Professional Documents

Culture Documents

Azizy2023 Effect of Fixed Assets and Local Revenue on Maintenance Expenditure

Azizy2023 Effect of Fixed Assets and Local Revenue on Maintenance Expenditure

Uploaded by

nangat lenakCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Azizy2023 Effect of Fixed Assets and Local Revenue on Maintenance Expenditure

Azizy2023 Effect of Fixed Assets and Local Revenue on Maintenance Expenditure

Uploaded by

nangat lenakCopyright:

Available Formats

Proceedings Conference on Economics and Business Innovation

Volume 3, Issue 1, 2023

The Effect Of Fixed Assets And Local Revenue On

Maintenance Expenditure

Nurul Azizy1, Indayani2, Syukriy Abdullah3

1

Accounting, Faculty of Economics and Business, Syiah Kuala University, Indonesia

2

Accounting, Faculty of Economics and Business, Syiah Kuala University, Indonesia

3

Accounting, Faculty of Economics and Business, Syiah Kuala University, Indonesia

*Corresponding Author: nurulazizy185@gmail.com

ABSTRACT

The purpose of this study was to examine the effect of fixed assets and local original

income on maintenance expenditure on local governments in Aceh. The population in

this study is all local governments in Aceh province, totaling 23 local governments

during the 2015-2019 period. Data analysis in this study used multiple linier

regression. The results of the study show that fixed assets and local original income

have a joint effect on maintenance expenditure on local government in Aceh. Fixed

assets have effect on maintenance expenditure, and local original income has an effect

on maintenance expenditure on local governments in Aceh.

Keywords: Fixed Assets, Local Regional Income, and Maintenance Expenditure

Received: January Accepted: February, Published: March

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

https://creativecommons.org/licenses/by-sa/4.0/ 197

Proceedings Conference on Economics and Business Innovation

Volume 3, Issue 1, 2023

INTRODUCTION

The existence of regional autonomy causes the regions to gain the power

to regulate their own regional financial budgeting. The budgeting is related to

revenue, financing, and regional expenditure. One of the sub-expenditures for

goods and services proposed by SKPD every fiscal year is maintenance

expenditure. Although the value of maintenance expenditure realisation is not

very large when compared to other regional expenditures, maintenance

expenditure is important to maintain the condition of assets.

Although maintenance expenditure is always realised almost one hundred

percent, there are still regional assets that are not properly maintained and

maintained. In fact, there are still local governments that record assets in the

balance sheet even though the assets can no longer be used or their whereabouts

are unknown. For example, there are fixed assets in the Langsa City Health Office

that are not properly maintained so that they are withdrawn by the mayor. This

also happened in East Aceh Regency where the official residence for Rantau

Seulamat Health Centre officers was abandoned and not maintained like a

warehouse whose yard was filled with weeds (SerambiNews, 2020).

Maintenance expenditure is the budget item that is most often fictitious in

its accountability (Sinaga and Sidabutar, 2012). This happens because

maintenance expenditures do not have to have physical evidence so that a lot of

accountability is found related to fictitious regional asset maintenance

expenditures (Tarihoran, 2016). BPK found several findings related to the

management of regional assets in Indonesia, namely: first, fixed assets are not

found or controlled by parties that should not be. Second, there is no sign of

ownership, and third, the elimination or depreciation does not meet the applicable

regulations (IHPS I BPK RI, 2019). This problem was also found in local

governments in Aceh, for example North Aceh District where in the 2018 fiscal

year as many as forty official vehicles were used by unauthorised parties and as

many as nine ambulance units were unknown.

From observations of several LKPDs in Aceh, there are allocations for

maintenance that are not managed properly, such as in Aceh Tamiang District,

Central Aceh District, and Subulussalam City in the 2017 fiscal year it was found

that the accountability related to maintenance expenditures was not in accordance

with the provisions and also found differences between SPJ evidence and real

evidence of purchases.

Maintenance expenditures are funded from regional revenues, including

PAD. Regions are free to utilise PAD for any expenditure as long as it is in

accordance with local regulations. However, PAD in Aceh is only able to finance

12.12 per cent of regional expenditure (Regional Office of DGT Aceh, 2019).

Based on the phenomena and research results that have occurred so far, it

is clear that the value of assets owned by a region is related to maintenance

expenditures. Research by Purba (2013) and Tarihoran (2016) found that the value

of fixed assets has a positive influence on the estimated maintenance expenditure.

The same thing was found by Brillianto and Nugroho (2019) who stated that in

allocating maintenance expenditure, BPPK considers the value of its fixed assets.

However, different things were found by Andini et.al (2022) where fixed assets

have no influence on maintenance spending.

Research by Sembiring (2009), Widiasa et al. (2014), and Ramadani

Received: January Accepted: February, Published: March

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

https://creativecommons.org/licenses/by-sa/4.0/ 198

Proceedings Conference on Economics and Business Innovation

Volume 3, Issue 1, 2023

(2019) found the results that PAD had an effect on maintenance spending, but

Purba (2013) and Budi (2019) found that PAD had no effect on maintenance

spending.

Based on the previous explanation, the problem formulation proposed is:

Do fixed assets and local own-source revenues jointly affect maintenance

expenditures?, Do fixed assets affect maintenance expenditures?, and Do local

own-source revenues affect maintenance expenditures?

This research aims to examine the effect of fixed assets and local revenue

together on maintenance expenditure, to examine the effect of fixed assets on

maintenance expenditure, and to examine the effect of local revenue on

maintenance expenditure.

