Professional Documents

Culture Documents

2012_FA.3_Asg2

2012_FA.3_Asg2

Uploaded by

TS YONGCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2012_FA.3_Asg2

2012_FA.3_Asg2

Uploaded by

TS YONGCopyright:

Available Formats

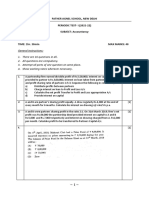

BDC 201: Financial Accounting 3

Assignment (2)

Full Name:

Student Number:

******************************************************************************

[Total: 10%]

Question 1 (2 marks)

Why partnerships give salary to their partners?

Question 2 (4 marks)

(a) Partners may also revalue their partnership assets. Give TWO (2) reasons which bring

them to make revaluation on their partnership assets.

(b) Give the journal entries for loss on revaluation of asset.

Question 3 (3 marks)

Given that the amount invested by Amy, Betty and Cindy in their partnership business are:

RM 60,000 ; RM 15,000 and RM 45,000 respectively. During the financial year ended

31 December 2011, the net profit for distribution to partners is RM 240,000. Find the amount

of profit shared by each of them.

Question 4 (5 marks)

According to the partnership business, Kent found that the following is

the record of his withdrawal from the business:

Date RM

7 February 2010 1,720

26 August 2010 1,830

9 December 2010 517

According to the agreement, partners’ drawings are charged 8.5% p.a. Find the amount for

interest on drawings in Kent’s record.

continue next page…

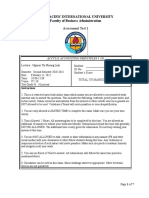

BDC 201: Financial Accounting 3

Assignment (2)

Question 5 (6 marks)

Roy and Jas share profit on 1/3 and 2/3 basis in their partnership business. The interest on capital

are S$5,000 andS$15,000. Salary for Jas is S$30,000. Net profit for the business is S$60,000.

Interest on drawings applied to Roy is S$700. Find the profit shared by Roy and Jas respectively.

You might also like

- CH 10Document9 pagesCH 10Tien Thanh DangNo ratings yet

- QUESTION 01 (Account Q. Section C)Document3 pagesQUESTION 01 (Account Q. Section C)prince falakuNo ratings yet

- 12th Accountancy Set - 1 QuestionsDocument9 pages12th Accountancy Set - 1 QuestionsKaran SinghNo ratings yet

- ACC Assignment Questions Extra PractiseDocument20 pagesACC Assignment Questions Extra Practisesikeee.exeNo ratings yet

- Partnership FundamentalsDocument5 pagesPartnership Fundamentalsdiyadhannawat06No ratings yet

- Dileep PreboardDocument10 pagesDileep PreboardmktknpNo ratings yet

- M.M 80 Accounts 12thDocument7 pagesM.M 80 Accounts 12thjashanjeetNo ratings yet

- 12 Accounts 2020 21 Practice Paper 4Document14 pages12 Accounts 2020 21 Practice Paper 4Vijey RamalingamNo ratings yet

- 12 Accounts 2020 21 Practice Paper 2Document8 pages12 Accounts 2020 21 Practice Paper 2Vijey RamalingamNo ratings yet

- Class 12 Mock Test AccountancyDocument13 pagesClass 12 Mock Test AccountancyLPS ANJALI SHARMANo ratings yet

- Kendriya Vidyalaya Sangathan, Delhi Region Pre-Board Examination 2020-21 Class XII - AccountancyDocument9 pagesKendriya Vidyalaya Sangathan, Delhi Region Pre-Board Examination 2020-21 Class XII - Accountancyraghu monnappaNo ratings yet

- Wa0011.Document6 pagesWa0011.Pieck AckermannNo ratings yet

- Economics Pa 1 Class IXDocument2 pagesEconomics Pa 1 Class IXidealNo ratings yet

- General Instructions:: Class: XII Max. Marks: 30 Date: 13-08-2021 Time: 1 HourDocument3 pagesGeneral Instructions:: Class: XII Max. Marks: 30 Date: 13-08-2021 Time: 1 HourDANESH RICHARDNo ratings yet

- Class-Xii Accountancy (2020-2021) General InstructionsDocument10 pagesClass-Xii Accountancy (2020-2021) General InstructionsSaad AhmadNo ratings yet

- Xii Acc WorksheetssDocument55 pagesXii Acc WorksheetssUnknown patelNo ratings yet

- Xii Acc Worksheetss-1-29Document29 pagesXii Acc Worksheetss-1-29Unknown patelNo ratings yet

- ACCOUNTS Specimen For ISCDocument15 pagesACCOUNTS Specimen For ISCStudy HelpNo ratings yet

- Accountancy Class XII Practice PaperDocument7 pagesAccountancy Class XII Practice PaperмŕίȡùĻ νέŕмάNo ratings yet

- Maximum Marks: 80 Time Allowed: One and A Half Hours: Isc Semester 1 Examination Sample Paper 2 AccountsDocument16 pagesMaximum Marks: 80 Time Allowed: One and A Half Hours: Isc Semester 1 Examination Sample Paper 2 AccountsShantanu Mishra100% (1)

- Class Test Fundamentals and Goodwill Set A 01.05.2023 1Document2 pagesClass Test Fundamentals and Goodwill Set A 01.05.2023 1ANTECNo ratings yet

- Blossom Senior Secondary School 1Document8 pagesBlossom Senior Secondary School 1raviNo ratings yet

- Class - XII CommerceDocument8 pagesClass - XII CommercehardikNo ratings yet

- XII ACC 1st Online Pre-Board Exam QP 2020-21Document11 pagesXII ACC 1st Online Pre-Board Exam QP 2020-21Melvin CristoNo ratings yet

