Professional Documents

Culture Documents

Bond Price Duration and Convexity CT10 Example - BLANK

Bond Price Duration and Convexity CT10 Example - BLANK

Uploaded by

Mohitkumar Shah0 ratings0% found this document useful (0 votes)

0 views3 pagesCopyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

0 views3 pagesBond Price Duration and Convexity CT10 Example - BLANK

Bond Price Duration and Convexity CT10 Example - BLANK

Uploaded by

Mohitkumar ShahCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 3

Table of Content

Bond Price Duration and Convexity Exercise Strictly Confidential

Notes

This Excel model is for educational purposes only and should not be used for any other reason.

All content is Copyright material of CFI Education Inc.

https://corporatefinanceinstitute.com/

© 2019 CFI Education Inc.

All rights reserved. The contents of this publication, including but not limited to all written material, content layout, images, formulas, and code, are protected under international copyright and trademark laws.

No part of this publication may be modified, manipulated, reproduced, distributed, or transmitted in any form by any means, including photocopying, recording, or other electronic or mechanical methods,

© Corporate Finance Institute. All rights reserved.

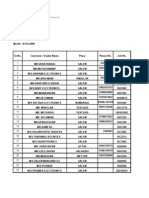

Bond Price, Duration, and Convexity Exercise

Inputs Periods (t) Coupon Cash Flow Face Value Total Cash Flow

Face Value

Number of Years to Maturity

Coupon Payment Frequency (f)

Coupon Rate (r)

Yield-To-Maturity (Y)

Change in Yield

Number of Periods (n)

Discount Rate Per Period

Outputs

Bond Price $0.00

Macaulay Duration 0.000 Years

Modified Duration 0.000

Risk 0.000

DV01 0.0000

Convexity 0.0000

Duration Effect 0.00%

Convexity Adjustment 0.0000%

Change in Price ($) $ -

Discount Factor PV t*PV t*PV/f*Price t^2+t PV*(t^2+t) (PV*(t^2+t)/(f^2*Price)

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- LA Times 0412Document32 pagesLA Times 0412Flavia Cavalcante Oliveira KoppNo ratings yet

- Urvi GuptaDocument11 pagesUrvi GuptaUrvi GuptaNo ratings yet

- PMC - Scope of ServicesDocument8 pagesPMC - Scope of ServicesAr Kajal GangilNo ratings yet

- Eagle Software India PVT LTD - Google SearchDocument1 pageEagle Software India PVT LTD - Google Searchyuva siranNo ratings yet

- Tata MotorsDocument12 pagesTata MotorsAbhijeet KaushikNo ratings yet

- Biaco vs. Phil. Countryside Rural BankDocument5 pagesBiaco vs. Phil. Countryside Rural BankMykaNo ratings yet

- Solutions Manual: An Introduction To TaxDocument21 pagesSolutions Manual: An Introduction To Taxyea okayNo ratings yet

- Herbalife International India, Pvt. LTD.: Digitally Signed by Arnab Chakraborty Date: 09-Dec-2023 04:16:27 ISTDocument2 pagesHerbalife International India, Pvt. LTD.: Digitally Signed by Arnab Chakraborty Date: 09-Dec-2023 04:16:27 ISTLalit bobadeNo ratings yet

- T7 B12 Flight 93 Calls - Toshiya Kuge FDR - Entire Contents - 2 FBI 302s - No Familiy Inquries To UA Re Hijackers 431Document5 pagesT7 B12 Flight 93 Calls - Toshiya Kuge FDR - Entire Contents - 2 FBI 302s - No Familiy Inquries To UA Re Hijackers 4319/11 Document ArchiveNo ratings yet

- BANDocument41 pagesBANquadriganiyuNo ratings yet

- SSF 3044 Sociology of DevelopmentDocument25 pagesSSF 3044 Sociology of DevelopmentKhairul AmriNo ratings yet

- Basic Rack Tooth Gear Profiles DIN 867 - Engineers Edge - WWW - EngineersedgeDocument4 pagesBasic Rack Tooth Gear Profiles DIN 867 - Engineers Edge - WWW - EngineersedgeEducation malarsNo ratings yet

- Indian Patents Act 1970 and Recent AmendmentsDocument7 pagesIndian Patents Act 1970 and Recent AmendmentsHarneet Kaur Kansal0% (1)

- Home Designer Suite 2021 Users GuideDocument122 pagesHome Designer Suite 2021 Users Guiderick.mccort2766No ratings yet

- Foliodete 20230308025134Document1 pageFoliodete 20230308025134marco tapiaNo ratings yet

- Germany: Referat - ClopotelDocument5 pagesGermany: Referat - ClopotelDarius CuceaNo ratings yet

- Bhaichung BhutiyaDocument8 pagesBhaichung BhutiyaPriyankaSinghNo ratings yet

- Airport Planning and Management: Assignment 1Document7 pagesAirport Planning and Management: Assignment 1SharanNo ratings yet

- Statement of Account: 454 L & E Villas Pasolo St. - Pasolo Valenzuela Metro ManilaDocument1 pageStatement of Account: 454 L & E Villas Pasolo St. - Pasolo Valenzuela Metro ManilakurttNo ratings yet

- BPCA Application Form 2023Document11 pagesBPCA Application Form 2023BobNo ratings yet

- Montana 2010 Black Bear RegulationsDocument12 pagesMontana 2010 Black Bear RegulationsAmmoLand Shooting Sports NewsNo ratings yet

- Franchisee Claim Report Format (1) (Version 1)Document32 pagesFranchisee Claim Report Format (1) (Version 1)ramanikarthiNo ratings yet

- TrendMicro Hosted Email SecurityDocument122 pagesTrendMicro Hosted Email Securitymarcianocalvi4611No ratings yet

- Vehicle Collision With Student Pedestrians Crossing in Rochester Indiana NTSB ReportDocument70 pagesVehicle Collision With Student Pedestrians Crossing in Rochester Indiana NTSB ReportFOX59/CBS4No ratings yet

- Transaction Summary - 10 July 2021 To 6 August 2021: Together We Make A DifferenceDocument2 pagesTransaction Summary - 10 July 2021 To 6 August 2021: Together We Make A Differencebertha kiaraNo ratings yet

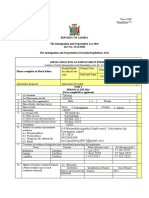

- ザンビアビザ申請書Page65Document6 pagesザンビアビザ申請書Page65Portipher J MungaNo ratings yet

- Chapter 7 - 18may 2022Document51 pagesChapter 7 - 18may 2022Hazlina HusseinNo ratings yet

- The 1935 Philippine ConstitutionDocument17 pagesThe 1935 Philippine Constitutionkfbrand71100% (8)

- Q.1. (E) Comparison ChartDocument19 pagesQ.1. (E) Comparison Chartshiv mehraNo ratings yet

- PAS 36 Impairment of AssetsDocument8 pagesPAS 36 Impairment of AssetswalsondevNo ratings yet