For academics, this research is expected to be a reference and as a

comparison for further researchers. For practitioners, the results of this study are

expected to provide information for local governments so that they can be input

in formulating future policies.

THEORETICAL STUDIES

Fixed Assets

According to Kawatu (2019), fixed assets are tangible assets owned by

local governments that function in their regional operational activities and for the

benefit of the community.

Furthermore, according to Afiah et al. (2020), fixed assets are tangible

assets with an economic life exceeding twelve months whose acquisition purpose

is to be used in the context of local government activities or for the benefit of the

community. In order for fixed assets to function properly, local governments

allocate funds for their maintenance.

Local Revenue

According to Nurkholis and Khusaini (2019), regional own-source

revenue is defined as part of the local government's income where its acquisition

comes from the region's own capabilities, where the collection rules are based on

regional regulations that are adjusted to the current law.

Then according to Rohmah and Sa'adah (2021), regional own-source

revenue is a regional income whose revenue is caused by the potential of the

region and is compelling because it has its own regulations that adjust to the

legislation (Rohmah and Sa'adah, 2021).

The use of PAD by local governments is not limited in laws and

regulations. This means that local governments can use funds from PAD for

maintenance spending.

Maintenance Expenditure

Maintenance expenditure is the cost of keeping assets or property owned

by the government well maintained (Sadat, 2022). Maintenance expenditure

according to Effendi (2021) is expenditure incurred to maintain the condition of

fixed assets to match the original condition.

Maintenance expenditure can be financed from several revenues owned by

Received: January Accepted: February, Published: March

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

https://creativecommons.org/licenses/by-sa/4.0/ 199

Proceedings Conference on Economics and Business Innovation

Volume 3, Issue 1, 2023

a region such as own revenue, general allocation funds, and special allocation

funds.

Previous Research

Research by Widiasa et al. (2014) examined the relationship between

capital expenditure and local revenue with maintenance expenditure in the

Buleleng Regency government. Their research found that together or alone the

two independent variables had an effect on maintenance expenditure.

Research by Brillianto and Nugroho (2019), examines the effect of fixed asset

value and capital expenditure on the allocation of maintenance expenditure at

BPPK. Their research found that in allocating maintenance expenditure the value

of fixed assets is considered while capital expenditure is not.

Tama et al. (2021) examined the relationship between the realisation of

maintenance expenditure, the book value of fixed assets, and the realisation of

capital expenditure on the amount of maintenance estimates in work units within

the Supreme Audit Agency (BPK). The results of their study found that the three

variables had a relationship with the maintenance estimate simultaneously while

individually only the book value of fixed assets and the realisation of maintenance

expenditures.

Framework of Thought

The Effect of Fixed Assets on Maintenance Expenditure

Local governments have fixed assets whose value can increase or decrease each

year. The addition of fixed assets occurs due to the realisation of the implementation

of capital expenditure, or from grants. There are several causes of the value of fixed

assets to decrease such as damage, loss, and transfer such as donated or sold.

One of the characteristics of fixed assets is that they have a useful life of more

than one year. Therefore, to support its performance, the local government requires

costs so that the condition of the asset is always stable so that it can perform its

function properly until its useful life expires. The expenditure is maintenance

expenditure, so it is suspected that an increase in fixed assets in local government

will increase its maintenance expenditure.

This hypothesis is supported by the research results of Sidabutar and Sinaga

(2012) and Purba (2013) proving that directly the value of fixed assets has a positive

effect on maintenance expenditure. Furthermore, Brillianto and Nugroho (2019)

also state that the value of fixed assets owned by the BPPK is taken into account in

allocating maintenance expenditures.

H2 : Fixed assets have a positive influence on maintenance expenditure

Received: January Accepted: February, Published: March

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

https://creativecommons.org/licenses/by-sa/4.0/ 200

Proceedings Conference on Economics and Business Innovation

Volume 3, Issue 1, 2023

The Effect of Local Revenue on Maintenance Expenditure

There have been many studies on the relationship between PAD and regional

expenditure, such as Blackley (1986), Von Furstenberg et al. (1986), and Aziz et al.

(2000). The findings of these studies prove that local revenue will have an influence

on local expenditure budgets, especially those sourced from taxes. According to

Abdullah and Halim (2004), local government spending will adjust to local revenue.

PAD is one of the regional revenues that can be used to finance maintenance

expenditures, so it is suspected that an increase in PAD will increase maintenance

expenditures in local governments.

This is in accordance with the results of research by Sembiring (2009), Widiasa

et al. (2014) and Ramadani (2019) found that maintenance expenditure is positively

influenced by regional own-source revenue.

H3 : Local own-source revenue has a positive influence on maintenance

expenditure

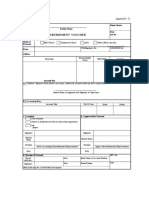

The framework for this research is summarised as follows:

G

a

m

b

a

r

S

E

Q

G

a

m Source: Data processed (2022 )

b

a

RESEARCH METHODS r

Scope of Research \

This research

* aims to provide information on the effect of fixed assets and

A

local revenue on the realisation of maintenance expenditure. Local governments

in Aceh are the objectR of this research. The data used in this study spans five years,

A

starting from 2015 B to 2019.

I

Data Type andCSource

This study 1 uses secondary data sourced from the Audit Report on the

Financial Statements . of the district / city Regional Government in Aceh Province

in 2015-2019. K

e

r

Data Collectiona Technique

The datan in this research was collected using two methods, namely

documentation and g literature study. The documentation technique is carried out

by collecting existingk data on records that are already available in the Local

a

Government Financial Statements of local governments in Aceh in 2015-2019.

