Professional Documents

Culture Documents

1.2013_FA.3_Ass4

1.2013_FA.3_Ass4

Uploaded by

TS YONGCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1.2013_FA.3_Ass4

1.2013_FA.3_Ass4

Uploaded by

TS YONGCopyright:

Available Formats

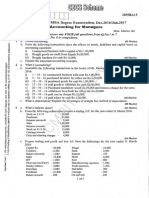

BDC 201: Financial Accounting 3

Assessment (4)

Full Name:

Student Number:

******************************************************************************

[Total: 20%]

Question

Archer and Tam have always shared profits in a 2:1 ratio respectively. They admit Read as a

partner as on 1 December 2012, who will contribute £ 20,000,000 cash as capital. The partners

decided to revalue their assets as on 30 November 2012.

Balance Sheet as at 30 November 2012

£ ’000 £ ’000

Non Current Assets

Equipment 90,000

Machinery 44,000

134,000

Current Assets

Inventory 3,000

Bank 9,500

Cash 3,500 16,000

150,000

Capitals

Archer 90,000

Tam 60,000

150,000

Assets are to be revalued as follows:-

£ ’000

Equipment 160,000

Machinery 40,000

Inventory 6,000

Required:

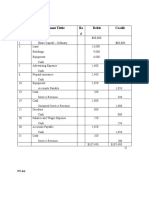

a) Revaluation Account (10 marks)

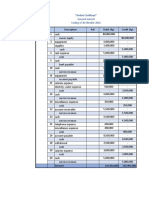

b) New balance sheet after the admission of Read on 1 December 2012 (10 marks)

***Please show detailed workings***

You might also like

- Advanced Accounting Dayag Solution Manual PDFDocument234 pagesAdvanced Accounting Dayag Solution Manual PDFAnggë Crüz89% (9)

- Acctg13exercise3 FinalDocument10 pagesAcctg13exercise3 FinalGarp Barroca100% (1)

- Advacc 1 Millan 2019 Advac 1 Special Transactions 2019Document11 pagesAdvacc 1 Millan 2019 Advac 1 Special Transactions 2019Charlene BolandresNo ratings yet

- Problems Chapter 7-1: RequiredDocument16 pagesProblems Chapter 7-1: RequiredTanyelle Louv0% (1)

- PartnershipDocument7 pagesPartnershipShane Nayah100% (2)

- 2012_FA.3_Asg4Document1 page2012_FA.3_Asg4TS YONGNo ratings yet

- Question_Revaluation_ 11.7.2013Document1 pageQuestion_Revaluation_ 11.7.2013TS YONGNo ratings yet

- Lecture 5Document5 pagesLecture 5oluwafemioyeyemi077No ratings yet

- BUSINESS COMBI (Activity On Goodwill Computation) - PALLERDocument5 pagesBUSINESS COMBI (Activity On Goodwill Computation) - PALLERGlayca PallerNo ratings yet

- Solution of 16MBA13 Accounting For Managers (I Sem MBA) December 2016 by Hema Vidya CS PDFDocument22 pagesSolution of 16MBA13 Accounting For Managers (I Sem MBA) December 2016 by Hema Vidya CS PDFSahil KhanNo ratings yet

- Accounting - Partnership Formation (Answer)Document4 pagesAccounting - Partnership Formation (Answer)mdgomez2021No ratings yet

- LEC09A - BSA 2201 - 022021-Single Entry Accounting (P)Document2 pagesLEC09A - BSA 2201 - 022021-Single Entry Accounting (P)Kim FloresNo ratings yet

- ..'::::! Receivable ..: ProblemsDocument3 pages..'::::! Receivable ..: ProblemsRamadhani AwwaliaNo ratings yet

- Tugas 4 Dasar AkuntansiDocument15 pagesTugas 4 Dasar AkuntansiSamuel PurbaNo ratings yet

- SBR1 Dummy With Cash FlowDocument15 pagesSBR1 Dummy With Cash Flowakansha.associate.workNo ratings yet

- SW - Chapter 7Document8 pagesSW - Chapter 7andrie gardoseNo ratings yet

- Tugas Kelompok 11 November - Cicilia Cindy (20-026) - Siska Muliatri (20-066)Document22 pagesTugas Kelompok 11 November - Cicilia Cindy (20-026) - Siska Muliatri (20-066)Cicilia Cindy100% (1)

- Seatwork Partnership Formation - SEATWORK - PARTNERSHIP - FORMATIONDocument8 pagesSeatwork Partnership Formation - SEATWORK - PARTNERSHIP - FORMATIONshe kioraNo ratings yet

- Worksheet TabaranzaDocument6 pagesWorksheet Tabaranzakianna doctoraNo ratings yet

