Professional Documents

Culture Documents

Microsoft

Microsoft

Uploaded by

pgpwe200070 ratings0% found this document useful (0 votes)

3 views17 pagesCopyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

3 views17 pagesMicrosoft

Microsoft

Uploaded by

pgpwe20007Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 17

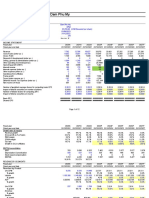

Company Fundamentals - Segments

Company Name Microsoft Corp (MSFT.O)

Country of Exchange United States of America

Country of Headquarters United States of America

TRBC Industry Group Software & IT Services

CF Template IND

Consolidation Basis Consolidated

Scaling Millions

Period Annual

Export Date 24-05-2024

Statement Data 2019 2020 2021 2022 2023

Period End Date 30-06-2019 30-06-2020 30-06-2021 30-06-2022 30-06-2023

Standardized Currency USD USD USD USD USD

Segments - Business Line By Statement Item (Currency: Standardized)

Field Name TRBC 30-06-2019 30-06-2020 30-06-2021 30-06-2022 30-06-2023

Income/Expense - Business

External Revenue - Business Segment 125,843 143,015 168,088 198,270 211,915

Intelligent Cloud 513210, 541512, 38,985 48,366 59,728 74,965 87,907

541511

513210, 541519,

More Personal Computing 45,698 48,251 54,445 59,941 54,734

541512,

339930, 334111

334118,

Productivity and Business Processes 41,160 46,398 53,915 63,364 69,274

519290, 513210

Segment Revenue - % - Business Segment 100.0% 100.0% 100.0% 100.0% 100.0%

Intelligent Cloud 513210, 541512, 31.0% 33.8% 35.5% 37.8% 41.5%

541511

513210, 541519,

More Personal Computing 36.3% 33.7% 32.4% 30.2% 25.8%

541512,

339930, 334111

334118,

Productivity and Business Processes 32.7% 32.4% 32.1% 32.0% 32.7%

519290, 513210

Standardized Revenue - Business Segment 125,843 143,015 168,088 198,270 211,915

Intelligent Cloud 513210, 541512, 38,985 48,366 59,728 74,965 87,907

541511

513210, 541519,

More Personal Computing 45,698 48,251 54,445 59,941 54,734

541512,

339930, 334111

334118,

Productivity and Business Processes 41,160 46,398 53,915 63,364 69,274

519290, 513210

Operating Income/Loss - Business Segment 42,959 52,959 69,916 83,383 88,523

Intelligent Cloud 513210, 541512, 13,920 18,324 26,471 33,203 37,884

541511

513210, 541519,

More Personal Computing 12,820 15,911 19,094 20,490 16,450

541512,

339930, 334111

334118,

Productivity and Business Processes 16,219 18,724 24,351 29,690 34,189

519290, 513210

Corporate and other 0

Operating Margin (%) - Business Segment 34.1% 37.0% 41.6% 42.1% 41.8%

Intelligent Cloud 513210, 541512, 35.7% 37.9% 44.3% 44.3% 43.1%

541511

513210, 541519,

More Personal Computing 28.1% 33.0% 35.1% 34.2% 30.1%

541512,

339930, 334111

334118,

Productivity and Business Processes 39.4% 40.4% 45.2% 46.9% 49.4%

519290, 513210

Company Fundamentals - Segments

Company Name Microsoft Corp (MSFT.O)

Country of Exchange United States of America

Country of Headquarters United States of America

TRBC Industry Group Software & IT Services

CF Template IND

Consolidation Basis Consolidated

Scaling Millions

Period Annual

Export Date 24-05-2024

Statement Data 2019 2020 2021 2022 2023

Period End Date 30-06-2019 30-06-2020 30-06-2021 30-06-2022 30-06-2023

Standardized Currency USD USD USD USD USD

Segments - Geographic Line By Statement Item (Currency: Standardized)

Field Name 30-06-2019 30-06-2020 30-06-2021 30-06-2022 30-06-2023

Income/Expense - Geographic

External Revenue - Geographic Segment 125,843 143,015 168,088 198,270 211,915

Other countries 61,644 69,855 84,135 98,052 105,171

United States 64,199 73,160 83,953 100,218 106,744

Segment Revenue - % - Geographic Segment 100.0% 100.0% 100.0% 100.0% 100.0%

Other countries 49.0% 48.8% 50.1% 49.5% 49.6%

United States 51.0% 51.2% 50.0% 50.6% 50.4%

Standardized Revenue - Geographic Segment 125,843 143,015 168,088 198,270 211,915

Other countries 61,644 69,855 84,135 98,052 105,171

United States 64,199 73,160 83,953 100,218 106,744

International Sales - Geographic Segment 61,644 69,855 84,135 98,052 105,171

International Operating Income - Geographic Segment 15,799 24,116 36,130 35,879 36,394

Pre-Tax Margin (%) - Geographic Segment 34.7% 37.1% 42.3% 42.2% 42.1%

Other countries 25.6% 34.5% 42.9% 36.6% 34.6%

United States 43.4% 39.5% 41.7% 47.7% 49.6%

Net Income before Tax - Geographic Segment 43,688 53,036 71,102 83,716 89,311

Other countries 15,799 24,116 36,130 35,879 36,394

United States 27,889 28,920 34,972 47,837 52,917

Assets - Geographic

Long-lived Assets - Geographic Segment 93,632 103,293 128,314 166,368 187,239

Ireland 12,958 12,734 13,303 15,505 16,359

Other countries 25,422 29,770 38,858 44,433 56,500

United States 55,252 60,789 76,153 106,430 114,380

Standardized Assets - Geographic Segment 93,632 103,293 128,314 166,368 187,239

Ireland 12,958 12,734 13,303 15,505 16,359

Other countries 25,422 29,770 38,858 44,433 56,500

United States 55,252 60,789 76,153 106,430 114,380

Segment Assets - % - Geographic Segment 100.0% 100.0% 100.0% 100.0% 100.0%

Ireland 13.8% 12.3% 10.4% 9.3% 8.7%

Other countries 27.2% 28.8% 30.3% 26.7% 30.2%

United States 59.0% 58.9% 59.4% 64.0% 61.1%

International Assets - Geographic Segment 38,380 42,504 52,161 59,938 72,859

Employees - Geographic

Employees - Full-Time/Full-Time Equivalents -Prd End-Geo Seg 144,000 163,000 221,000 221,000

Other countries 59,000 67,000 99,000 101,000

United States 85,000 96,000 122,000 120,000

Company Fundamentals - Segments

Company Name Microsoft Corp (MSFT.O)

Country of Exchange United States of America

Country of Headquarters United States of America

TRBC Industry Group Software & IT Services

CF Template IND

Consolidation Basis Consolidated

Scaling Millions

Period Annual

Export Date 24-05-2024

Statement Data 2019 2020 2021 2022 2023

Period End Date 30-06-2019 30-06-2020 30-06-2021 30-06-2022 30-06-2023

Standardized Currency USD USD USD USD USD

Segments - Geographic Segment Aggregation (Currency: Standardized)

Field Name 30-06-2019 30-06-2020 30-06-2021 30-06-2022 30-06-2023

Revenue - Geographic Aggregation

Americas 64,199 73,160 83,953 100,218 106,744

Northern America 64,199 73,160 83,953 100,218 106,744

United States 64,199 73,160 83,953 100,218 106,744

Rest of the World 61,644 69,855 84,135 98,052 105,171

Assets - Geographic Aggregation

European Union 12,958 12,734 13,303 15,505 16,359

Ireland 12,958 12,734 13,303 15,505 16,359

Americas 55,252 60,789 76,153 106,430 114,380

Northern America 55,252 60,789 76,153 106,430 114,380

United States 55,252 60,789 76,153 106,430 114,380

Europe 12,958 12,734 13,303 15,505 16,359

Northern Europe 12,958 12,734 13,303 15,505 16,359

Ireland 12,958 12,734 13,303 15,505 16,359

Rest of the World 25,422 29,770 38,858 44,433 56,500

Company Fundamentals - Segments

Company Name Microsoft Corp (MSFT.O)

Country of Exchange United States of America

Country of Headquarters United States of America

TRBC Industry Group Software & IT Services

CF Template IND

Consolidation Basis Consolidated

Scaling Millions

Period Annual

Export Date 24-05-2024

Statement Data 2019 2020 2021 2022 2023

Period End Date 30-06-2019 30-06-2020 30-06-2021 30-06-2022 30-06-2023

Standardized Currency USD USD USD USD USD

Segments - Product Line By Statement Item (Currency: Standardized)

Field Name 30-06-2019 30-06-2020 30-06-2021 30-06-2022 30-06-2023

Income/Expense - Product

External Revenue - Product Segment 125,843 143,015 168,088 198,270 211,915

Devices 6,095.0 6,457.0 7,143.0 7,306.0 5,521.0

Dynamics 3,754.0 4,687.0 5,437.0

Enterprise Services 6,124.0 6,409.0 6,943.0 7,407.0 7,722.0

Gaming 11,386 11,575 15,370 16,230 15,466

LinkedIn 6,754.0 8,077.0 10,289 13,816 15,145

Office Products And Cloud Services 31,769 35,316 39,872 44,862 48,728

Other 3,070.0 3,768.0 373.0 289.0 211.0

Search and news advertising 7,628.0 7,740.0 9,267.0 11,591 12,208

Server Products And Cloud Services 32,622 41,379 52,589 67,350 79,970

Windows 20,395 22,294 22,488 24,732 21,507

Segment Revenue - % - Product Segment 100.0% 100.0% 100.0% 100.0% 100.0%

Devices 4.8% 4.5% 4.3% 3.7% 2.6%

Dynamics 2.2% 2.4% 2.6%

Enterprise Services 4.9% 4.5% 4.1% 3.7% 3.6%

Gaming 9.1% 8.1% 9.1% 8.2% 7.3%

LinkedIn 5.4% 5.7% 6.1% 7.0% 7.2%

Office Products And Cloud Services 25.2% 24.7% 23.7% 22.6% 23.0%

Other 2.4% 2.6% 0.2% 0.2% 0.1%

Search and news advertising 6.1% 5.4% 5.5% 5.9% 5.8%

Server Products And Cloud Services 25.9% 28.9% 31.3% 34.0% 37.7%

Windows 16.2% 15.6% 13.4% 12.5% 10.2%

Standardized Revenue - Product Segment 125,843 143,015 168,088 198,270 211,915

Devices 6,095.0 6,457.0 7,143.0 7,306.0 5,521.0

Dynamics 3,754.0 4,687.0 5,437.0

Enterprise Services 6,124.0 6,409.0 6,943.0 7,407.0 7,722.0

Gaming 11,386 11,575 15,370 16,230 15,466

LinkedIn 6,754.0 8,077.0 10,289 13,816 15,145

Office Products And Cloud Services 31,769 35,316 39,872 44,862 48,728

Other 3,070.0 3,768.0 373.0 289.0 211.0

Search and news advertising 7,628.0 7,740.0 9,267.0 11,591 12,208

Server Products And Cloud Services 32,622 41,379 52,589 67,350 79,970

Windows 20,395 22,294 22,488 24,732 21,507

Company Fundamentals - Income Statement

Company Name Microsoft Corp (MSFT.O)