P

Meanwhile, literature e study can be done by retrieving relevant data related to this

m

i

Received: January Accepted:

k February, Published: March

This work

i is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

https://creativecommons.org/licenses/by-sa/4.0/

r 201

a

n

Proceedings Conference on Economics and Business Innovation

Volume 3, Issue 1, 2023

research from other sources such as books, scientific articles, and news.

Population and Sample

In this research, the population is the entire local government in Aceh in

2015-2019, totalling 23 local governments. In this research, the sampling uses the

census method, where all members of the population are included in the sample

(Sugiyono, 2017).

Operational Definition of Variables

a. Fixed Assets

Fixed asset variables are defined as assets that have a form and have an

economic life of more than a year and function in local government operations.

Measurement for fixed asset variables uses the value of equipment and machinery,

and buildings and structures presented in the balance sheet.

b. Local Owned Revenue

Local revenue is revenue from the potential owned by the region, such as

local income obtained from the collection of local levies and taxes, then the results

of the management of local assets that are separated, as well as other legitimate

own revenues. This variable is measured using the realised value of PAD in

LKPD.

c. Maintenance expenditure

Maintenance expenditure is a budget allocation issued by the region aimed

at maintaining the condition of its fixed assets so that they are always in a state

ready for use. Measurement for this variable uses the realisation rate of

maintenance expenditure.

Data Analysis Method

The research hypothesis was tested using multiple regression, with the

equation formula displayed as follows:

Description:

Y = Maintenance Expenditure

X1 = Fixed Assets

X2 = Local Revenue

β1, β2 = Coefficient of X1, X2

α = Constant

e = error term.

RESULTS AND DISCUSSION

Descriptive Statistics

This test is an overview of data that can be seen from the mean, standard

deviation, minimum, and maximum values of each research variable. There are

115 data obtained from 23 local governments in Aceh with a research time span

of five years, namely 2015 to 2019. The following descriptive statistics table is

displayed.

Received: January Accepted: February, Published: March

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

https://creativecommons.org/licenses/by-sa/4.0/ 202

Proceedings Conference on Economics and Business Innovation

Volume 3, Issue 1, 2023

Tabel 1. Statistik Deskriptif

Maximum(ju Minimum Average Standard

taan) (jutaan) (jutaan) Deviation

(jutaan)

Fixed Assets 442.037 1.992.293 1.017.366 308.688.127.2

15.597

PAD 35.905 388.251 114.144 69.196.188.48

5.501

Maintenance 4.613 56.160 16.371 9.933.674.192

Expenditure .869

Source: Data processed (2022)

Classical Assumption Test

1. Normality Test

Based on normality testing using Kolmogorov Smirnov, the significance

value of Asymp. Sig (2 - tailed) shows 0.0000 where 0.0000 <0.05, meaning that

the data is not normally distributed. Therefore, the data is transformed using

Natural Log (LN), so that the Kolmogorov Smirnov test results produce a

significance value of 0.200 which means that the data is normally distributed.

2. Multicollinearity Test

Table 3. Multicollinearity Test Results

Model Tolerance VIF

Aset Tetap .444 2.252

PAD .444 2.252

Source: Data processed (2022)

In the regression model of this study, there was no multicollinearity

between the independent variables because both independent variables obtained a

tolerance value of more than 0.1 and VIF less than ten.

3. Autocorrelation Test

Based on the test, it shows that there is no autocorrelation problem in

this regression model because it is in accordance with the provisions of du < d <

(4-du). Where the DW value obtained of 1.889 is greater than the du value

(1.7313), and lower than the 4-du value of 2.2687..

4. Heteroscedasticity Test

Table 5. Heteroscedasticity Test

Model Signifikansi

Aset Tetap .442

PAD .707

Source: Data processed (2022)

Table 5 provides information that there is no heteroscedasticity in this test

model because both independent variables have a significance value exceeding

0.05..

Received: January Accepted: February, Published: March

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

https://creativecommons.org/licenses/by-sa/4.0/ 203

Proceedings Conference on Economics and Business Innovation

Volume 3, Issue 1, 2023

Multiple Linear Regression Results and Hypothesis Testing

Table 6. Linear Regression Results

Model Koefisien Beta

Konstan 4,078

Aset Tetap 0,607

PAD 0,100

Sumber : Data diolah (2022)

Based on the previous table, the multiple regression equation can be

written as follows:

Y = 4,078 + 0,607X1 + 0, 100X2

Simultaneous Test

From Table 6, it can be seen that the coefficient of determination (β)

of both independent variables ≠ 0 means accepting Ha and rejecting H0, so it

can be concluded that the independent variables (Fixed Assets and Local

Revenue) simultaneously have an influence on the dependent variable

(Maintenance Expenditure).

Partial Test

Based on the Beta coefficient produced in table 6, the conclusions that can

be drawn are:

1. Fixed Asset variable obtained coefficient value β1 = 0.607 means

Ha2: β ≠ 0, namely 0.607> 0 so that Ho is rejected, pHa is

accepted. This indicates that partially fixed assets have an

influence on maintenance expenditure on local governments in

Aceh. Thus the second hypothesis is accepted.

2. Local Revenue variable obtained coefficient value β2 = 0.100.

H3: β ≠ 0, namely 0.100 > 0 so that Ha is accepted, Ho is

rejected. This indicates that local revenue alone has an influence

on maintenance expenditure on local governments in Aceh.