- Practice Questions Set 3Document2 pagesPractice Questions Set 3Akhil GargNo ratings yet

- PacoaDocument12 pagesPacoaSassy GirlNo ratings yet

- Assignment Ans KeyDocument8 pagesAssignment Ans KeyJay Mark Marcial JosolNo ratings yet

- Final Accounts QuestionsDocument6 pagesFinal Accounts QuestionsKID ZONENo ratings yet

- A 1. FormationDocument3 pagesA 1. Formationmartinfaith958No ratings yet

- Revision Accounts 2 XIIDocument3 pagesRevision Accounts 2 XIISahej Kaur AroraNo ratings yet

- Partnership Suggested SolutionsDocument6 pagesPartnership Suggested SolutionsMisana ElbancolNo ratings yet

- Partnership AppDocument22 pagesPartnership AppPeter AkramNo ratings yet

- 10 1Document7 pages10 1Maxene YbañezNo ratings yet

- The Institute of Chartered Accountants of Nepal: Suggested Answers of Advanced AccountingDocument97 pagesThe Institute of Chartered Accountants of Nepal: Suggested Answers of Advanced AccountingSujit DasNo ratings yet

- Home Assignment FADocument14 pagesHome Assignment FAMohit SharmaNo ratings yet

- Example Problems W Solutions in SFP & SCFDocument7 pagesExample Problems W Solutions in SFP & SCFQueen Valle100% (1)

- Partnership - FormationDocument5 pagesPartnership - FormationJay Mayca TyNo ratings yet

- PDF Advanced Accounting Solman CompressDocument91 pagesPDF Advanced Accounting Solman CompressLeah Mae NolascoNo ratings yet

- Business Combination - GROUP 1Document4 pagesBusiness Combination - GROUP 1Ejoyce KimNo ratings yet

- Cash Inflows: Cash Surplus/loan RequirementDocument7 pagesCash Inflows: Cash Surplus/loan RequirementMIRZA WAQAR BAIGNo ratings yet

- Bucom 2Document3 pagesBucom 2dmangiginNo ratings yet

- Pembahasan Genap ACT Genap 2020 19 MarDocument12 pagesPembahasan Genap ACT Genap 2020 19 MarSoca NarendraNo ratings yet

- Chapter 17 Answer Key-1Document4 pagesChapter 17 Answer Key-1NCTNo ratings yet

- 16 UNIT III LiquidationDocument20 pages16 UNIT III LiquidationLeslie Mae Vargas ZafeNo ratings yet

- AS Book 1Document4 pagesAS Book 1Vashu ShrivastavNo ratings yet

- Sesi 11 & 12 SharedDocument28 pagesSesi 11 & 12 SharedDian Permata SariNo ratings yet

- IT Excel Financial StatementDocument17 pagesIT Excel Financial StatementMadelline San PedroNo ratings yet

- Business Combi PDF FreeDocument13 pagesBusiness Combi PDF FreeEricka RedoñaNo ratings yet

- Exercise No.2Document4 pagesExercise No.2Jeane Mae BooNo ratings yet

- Exercise No.2Document4 pagesExercise No.2Jeane Mae BooNo ratings yet

- SFP and SCF - Practice QuestionsDocument3 pagesSFP and SCF - Practice QuestionsFazelah YakubNo ratings yet

- Problem Solving - Statement of Cash FlowDocument7 pagesProblem Solving - Statement of Cash FlowHossain AlmasNo ratings yet

- AKD - Amboi CanteknyeDocument1 pageAKD - Amboi CanteknyePuspita SariNo ratings yet

- Mountain Company CFS ProblemDocument1 pageMountain Company CFS ProblemBryan NograNo ratings yet

- Long Problem - Corporate LiquidationDocument3 pagesLong Problem - Corporate LiquidationBanna SplitNo ratings yet

- Part 4 - AccountingDocument12 pagesPart 4 - AccountingAmr Youssef100% (1)

- Exercise 1 1. P290,000 2. P29,000: SolutionDocument5 pagesExercise 1 1. P290,000 2. P29,000: SolutionSheena MarieNo ratings yet

- BADVAC2X Review (Partnership Formation-Dissolution) - P1Document15 pagesBADVAC2X Review (Partnership Formation-Dissolution) - P1Reymark SadoyNo ratings yet

- 01 Act 1Document1 page01 Act 1dimayugadesiree5No ratings yet

- WORKSHEET - 5 On CFSDocument6 pagesWORKSHEET - 5 On CFSNavya KhemkaNo ratings yet

- John Paul Mi Oza - Midterm - Sample Worksheet - 1ST ActivityDocument21 pagesJohn Paul Mi Oza - Midterm - Sample Worksheet - 1ST Activityjohnpaulminoza2No ratings yet