Country of Exchange United States of America

Country of Headquarters United States of America

TRBC Industry Group Software & IT Services

CF Template IND

Consolidation Basis Consolidated

Scaling Millions

Period Annual

Export Date 24-05-2024

Statement Data 2019 2020 2021 2022 2023

Period End Date 30-06-2019 30-06-2020 30-06-2021 30-06-2022 30-06-2023

Standardized Currency USD USD USD USD USD

Income Statement - Standardized (Currency: Standardized)

Field Name 30-06-2019 30-06-2020 30-06-2021 30-06-2022 30-06-2023

Revenues

Revenue from Goods & Services 125,843 143,015 168,088 198,270 211,915

Sales of Goods & Services - Net - Unclassified 125,843 143,015 168,088 198,270 211,915

Revenue from Business Activities - Total 125,843 143,015 168,088 198,270 211,915

Operating Expenses

Cost of Operating Revenue 42,910 46,078 52,232 62,650 65,863

Cost of Revenues - Total 42,910 46,078 52,232 62,650 65,863

Gross Profit - Industrials/Property - Total 82,933 96,937 115,856 135,620 146,052

Selling, General & Administrative Expenses - Total 39,974 43,978 45,940 52,237 56,358

Selling, General & Administrative Expenses - Unclassified 21,498 23,109 23,724 26,225 28,259

Research & Development Expense 16,876 19,269 20,716 24,512 27,195

Selling, General & Administrative Expenses - Other - Total 1,600.0 1,600.0 1,500.0 1,500.0 904.0

Advertising Expense 1,600.0 1,600.0 1,500.0 1,500.0 904.0

Operating Expenses - Total 82,884 90,056 98,172 114,887 122,221

Operating Profit

Operating Profit before Non-Recurring Income/Expense 42,959 52,959 69,916 83,383 89,694

Non-Operating Expenses

Financing Income/(Expense) - Net - Total 189.0 -6.00 27.00 9.00 1,194.0

Interest Expense - Net of (Interest Income) 2,686.0 2,591.0 2,346.0 2,063.0 1,968.0

Interest Expense - Net of Capitalized Interest 2,686.0 2,591.0 2,346.0 2,063.0 1,968.0

Non-Interest Financial Income/(Expense) - Total 2,875.0 2,585.0 2,373.0 2,072.0 3,162.0

Dividend & Investment Income 2,762.0 2,680.0 2,131.0 2,094.0 2,994.0

Foreign Exchange Gain/(Loss) - Non-Business -82.00 -191.0 54.00 -75.00 181.0

Sale of Investments Held for Sale, Maturity & Trading - Gain/(Loss) 195.0 96.00 188.0 53.00 -13.00

Other Non-Operating Income/(Expense) - Total -57.00 146.0 98.00 -32.00 -223.0

Derivatives - Hedging - Effective Gain/(Loss) 0

Non-Recurring Adjustments - Non-Operating- Decrease/(Increase) 186.0

Normalized Pre-tax Profit 43,091 53,099 70,041 83,360 90,665

Non-Recurring Income/Expense

Non-Recurring Income/(Expense) - Total 597.0 -63.00 1,061.0 356.0 -1,354.0

Impairment - Tangible & Intangible Fixed Assets 186.0

Impairment - Fixed Assets 186.0

Impairment - Financial Investments 10.00 116.0 11.00 20.00 20.00

Other than Temporary Impairment Losses on Investments 16.00 17.00 2.00 81.00 10.00

Restructuring Charges 0 800.0

Derivatives - Hedging - Gain/(Loss) 2.00 187.0 17.00 -52.00 -456.0

Derivatives - Hedging - Ineffective Gain/(Loss) 142.0

Fair Value Adjustments - Financial Investments 479.0 69.00 1,057.0 509.0 303.0

Non-Recurring Income/(Expense) - Other - Total -371.0

Pre-Tax Income

Income before Taxes 43,688 53,036 71,102 83,716 89,311

Taxes

Income Taxes 4,291.0 8,755.0 9,831.0 10,978 16,950

Income Taxes for the Year - Current 10,911 8,744.0 9,981.0 16,680 23,009

Income Taxes - Domestic - Current 5,380.0 4,300.0 4,514.0 10,008 16,331

Income Taxes - Foreign - Current 5,531.0 4,444.0 5,467.0 6,672.0 6,678.0

Income Taxes - Deferred -6,620.0 11.00 -150.0 -5,702.0 -6,059.0

Income Taxes - Domestic - Deferred -6,814.0 52.00 -179.0 -5,877.0 -6,623.0

Income Taxes - Foreign - Deferred 194.0 -41.00 29.00 175.0 564.0

Net Income After Tax

Net Income after Tax 39,397 44,281 61,271 72,738 72,361

After Tax Income/Expense

Income before Discontinued Operations & Extraordinary Items 39,397 44,281 61,271 72,738 72,361

Extraordinary Activities - after Tax - Gain/(Loss) -157.0 0

Extraordinary Items -157.0 0

Net Income before Minority Interest 39,240 44,281 61,271 72,738 72,361

Net Income after Minority Interest 39,240 44,281 61,271 72,738 72,361

Net Income

Income Available to Common Shares 39,240 44,281 61,271 72,738 72,361

Other Comprehensive Income

Other Comprehensive Income - Starting Line 39,240 44,281 61,271 72,738 72,361

Other Comprehensive Income - Foreign Currency -318.0 -426.0 873.0 -1,146.0 -207.0

Other Comprehensive Income - Unrealized Investment Gain/(Loss) 2,405.0 3,990.0 -2,266.0 -5,360.0 -1,444.0

Other Comprehensive Income - Hedging Gain/(Loss) -173.0 -38.00 19.00 6.00 -14.00

Other Comprehensive Income - Net of Tax - Total 1,914.0 3,526.0 -1,374.0 -6,500.0 -1,665.0

Comprehensive Income before Minority Interest - Total 41,154 47,807 59,897 66,238 70,696

Comprehensive Income - Attributable to Parent Company Equity Holders - Total 41,154 47,807 59,897 66,238 70,696

Share/Per Share - Basic

Net Income - Basic - including Extraordinary Items Applicable to Common - Total 39,240 44,281 61,271 72,738 72,361

Income available to Common excluding Extraordinary Items 39,397 44,281 61,271 72,738 72,361

Shares used to calculate Basic EPS - Total 7,673.0 7,610.0 7,547.0 7,496.0 7,446.0

EPS - Basic - including Extraordinary Items Applicable to Common - Total 5.11 5.82 8.12 9.70 9.72

EPS - Basic - excluding Extraordinary Items Applicable to Common - Total 5.13 5.82 8.12 9.70 9.72

EPS - Basic - excluding Extraordinary Items - Normalized - Total 5.06 5.83 7.98 9.66 9.90

Allocated Net Income including Extraordinary Items Applicable to Common - Issue Specific 39,240 44,281 61,271 72,738 72,361

Earnings Allocation Factor - Basic - Issue Specific 1.00 1.00 1.00 1.00 1.00

Shares used to calculate Basic EPS - Issue Specific 7,673.0 7,610.0 7,547.0 7,496.0 7,446.0

EPS - Basic - including Extraordinary Items Applicable to Common - Issue Specific 5.11 5.82 8.12 9.70 9.72

EPS - Basic - excluding Extraordinary Items Applicable to Common - Issue Specific 5.13 5.82 8.12 9.70 9.72

EPS - Basic - excluding Extraordinary Items - Normalized - Issue Specific 5.06 5.83 7.98 9.66 9.90

EPS - Basic from Discontinued Operations & Extraordinary Items -0.02 0 0 0 0

Comprehensive Earnings Per Share - Basic - Issue Specific 5.36 6.28 7.94 8.84 9.49

Share/Per Share - Diluted

Net Income - Diluted - including Extraordinary Items Applicable to Common - Total 39,240 44,281 61,271 72,738 72,361

Diluted Income available to Common excluding Extraordinary Items 39,397 44,281 61,271 72,738 72,361

Shares used to calculate Diluted EPS - Total 7,753.0 7,683.0 7,608.0 7,540.0 7,472.0

EPS - Diluted - including Extraordinary Items Applicable to Common - Total 5.06 5.76 8.05 9.65 9.68

EPS - Diluted - excluding Extraordinary Items Applicable to Common - Total 5.08 5.76 8.05 9.65 9.68

EPS - Diluted - excluding Extraordinary Items - Normalized - Total 5.00 5.77 7.91 9.60 9.87

Allocated Diluted Net Income including Extraordinary Items Applicable to Common - Issue Specific 39,240 44,281 61,271 72,738 72,361

Earnings Allocation Factor - Diluted - Issue Specific 1.00 1.00 1.00 1.00 1.00

Shares used to calculate Diluted EPS - Issue Specific 7,753.0 7,683.0 7,608.0 7,540.0 7,472.0

EPS - Diluted - including Extraordinary Items Applicable to Common - Issue Specific 5.06 5.76 8.05 9.65 9.68