Thus the third hypothesis is accepted.

Test Coefficient of Determination (R² Test)

Table 7. Coefficient of Determination

R = 0,421 R2 = 0,177 Adj.R2 = 0,163

Sumber : Data diolah (2022)

Based on the calculation in table 7, the R2 value is 0.177. This test means

that only 17.7 per cent of the dependent variable, namely Maintenance

Expenditure, can be explained by the independent variables in this study, while

82.3 per cent is influenced by other variables that are not included in this test.

Received: January Accepted: February, Published: March

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

https://creativecommons.org/licenses/by-sa/4.0/ 204

Proceedings Conference on Economics and Business Innovation

Volume 3, Issue 1, 2023

DISCUSSION

1. The Effect of Fixed Assets and Local Revenue on Maintenance

Expenditure

Based on the results of statistical testing together, the fixed asset and local

revenue variables have a positive influence on maintenance expenditure on local

governments in Aceh. That is, the results of the study accept the first hypothesis

(H1).

2. The Effect of Fixed Assets on Maintenance Expenditure

Based on the results of statistical testing, partially fixed assets have a

positive effect on maintenance expenditure in local governments in Aceh. This

can be seen from the test results which show that the fixed asset variable has a

positive β1 coefficient of 0.607. So it can be concluded that the second hypothesis

(H2) is accepted in this test.

Maintenance expenditure has a function that is inherent in its correlation

with fixed assets or other assets that belong to an organisation. This is in

accordance with the main purpose of maintenance, namely to keep the assets

owned always in a normal state. Therefore, an asset needs to be maintained.

The value of fixed assets acquired by the region can increase or decrease

each year. The addition of fixed assets occurs due to the realisation of capital

expenditure, or grants which cause the allocation for maintenance expenditure to

increase with the aim of maintaining the condition of these fixed assets. In

addition, the high realisation of maintenance expenditure in a region can also

occur because the region has more assets in a lightly damaged or heavily damaged

condition, causing the cost of repairing these assets to be greater.

The results of this test are in line with the research of Sinaga and Sidabutar

(2012) who found that the value of fixed assets has a positive influence on

maintenance expenditure directly and Purba (2013) who found that the value of

fixed assets has a significant influence on the estimated maintenance expenditure.

Brillianto and Nugroho (2019) also found that the value of fixed assets owned was

taken into account in allocating maintenance expenditure at BPPK.

This study has differences with previous research, in this study the location

is local government in Aceh, the data used is in the form of maintenance

expenditure realisation not maintenance expenditure budget. Furthermore, the

difference in variable measurement where in this study the fixed asset variable is

measured not by the total amount of fixed assets but only fixed assets in the form

of equipment and machinery and buildings and buildings.

3. The Effect of Local Revenue on Maintenance Expenditure

Based on statistical calculations, local revenue alone has a positive effect

on maintenance expenditure in local governments in Aceh. This can be seen from

the results showing that the fixed asset variable has a positive β1 coefficient of

0.100. So it can be concluded that the third hypothesis (H3) is accepted in this test.

Theoretically, revenue from its own region should have a big influence on

the expenditure of a region because in the implementation of regional autonomy,

funding from its own revenue is more attractive to the region than other funding.

This is because own-source revenues can be used as the local government wishes

in accordance with local regulations, while other sources of funding outside of

own-source revenues are limited and tied.

Received: January Accepted: February, Published: March

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

https://creativecommons.org/licenses/by-sa/4.0/ 205

Proceedings Conference on Economics and Business Innovation

Volume 3, Issue 1, 2023

The results of this test found the same results as previous researchers,

namely Sembiring (2009), Widiasa et al. (2014), and Ramadani (2019) who found

that local own-source revenue has a positive effect on maintenance expenditure.

This research differs from previous research from the place and time used.

Where this research only examines local governments in Aceh during 2015-2019,

so that the results of this study are still low in generalisation.

CONCLUSIONS

Based on the research results that have been presented previously, the

conclusions that can be drawn are: first, fixed assets and local revenue together

have a positive effect on maintenance expenditure, second fixed assets have a

positive effect on maintenance expenditure, and third local revenue has a positive

effect on maintenance expenditure.

The limitations in this study lie in the object of research which is only

limited to local governments in Aceh so that the level of generalisation is low and

the time period is only 5 years.

Based on the previous limitations, future researchers are expected to

expand the range of research objects, and can use a mix method to get more

accurate results, and can add other independent variables that are thought to affect

maintenance expenditure such as capital expenditure and SiLPA.

REFERENCES

Abdullah, Syukriy & Halim, A. (2004). Pengaruh Dana Alokasi Umum (DAU)

dan Pendapatan Asli Daerah (PAD) terhadap Belanja Pemerintah

Daerah : Studi Kasus Kabupaten/Kota di Jawa dan Bali. Jurnal Ekonomi

STEI, Volume 8, Nomor 2, Halaman 90-109.

Afiah, N.N., S.M., & Adhi A. (2020). Akuntansi Pemerintah Daerah Berbasis

Akrual pada Entitas Akuntansi : Konsep dan Aplikasi. Jakarta : Kencana.

Andini, M. N., & Arifin, Kiagus Zainal, dan N. (2022). The effect of fixed

assets value, regional original income and capital expenditures on

maintenance expenditures in the district/city of south Sumatra province.

Indonesian Journal of Multidisciplinary Science, Volume 1, Nomor 10,

Halaman 1245-1259.

Aziz, M. A., Habibullah, M. S., Azman-saini, W. N., & Azali, M. (2000).