- Screenshot 2023-03-11 at 12.52.38 PM PDFDocument56 pagesScreenshot 2023-03-11 at 12.52.38 PM PDFpalak sanghviNo ratings yet

- Accountancy Final (R) XIIDocument55 pagesAccountancy Final (R) XIIKavin .DNo ratings yet

- Last 5 Year Accounting For Partnership FirmDocument13 pagesLast 5 Year Accounting For Partnership FirmTCPS UNFILTEREDNo ratings yet

- Assign QP 2024 May - DP11.2 Intro Fin MGTDocument5 pagesAssign QP 2024 May - DP11.2 Intro Fin MGTshalomechinodyaNo ratings yet

- Accountancy QP-Term II-Pre Board 1 - Class XIIDocument6 pagesAccountancy QP-Term II-Pre Board 1 - Class XIIRaunofficialNo ratings yet

- Xii RT 1 FundamentalsDocument3 pagesXii RT 1 Fundamentalsameyagoel831No ratings yet

- 2023 Practice Paper 1Document16 pages2023 Practice Paper 1AyushNo ratings yet

- Father Agnel School, New Delhi PERIODIC TEST-I (2021-22) SUBJECT: Accountancy Class: Xii TIME: 1hr. 30min Max Marks: 40Document4 pagesFather Agnel School, New Delhi PERIODIC TEST-I (2021-22) SUBJECT: Accountancy Class: Xii TIME: 1hr. 30min Max Marks: 40fffffNo ratings yet

- Partnership Fundamentals WorksheetDocument7 pagesPartnership Fundamentals Worksheetmpsaj1177b9No ratings yet

- Indian School Sohar UNIT TEST (2021-22) Accountancy Date: Max Marks:50 Class: XII Duration: 2 HoursDocument5 pagesIndian School Sohar UNIT TEST (2021-22) Accountancy Date: Max Marks:50 Class: XII Duration: 2 HoursRitaNo ratings yet

- Kerala Sahodaya CME Acc (055) QP & MS Set 1 (23-24)Document30 pagesKerala Sahodaya CME Acc (055) QP & MS Set 1 (23-24)SIBINo ratings yet

- Assessment Test 1 - Without KeyDocument7 pagesAssessment Test 1 - Without KeyNicolas ErnestoNo ratings yet

- Korteweg FBE 432: Corporate Financial Strategy Spring 2019Document6 pagesKorteweg FBE 432: Corporate Financial Strategy Spring 2019PeterNo ratings yet

- RA1 AccountsPDFDocument2 pagesRA1 AccountsPDFAnshita KohliNo ratings yet

- Accounts: (Maximum Marks: 80) (Time Allowed: Three Hours)Document12 pagesAccounts: (Maximum Marks: 80) (Time Allowed: Three Hours)Badiuz FaruquiNo ratings yet

- Accountancy XIIDocument43 pagesAccountancy XIIarinprakash0No ratings yet

- 1 TEST, 2020-21 Class: Xii AccountancyDocument1 page1 TEST, 2020-21 Class: Xii AccountancyKul DeepNo ratings yet

- Partnership Fundamental 12 (2023)Document3 pagesPartnership Fundamental 12 (2023)Hansika SahuNo ratings yet

- 2022 FIA132 Term Test 1 FinalDocument9 pages2022 FIA132 Term Test 1 FinalkaityNo ratings yet

- Chapter 11 Online TestDocument3 pagesChapter 11 Online TestGodfreyFrankMwakalingaNo ratings yet

- 2019 Dse Bafs 2a (E)Document10 pages2019 Dse Bafs 2a (E)lehcarNo ratings yet

- 9706 31 Insert o N 20Document5 pages9706 31 Insert o N 20chirag mehtaNo ratings yet

- Assignments For +2Document3 pagesAssignments For +2Prakhar SinghNo ratings yet

- DocumentDocument4 pagesDocument4G BADGENo ratings yet

- November 2020 Insert Paper 31Document12 pagesNovember 2020 Insert Paper 31Shahmeer HasanNo ratings yet

- Wa0017Document13 pagesWa0017Tûshar ThakúrNo ratings yet

- PT-1 Accountancy 2022-23Document3 pagesPT-1 Accountancy 2022-23Ajit HuidromNo ratings yet

- Accountancy SQPDocument12 pagesAccountancy SQPSnigdha RohillaNo ratings yet

- Practice Paper 1 - Accounts MCQ With AnswersDocument24 pagesPractice Paper 1 - Accounts MCQ With AnswersHarshal KaramchandaniNo ratings yet

- Class XII ACCOUNTANCY ASSIGNMENTDocument3 pagesClass XII ACCOUNTANCY ASSIGNMENTTvisha DhingraNo ratings yet

- Xii PB 2023 Acct QP 16112023Document9 pagesXii PB 2023 Acct QP 16112023NARESH KUMARNo ratings yet

- Cambridge International AS & A Level: ACCOUNTING 9706/32Document12 pagesCambridge International AS & A Level: ACCOUNTING 9706/32muhammadxiaullahgNo ratings yet

- Accounting - IIDocument12 pagesAccounting - IISethmika DiasNo ratings yet

- BACC 2021 - 22 Sem 2 - MST Questions 2Document5 pagesBACC 2021 - 22 Sem 2 - MST Questions 2xa. vieNo ratings yet

- Economic and Business Forecasting: Analyzing and Interpreting Econometric ResultsFrom EverandEconomic and Business Forecasting: Analyzing and Interpreting Econometric ResultsNo ratings yet

- The Complete Direct Investing Handbook: A Guide for Family Offices, Qualified Purchasers, and Accredited InvestorsFrom EverandThe Complete Direct Investing Handbook: A Guide for Family Offices, Qualified Purchasers, and Accredited InvestorsNo ratings yet