EPS - Diluted - excluding Extraordinary Items Applicable to Common - Issue Specific 5.08 5.76 8.05 9.65 9.68

EPS - Diluted - excluding Extraordinary Items - Normalized - Issue Specific 5.00 5.77 7.91 9.60 9.87

EPS - Diluted from Discontinued Operations & Extraordinary Items -0.02 0 0 0 0

Comprehensive Earnings Per Share - Diluted - Issue Specific 5.31 6.22 7.87 8.78 9.46

Share/Per Share - Dividends

DPS - Common - Gross - Issue - By Announcement Date 1.84 2.04 2.24 2.48 2.72

DPS - Common - Net - Issue - By Announcement Date 1.84 2.04 2.24 2.48 2.72

EBIT/EBITDA & related

Earnings before Interest & Taxes (EBIT) 42,959 52,959 69,916 83,383 89,694

Earnings before Interest, Taxes, Depreciation & Amortization (EBITDA) 54,929 65,755 81,602 97,983 103,555

Earnings before Interest, Taxes, Depreciation & Amortization (EBITDA) and Operating Lease Payments 56,636 67,798 83,729 100,444 106,430

Depreciation/Amortization - Income Statement

Depreciation & Amortization - Supplemental 11,970 12,911 11,821 15,580 13,500

Depreciation Expense - Total - Supplemental 10,070 11,311 10,221 13,580 11,000

Depreciation - Fin Lease Right-of-Use Assets - Total - Suppl 370.0 611.0 921.0 980.0 1,352.0

Amortization - Total - Supplemental 1,900.0 1,600.0 1,600.0 2,000.0 2,500.0

Intangible Amortization - Other - Supplemental 1,900.0 1,600.0 1,600.0 2,000.0 2,500.0

Depreciation/Amortization - Total

Depreciation, Depletion & Amortization - Total 11,970 12,796 11,686 14,600 13,861

Depreciation - Total 9,700.0 10,700 9,300.0 12,600 11,000

Amortization of Intangible Assets excluding Goodwill - Total 1,900.0 1,600.0 1,600.0 2,000.0 2,500.0

Research & Development

Research & Development Expense - Expensed & Capitalized - Total - Supplemental 16,876 19,269 20,716 24,512 27,195

Research & Development Expense - Supplemental 16,876 19,269 20,716 24,512 27,195

Labor & Related Expenses

Stock-Based Compensation Expense - Net of Tax - Supplemental 3,836.0 4,351.0 5,053.0 6,209.0 7,960.0

Stock-Based Compensation Expense - Pre-tax - Supplemental 4,652.0 5,289.0 6,118.0 7,502.0 9,611.0

Stock-Based Compensation - Tax Benefit - Supplemental 816.0 938.0 1,065.0 1,293.0 1,651.0

Auditor Fees

Auditor Fees 58.28 55.29 57.14 57.52 61.40

Audit-Related Fees 55.89 51.86 52.79 52.96 56.34

Tax Fees 2.24 3.38 4.31 4.55 5.05

Fees - Other 0.15 0.05 0.04 0.01 0.01

Non-GAAP

Non-GAAP Income from Operations - Company Reported 42,959 89,694

Non-GAAP Adjusted Net Earnings - Company Reported 36,830 44,281 60,651 69,447 73,307

Non-GAAP EPS Diluted - Company Reported 4.75 5.76 7.97 9.21 9.81

Normalized

Normalized after Tax Profit 38,800 44,344 60,210 72,382 73,715

Normalized Net Income from Continuing Operations 38,800 44,344 60,210 72,382 73,715

Normalized Net Income - Bottom Line 38,800 44,344 60,210 72,382 73,715

Earnings before Interest & Taxes (EBIT) - Normalized 45,777 55,690 72,387 85,423 92,633

Earnings before Interest, Taxes, Depreciation & Amortization (EBITDA) - Normalized 57,747 68,486 84,073 100,023 106,494

Derivatives

Derivatives - Hedging - Gain/(Loss) - Total - Supplemental 144.0 187.0 17.00 -52.00 -456.0

Derivatives - Hedging - Realized Gain/(Loss) - Total - Supplemental 142.0

Derivatives - Hedging - Effective Gain/(Loss) - Supplemental 0

Derivatives - Hedging - Ineffective Gain/(Loss) - Supplemental 142.0

Lease Expenses

Lease Expense -Total - Supplemental 2,324.0 2,990.0 3,434.0 3,870.0 4,728.0

Operating /Rental Expense - Supplemental 1,707.0 2,043.0 2,127.0 2,461.0 2,875.0

Depreciation of Financial Lease ROU Assets - Supplemental 370.0 611.0 921.0 980.0 1,352.0

Interest Expense on Financial Lease Liabilities - Supple 247.0 336.0 386.0 429.0 501.0

Other

Rental/Operating Lease Expense 1,707.0 2,043.0 2,127.0 2,461.0 2,875.0

Advertising Expenses - Supplemental 1,600.0 1,600.0 1,500.0 1,500.0 904.0

Cost of Revenue including Operation & Maintenance (Utility) - Total 42,910 46,078 52,232 62,650 65,863

Cost of Revenues excluding Depreciation 42,910 46,078 52,232 62,650 65,863

Interest Expense 2,686.0 2,591.0 2,346.0 2,063.0 1,968.0

Operating Expenses 82,884 90,056 98,172 114,887 122,221

Selling, General & Administrative Expenses excluding Research & Development Expenses 23,098 24,709 25,224 27,725 29,163

Company Fundamentals - Balance Sheet

Company Name Microsoft Corp (MSFT.O)

Country of Exchange United States of America

Country of Headquarters United States of America

TRBC Industry Group Software & IT Services

CF Template IND

Consolidation Basis Consolidated

Scaling Millions

Period Annual

Export Date 24-05-2024

Statement Data 2019 2020 2021 2022 2023

Period End Date 30-06-2019 30-06-2020 30-06-2021 30-06-2022 30-06-2023

Standardized Currency USD USD USD USD USD

Balance Sheet - Standardized (Currency: Standardized)

Field Name 30-06-2019 30-06-2020 30-06-2021 30-06-2022 30-06-2023

Current Assets

Cash & Short-Term Investments 133,819 136,527 130,334 104,757 111,262

Cash & Cash Equivalents 11,356 13,576 14,224 13,931 34,704

Short-Term Investments - Total 122,463 122,951 116,110 90,826 76,558

Derivative Financial Instruments - Hedging - Short-Term 133.0

Loans & Receivables - Net - Short-Term 29,524 32,011 38,043 44,261 48,688

Trade Accounts & Trade Notes Receivable - Net 29,524 32,011 38,043 44,261 48,688

Trade Accounts & Trade Notes Receivable - Gross 29,935 32,799 38,794 44,894 49,338

Provision - Trade Accounts & Trade Notes Receivable 411.0 788.0 751.0 633.0 650.0

Inventories - Total 2,063.0 1,895.0 2,636.0 3,742.0 2,500.0

Inventories - Raw Materials 399.0 700.0 1,190.0 1,144.0 709.0

Inventories - Work in Progress 53.00 83.00 79.00 82.00 23.00

Inventories - Finished Goods 1,611.0 1,112.0 1,367.0 2,516.0 1,768.0

Other Current Assets - Total 10,013 11,482 13,393 16,924 21,807

Other Current Assets 10,013 11,482 13,393 16,924 21,807

Total Current Assets 175,552 181,915 184,406 169,684 184,257

Non-Current Assets

Investments in Associates, Joint Ventures and Unconsolidated Subsidiaries 2,649.0 2,965.0 5,984.0 6,891.0 9,879.0

Receivables & Loans - Long-Term 2,200.0 2,700.0 3,400.0 3,800.0 4,500.0

Accounts & Notes Receivable - Trade - Net - Long-Term 2,200.0 2,700.0 3,400.0 3,800.0 4,500.0

Derivative Financial Instruments - Hedging - Long-Term 4.00

Property, Plant & Equipment - Net - Total 43,856 52,904 70,803 87,546 109,987

Property, Plant & Equipment - excluding Assets Leased Out - Net - Total 43,856 52,904 70,803 87,546 109,987

Property, Plant & Equipment - Gross - Total 79,186 96,101 122,154 147,206 178,238

Property, Plant & Equipment - excluding Assets Leased Out - Gross 79,186 96,101 122,154 147,206 178,238

Land & Buildings - Gross 33,144 41,305 54,472 67,567 82,685

Land/Improvements - Gross 1,540.0 1,823.0 3,660.0 4,734.0 5,683.0

Buildings - Gross 26,288 33,995 43,928 55,014 68,465

Leasehold Improvements - Gross 5,316.0 5,487.0 6,884.0 7,819.0 8,537.0

Plant, Machinery & Equipment - Gross 33,823 41,261 51,250 60,631 74,961

Computer Software & Equipment - Gross 33,823 41,261 51,250 60,631 74,961

Right of Use Tangible Assets - Total - Gross 7,379.0 8,753.0 11,088 13,148 14,346

Right of Use Tangible Assets - Operating Lease - Gross 7,379.0 8,753.0 11,088 13,148 14,346

Property, Plant & Equipment - Other - Gross 4,840.0 4,782.0 5,344.0 5,860.0 6,246.0

Property, Plant & Equipment - Accumulated Depreciation & Impairment - Total 35,330 43,197 51,351 59,660 68,251

Property, Plant & Equipment - excluding Assets Leased Out - Accumulated Depreciation & Impairment - Total 35,330 43,197 51,351 59,660 68,251

Other Non-Current Assets - Total 12,519 10,438 11,675 18,097 26,101

Deferred Tax - Asset - Long-Term 7,536.0 6,405.0 7,181.0 13,515 20,163

Other Non-Current Assets 4,983.0 4,033.0 4,494.0 4,582.0 5,938.0

Intangible Assets - Total - Net 49,776 50,389 57,511 78,822 77,252

Goodwill/Cost in Excess of Assets Purchased - Net 42,026 43,351 49,711 67,524 67,886

Intangible Assets - excluding Goodwill - Net - Total 7,750.0 7,038.0 7,800.0 11,298 9,366.0