Testing for Causality Between Taxation and Government Spending : An

Application of Toda-Yamamoto Approach. Journal of Socio-Sciecnce &

Humanity, Volume 8, Nomor 1, Halaman 45-50.

Badan Pemeriksa Keuangan Republik Indonesia. 2019. Ikhtisar Hasil

Pemeriksaan Semester I Tahun 2019. Jakarta : BPK RI.

Blackley, P. R. (1986). Causality between revenues and expenditures and the

size of the federal budget. Public Finance Quarterly, Volume 14, Nomor

2, Halaman 139-156.

Brillianto, Dio Koes. & Nugroho, R. (2019). Pengaruh Nilai Aset Tetap dan

Belanja Modal dalam Alokasi Belanja Pemeliharaan Badan Pendidikan

dan Pelatihan Keuangan. Jurnal BPPK, Volume 12, Nomor 2, Halaman

92-101.

Budi, H. (2019). Analisis Pengaruh Belanja Modal Dan Pendapatan Asli

Received: January Accepted: February, Published: March

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

https://creativecommons.org/licenses/by-sa/4.0/ 206

Proceedings Conference on Economics and Business Innovation

Volume 3, Issue 1, 2023

Daerah Terhadap Belanja Pemeliharaan Pemerintah Kabupaten Dan

Kota Di Provinsi Aceh. Jurnal Biram Samtani Sains, Volume 2, Nomor

2, Halaman 1-19.

Effendi, S. (2021). Akuntansi Pemerintahan Berbasis Akrual. Batam : CV

Batam Publisher.

Kanwil Ditjen Perbendaharaan Provinsi Aceh. 2019. Kajian Fiskal Regional.

Banda Aceh : Kementerian Keuangan.

Kawatu, F.S. 2019. Analisis Laporan Keuangan Sektor Publik. Yogyakarta :

Deepublish.

Komite Standar Akuntansi Pemerintahan. Buletin Teknis No. 04 tentang

Penyajian dan Pengungkapan Belanja Pemerintah.

Nurkholis, N dan Khusaini, M. 2019. Penganggaran Sektor Publik. Malang :

UB Press.

Purba, B. M. (2013). Pengaruh Nilai Aset Tetap yang akan dipelihara dan

Pendapatan Asli Daerah terhadap Anggaran Belanja Pemeliharaan dalam

Penyusunan APBD pada Pemerintahan daerah di Provinsi Sumatera

Utara. Tesis. Universitas Sumatera Utara : Medan (Tidak Diterbitkan).

Ramadani, S. (2019). Pengaruh Belanja Modal dan Pendapatan Asli Daerah

Terhadap Belanja Pemeliharaan dalam Realisasi Anggaran Pemerintah

Kota Kediri. Jurnal Simki Economic, Volume 3, Nomor 2, Halaman 54-

61.

Rohmah, Z.M. dan Sa’adah, L. (2021). Pengelolaan Retribusi Pasar Daerah

dalam Menunjang PAD. Jombang : LPPM Universitas KH. A. Wahab

Hasbullah.

Sadat, A. (2022). Tata Kelola Keuangan Pemerintahan.Yogyakarta :

Deepublish.

Sembiring, S. H. B. (2009). Analisis Pengaruh Belanja Modal dan Pendapatan

Asli Daerah terhadap Belanja Pemeliharaan dalam Realisasi Anggaran

Pemerintahan Kabupaten dan Kota di Provinsi Sumatera Utara.Tesis.

Universitas Sumatera Utara : Medan . (Tidak Diterbitkan)

Sinaga, Timbul dan Sidabutar, R. C. . (2012). Pengaruh Belanja Kendaraan

Dinas dan Nilai Kendaraan Dinas terhadap Belanja Pemeliharaan

Kendaraan Dinas pada Dinas Provinsi Jawa Barat. Jurnal Ekonomi Dan

Bisnis,Volume 3, Nomor 1, Halaman 11-22.

Standar Akuntansi Pemerintahan Pernyataan No. 07 Akuntansi Aset Tetap.

Sugiyono. (2017). Metode Penelitian Kuantitatif Kualitatif dan R & D.

Bandung : Alfabeta.

Tama, W. A., Yuliasari, R., Susilowati, W., & Rafinah, S. (2021). Special

Issue : Analysis the Effect of Realized Capital Expenditure , Fixed Assets

Book Value and Realized Maintenance Expenditure on Maintenance

Budget of Work Units within the BPK RI. Humanities, Management and

Science Proceeding, Volume 2, Nomor 1,Halaman 10-16.

Tarihoran, G. D. H. (2016). Faktor-Faktor yang Mempengaruhi Anggaran

Belanja Pemeliharaan SKPD pada Pemerintah Kota Tebing Tinggi.

Tesis. Universitas Sumatera Utara : Medan (Tidak Diterbitkan).

Von Furstenberg, G. M., Green, R. J., & Jeong, J.-H. (1986). Tax and Spend,

or Spend and Tax? .The Review of Economics and Statistics, Volume 68,

Nomor 2, Halaman 179–188.

Received: January Accepted: February, Published: March

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

https://creativecommons.org/licenses/by-sa/4.0/ 207

Proceedings Conference on Economics and Business Innovation

Volume 3, Issue 1, 2023

Widiasa, Gede, Edy Sujana, dan N. A. S. D. (2014). Belanja modal dan

pendapatan asli daerah (PAD) terhadap belanja pemeliharaan dalam

realisasi anggaran pemerintah daerah (Studi kasus Pemkab Buleleng).

