020

SAIL

21.37 48.73 22.77 JSPL 172.47 323.84 202.66

-19.81 0.02 14.91 RINL -2.93 -0.11 -8.09

0.033 0.0895 0.143 JSW 22.82 33.77 22.03

Mid East Integrated Steels

2021 2022

51 50.54

4,889,846,200 4,889,846,200

3.02 3.01

2021 2022

606.61 734.05

4.4 6.34

155.55 210.97

2021 2022

470.01 163.36

-2 1.85

34.52 69.48

You might also like

- Finance League - Keshav BansalDocument15 pagesFinance League - Keshav BansalJohn DoeNo ratings yet

- What Is The Degree of Association Between GWA and RC? GWA and MA?Document3 pagesWhat Is The Degree of Association Between GWA and RC? GWA and MA?alliah molanoNo ratings yet

- FM Assignment 22021241198Document14 pagesFM Assignment 22021241198Sanchit GoteNo ratings yet

- Corp FinDocument32 pagesCorp FinsivagabbiNo ratings yet

- TabulasiDocument2 pagesTabulasivtzgnvy7jhNo ratings yet

- JPC - Steel DataDocument20 pagesJPC - Steel DatasauravpaulNo ratings yet

- Status of Railway Electrification As On 01 - 04 - 22Document4 pagesStatus of Railway Electrification As On 01 - 04 - 22Namma MudholNo ratings yet

- Anand Ratpital Goods Q2FY22 Result PreviewDocument13 pagesAnand Ratpital Goods Q2FY22 Result PreviewRaktim BiswasNo ratings yet

- Jindal Saw: FAR Assignment 5Document12 pagesJindal Saw: FAR Assignment 5thamil marpanNo ratings yet

- Tugas 4 Mip Elsa Rezino Tiyafani (0120077301)Document5 pagesTugas 4 Mip Elsa Rezino Tiyafani (0120077301)9wyz9k9mptNo ratings yet

- Bagian 1Document1 pageBagian 1Julia JunaediNo ratings yet

- ValueResearchFundcard SBISmallCapFund DirectPlan 2019nov11Document4 pagesValueResearchFundcard SBISmallCapFund DirectPlan 2019nov11asddsffdsfNo ratings yet

- No Saham ROE 2020 (%) EV/Ebitda (X)Document64 pagesNo Saham ROE 2020 (%) EV/Ebitda (X)PutriAnindyaListyaPurwaNo ratings yet

- Detail AnalysisDocument1 pageDetail AnalysisPraveen ShresthaNo ratings yet

- Data Di OlahDocument2 pagesData Di OlahtiresmikeNo ratings yet

- JSW Steel: (Jswste)Document8 pagesJSW Steel: (Jswste)XYZNo ratings yet

- Kotak Mahindra BankDocument25 pagesKotak Mahindra BankSaMyak JAinNo ratings yet

- Data ImportDocument24 pagesData ImportAnkit VermaNo ratings yet

- Scania RFQ PPT - 03.01.2016Document22 pagesScania RFQ PPT - 03.01.2016Laxmikant JoshiNo ratings yet

- 234 Prerana Palande SAPM 3rd CriteriaDocument6 pages234 Prerana Palande SAPM 3rd CriteriaPrerana PalandeNo ratings yet

- Financial Accounting Steel SectorDocument36 pagesFinancial Accounting Steel SectorashishNo ratings yet

- Zerotha Trading Order DetailsDocument5 pagesZerotha Trading Order Detailsnagaraj.rajaNo ratings yet

- FinancialsDocument2 pagesFinancialsclendeavourNo ratings yet

- TrendlineDocument34 pagesTrendlineRifqi SetyobudiNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyNo ratings yet

- BookDocument6 pagesBookalichangwani9No ratings yet

- Book 2Document4 pagesBook 2Aniket KolheNo ratings yet

- CF - Group 1Document8 pagesCF - Group 1swapnil anandNo ratings yet

- Akash 5yr PidiliteDocument9 pagesAkash 5yr PidiliteAkash Didharia100% (1)

- Assignment S1 2023 PDFDocument13 pagesAssignment S1 2023 PDFDuy Trung BuiNo ratings yet

- IndusInd BankDocument9 pagesIndusInd BankSrinivas NandikantiNo ratings yet

- L&TIndiaValueFund 2017jul25Document4 pagesL&TIndiaValueFund 2017jul25Krishnan ChockalingamNo ratings yet

- Presentation 1Document6 pagesPresentation 1tichimuteroNo ratings yet

- ValueResearchFundcard DSPSmallCapFund DirectPlan 2019jun29Document4 pagesValueResearchFundcard DSPSmallCapFund DirectPlan 2019jun29Chiman RaoNo ratings yet