Computer Software - Intangible Assets - Net 1,920.0 1,779.0 2,772.0 4,319.0 3,656.0

Brands, Patents, Trademarks, Marketing & Artistic Intangibles - Net 2,838.0 2,570.0 2,914.0 2,799.0 2,462.0

Licenses, Franchises, Copyrights, Property Rights, Prototypes, Contract Based, Models & Designs - Net 2,924.0 42.00 15.00 9.00 14.00

Intangible Assets - Other - Net 68.00 2,647.0 2,099.0 4,171.0 3,234.0

Intangible Assets - Gross - Total 102,401 102,676

Goodwill/Cost in Excess of Assets Purchased - Gross 78,824 79,186

Intangible Assets - excluding Goodwill - Gross 17,139 17,759 19,975 23,577 23,490

Computer Software - Intangible Assets - Gross 7,691.0 8,160.0 9,779.0 11,277 11,245

Brands, Patents, Trademarks, Marketing & Artistic Intangibles - Gross 4,165.0 4,158.0 4,792.0 4,942.0 4,935.0

Licenses, Franchises, Copyrights, Property Rights, Prototypes, Contract Based, Models & Designs - Gross 4,709.0 474.0 446.0 16.00 29.00

Intangible Assets - Other - Gross - Total 574.0 4,967.0 4,958.0 7,342.0 7,281.0

Intangible Assets - Accumulated Amortization & Impairment - Total 23,579 25,424

Goodwill - Accumulated Amortization & Impairment 11,300 11,300

Intangible Assets - excluding Goodwill - Accumulated Amortization & Impairment - Total 9,389.0 10,721 12,175 12,279 14,124

Computer Software - Intangible Assets - Accumulated Amortization & Impairment 5,771.0 6,381.0 7,007.0 6,958.0 7,589.0

Brands, Patents, Trademarks, Marketing & Artistic Intangibles - Accumulated Amortization & Impairment 1,327.0 1,588.0 1,878.0 2,143.0 2,473.0

Licenses, Franchises, Copy/Property Rights, Prototypes, Contract Based, Models & Designs - Accumulated 1,785.0 432.0 431.0 7.00 15.00

Amortization & Impairment

Intangible Assets - Other - Accumulated Amortization & Impairment 506.0 2,320.0 2,859.0 3,171.0 4,047.0

Total Non-Current Assets 111,004 119,396 149,373 195,156 227,719

Total Assets

Total Assets 286,556 301,311 333,779 364,840 411,976

Current Liabilities

Trade Accounts Payable & Accruals - Short-Term 16,212 20,404 25,220 29,661 29,104

Trade Accounts & Trade Notes Payable - Short-Term 9,382.0 12,530 15,163 19,000 18,095

Accrued Expenses - Short-Term 6,830.0 7,874.0 10,057 10,661 11,009

Short-Term Debt & Current Portion of Long-Term Debt 5,833.0 4,289.0 8,863.0 3,809.0 6,444.0

Current Portion of Long-Term Debt including Capitalized Leases 5,833.0 4,289.0 8,863.0 3,809.0 6,444.0

Current Portion of Long-Term Debt excluding Capitalized Leases 5,516.0 3,749.0 8,072.0 2,749.0 5,247.0

Capitalized Leases - Current Portion 317.0 540.0 791.0 1,060.0 1,197.0

Derivative Liabilities - Hedging - Short-Term 221.0

Income Taxes - Payable - Short-Term 5,665.0 2,130.0 2,174.0 4,067.0 4,152.0

Operating Lease Liabilities - Current Portion/Short-Term 1,515.0 1,616.0 1,962.0 2,228.0 2,409.0

Other Current Liabilities - Total 39,974 43,871 50,438 55,317 62,040

Deferred Income - Short-Term 32,676 36,000 41,525 45,538 50,901

Other Current Liabilities 7,298.0 7,871.0 8,913.0 9,779.0 11,139

Total Current Liabilities 69,420 72,310 88,657 95,082 104,149

Non-Current Liabilities

Debt - Long-Term - Total 72,919 68,534 61,824 60,874 57,860

Long-Term Debt excluding Capitalized Leases 66,662 59,578 50,074 47,032 41,990

Debt - Non-Convertible - Long-Term 66,662 59,578 50,074 47,032 41,990

Capitalized Lease Obligations - Long-Term 6,257.0 8,956.0 11,750 13,842 15,870

Derivative Liabilities - Hedging - Long-Term 15.00

Deferred Tax & Investment Tax Credits - Long-Term 233.0 204.0 198.0 230.0 433.0

Deferred Tax - Liability - Long-Term 233.0 204.0 198.0 230.0 433.0

Operating Lease Liabilities - Long-Term 6,188.0 7,671.0 9,629.0 11,489 12,728

Other Non-Current Liabilities - Total 35,451 34,288 31,483 30,623 30,583

Deferred Revenue - Long-Term 4,530.0 3,180.0 2,616.0 2,870.0 2,912.0

Other Non-Current Liabilities 30,921 31,108 28,867 27,753 27,671

Total Non-Current Liabilities 114,806 110,697 103,134 103,216 101,604

Total Liabilities

Total Liabilities 184,226 183,007 191,791 198,298 205,753

Shareholders' Equity

Shareholders' Equity - Attributable to Parent Shareholders - Total 102,330 118,304 141,988 166,542 206,223

Common Equity Attributable to Parent Shareholders 102,330 118,304 141,988 166,542 206,223

Common Equity - Contributed 78,520 80,552 83,111 86,939 93,718

Common Stock - Issued & Paid 49,680 47,319 46,994 46,650 46,450

Common Stock - Additional Paid in Capital including Option Reserve 28,841 33,233 36,117 40,289 47,268

Equity - Non-Contributed - Reserves & Retained Earnings 23,810 37,752 58,877 79,603 112,505

Retained Earnings - Total 24,150 34,566 57,055 84,281 118,848

Comprehensive Income - Accumulated - Total -340.0 3,186.0 1,822.0 -4,678.0 -6,343.0

Investments - Unrealized Gain/Loss 1,488.0 5,478.0 3,222.0 -2,138.0 -3,582.0

Hedging Reserves 0 -38.00 -19.00 -13.00 -27.00

Foreign Currency Translation Adjustment - Accumulated -1,828.0 -2,254.0 -1,381.0 -2,527.0 -2,734.0

Common Equity - Total 102,330 118,304 141,988 166,542 206,223

Total Shareholders' Equity

Total Shareholders' Equity - including Minority Interest & Hybrid Debt 102,330 118,304 141,988 166,542 206,223

Total Liabilities & Shareholders' Equity

Total Liabilities & Equity 286,556 301,311 333,779 364,840 411,976

Share/Per Share - Common

Common Shares - Issued - Total 7,643.0 7,571.0 7,519.0 7,464.0 7,432.0

Common Shares - Outstanding - Total 7,643.0 7,571.0 7,519.0 7,464.0 7,432.0

Common Shares - Treasury - Total 0 0 0 0 0

Common Shares - Authorized - Issue Specific 24,000 24,000 24,000 24,000 24,000

Common Shares - Issued - Issue Specific 7,643.0 7,571.0 7,519.0 7,464.0 7,432.0

Common Shares - Outstanding - Issue Specific 7,643.0 7,571.0 7,519.0 7,464.0 7,432.0

Common Shares - Treasury - Issue Specific 0 0 0 0 0

Share/Per Share - Other

Asset Allocation Factor - Issue Specific 1.00 1.00 1.00 1.00 1.00

Right of Use Tangible Assets

Right of Use Tangible Assets - Total - Net - Supplemental 13,646 17,739 22,889 27,251 30,237

Right of Use Tangible Assets - Operating Lease - Net - Supplemental 7,379.0 8,753.0 11,088 13,148 14,346

Right of Use Tangible Assets - Capital/Finance Lease - Net - Supplemental 6,267.0 8,986.0 11,801 14,103 15,891

Property, Plant & Equipment - excluding Right of Use Tangible Assets & Capital Leases - Net 30,210 35,165 47,914 60,295 79,750

Right of Use Liabilities

Total Operating Lease Liabilities 7,703.0 9,287.0 11,591 13,717 15,137

Operating Lease Liabilities - Current Portion/Short-Term - Supplemental 1,515.0 1,616.0 1,962.0 2,228.0 2,409.0

Operating Lease Liabilities - Long-Term - Supplemental 6,188.0 7,671.0 9,629.0 11,489 12,728

Finance and Operating Lease Liabilities - Total 14,277 18,783 24,132 28,619 32,204

Debt including Finance and Operating Lease Liabilities 86,455 82,110 82,278 78,400 79,441

Long-Term & Short-Term

Derivative Financial Instruments - Hedging - Total 137.0

Investments - Total 122,463 122,951 116,110 90,826 76,558

Loans & Receivables - Total 31,724 34,711 41,443 48,061 53,188

Accounts & Notes Receivable - Trade - Gross - Total 29,935 32,799 38,794 44,894 49,338

Other Assets - Total 22,532 21,920 25,068 35,021 47,908

Income Taxes - Payable - Long-Term & Short-Term 5,665.0 2,130.0 2,174.0 4,067.0 4,152.0

Payables & Accrued Expenses 16,212 20,404 25,220 29,661 29,104

Trade Account Payables - Total 9,382.0 12,530 15,163 19,000 18,095

Accrued Expenses 6,830.0 7,874.0 10,057 10,661 11,009

Derivative Liabilities - Hedging 236.0

Debt Related

Net Debt -55,067 -63,704 -59,647 -40,074 -46,958

Debt - Total 78,752 72,823 70,687 64,683 64,304

Debt Maturity

Debt - Long-Term - Maturities - Total 72,781 67,407 63,910 55,511 52,866

Debt - Long-Term - Maturities - within 1 Year 5,518.0 3,750.0 8,075.0 2,750.0 5,250.0