JIMAT (Jurnal Ilmiah Mahasiswa Akuntansi) Undiksha, Volume 2,

Nomor 1.

Zubir (2020), Walikota Langsa Mengaku Kecewa, Tarik 5 Mobil Ambulance

Dinkes Karena tak

Terawat.https://aceh.tribunnews.com/ucnews/2020/04/02/wali-kota-

langsa-mengaku-kecewa-tarik-5-mobil-ambulance-dinkes-karena-tak-

terawat. Diakses Juni 2022 Pukul 12.30.

Zubir (2020), Rumah Dinas Medis Puskesmas Rantau Seulamat Terbengkalai

Mirip Gudang. https://aceh.tribunnews.com/2020/10/22/rumah-dinas-

medis-puskesmas-rantau-seulamat-terbengkalai-mirip-gudang. Diakses

pada 23 Juni 2022 pukul 14.35.

Received: January Accepted: February, Published: March

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

https://creativecommons.org/licenses/by-sa/4.0/ 208

You might also like

- Free Bonus Book For A Beginners Guide To The StockmarketDocument22 pagesFree Bonus Book For A Beginners Guide To The StockmarketDraganNo ratings yet

- Final Project Reports SBI POSDocument83 pagesFinal Project Reports SBI POSTarun Kathiriya80% (5)

- 6606-Article Text-27458-1-10-20200323Document12 pages6606-Article Text-27458-1-10-20200323silvia wulandariNo ratings yet

- Factors Affecting Capital Expenditure Allocation: Empirical Evidence From Regency/City Government in IndonesiaDocument23 pagesFactors Affecting Capital Expenditure Allocation: Empirical Evidence From Regency/City Government in IndonesiaBrian PramaharjanNo ratings yet

- Capital Expenditure of Local GovernmentsDocument14 pagesCapital Expenditure of Local GovernmentsAbid KhawajaNo ratings yet

- Analysis of The Determinant Factors of Government PerformanceDocument6 pagesAnalysis of The Determinant Factors of Government Performancejouzar farouq ishakNo ratings yet

- Pbjeko 13-19Document13 pagesPbjeko 13-19ENDANG TRI PRATIWINo ratings yet

- Factors Affecting Budget Absorption at Regional Apparatus OrganizationsDocument12 pagesFactors Affecting Budget Absorption at Regional Apparatus OrganizationsPustaka SemestaNo ratings yet

- A2Document12 pagesA2KilldawnNo ratings yet

- Adnan, Abdullah, Kamal 2023Document10 pagesAdnan, Abdullah, Kamal 2023nangat lenakNo ratings yet

- 5552-Article Text-25748-1-10-20221010Document9 pages5552-Article Text-25748-1-10-20221010Agung Giantino ManfaNo ratings yet

- Zo 2041292302Document11 pagesZo 2041292302Ibnu Hamzami UlfiNo ratings yet

- The Influence of Local Own Income and Balanced Fund On HDI With Capital Expenditure As An Intervening Variable in Districts / Cities of Central Java (2019-2021)Document15 pagesThe Influence of Local Own Income and Balanced Fund On HDI With Capital Expenditure As An Intervening Variable in Districts / Cities of Central Java (2019-2021)AJHSSR JournalNo ratings yet

- Buget Utilization ResearchDocument11 pagesBuget Utilization ResearchhailemariamNo ratings yet

- Local Government Financial Statements Disclosure - Central - JavaDocument14 pagesLocal Government Financial Statements Disclosure - Central - JavaCheetah ShopNo ratings yet

- JAFAS7 (4) A4llllljhbgghgyggvghgfDocument19 pagesJAFAS7 (4) A4llllljhbgghgyggvghgfvashNo ratings yet

- 11366-Article Text-22440-1-10-20220921Document23 pages11366-Article Text-22440-1-10-20220921Azzam AljashamiNo ratings yet

- Jambi CityDocument14 pagesJambi CityAndy RachdanaNo ratings yet

- Local Level Financial Systems: A Study On Three Union at Sylhet Sadar Upazilla in BangladeshDocument10 pagesLocal Level Financial Systems: A Study On Three Union at Sylhet Sadar Upazilla in BangladeshTriple A Research Journal of Social Science and HumanityNo ratings yet

- Fatimah2023 the Influence of Budget Participation, Information Asymmetry, And Budget Emphasis on Budgetary Slack in AcehDocument12 pagesFatimah2023 the Influence of Budget Participation, Information Asymmetry, And Budget Emphasis on Budgetary Slack in Acehnangat lenakNo ratings yet

- Vol: 01, No. 02, Oct-Nov 2021: Journal of Production, Operations Management and Economics ISSN: 2799-1008Document45 pagesVol: 01, No. 02, Oct-Nov 2021: Journal of Production, Operations Management and Economics ISSN: 2799-1008jifri syamNo ratings yet

- 34-Article Text-114-1-10-20200711Document6 pages34-Article Text-114-1-10-20200711Presly Kore DjuNo ratings yet

- The Effect of Local Tax and Retribution On Direct Expenditure With Special Autonomy FundDocument5 pagesThe Effect of Local Tax and Retribution On Direct Expenditure With Special Autonomy FundDR. SYUKRIY ABDULLAH , S.E, M.SINo ratings yet

- Volume 1, Issue 1, March 2020 E-ISSN: 2721-303X, P-ISSN: 2721-3021Document19 pagesVolume 1, Issue 1, March 2020 E-ISSN: 2721-303X, P-ISSN: 2721-3021Adella WulandariNo ratings yet