- Index of English (7600)Document6 pagesIndex of English (7600)nitinkumar9828087795No ratings yet

- Tabulasi Data SekunderDocument4 pagesTabulasi Data SekunderLusi rahmawatiNo ratings yet

- Performance Highlights - DPL - March - 2023Document1 pagePerformance Highlights - DPL - March - 2023Sandipan MukherjeeNo ratings yet

- Bajaaj Auto With GraphsDocument46 pagesBajaaj Auto With Graphssatyamankushe99No ratings yet

- Fundcard: Franklin India Smaller Companies FundDocument4 pagesFundcard: Franklin India Smaller Companies FundChiman RaoNo ratings yet

- Gail Project Phase 1Document17 pagesGail Project Phase 1S.K. PraveenNo ratings yet

- ValueResearchFundcard CanaraRobecoEmergingEquitiesFund DirectPlan 2019mar04Document4 pagesValueResearchFundcard CanaraRobecoEmergingEquitiesFund DirectPlan 2019mar04ChittaNo ratings yet

- Fundcard: BNP Paribas Midcap FundDocument4 pagesFundcard: BNP Paribas Midcap FundChiman RaoNo ratings yet

- Balance Sheet - Subros: Optimistic Senario Normal ScenarioDocument9 pagesBalance Sheet - Subros: Optimistic Senario Normal ScenarioAnonymous tgYyno0w6No ratings yet

- Putri Nur Fitriani - Tugas 5Document16 pagesPutri Nur Fitriani - Tugas 5Putri NurNo ratings yet

- Financial ReportDocument60 pagesFinancial ReportAastha GuptaNo ratings yet

- Contoh HASIL OLAH DATADocument5 pagesContoh HASIL OLAH DATARirin YulianiNo ratings yet

- Sektor Aneka Industry - Sub ElektronikaDocument3 pagesSektor Aneka Industry - Sub ElektronikaEga PriyatnaNo ratings yet

- Financial Modelling ExcelDocument6 pagesFinancial Modelling ExcelAanchal Mahajan100% (1)

- BUDGET FOR THE YEAR 2021 & 2022 (Elec)Document1 pageBUDGET FOR THE YEAR 2021 & 2022 (Elec)Electrical DCM AstroNo ratings yet

- CalculationDocument6 pagesCalculationDORAEMON MY JAANNo ratings yet

- Wirdawati-B2092221017-Tugas Statistik Untuk BisnisDocument5 pagesWirdawati-B2092221017-Tugas Statistik Untuk BisnisEMI PURWANINo ratings yet

- Project ValuesDocument30 pagesProject ValueshariharanpNo ratings yet

- Book 1Document3 pagesBook 1riyadh al kamalNo ratings yet

- ValueResearchFundcard HDFCEquity 2012jul30Document6 pagesValueResearchFundcard HDFCEquity 2012jul30Rachit GoyalNo ratings yet

- Data Analysis and InterpretationDocument15 pagesData Analysis and InterpretationDeep ShahNo ratings yet

- Bab IVDocument44 pagesBab IVIlyasa YusufNo ratings yet

- Merkator International DooDocument1 pageMerkator International DooArbenita SahitiNo ratings yet

- Data Excel Ke Spss 3Document8 pagesData Excel Ke Spss 3Wawan JayanetNo ratings yet

- Jindal SawDocument2 pagesJindal SawSubir BhuniaNo ratings yet

- To the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioFrom EverandTo the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioNo ratings yet

- Adolescents 02 00007Document20 pagesAdolescents 02 00007Hrishika GuptaNo ratings yet

- Family Dynamics Questionnaire HandoutDocument2 pagesFamily Dynamics Questionnaire HandoutHrishika GuptaNo ratings yet

- B00309V2I42015Document6 pagesB00309V2I42015Hrishika GuptaNo ratings yet

- Except For Common Exam, There Will Be Separate Test Papers For Each SubjectDocument1 pageExcept For Common Exam, There Will Be Separate Test Papers For Each SubjectHrishika GuptaNo ratings yet

- Etd10448 LBao PDFDocument57 pagesEtd10448 LBao PDFHrishika GuptaNo ratings yet

- Ugnotification2020 PDFDocument1 pageUgnotification2020 PDFHrishika GuptaNo ratings yet

- MathematicsDocument4 pagesMathematicsHrishika GuptaNo ratings yet

- Dog Puppy Bill of Sale FormDocument2 pagesDog Puppy Bill of Sale FormPeculiar TimilehinNo ratings yet