Debt - Long-Term - Maturities - Year 2 3,750.0 7,966.0 2,750.0 5,250.0 2,250.0

Debt - Long-Term - Maturities - Year 3 7,994.0 2,750.0 5,250.0 2,250.0 3,000.0

Debt - Long-Term - Maturities - Year 4 2,750.0 5,250.0 2,250.0 3,000.0 8,000.0

Debt - Long-Term - Maturities - Year 5 5,250.0 2,250.0 3,000.0 8,000.0 0

Debt - Long-Term - Maturities - Remaining 47,519 45,441 42,585 34,261 34,366

Debt - Long-Term - Maturities - 2-3 Years 11,744 10,716 8,000.0 7,500.0 5,250.0

Debt - Long-Term - Maturities - 4-5 Years 8,000.0 7,500.0 5,250.0 11,000 8,000.0

Debt - Long-Term - Maturities - Year 6 & Beyond 47,519 45,441 42,585 34,261 34,366

Capital Lease Maturity

Capital Lease Maturities - Total 6,574.0 9,496.0 12,541 14,902 17,067

Capital Lease Maturities - Due within 1 Year 591.0 880.0 1,179.0 1,477.0 1,747.0

Capital Lease Maturities - Due in Year 2 616.0 894.0 1,198.0 1,487.0 2,087.0

Capital Lease Maturities - Due in Year 3 626.0 903.0 1,211.0 1,801.0 1,771.0

Capital Lease Maturities - Due in Year 4 631.0 916.0 1,537.0 1,483.0 1,780.0

Capital Lease Maturities - Due in Year 5 641.0 1,236.0 1,220.0 1,489.0 1,787.0

Capital Lease Maturities - Remaining Maturities 5,671.0 7,194.0 8,856.0 9,931.0 11,462

Capital Lease Maturities - Interest Costs 2,202.0 2,527.0 2,660.0 2,766.0 3,567.0

Capital Lease Maturities - Due in 2-3 Years 1,242.0 1,797.0 2,409.0 3,288.0 3,858.0

Capital Lease Maturities - Due in 4-5 Years 1,272.0 2,152.0 2,757.0 2,972.0 3,567.0

Capital Lease Maturities - Due in Year 6 & Beyond 5,671.0 7,194.0 8,856.0 9,931.0 11,462

Weighted Average Leases

Wgt Avg Remaining Lease Term (Years)-Operating Lease-US GAAP 8.00 8.00 8.00 8.00

Wgt Avg Remaining Lease Term (Years) - Finance Lease 13.00 12.00 12.00 11.00

Weighted Average Discount Rate - Operating Lease - US GAAP 0.0% 0.0% 0.0% 0.0%

Weighted Average Discount Rate - Finance Lease 0.0% 0.0% 0.0% 0.0%

Other

Accruals - Short-Term 94,776 96,029 81,525 60,671 45,404

Asset Accruals 230,974 241,684 266,444 279,585 304,886

Cash & Cash Equivalents - Total 11,356 13,576 14,224 13,931 34,704

Cash & Short Term Investments - Total 133,819 136,527 130,334 104,757 111,262

Debt - including Preferred Equity & Minority Interest - Total 78,752 72,823 70,687 64,683 64,304

Investments - Permanent 2,649.0 2,965.0 5,984.0 6,891.0 9,879.0

Net Book Capital 47,263 54,600 82,341 126,468 159,265

Net Operating Assets 47,263 54,600 82,341 126,468 159,265

Provisions - Total 233.0 204.0 198.0 230.0 433.0

Shareholders Equity - Common 102,330 118,304 141,988 166,542 206,223

Tangible Total Equity 52,554 67,915 84,477 87,720 128,971

Tangible Book Value 52,554 67,915 84,477 87,720 128,971

Total Book Capital 181,082 191,127 212,675 231,225 270,527

Total Capital 181,082 191,127 212,675 231,225 270,527

Total Long Term Capital 217,136 229,001 245,122 269,758 307,827

Total Fixed Assets - Net 66,778 73,345 96,262 123,832 155,333

Unearned Revenue - Total 37,206 39,180 44,141 48,408 53,813

Working Capital 106,132 109,605 95,749 74,602 80,108

Working Capital - Non-Cash -27,687 -26,922 -34,585 -30,155 -31,154

Working Capital excluding Other Current Assets & Liabilities 136,093 141,994 132,794 112,995 120,341

Book Value excluding Other Equity 102,330 118,304 141,988 166,542 206,223

Shareholders

Common Shareholders - Number 94,069 91,674 89,291 86,465 83,883

Operating Lease Maturity

Operating Lease Payments - Total 7,703.0 9,287.0 11,591 13,717 15,137

Operating Lease Payments - Due in Year 1 1,678.0 1,807.0 2,125.0 2,456.0 2,784.0

Operating Lease Payments - Due in Year 2 1,438.0 1,652.0 1,954.0 2,278.0 2,508.0

Operating Lease Payments - Due in Year 3 1,235.0 1,474.0 1,751.0 1,985.0 2,142.0

Operating Lease Payments - Due in Year 4 1,036.0 1,262.0 1,463.0 1,625.0 1,757.0

Operating Lease Payments - Due in Year 5 839.0 1,000.0 1,133.0 1,328.0 1,582.0

Operating Lease Payments - Remaining Maturities 2,438.0 3,122.0 4,111.0 5,332.0 6,327.0

Operating Lease Payments - Interest Cost/Imputed Interest 961.0 1,030.0 946.0 1,287.0 1,963.0

Operating Lease Payments - Due in 2-3 Years 2,673.0 3,126.0 3,705.0 4,263.0 4,650.0

Operating Lease Payments - Due in 4-5 Years 1,875.0 2,262.0 2,596.0 2,953.0 3,339.0

Operating Lease Payments - Due in Year 6 & Beyond 2,438.0 3,122.0 4,111.0 5,332.0 6,327.0

Employees

Employees - Full-Time/Full-Time Equivalents - Period End 144,000 163,000 181,000 221,000 221,000

Employees - Full-Time/Full-Time Equivalents - Current Date 144,000 163,000 181,000 221,000 221,000

Company Fundamentals - Cash Flow

Company Name Microsoft Corp (MSFT.O)

Country of Exchange United States of America

Country of Headquarters United States of America

TRBC Industry Group Software & IT Services

CF Template IND

Consolidation Basis Consolidated

Scaling Millions

Period Annual

Export Date 24-05-2024

Statement Data 2019 2020 2021 2022 2023

Period End Date 30-06-2019 30-06-2020 30-06-2021 30-06-2022 30-06-2023

Standardized Currency USD USD USD USD USD

Cash Flow - Standardized (Currency: Standardized)

Field Name 30-06-2019 30-06-2020 30-06-2021 30-06-2022 30-06-2023

Operating Cash Flow - Indirect

Profit/(Loss) - Starting Line - Cash Flow 39,240 44,281 61,271 72,738 72,361

Non-cash Items & Reconciliation Adjustments - Cash Flow 9,079.0 17,877 16,405 15,851 17,609

Depreciation, Depletion & Amortization including Impairment - Cash Flow - to Reconcile 11,682 12,796 11,686 14,460 13,861

Depreciation & Depletion - Property, Plant & Equipment - Cash Flow - to Reconcile 11,682 12,796 11,686 14,460 13,861

Deferred Income Taxes & Income Tax Credits - Cash Flow - to Reconcile -6,463.0 11.00 -150.0 -5,702.0 -6,059.0

Assets Sale - Gain/(Loss) - Cash Flow - to Reconcile -792.0 -219.0 -1,249.0 -409.0 196.0

Share Based Payments - Cash Flow - to Reconcile 4,652.0 5,289.0 6,118.0 7,502.0 9,611.0

Cash Flow from Operating Activities before Changes in Working Capital 48,319 62,158 77,676 88,589 89,970

Working Capital - Increase/(Decrease) - Cash Flow 3,866.0 -1,483.0 -936.0 446.0 -2,388.0

Accounts Receivables - Decrease/(Increase) - Cash Flow -2,812.0 -2,577.0 -6,481.0 -6,834.0 -4,087.0

Inventories - Decrease/(Increase) - Cash Flow 597.0 168.0 -737.0 -1,123.0 1,242.0

Other Assets - Decrease/(Increase) - Cash Flow -3,552.0 -3,367.0 -4,391.0 -3,514.0 -4,824.0

Accounts Payable - Increase/(Decrease) - Cash Flow 232.0 3,018.0 2,798.0 2,943.0 -2,721.0

Taxes Payable - Increase/(Decrease) - Cash Flow 2,929.0 -3,631.0 -2,309.0 696.0 -358.0

Other Liabilities - Increase/(Decrease) -Total - Cash Flow 6,472.0 4,906.0 10,184 8,278.0 8,360.0

Net Cash Flow from Operating Activities 52,185 60,675 76,740 89,035 87,582

Investing Cash Flow

Capital Expenditures - Net - Cash Flow 13,925 15,441 20,622 23,886 28,107

Property, Plant & Equipment - Purchased/(Sold) - Net - Cash Flow 13,925 15,441 20,622 23,886 28,107

Property, Plant & Equipment - Purchased - Cash Flow 13,925 15,441 20,622 23,886 28,107

Capital Expenditures - Total 13,925 15,441 20,622 23,886 28,107

Acquisition & Disposals of Business - Assets - Sold/(Acquired) - Net - Cash Flow -2,388.0 -2,521.0 -8,909.0 -22,038 -1,670.0

Acquisition of Business - Cash Flow 2,388.0 2,521.0 8,909.0 22,038 1,670.0

Investments excluding Loans - Decrease/(Increase) - Cash Flow 540.0 6,980.0 2,876.0 18,438 10,213

Investment Securities - Unclassified - Sold/(Purchased) - Net - Total - Cash Flow 540.0 6,980.0 2,876.0 18,438 10,213

Investment Securities - Sold/Matured - Unclassified - Cash Flow 58,237 84,170 65,800 44,894 47,864

Investment Securities - Purchased - Unclassified - Cash Flow 57,697 77,190 62,924 26,456 37,651

Other Investing Cash Flow - Decrease/(Increase) 0 -1,241.0 -922.0 -2,825.0 -3,116.0