- 8037 29358 2 PBDocument11 pages8037 29358 2 PBRafi Alfin UtamaNo ratings yet

- Jurnal Syapsan-Taryono 2021Document16 pagesJurnal Syapsan-Taryono 2021taryonoNo ratings yet

- Analysis of Local Taxes of Tarakan CityDocument7 pagesAnalysis of Local Taxes of Tarakan CityAJHSSR JournalNo ratings yet

- 25063-Article Text-75009-81582-10-20221222Document16 pages25063-Article Text-75009-81582-10-20221222DRHNo ratings yet

- Savitri Village Fund Management2019 PDFDocument6 pagesSavitri Village Fund Management2019 PDFMama MamamaNo ratings yet

- Local Revenue Toward Capital ExpenditureDocument9 pagesLocal Revenue Toward Capital Expenditurejouzar farouq ishakNo ratings yet

- Univesitas Sumatera Utara: Keywords: Regional Tax, Regional Retribution, Other Valid PAD, DAU, DAK, DBHDocument17 pagesUnivesitas Sumatera Utara: Keywords: Regional Tax, Regional Retribution, Other Valid PAD, DAU, DAK, DBHayu desiNo ratings yet

- Analysing Service-Level Solvency of Local Governments From Accounting Perspective: A Study of Local Governments in The Province of Yogyakarta Special Territory, IndonesiaDocument15 pagesAnalysing Service-Level Solvency of Local Governments From Accounting Perspective: A Study of Local Governments in The Province of Yogyakarta Special Territory, IndonesiaAlicia JasmineNo ratings yet

- Ananda2023 the Influence of Employee Competency, Budget Planning and the Bureaucratic Environment on Budget ImplementationDocument20 pagesAnanda2023 the Influence of Employee Competency, Budget Planning and the Bureaucratic Environment on Budget Implementationnangat lenakNo ratings yet

- Ananda2023 The Influence of Employee Competency, Budget Planning and The Bureaucratic Environment On Budget ImplementationDocument20 pagesAnanda2023 The Influence of Employee Competency, Budget Planning and The Bureaucratic Environment On Budget Implementationnangat lenakNo ratings yet

- Effect of Budgetary Process On Financial Performance Case Study of Selected Savings and Credit Cooperative Societies in Hoima District, UgandaDocument9 pagesEffect of Budgetary Process On Financial Performance Case Study of Selected Savings and Credit Cooperative Societies in Hoima District, UgandaInternational Journal of Innovative Science and Research Technology100% (1)

- Jurnal - L Suparto LM Hal 132-145Document14 pagesJurnal - L Suparto LM Hal 132-145Dede BhubaraNo ratings yet

- Junita Et Al (2018) The Effect of Budget Variances On The Local Government Budget Changes With Legislature Size As ModeratorDocument12 pagesJunita Et Al (2018) The Effect of Budget Variances On The Local Government Budget Changes With Legislature Size As ModeratorSyukriy AbdullahNo ratings yet

- English 4 PDFDocument8 pagesEnglish 4 PDFwihelmina jaengNo ratings yet

- Teori Agensi Putri - 46-Ika-Yusrianti - Et - AlDocument17 pagesTeori Agensi Putri - 46-Ika-Yusrianti - Et - Al01022682327001No ratings yet

- Role of Budgeting in GhanaDocument12 pagesRole of Budgeting in GhanaMike TeeNo ratings yet

- Syahriya2024 What Determines Financial Sustainability in Local Government Evidence From Aceh Province, IndonesiaDocument14 pagesSyahriya2024 What Determines Financial Sustainability in Local Government Evidence From Aceh Province, Indonesianangat lenakNo ratings yet

- Enviromental AccountingDocument9 pagesEnviromental AccountingAprilia VanaNo ratings yet

- Setiyawati 2020 E R PDFDocument18 pagesSetiyawati 2020 E R PDFFauzi RahmanNo ratings yet

- Tri PriyatmoDocument22 pagesTri PriyatmoDEDY KURNIAWANNo ratings yet

- Municipal Finance of West BengalDocument20 pagesMunicipal Finance of West BengalIJRASETPublicationsNo ratings yet

- International Journal of Asian Social Science: Ebenezer Nana Yeboah Marfo AndrewDocument13 pagesInternational Journal of Asian Social Science: Ebenezer Nana Yeboah Marfo AndrewNana Aboagye DacostaNo ratings yet

- Raudhatinur, R., Meutia, R., & Saputra, M. (2023) .Document12 pagesRaudhatinur, R., Meutia, R., & Saputra, M. (2023) .agus muharamNo ratings yet

- 1330 2817 2 PBDocument8 pages1330 2817 2 PBInderawatiNo ratings yet

- JBB 2021 Increasing The Capacity Building Program Based On Local WisdomDocument13 pagesJBB 2021 Increasing The Capacity Building Program Based On Local WisdomYuni WoroNo ratings yet

- Integrated Reporting Disclosure Alignment Levels in Annual Reports by Listed Firms in Vietnam and in Uencing FactorsDocument28 pagesIntegrated Reporting Disclosure Alignment Levels in Annual Reports by Listed Firms in Vietnam and in Uencing FactorsminnvalNo ratings yet

- Istiqamah2023 the Influence of Apparatus Competency, The Role of Government Internal Supervisory Apparatus, And the Effectiveness of the Government'sDocument12 pagesIstiqamah2023 the Influence of Apparatus Competency, The Role of Government Internal Supervisory Apparatus, And the Effectiveness of the Government'snangat lenakNo ratings yet