- Subject:: Payment of Education StipendDocument12 pagesSubject:: Payment of Education StipendShahaan ZulfiqarNo ratings yet

- Milestone ScheduleDocument1 pageMilestone ScheduleKiyimba DanielNo ratings yet

- Architectural WorksDocument9 pagesArchitectural WorksFranklin TardecillaNo ratings yet

- Fakultas Rekayasa Industri: Pengantar Ilmu Ekonomi (Iei2C2)Document32 pagesFakultas Rekayasa Industri: Pengantar Ilmu Ekonomi (Iei2C2)aliffian alifNo ratings yet

- Vessel and Conveyors - VPDDocument4 pagesVessel and Conveyors - VPDAntonio Mizraim Magallon SantanaNo ratings yet

- Design of Breast WallsDocument33 pagesDesign of Breast WallsSabin MaharjanNo ratings yet

- Agreement Sound and Light Show Srisailam PDFDocument75 pagesAgreement Sound and Light Show Srisailam PDFasdfNo ratings yet

- MRL2601 2024 Semester 1 Assignment 01Document4 pagesMRL2601 2024 Semester 1 Assignment 01khayaNo ratings yet

- Business Planning and Project Management: Faculty Name: Ms. Supriya KamaleDocument21 pagesBusiness Planning and Project Management: Faculty Name: Ms. Supriya KamaleTaha MerchantNo ratings yet

- Week 2 - Attempt 4Document4 pagesWeek 2 - Attempt 4paulw22No ratings yet

- Catalog Pasx 710Document65 pagesCatalog Pasx 710Drew Reaz100% (1)

- SAMPLE PDF Macroeconomics XII 2021-22 Edition by Subhash DeyDocument124 pagesSAMPLE PDF Macroeconomics XII 2021-22 Edition by Subhash DeyAbhinav Kalra100% (1)

- Chapter 9 SolutionsDocument49 pagesChapter 9 SolutionsMasha LankNo ratings yet

- Invoice AmzDocument1 pageInvoice AmzSohail AslamNo ratings yet

- Cavinkare: Company Website AboutDocument3 pagesCavinkare: Company Website AboutKpvs NikhilNo ratings yet

- Intermediate Financial Management 11th Edition Brigham Solutions ManualDocument26 pagesIntermediate Financial Management 11th Edition Brigham Solutions ManualSabrinaFloresmxzie100% (51)

- Econometrics 2Document110 pagesEconometrics 2Nguyễn Quỳnh HươngNo ratings yet

- Revival Letter: Indian Overseas Bank Branch Dear Sir(s)Document1 pageRevival Letter: Indian Overseas Bank Branch Dear Sir(s)sri_iasNo ratings yet

- Daftar Lowongan Untuk Lulusan SMA SMK - Job Fair UIN - Update 050919Document2 pagesDaftar Lowongan Untuk Lulusan SMA SMK - Job Fair UIN - Update 050919Aji SamudraNo ratings yet

- Weekly Account Statement - RW9913Document1 pageWeekly Account Statement - RW9913swastik prasadNo ratings yet

- Yudelki Pediet Rodríguez 152516622 Supplementary Agreement 9a8b4a6eDocument6 pagesYudelki Pediet Rodríguez 152516622 Supplementary Agreement 9a8b4a6epedietyudelkisNo ratings yet

- Cost Control & MonitoringDocument18 pagesCost Control & MonitoringAngela Dichoso100% (1)

- Apy ChartDocument1 pageApy Chartvinay chaudhariNo ratings yet

- Full Download PDF of Elementary Statistics Triola 11th Edition Solutions Manual All ChapterDocument30 pagesFull Download PDF of Elementary Statistics Triola 11th Edition Solutions Manual All Chapterkaluzzfurger100% (5)

- Faculty of Economics - PHDDocument150 pagesFaculty of Economics - PHDMuhammad YasirNo ratings yet

- Compact Solenoid Valve - General Purpose: Threaded Port 1/8"-1/4" NPT and Sub-BaseDocument4 pagesCompact Solenoid Valve - General Purpose: Threaded Port 1/8"-1/4" NPT and Sub-BasekicsnerNo ratings yet

- Technology and Automation As Sources of 21 - Century Firm Productivity: The Economics of Slow Internet Connectivity in The PhilippinesDocument5 pagesTechnology and Automation As Sources of 21 - Century Firm Productivity: The Economics of Slow Internet Connectivity in The PhilippinesCholo Marcus GetesNo ratings yet

- Line 2013 2014 2015 2016 2017 2018Document6 pagesLine 2013 2014 2015 2016 2017 2018phcedzovNo ratings yet

- Exm 12975Document17 pagesExm 12975Pavan Jp100% (3)