Net Cash Flow from Investing Activities -15,773 -12,223 -27,577 -30,311 -22,680

Financing Cash Flow

Dividends Paid - Cash - Total - Cash Flow 13,811 15,137 16,521 18,135 19,800

Dividends - Common - Cash Paid 13,811 15,137 16,521 18,135 19,800

Stock - Total - Issuance/(Retirement) - Net - Cash Flow -18,401 -21,625 -25,692 -30,855 -20,379

Stock - Issuance/(Retirement) - Net - Excluding Options/Warrants - Cash Flow -18,401 -21,625 -25,692 -30,855 -20,379

Stock - Common - Issuance/(Retirement) - Net - Cash Flow -18,401 -21,625 -25,692 -30,855 -20,379

Stock - Common - Issued/Sold - Cash Flow 1,142.0 1,343.0 1,693.0 1,841.0 1,866.0

Stock - Common - Repurchased/Retired - Cash Flow 19,543 22,968 27,385 32,696 22,245

Debt - Long-Term & Short-Term - Issuance/(Retirement) - Total - Cash Flow -4,000.0 -5,518.0 -3,750.0 -9,023.0 -2,750.0

Debt - Issued/(Reduced) - Long-Term & Short-Term - Cash Flow 0 -5,518.0

Debt - Issued - Long-Term & Short-Term - Cash Flow 0 0

Debt - Reduced - Long-Term & Short-Term - Cash Flow 5,518.0

Debt - Issued/(Reduced) - Short-Term - Total - Cash Flow 0 0

Debt - Issued/(Reduced) - Long-Term - Cash Flow -4,000.0 -3,750.0 -9,023.0 -2,750.0

Debt - Reduced - Long-Term - Cash Flow 4,000.0 3,750.0 9,023.0 2,750.0

Other Financing Cash Flow - Increase/(Decrease) -675.0 -3,751.0 -2,523.0 -863.0 -1,006.0

Net Cash Flow from Financing Activities -36,887 -46,031 -48,486 -58,876 -43,935

Foreign Exchange Effects

Foreign Exchange Effects - Cash Flow -115.0 -201.0 -29.00 -141.0 -194.0

Change in Cash

Net Change in Cash - Total -590.0 2,220.0 648.0 -293.0 20,773

Net Cash from Continuing Operations -590.0 2,220.0 648.0 -293.0 20,773

Net Cash - Beginning Balance 11,946 11,356 13,576 14,224 13,931

Net Cash - Ending Balance 11,356 13,576 14,224 13,931 34,704

Supplemental

Income Taxes - Paid/(Reimbursed) - Cash Flow - Supplemental 8,400.0 12,500 13,400 16,000 23,100

Interest Paid - Cash Flow - Supplemental 2,400.0 2,400.0 2,000.0 1,900.0 1,700.0

CF from Optg Activities before Change in WC & Int Payments 48,319 62,158 77,676 88,589 89,970

Cash Dividends Paid & Common Stock Buyback - Net 32,212 36,762 42,213 48,990 40,179

Common Stock Buyback - Net 18,401 21,625 25,692 30,855 20,379

Depreciation, Depletion & Amortization - Cash Flow 11,682 12,796 11,686 14,460 13,861

Free Cash Flow to Equity 34,260 39,716 52,368 56,126 56,725

Free Cash Flow Net of Dividends 24,449 30,097 39,597 47,014 39,675

Free Cash Flow 38,260 45,234 56,118 65,149 59,475

Dividends Provided/Paid - Common 14,103 15,483 16,871 18,552 20,226

Company Fundamentals - Pension

Company Name Microsoft Corp (MSFT.O)

Country of Exchange United States of America

Country of Headquarters United States of America

TRBC Industry Group Software & IT Services

CF Template IND

Consolidation Basis Consolidated

Scaling Millions

Period Annual

Export Date 24-05-2024

Statement Data 2019 2020 2021 2022 2023

Period End Date 30-06-2019 30-06-2020 30-06-2021 30-06-2022 30-06-2023

Standardized Currency USD USD USD USD USD

Pension - Standardized (Currency: Standardized)

Field Name 30-06-2019 30-06-2020 30-06-2021 30-06-2022 30-06-2023

Income/Expense

Total Pension Plans - Total Pension & Post-Retirement 877.0 1,000.0 1,200.0 1,400.0 1,600.0

Total Pension Plan Expense - Total 877.0 1,000.0 1,200.0 1,400.0 1,600.0

Total Pension Plans - Domestic 877.0 1,000.0 1,200.0 1,400.0 1,600.0

401(K) Plan Expense 877.0 1,000.0 1,200.0 1,400.0 1,600.0

401(K) Plan Expense - Total 877.0 1,000.0 1,200.0 1,400.0 1,600.0

401(K) Plan Expense - Domestic 877.0 1,000.0 1,200.0 1,400.0 1,600.0

Company Fundamentals - Financial Summary

Company Name Microsoft Corp (MSFT.O)

Country of Exchange United States of America

Country of Headquarters United States of America

TRBC Industry Group Software & IT Services

CF Template IND

Consolidation Basis Consolidated

Scaling Millions

Period Annual

Export Date 24-05-2024

Statement Data 2019 2020 2021 2022 2023

Period End Date 30-06-2019 30-06-2020 30-06-2021 30-06-2022 30-06-2023

Standardized Currency USD USD USD USD USD

Financial Summary - Standardized (Currency: Standardized)

Field Name 30-06-2019 30-06-2020 30-06-2021 30-06-2022 30-06-2023

Selected Income Statement Items

Revenue from Business Activities - Total 125,843 143,015 168,088 198,270 211,915

Gross Profit - Industrials/Property - Total 82,933 96,937 115,856 135,620 146,052

Operating Profit before Non-Recurring Income/Expense 42,959 52,959 69,916 83,383 89,694

Earnings before Interest, Taxes, Depreciation & Amortization (EBITDA) 54,929 65,755 81,602 97,983 103,555

Income before Discontinued Operations & Extraordinary Items 39,397 44,281 61,271 72,738 72,361

Selected Balance Sheet Items

Cash & Cash Equivalents 11,356 13,576 14,224 13,931 34,704

Cash & Short-Term Investments 133,819 136,527 130,334 104,757 111,262

Total Assets 286,556 301,311 333,779 364,840 411,976

Debt - Total 78,752 72,823 70,687 64,683 64,304

Common Equity - Total 102,330 118,304 141,988 166,542 206,223

Selected Cash Flow Items

Net Cash Flow from Operating Activities 52,185 60,675 76,740 89,035 87,582

Depreciation, Depletion & Amortization including Impairment - Cash Flow - to Reconcile 11,682 12,796 11,686 14,460 13,861

Capital Expenditures - Net - Cash Flow 13,925 15,441 20,622 23,886 28,107

Net Change in Cash - Total -590.0 2,220.0 648.0 -293.0 20,773

Free Cash Flow Net of Dividends 24,449 30,097 39,597 47,014 39,675

Selected Per Share Data

Dividend Yield - Common Stock - Gross - Issue Specific - % 1.4% 1.0% 0.8% 1.0% 0.8%

Dividend Yield - Common Stock - Net - Issue Specific - % 1.4% 1.0% 0.8% 1.0% 0.8%

EPS - Diluted - excluding Extraordinary Items Applicable to Common - Total 5.08 5.76 8.05 9.65 9.68

Shares used to calculate Diluted EPS - Total 7,753.0 7,683.0 7,608.0 7,540.0 7,472.0

Company Reported Non-GAAP Measures

Non-GAAP Income from Operations - Company Reported 42,959 89,694

Non-GAAP Adjusted Net Earnings - Company Reported 36,830 44,281 60,651 69,447 73,307

Non-GAAP EPS Diluted - Company Reported 4.75 5.76 7.97 9.21 9.81

Profitability / Return

Gross Profit Margin - % 65.9% 67.8% 68.9% 68.4% 68.9%

EBITDA Margin - % 43.7% 46.0% 48.6% 49.4% 48.9%

Operating Margin - % 34.1% 37.0% 41.6% 42.1% 42.3%

Income before Tax Margin - % 34.7% 37.1% 42.3% 42.2% 42.1%

Income Tax Rate - % 9.8% 16.5% 13.8% 13.1% 19.0%

Net Margin - % 31.3% 31.0% 36.5% 36.7% 34.2%

Free Cash Flow 38,260 45,234 56,118 65,149 59,475

Return on Average Common Equity - % (Income available to Common excluding Extraordinary Items) 42.6% 40.1% 47.1% 47.2% 38.8%

Return on Average Total Assets - % (Income before Discontinued Operations & Extraordinary Items) 14.5% 15.1% 19.3% 20.8% 18.6%

Return on Invested Capital - % 24.2% 25.0% 31.4% 33.6% 29.5%

Growth

Revenue from Business Activities - Total 125,843 143,015 168,088 198,270 211,915

Operating Profit before Non-Recurring Income/Expense 42,959 52,959 69,916 83,383 89,694

Earnings before Interest, Taxes, Depreciation & Amortization (EBITDA) 54,929 65,755 81,602 97,983 103,555

Income before Discontinued Operations & Extraordinary Items 39,397 44,281 61,271 72,738 72,361

EPS - Diluted - excluding Extraordinary Items Applicable to Common - Total 5.08 5.76 8.05 9.65 9.68

Common Shares - Outstanding - Total 7,643.0 7,571.0 7,519.0 7,464.0 7,432.0

Financial Strength / Leverage

Total Debt Percentage of Total Assets 27.5% 24.2% 21.2% 17.7% 15.6%

Total Debt Percentage of Total Capital 43.5% 38.1% 33.2% 28.0% 23.8%

Total Debt Percentage of Total Equity 77.0% 61.6% 49.8% 38.8% 31.2%

Debt Service 7,689.5 7,652.0 8,922.0 8,399.0 7,094.5

Debt Service Percentage of Normalized after Tax Profit 19.8% 17.3% 14.8% 11.6% 9.6%