- The Implementation of Accrual-Based Accounting in Indonesian Government: Has Local Government Financial Statement Quality Improved?Document22 pagesThe Implementation of Accrual-Based Accounting in Indonesian Government: Has Local Government Financial Statement Quality Improved?Naza KerenzzNo ratings yet

- The Flypaper Effect in Central Java, Indonesia Did It Happen or NotDocument5 pagesThe Flypaper Effect in Central Java, Indonesia Did It Happen or NotInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- The Effect of Human Resource Capacity, Internal Control and Utilization of Accounting Information TechnologyDocument5 pagesThe Effect of Human Resource Capacity, Internal Control and Utilization of Accounting Information TechnologyDR. SYUKRIY ABDULLAH , S.E, M.SINo ratings yet

- Budget ProcessDocument17 pagesBudget ProcessLouie GerenteNo ratings yet

- Assessment of Budget Preparation Utilization and EDocument16 pagesAssessment of Budget Preparation Utilization and ENatinael FeteneNo ratings yet

- Nizar Fachry Adam, Burhan M.Umar SosiloDocument14 pagesNizar Fachry Adam, Burhan M.Umar SosiloinventionjournalsNo ratings yet

- Jurnal: MantikDocument9 pagesJurnal: MantikdwiiayuchanNo ratings yet

- Impact of Integrated Personnel Payroll Information System On Employees Satisfaction in Kogi StateDocument11 pagesImpact of Integrated Personnel Payroll Information System On Employees Satisfaction in Kogi StateMARIANO , PAMELA FLORENTINONo ratings yet

- SxcsDocument10 pagesSxcsayu desiNo ratings yet

- Strengthening Fiscal Decentralization in Nepal’s Transition to FederalismFrom EverandStrengthening Fiscal Decentralization in Nepal’s Transition to FederalismNo ratings yet

- Estimating the Job Creation Impact of Development AssistanceFrom EverandEstimating the Job Creation Impact of Development AssistanceNo ratings yet

- Ifric 4 PDFDocument4 pagesIfric 4 PDFKarina Barretto AgnesNo ratings yet

- Financial Plan 4.1 Project Cost The Total Project Cost of Printing Urbane Is P80,000. This Is Also Known As TotalDocument11 pagesFinancial Plan 4.1 Project Cost The Total Project Cost of Printing Urbane Is P80,000. This Is Also Known As TotalNormailah Sultan MacalaNo ratings yet

- Appendix 32 DVDocument1 pageAppendix 32 DVVerena Raga0% (1)

- 0809 KarlsenDocument5 pages0809 KarlsenprateekbaldwaNo ratings yet

- D.1 UM vs. BSPDocument1 pageD.1 UM vs. BSPNLainie OmarNo ratings yet

- Banking Extra PracticeDocument17 pagesBanking Extra PracticeSubham PatiNo ratings yet

- A. Intax NotesDocument13 pagesA. Intax NotesIssy BNo ratings yet

- Sample Real Estate Research PaperDocument6 pagesSample Real Estate Research Paperfemeowplg100% (1)

- Shkreli - Lehman ComplaintDocument14 pagesShkreli - Lehman ComplaintAdviseandconsentNo ratings yet

- Quotation For Australian Immigration - VetassessDocument2 pagesQuotation For Australian Immigration - VetassessayesharahimNo ratings yet

- BSP Circular No. 942-17: January 20, 2017Document16 pagesBSP Circular No. 942-17: January 20, 2017Kat GuiangNo ratings yet

- PayslipDocument1 pagePayslipsuzieebillsNo ratings yet

- Advanced Financial Accounting 2Document5 pagesAdvanced Financial Accounting 2Acong WongNo ratings yet

- International Capilat BudgetingDocument43 pagesInternational Capilat BudgetingHimanshu GuptaNo ratings yet

- Chatham Lodging TrustDocument5 pagesChatham Lodging Trustpresentation111No ratings yet

- P AccoDocument9 pagesP Acco224252No ratings yet

- Summative Test 1-Q2Document2 pagesSummative Test 1-Q2Dina Jean Sombrio0% (1)

- Lecture 1 - Concepts and EthicsDocument10 pagesLecture 1 - Concepts and EthicsNikki MathysNo ratings yet

- Course File - Financial ManagementDocument7 pagesCourse File - Financial ManagementMello JonesNo ratings yet

- C PH Z3 GN JQre Os 2 SDDocument6 pagesC PH Z3 GN JQre Os 2 SDMumtaj ShahNo ratings yet

- The Blockchain Catalyst For Change - CEPRDocument7 pagesThe Blockchain Catalyst For Change - CEPRJonathan CanteroNo ratings yet

- Investment Banking PDFDocument2 pagesInvestment Banking PDFTirupatinath BhatNo ratings yet

- Corporate Governance Failure in The Lehman Brothers CaseDocument6 pagesCorporate Governance Failure in The Lehman Brothers Caseranasanjeev0007No ratings yet

- Time Lines and NotationDocument7 pagesTime Lines and NotationShreya Ramaswamy100% (1)

- Home LoanDocument26 pagesHome LoanVandan SapariaNo ratings yet

- QuizDocument2 pagesQuizaprilbetito02No ratings yet

- Math of FinanceDocument34 pagesMath of FinanceJP ResurreccionNo ratings yet

- Chapter - V Data Analysis & InterpretationDocument26 pagesChapter - V Data Analysis & InterpretationMubeenNo ratings yet