Interest Coverage Ratio 15.99 20.44 29.80 40.42 45.58

Dividend Coverage - % 279.4% 286.0% 363.2% 392.1% 357.8%

Earnings Retention Rate 0.64 0.65 0.72 0.74 0.72

Dividend Payout Ratio - % 35.8% 35.0% 27.5% 25.5% 28.0%

Enterprise Value Breakdown

Market Capitalization 1,026,511 1,543,306 2,040,304 1,916,979 2,530,893

Debt - Total 78,752 72,823 70,687 64,683 64,304

Cash & Short Term Investments - Total 133,819 136,527 130,334 104,757 111,262

Enterprise Value 971,444 1,479,602 1,980,657 1,876,905 2,483,935

Dupont / Earning Power

Asset Turnover 0.46 0.49 0.53 0.57 0.55

Income before Tax Margin - % 34.7% 37.1% 42.3% 42.2% 42.1%

Pretax ROA - % 16.0% 18.0% 22.4% 24.0% 23.0%

Total Assets to Total Shareholders Equity - including Minority Interest & Hybrid Debt 2.95 2.66 2.44 2.26 2.08

Pretax ROE - % 47.2% 48.1% 54.6% 54.3% 47.9%

Tax Complement 0.90 0.83 0.86 0.87 0.81

Return on Average Common Equity - % (Income available to Common excluding Extraordinary Items) 42.6% 40.1% 47.1% 47.2% 38.8%

Earnings Retention Rate 0.64 0.65 0.72 0.74 0.72

Reinvestment Rate - % 27.3% 26.1% 34.1% 35.1% 28.0%

Productivity

Net Income after Tax per Employee 286,524 288,476 356,227 361,881 327,425

Sales per Employee 915,222 931,694 977,256 986,418 958,891

Total Assets per Employee 1,989,972 1,848,534 1,844,083 1,650,860 1,864,145

Liquidity

Current Ratio 2.53 2.52 2.08 1.78 1.77

Quick Ratio 2.50 2.49 2.05 1.75 1.75

Working Capital to Total Assets 0.37 0.36 0.29 0.20 0.19

Operating

Accounts Receivable Turnover 4.49 4.65 4.80 4.82 4.56

Average Receivables Collection Days 81.44 78.74 76.27 75.97 80.27

Payables Turnover 4.77 4.21 3.77 3.67 3.55

Average Payables Payment Days 76.76 87.02 97.03 99.79 103.1

Inventory Turnover 18.16 23.28 23.06 19.65 21.10

Average Inventory Days 20.15 15.72 15.87 18.63 17.34

Average Net Trade Cycle Days 24.83 7.43 -4.88 -5.19 -5.46

Company Fundamentals - Valuation

Company Name Microsoft Corp (MSFT.O)

Country of Exchange United States of America

Country of Headquarters United States of America

TRBC Industry Group Software & IT Services

CF Template IND

Consolidation Basis Consolidated

Scaling Millions

Period Annual

Export Date 24-05-2024

Statement Data 2019 2020 2021 2022 2023

Period End Date 30-06-2019 30-06-2020 30-06-2021 30-06-2022 30-06-2023

Standardized Currency USD USD USD USD USD

Valuation - Standardized (Currency: Standardized)

Field Name 30-06-2019 30-06-2020 30-06-2021 30-06-2022 30-06-2023

Enterprise Value

Enterprise Value 971,444 1,479,602 1,980,657 1,876,905 2,483,935

Enterprise Value, 5 Year Average 560,693 797,381 1,124,852 1,402,628 1,758,509

Market Capitalization

Market Capitalization 1,026,511 1,543,306 2,040,304 1,916,979 2,530,893

Market Capitalization, 5 Year Average 615,140 852,370 1,179,987 1,456,948 1,811,599

Price Close

Price Close (End of Period) 134.0 203.5 270.9 256.8 340.5

Price Close (End of Period), 5 Year Average 79.36 111.2 155.2 192.8 241.2

FOCF Yield

Free Cash Flow Yield - % 3.7% 2.9% 2.7% 3.4% 2.3%

Free Cash Flow Yield - %, 5 Year Average 4.8% 4.0% 3.4% 3.2% 2.9%

Dividend Yield

Dividend Yield - Common Stock - Net - Issue Specific - % 1.4% 1.0% 0.8% 1.0% 0.8%

Dividend Yield - Common Stock - Net - Issue Specific - %, 5 Year Average 1.9% 1.5% 1.2% 1.1% 0.9%

Dividend Yield - Common Stock - Gross - Issue Specific - % 1.4% 1.0% 0.8% 1.0% 0.8%

Dividend Yield - Common Stock - Gross - Issue Specific - %, 5 Year Average 2.0% 1.5% 1.2% 1.1% 0.9%

Price to Book

Price to Book Value per Share - Issue Specific 10.01 13.02 14.35 11.51 12.27

Price to Book Value per Share - Issue Specific, 5 Year Average 7.25 9.21 11.08 11.90 12.31

Price to Tangible Book

Price to Tangible Book Value per Share 19.48 22.69 24.11 21.85 19.62

Price to Tangible Book Value per Share, 5 Year Average 12.73 16.91 20.60 21.95 21.46

Price to Sales

Price to Revenue from Business Activities - Total per Share 8.25 10.93 12.26 9.77 12.01

Price to Revenue from Business Activities - Total per Share, 5 Year Average 6.06 7.65 9.30 9.90 10.80

Price to FOCF

Price to Free Cash Flow per Share 27.15 34.57 36.73 29.72 42.78

Price to Free Cash Flow per Share, 5 Year Average 20.89 25.18 29.45 31.11 34.65

Price to CF Per Share

Price to Cash Flow per Share 20.22 27.39 28.25 22.17 29.51

Price to Cash Flow per Share, 5 Year Average 18.21 20.58 23.36 23.84 25.78

Price to Diluted EPS

Price to EPS - Diluted - excluding Extraordinary Items Applicable to Common - Total 26.36 35.31 33.64 26.62 35.16

Price to EPS - Diluted - excluding Extraordinary Items Applicable to Common - Total, 5 Year Average 24.40 27.07 29.80 29.72 31.54

Price to Normalized Diluted EPS

Price to EPS - Diluted - excluding Extraordinary Items - Normalized - Total 26.77 35.26 34.23 26.75 34.52

Price to EPS - Diluted - excluding Extraordinary Items - Normalized - Total, 5 Year Average 7.25 9.21 11.08 11.90 12.31

PEG Ratio

PE Growth Ratio 0.85 2.63 0.85 1.35 90.85

PE Growth Ratio, 5 Year Average 1.73 0.86 1.16 1.22 1.57

EV to Sales

Enterprise Value to Revenue from Business Activities - Total 7.72 10.35 11.78 9.47 11.72

Enterprise Value to Revenue from Business Activities - Total, 5 Year Average 5.42 7.03 8.73 9.41 10.38

EV to EBITDA

Enterprise Value to Earnings before Interest, Taxes, Depreciation & Amortization (EBITDA) 17.69 22.50 24.27 19.16 23.99

Enterprise Value to Earnings before Interest, Taxes, Depreciation & Amortization (EBITDA), 5 Year Average 13.40 16.55 19.48 20.29 21.77

EV to CFO

Enterprise Value to Net Cash Flow from Operating Activities 18.62 24.39 25.81 21.08 28.36

Enterprise Value to Net Cash Flow from Operating Activities, 5 Year Average 14.16 17.37 20.60 21.74 24.01

EV to FOCF

Enterprise Value to Free Cash Flow 25.39 32.71 35.29 28.81 41.76

Enterprise Value to Free Cash Flow, 5 Year Average 18.69 23.17 27.67 29.59 33.28

You might also like

- New Heritage Doll Capital Budgeting Case SolutionDocument5 pagesNew Heritage Doll Capital Budgeting Case SolutiontroyanxNo ratings yet

- The Champion Legal Ads 04-29-21Document40 pagesThe Champion Legal Ads 04-29-21Donna S. SeayNo ratings yet

- Trial at Chernobyl Disaster: Karpan N.VDocument61 pagesTrial at Chernobyl Disaster: Karpan N.VТ-72урал-1100% (2)

- New Heritage Doll CompanDocument9 pagesNew Heritage Doll CompanArima ChatterjeeNo ratings yet

- OracleDocument16 pagesOraclepgpwe20007No ratings yet

- AbobeDocument15 pagesAbobepgpwe20007No ratings yet

- CF-Export-26-02-2024 43Document12 pagesCF-Export-26-02-2024 43v4d4f8hkc2No ratings yet

- CF-Export-26-02-2024 41Document11 pagesCF-Export-26-02-2024 41v4d4f8hkc2No ratings yet

- September Quarter 2023 ResultsDocument20 pagesSeptember Quarter 2023 ResultsPony BakerNo ratings yet

- Annual Report 2013Document102 pagesAnnual Report 2013renedosrNo ratings yet

- New Heritage Doll Company: Capital Budgeting Exhibit 1 Selected Operating Projections For Match My Doll Clothing Line ExpansionDocument9 pagesNew Heritage Doll Company: Capital Budgeting Exhibit 1 Selected Operating Projections For Match My Doll Clothing Line ExpansionIleana StirbuNo ratings yet

- CF-Export-26-02-2024 11Document11 pagesCF-Export-26-02-2024 11v4d4f8hkc2No ratings yet

- Calculation of Free Cashflow To The Firm: DCF Valuation (Amounts in Millions)Document1 pageCalculation of Free Cashflow To The Firm: DCF Valuation (Amounts in Millions)Prachi NavghareNo ratings yet

- International Final 2016 - Scenario 16C1Document24 pagesInternational Final 2016 - Scenario 16C1souvik_cNo ratings yet

- New Heritage Doll Company Capital Budgeting SolutionDocument10 pagesNew Heritage Doll Company Capital Budgeting SolutionBiswadeep royNo ratings yet

- Nagarro AR 2022 - ENDocument175 pagesNagarro AR 2022 - ENaleix720No ratings yet

- Revenue Production Costs: Initial ExpendituresDocument16 pagesRevenue Production Costs: Initial Expendituresajeetkumarverma 2k21dmba20No ratings yet

- Big Data - New - 19401Document14 pagesBig Data - New - 19401Ahmad Subrata WijayaNo ratings yet

- Análisis Caso New Heritage - Nutresa LinaDocument27 pagesAnálisis Caso New Heritage - Nutresa LinaSARA ZAPATA CANONo ratings yet

- SS Cloud Business PlanDocument5 pagesSS Cloud Business Planminhbu114No ratings yet

- Bank 11Document10 pagesBank 11sonicholasfilesNo ratings yet

- Corpfin Case 2Document5 pagesCorpfin Case 2rthakkar97No ratings yet

- Financial Model For A Potential M&A TransactionDocument206 pagesFinancial Model For A Potential M&A TransactionZheena OcampoNo ratings yet

- Xls307 Xls EngDocument13 pagesXls307 Xls EngvhgomezrNo ratings yet

- December Quarter 2023 ResultsDocument21 pagesDecember Quarter 2023 ResultsPony BakerNo ratings yet

- ROTODocument13 pagesROTOmslamh981No ratings yet

- IcsiDocument12 pagesIcsiUday NegiNo ratings yet

- 3-SIB Infy TemplateDocument8 pages3-SIB Infy TemplateKunal ChawlaNo ratings yet

- Presented by Haily Shah (SYBFM A044)Document19 pagesPresented by Haily Shah (SYBFM A044)HailyNo ratings yet

- Yearly ReportDocument20 pagesYearly ReportForrulh AbdullahNo ratings yet

- Vietnam DX SaaS Landscape 2022 enDocument32 pagesVietnam DX SaaS Landscape 2022 enLinh Nguyễn VănNo ratings yet

- CD Projekt Group Presentation q1 2024 1Document17 pagesCD Projekt Group Presentation q1 2024 1applechip5513No ratings yet

- Mid Term Exam - FACD - 19P186Document12 pagesMid Term Exam - FACD - 19P186Aditya AnandNo ratings yet

- Mitra Integrasi Informatika Company Profile 2023Document73 pagesMitra Integrasi Informatika Company Profile 2023claudius.andikaNo ratings yet

- Org Mis April 21Document2,560 pagesOrg Mis April 21INDLA HARSHAVARDHANREDDYNo ratings yet

- Bpo PsebDocument16 pagesBpo PsebJilani HussainNo ratings yet

- 2023 ADB Asia SME Monitor - PhilippinesDocument15 pages2023 ADB Asia SME Monitor - PhilippinesCyrishNo ratings yet

- Tarea Heritage Doll CompanyDocument6 pagesTarea Heritage Doll CompanyFelipe HidalgoNo ratings yet

- Stastical Calculations of Gul AhmedDocument18 pagesStastical Calculations of Gul AhmedM.Junaid -ur-RehmanNo ratings yet

- Financial Statements enDocument30 pagesFinancial Statements enNHÃ THY TRẦN PHƯƠNGNo ratings yet

- Business Case Example 1.1Document15 pagesBusiness Case Example 1.1Sergei MoshenkovNo ratings yet

- Prezentacja Wynikowa Grupy CD Projekt Fy 2023 en 1Document19 pagesPrezentacja Wynikowa Grupy CD Projekt Fy 2023 en 1applechip5513No ratings yet

- Indonesian Footwear Industry Country Report 2017: Presented at 36Th Ifc 2017 of Cifa at DhakaDocument30 pagesIndonesian Footwear Industry Country Report 2017: Presented at 36Th Ifc 2017 of Cifa at DhakaDuyên MỹNo ratings yet

- FIN201 Assignment Cisco Ratio AnalysisDocument23 pagesFIN201 Assignment Cisco Ratio AnalysisDark RushNo ratings yet

- Ejercicio 2 ParcialDocument18 pagesEjercicio 2 ParcialHector Armando FernandezNo ratings yet

- CF-Export-05-03-2024 10Document11 pagesCF-Export-05-03-2024 10v4d4f8hkc2No ratings yet

- Amazon - MGM AcquisitionDocument8 pagesAmazon - MGM AcquisitionPinaki TikadarNo ratings yet

- 1 Eco - 21155Document22 pages1 Eco - 21155KLN CHUNo ratings yet

- COURSE 7 ECONOMETRICS 2009 Multiple RegressionDocument18 pagesCOURSE 7 ECONOMETRICS 2009 Multiple RegressionMihai StoicaNo ratings yet

- America'S Top Companies: Available On The IpadDocument4 pagesAmerica'S Top Companies: Available On The IpadMichele KongNo ratings yet

- Individual AssessmentDocument10 pagesIndividual AssessmentSaujanya PrasoonNo ratings yet

- Financing The Growth: 4 March 2011Document9 pagesFinancing The Growth: 4 March 2011aagarwal_46No ratings yet

- PGP Heritage Doll ExcelDocument5 pagesPGP Heritage Doll ExcelPGP37 392 Abhishek SinghNo ratings yet

- KPI Result H2 2023Document12 pagesKPI Result H2 2023uyeekNo ratings yet

- Dietrich Farms - Worksheet 2Document39 pagesDietrich Farms - Worksheet 2spam.ml2023No ratings yet

- Colgate DCF ModelDocument19 pagesColgate DCF Modelpallavi thakurNo ratings yet

- Ratio Analysis Reliance IndustriesDocument5 pagesRatio Analysis Reliance IndustriesTamish Gambhir0% (1)

- The Discounted Free Cash Flow Model For A Complete BusinessDocument1 pageThe Discounted Free Cash Flow Model For A Complete BusinessKhalil LaamiriNo ratings yet

- "Turning Glove From GOLD To DIAMOND": Supermax Corporation Berhad Analyst Briefing Slides 4Q'2020 RESULTSDocument35 pages"Turning Glove From GOLD To DIAMOND": Supermax Corporation Berhad Analyst Briefing Slides 4Q'2020 RESULTSmroys mroysNo ratings yet

- DiviđenDocument12 pagesDiviđenPhan GiápNo ratings yet

- IT Sector UpdateDocument12 pagesIT Sector UpdateWangchukNo ratings yet

- RoD BloodlineDocument13 pagesRoD BloodlineChris FalcoNo ratings yet

- Uuwi Na Si Udong, Buto't Balat Film AnalysisDocument2 pagesUuwi Na Si Udong, Buto't Balat Film AnalysisJOHN MEGGY SALINASNo ratings yet

- A Photo & Toll Road Log From San Luis Rio Colorado To Rocky PointDocument2 pagesA Photo & Toll Road Log From San Luis Rio Colorado To Rocky PointRockyPointGoNo ratings yet

- What Are The Different Types of Stocks Available in The Market?Document5 pagesWhat Are The Different Types of Stocks Available in The Market?rachit2383No ratings yet

- Contemporary ArtsDocument2 pagesContemporary ArtsKess MontallanaNo ratings yet

- Ex Nihilo CreationDocument3 pagesEx Nihilo CreationAnonymous b7ccvQSQpNo ratings yet

- SummaryDocument10 pagesSummaryIliyana IlievaNo ratings yet

- Obligations: GR: Obligation Is Not Demandable Before Lapse of The PeriodDocument1 pageObligations: GR: Obligation Is Not Demandable Before Lapse of The PeriodDiane CabiscuelasNo ratings yet

- The Prophetic Way of Purgation of InnerselfDocument30 pagesThe Prophetic Way of Purgation of InnerselfSultan ul Faqr Publications100% (3)

- Impact of Dividend Policy On Share PricesDocument16 pagesImpact of Dividend Policy On Share PricesAli JarralNo ratings yet

- Letter To The Editor - NOTESDocument4 pagesLetter To The Editor - NOTESSonia100% (1)

- ADR Test 2 MaterialsDocument9 pagesADR Test 2 MaterialsAditya RsNo ratings yet

- Compliance Checklist - HSE-OH-ST07 Cont Welfare MGMTDocument5 pagesCompliance Checklist - HSE-OH-ST07 Cont Welfare MGMTjerinNo ratings yet

- National Bookstore's Founder Maria Socorro "Nanay Coring" Cancio RamosDocument12 pagesNational Bookstore's Founder Maria Socorro "Nanay Coring" Cancio RamosRyan Joshua FloresNo ratings yet

- Non-Directive Play Therapy As A Means Recreating Optimal Infant Socialization PatternsDocument10 pagesNon-Directive Play Therapy As A Means Recreating Optimal Infant Socialization Patternscristina.balasa777No ratings yet

- Presentation 1Document10 pagesPresentation 1vjy stvkbNo ratings yet

- MBA 706 Mod 2Document35 pagesMBA 706 Mod 2Kellie ParendaNo ratings yet

- Kenya Tourism and Elephants - Case StudyDocument3 pagesKenya Tourism and Elephants - Case StudyAloo Charles. OchukaNo ratings yet

- Sigmund Freud: Psychosexual DevelopmentDocument6 pagesSigmund Freud: Psychosexual DevelopmentKarlo Gil ConcepcionNo ratings yet

- Kamaya - Http-Dahamvila-Blogspot-ComDocument19 pagesKamaya - Http-Dahamvila-Blogspot-ComDaham Vila Blogspot100% (1)

- 2023 Memo On Annual Physical Examination of DepEd PersonnelDocument3 pages2023 Memo On Annual Physical Examination of DepEd PersonnelJoy Valerie100% (1)

- DigitalmarketingDocument11 pagesDigitalmarketingEngr Muhammad Mustafijur RahmanNo ratings yet

- Retail Location TheoriesDocument24 pagesRetail Location Theoriesdhruvbarman1100% (1)

- F-Conduct, Discipline & Appeal Rules-Chapter-2 - 0 PDFDocument68 pagesF-Conduct, Discipline & Appeal Rules-Chapter-2 - 0 PDFSaurabh YadavNo ratings yet

- Alsaada, Et Al vs. City of Columbus, Et Al.Document81 pagesAlsaada, Et Al vs. City of Columbus, Et Al.Chanda Brown33% (3)

- Notice of DefaultDocument1 pageNotice of DefaultS Pablo AugustNo ratings yet

- Ballot Guidelines For General Secretary Election: (Insert Date)Document12 pagesBallot Guidelines For General Secretary Election: (Insert Date)Paul WaughNo ratings yet

- Case Study 6 - Team 3 - Diversity in Global OrganizationDocument13 pagesCase Study 6 - Team 3 - Diversity in Global OrganizationWalker SkyNo ratings yet